Global Hemostats Market

Market Size in USD Billion

CAGR :

%

USD

3.34 Billion

USD

5.67 Billion

2024

2032

USD

3.34 Billion

USD

5.67 Billion

2024

2032

| 2025 –2032 | |

| USD 3.34 Billion | |

| USD 5.67 Billion | |

|

|

|

|

Hemostats Market Size

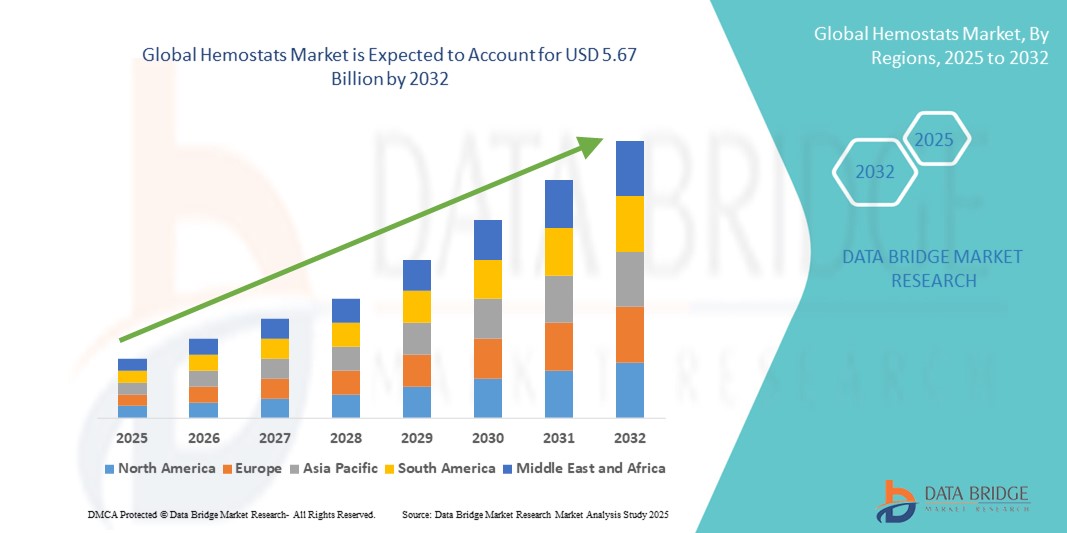

- The global hemostats market size was valued at USD 3.34 billion in 2024 and is expected to reach USD 5.67 billion by 2032, at a CAGR of 6.85% during the forecast period

- The market growth is largely fueled by the rising incidence of surgical procedures worldwide and the growing need for effective blood loss management, especially in trauma and emergency care settings. hemostats are playing a critical role in enhancing surgical efficiency by offering rapid and localized control of bleeding, thus reducing intraoperative complications and improving patient outcomes

- Furthermore, advancements in hemostatic technologies—including bioabsorbable materials, thrombin-based agents, and combination products—are accelerating the adoption of hemostats across general surgery, cardiovascular procedures, and orthopedic interventions. These innovations are not only improving efficacy but also enabling broader application in minimally invasive and laparoscopic surgeries, thereby significantly boosting the market’s growth

Hemostats Market Analysis

- Hemostats, vital surgical agents designed to control bleeding and facilitate clotting during surgeries, are increasingly indispensable in trauma care, orthopedic procedures, cardiovascular surgeries, and minimally invasive interventions due to their ability to ensure rapid hemostasis and improve surgical outcomes

- The rising demand for hemostats is primarily driven by the growing volume of surgical procedures globally, increasing incidences of trauma and accidents, and the expanding elderly population prone to chronic diseases requiring operative care

- North America dominated the hemostats market with the largest revenue share of 39.8% in 2024, attributed to its advanced healthcare infrastructure, high per capita healthcare expenditure, and the strong presence of leading market players. The U.S. in particular has witnessed high adoption of both passive and active hemostatic agents in hospitals and ambulatory surgical centers

- Asia-Pacific is projected to be the fastest growing region in the hemostats market during the forecast period of 2025 to 2032, driven by rapid urbanization, rising healthcare investments, improving access to surgical care in countries such as China and India, and increasing awareness about effective blood loss management during procedures

