Global Hpmc Hydroxypropyl Methylcellulose Market

Market Size in USD Billion

CAGR :

%

USD

5.35 Billion

USD

6.98 Billion

2025

2033

USD

5.35 Billion

USD

6.98 Billion

2025

2033

| 2026 –2033 | |

| USD 5.35 Billion | |

| USD 6.98 Billion | |

|

|

|

|

Hydroxypropyl Methylcellulose (HPMC) Market Size

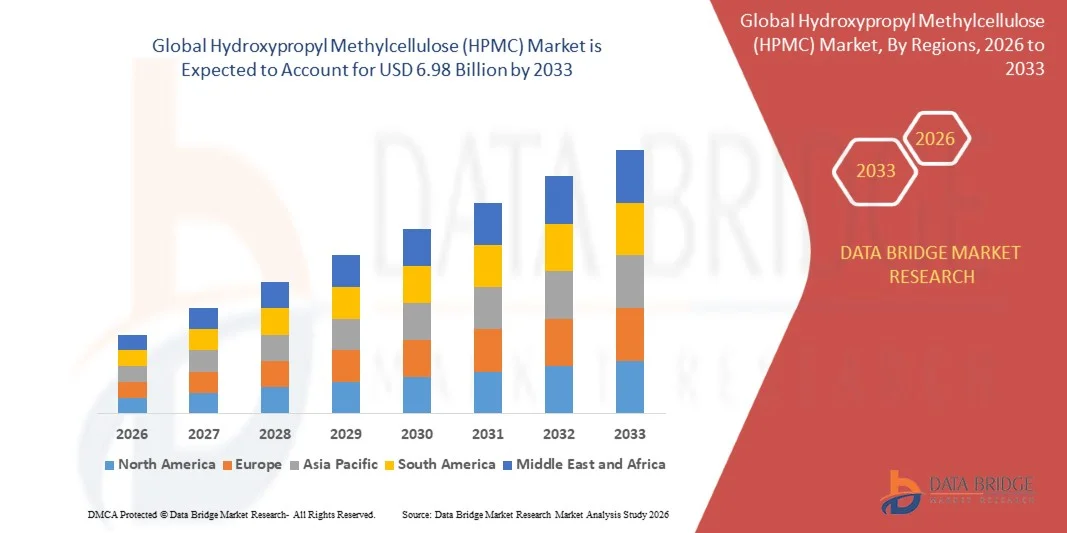

- The global Hydroxypropyl Methylcellulose (HPMC) market size was valued at USD 5.35 billion in 2025 and is expected to reach USD 6.98 billion by 2033, at a CAGR of 3.38% during the forecast period

- The market growth is largely fueled by rising demand for Hydroxypropyl Methylcellulose across construction, pharmaceutical, food, and personal care industries, supported by its multifunctional properties such as thickening, binding, water retention, and film forming, which enhance product performance and process efficiency

- Furthermore, rapid urbanization, increasing infrastructure development, and expanding pharmaceutical manufacturing are reinforcing the adoption of Hydroxypropyl Methylcellulose (HPMC) as a reliable and versatile cellulose ether. These converging factors are accelerating large-scale usage of Hydroxypropyl Methylcellulose (HPMC) across end-use sectors, thereby significantly strengthening overall market growth

Hydroxypropyl Methylcellulose (HPMC) Market Analysis

- Hydroxypropyl Methylcellulose, a non-ionic cellulose ether derived from natural polymers, plays a critical role in construction chemicals, drug formulations, food processing, and personal care products due to its stability, safety, and functional versatility

- The growing demand for Hydroxypropyl Methylcellulose (HPMC) is primarily driven by expansion of the construction sector, rising pharmaceutical production with focus on controlled-release formulations, and increasing preference for plant-based, non-toxic, and sustainable ingredients across industrial and consumer applications

- Asia-Pacific dominated the Hydroxypropyl Methylcellulose (HPMC) market with a share of 50.5% in 2025, due to rapid construction activity, expanding pharmaceutical manufacturing, and strong demand from food and personal care industries

