Global Home Diagnostics For Urinary Tract Infection Market

Market Size in USD Billion

CAGR :

%

USD

1.31 Billion

USD

2.05 Billion

2025

2033

USD

1.31 Billion

USD

2.05 Billion

2025

2033

| 2026 –2033 | |

| USD 1.31 Billion | |

| USD 2.05 Billion | |

|

|

|

|

Home Diagnostics for Urinary Tract Infection Market Size

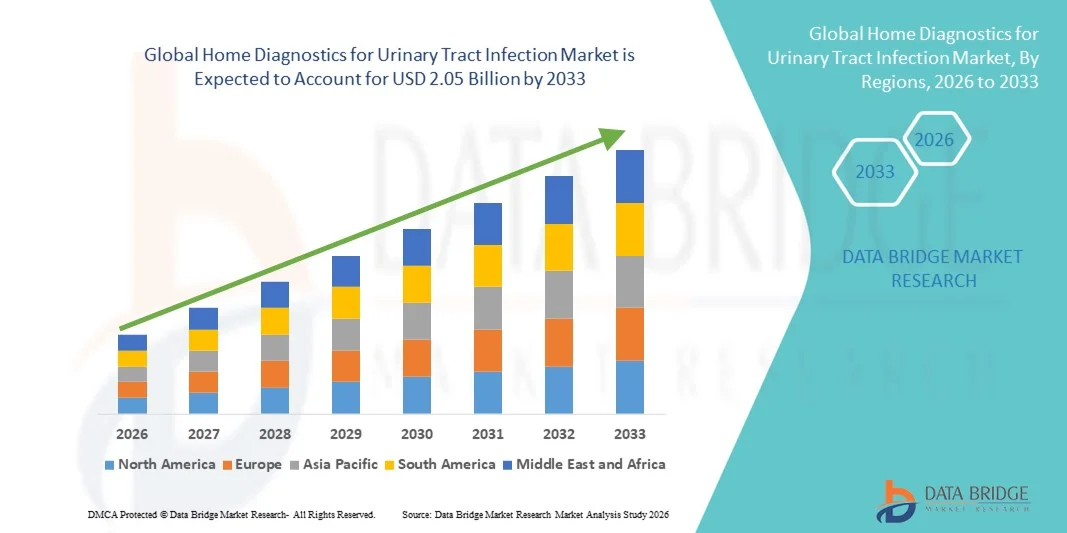

- The global home diagnostics for urinary tract infection market size was valued at USD 1.31 billion in 2025 and is expected to reach USD 2.05 billion by 2033, at a CAGR of 5.78% during the forecast period

- The market growth is largely driven by the increasing shift toward home-based healthcare and self-diagnostic solutions, supported by technological advancements in rapid test kits, digital health tools, and smartphone-enabled diagnostics, leading to improved accessibility and early detection in residential settings

- Furthermore, rising consumer demand for convenient, accurate, and easy-to-use diagnostic solutions—along with growing awareness of urinary tract infections and the need for timely diagnosis—is positioning home diagnostics as a preferred first-line screening option. These converging factors are accelerating the adoption of Home Diagnostics for Urinary Tract Infection solutions, thereby significantly boosting overall market growth

Home Diagnostics for Urinary Tract Infection Market Analysis

- Home diagnostics for urinary tract infection, which include rapid test strips, digital urine analyzers, and smartphone-enabled testing kits, are becoming essential components of preventive and home-based healthcare due to their ability to provide quick results, early detection, and improved patient convenience in both residential and remote care settings

- The rising demand for home UTI diagnostic solutions is primarily driven by increasing prevalence of urinary tract infections, growing preference for self-testing and remote monitoring, heightened awareness of early diagnosis, and the need to reduce hospital visits, particularly among women, the elderly, and recurrent UTI patients

