Global Humate Market

Market Size in USD Billion

CAGR :

%

USD

1.00 Billion

USD

2.33 Billion

2025

2033

USD

1.00 Billion

USD

2.33 Billion

2025

2033

| 2026 –2033 | |

| USD 1.00 Billion | |

| USD 2.33 Billion | |

|

|

|

|

Humate Market Size

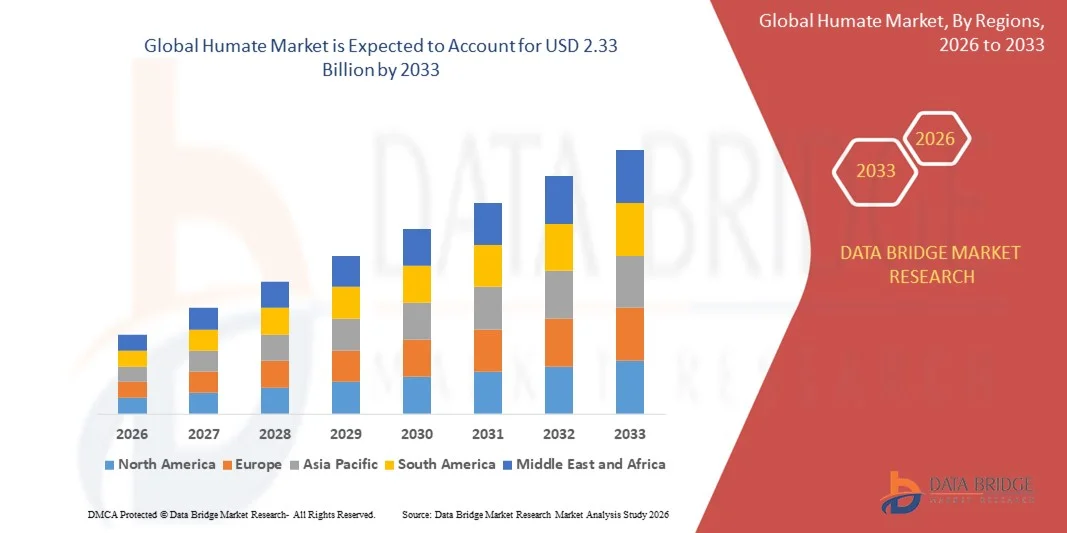

- The global humate market size was valued at USD 1.00 billion in 2025 and is expected to reach USD 2.33 billion by 2033, at a CAGR of 11.21% during the forecast period

- The market growth is largely fueled by the increasing adoption of organic and sustainable farming practices, along with advancements in humate extraction and formulation technologies, leading to enhanced soil fertility and crop productivity

- Furthermore, rising awareness among farmers and agribusinesses about eco-friendly soil amendments and nutrient-efficient fertilizers is establishing humates as a preferred solution for soil conditioning and crop yield enhancement. These converging factors are accelerating the uptake of humate products, thereby significantly boosting the industry’s growth

Humate Market Analysis

- Humates, derived from naturally occurring humic substances, are increasingly vital components of modern agricultural practices due to their ability to improve soil structure, nutrient retention, microbial activity, and water-holding capacity, supporting both conventional and organic farming

- The escalating demand for humates is primarily fueled by the growing focus on sustainable agriculture, increasing crop yield requirements, and expanding adoption of organic fertilizers and feed additives across commercial farming, horticulture, and turf management sectors

- Asia-Pacific dominated the humate market with a share of 39% in 2025, due to expanding agricultural activities, increasing adoption of organic and sustainable fertilizers, and a strong presence of humate production hubs

- North America is expected to be the fastest growing region in the humate market during the forecast period due to strong adoption of organic farming, increasing awareness of soil health, and expanding commercial agriculture practices

- Powder segment dominated the market with a market share of 52.5% in 2025, due to its ease of handling, solubility, and compatibility with various soil types and crop systems. Farmers and agricultural professionals often prefer powder humates for their rapid dispersion in irrigation systems and efficient nutrient delivery. The market also experiences strong demand for powder forms due to their adaptability in liquid fertilizers, foliar sprays, and soil amendments, enhancing crop yield and soil health. Powder humates are widely used in both small-scale and large-scale farming operations because of their cost-effectiveness and ease of storage. Their versatility in mixing with other nutrients and agrochemicals further strengthens their market position