- North America is expected to be the fastest growing region in the Hydroxypropyl Methylcellulose (HPMC) market during the forecast period due to rising pharmaceutical production, increasing demand for controlled-release formulations, and growing use of specialty construction chemicals

- Industrial grade HPMC segment dominated the market with a market share of 47% in 2025, due to its extensive use in construction applications such as cement, mortar, tile adhesives, and wall putty. Its superior water retention, thickening, and workability enhancement properties make it a preferred additive in large-scale infrastructure and residential construction projects. Rapid urbanization, increasing investment in real estate development, and rising demand for high-performance construction chemicals continue to support the dominance of this segment. Industrial grade HPMC also benefits from cost-effectiveness and high-volume consumption compared to other grades. Its stable demand across emerging and developed economies further reinforces its leading position in the overall HPMC market

Report Scope and Hydroxypropyl Methylcellulose (HPMC) Market Segmentation

|

Attributes |

Hydroxypropyl Methylcellulose (HPMC) Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Hydroxypropyl Methylcellulose (HPMC) Market Trends

“Rising Adoption of HPMC in Pharmaceutical and Controlled-Release Formulations”

- A notable trend in the Hydroxypropyl Methylcellulose (HPMC) market is the increasing use of Hydroxypropyl Methylcellulose (HPMC) in pharmaceutical and controlled-release formulations, driven by its ability to act as a reliable excipient, binder, and controlled-release matrix in tablets and capsules. This trend is enhancing the efficiency, safety, and effectiveness of oral drug delivery systems

- For instance, Ashland and Dow supply high-quality Hydroxypropyl Methylcellulose (HPMC) grades specifically designed for controlled-release pharmaceutical applications. Their products are widely used by leading pharmaceutical manufacturers to achieve consistent drug release profiles and improve patient compliance

- The adoption of Hydroxypropyl Methylcellulose (HPMC) in nutraceuticals and dietary supplements is rising, with its film-forming and stabilizing properties helping in capsule production and functional coating applications. This is positioning Hydroxypropyl Methylcellulose (HPMC) as a critical ingredient for enhancing product stability and shelf life

- In the personal care and cosmetic industry, Hydroxypropyl Methylcellulose (HPMC) is being incorporated in lotions, creams, and hair-care products to improve texture, viscosity, and moisture retention. Manufacturers are leveraging its multifunctional properties to develop higher-quality consumer formulations

- The food and beverage sector is expanding the use of Hydroxypropyl Methylcellulose (HPMC) for its emulsifying, thickening, and stabilizing capabilities in bakery, dairy, and gluten-free products. This trend is boosting demand for plant-based, vegan, and clean-label formulations that rely on natural hydrocolloids

- The market is witnessing growth in construction and building applications where Hydroxypropyl Methylcellulose (HPMC) is used as a thickener, water retention agent, and binder in tile adhesives, cement-based products, and plasters. Rising infrastructure development and renovation projects are reinforcing HPMC’s importance as a multifunctional additive

Hydroxypropyl Methylcellulose (HPMC) Market Dynamics

Driver

“Growing Demand from the Buildings and Construction Industry”

- The demand for Hydroxypropyl Methylcellulose (HPMC) in the construction sector is rising due to its ability to improve workability, water retention, and adhesion in cement-based products, mortar, and plaster. These properties support higher-quality finishes and longer-lasting construction materials

- For instance, BASF supplies HPMC-based additives for tile adhesives and self-leveling mortars, widely used in residential and commercial building projects. Their products help reduce material cracking, enhance application consistency, and improve overall structural performance

- Increasing infrastructure development in emerging economies is driving the adoption of Hydroxypropyl Methylcellulose (HPMC) as a key functional additive for modern construction practices. Its use ensures compliance with building standards and sustainability regulations

