Global Home Based Molecular Testing Market

Market Size in USD Billion

CAGR :

%

USD

1.18 Billion

USD

2.36 Billion

2024

2032

USD

1.18 Billion

USD

2.36 Billion

2024

2032

| 2025 –2032 | |

| USD 1.18 Billion | |

| USD 2.36 Billion | |

|

|

|

|

Home-Based Molecular Testing Market Size

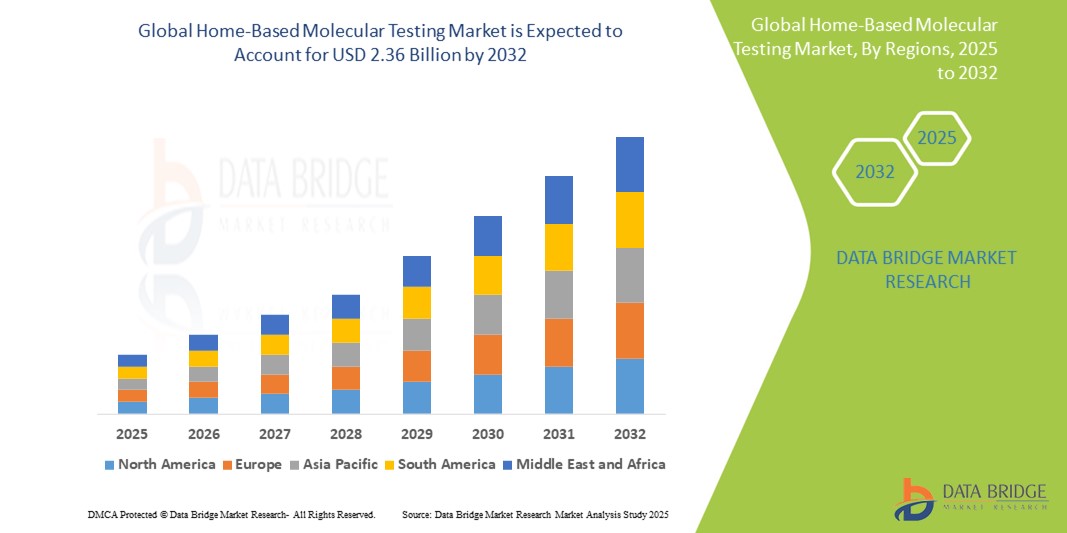

- The global home-based molecular testing market size was valued at USD 1.18 billion in 2024 and is expected to reach USD 2.36 billion by 2032, at a CAGR of 9.10% during the forecast period

- The market growth is largely fueled by the increasing prevalence of chronic diseases, infectious diseases, and a growing consumer awareness of personalized medicine. This rising health consciousness and the need for proactive health management are driving the demand for convenient and accessible diagnostic tools, thereby boosting market expansion

- Furthermore, advancements in molecular biology technologies and the development of user-friendly testing kits are enhancing diagnostic accuracy, speed, and patient comfort. These innovations, coupled with the increasing adoption of telehealth services, are accelerating the uptake of home-based molecular testing solutions, significantly contributing to the growth of the global market

Home-Based Molecular Testing Market Analysis

- The home-based molecular testing market growth is largely fueled by the increasing prevalence of infectious diseases, chronic conditions requiring regular monitoring (such as diabetes and cardiovascular diseases), and a rising consumer preference for convenient, private, and accessible diagnostic solutions. This shift towards patient-centric healthcare and proactive health management is a primary driver

- Furthermore, significant advancements in molecular diagnostics technologies, including PCR and next-generation sequencing (NGS), along with the development of user-friendly self-collection kits and digital health platforms, are enhancing the reliability and ease of home testing. These innovations are accelerating the uptake of home-based molecular testing solutions, significantly contributing to the market's expansion

- North America dominates the home-based molecular testing market with a substantial revenue share, estimated at around 39.2% in 2024. This is driven by advanced healthcare infrastructure, high awareness and adoption rates of preventative health measures, significant investments in R&D, and favorable reimbursement policies for molecular diagnostics

