Global Hybrid Cloud Market

Market Size in USD Billion

CAGR :

%

USD

47.67 Billion

USD

135.98 Billion

2021

2029

USD

47.67 Billion

USD

135.98 Billion

2021

2029

| 2022 –2029 | |

| USD 47.67 Billion | |

| USD 135.98 Billion | |

|

|

|

|

Hybrid Cloud Market Analysis and Size

The digital transformation is expected to significantly increase revenue throughout the projected period in the global market for hybrid clouds. Moreover, the major players are using hybrid cloud platforms due to the benefits offered by the hybrid cloud to meet their present business requirements in line with digital transformation. Smaller businesses are also working on updating their IT infrastructure, accelerating market expansion. However, market expansion may be constrained during the anticipated timeframe by a lack of skills and weak security procedures.

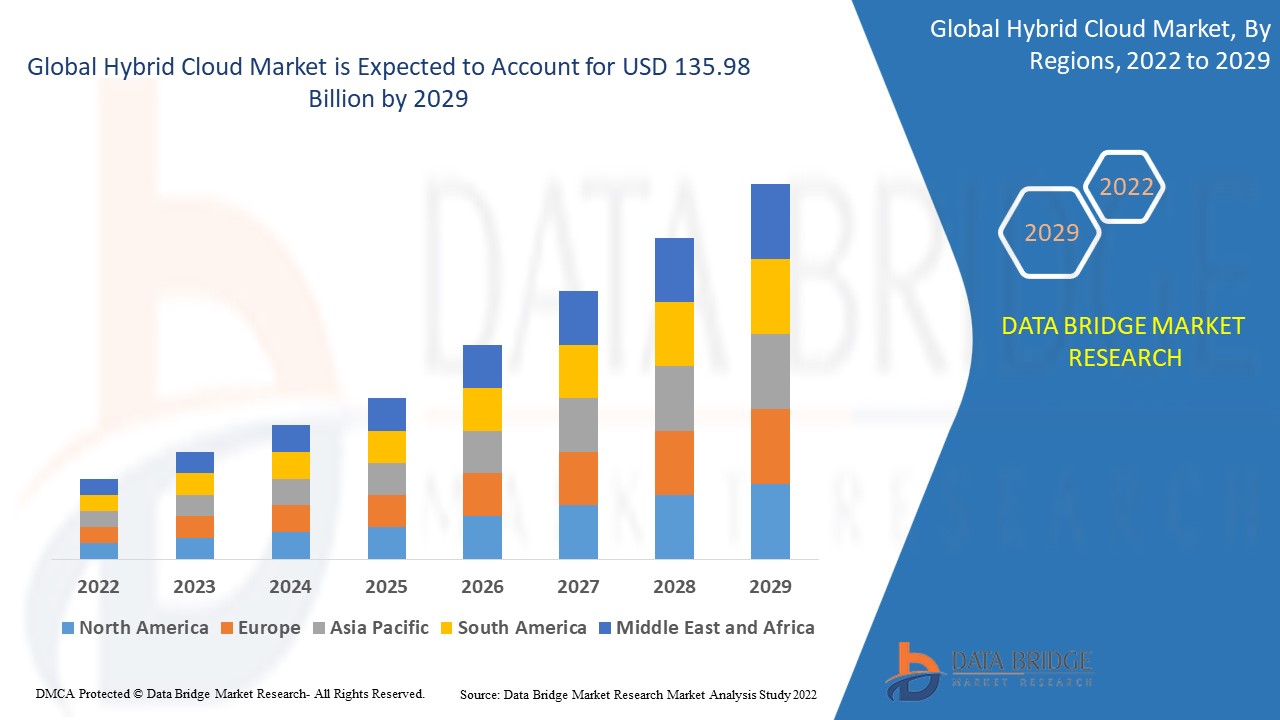

Hybrid cloud market was valued at USD 47.67 billion in 2021 and is expected to reach USD 135.98 billion by 2029, registering a CAGR of 14.00% during the forecast period of 2022-2029. In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis.