- Manufacturers in the construction chemical sector are innovating with Hydroxypropyl Methylcellulose (HPMC) derivatives to meet specific performance requirements such as enhanced flexibility, higher viscosity, and improved slump retention. These innovations are supporting more efficient on-site construction processes

- Urbanization and rising residential, commercial, and industrial construction activities continue to strengthen Hydroxypropyl Methylcellulose (HPMC) demand. The combination of functional performance, ease of use, and regulatory acceptance positions Hydroxypropyl Methylcellulose (HPMC) as an essential component for modern construction materials

Restraint/Challenge

“Fluctuating Raw Material Prices and Supply Chain Volatility”

- The Hydroxypropyl Methylcellulose (HPMC) market faces challenges due to the volatility of raw material costs, primarily cellulose derivatives and chemical reagents, which directly affect production expenses and profit margins. Price fluctuations can hinder consistent supply and impact smaller manufacturers more significantly

- For instance, Dow and Ashland report occasional raw material shortages affecting Hydroxypropyl Methylcellulose (HPMC) production timelines and regional distribution. Supply chain disruptions caused by transportation delays, regulatory compliance, or geopolitical factors can exacerbate cost instability

- Manufacturing Hydroxypropyl Methylcellulose (HPMC) requires high-quality cellulose and precise chemical processing to meet pharmaceutical, food, and construction-grade standards. Any inconsistency in raw material quality or availability can compromise end-product performance and market reliability

- Global logistics challenges, including shipping delays and import/export restrictions, add complexity to sourcing and distributing HPMC. This may result in delays for construction projects, pharmaceutical production, or food product launches

- Sustaining stable production while managing raw material costs remains a significant challenge for Hydroxypropyl Methylcellulose (HPMC) manufacturers. Companies must optimize supply chains and establish long-term agreements with suppliers to mitigate volatility and ensure uninterrupted product availability

Hydroxypropyl Methylcellulose (HPMC) Market Scope

The market is segmented on the basis of product type and end user.

• By Product Type

On the basis of product type, the Hydroxypropyl Methylcellulose (HPMC) market is segmented into industrial grade HPMC, pharmaceutical grade HPMC, and food grade HPMC. The industrial grade HPMC segment dominated the market with the largest revenue share of 47% in 2025, driven by its extensive use in construction applications such as cement, mortar, tile adhesives, and wall putty. Its superior water retention, thickening, and workability enhancement properties make it a preferred additive in large-scale infrastructure and residential construction projects. Rapid urbanization, increasing investment in real estate development, and rising demand for high-performance construction chemicals continue to support the dominance of this segment. Industrial grade HPMC also benefits from cost-effectiveness and high-volume consumption compared to other grades. Its stable demand across emerging and developed economies further reinforces its leading position in the overall Hydroxypropyl Methylcellulose (HPMC) market.

The pharmaceutical grade HPMC segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by the expanding pharmaceutical and nutraceutical industries worldwide. Pharmaceutical grade HPMC is widely used as a binder, film former, and controlled-release agent in tablets and capsules due to its safety, non-toxicity, and compatibility with active ingredients. Increasing production of generic drugs, rising prevalence of chronic diseases, and growing focus on advanced drug delivery systems are accelerating demand for this grade. Regulatory acceptance and growing adoption of plant-based excipients further support its rapid growth. Continuous innovation in oral solid dosage formulations is expected to sustain strong momentum for pharmaceutical grade HPMC during the forecast period.

• By End User

On the basis of end user, the Hydroxypropyl Methylcellulose (HPMC) market is segmented into pharmaceutical, buildings and construction, food and beverages, paints and coatings, personal care, adhesives, and others. The buildings and construction segment dominated the market in 2025, driven by large-scale consumption of Hydroxypropyl Methylcellulose (HPMC) in cement-based products and construction additives. Hydroxypropyl Methylcellulose (HPMC) improves water retention, adhesion, open time, and consistency, which are critical for achieving high-quality construction outcomes. Growing infrastructure development, renovation activities, and demand for energy-efficient and durable building materials continue to drive adoption. The segment benefits from steady demand in both residential and commercial construction projects. Its high-volume usage compared to other end-user industries reinforces its leading revenue contribution.