- Asia-Pacific is expected to be the fastest-growing region in the home-based molecular testing market during the forecast period, with a CAGR of 7.2% from 2025 to 2032. This growth is fueled by rising disposable incomes, rapid urbanization, expanding healthcare access, increasing health awareness, and growing government initiatives promoting early disease detection in populous countries such as China and India

- The kits segment dominates the home-based molecular testing market with a market share of 61.3% in 2024. This is due to their essential and recurring use in every test performed, cost-effectiveness, extensive application across infectious diseases, oncology, and genetic diagnostics, and continuous innovation in assay development ensuring consistent demand

Report Scope and Home-Based Molecular Testing Market Segmentation

|

Attributes |

Home-Based Molecular Testing Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Home-Based Molecular Testing Market Trends

“The Evolving Landscape of Home-Based Molecular Testing”

- A significant and accelerating trend in the global home-based molecular testing market is the increasing consumer demand for convenient, private, and accessible health solutions, particularly for routine monitoring and early disease detection. This rising preference is fueled by the desire to avoid clinic visits, manage personal health proactively, and receive timely results, thereby integrating diagnostic capabilities directly into daily life

- For instance, the development of user-friendly sample collection methods (such as saliva and nasal swabs) and rapid analytical technologies is seamlessly integrating into self-testing paradigms, offering more precise and effective diagnostic solutions. These advanced assays, such as PCR-based tests for infectious diseases or genetic predisposition screenings, are reshaping the market by empowering individuals to take a more active role in their health management

- Growing awareness among patients and healthcare professionals regarding the benefits of early diagnosis and personalized health insights is enabling broader adoption and driving demand for advanced home-based molecular testing. This increased understanding facilitates more intelligent health pathways, leading to better patient outcomes and empowering individuals with actionable health data. Furthermore, the expansion of clinical validations for home-use diagnostics is creating new opportunities for industry players to bring more effective and reliable options to market

- The increasing geriatric population is a key demographic factor amplifying market demand, as older adults often prefer the convenience and reduced mobility burden of home-based molecular testing for managing chronic conditions and monitoring health. This demographic shift necessitates the development of accessible and easy-to-use testing suitable for an aging patient base

- The seamless integration of new molecular diagnostic innovations with telehealth platforms and digital health ecosystems facilitates a more centralized and comprehensive approach to patient care. Through a multidisciplinary approach, healthcare providers can interpret results remotely, offer personalized advice, and manage follow-up, creating a unified and effective diagnostic and management experience

Home-Based Molecular Testing Market Dynamics

Driver

“Growing Demand for Personalized Health and Accessible Diagnostics”

- The increasing demand for proactive health management and personalized medicine among individuals worldwide, coupled with the accelerating advancements in molecular diagnostic technologies, is a significant driver for the heightened demand for home-based molecular testing solutions. Consumers are increasingly seeking convenient and private ways to understand their health status from home

- For instance, the development of rapid, accurate, and user-friendly molecular assays for infectious diseases (such as respiratory viruses) and genetic screenings has highlighted advancements in understanding individual health profiles. Such advancements in home-based molecular testing development by diagnostic companies are expected to drive the home-based molecular testing industry growth in the forecast period

- As patients become more aware of the benefits of early disease detection and personalized insights into their predispositions, home-based molecular testing options offer advanced features such as highly sensitive pathogen detection, genetic risk assessment, and long-term health monitoring, providing a compelling upgrade over traditional, often inconvenient, lab-based diagnostics

- Furthermore, the growing adoption of telehealth services and the desire for improved patient empowerment are making novel home-based molecular testing classes an integral component of comprehensive health management regimens, offering seamless integration with existing digital health platforms and remote care models

- The convenience of self-collection, quick turnaround times for results, and the ability to manage health through more effective, personalized health interventions are key factors propelling the adoption of home-based molecular testing solutions in home care settings. The trend towards consumer-centric healthcare and the increasing availability of affordable, user-friendly home-based molecular testing options further contribute to market growth

Restraint/Challenge

“Concerns Regarding Regulatory Clarity, Data Privacy, and Test Accuracy”

