Global Hemp Protein Market

Market Size in USD Million

CAGR :

%

USD

173.20 Million

USD

504.56 Million

2025

2033

USD

173.20 Million

USD

504.56 Million

2025

2033

| 2026 –2033 | |

| USD 173.20 Million | |

| USD 504.56 Million | |

|

|

|

|

Hemp Protein Market Size

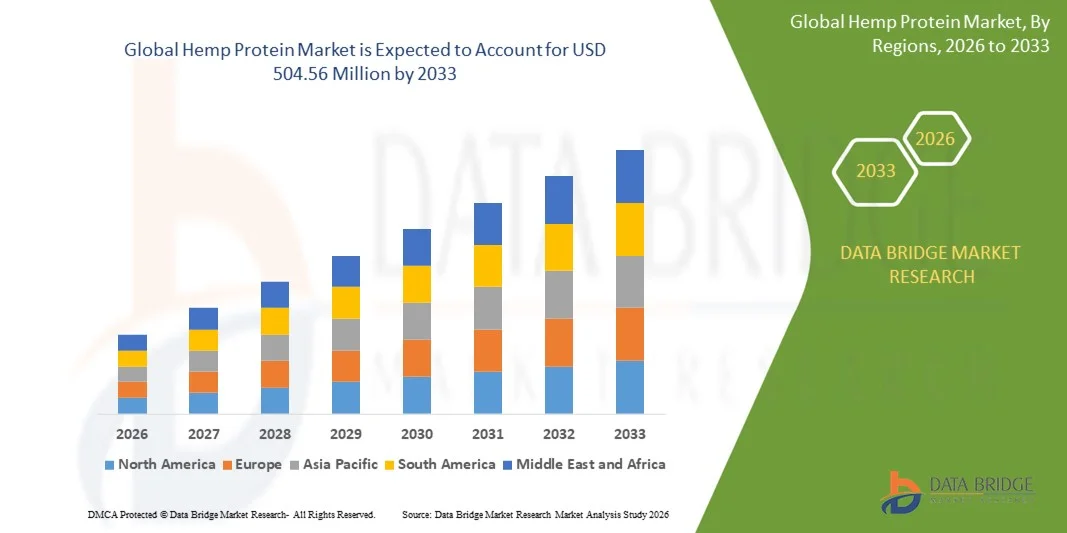

- The global hemp protein market size was valued at USD 173.20 million in 2025 and is expected to reach USD 504.56 million by 2033, at a CAGR of 14.30% during the forecast period

- The market growth is largely fueled by the rising shift toward plant-based nutrition and the increasing preference for clean-label, sustainable protein sources, leading to strong uptake of hemp protein across food, beverage, and nutraceutical categories

- Furthermore, growing consumer awareness of the nutritional benefits of hemp protein, including its digestibility, amino acid profile, and allergen-free nature, is strengthening its demand among health-conscious individuals. These converging factors are accelerating the use of hemp protein in functional foods and dietary supplements, thereby significantly boosting the market’s expansion

Hemp Protein Market Analysis

- Hemp protein, derived from hemp seeds and valued for its rich nutrient profile and natural digestibility, is becoming a key ingredient in modern health and wellness products due to its suitability for vegan, allergen-free, and clean-label formulations

- The escalating demand for hemp protein is primarily fueled by the rising global inclination toward plant-based diets, expanding sports nutrition consumption, and increasing reliance on sustainable protein alternatives that support environmental and nutritional objectives

- Asia-Pacific dominated the hemp protein market with a share of 48.17% in 2025, due to rising health awareness, increasing demand for plant-based proteins, and strong presence of organic farming and processing hubs

- North America is expected to be the fastest growing region in the hemp protein market during the forecast period due to rising health consciousness, growth in the sports nutrition and dietary supplement sectors, and increasing popularity of plant-based protein alternatives

- Organic segment dominated the market with a market share of 58.5% in 2025, due to increasing consumer preference for clean-label and chemical-free protein sources. Organic hemp protein is perceived as healthier and safer, attracting health-conscious individuals and fitness enthusiasts. The segment benefits from rising awareness regarding sustainable agricultural practices and environmental impact, as consumers increasingly seek products that are ethically produced. Furthermore, organic hemp protein often commands premium pricing due to perceived quality and nutritional superiority, reinforcing its dominance. Its availability across health stores, e-commerce platforms, and premium retail outlets further supports market growth