Hybrid Cloud Market Scope and Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2014 - 2019) |

|

Quantitative Units |

Revenue in USD Billion, Volumes in Units, Pricing in USD |

|

Segments Covered |

Component (Solution, Services), Service Type (Cloud Management and Orchestration, Disaster Recovery, Hybrid Hosting), Service Model (Infrastructure as a Service, Platform as a Service, Software as a Service), Workloads (Storage, Backup, and Disaster Recovery, Application Development and Testing, Database Management, Business Analytics, Integration and Orchestration, Customer Relationship Management, Enterprise Resource Management, Cloud Collaboration and Content Management, Others), Organization Size (Small and Medium-Sized Enterprises, Large Enterprises), Vertical (Banking, Financial Services, and Insurance, IT and Telecommunications, Government and Public Sector, Retail and Consumer Goods, Manufacturing, Energy and Utilities, Media and Entertainment, Healthcare and Life Sciences, Others) |

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America |

|

Market Players Covered |

General Electric (U.S.), IBM (U.S.), PTC (U.S.), Microsoft (U.S.), Siemens (Germany), ANSYS, Inc (U.S.), SAP SE (Germany), Robert Bosch GmbH (Germany), Swim Inc. (U.S.)., RACKSPACE TECHNOLOGY (U.S.), NetApp (U.S.), Atos SE (U.S.), Fujitsu (Japan), CenturyLink (U.S.), Hewlett Packard Enterprise Development LP (U.S.), Dell Inc., (U.S.), Cisco Systems Inc., (U.S.), AWS (U.S.), Oracle (U.S.), Google Inc., (U.S.), Atos SE (France), KELLTON TECH (India) |

|

Market Opportunities |

|

Market Definition

A cloud computing infrastructure known as a hybrid cloud integrates on-premises, private, public, and third-party cloud services. Integrating, automating, and managing a computing environment permits the mobility of workloads across public and private platforms. Three different service models—Infrastructure as a Service, Platform as a Service, and Software as a Service—are typically used in hybrid cloud architecture. Additionally, it makes use of a private cloud that is either hosted on-site or by a different cloud service provider, as well as dependable wide-area network (WAN) connectivity between the environments.

Hybrid Cloud Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints and challenges. All of this is discussed in detail as below:

Drivers

- Escalating Need For Flexible, Scalable and Economical Computing

The businesses are using the hybrid cloud approach to get rid of problems that are hard to solve with conventional IT infrastructure. Hybrid cloud is bridging the gap between IT and companies by increasing agility and efficiency and swiftly delivering IT resources at a reasonable cost. It gives businesses the opportunity to expand their infrastructure and applications as needed and provides users with excellent performance and availability. Scalable economies of scale are offered by hybrid clouds, while at the same time, enterprises' sensitive data is protected. Organizations would be more likely to explore various operational avenues if secure, scalable, and affordable resources were more readily available, which would encourage the adoption of the hybrid cloud environment. This factor will largely boost over the forecast period.

- High Usage across Retail Sector

Another benefit of hybrid cloud solutions for retailers is a cost-effective, secure infrastructure that can scale, provide cutting-edge services to customers, and provide businesses a competitive edge. This is because this approach offers a secure firewall for private services and enough integration for public ones, many major and medium-sized shops are embracing hybrid cloud computing solutions. With a second-highest rate of hybrid cloud deployments at 21%, the retail sector outperforms the norm for all other industries globally in its acceptance of hybrid cloud. Clothing e-commerce sites, in particular, can choose to convert to a hybrid cloud architecture for various functions to maintain smooth business operations. Order processing and resource scalability management could be handled using public cloud resources. On the other hand, the private cloud approach might be utilized to work on regulatory requirements, including vital data like client payment information that requires rigorous supervision. As a result, the high usage across retail sector will bolster the market’s growth rate over the forecast period.

Furthermore, it also provides a number of advantages, including complete support for the remote workforce, reduced operational expenses, and enhanced scalability, control, security, and risk management, which will accelerate the overall market expansion during the forecast period. Moreover, it has many applications in a variety of industries, including manufacturing, retail, banking, and financial services and insurance (BFSI), as well as information technology (IT), healthcare, and public and government sectors, which is anticipated to drive the growth rate of the hybrid cloud market. The widespread adoption of cloud-computing services will further positively impact the market's growth rate during the forecast period.

Opportunities

- Emergence of Hybrid IT Services

The emergence of hybrid IT services is estimated to generate lucrative opportunities for the market, which will further expand the hybrid cloud market's growth rate in the future. In an enterprise computing strategy known as hybrid IT services, a firm manages and offers some information technology resources internally while using cloud-based services for others. This enables an organization to experiment with cloud computing while maintaining a centralized approach to IT governance. IT architectures are changing as a result of hybrid IT, which is a blend of internal and external services—typically internal and public clouds. Cloud consulting, implementation, migration, automation, containerization as a service, full managed services, and other services are included in hybrid IT.