Report Scope and Humate Market Segmentation

|

Attributes |

Humate Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Humate Market Trends

Growing Adoption of Organic and Sustainable Farming Practices

- A significant trend in the humate market is the increasing adoption of organic and sustainable farming practices, driven by the rising global emphasis on eco-friendly agriculture and soil health improvement. Humates are being integrated into conventional and organic fertilizers to enhance soil structure, nutrient retention, and crop productivity, positioning them as critical inputs for modern sustainable agriculture

- For instance, ACTAGRO’s Humic Acid 10% product, approved by California’s CDFA for certified organic agriculture, exemplifies the growing use of humates in premium organic farming segments, strengthening market confidence in plant-friendly soil amendments. Such certified products are accelerating adoption by farmers and agribusinesses seeking reliable, eco-conscious soil improvement solutions

- Increasing focus on soil regeneration and environmentally responsible crop production is encouraging the use of humates in large-scale agricultural applications. Companies such as Live Earth, with its Humate Soil Conditioner and Blitz 22 Plus Liquid Lawn Fertilizer, are driving awareness and adoption by offering products tailored to both turf management and high-value crops

- Expansion of humate applications in precision agriculture and controlled-release fertilizers is also a rising trend. The development of pilot-scale production lines by Grupa Azoty S.A. to supply humic acids supports large-scale adoption and demonstrates growing industrial interest in humates

- Emerging awareness of humates’ benefits in water retention, microbial activity enhancement, and nutrient efficiency is motivating agronomists and farmers to integrate humic-based amendments into routine farming practices

- The market is witnessing increasing research and innovation in humate formulations to cater to varied soil types, crops, and regional agricultural needs. This trend is reinforcing humates as essential enablers of sustainable, high-yield agriculture across global farming systems.

Humate Market Dynamics

Driver

Increasing Awareness of Soil Health and Crop Productivity

- The growing emphasis on improving soil fertility, crop yield, and sustainable farming practices is driving the humate market. Humates enhance microbial activity, nutrient uptake, water retention, and overall soil structure, which are vital for both conventional and organic agriculture, thereby encouraging widespread adoption

- For instance, Neova’s launch of its NeoTerra range of humate-enriched soil conditioners illustrates how companies are responding to farmer and agribusiness demand for soil health enhancement products. Such innovations support productivity while aligning with environmental sustainability and regulatory requirements in agriculture

- The rising global demand for higher crop output, coupled with the need for eco-friendly fertilizers and organic amendments, is reinforcing humates as a critical component in modern agricultural strategies

- Educational campaigns, agronomic consultancy, and collaborations between fertilizer companies and farming cooperatives are spreading knowledge about humates’ benefits, increasing trust, awareness, and market penetration

- This expanding awareness among farmers, agribusinesses, agricultural consultants, and distributors is significantly boosting the adoption of humates, reinforcing overall market growth and positioning humates as a key solution for soil health management across global regions

Restraint/Challenge

High Cost and Limited Availability of High-Quality Humates

- The humate market faces challenges due to the high cost of extraction, purification, and formulation processes, which can limit the availability of high-quality humates for large-scale agricultural use

- For instance, premium humic acid products from companies such as ACTAGRO, Borregaard, and Novihum Technologies GmbH provide certified quality and consistent performance, but their higher price points can restrict adoption among smallholder farmers and cost-sensitive agricultural regions

- Limited raw material availability, variability in humate quality depending on source deposits, and the technical complexity of processing further constrain supply chains, affecting timely delivery and market penetration

- The market also contends with competition from alternative soil amendments, chemical fertilizers, and synthetic growth promoters, which may be more readily available and lower cost, posing adoption barriers for high-quality humate products

- Furthermore, logistical challenges in transporting and storing humates without degrading their efficacy add another layer of constraint, reinforcing the need for technological innovation and strategic partnerships in the supply chain

Humate Market Scope

The market is segmented on the basis of type and application.

