Global Hybrid Operating Room Market

Market Size in USD Billion

CAGR :

%

USD

1.47 Billion

USD

3.41 Billion

2025

2033

USD

1.47 Billion

USD

3.41 Billion

2025

2033

| 2026 –2033 | |

| USD 1.47 Billion | |

| USD 3.41 Billion | |

|

|

|

|

Hybrid Operating Room Market Size

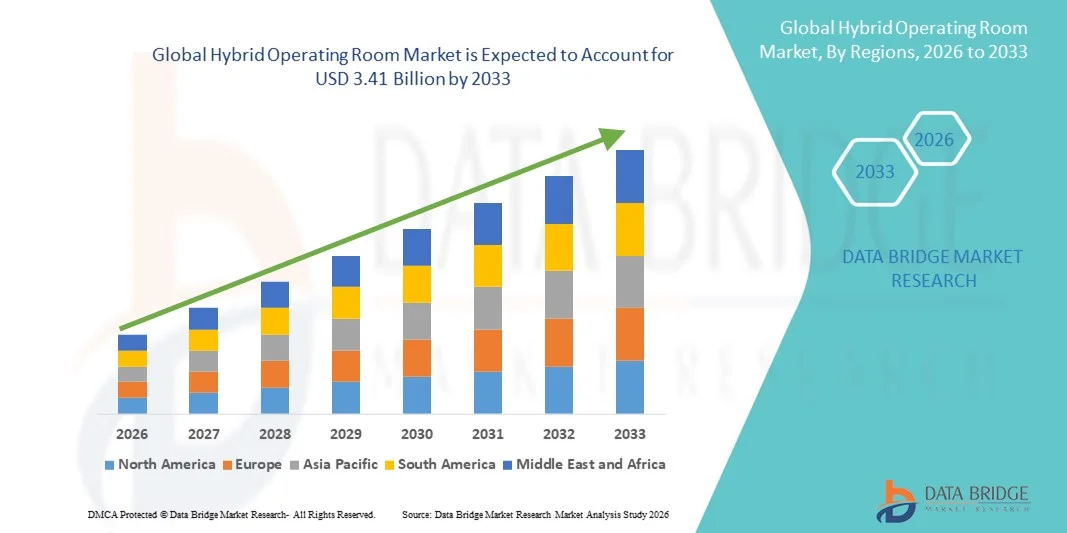

- The global hybrid operating room market size was valued at USD 1.47 billion in 2025 and is expected to reach USD 3.41 billion by 2033, at a CAGR of 11.12% during the forecast period

- The market growth is largely fueled by the increasing adoption of advanced surgical environments that integrate high‑resolution imaging, real‑time diagnostics, and minimally invasive procedure capabilities, driving demand across hospitals and specialty surgical centers worldwide

- Furthermore, rising prevalence of chronic diseases, growing focus on improving patient outcomes, and technological advancements in surgical imaging and robotics are reinforcing hybrid ORs as essential infrastructure in modern healthcare facilities. These converging factors are accelerating the uptake of hybrid operating room solutions, thereby significantly boosting the industry’s growth

Hybrid Operating Room Market Analysis

- Hybrid operating room market, combining advanced surgical suites with integrated imaging systems such as angiography, CT, and MRI, is increasingly vital in modern hospitals and specialty surgical centers due to its ability to support minimally invasive procedures, real-time diagnostics, and improved surgical precision

- The escalating demand for hybrid operating room market is primarily fueled by the rising prevalence of cardiovascular diseases, growing focus on improving patient outcomes, and technological advancements in surgical imaging, robotics, and navigation systems

- North America dominated the hybrid operating room market with the largest revenue share of 38.5% in 2025, characterized by early adoption of advanced surgical technologies, high healthcare expenditure, and a strong presence of key market players, with the U.S. witnessing substantial growth in hybrid or installations, particularly in tertiary care hospitals and specialized cardiac and neurosurgery centers

- Asia-Pacific is expected to be the fastest growing region in the hybrid operating room market during the forecast period due to increasing hospital infrastructure development, rising healthcare spending, and growing demand for advanced surgical procedures

- Cardiovascular application segment dominated the hybrid operating room market with a market share of 41.7% in 2025, driven by the high demand for minimally invasive cardiac interventions and the integration of advanced imaging systems that enhance procedural safety and efficiency