- Various Technological Advancements

Additionally, the various technological advancements further offer numerous growth opportunities within the market. The integration of artificial intelligence (AI), the Internet of Things (IoT), machine learning (ML), and edge computing, among other technical breakthroughs, are supporting the market's expansion. The market is anticipated to be further fueled by additional factors such as rising Software-as-a-Service (SaaS), multi-cloud adoption rates and advancements in IT infrastructure.

Restraints/Challenges

- High Cost and Investments

The adoption of the hybrid cloud has been hampered by the lack of knowledge regarding privacy and security risks. Users' adoption of the hybrid cloud is being hampered by their lack of knowledge of its security advantages. Enterprises are hesitant to migrate their operations to the cloud because of privacy and data security concerns. The ambiguity around cloud governance increases the limitations for hybrid clouds. To reduce risks and enhance security features, cloud processes must be regularly monitored. This factor is therefore further expected to obstruct market growth over the forecast period.

- Lack of Technical Expertise

Lack of skilled workers or technological know-how, particularly in developing and underdeveloped economies, will further impede the market's growth rate. The dearth of technical expertise is therefore estimated to be significant challenge for the hybrid cloud market over the forecast period.

This hybrid cloud market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the hybrid cloud market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

COVID-19 Impact on Hybrid Cloud Market

Coronavirus has a negative impact on small, medium, and large businesses right now. The whole shutdown had a negative impact on the production units. In 2020, a lack of labour and government regulations caused the market to decline.

The hybrid cloud market was however positively impacted by the outbreak of COVID-19, as the epidemic forced the major businesses to make investments in cloud services to upgrade the technical foundation for long-term success. The COVID-19 epidemic forced the major businesses to make investments in cloud services to upgrade the technical foundation for long-term success. The COVID-19 pandemic's acceptance of work-from-home models has led to a higher and faster rate of large businesses adopting hybrid cloud solutions, which will boost the market's expansion. This has led to a higher and faster rate of large businesses adopting hybrid cloud solutions, which will boost the market's expansion.

Recent Developments

- In October 2021, Citrix Systems and Google Cloud, Citrix will introduce a new Desktop-as-a-Service (DaaS) offering on Google Cloud in a recently announced partnership. To support the seamless delivery of virtualized applications and desktops on Google Cloud, the service makes use of Citrix's management plan and HDX protocol.

- In August 2021, Tech Mahindra revealed that it had strengthened its partnership with Microsoft to improve hybrid cloud capabilities. The partnership aims to make use of Microsoft Azure Stack HCI, a fresh hyper-converged infrastructure (HCI) solution, to hasten the transition to a hybrid cloud, gather virtualized workloads, and strengthen business resiliency.

Global Hybrid Cloud Market Scope

The hybrid cloud market is segmented on the basis of component, service type, service model, workloads, organization size and vertical. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Component

- Solution

- Services

Service Type

- Cloud Management and Orchestration

- Disaster Recovery

- Hybrid Hosting

Service Model

- Infrastructure as a Service

- Platform as a Service

- Software as a Service

Workloads

- Storage

- Backup and Disaster Recovery

- Application Development and Testing

- Database Management

- Business Analytics

- Integration and Orchestration

- Customer Relationship Management

- Enterprise Resource Management

- Cloud Collaboration and Content Management

- Others

Organization Size

- Small and Medium-Sized Enterprises

- Large Enterprises

Vertical

- Banking

- Financial Services and Insurance

- IT and Telecommunications

- Government and Public Sector

- Retail and Consumer Goods

- Manufacturing

- Energy and Utilities

- Media and Entertainment

- Healthcare and Life Sciences

- Others

Hybrid Cloud Market Regional Analysis/Insights

The hybrid cloud market is analyzed and market size insights and trends are provided by country, component, service type, service model, workloads, organization size and vertical as referenced above.

The countries covered in the hybrid cloud market report U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

North America dominates the hybrid cloud market because of the presence of a well-established infrastructure and low labor costs in the advancing countries within the region over the forecast period of 2022 to 2029. Moreover, the effective after-sale services offered by manufacturers within the economies is further estimated to accelerate the expansion over the forecast period.

Asia-Pacific is expected to witness significant growth during the forecast period of 2022 to 2029 due to the region's high demand for scalable and cost efficient computing. Moreover, the growth in digital services and their applications further expands the regional market.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Hybrid Cloud Market Share Analysis

The hybrid cloud market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to hybrid cloud market.