- Concerns surrounding the evolving regulatory landscape and the need for standardized oversight of home-based molecular testing systems, particularly for direct-to-consumer offerings, pose a significant challenge to broader market penetration. As these home-based molecular testing solutions rely on complex analytical processes and often provide sensitive health information, regulatory inconsistencies raise anxieties among potential consumers about the reliability and validity of their results

- For instance, reports regarding the varying accuracy claims of some at-home tests and the lack of stringent validation protocols have made some healthcare providers and payers hesitant to adopt widespread use of these advanced home-based molecular testing solutions, especially without clear clinical utility or follow-up pathways

- Addressing these concerns through robust regulatory frameworks, transparent data privacy policies, and the development of clear guidelines for test validation is crucial for building consumer trust and broader market acceptance. Companies in the home-based molecular testing space emphasize their commitment to data security and clinical validation in their marketing to reassure potential buyers. In addition, the relatively limited awareness of how to interpret complex molecular test results and the need for professional genetic counseling can be a barrier to informed patient action

- While prices for some home-based molecular testing categories are gradually decreasing, the perceived complexity or the need for professional interpretation can still hinder widespread adoption, especially for those who do not see an immediate need for the advanced insights offered

Home-Based Molecular Testing Market Scope

The home-based molecular testing market is segmented into test types, product, sample type, technology and distribution channel.

• By Test Types

On the basis of test types, the home-based molecular testing market is segmented into infectious diseases, oncology testing, genetic testing, chronic disease management, reproductive health, wellness & lifestyle, and others. The infectious diseases segment captured the largest market revenue share of 36.4% in 2024, driven by increasing demand for rapid at-home diagnostics for conditions such as COVID-19, influenza, and respiratory syncytial virus (RSV). The growing emphasis on preventing disease spread and minimizing healthcare system burdens has bolstered usage of these kits.

The genetic testing segment is projected to witness the fastest CAGR of 18.6% from 2025 to 2032, fueled by heightened consumer interest in ancestry, hereditary risk assessment, and personalized medicine. Rising awareness, cost reductions, and integration with digital health platforms are also boosting demand for genetic self-testing.

• By Product

On the basis of product, the home-based molecular testing market is categorized into kits, reagents & consumables, instruments/devices, and software & services. Kits held the largest market share of 61.3% in 2024, as they form the core component of home-based molecular diagnostics, offering convenience, ease of use, and quick results. The proliferation of multiplexed testing kits for multiple conditions further strengthens this segment.

The software & services segment is expected to register the fastest CAGR of 19.2% from 2025 to 2032, driven by the growing integration of AI-powered analytics, mobile apps, cloud-based result tracking, and telemedicine platforms that enhance the utility and user experience of home testing.

• By Sample Type

On the basis of sample type, the home-based molecular testing market is segmented into saliva, blood, urine, nasal swabs, and others. Saliva-based testing led with the highest revenue share of 33.7% in 2024, due to its non-invasive nature, ease of self-collection, and growing use in genetic, infectious, and lifestyle-related tests.

The blood-based sample segment is forecasted to grow at the fastest CAGR of 16.4% from 2025 to 2032, as technological advancements now enable accurate finger-prick blood tests for chronic disease monitoring, hormone analysis, and metabolic assessments.

• By Technology

On the basis of technology, the home-based molecular testing market is segmented into PCR-based methods, next-generation sequencing (NGS), isothermal nucleic acid amplification technology (INAAT), microarrays, CRISPR-based technologies, and others. PCR-based methods dominated the market with a revenue share of 39.5% in 2024, due to their high sensitivity, specificity, and established role in detecting viral and bacterial infections at home.

The CRISPR-based technologies segment is expected to expand at the fastest CAGR of 20.3% from 2025 to 2032, owing to their emerging role in precise, low-cost molecular diagnostics and expanding applicability across various test types, especially for infectious and genetic diseases.