Report Scope and Hybrid Operating Room Market Segmentation

|

Attributes |

Hybrid Operating Room Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Hybrid Operating Room Market Trends

Advancements in Real-Time Imaging and Surgical Robotics

- A significant and accelerating trend in the global hybrid operating room market is the integration of advanced real-time imaging systems such as CT, MRI, and angiography with robotic-assisted surgical tools, enhancing precision and efficiency during complex procedures

- For instance, the verb surgical hybrid suite allows surgeons to switch seamlessly between minimally invasive interventions and open surgery using integrated imaging and robotic support, reducing procedure times and improving outcomes

- Robotic integration in hybrid operating rooms enables features such as automated instrument positioning, motion scaling, and enhanced visualization, allowing more accurate interventions. For instance, some siemens hybrid or solutions utilize robotics to assist in cardiovascular and neurovascular procedures, improving procedural safety and efficiency

- The seamless integration of hybrid or systems with hospital information and imaging platforms facilitates centralized control over multiple aspects of surgical procedures, enabling real-time collaboration among surgeons, anesthesiologists, and interventional radiologists

- This trend towards more intelligent, connected, and versatile surgical environments is fundamentally reshaping expectations for operating room capabilities. Consequently, companies such as philips and verb are developing hybrid or suites with ai-powered imaging guidance, robotic assistance, and seamless data integration for improved surgical workflows

- The demand for hybrid operating rooms that offer integrated imaging, robotics, and centralized surgical control is growing rapidly across both tertiary care hospitals and specialty surgical centers, as healthcare providers increasingly prioritize precision, safety, and procedural efficiency

Hybrid Operating Room Market Dynamics

Driver

Rising Demand Due to Complex Surgeries and Minimally Invasive Procedures

- The increasing prevalence of complex cardiovascular, neurovascular, and orthopedic surgeries, coupled with the rising adoption of minimally invasive procedures, is a significant driver for the heightened demand for hybrid operating rooms

- For instance, in march 2025, verb medical announced the deployment of hybrid or suites in multiple U.S. hospitals, integrating advanced imaging with surgical robotics to improve patient outcomes in high-risk interventions

- As healthcare providers aim to enhance patient safety and procedural efficiency, hybrid or solutions offer features such as real-time imaging guidance, intraoperative diagnostics, and multi-disciplinary collaboration, providing a compelling upgrade over traditional operating rooms

- Furthermore, the growing emphasis on reducing procedure times, hospital stays, and postoperative complications is making hybrid or systems an integral part of modern surgical infrastructure, supporting multiple surgical specialties in a single suite

- The ability to perform complex, minimally invasive procedures with improved precision, along with enhanced integration with hospital it and imaging systems, are key factors propelling the adoption of hybrid operating rooms across hospitals and specialty centers

- Increasing investments in hospital infrastructure and expansion of multi-specialty centers are further driving demand for hybrid or suites that can accommodate high patient volumes while offering advanced surgical capabilities

- The rising adoption of telemedicine and remote surgical guidance tools is complementing hybrid or systems, enabling expert consultation and intervention in complex procedures across different locations

Restraint/Challenge

High Capital Costs and Infrastructure Requirements

- The substantial initial investment and specialized infrastructure requirements of hybrid operating rooms pose a significant challenge to broader market penetration. As hybrid or suites require advanced imaging equipment, robotics, and staff training, only well-funded hospitals can afford deployment

- For instance, the installation of a philips hybrid or suite in a tertiary care hospital can exceed several million USD, making adoption challenging for budget-constrained healthcare providers

- Addressing these financial and infrastructure challenges through modular designs, financing options, and scalable installations is crucial for wider adoption. Companies such as siemens and verb emphasize flexible solutions and turnkey setups to reduce adoption barriers

- In addition, ongoing maintenance, staff training, and regulatory compliance requirements can increase operational costs, further limiting adoption in smaller hospitals or emerging markets

- While the clinical benefits are substantial, the high capital expenditure and technical complexity can still hinder widespread implementation, especially in developing regions or mid-tier healthcare facilities. Overcoming these challenges through cost-effective solutions, training programs, and infrastructure support will be vital for sustained market growth

- The need for highly skilled surgical teams and radiology specialists to operate hybrid or suites can constrain adoption in regions with limited trained professionals, requiring additional workforce development

- Integration complexities with existing hospital it and legacy imaging systems may create operational inefficiencies and additional costs, slowing the deployment of hybrid or systems in established medical facilities

Hybrid Operating Room Market Scope

The market is segmented on the basis of component, technique, application and end user.