Some of the major players operating in the hybrid cloud market are

- General Electric (U.S.)

- IBM (U.S.)

- PTC (U.S.)

- Microsoft (U.S.)

- Siemens (Germany)

- ANSYS, Inc (U.S.)

- SAP SE (Germany)

- Robert Bosch GmbH (Germany)

- Swim Inc. (U.S.)

- RACKSPACE TECHNOLOGY (U.S.)

- NetApp (U.S.)

- Atos SE (U.S.)

- Fujitsu (Japan)

- CenturyLink (U.S.)

- Hewlett Packard Enterprise Development LP (U.S.)

- Dell Inc., (U.S.)

- Cisco Systems Inc., (U.S.)

- AWS (U.S.)

- Oracle (U.S.)

- Google Inc., (U.S.)

- Atos SE (France)

- KELLTON TECH (India)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL HYBRID CLOUD MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.1.1 ARRIVING AT THE GLOBAL HYBRID CLOUD MARKET

2.1.2 VENDOR POSITIONING GRID

2.1.3 TECHNOLOGY LIFE LINE CURVE

2.1.4 MARKET GUIDE

2.1.5 COMPANY POSITIONING GRID

2.1.6 COMAPANY MARKET SHARE ANALYSIS

2.1.7 MULTIVARIATE MODELLING

2.1.8 TOP TO BOTTOM ANALYSIS

2.1.9 STANDARDS OF MEASUREMENT

2.1.10 VENDOR SHARE ANALYSIS

2.1.11 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.1.12 DATA POINTS FROM KEY SECONDARY DATABASES

