Global Home Healthcare Market

Market Size in USD Billion

CAGR :

%

USD

117.67 Billion

USD

232.76 Billion

2024

2032

USD

117.67 Billion

USD

232.76 Billion

2024

2032

| 2025 –2032 | |

| USD 117.67 Billion | |

| USD 232.76 Billion | |

|

|

|

|

Home Healthcare Market Size

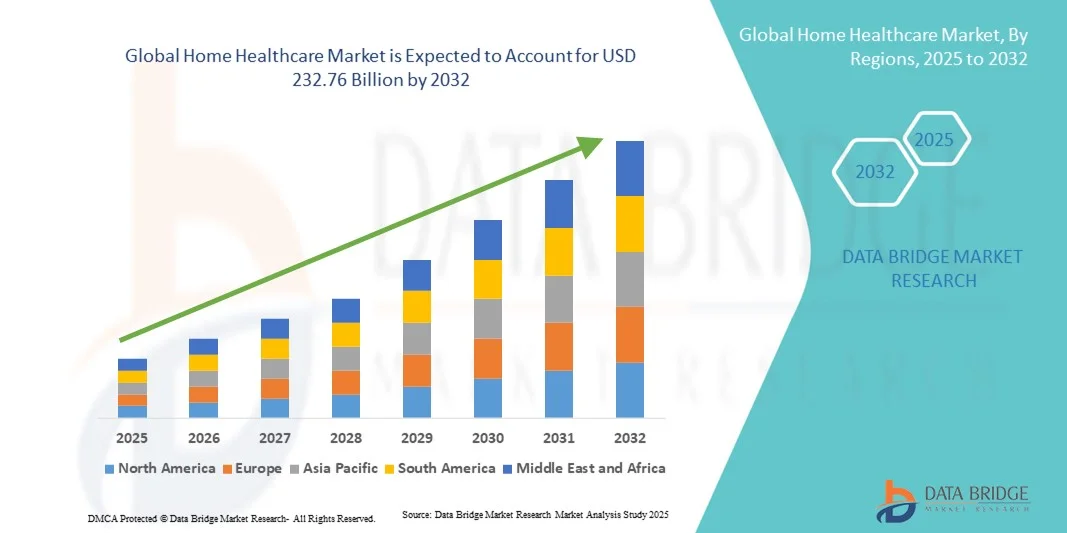

- The global home healthcare market size was valued at USD 117.67 billion in 2024 and is expected to reach USD 232.76 billion by 2032, at a CAGR of 8.90% during the forecast period

- The market growth is largely fueled by the increasing adoption of remote patient monitoring, telehealth services, and advanced medical devices, driving digitalization in both home care and clinical support setting

- Furthermore, rising consumer demand for convenient, reliable, and integrated healthcare solutions at home is accelerating the uptake of home healthcare services and devices, thereby significantly boosting the industry’s growth. Home healthcare solutions are increasingly valued for enabling continuous care, early intervention, and enhanced patient outcomes, while reducing hospital visits and associated costs

Home Healthcare Market Analysis

- Home healthcare, encompassing remote patient monitoring, telehealth services, and at-home medical support, is increasingly vital in improving patient outcomes, reducing hospital visits, and lowering healthcare costs in both developed and emerging regions

- The escalating demand for home healthcare is primarily fueled by aging populations, the rising prevalence of chronic diseases, and the growing emphasis on patient-centric care models that allow treatment in the comfort of one’s home

- North America dominated the home healthcare market with the largest revenue share of 38.7% in 2024, characterized by high adoption of telehealth technologies, strong healthcare infrastructure, and a robust presence of key market players, with the U.S. witnessing substantial growth in remote patient monitoring devices and home care services

- Asia-Pacific is expected to be the fastest growing region in the Home Healthcare market during the forecast period, projected to expand at a CAGR from 2025 to 2032, driven by increasing urbanization, rising disposable incomes, government initiatives to improve healthcare access, and expanding telemedicine infrastructure in countries such as China and India

- The Devices segment dominated the home healthcare market with the largest revenue share of 42.5% in 2024, owing to the rapid adoption of home-use monitoring devices such as glucose meters, blood pressure monitors, oxygen concentrators, wearable health trackers, and connected thermometers

Report Scope and Home Healthcare Market Segmentation

|

Attributes |

Home Healthcare Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Home Healthcare Market Trends

Enhanced Convenience Through Remote Monitoring and Telehealth Integration

- A significant and accelerating trend in the global home healthcare market is the growing integration of remote patient monitoring (RPM) devices and telehealth platforms, which is significantly enhancing convenience and continuity of care for patients managing chronic conditions at home