- The Surgery segment dominated the hemostats market with a market share of 65.4% in 2024, owing to the growing number of complex surgical interventions that require immediate and efficient bleeding control to minimize complications

Report Scope and Hemostats Market Segmentation

|

Attributes |

Hemostats Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Hemostats Market Trends

Growing Demand for Advanced Hemostatic Agents in Modern Surgery

- A significant and accelerating trend in the global hemostats market is the growing adoption of advanced hemostatic agents across diverse surgical fields, including orthopedics, cardiovascular, trauma, and neurosurgery. The evolution of surgical techniques has led to increased demand for reliable, fast-acting solutions to manage intraoperative bleeding efficiently

- Modern hemostats, including active agents such as thrombin and fibrin sealants, are gaining popularity due to their superior efficacy, especially in complex or minimally invasive procedures where traditional mechanical methods (such as sutures or ligatures) are not sufficient

- Hospitals and ambulatory surgical centers are increasingly favoring combination hemostats that offer dual mechanisms—physical and biochemical—to control bleeding. This shift reflects a broader preference for versatile agents that can be used across a range of surgical settings and wound types

- In addition, the rise in geriatric populations globally—who are more prone to chronic illnesses requiring surgery—has directly influenced the increased consumption of hemostatic products in operative care and post-surgical recovery

- Leading manufacturers are focused on developing next-generation hemostats with enhanced biocompatibility, minimal immunogenic response, and faster application times, which align with the rising trend of reducing surgical duration and improving patient outcomes

- With increasing investments in healthcare infrastructure and surgical innovation, particularly in emerging economies, the global Hemostats market is poised for sustained growth—driven by clinical efficacy, patient safety, and the expanding scope of surgical procedures requiring precise blood loss control

Hemostats Market Dynamics

Driver

Rising Demand for Blood Loss Management Across Surgical Specialties

- The growing global surgical volume—particularly in cardiovascular, orthopedic, trauma, and neurosurgery procedures—is significantly driving the demand for efficient hemostatic agents

- Hospitals and surgical centers are prioritizing the use of advanced Hemostats to manage intraoperative and postoperative bleeding more effectively, thereby reducing complication rates and improving patient outcomes

- For instance, the increasing adoption of minimally invasive surgical techniques, where visibility and precision are paramount, has reinforced the need for fast-acting topical hemostatic agents

- This is encouraging manufacturers to develop innovative solutions that provide rapid clotting without interfering with the operative field

- Chronic conditions such as diabetes, liver disease, and coagulopathies, which elevate the risk of bleeding during surgery, are further propelling the demand for reliable hemostatic solutions in both elective and emergency procedures

- The use of adjunctive Hemostats is becoming standard practice in many high-risk surgeries

Restraint/Challenge

High Costs and Regulatory Constraints

- Despite their clinical efficacy, the high cost associated with advanced biologic and active Hemostats, such as thrombin- or fibrin-based products, remains a key barrier in resource-limited healthcare settings. Many public hospitals and small surgical centers, particularly in developing economies, still rely on basic mechanical methods due to cost constraints

- Furthermore, the stringent regulatory framework governing the approval of biologically derived hemostatic products adds complexity and cost to market entry. Manufacturers must invest heavily in clinical validation and adhere to rigorous compliance requirements, which can slow down innovation and accessibility

- Another challenge lies in product compatibility and ease of use. Some hemostatic agents require specialized storage or preparation, making them less convenient in emergency or rural settings. As a result, there is increasing demand for ready-to-use, shelf-stable products with broad applicability across different types of procedures

- The lack of widespread awareness about the benefits of advanced Hemostats in certain developing markets limits their adoption. Surgeons and procurement departments may remain reliant on traditional techniques due to limited training or exposure to new technologies

- Reimbursement challenges across several regions also restrain market growth. Many healthcare systems do not offer full reimbursement for expensive hemostatic products, creating a financial burden for both providers and patients

- Supply chain disruptions, especially during global events such as the COVID-19 pandemic, can hinder the consistent availability of essential Hemostats in hospitals and surgical centers, affecting treatment protocols and inventory decisions

- Product recalls and concerns related to safety or contamination can significantly impact brand trust and adoption. For instance, biologic products may carry a risk of immunogenic reaction or viral transmission if not properly handled or processed

- There is also a growing concern about the environmental impact and waste generation from single-use hemostatic products, pushing regulatory bodies and hospitals to seek more sustainable alternatives—something not all companies are currently equipped to offer

Hemostats Market Scope

The market is segmented on the basis of product type, formulation, application, indication, and end-user.