- By Component

On the basis of component, the hybrid operating room market is segmented into intraoperative diagnostic imaging systems, operating room fixtures, surgical instruments, audiovisual display systems and tools, and others. Intraoperative Diagnostic Imaging Systems dominated the market with the largest revenue share in 2025 due to their critical role in enabling real-time visualization during complex surgical procedures. These systems, including CT, MRI, and angiography, allow surgeons to make precise decisions intraoperatively, reducing risks and improving patient outcomes. Hospitals and specialty surgical centers prioritize hybrid or suites equipped with advanced imaging to support minimally invasive procedures. The high demand is further driven by the need for multi-disciplinary collaboration, as imaging systems integrate seamlessly with surgical workflows. Compatibility with robotic-assisted surgery enhances procedural efficiency and safety. In addition, healthcare providers increasingly invest in these systems to offer advanced cardiac, neurovascular, and orthopedic interventions in a single operating room.

Operating Room Fixtures are anticipated to witness the fastest growth rate from 2026 to 2033 due to hospitals upgrading infrastructure to support hybrid or setups. Fixtures include surgical lights, ceiling booms, and modular tables that are essential for accommodating complex equipment and ensuring ergonomic workflow. The growth is fueled by rising hospital construction and modernization in emerging markets. Flexible fixtures also support multi-specialty procedures, reducing the need for separate operating rooms. Their compatibility with digital and robotic systems enhances efficiency and safety. Hospitals adopting state-of-the-art fixtures benefit from reduced procedure times and improved staff productivity.

- By Technique

On the basis of technique, the hybrid operating room market is segmented into fluoroscopy and data acquisition, rotational angiography, digital subtraction angiography, and others. Fluoroscopy and Data Acquisition dominated the market in 2025 due to its widespread use in cardiovascular and interventional procedures. Fluoroscopy provides real-time imaging, allowing surgeons to guide catheters, stents, and other instruments with high precision. Its established role in minimally invasive surgeries drives continuous investment by hospitals. Integration with hybrid or suites enables seamless transition between imaging and surgical intervention. Fluoroscopy systems also support high-quality image acquisition with minimal radiation exposure. These factors make it a preferred technique in tertiary care and specialty surgical centers. Hospitals leverage its real-time capabilities to enhance procedural safety and patient outcomes.

Rotational Angiography is expected to witness the fastest growth rate from 2026 to 2033, driven by its ability to provide three-dimensional imaging and improved visualization of complex vascular structures. The technique enhances accuracy in cardiovascular, neurovascular, and interventional radiology procedures. Hospitals adopting rotational angiography benefit from reduced procedure times and higher success rates for minimally invasive surgeries. Its integration with robotic and navigation systems further boosts efficiency. Increasing prevalence of cardiovascular diseases and rising demand for advanced surgical imaging in emerging economies are also driving growth. The enhanced procedural insights offered by rotational angiography make it a rapidly growing preference among modern surgical centers.

- By Application

On the basis of application, the hybrid operating room market is segmented into cardiovascular applications, neurosurgical applications, thoracic applications, orthopedic applications, endo-bronchial applications, and others. Cardiovascular Applications dominated the market in 2025 with a market share of 41.7% due to the high prevalence of cardiovascular diseases and increasing demand for minimally invasive cardiac procedures. Hybrid ORs enable simultaneous imaging and intervention, allowing cardiologists and surgeons to perform complex procedures with greater accuracy. The adoption is particularly strong in tertiary care hospitals and cardiac specialty centers. Real-time imaging reduces procedural risks and improves patient recovery. Integration with robotic-assisted devices enhances precision in interventions such as stent placement and valve repairs. Continuous advancements in cardiovascular imaging technologies further solidify its market dominance.

Neurosurgical Applications are expected to witness the fastest growth from 2026 to 2033, driven by increasing adoption of minimally invasive neurovascular procedures and the integration of advanced imaging and navigation systems. Hybrid ORs facilitate procedures such as aneurysm repair, tumor resection, and spine surgery with real-time guidance. The growing number of neurosurgical centers in emerging markets contributes to rapid adoption. Improved patient safety, reduced complications, and enhanced surgical accuracy are key factors fueling growth. Neurosurgeons increasingly prefer hybrid OR setups that allow seamless switching between imaging and operative interventions. Technological advancements such as AI-assisted navigation and 3D imaging further accelerate market expansion.