2.2 GLOBAL HYBRID CLOUD MARKET: RESEARCH SNAPSHOT

2.3 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHT

5.1 PORTERS FIVE FORCES

5.2 REGULATORY STANDARDS

5.3 TECHNOLOGICAL TRENDS

5.4 PATENT ANALYSIS

5.5 CASE STUDY

5.6 VALUE CHAIN ANALYSIS

5.7 COMPANY COMPARITIVE ANALYSIS

6 GLOBAL HYBRID CLOUD MARKET, BY OFFERING

6.1 OVERVIEW

6.2 SOLUTION

6.3 SERVICES

6.3.1 BY SERVICE TYPE

6.3.1.1. CLOUD MANAGEMENT & ORCHESTRATION

6.3.1.2. DISASTER RECOVERY

6.3.1.3. HYBRID HOSTING

6.3.2 BY SERVICE MODEL

6.3.2.1. INFRASTRUCTURE-AS-A-SERVICE (IAAS)

6.3.2.2. PLATFORM-AS-A-SERVICE (PAAS)

6.3.2.3. SOFTWARE-AS-A-SERVICE (SAAS)

7 GLOBAL HYBRID CLOUD MARKET, BY ENVIRONMENT TYPE

7.1 OVERVIEW

7.2 PUBLIC CLOUD

7.3 ON-PREMISE PRIVATE CLOUD

7.4 HOSTED PRIVATE CLOUD

7.5 ON-PREMISE (LEGACY)

8 GLOBAL HYBRID CLOUD MARKET, BY ENTERPRISE SIZE

8.1 OVERVIEW

8.2 SMALL & MEDIUM SIZE ENTERPRISE

8.3 LARGE SIZE ENTERPRISE

9 GLOBAL HYBRID CLOUD MARKET, BY WORKLOADS

9.1 OVERVIEW

9.2 STORAGE, BACKUP, & DISASTER RECOVERY

9.3 APPLICATION DEVELOPMENT & TESTING

9.4 DATABASE MANAGEMENT

9.5 INTEGRATION & ORCHESTRATION

9.6 CUSTOMER RELATIONSHIP MANAGEMENT

9.7 ENTERPRISE RESOURCE MANAGEMENT

9.8 CLOUD COLLABBORATION & CONTENT MANAGEMENT

9.9 OTHERS

10 GLOBAL HYBRID CLOUD MARKET, BY END USER

10.1 OVERVIEW

10.2 BFSI

10.2.1 BY OFFERING

10.2.1.1. SOLUTION

10.2.1.2. SERVICES

10.2.1.2.1. BY SERVICE TYPE

10.2.1.2.1.1 CLOUD MANAGEMENT & ORCHESTRATION

10.2.1.2.1.2 DISASTER RECOVERY

10.2.1.2.1.3 HYBRID HOSTING

10.2.1.2.2. BY SERVICE MODEL

10.2.1.2.2.1 INFRASTRUCTURE-AS-A-SERVICE (IAAS)

10.2.1.2.2.2 PLATFORM-AS-A-SERVICE (PAAS)

10.2.1.2.2.3 SOFTWARE-AS-A-SERVICE (SAAS)

10.3 IT & TELECOMMUNICATION

10.3.1 BY OFFERING

10.3.1.1. SOLUTION

10.3.1.2. SERVICES

10.3.1.2.1. BY SERVICE TYPE

10.3.1.2.1.1 CLOUD MANAGEMENT & ORCHESTRATION

10.3.1.2.1.2 DISASTER RECOVERY

10.3.1.2.1.3 HYBRID HOSTING

10.3.1.2.2. BY SERVICE MODEL

10.3.1.2.2.1 INFRASTRUCTURE-AS-A-SERVICE (IAAS)

10.3.1.2.2.2 PLATFORM-AS-A-SERVICE (PAAS)

10.3.1.2.2.3 SOFTWARE-AS-A-SERVICE (SAAS)

10.4 HEALTHCARE

10.4.1 BY OFFERING

10.4.1.1. SOLUTION

10.4.1.2. SERVICES

10.4.1.2.1. BY SERVICE TYPE

10.4.1.2.1.1 CLOUD MANAGEMENT & ORCHESTRATION

10.4.1.2.1.2 DISASTER RECOVERY

10.4.1.2.1.3 HYBRID HOSTING

10.4.1.2.2. BY SERVICE MODEL

10.4.1.2.2.1 INFRASTRUCTURE-AS-A-SERVICE (IAAS)

10.4.1.2.2.2 PLATFORM-AS-A-SERVICE (PAAS)

10.4.1.2.2.3 SOFTWARE-AS-A-SERVICE (SAAS)

10.5 RETAIL

10.5.1 BY OFFERING

10.5.1.1. SOLUTION

10.5.1.2. SERVICES

10.5.1.2.1. BY SERVICE TYPE

10.5.1.2.1.1 CLOUD MANAGEMENT & ORCHESTRATION

10.5.1.2.1.2 DISASTER RECOVERY

10.5.1.2.1.3 HYBRID HOSTING

10.5.1.2.2. BY SERVICE MODEL

10.5.1.2.2.1 INFRASTRUCTURE-AS-A-SERVICE (IAAS)

10.5.1.2.2.2 PLATFORM-AS-A-SERVICE (PAAS)

10.5.1.2.2.3 SOFTWARE-AS-A-SERVICE (SAAS)