• By Distribution Channel

On the basis of distribution channel, the home-based molecular testing market is segmented into online pharmacies/e-commerce platforms, retail pharmacies, hospital pharmacies, direct-to-consumer (DTC) sales, and others. Online pharmacies/e-commerce platforms accounted for the largest market share of 38.2% in 2024, supported by the growing trend of digital health, contactless delivery, and access to a wide range of self-testing kits from home.

The direct-to-consumer (DTC) sales channel is projected to grow at the fastest CAGR of 17.5% from 2025 to 2032, driven by consumer demand for privacy, convenience, and empowerment in managing personal health outside traditional healthcare settings.

Home-Based Molecular Testing Market Regional Analysis

- North America dominates the home-based molecular testing market with a substantial revenue share, estimated at 39.2% of the global molecular diagnostics market in 2024. This leadership is primarily driven by its technologically advanced healthcare infrastructure, high consumer awareness regarding personalized medicine and preventive health, and substantial healthcare expenditures supporting innovative diagnostic solutions.

- Consumers and healthcare providers in the region highly value access to cutting-edge diagnostic technologies and patient-centric healthcare services. This includes a strong inclination towards at-home testing solutions that offer convenience and privacy for managing various health conditions, from infectious diseases to genetic screening.

- This widespread adoption is further supported by high disposable incomes, increasing demand for early disease detection, and the strong presence of key market players actively developing and launching innovative home-based molecular testing products. Robust regulatory frameworks and significant investments in research and development also contribute to the region's leading position, establishing North America as a favored hub for both diagnostic innovation and widespread consumer uptake of home-based molecular testing solutions.

U.S. Home-Based Molecular Testing Market Insight

The U.S. home-based molecular testing market captured the largest revenue share of 39.4% in 2024 within North America. This dominance is primarily fueled by a technologically advanced healthcare infrastructure, high consumer adoption of self-care and preventive health solutions, and significant investments in research and development within the region. Consumers and healthcare providers in the U.S. highly value access to advanced diagnostic capabilities, particularly for infectious disease surveillance, genetic screening, and chronic disease monitoring. The well-established reimbursement landscape and a strong presence of key market players actively developing and launching innovative home-based molecular testing solutions further propel the industry. Moreover, increasing awareness campaigns and patient empowerment initiatives are significantly contributing to the market's expansion.

Europe Home-Based Molecular Testing Market Insight

The Europe home-based molecular testing market is projected to expand at a substantial CAGR throughout the forecast period. This growth is primarily driven by the increasing prevalence of various infectious and chronic diseases, coupled with an aging population that increasingly seeks convenient healthcare solutions. The rising focus on patient quality of life and improved diagnostic capabilities, particularly for point-of-care and at-home applications, are fostering the adoption of advanced home-based molecular testing. European healthcare systems are also emphasizing decentralized testing to reduce hospital burden, leading to greater acceptance of innovative home-based molecular testing solutions. The region is experiencing significant growth across various diagnostic areas, with new molecular diagnostic assays being integrated into standard healthcare protocols.

U.K. Home-Based Molecular Testing Market Insight

The U.K. home-based molecular testing market is anticipated to grow at a noteworthy CAGR during the forecast period. This growth is driven by the increasing demand for rapid diagnostics, a strong emphasis on improved patient outcomes within the National Health Service (NHS), and the rising prevalence of chronic conditions requiring continuous monitoring. In addition, growing awareness of the benefits of early and convenient diagnosis is encouraging both patients and healthcare providers to explore advanced home-based molecular testing options. The U.K.'s robust diagnostic research landscape, alongside its accessible healthcare infrastructure that supports decentralized testing, is expected to continue to stimulate home-based molecular testing market growth.

Germany Home-Based Molecular Testing Market Insight

The Germany home-based molecular testing market is expected to expand at a considerable CAGR during the forecast period. This is fueled by increasing awareness of complex health conditions and the demand for effective, well-tolerated diagnostic solutions that offer convenience. Germany’s well-developed healthcare system, combined with its emphasis on innovation and high-quality patient care, promotes the adoption of advanced home-based molecular testing therapies, particularly in specialist clinics and homecare settings. The integration of novel molecular diagnostic platforms, including PCR-based and next-generation sequencing technologies, is becoming increasingly prevalent, with a strong preference for secure, patient-focused solutions aligning with local consumer expectations.