Report Scope and Hemp Protein Market Segmentation

|

Attributes |

Hemp Protein Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Hemp Protein Market Trends

Rising Adoption of Plant-Based and Clean-Label Protein Ingredients

- Growing consumer preference for plant-based and clean-label proteins is driving robust expansion in the hemp protein market. This trend is shaped by rising awareness of the nutritional benefits of hemp, which offers a complete amino acid profile, omega-3 and omega-6 fatty acids, and essential micronutrients while remaining allergen-friendly and easy to digest

- For instance, Axiom Foods Inc. and Manitoba Harvest Hemp Foods are expanding their hemp protein product lines to address demand for organic and non-GMO ingredients in North America and Asia Pacific. Their focus on flavor innovation, solubility enhancement, and cost-effective sourcing has increased adoption among manufacturers of protein powders, bars, and ready-to-drink beverages

- Market developments highlight increased integration of hemp protein in bakery, snack, and beverage formulations, responding to consumer demand for nutrient-rich and sustainable alternatives in everyday foods. Companies leverage the versatility and neutral taste of hemp protein powder to deliver protein fortification without compromising product texture or flavor

- Advancements in extraction and processing technologies have improved the functional properties of hemp protein, facilitating its use in diverse applications. Improved solubility and enhanced sensory profiles are expanding its acceptance among mainstream consumer groups previously hesitant about hemp flavors

- In addition, increasing regulatory approvals and supportive government nutrition initiatives in key regions such as China and India are catalyzing growth in Asia Pacific. National programs such as India’s National Nutrition Mission promote plant-based alternatives, strengthening hemp protein consumption in mainstream markets

- The continuing shift toward veganism, sustainability, and health-focused diets is reinforcing the global prevalence of hemp protein. As taste, pricing, and accessibility improve, plant-based hemp protein is poised to capture a growing share of the global protein ingredient market in the coming years

Hemp Protein Market Dynamics

Driver

Growing Consumer Shift Toward Nutritional and Sustainable Protein Sources

- The increasing shift among consumers towards nutritional and environmentally sustainable protein sources is a primary growth driver for the hemp protein market. Hemp protein, being plant-based and minimally processed, appeals to environmentally conscious consumers seeking renewable, high-protein alternatives to animal and soy proteins

- For instance, major players such as Tilray Brands Inc. and ETChem have invested in expanding their supply capabilities and distribution networks in both established and emerging markets. Their integration of vertical supply chains helps meet regional demand spikes and ensures a reliable flow of high-quality, traceable hemp protein products

- The surge in lifestyle diseases such as obesity and diabetes, combined with a global emphasis on fitness and preventive nutrition, is motivating consumers to explore new protein sources. Hemp protein meets these needs through its rich micronutrient composition and low allergenicity, aiding daily nutrient intake and supporting diverse dietary preferences

- Central to this demand is the growing variety of food and beverage applications, ranging from smoothies and energy bars to fortified baked goods. Hemp protein enables manufacturers to reformulate products for higher protein content while maintaining clean-label appeal, helping brands capture health-oriented consumer segments

- The steady growth in vegan and flexitarian diets across all age groups further secures the role of hemp protein as a core ingredient in nutritional planning. Integrated government nutrition programs, public health campaigns, and rising digital access to wellness information continue to propel adoption worldwide

Restraint/Challenge

Limited Processing Infrastructure and High Production Costs

- Limited processing infrastructure and high production costs remain significant challenges in the global hemp protein market. In many regions, insufficient investment in advanced extraction and filtration facilities restricts the scalability and cost compatibility of hemp protein compared to established proteins such as soy or pea

- For instance, companies such as Martin Bauer Group and ETChem highlight the impact of variable processing yields and tightening regulatory controls on the overall cost structure for hemp protein production. These constraints sometimes lead to inconsistent supply, seasonal shortages, and increased end pricing

- Complex regulatory requirements related to hemp cultivation and product standards can also hamper scaling efforts in certain countries, especially where hemp farming is subject to strict licensing and compliance checks. This results in a limited number of qualified suppliers and higher input costs across the supply chain

- In addition, the need for specialized processing expertise and advanced quality control increases operating costs for manufacturers focused on organic and clean-label hemp proteins. Seasonal variations in hemp seed yield and purity further complicate cost management for smaller or new market entrants

- Overcoming these challenges will require expanded investment in regional processing capacity, improved supply chain traceability, and focused government support for hemp farming technology. Collaborative efforts between manufacturers, farmers, and regulatory bodies will be key in stabilizing production costs, streamlining operations, and increasing the global accessibility of hemp protein products

Hemp Protein Market Scope

The market is segmented on the basis of nature, form, grade type, application, and distribution channel.