- North America dominated the Home Diagnostics for Urinary Tract Infection market with the largest revenue share of approximately 38.6% in 2025, supported by high adoption of home healthcare solutions, strong presence of diagnostic kit manufacturers, favorable reimbursement policies, and widespread awareness of preventive healthcare, with the U.S. accounting for the majority of regional revenue due to high testing volumes and rapid uptake of digital health technologies

- Asia-Pacific is expected to be the fastest-growing region in the Home Diagnostics for Urinary Tract Infection market during the forecast period, registering a CAGR of around 14.9%, driven by increasing incidence of UTIs, expanding access to home healthcare products, improving healthcare infrastructure, rising disposable incomes, and growing awareness of self-diagnostic solutions

- The Dipsticks segment dominated the largest market revenue share of approximately 46.5% in 2025, driven by its ease of use, affordability, and widespread consumer familiarity

Report Scope and Home Diagnostics for Urinary Tract Infection Market Segmentation

|

Attributes |

Home Diagnostics for Urinary Tract Infection Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Home Diagnostics for Urinary Tract Infection Market Trends

Rising Adoption of At-Home Diagnostic Testing and Digital Health Solutions

- A significant and accelerating trend in the global home diagnostics for urinary tract infection market is the growing adoption of at-home testing kits supported by advances in digital health, rapid diagnostics, and telemedicine integration. These solutions are enhancing patient convenience by enabling early detection and monitoring of UTIs without the need for immediate clinical visits

- For instance, several home UTI test kits now offer rapid dipstick or strip-based testing that provides results within minutes, allowing users to identify infection indicators such as leukocytes and nitrites accurately at home. Some solutions also integrate with mobile applications to help users interpret results and seek timely medical consultation

- Technological advancements in diagnostics have led to improved accuracy, sensitivity, and ease of use of home UTI tests. Innovations in reagent chemistry and digital result interpretation are reducing user error and increasing confidence in self-testing outcomes

- The integration of home diagnostics with telehealth platforms is further supporting this trend, enabling patients to share test results with healthcare professionals remotely and receive prompt treatment recommendations, thereby improving disease management and reducing healthcare burden

- This shift toward patient-centric, decentralized diagnostics is reshaping expectations around UTI testing and care delivery. As a result, companies are increasingly focusing on developing reliable, affordable, and user-friendly home UTI diagnostic kits to meet rising consumer demand

- The demand for convenient, rapid, and privacy-focused diagnostic solutions is growing across diverse populations, including women, the elderly, and individuals with recurrent UTIs, supporting sustained market expansion

Home Diagnostics for Urinary Tract Infection Market Dynamics

Driver

Growing Prevalence of UTIs and Demand for Early, Convenient Diagnosis

- The rising global prevalence of urinary tract infections, particularly among women and aging populations, is a major driver fueling demand for home UTI diagnostic solutions

- For instance, in July 2022, LetsGetChecked introduced an enhanced at-home UTI test kit with clinician follow-up services, enabling early diagnosis and prescription support, highlighting how rising infection rates are driving demand for convenient home-based testing solutions

- Increasing awareness regarding the importance of early detection and prompt treatment to prevent complications such as kidney infections is encouraging consumers to adopt home-based diagnostic tools

- Home UTI diagnostics offer key benefits such as time savings, cost efficiency, privacy, and reduced dependence on laboratory testing, making them an attractive alternative to traditional diagnostic methods

- The expansion of telemedicine and remote healthcare services further supports market growth, as home diagnostic results can be easily shared with clinicians for faster clinical decision-making

- In addition, growing healthcare expenditure, improved access to over-the-counter diagnostic products, and the increasing focus on preventive healthcare are accelerating adoption in both developed and emerging markets

Restraint/Challenge

Concerns Regarding Diagnostic Accuracy and Limited Clinical Validation

- Concerns related to the accuracy and reliability of home UTI diagnostic kits compared to laboratory-based urine culture tests pose a significant challenge to widespread adoption. False positives or negatives may lead to delayed treatment or unnecessary antibiotic use

- For instance, several clinical studies published between 2021 and 2024 have highlighted variability in sensitivity among over-the-counter UTI dipstick tests when compared with laboratory urine cultures, raising concerns among clinicians regarding sole reliance on home-based diagnostics