- For instance, in March 2023, Philips launched its next-generation wearable remote monitoring device for cardiac patients, enabling real-time transmission of vital signs to healthcare providers, improving early detection of complications, and reducing hospital readmissions

- Integration with telehealth platforms allows patients to receive virtual consultations, timely medication reminders, and automated health alerts, improving adherence to care plans and reducing the need for frequent in-person visits

- The seamless integration of monitoring devices with healthcare management platforms also facilitates centralized data collection and analytics, enabling providers to track patient progress, adjust treatment plans remotely, and proactively manage health risks

- This trend towards more connected and patient-centric home care solutions is fundamentally reshaping the expectations of both patients and healthcare providers, emphasizing convenience, efficiency, and improved clinical outcomes

- The demand for integrated home healthcare solutions is growing rapidly across both developed and emerging markets, as governments, insurers, and healthcare providers increasingly prioritize scalable, cost-effective, and technology-driven approaches to deliver high-quality care outside hospital settings

Home Healthcare Market Dynamics

Driver

Growing Need Due to Aging Population and Rising Chronic Disease Prevalence

- The increasing prevalence of chronic diseases, an aging population, and a growing focus on patient-centric care are significant drivers for the heightened demand for Home Healthcare solutions

- For instance, in April 2024, Philips introduced its next-generation remote monitoring and wearable device solutions, enabling healthcare providers to track vital signs and chronic condition metrics in real time. Such strategies by key companies are expected to drive Home Healthcare industry growth in the forecast period

- As patients and caregivers become more aware of the benefits of home-based care, Home Healthcare solutions provide advanced features such as remote monitoring, teleconsultations, medication management, and emergency alerts, enhancing patient safety and reducing hospital readmissions

- Furthermore, the growing popularity of telehealth platforms and connected health devices is making Home Healthcare an integral component of modern healthcare systems, offering seamless integration with electronic health records (EHRs) and provider network

- The convenience of continuous health monitoring, personalized care plans, and remote provider interactions are key factors propelling the adoption of Home Healthcare solutions in both developed and emerging markets. The trend towards cost-effective and patient-friendly care options further contributes to market growth

Restraint/Challenge

High Initial Costs, Regulatory Hurdles, and Technology Adoption Barriers

- The relatively high initial cost of advanced home healthcare systems and devices can be a barrier to adoption, particularly for price-sensitive consumers and healthcare facilities in developing regions

- Strict regulatory requirements for medical devices and telehealth solutions pose challenges for market expansion, as companies must ensure compliance with various regional health authorities and standards

- Reimbursement and insurance coverage limitations in certain regions can restrict the adoption of Home Healthcare solutions, especially in emerging economies where out-of-pocket expenses are high

- Variations in technological infrastructure and internet connectivity can affect the effective deployment of remote monitoring and telehealth services in rural or underserved areas

- Limited digital literacy among patients and caregivers can slow the adoption of smart Home Healthcare devices, as some users may struggle to operate advanced monitoring systems or telehealth platforms

- Data privacy and patient confidentiality concerns may hinder acceptance, as sensitive medical information is transmitted and stored electronically, requiring strict adherence to privacy regulations

- Lack of trained healthcare professionals for remote monitoring and virtual care delivery can affect the effectiveness and reliability of Home Healthcare services

- Overcoming these challenges through cost-effective solutions, improved regulatory support, better insurance coverage, patient education programs, and robust cybersecurity measures will be vital for sustained Home Healthcare market growth

Home Healthcare Market Scope

The market is segmented on the basis of type, disease, and distribution channel.

- By Type

On the basis of type, the home healthcare market is segmented into devices, services, and software. The devices segment dominated the market with the largest revenue share of 42.5% in 2024, owing to the rapid adoption of home-use monitoring devices such as glucose meters, blood pressure monitors, oxygen concentrators, wearable health trackers, and connected thermometers. These devices are increasingly preferred for their ability to deliver real-time patient monitoring, early diagnosis, and proactive healthcare interventions, which help reduce hospital readmissions and enhance patient safety. Integration with mobile applications and cloud-based platforms provides patients and caregivers with easy access to health data, alerts, and analytics, making self-management more efficient. Furthermore, growing awareness of chronic disease management, increasing healthcare expenditure, and the rise of aging populations globally are driving sustained demand. The segment also benefits from government initiatives promoting home-based care, technological advancements in miniaturized medical devices, and increasing partnerships between healthcare providers and device manufacturers.