- By End User

On the basis of end user, the hybrid operating room market is segmented into hospitals and surgical centers, clinics, medical research firms, and ambulatory surgical centers. Hospitals and Surgical Centers dominated the market in 2025, accounting for the largest revenue share due to the high procedural volume and demand for advanced surgical infrastructure. Tertiary care hospitals and multi-specialty surgical centers require hybrid ORs to support cardiovascular, neurovascular, and orthopedic procedures in a single suite. Integration of imaging, robotics, and audiovisual systems enhances operational efficiency. Hospitals also benefit from improved patient outcomes and reduced procedural complications. High adoption is driven by continuous investment in modern surgical facilities. Large-scale healthcare providers prioritize hybrid ORs to meet growing patient demand for minimally invasive surgeries.

Ambulatory Surgical Centers are expected to witness the fastest growth from 2026 to 2033 due to the increasing trend of outpatient minimally invasive procedures. These centers are adopting compact and cost-efficient hybrid OR setups to offer advanced interventions without full hospital infrastructure. Growth is fueled by rising patient preference for outpatient surgeries with shorter recovery times. Integration with imaging and navigation systems improves procedural accuracy. Emerging markets with expanding outpatient healthcare services are also contributing to adoption. Ambulatory surgical centers leverage hybrid ORs to attract patients and enhance service quality, driving rapid segment growth.

Hybrid Operating Room Market Regional Analysis

- North America dominated the hybrid operating room market with the largest revenue share of 38.5% in 2025, characterized by early adoption of advanced surgical technologies, high healthcare expenditure, and a strong presence of key market players

- Hospitals and specialty surgical centers in the region prioritize hybrid ORs for complex cardiovascular, neurovascular, and orthopedic procedures, leveraging real-time imaging, robotics, and integrated surgical tools

- This widespread adoption is further supported by well-established hospital infrastructure, a strong presence of key market players, and high investment in healthcare innovation, establishing hybrid operating rooms as essential assets in modern surgical facilities

U.S. Hybrid Operating Room Market Insight

The U.S. hybrid operating room market captured the largest revenue share of 42% in 2025 within North America, fueled by early adoption of advanced surgical technologies and the increasing trend of minimally invasive procedures. Hospitals and specialty surgical centers are prioritizing hybrid ORs to enhance procedural precision and patient outcomes. The growing integration of real-time imaging systems, robotic-assisted surgery, and AI-driven surgical planning further propels market growth. Moreover, the expansion of multi-specialty and tertiary care hospitals, along with a strong focus on reducing procedural complications, is significantly contributing to market adoption.

Europe Hybrid Operating Room Market Insight

The Europe hybrid operating room market is projected to expand at a substantial CAGR during the forecast period, primarily driven by rising investments in modern healthcare infrastructure and the increasing need for advanced surgical solutions. The adoption of hybrid ORs is supported by strict healthcare regulations, growing prevalence of cardiovascular and neurovascular diseases, and a shift toward minimally invasive procedures. Hospitals in Western Europe are integrating hybrid ORs with imaging and robotic systems to improve surgical precision, efficiency, and patient safety. The market is seeing strong growth across cardiovascular, neurosurgical, and orthopedic applications.

U.K. Hybrid Operating Room Market Insight

The U.K. hybrid operating room market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the growing focus on improving patient outcomes and surgical efficiency in both public and private hospitals. The rising trend of minimally invasive procedures and increased funding for healthcare modernization are encouraging adoption. In addition, the U.K.’s strong presence of healthcare technology providers and growing integration of imaging and navigation systems in surgical suites is expected to further stimulate market growth. Hybrid ORs are increasingly being deployed in cardiovascular and neurosurgical applications in leading hospitals.