- Limited clinical validation of some over-the-counter products and variability in test interpretation by users can affect confidence in self-diagnosis, particularly among first-time users

- Regulatory differences across regions and the lack of standardized guidelines for home diagnostic testing further restrict market penetration in certain geographies

- In addition, limited awareness in low-income and rural populations, along with affordability constraints in developing regions, may hinder adoption

- Addressing these challenges through improved test accuracy, stronger regulatory approvals, consumer education, and integration with professional healthcare support will be critical for sustained growth of the Home Diagnostics for Urinary Tract Infection market

Home Diagnostics for Urinary Tract Infection Market Scope

The market is segmented on the basis of type and distribution channel.

- By Type

On the basis of type, the Home Diagnostics for Urinary Tract Infection market is segmented into Dipsticks, Cup, Dipslide, Cassette, and Others. The Dipsticks segment dominated the largest market revenue share of approximately 46.5% in 2025, driven by its ease of use, affordability, and widespread consumer familiarity. Dipstick-based UTI tests allow rapid detection of leukocytes, nitrites, and protein, making them highly suitable for home-based screening. Their non-invasive nature significantly improves patient compliance, especially among elderly and female populations. Dipsticks are widely available across pharmacies and online platforms, supporting strong sales volume. The minimal requirement for technical expertise further strengthens adoption. Increasing prevalence of recurrent UTIs globally boosts repeat usage. High accuracy for preliminary diagnosis supports physician recommendation for at-home monitoring. Strong demand from developed markets enhances revenue contribution. Continuous product improvements improve sensitivity and readability. Growing awareness of early UTI detection supports uptake. Favorable pricing compared to laboratory testing strengthens dominance. As a result, dipsticks remain the leading product type.

The Cassette segment is expected to witness the fastest growth, registering a CAGR of around 14.9% from 2026 to 2033, driven by higher diagnostic accuracy and advanced result interpretation. Cassette-based tests often incorporate immunoassay or molecular techniques, offering improved reliability compared to traditional dipsticks. Increasing consumer preference for laboratory-like accuracy at home supports growth. Technological advancements enhance ease of sample handling and result visualization. Rising adoption among patients with chronic or recurrent UTIs fuels demand. Healthcare professionals increasingly recommend cassette tests for confirmation purposes. Expanding availability through online pharmacies accelerates penetration. Higher sensitivity reduces false-negative rates, improving trust. Growing awareness in emerging economies supports volume growth. Product innovation and miniaturization drive acceptance. Increasing telehealth integration supports usage. These factors collectively drive the fastest CAGR.

- By Distribution Channel

On the basis of distribution channel, the Home Diagnostics for Urinary Tract Infection market is segmented into Retail Pharmacies and Drug Stores, Supermarket/Hypermarket, and Online Pharmacies. The Retail Pharmacies and Drug Stores segment accounted for the largest market revenue share of approximately 44.2% in 2025, driven by strong consumer trust and immediate product availability. Pharmacies serve as primary access points for OTC diagnostic products. Pharmacist guidance plays a key role in influencing purchase decisions. Established distribution networks ensure consistent product supply. High foot traffic supports sustained sales volume. Consumers prefer pharmacies for health-related purchases due to perceived reliability. Prescription-to-OTC transition trends support dominance. Strong presence in urban and semi-urban regions boosts reach. Retail pharmacies offer multiple brand options, increasing choice. Favorable regulatory support enhances accessibility. Immediate purchase convenience strengthens adoption. Hence, retail pharmacies lead distribution.

The Online Pharmacies segment is projected to grow at the fastest CAGR of around 17.3% from 2026 to 2033, driven by rising digital health adoption and e-commerce penetration. Home delivery convenience significantly improves patient adherence. Increasing use of telemedicine supports online diagnostic purchases. Competitive pricing and discounts attract cost-sensitive consumers. Wider product availability boosts choice and accessibility. Growing internet penetration in emerging markets accelerates growth. Privacy concerns encourage online purchasing for UTI tests. Subscription-based repeat ordering supports revenue growth. Improved logistics ensure timely delivery. Digital awareness campaigns increase adoption. Smartphone-based health monitoring supports online integration. These factors collectively drive rapid CAGR expansion.

