Global Hydrochloric Acid Market

Market Size in USD Million

CAGR :

%

USD

79.56 Million

USD

116.65 Million

2024

2032

USD

79.56 Million

USD

116.65 Million

2024

2032

| 2025 –2032 | |

| USD 79.56 Million | |

| USD 116.65 Million | |

|

|

|

|

Hydrochloric Acid Market Size

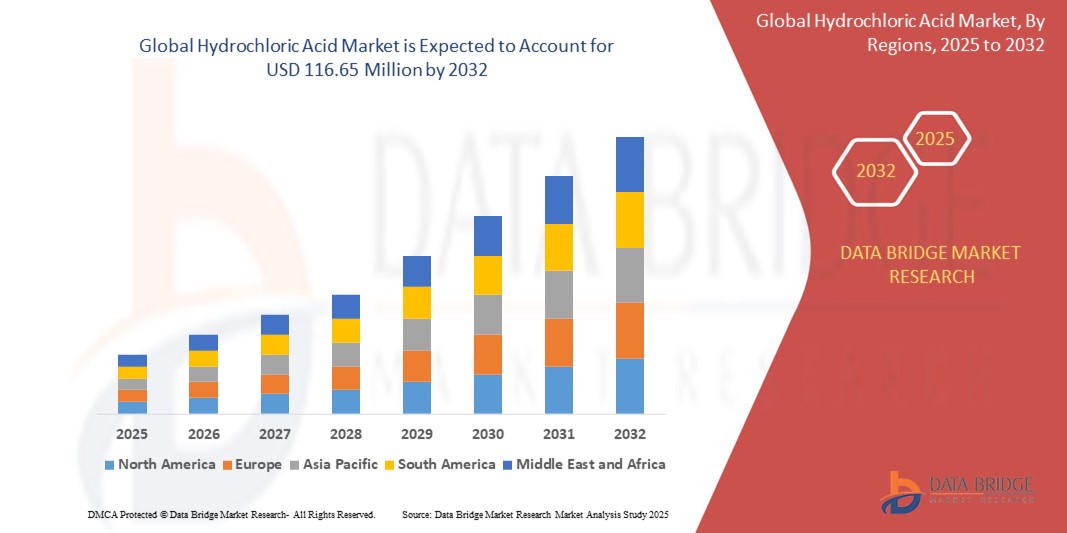

- The global hydrochloric acid market size was valued at USD 79.56 million in 2024 and is expected to reach USD 116.65 million by 2032, at a CAGR of 4.90% during the forecast period

- The market growth is primarily driven by increasing demand from industries such as steel, food processing, and oil and gas, coupled with advancements in chemical manufacturing processes

- Rising industrial activities, particularly in emerging economies, and the growing need for effective chemical solutions for applications such as steel pickling and oil well acidizing are key factors accelerating market expansion

Hydrochloric Acid Market Analysis

- Hydrochloric acid, a strong, corrosive acid used in various industrial processes, is a critical component in applications ranging from steel pickling to food processing and oil well acidizing, owing to its versatility and cost-effectiveness

- The demand for hydrochloric acid is fueled by rapid industrialization, increasing infrastructure development, and the growing adoption of the acid in pharmaceutical and food processing industries for pH regulation and sanitization

- North America dominated the hydrochloric acid market with the largest revenue share of 38.5% in 2024, driven by robust industrial infrastructure, high demand from the steel and oil and gas sectors, and the presence of major chemical manufacturers in the U.S.