The software segment is expected to witness the fastest CAGR of 18.7% from 2025 to 2032, fueled by the increasing adoption of telehealth solutions, AI-driven health management applications, and remote patient monitoring platforms. Software solutions allow seamless communication between patients and healthcare providers, real-time tracking of vital signs, and predictive health analytics for early intervention. The rising popularity of mobile health applications and cloud-based electronic health records enables better patient engagement and remote care management. Supportive regulatory policies, growing smartphone penetration, and the integration of software with wearable devices enhance adoption. Healthcare organizations are leveraging these solutions for chronic disease monitoring, medication adherence, post-surgery care, and preventive healthcare management. In addition, continuous innovations in AI algorithms and data analytics are driving more personalized and efficient healthcare delivery, contributing to this segment’s rapid growth.

- By Disease

On the basis of disease, the home healthcare market is segmented into heart diseases, hypertension, bone and joint diseases, diabetes, chronic obstructive pulmonary diseases (COPD), obesity, Dementia/Alzheimer’s diseases, infective diseases (HIV/AIDS), Parkinson’s Diseases, smoking, asthma, and depression. The Diabetes segment dominated with the largest revenue share of 38.4% in 2024, driven by the rising prevalence of diabetes globally and the increased use of home-based glucose monitoring devices, insulin pens, and continuous insulin delivery systems. Patients are increasingly prioritizing self-care and convenient disease management solutions that reduce hospital visits and improve quality of life. The segment’s growth is further supported by awareness programs, reimbursement policies, and government initiatives promoting chronic disease management. Technological advancements, such as connected glucose meters and smart insulin delivery systems, are enhancing monitoring accuracy and patient engagement, while healthcare providers are recommending home-based diabetes management to improve compliance and reduce complications.

The Dementia/Alzheimer’s Diseases segment is expected to witness the fastest CAGR of 19.3% from 2025 to 2032, propelled by the increasing elderly population and rising incidence of neurodegenerative disorders worldwide. The segment benefits from a growing demand for home-based cognitive care, wearable safety devices, remote monitoring solutions, and telehealth platforms that allow caregivers to track patients’ activities, medication adherence, and vital parameters. Rising healthcare expenditure, expanding awareness of early detection, and government programs for elderly care are key drivers. The adoption of AI-powered monitoring devices and software for memory care, fall detection, and emergency alerts further supports the rapid growth of this segment, particularly in regions with aging populations and advanced healthcare infrastructure.

- By Distribution Channel

On the basis of distribution channel, the home healthcare market is segmented into direct tenders and retail sales. The Retail Sales segment dominated the market with the largest revenue share of 44.7% in 2024, supported by the growing preference of consumers to purchase home healthcare devices and services directly from pharmacies, online stores, and medical equipment retailers. Retail channels provide convenience, faster access to devices, a variety of product options, and the ability to compare features and prices. Increasing awareness about the importance of home healthcare, coupled with promotional campaigns and the growth of e-commerce platforms, further drives adoption. The segment also benefits from collaborations between device manufacturers and retail chains, enabling easier distribution and demonstration of advanced home healthcare solutions.

The Direct Tenders segment is expected to witness the fastest CAGR of 17.9% from 2025 to 2032, driven by bulk procurement by hospitals, clinics, government institutions, and long-term care facilities. Institutional purchases ensure product standardization, cost efficiency, regulatory compliance, and reliable supply for multiple patients. The segment is fueled by rising investments in healthcare infrastructure in emerging markets, government programs promoting home healthcare adoption, and increasing demand for advanced monitoring systems and devices. Long-term supply contracts, strategic partnerships between manufacturers and healthcare institutions, and the need for consistent quality in chronic care management further strengthen growth. In addition, the adoption of bundled solutions, including devices, software, and services, supports efficiency and scalability in institutional setups, contributing to the segment’s rapid expansion.

Home Healthcare Market Regional Analysis

- North America dominated the home healthcare market with the largest revenue share of 38.7% in 2024, characterized by high adoption of telehealth technologies, strong healthcare infrastructure, and a robust presence of key market players

- The market witnessed substantial growth in remote patient monitoring devices and home care services, driven by increasing demand for convenient, cost-effective healthcare delivery and favorable reimbursement policies

- The presence of major healthcare providers and advanced medical technology solutions further strengthened market penetration in the region

U.S. Home Healthcare Market Insight

The U.S. home healthcare market captured the largest revenue share in 2024 within North America, fueled by the growing prevalence of chronic diseases, rising elderly population, and swift adoption of connected remote care devices. Consumers are increasingly relying on home-based care solutions for continuous health monitoring, convenience, and reduced hospital visits. In addition, supportive government regulations and reimbursement programs are encouraging the use of telehealth services, accelerating the adoption of Home Healthcare solutions across the country.

Europe Home Healthcare Market Insight

The Europe home healthcare market is projected to expand at a substantial CAGR throughout the forecast period, driven by growing healthcare awareness, increasing elderly population, and supportive healthcare policies. Countries across Europe are emphasizing home-based care solutions to reduce hospital congestion and improve patient convenience. Rising demand for chronic disease management, advancements in home monitoring devices, and well-established healthcare infrastructure are further fueling growth. The market is witnessing increased adoption across residential and specialized care facilities.