10.6 MEDIA & ENTERTAINMENT

10.6.1 BY OFFERING

10.6.1.1. SOLUTION

10.6.1.2. SERVICES

10.6.1.2.1. BY SERVICE TYPE

10.6.1.2.1.1 CLOUD MANAGEMENT & ORCHESTRATION

10.6.1.2.1.2 DISASTER RECOVERY

10.6.1.2.1.3 HYBRID HOSTING

10.6.1.2.2. BY SERVICE MODEL

10.6.1.2.2.1 INFRASTRUCTURE-AS-A-SERVICE (IAAS)

10.6.1.2.2.2 PLATFORM-AS-A-SERVICE (PAAS)

10.6.1.2.2.3 SOFTWARE-AS-A-SERVICE (SAAS)

10.7 MANUFACTURING

10.7.1 BY OFFERING

10.7.1.1. SOLUTION

10.7.1.2. SERVICES

10.7.1.2.1. BY SERVICE TYPE

10.7.1.2.1.1 CLOUD MANAGEMENT & ORCHESTRATION

10.7.1.2.1.2 DISASTER RECOVERY

10.7.1.2.1.3 HYBRID HOSTING

10.7.1.2.2. BY SERVICE MODEL

10.7.1.2.2.1 INFRASTRUCTURE-AS-A-SERVICE (IAAS)

10.7.1.2.2.2 PLATFORM-AS-A-SERVICE (PAAS)

10.7.1.2.2.3 SOFTWARE-AS-A-SERVICE (SAAS)

10.8 GOVERNMENT

10.8.1 BY OFFERING

10.8.1.1. SOLUTION

10.8.1.2. SERVICES

10.8.1.2.1. BY SERVICE TYPE

10.8.1.2.1.1 CLOUD MANAGEMENT & ORCHESTRATION

10.8.1.2.1.2 DISASTER RECOVERY

10.8.1.2.1.3 HYBRID HOSTING

10.8.1.2.2. BY SERVICE MODEL

10.8.1.2.2.1 INFRASTRUCTURE-AS-A-SERVICE (IAAS)

10.8.1.2.2.2 PLATFORM-AS-A-SERVICE (PAAS)

10.8.1.2.2.3 SOFTWARE-AS-A-SERVICE (SAAS)

10.9 TRANSPORTATION & LOGISTICS

10.9.1 BY OFFERING

10.9.1.1. SOLUTION

10.9.1.2. SERVICES

10.9.1.2.1. BY SERVICE TYPE

10.9.1.2.1.1 CLOUD MANAGEMENT & ORCHESTRATION

10.9.1.2.1.2 DISASTER RECOVERY

10.9.1.2.1.3 HYBRID HOSTING

10.9.1.2.2. BY SERVICE MODEL

10.9.1.2.2.1 INFRASTRUCTURE-AS-A-SERVICE (IAAS)

10.9.1.2.2.2 PLATFORM-AS-A-SERVICE (PAAS)

10.9.1.2.2.3 SOFTWARE-AS-A-SERVICE (SAAS)

10.1 TRAVEL & HOSPITALITY

10.10.1 BY OFFERING

10.10.1.1. SOLUTION

10.10.1.2. SERVICES

10.10.1.2.1. BY SERVICE TYPE

10.10.1.2.1.1 CLOUD MANAGEMENT & ORCHESTRATION

10.10.1.2.1.2 DISASTER RECOVERY

10.10.1.2.1.3 HYBRID HOSTING

10.10.1.2.2. BY SERVICE MODEL

10.10.1.2.2.1 INFRASTRUCTURE-AS-A-SERVICE (IAAS)

10.10.1.2.2.2 PLATFORM-AS-A-SERVICE (PAAS)

10.10.1.2.2.3 SOFTWARE-AS-A-SERVICE (SAAS)

10.11 EDUCATION

10.11.1 BY OFFERING

10.11.1.1. SOLUTION

10.11.1.2. SERVICES

10.11.1.2.1. BY SERVICE TYPE

10.11.1.2.1.1 CLOUD MANAGEMENT & ORCHESTRATION

10.11.1.2.1.2 DISASTER RECOVERY

10.11.1.2.1.3 HYBRID HOSTING

10.11.1.2.2. BY SERVICE MODEL

10.11.1.2.2.1 INFRASTRUCTURE-AS-A-SERVICE (IAAS)

10.11.1.2.2.2 PLATFORM-AS-A-SERVICE (PAAS)

10.11.1.2.2.3 SOFTWARE-AS-A-SERVICE (SAAS)

10.12 OTHERS

11 GLOBAL HYBRID CLOUD MARKET, BY GEOGRAPHY

11.1 GLOBAL HYBRID CLOUD MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

11.1.1 NORTH AMERICA

11.1.1.1. U.S.

11.1.1.2. CANADA

11.1.1.3. MEXICO

11.1.2 EUROPE

11.1.2.1. GERMANY

11.1.2.2. FRANCE

11.1.2.3. U.K.

11.1.2.4. ITALY

11.1.2.5. SPAIN

11.1.2.6. RUSSIA

11.1.2.7. TURKEY

11.1.2.8. BELGIUM

11.1.2.9. NETHERLANDS

11.1.2.10. NORWAY

11.1.2.11. FINLAND

11.1.2.12. SWITZERLAND

11.1.2.13. DENMARK

11.1.2.14. SWEDEN

11.1.2.15. POLAND