- By Nature

On the basis of nature, the hemp protein market is segmented into organic and conventional. The organic segment dominated the market with the largest market revenue share of 58.5% in 2025, driven by increasing consumer preference for clean-label and chemical-free protein sources. Organic hemp protein is perceived as healthier and safer, attracting health-conscious individuals and fitness enthusiasts. The segment benefits from rising awareness regarding sustainable agricultural practices and environmental impact, as consumers increasingly seek products that are ethically produced. Furthermore, organic hemp protein often commands premium pricing due to perceived quality and nutritional superiority, reinforcing its dominance. Its availability across health stores, e-commerce platforms, and premium retail outlets further supports market growth.

The conventional segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by wider availability and cost-effectiveness compared with organic variants. Conventional hemp protein appeals to price-sensitive consumers and emerging markets where affordability is a key purchasing factor. Manufacturers continue to invest in conventional hemp protein production to enhance scalability and distribution, ensuring consistent supply for industrial applications. The segment also benefits from integration into mainstream food and beverage products, making it a practical choice for mass-market adoption.

- By Form

On the basis of form, the hemp protein market is segmented into powder and paste. The powder segment dominated the market with the largest revenue share in 2025, driven by its versatility and ease of incorporation into various food, beverage, and nutraceutical products. Powdered hemp protein is preferred by consumers for shakes, smoothies, protein bars, and bakery items, offering convenient dosing and long shelf life. Its lightweight packaging, ease of transport, and compatibility with blending equipment make it highly appealing for both commercial and household use. In addition, the powder form is favored in fitness and wellness communities for precise nutritional intake and digestibility. Its growing availability across retail and online channels further strengthens market dominance.

The paste segment is expected to witness the fastest CAGR from 2026 to 2033, driven by rising adoption in ready-to-eat and convenience food products. Hemp protein paste provides a concentrated nutrient source and smooth texture suitable for spreads, sauces, and fortified foods. The segment is also seeing growth due to innovations in formulation and flavor enhancement, making paste more palatable for general consumers. Increasing demand from the food processing industry and ease of incorporation into culinary products contribute to the rapid expansion of this segment.

- By Grade Type

On the basis of grade type, the hemp protein market is segmented into food grade, pharmaceutical grade, and industrial grade. The food grade segment dominated the market with the largest market revenue share in 2025, driven by the increasing inclusion of hemp protein in dietary supplements, functional foods, and beverages. Food grade hemp protein meets strict safety and quality standards, making it suitable for human consumption across various product categories. Rising health consciousness and consumer demand for plant-based protein sources further drive the adoption of food grade hemp protein. Its incorporation into protein shakes, snacks, and fortified foods allows manufacturers to cater to a growing population of fitness enthusiasts and vegetarians. The segment’s dominance is reinforced by robust distribution networks and online retail penetration.

The pharmaceutical grade segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by its utilization in nutraceuticals, therapeutic formulations, and medicinal applications. Pharmaceutical grade hemp protein is characterized by higher purity levels, controlled processing, and regulatory compliance, making it ideal for health supplements and clinical use. Increasing investment in research and development, along with the rise of preventive healthcare products, supports the segment’s rapid expansion. The segment also benefits from collaborations between pharmaceutical companies and ingredient suppliers to develop innovative protein-based therapeutics.

- By Application

On the basis of application, the hemp protein market is segmented into food, beverages, pharmaceuticals, nutraceuticals, and personal care and cosmetics. The food segment dominated the market with the largest revenue share in 2025, driven by the integration of hemp protein into protein bars, bakery items, snacks, and ready-to-eat meals. Consumers are increasingly seeking plant-based protein alternatives to supplement their daily diet, which supports sustained demand. The segment benefits from extensive product innovation, convenient packaging, and compatibility with various culinary applications. Rising awareness of dietary supplements and functional foods further contributes to market dominance. Food applications are also supported by partnerships between manufacturers and retailers to offer health-focused products in mainstream outlets.