Home Diagnostics for Urinary Tract Infection Market Regional Analysis

- North America dominated the home diagnostics for urinary tract infection market with the largest revenue share of approximately 38.6% in 2025, supported by high adoption of home healthcare solutions, strong presence of diagnostic kit manufacturers, favorable reimbursement policies, and widespread awareness of preventive healthcare

- Consumers in the region highly value the convenience, privacy, and rapid results offered by home UTI diagnostic kits, which enable early detection and reduce the need for frequent clinical visits

- This widespread adoption is further supported by high healthcare spending, a technologically aware population, strong penetration of digital health platforms, and the growing preference for self-testing and remote healthcare management, establishing home UTI diagnostics as a preferred solution for early infection screening

U.S. Home Diagnostics for Urinary Tract Infection Market Insight

The U.S. home diagnostics for urinary tract infection market captured the largest revenue share within North America in 2025, driven by high testing volumes, strong consumer awareness, and rapid uptake of digital health technologies. Patients are increasingly prioritizing early diagnosis and convenient at-home testing solutions to manage recurrent UTIs. The growing availability of FDA-cleared home diagnostic kits, combined with telehealth integration and clinician-supported testing services, further propels market growth. Moreover, continuous innovation by leading diagnostic companies and strong reimbursement support significantly contribute to market expansion in the U.S.

Europe Home Diagnostics for Urinary Tract Infection Market Insight

The Europe home diagnostics for urinary tract infection market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by increasing awareness of early infection detection, supportive public healthcare systems, and rising adoption of preventive healthcare practices. The region is witnessing growing demand for reliable, easy-to-use home UTI test kits across households, elderly care settings, and outpatient environments. Expansion is observed across both Western and Eastern Europe, supported by improving access to home healthcare products and digital diagnostics.

U.K. Home Diagnostics for Urinary Tract Infection Market Insight

The U.K. home diagnostics for urinary tract infection market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by strong government focus on early disease detection, widespread adoption of self-care diagnostics, and increasing burden of recurrent UTIs. National healthcare initiatives encouraging home-based testing and reduced hospital visits are supporting market growth. The U.K.’s well-established healthcare infrastructure and strong presence of diagnostic solution providers continue to stimulate adoption.

Germany Home Diagnostics for Urinary Tract Infection Market Insight

The Germany home diagnostics for urinary tract infection market is expected to expand at a considerable CAGR during the forecast period, fueled by advanced healthcare infrastructure, high emphasis on preventive medicine, and growing acceptance of self-diagnostic solutions. Germany’s strong focus on medical innovation and quality standards supports the adoption of clinically validated home UTI diagnostic kits. Increasing use of digital health tools and growing awareness of early infection management are further contributing to market growth.

Asia-Pacific Home Diagnostics for Urinary Tract Infection Market Insight

The Asia-Pacific home diagnostics for urinary tract infection market is expected to be the fastest-growing region, registering a CAGR of around 14.9% during the forecast period, driven by rising incidence of UTIs, expanding access to home healthcare products, and improving healthcare infrastructure. Increasing disposable incomes, urbanization, and growing awareness of self-diagnostic solutions in countries such as China, Japan, and India are accelerating market growth. Government initiatives promoting preventive healthcare and digital health adoption further support regional expansion.

Japan Home Diagnostics for Urinary Tract Infection Market Insight

The Japan home diagnostics for urinary tract infection market is gaining momentum due to the country’s aging population, high healthcare awareness, and strong demand for convenient diagnostic solutions. The adoption of home UTI test kits is driven by the need for early detection and effective management of infections among elderly and female populations. Integration of home diagnostics with digital health platforms and teleconsultation services is further supporting market growth.