U.K. Home Healthcare Market Insight

The U.K. home healthcare market is expected to grow at a noteworthy CAGR during the forecast period, supported by rising demand for remote patient monitoring and home-based care services. Increasing prevalence of chronic conditions, coupled with a growing aging population, is driving the adoption of telehealth and home healthcare solutions. The U.K.’s robust healthcare infrastructure and increasing investment in digital health technologies are further strengthening market expansion.

Germany Home Healthcare Market Insight

The Germany home healthcare market is anticipated to expand at a considerable CAGR during the forecast period, fueled by high healthcare expenditure, well-developed infrastructure, and an aging population requiring home-based medical care. Government initiatives to promote digital healthcare, including telemedicine and remote monitoring solutions, are encouraging the adoption of Home Healthcare devices and services. In addition, rising patient awareness regarding personalized care and continuous health monitoring is boosting market growth.

Asia-Pacific Home Healthcare Market Insight

The Asia-Pacific home healthcare market is expected to be the fastest growing region, projected to expand at a CAGR from 2025 to 2032. Growth is driven by increasing urbanization, rising disposable incomes, government initiatives to improve healthcare access, and expanding telemedicine infrastructure in countries such as China and India. Rapidly growing elderly populations and rising incidence of chronic diseases are further contributing to the adoption of home-based healthcare solutions across the region.

Japan Home Healthcare Market Insight

The Japan home healthcare market is witnessing steady growth due to the country’s aging population, high healthcare awareness, and strong demand for remote monitoring and home care services. Government support for home healthcare and telemedicine, coupled with technological advancements in medical devices, is promoting the adoption of home-based health solutions. The trend towards personalized healthcare and increasing focus on elderly care is expected to continue driving market growth.

China Home Healthcare Market Insight

The China home healthcare market accounted for the largest revenue share in Asia-Pacific in 2024, driven by rapid urbanization, expanding middle-class population, rising disposable incomes, and growing prevalence of chronic diseases. Government initiatives to improve healthcare accessibility, along with increased investment in telemedicine and home healthcare infrastructure, are accelerating market adoption. The market is witnessing rising demand for remote patient monitoring devices, home nursing services, and other telehealth solutions, positioning China as a key growth hub in the region.

Home Healthcare Market Share

The Home Healthcare industry is primarily led by well-established companies, including:

- Koninklijke Philips N.V. (Netherlands)

- Omron Healthcare, Inc. (Japan)

- B. Braun SE (Germany)

- Medtronic (Ireland)

- DaVita Inc. (U.S.)

- Cardinal Health (U.S.)

- Sunrise Medical (U.S.)

- General Electric Company (U.S.)

- A&D Company, Limited (Japan)

- BAYADA Home Health Care (U.S.)

- Invacare Corporation (U.S.)

- Fresenius SE & Co KGaA (Germany)

- Baxter (U.S.)

- F. Hoffmann-La Roche Ltd (Switzerland)

- Health Care At Home Private Limited (India)

Latest Developments in Global Home Healthcare Market

- In May 2025, Axle Health, a pioneering technology company transforming home healthcare operations, announced a Series A financing round of USD10 million. The investment was led by F-Prime Capital, with participation from Y Combinator, Pear VC, and Lightbank. This funding aims to enhance Axle Health's AI-powered scheduling and routing algorithms, making them more efficient and responsive to real-world conditions. In addition, the company plans to accelerate the development of its generative AI patient engagement solutions, promising to further improve the patient experience and clinical outcomes

- In June 2025, Ellipsis Health, a San Francisco-based health-tech company, raised USD45 million in Series A-1 funding to expand its AI-powered care platform, Sage. Designed to alleviate the strain on healthcare systems facing staffing shortages, Sage autonomously communicates with patients between medical appointments, helping them understand discharge instructions, monitor medication adherence, arrange transportation, and more. The new funding, led by CVS Health Ventures, Salesforce, and Khosla Ventures, will help integrate Sage with electronic medical records, tailor its capabilities for specific diseases like diabetes and cancer, expand its customer portfolio, and support research to advance AI evaluation methods in healthcare

- In August 2025, Arintra, a Texas-based GenAI-native autonomous medical coding platform, raised USD21 million in a Series A funding round led by Peak XV Partners. Arintra aims to revolutionize the healthcare documentation process by automating medical coding, improving efficiency, and reducing the administrative burden in the healthcare industry. This investment marks a significant milestone in Arintra's growth, supporting its continued innovation and expansion in the AI-driven healthcare technology space

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.