11.1.2.16. REST OF EUROPE

11.1.3 ASIA PACIFIC

11.1.3.1. JAPAN

11.1.3.2. CHINA

11.1.3.3. SOUTH KOREA

11.1.3.4. INDIA

11.1.3.5. AUSTRALIA

11.1.3.6. NEW ZEALAND

11.1.3.7. SINGAPORE

11.1.3.8. THAILAND

11.1.3.9. MALAYSIA

11.1.3.10. INDONESIA

11.1.3.11. PHILIPPINES

11.1.3.12. TAIWAN

11.1.3.13. VIETNAM

11.1.3.14. REST OF ASIA PACIFIC

11.1.4 SOUTH AMERICA

11.1.4.1. BRAZIL

11.1.4.2. ARGENTINA

11.1.4.3. REST OF SOUTH AMERICA

11.1.5 MIDDLE EAST AND AFRICA

11.1.5.1. SOUTH AFRICA

11.1.5.2. EGYPT

11.1.5.3. SAUDI ARABIA

11.1.5.4. U.A.E

11.1.5.5. OMAN

11.1.5.6. BAHRAIN

11.1.5.7. ISRAEL

11.1.5.8. KUWAIT

11.1.5.9. QATAR

11.1.5.10. REST OF MIDDLE EAST AND AFRICA

11.2 KEY PRIMARY INSIGHTS: BY MAJOR COUNTRIES

12 GLOBAL HYBRID CLOUD MARKET,COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: GLOBAL

12.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

12.3 COMPANY SHARE ANALYSIS: EUROPE

12.4 COMPANY SHARE ANALYSIS: ASIA PACIFIC

12.5 MERGERS & ACQUISITIONS

12.6 NEW PRODUCT DEVELOPMENT AND APPROVALS

12.7 EXPANSIONS

12.8 REGULATORY CHANGES

12.9 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

13 GLOBAL HYBRID CLOUD MARKET, SWOT & DBMR ANALYSIS

14 GLOBAL HYBRID CLOUD MARKET, COMPANY PROFILE

14.1 GOOGLE

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 GEOGRAPHIC PRESENCE

14.1.4 PRODUCT PORTFOLIO

14.1.5 RECENT DEVELOPMENT

14.2 MICROSOFT

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 GEOGRAPHIC PRESENCE

14.2.4 PRODUCT PORTFOLIO

14.2.5 RECENT DEVELOPMENT

14.3 AMAZON WEB SERVICES, INC.

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 GEOGRAPHIC PRESENCE

14.3.4 PRODUCT PORTFOLIO

14.3.5 RECENT DEVELOPMENT

14.4 ORACLE

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 GEOGRAPHIC PRESENCE

14.4.4 PRODUCT PORTFOLIO

14.4.5 RECENT DEVELOPMENT

14.5 CISCO SYSTEMS, INC.

14.5.1 COMPANY SNAPSHOT

14.5.2 REVENUE ANALYSIS

14.5.3 GEOGRAPHIC PRESENCE

14.5.4 PRODUCT PORTFOLIO

14.5.5 RECENT DEVELOPMENT

14.6 IBM

14.6.1 COMPANY SNAPSHOT

14.6.2 REVENUE ANALYSIS

14.6.3 GEOGRAPHIC PRESENCE

14.6.4 PRODUCT PORTFOLIO

14.6.5 RECENT DEVELOPMENT

14.7 NETAPP

14.7.1 COMPANY SNAPSHOT

14.7.2 REVENUE ANALYSIS

14.7.3 GEOGRAPHIC PRESENCE

14.7.4 PRODUCT PORTFOLIO

14.7.5 RECENT DEVELOPMENT

14.8 VMWARE, INC.

14.8.1 COMPANY SNAPSHOT

14.8.2 REVENUE ANALYSIS

14.8.3 GEOGRAPHIC PRESENCE

14.8.4 PRODUCT PORTFOLIO

14.8.5 RECENT DEVELOPMENT

14.9 CITRIX SYSTEMS, INC.

14.9.1 COMPANY SNAPSHOT

14.9.2 REVENUE ANALYSIS

14.9.3 GEOGRAPHIC PRESENCE

14.9.4 PRODUCT PORTFOLIO

14.9.5 RECENT DEVELOPMENT

14.1 HEWLETT PACKARD ENTERPRISE DEVELOPMENT LP

14.10.1 COMPANY SNAPSHOT

14.10.2 REVENUE ANALYSIS

14.10.3 GEOGRAPHIC PRESENCE

14.10.4 PRODUCT PORTFOLIO

14.10.5 RECENT DEVELOPMENT

14.11 NUTANIX

14.11.1 COMPANY SNAPSHOT

14.11.2 REVENUE ANALYSIS

14.11.3 GEOGRAPHIC PRESENCE