Germany Hybrid Operating Room Market Insight

The Germany hybrid operating room market is expected to expand at a considerable CAGR during the forecast period, fueled by increasing awareness of advanced surgical solutions and rising healthcare expenditure. Germany’s well-developed hospital infrastructure, emphasis on innovation, and focus on minimally invasive interventions promote hybrid OR adoption, particularly in tertiary care and specialty hospitals. The integration of real-time imaging, surgical robotics, and AI-guided navigation enhances procedural efficiency and patient safety. Strong demand in cardiovascular, neurosurgical, and orthopedic applications supports market growth, along with government initiatives to upgrade surgical infrastructure.

Asia-Pacific Hybrid Operating Room Market Insight

The Asia-Pacific hybrid operating room market is poised to grow at the fastest CAGR of 19% during the forecast period of 2026 to 2033, driven by increasing hospital infrastructure, rising healthcare spending, and growing adoption of minimally invasive surgeries in countries such as China, Japan, and India. The region’s expanding urban population and government support for advanced healthcare facilities are boosting hybrid OR installations. Furthermore, technological advancements and increasing collaboration with global healthcare technology providers are enhancing the accessibility and adoption of hybrid OR solutions across emerging economies.

Japan Hybrid Operating Room Market Insight

The Japan hybrid operating room market is gaining momentum due to the country’s high-tech healthcare ecosystem, aging population, and increasing demand for minimally invasive interventions. Hospitals are adopting hybrid ORs to improve surgical precision, reduce procedure times, and enhance patient outcomes. The integration of imaging systems, robotics, and AI-assisted navigation is driving growth. In addition, Japan’s emphasis on hospital modernization and advanced surgical care, particularly in cardiovascular and neurosurgical applications, is further fueling market expansion.

India Hybrid Operating Room Market Insight

The India hybrid operating room market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to rapid hospital infrastructure development, increasing healthcare expenditure, and rising demand for minimally invasive procedures. India is witnessing growth in multi-specialty hospitals and tertiary care centers adopting hybrid ORs for cardiovascular, neurovascular, and orthopedic surgeries. Government initiatives supporting smart hospitals and collaborations with global healthcare technology providers are also key factors propelling market growth. The availability of cost-effective solutions and rising awareness of advanced surgical outcomes are further driving adoption.

Hybrid Operating Room Market Share

The Hybrid Operating Room industry is primarily led by well-established companies, including:

- GE HealthCare (U.S.)

- STERIS plc (U.S.)

- Siemens Healthineers AG (Germany)

- CANON MEDICAL SYSTEMS CORPORATION (Japan)

- IMRIS, Deerfield Imaging, Inc. (U.S.)

- Stryker (U.S.)

- Getinge AB (Sweden)

- Trumpf Medical (Germany)

- Skytron LLC (U.S.)

- Alvo Medical (Poland)

- Mizuho Corporation (Japan)

- Toshiba Corporation (Japan)

- Brainlab AG (Germany)

- Medtronic (Ireland)

- Johnson & Johnson Services, Inc. (U.S.)

- Olympus Corporation (Japan)

- Zimmer Biomet (U.S.)

- United Imaging Healthcare Co., Ltd (China)

What are the Recent Developments in Global Hybrid Operating Room Market?

- In December 2024, Getinge and Siemens Healthineers partnered to install state‑of‑the‑art multi‑modality hybrid operating rooms at ASST Sette Laghi Hospital in Varese, Italy, incorporating advanced imaging systems and integrated OR technology to support complex multidisciplinary surgeries and improve patient safety and workflow coordination

- In July 2024, Cheyenne Regional Medical Center unveiled a new hybrid operating room equipped with Philips Azurion 7 and ClarityIQ imaging systems that significantly reduce X‑ray exposure and enhance visualization during procedures, setting a new standard for precision healthcare in the region

- In December 2023, MarinHealth Medical Center unveiled a state‑of‑the‑art hybrid operating room at its Haynes Cardiovascular Institute, allowing open and minimally invasive procedures in a single space with advanced imaging guidance, reducing hospital stays and accelerating recovery times

- In June 2023, Elliot Hospital introduced its advanced hybrid operating room for complex surgical procedures, enabling real‑time imaging and expanded procedural capabilities across vascular, thoracic, and acute care specialties, improving surgical outcomes and patient experience

- In February 2023, two multi‑modality hybrid operating rooms were inaugurated at the University of Padua’s Azienda Ospedale in Italy, as part of a collaboration between Getinge and Siemens Healthineers, designed to support complex, multi‑specialty procedures with fully integrated imaging and surgical technologies

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.