The nutraceuticals segment is expected to witness the fastest CAGR from 2026 to 2033, fueled by the growing adoption of hemp protein in dietary supplements, protein powders, and fortified nutrition products. Hemp protein’s high digestibility, amino acid profile, and potential health benefits make it suitable for functional foods and supplements. For instance, companies such as NutraGreen are introducing hemp-based protein formulations targeting immunity, muscle recovery, and overall wellness. The segment benefits from increased health awareness, rising lifestyle diseases, and demand for preventive nutrition, driving rapid adoption.

- By Distribution Channel

On the basis of distribution channel, the hemp protein market is segmented into B2B and B2C. The B2C segment dominated the market with the largest revenue share in 2025, driven by direct consumer access to packaged hemp protein products through retail stores, e-commerce platforms, and subscription services. Increasing health consciousness and online purchasing habits have significantly boosted consumer demand for plant-based protein. B2C channels provide extensive reach, product variety, and promotional opportunities that attract end users seeking convenience and quality. Consumer education campaigns on the benefits of hemp protein further strengthen the segment’s dominance. Retail partnerships and digital marketing strategies have enhanced visibility, making B2C the preferred choice for manufacturers to capture market share.

The B2B segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by increasing adoption of hemp protein as an ingredient in food processing, beverage production, and nutraceutical manufacturing. B2B buyers benefit from bulk supply, cost efficiency, and consistent quality standards, enabling integration into commercial products. For instance, ingredient suppliers such as Hemp Ingredients Co. are expanding partnerships with food and beverage manufacturers to meet growing industrial demand. Rising demand from institutional clients, health supplement companies, and cosmetic formulators contributes to the rapid growth of the B2B segment.

Hemp Protein Market Regional Analysis

- Asia-Pacific dominated the hemp protein market with the largest revenue share of 48.17% in 2025, driven by rising health awareness, increasing demand for plant-based proteins, and strong presence of organic farming and processing hubs

- The region’s cost-effective agricultural practices, growing investment in functional foods and nutraceuticals, and expanding e-commerce channels are accelerating market expansion

- The availability of skilled labor, supportive government policies for organic farming, and rapid urbanization across developing economies are contributing to increased consumption of hemp protein in both food and nutraceutical sectors

China Hemp Protein Market Insight

China held the largest share in the Asia-Pacific hemp protein market in 2025, owing to its robust production capacity for plant-based proteins and expanding functional food industry. The country's strong agricultural base, favorable policies for organic cultivation, and extensive export capabilities for protein ingredients are major growth drivers. Demand is also bolstered by increasing urban health-conscious consumers and investment in nutraceutical R&D for domestic and international markets.

India Hemp Protein Market Insight

India is witnessing the fastest growth in the Asia-Pacific region, fueled by rising plant-based diet adoption, growing functional food and nutraceutical industry, and increasing awareness of sustainable protein sources. Government initiatives promoting organic farming and self-reliance in food production are strengthening demand for hemp protein. In addition, expanding e-commerce penetration, rising fitness culture, and innovative product launches are contributing to robust market expansion.

Europe Hemp Protein Market Insight

The Europe hemp protein market is expanding steadily, supported by stringent food safety regulations, high consumer awareness of plant-based nutrition, and growing investment in organic and functional foods. The region places strong emphasis on quality, traceability, and environmentally friendly production, particularly in food and nutraceutical applications. Increasing incorporation of hemp protein in health supplements and bakery products is further enhancing market growth.

Germany Hemp Protein Market Insight

Germany’s hemp protein market is driven by its leadership in organic and functional food manufacturing, strong consumer preference for clean-label products, and well-established distribution networks. The country has extensive R&D initiatives and partnerships between food manufacturers and research institutions, fostering continuous innovation in hemp-based products. Demand is particularly strong in dietary supplements, protein shakes, and bakery applications.

U.K. Hemp Protein Market Insight

The U.K. market is supported by a mature health and wellness industry, rising adoption of plant-based diets, and growing efforts to source sustainable protein ingredients. With increasing focus on product innovation, clinical research on plant proteins, and expanding organic retail channels, the U.K. continues to play a significant role in high-value hemp protein products.