14.11.4 PRODUCT PORTFOLIO

14.11.5 RECENT DEVELOPMENT

14.12 HITACHI VANTARA LLC

14.12.1 COMPANY SNAPSHOT

14.12.2 REVENUE ANALYSIS

14.12.3 GEOGRAPHIC PRESENCE

14.12.4 PRODUCT PORTFOLIO

14.12.5 RECENT DEVELOPMENT

14.13 CLOUDFLARE, INC.

14.13.1 COMPANY SNAPSHOT

14.13.2 REVENUE ANALYSIS

14.13.3 GEOGRAPHIC PRESENCE

14.13.4 PRODUCT PORTFOLIO

14.13.5 RECENT DEVELOPMENT

14.14 FORTINET, INC.

14.14.1 COMPANY SNAPSHOT

14.14.2 REVENUE ANALYSIS

14.14.3 GEOGRAPHIC PRESENCE

14.14.4 PRODUCT PORTFOLIO

14.14.5 RECENT DEVELOPMENT

14.15 INTEL CORPORATION

14.15.1 COMPANY SNAPSHOT

14.15.2 REVENUE ANALYSIS

14.15.3 GEOGRAPHIC PRESENCE

14.15.4 PRODUCT PORTFOLIO

14.15.5 RECENT DEVELOPMENT

14.16 LUMEN TECHNOLOGIES

14.16.1 COMPANY SNAPSHOT

14.16.2 REVENUE ANALYSIS

14.16.3 GEOGRAPHIC PRESENCE

14.16.4 PRODUCT PORTFOLIO

14.16.5 RECENT DEVELOPMENT

14.17 HCL TECHNOLOGIES LIMITED

14.17.1 COMPANY SNAPSHOT

14.17.2 REVENUE ANALYSIS

14.17.3 GEOGRAPHIC PRESENCE

14.17.4 PRODUCT PORTFOLIO

14.17.5 RECENT DEVELOPMENT

14.18 DELL INC.

14.18.1 COMPANY SNAPSHOT

14.18.2 REVENUE ANALYSIS

14.18.3 GEOGRAPHIC PRESENCE

14.18.4 PRODUCT PORTFOLIO

14.18.5 RECENT DEVELOPMENT

14.19 TELEFONAKTIEBOLAGET LM ERICSSON

14.19.1 COMPANY SNAPSHOT

14.19.2 REVENUE ANALYSIS

14.19.3 GEOGRAPHIC PRESENCE

14.19.4 PRODUCT PORTFOLIO

14.19.5 RECENT DEVELOPMENT

14.2 FUJITSU

14.20.1 COMPANY SNAPSHOT

14.20.2 REVENUE ANALYSIS

14.20.3 GEOGRAPHIC PRESENCE

14.20.4 PRODUCT PORTFOLIO

14.20.5 RECENT DEVELOPMENT

14.21 ACCENTURE

14.21.1 COMPANY SNAPSHOT

14.21.2 REVENUE ANALYSIS

14.21.3 GEOGRAPHIC PRESENCE

14.21.4 PRODUCT PORTFOLIO

14.21.5 RECENT DEVELOPMENT

14.22 PURE STORAGE, INC.

14.22.1 COMPANY SNAPSHOT

14.22.2 REVENUE ANALYSIS

14.22.3 GEOGRAPHIC PRESENCE

14.22.4 PRODUCT PORTFOLIO

14.22.5 RECENT DEVELOPMENT

14.23 QUEST SOFTWARE INC.

14.23.1 COMPANY SNAPSHOT

14.23.2 REVENUE ANALYSIS

14.23.3 GEOGRAPHIC PRESENCE

14.23.4 PRODUCT PORTFOLIO

14.23.5 RECENT DEVELOPMENT

14.24 UNITAS GLOBAL

14.24.1 COMPANY SNAPSHOT

14.24.2 REVENUE ANALYSIS

14.24.3 GEOGRAPHIC PRESENCE

14.24.4 PRODUCT PORTFOLIO

14.24.5 RECENT DEVELOPMENT

14.25 NTT COMMUNICATIONS CORPORATION

14.25.1 COMPANY SNAPSHOT

14.25.2 REVENUE ANALYSIS

14.25.3 GEOGRAPHIC PRESENCE

14.25.4 PRODUCT PORTFOLIO

14.25.5 RECENT DEVELOPMENT

14.26 OPEN TEXT CORPORATION (MICRO FOCUS)

14.26.1 COMPANY SNAPSHOT

14.26.2 REVENUE ANALYSIS

14.26.3 GEOGRAPHIC PRESENCE

14.26.4 PRODUCT PORTFOLIO

14.26.5 RECENT DEVELOPMENT

14.27 EQUINIX

14.27.1 COMPANY SNAPSHOT

14.27.2 REVENUE ANALYSIS

14.27.3 GEOGRAPHIC PRESENCE

14.27.4 PRODUCT PORTFOLIO

14.27.5 RECENT DEVELOPMENT

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

15 CONCLUSION

16 QUESTIONNAIRE

17 RELATED REPORTS

18 ABOUT DATA BRIDGE MARKET RESEARCH

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.