- By Type

On the basis of type, the humate market is segmented into powder, flake, and spherical. The powder segment dominated the market with the largest market revenue share of 52.5% in 2025, driven by its ease of handling, solubility, and compatibility with various soil types and crop systems. Farmers and agricultural professionals often prefer powder humates for their rapid dispersion in irrigation systems and efficient nutrient delivery. The market also experiences strong demand for powder forms due to their adaptability in liquid fertilizers, foliar sprays, and soil amendments, enhancing crop yield and soil health. Powder humates are widely used in both small-scale and large-scale farming operations because of their cost-effectiveness and ease of storage. Their versatility in mixing with other nutrients and agrochemicals further strengthens their market position.

The spherical segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by increasing adoption in controlled-release fertilizer formulations and specialized agricultural applications. Spherical humates offer uniformity in particle size, improving application efficiency and reducing nutrient loss. Their compatibility with automated seeding and fertilization systems makes them highly appealing for modern precision agriculture practices. The gradual release properties of spherical humates also enhance long-term soil fertility, attracting commercial farms focused on sustainability and productivity. Growing awareness of eco-friendly fertilization techniques contributes to the rising demand for spherical humate products.

- By Application

On the basis of application, the humate market is segmented into pharmaceutical, agriculture use fertilizer, feed additive, and others. The agriculture use fertilizer segment dominated the market with the largest market revenue share in 2025, driven by the increasing need to enhance soil fertility and crop productivity. Humates improve nutrient retention and microbial activity in soil, which boosts crop yield and reduces dependency on chemical fertilizers. For instance, leading companies such as Bio Huma Netics have developed humate-enriched fertilizers that are widely adopted in intensive farming regions. The segment also benefits from the growing focus on sustainable and organic farming practices, where humates serve as eco-friendly soil amendments. The widespread availability and cost-effectiveness of humates for large-scale agriculture further solidify their dominance in this application segment.

The feed additive segment is expected to witness the fastest CAGR from 2026 to 2033, driven by rising demand for natural growth promoters and health supplements in livestock and poultry farming. Humates improve nutrient absorption, gut health, and immunity in animals, reducing the reliance on antibiotics. Companies such as Alltech are investing in humate-based feed additives to enhance animal productivity and meet consumer demand for natural and safe products. Increasing awareness of animal welfare and sustainable livestock practices further fuels the adoption of humate feed additives. The segment’s growth is supported by regulatory encouragement for eco-friendly and non-chemical animal nutrition solutions.

Humate Market Regional Analysis

- Asia-Pacific dominated the humate market with the largest revenue share of 39% in 2025, driven by expanding agricultural activities, increasing adoption of organic and sustainable fertilizers, and a strong presence of humate production hubs

- The region’s cost-effective agricultural practices, rising investments in soil enhancement products, and growing export of humate-based fertilizers are accelerating market expansion

- The availability of skilled agricultural workforce, favorable government policies promoting organic farming, and rapid adoption of modern farming techniques across developing economies are contributing to increased consumption of humates

China Humate Market Insight

China held the largest share in the Asia-Pacific humate market in 2025, owing to its status as a leading agricultural producer and major humate manufacturer. The country's extensive farmland, government support for organic and sustainable farming practices, and strong export capabilities for humate-based fertilizers are major growth drivers. Demand is further bolstered by ongoing investments in soil improvement and crop yield enhancement programs for both domestic consumption and international markets.

India Humate Market Insight

India is witnessing the fastest growth in the Asia-Pacific region, fueled by a rapidly expanding agricultural sector, increasing adoption of organic farming practices, and growing investments in soil fertility enhancement. Government initiatives promoting sustainable agriculture, along with rising awareness of eco-friendly fertilizers, are strengthening the demand for humates. In addition, increasing crop exports and expanding R&D in soil nutrient solutions are contributing to robust market expansion.

Europe Humate Market Insight

The Europe humate market is expanding steadily, supported by stringent agricultural regulations, rising adoption of organic fertilizers, and growing investments in sustainable crop production. The region emphasizes soil health, environmental compliance, and high-quality inputs, particularly in horticulture and high-value crop cultivation. Increasing use of humate-based products in sustainable farming practices is further enhancing market growth.

Germany Humate Market Insight

Germany’s humate market is driven by its focus on sustainable agriculture, strong organic farming practices, and export-oriented crop production. The country has well-established agricultural research networks and collaborations between universities and fertilizer manufacturers, fostering innovation in humate-based soil amendments. Demand is particularly strong for use in high-value crops, organic fertilizers, and soil conditioning products.