Asia-Pacific Home-Based Molecular Testing Market Insight

The Asia-Pacific home-based molecular testing market is poised to grow at the fastest CAGR of 7.2% from 2025 to 2032. This rapid expansion is driven by increasing disease prevalence (infectious diseases, chronic conditions), rising disposable incomes, and improving healthcare access in countries such as China, Japan, and India. The region's growing understanding of preventive healthcare and early diagnosis, supported by government initiatives promoting public health, is driving the adoption of home-based molecular testing solutions. Furthermore, as APAC's diagnostic manufacturing capabilities expand, the affordability and accessibility of home-based molecular testing options are reaching a wider consumer base.

Japan Home-Based Molecular Testing Market Insight

The Japan home-based molecular testing market is gaining momentum due to the country’s aging population, high healthcare spending, and a strong demand for advanced medical solutions that facilitate home-based care. The Japanese market places a significant emphasis on addressing chronic conditions and infectious disease monitoring, and the adoption of home-based molecular testing is driven by the increasing incidence of these health concerns. The integration of novel molecular diagnostic technologies, such as advanced PCR and sequencing methods, is fueling growth. Moreover, Japan's robust research and development activities are likely to spur demand for more effective and specialized diagnostic access solutions in both clinical and home care sectors.

China Home-Based Molecular Testing Market Insight

The China home-based molecular testing market accounted for a significant market revenue share in Asia-Pacific in 2024, representing 8.9% of the global molecular diagnostics market. This is attributed to the country's expanding middle class, rapid urbanization, and an increasing burden of infectious diseases and chronic conditions. China stands as a large market for diagnostic products, and home-based molecular testing is becoming increasingly popular in addressing widespread health monitoring needs. The push towards improved healthcare access and the availability of advanced home-based molecular testing options, alongside strong domestic manufacturers and a growing biopharmaceutical sector, are key factors propelling the market in China.

Home-Based Molecular Testing Market Share

The home-based molecular testing industry is primarily led by well-established companies, including:

- Abbott (U.S.)

- F. Hoffmann-La Roche Ltd. (Switzerland)

- Thermo Fisher Scientific Inc. (U.S.)

- QIAGEN (Netherlands)

- BIOMÉRIEUX (France)

- Danaher Corporation (U.S.)

- BD (U.S.)

- Siemens Healthineers AG (Germany)

- Hologic, Inc. (U.S.)

- Illumina, Inc. (U.S.)

- QuidelOrtho Corporation (U.S.)

- Bio-Rad Laboratories, Inc. (U.S.)

- DiaSorin S.p.A. (Italy)

- Myriad Genetics, Inc. (U.S.)

- Exact Sciences Corporation (U.S.)

- Molbio Diagnostics Limited (India)

- Mylab Discovery Solutions Pvt. Ltd. (India)

- Labcorp (U.S.)

Latest Developments in Global Home-Based Molecular Testing Market

- In May 2024, Sherlock Biosciences initiated clinical trials for an over-the-counter rapid molecular test designed to detect sexually transmitted infections (STIs) such as chlamydia and gonorrhea. This innovative CRISPR-based test aims to deliver results within 30 minutes, enhancing accessibility and privacy for users. The company plans to launch the test by mid-2025, marking a significant advancement in at-home STI diagnostics

- In 2024, the Biomedical Advanced Research and Development Authority (BARDA) partnered with Sherlock Biosciences to develop a home-use molecular test capable of detecting and differentiating SARS-CoV-2, influenza A, and influenza B viruses. Utilizing isothermal amplification technology, this test represents a step forward in multiplexed at-home diagnostics for respiratory illnesses

- In 2024, the U.S. Food and Drug Administration (FDA) issued an Emergency Use Authorization (EUA) for certain RT-PCR molecular-based tests developed by laboratories for the detection of SARS-CoV-2. These tests are designed for use as part of a serial testing program, enhancing the availability of at-home molecular diagnostics during the COVID-19 pandemic

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.