China Home Diagnostics for Urinary Tract Infection Market Insight

The China home diagnostics for urinary tract infection market accounted for a significant revenue share in Asia Pacific in 2025, attributed to rising healthcare awareness, rapid urbanization, and expanding middle-class population. Increasing incidence of UTIs, along with improved access to affordable home diagnostic kits and growing penetration of e-commerce healthcare platforms, is driving market growth. Strong domestic manufacturing capabilities and government focus on preventive healthcare further support the expansion of home UTI diagnostic solutions in China.

Home Diagnostics for Urinary Tract Infection Market Share

The Home Diagnostics for Urinary Tract Infection industry is primarily led by well-established companies, including:

- Roche Diagnostics (Switzerland)

- Abbott (U.S.)

- Siemens Healthineers (Germany)

- BD (U.S.)

- Acon Laboratories (U.S.)

- ACON Biotech (China)

- Arkray Inc. (Japan)

- Bio-Rad Laboratories (U.S.)

- EKF Diagnostics (U.K.)

- QuidelOrtho Corporation (U.S.)

- Cardinal Health (U.S.)

- Thermo Fisher Scientific (U.S.)

- Sysmex Corporation (Japan)

- Trinity Biotech (Ireland)

- Atlas Medical (U.K.)

- Nova Biomedical (U.S.)

- Meridian Bioscience (U.S.)

- Sekisui Diagnostics (Japan)

- DiaSys Diagnostic Systems (Germany)

- Genrui Biotech (China)

Latest Developments in Global Home Diagnostics for Urinary Tract Infection Market

- In January 2023, Hologic Inc. received regulatory approval for its new UTI test strip that incorporates a unique biomarker technology, significantly improving sensitivity and specificity for detecting urinary tract infection pathogens compared with conventional methods. This approval strengthened Hologic’s competitive positioning in the home diagnostics space and encouraged investment in higher-accuracy rapid UTI tests

- In March 2023, Roche Diagnostics launched an advanced urinary tract infection (UTI) test strip that uses innovative biomarker detection to shorten time to diagnosis and facilitate early intervention, marking a key product introduction that supports rapid, at-home testing outside traditional lab environments

- In August 2023, Quidel Corporation announced its expansion into the Asian market with its UTI test strips, aiming to increase accessibility of home and point-of-care diagnostics for urinary tract infection across major healthcare systems and self-testing channels. This regional expansion indicated broader global interest in consumer diagnostics solutions

- In January 2024, Vivoo unveiled its digital at-home urinary tract infection (UTI) testing solution at the International Consumer Electronics Show (CES 2024), offering a smartphone-linked diagnostic strip that uses deep-learning image processing technology to generate rapid results and allow easier interpretation of home urinalysis tests

- In October 2024, Time magazine recognized the Winx Health “UTI Test & Treat” at-home product among the 200 Best Inventions of the year, highlighting innovation in self-diagnosis combined with treatment support for urinary tract infections, boosting visibility for consumer UTI kits

- In January 2025, Siemens Healthcare launched a smart UTI test strip with mobile connectivity that transmits results to a linked app, improving patient monitoring and data sharing with clinicians, and reinforcing the integration of digital health technology in at-home UTI diagnostics

- In March 2025, Henry Schein announced a strategic partnership with retail pharmacy chains to roll out UTI test kits across more than 5,000 stores in the U.S. and Europe, significantly expanding consumer access to rapid diagnostic strips and supporting broader distribution beyond traditional medical channels

- In April 2025, Arkray Inc. introduced a compact automated urinalysis system that integrates with UTI test strips for use in small clinics and mobile diagnostic vans, demonstrating how hybrid models of home and point-of-care testing are gaining traction for rapid infection detection

- In May 2025, Becton Dickinson (BD) initiated pilot testing of AI-powered colorimetric analysis for digital strip interpretation of UTI test results across hospital and clinical networks in North America, showcasing next-generation analytics that could soon be adapted for home diagnostics

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.