U.K. Humate Market Insight

The U.K. market is supported by a mature agricultural sector, growing emphasis on organic and eco-friendly fertilizers, and increased demand for soil health improvement solutions. With rising investments in R&D, collaboration between academia and agricultural input companies, and adoption of humates in horticulture and specialty crop farming, the U.K. continues to play a significant role in high-value fertilizer markets.

North America Humate Market Insight

North America is projected to grow at the fastest CAGR from 2026 to 2033, driven by strong adoption of organic farming, increasing awareness of soil health, and expanding commercial agriculture practices. Rising focus on sustainable fertilizers, crop yield improvement, and technological integration in agriculture are boosting demand. In addition, increasing production of humate-based fertilizers and collaboration between agritech companies are supporting market expansion.

U.S. Humate Market Insight

The U.S. accounted for the largest share in the North America market in 2025, underpinned by its large-scale commercial farming, strong adoption of organic and sustainable fertilizers, and investment in soil health research. The country’s focus on agricultural innovation, regulatory compliance, and sustainability is encouraging the use of humates in both conventional and organic crop production. Presence of key players and a mature distribution network further solidify the U.S.'s leading position in the region.

Humate Market Share

The humate industry is primarily led by well-established companies, including:

- Koppert Biological Systems (Netherlands)

- Valagro (Italy)

- Biolchim SPA (Italy)

- Haifa Group (Israel)

- Novihum Technologies GmbH (Germany)

- Humintech A (Germany)

- Borregaard (Norway)

- QINGDAO FUTURE GROUP CO., LTD (China)

- Promisol (Spain)

- BioLine Corporation (U.S.)

- Humic Growth Solutions Inc. (U.S.)

- ACTAGRO (U.S.)

- Rovensa (Spain)

- TAGROW CO., LTD. (China)

- Cifo Srl (Italy)

- Loveland Products, Inc. (U.S.)

Latest Developments in Global Humate Market

- In October 2025, Neova launched its NeoTerra range of soil conditioners enriched with humic acids, designed to improve soil structure, water retention, and nutrient availability. This launch strengthens Neova’s product portfolio and positions the company to capture increasing demand for advanced organic soil health solutions. The introduction of these high-performance humate products is expected to drive adoption in both large-scale and precision agriculture, supporting sustainable farming practices and enhancing crop yields, thereby reinforcing market growth

- In June 2024, ACTAGRO’s Humic Acid 10% product received official approval from California’s CDFA as an organic input for certified organic agriculture. This certification validates its use in premium organic farming segments, increasing farmer confidence and driving market penetration. The approval also strengthens ACTAGRO’s position in the North American humate market, as organic and sustainable agriculture practices continue to expand, boosting demand for plant-friendly humate solutions

- In March 2024, the European Union enacted Commission Implementing Regulation (EU) 2024/749, approving lignosulfonate as a technological additive in animal feed for all species with defined content and sugar limits. This regulatory move indirectly supports the broader humate and related feed additive market by enhancing confidence in the safety and efficacy of humic-related compounds in livestock nutrition. It encourages manufacturers to incorporate humates into feed formulations, creating opportunities for market expansion and innovation in sustainable animal farming

- In August 2022, Live Earth introduced its Humate Soil Conditioner and Blitz 22 Plus Liquid Lawn Fertilizer, expanding its lineup of humic and fulvic acid-based products. These launches improve soil quality and nutrient uptake for both turf and agricultural applications, highlighting the growing commercial adoption of humates. The new products reinforce the company’s market presence and demonstrate rising interest among end-users in eco-friendly soil amendments that enhance plant growth and soil sustainability

- In September 2021, Grupa Azoty S.A. launched a pilot production line for humic acids with an annual capacity of 2,500 tonnes at its Implementation Centre in Tarnów. This development represents a significant step toward scaling up humate production in Europe while supporting the objectives of the European Green Deal. By investing in large-scale production, Grupa Azoty enhances supply capabilities, promotes sustainable agriculture, and strengthens the overall humate market by enabling wider availability for both agricultural and industrial applications

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Humate Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Humate Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Humate Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.