- By Product Type

On the basis of product type, the Hemostats market is segmented into thrombin based, combination, oxidized regenerated cellulose based, gelatin based, and collagen based hemostat. The thrombin based hemostats segment dominated the market with a revenue share of 31.8% in 2024, owing to its rapid clotting ability and compatibility with diverse surgical procedures. These products are highly effective in controlling minor and major bleeding, making them widely preferred by surgeons globally.

Meanwhile, the Combination Hemostats segment is projected to grow at the fastest CAGR of 6.9% from 2025 to 2032, due to its dual-action mechanisms and enhanced efficacy in complex surgical environments such as cardiac and orthopedic procedures.

- By Formulation

On the basis of formulation, the hemostats market is segmented into matrix & gel hemostats, sheet & pad hemostats, sponge hemostats, and powder hemostats. The matrix & gel hemostats segment accounted for the largest revenue share of 34.2% in 2024, due to their excellent adaptability to irregular wound surfaces and their rapid action in minimally invasive surgeries. Their easy application and reduced tissue damage have made them a surgeon's choice in high-precision operations.

The powder hemostats segment is anticipated to witness the fastest CAGR of 7.3% from 2025 to 2032, driven by their versatility, ease of storage, and increased use in emergency trauma and laparoscopic procedures.

- By Application

On the basis of application, the hemostats market is segmented into orthopedic, general surgery, neurological surgery, cardiovascular surgery, reconstructive surgery, and gynecological surgery. General Surgery led the segment with a revenue share of 28.6% in 2024, attributed to the widespread use of hemostatic agents in abdominal, trauma, and hernia surgeries where effective blood loss control is critical.

The Neurological surgery segment is expected to grow at the fastest CAGR of 7.5% from 2025 to 2032, as these procedures require highly precise hemostatic tools to manage delicate bleeding near brain and spinal tissues.

- By Indication

On the basis of indication, the hemostats market is segmented into wound closure and surgery. The surgery segment captured the majority market share of 65.4% in 2024, owing to the growing number of complex surgical interventions that require immediate and efficient bleeding control to minimize complications.

The wound closure segment is expected to grow at the fastest CAGR from 2025 to 2032, due to the increasing use of topical hemostats in emergency care and post-operative recovery to reduce healing time and risk of infection.

- By End-User

On the basis of end-user, the Hemostats market is segmented into hospitals, clinics, ambulatory centers, community healthcare, and others. Hospitals held the largest market share of 58.1% in 2024, driven by the high surgical volume and availability of specialized surgical teams and infrastructure. Hospitals are the primary sites for complex procedures that require advanced bleeding control.

Ambulatory Centers are forecasted to register the fastest CAGR of 8.1% from 2025 to 2032, due to the rise in outpatient surgeries and increasing adoption of cost-effective, same-day procedures that require reliable, quick-action hemostats.

Hemostats Market Regional Analysis

- North America dominated the hemostats market with the largest revenue share of 39.8% in 2024, driven by increasing surgical procedures, high adoption of advanced hemostatic agents, and strong healthcare infrastructure

- The presence of major market players, coupled with favorable reimbursement policies and a rising focus on minimizing surgical complications, has further contributed to the region’s dominance

- The demand for Hemostats in North America is also supported by the region's rising geriatric population, high prevalence of chronic diseases, and increasing number of trauma and cardiovascular surgeries. Hospitals and surgical centers are increasingly investing in modern, efficient hemostatic solutions to reduce intraoperative bleeding and enhance patient outcomes

U.S. Hemostats Market Insight

The U.S. hemostats market captured the largest revenue share of 64% in 2024 within North America, fueled by the growing preference for minimally invasive surgeries, rising awareness about blood loss management, and technological advancements in hemostatic products. The country also benefits from a well-established regulatory framework, widespread clinical adoption of combination hemostats, and strategic collaborations between hospitals and medical device companies. Moreover, government funding and the presence of top-tier academic institutions conducting research in surgical hemostasis further support market growth.