The pharmaceutical end-user segment is expected to register the fastest growth from 2026 to 2033, supported by increasing demand for excipients in drug formulation and manufacturing. Hydroxypropyl Methylcellulose (HPMC) is extensively used in pharmaceuticals for controlled drug release, coating applications, and capsule production due to its excellent film-forming and stability characteristics. Rising healthcare expenditure, expansion of pharmaceutical manufacturing capacities, and growth in generic and specialty medicines are key growth drivers. The shift toward safer, non-animal-derived excipients further accelerates adoption in this segment. Continuous advancements in drug formulation technologies are likely to sustain strong growth for pharmaceutical end users over the forecast period.

Hydroxypropyl Methylcellulose (HPMC) Market Regional Analysis

- Asia-Pacific dominated the Hydroxypropyl Methylcellulose (HPMC) market with the largest revenue share of 50.5% in 2025, driven by rapid construction activity, expanding pharmaceutical manufacturing, and strong demand from food and personal care industries

- The region’s cost-efficient production capabilities, availability of raw materials, and increasing investments in infrastructure and healthcare manufacturing are accelerating overall market growth

- Rising urbanization, supportive government initiatives, and large-scale industrialization across developing economies are contributing to higher consumption of Hydroxypropyl Methylcellulose (HPMC) across construction, pharmaceutical, and industrial applications

China Hydroxypropyl Methylcellulose (HPMC) Market Insight

China held the largest share in the Asia-Pacific Hydroxypropyl Methylcellulose (HPMC) market in 2025, owing to its dominant position in construction chemicals manufacturing and large-scale pharmaceutical production. The country’s robust infrastructure development, strong domestic demand for cement and mortar additives, and well-established chemical manufacturing base are key growth drivers. In addition, extensive export activity and continuous capacity expansion by domestic manufacturers support China’s leadership in the global Hydroxypropyl Methylcellulose (HPMC) market.

India Hydroxypropyl Methylcellulose (HPMC) Market Insight

India is witnessing the fastest growth in the Asia-Pacific region, supported by rapid growth in the pharmaceutical sector, rising construction activities, and increasing adoption of processed and packaged foods. Government initiatives promoting infrastructure development and pharmaceutical self-reliance are strengthening demand for Hydroxypropyl Methylcellulose (HPMC). Expanding domestic manufacturing capabilities and growing use of cellulose ethers in drug formulations and construction applications are further fueling market expansion.

Europe Hydroxypropyl Methylcellulose (HPMC) Market Insight

The Europe Hydroxypropyl Methylcellulose (HPMC) market is growing steadily, driven by strong demand for high-quality excipients in pharmaceuticals and increasing emphasis on sustainable construction materials. Strict regulatory standards and a focus on performance-enhancing additives are encouraging the use of premium-grade Hydroxypropyl Methylcellulose (HPMC) across multiple industries. Growth is further supported by rising renovation activities and advancements in controlled-release drug formulations.

Germany Hydroxypropyl Methylcellulose (HPMC) Market Insight

Germany’s Hydroxypropyl Methylcellulose (HPMC) market benefits from its advanced pharmaceutical industry, strong construction standards, and leadership in specialty chemicals. The country’s emphasis on precision manufacturing, innovation, and compliance with stringent quality norms drives consistent demand for pharmaceutical and industrial grade Hydroxypropyl Methylcellulose (HPMC). Well-established R&D infrastructure and strong collaboration between chemical producers and end users further support market growth.

U.K. Hydroxypropyl Methylcellulose (HPMC) Market Insight

The U.K. Hydroxypropyl Methylcellulose (HPMC) market is supported by a mature pharmaceutical sector, increasing focus on advanced drug delivery systems, and steady demand from specialty construction applications. Growth is reinforced by investments in life sciences, rising use of cellulose-based excipients, and ongoing infrastructure refurbishment projects. The market also benefits from strong regulatory oversight ensuring high-quality product adoption.