North America Hemp Protein Market Insight

North America is projected to grow at the fastest CAGR from 2026 to 2033, driven by rising health consciousness, growth in the sports nutrition and dietary supplement sectors, and increasing popularity of plant-based protein alternatives. A strong focus on clean-label products, product innovation, and sustainability is boosting demand. In addition, partnerships between ingredient suppliers and food & beverage manufacturers are supporting market expansion.

U.S. Hemp Protein Market Insight

The U.S. accounted for the largest share in the North America market in 2025, underpinned by its well-established dietary supplement and functional food industry, strong R&D infrastructure, and increasing consumer preference for plant-based nutrition. The country’s focus on innovation, regulatory compliance, and clean-label trends is encouraging the use of hemp protein in diverse applications, including shakes, snacks, and bakery products. Presence of key players and a mature retail and online distribution network further solidify the U.S.'s leading position in the region.

Hemp Protein Market Share

The hemp protein industry is primarily led by well-established companies, including:

- Axiom Foods Inc. (U.S.)

- Manitoba Harvest Hemp Foods (Canada)

- Martin Bauer Group (Germany)

- ETChem (China)

- Tilray Brands Inc. (Canada)

- Fresh Hemp Foods Ltd. (Canada)

- North American Hemp & Grain Co. Ltd. (Canada)

- Victory Hemp Foods (U.S.)

- Navitas LLC (U.S.)

- Canah International (Romania)

- Hemp Oil Canada Inc. (Canada)

- GFR Ingredients Ltd. (Canada)

- Health Horizons (India)

- Hemp Foods Australia Pty Ltd. (Australia)

- India Hemp Organics (India)

- Nutiva Inc. (U.S.)

- Jinzhou Qiaopai Biotech (China)

- EnerLab Nutrition (Canada)

- HempFlax BV (Netherlands)

- Evo Hemp (U.S.)

Latest Developments in Global Hemp Protein Market

- In April 2025, Victory Hemp Foods unveiled North America’s largest processing line for hemp heart protein and oil, marking a major expansion of large-scale production capability in the region. This investment strengthens supply chain reliability, supports high-volume manufacturing, and positions the company to meet soaring demand for allergen-free, nutrient-rich hemp protein across food, nutrition, and industrial applications. The enhanced capacity also helps accelerate market penetration by enabling consistent ingredient availability for large CPG, nutraceutical, and specialty food manufacturers

- In March 2025, Manitoba Harvest launched a new generation of high-purity hemp protein concentrates tailored for functional foods, beverages, and sports nutrition products. This advancement broadens the formulation potential for hemp protein by improving its texture, solubility, and nutritional density, making it more suitable for mainstream protein shakes, bars, and ready-to-drink applications. The company’s innovation supports the market’s shift toward cleaner plant-based proteins and is likely to stimulate higher adoption among major brands seeking premium natural ingredients

- In February 2025, Nutiva expanded its California production facility to significantly increase output of organic hemp protein powders, addressing the rapid rise in demand for certified organic plant proteins. This expansion strengthens domestic manufacturing, reduces supply constraints, and enhances distribution capabilities across retail and online channels. With consumers increasingly prioritizing organic, minimally processed proteins, the expansion enhances Nutiva’s competitive standing and contributes to the overall growth trajectory of the hemp protein segment

- In February 2025, GFR Ingredients upgraded its extraction and protein isolation technologies to improve the purity, solubility, and functional performance of hemp protein for nutraceutical and beverage formulations. This technological enhancement enables smoother integration into high-protein drinks and functional supplements, areas where texture and mouthfeel are critical. By delivering higher-quality ingredients, the company boosts the credibility of hemp protein as a competitive alternative to traditional plant proteins such as pea and soy, thereby expanding its application footprint

- In January 2025, TRI-K Industries enhanced its manufacturing capabilities at its state-of-the-art Derry, New Hampshire facility with a focus on sustainable proteins and peptides for personal care. This expansion allows the company to explore hemp protein’s potential in cosmetics, particularly in moisturization, skin-repair, and eco-friendly formulations. As clean beauty trends accelerate, TRI-K’s increased capacity strengthens the entry of hemp protein into high-value cosmetic and skincare markets, broadening its commercial opportunities beyond food and nutraceuticals

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Hemp Protein Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Hemp Protein Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Hemp Protein Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.