Europe Hemostats Market Insight

The Europe hemostats market is projected to expand at a substantial CAGR throughout the forecast period, primarily due to an increasing volume of elective and emergency surgical procedures, rising focus on post-operative outcomes, and favorable public healthcare funding. Countries such as Germany, France, and the U.K. are seeing growing usage of advanced biologic and active hemostats in orthopedic, cardiovascular, and trauma surgeries. Additionally, growing efforts toward enhancing surgeon training, medical device innovation, and surgical safety are fostering adoption in both public and private healthcare facilities.

U.K. Hemostats Market Insight

The U.K. hemostats market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the increasing prevalence of chronic illnesses requiring surgical intervention and a strong emphasis on improving surgical outcomes through advanced intraoperative tools. National Health Service (NHS) investments in modern surgical equipment and the expanding role of ambulatory surgical centers (ASCs) are contributing to increased demand. Moreover, the rise of outpatient surgeries and laparoscopic procedures is increasing the requirement for quick-acting, absorbable hemostatic agents.

Germany Hemostats Market Insight

The Germany hemostats market is expected to expand at a considerable CAGR during the forecast period, fueled by a technologically advanced healthcare system, emphasis on quality care, and a growing number of aging patients undergoing surgical treatments. Hospitals across Germany are incorporating combination and fibrin sealant-based Hemostats for their effectiveness in complex surgeries. Regulatory incentives and local innovation in surgical materials are further supporting the expansion of the market in Germany.

Asia-Pacific Hemostats Market Insight

The Asia-Pacific hemostats market is poised to grow at the fastest CAGR during the forecast period of 2025 to 2032, driven by growing healthcare investments, increasing adoption of modern surgical practices, and a sharp rise in surgical volumes in emerging economies. Countries such as China, Japan, and India are witnessing rapid expansion in their hospital infrastructure, coupled with government-backed efforts to improve surgical outcomes. Increasing demand for cost-effective and efficient hemostatic solutions across both public and private hospitals is expected to drive growth significantly in the region.

Japan Hemostats Market Insight

The Japan hemostats market is gaining momentum, supported by a high volume of surgeries, rising geriatric population, and increasing focus on infection prevention and improved post-surgical healing. Japanese healthcare institutions prioritize high-quality hemostatic products with proven clinical safety and efficacy. Advanced hospitals are adopting combination and synthetic Hemostats to reduce surgical time and blood transfusion needs. Additionally, domestic innovation and strong regulatory guidance are accelerating new product introductions.

China Hemostats Market Insight

The China hemostats market accounted for the largest market revenue share in Asia Pacific in 2024, attributed to the country’s rapidly modernizing healthcare infrastructure, expansion of tertiary hospitals, and the increasing number of surgical procedures performed annually. Strong local manufacturing capabilities and government support for domestic medical device companies are further boosting the availability and affordability of Hemostats in the country. The growing middle-class population, combined with an uptick in health insurance penetration, is enhancing access to surgical care and driving demand for effective hemostatic agents

Hemostats Market Share

The hemostats industry is primarily led by well-established companies, including:

- CR Bard, Inc. (US)

- B. Braun SE (Germany)

- Baxter International, Inc. (US)

- Integra LifeSciences (US)

- Marine Polymer Technologies, Inc. (US)

- Teleflex (US)

- Ethicon, Inc. (US)

- Pfizer, Inc. (US)

- Z-Medica LLC (US)

- Gelita Medical GmbH (Germany)

- Anika Therapeutics, Inc. (US)

- Stryker (US)

- Integra LifeSciences Corporation (US)

Latest Developments in Global Hemostats Market

- In April 2023, Olympus introduced a trio of new hemostatic products—EndoClot Adhesive (ECA), EndoClot Polysaccharide Hemostatic Spray (PHS), and EndoClot Submucosal Injection—designed for rapid bleeding control during endoscopic procedures. These innovations reflect ongoing growth in minimally invasive surgical support tools

- In March 2023, Axio Biosolutions received U.S. FDA 510(k) clearance for its Ax‑Surgi Surgical Hemostat, a chitosan‑based product engineered for managing severe surgical bleeding. This approval highlights the regulatory momentum in hemostatic agent development

- In January 2024, Baxter International Inc. acquired PerClot, a plant starch‑based powdered hemostat, expanding its offering in the adjunctive hemostasis segment and underscoring strategic consolidation in the industry

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.