North America Hydroxypropyl Methylcellulose (HPMC) Market Insight

North America is projected to register the fastest CAGR from 2026 to 2033, driven by rising pharmaceutical production, increasing demand for controlled-release formulations, and growing use of specialty construction chemicals. Strong emphasis on innovation, sustainability, and high-performance materials is boosting Hydroxypropyl Methylcellulose (HPMC) adoption. Expansion of healthcare infrastructure and increasing consumption of processed foods are also contributing to regional growth.

U.S. Hydroxypropyl Methylcellulose (HPMC) Market Insight

The U.S. accounted for the largest share in the North America Hydroxypropyl Methylcellulose (HPMC) market in 2025, supported by its expansive pharmaceutical industry, advanced R&D ecosystem, and high demand for premium excipients. Strong construction activity, coupled with growing use of Hydroxypropyl Methylcellulose (HPMC) in personal care and food applications, continues to drive market demand. Presence of major manufacturers and a well-developed supply chain further reinforce the U.S.’s leading position in the region.

Hydroxypropyl Methylcellulose (HPMC) Market Share

The Hydroxypropyl Methylcellulose (HPMC) industry is primarily led by well-established companies, including:

- Shin-Etsu Chemical Co., Ltd. (Japan)

- Ashland (U.S.)

- DuPont (U.S.)

- LOTTE Fine Chemical (South Korea)

- Shandong Head Co., Ltd. (China)

- Shijiazhuang Shangdun Cellulose Co., LTD. (China)

- FENCHEM (China)

- Mitsubishi Chemical Holdings Corporation (Japan)

- Orison Chemicals Limited (India)

- Viachem (China)

- Paras Enterprises (India)

- Zhejiang Kelain New Materials Co., Ltd. (China)

- Paramount Chemical & Acid Corporation (India)

- Ottokemi (India)

Latest Developments in Global Hydroxypropyl Methylcellulose (HPMC) Market

- In November 2025, Lotte Fine Chemical announced the expansion of its cellulose ether production capacity to meet rising global demand from the construction and pharmaceutical sectors. This development strengthens the company’s ability to ensure stable supply, reduce lead times, and support growing consumption of Hydroxypropyl Methylcellulose (HPMC) in high-growth end-use industries, thereby intensifying competition among leading manufacturers

- In September 2025, Ashland launched its Hydroxypropyl Methylcellulose capsules portfolio, reflecting the company’s strategic focus on plant-based and clean-label pharmaceutical excipients. This product introduction enhances Ashland’s positioning in the pharmaceutical and nutraceutical segments, addressing rising consumer demand for vegetarian and sustainable dosage solutions while expanding its value-added offerings

- In July 2025, Shin-Etsu Chemical Co. of Japan entered into a strategic partnership with a leading pharmaceutical company to develop customized Hydroxypropyl Methylcellulose formulations. This collaboration reinforces Shin-Etsu’s focus on innovation and tailored solutions, enabling it to address specific formulation requirements and strengthen long-term relationships with pharmaceutical clients in a highly competitive market

- In March 2024, Colorcon announced investments in advanced formulation support services and technical centers for cellulose-based excipients, including HPMC. This initiative enhances customer support, accelerates product adoption, and improves formulation efficiency for pharmaceutical manufacturers, contributing to stronger brand differentiation in the excipients market

- In July 2021, Dow Chemical Company announced incremental, high-return capacity expansions aimed at addressing rising global demand for sustainable additives across performance materials and coatings markets. This move improved Dow’s supply capabilities and reinforced its commitment to innovation and sustainability, supporting long-term growth opportunities in HPMC-related and specialty additive applications

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Hpmc Hydroxypropyl Methylcellulose Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Hpmc Hydroxypropyl Methylcellulose Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Hpmc Hydroxypropyl Methylcellulose Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.