- Asia-Pacific is expected to be the fastest-growing region during the forecast period, attributed to rapid urbanization, expanding industrial base, and increasing investments in chemical production in countries such as China and India

- The Aqueous segment dominated the market with a revenue share of 70% in 2024, owing to its widespread use in industrial applications such as oil well acidizing and food processing, where its effectiveness and lack of harmful impurities are highly valued

Report Scope and Hydrochloric Acid Market Segmentation

|

Attributes |

Hydrochloric Acid Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Hydrochloric Acid Market Trends

“Increasing Integration of Advanced Production Technologies and Sustainability Practices”

- The global hydrochloric acid market is experiencing a notable trend toward the integration of advanced production technologies and sustainable practices

- Innovations in production processes, such as improved chlor-alkali processes and energy-efficient manufacturing, enable higher purity levels and reduced environmental impact

- These technologies enhance efficiency, lower production costs, and meet stringent environmental regulations, making hydrochloric acid more appealing for industrial applications

- For instance, companies are adopting automated systems and IoT-enabled monitoring to optimize production and minimize waste in hydrochloric acid manufacturing

- This trend is increasing the adoption of hydrochloric acid across industries by offering cost-effective and eco-friendly solutions, particularly for large-scale applications such as steel pickling and chemical processing

- Sustainable practices, such as recycling by-product hydrochloric acid from chemical manufacturing, are gaining traction, reducing reliance on synthetic production and supporting circular economy initiatives

Hydrochloric Acid Market Dynamics

Driver

“Rising Demand for Industrial Applications and Infrastructure Development”

- The growing demand for hydrochloric acid in industrial applications, such as steel pickling, oil well acidizing, and chemical manufacturing, is a key driver for the global hydrochloric acid market

- Hydrochloric acid enhances industrial processes by enabling efficient steel purification, well stimulation in oil and gas, and production of essential chemicals such as PVC and fertilizers

- Government initiatives and rapid urbanization, particularly in emerging economies, are increasing the demand for steel and construction materials, which rely heavily on hydrochloric acid for pickling and cleaning processes

- The proliferation of advanced technologies, such as improved chlor-alkali production and automation, is further enabling the expansion of hydrochloric acid applications, offering higher efficiency and scalability

- Manufacturers are increasingly integrating hydrochloric acid into processes for food processing, water treatment, and pharmaceuticals to meet regulatory standards and consumer demand for high-quality products

Restraint/Challenge

“High Production Costs and Stringent Environmental Regulations”

- The significant costs associated with producing high-purity hydrochloric acid, including raw materials, energy, and advanced equipment, pose a barrier to market growth, particularly in cost-sensitive regions

- Implementing and maintaining advanced production systems, such as those for synthetic hydrochloric acid, can be complex and capital-intensive

- In addition, environmental and safety concerns present major challenges. Hydrochloric acid production and handling generate emissions and hazardous waste, raising concerns about environmental impact and compliance with strict regulations

- The fragmented regulatory landscape across countries regarding emissions, waste disposal, and workplace safety complicates operations for global manufacturers and increases compliance costs

- These factors can limit market expansion, particularly in regions with high environmental awareness or where cost sensitivity restricts adoption of advanced production technologies

Hydrochloric Acid market Scope

The market is segmented on the basis of type, form, application, distribution channel, and end-user.

- By Form

On the basis of form, the global hydrochloric acid market is segmented into Water-Based, Aqueous, and Solution. The Aqueous segment dominated the market with a revenue share of 70% in 2024, owing to its widespread use in industrial applications such as oil well acidizing and food processing, where its effectiveness and lack of harmful impurities are highly valued.

The Solution segment is anticipated to experience the fastest growth from 2025 to 2032, driven by increasing demand for precise concentration formulations in pharmaceutical and chemical industries, where tailored solutions enhance efficiency and safety.

- By Application

On the basis of application, the global hydrochloric acid market is segmented into Steel Pickling, Oil Well Acidizing, Ore Processing, Food Processing, Pool Sanitation, Calcium Chloride, and Others. The Steel Pickling segment accounted for the largest market revenue share of 32.2% in 2024, propelled by the rising global demand for steel in construction and automotive industries, where hydrochloric acid is essential for removing rust and impurities.

The Food Processing segment is expected to witness the fastest growth rate from 2025 to 2032, driven by the increasing consumption of packaged foods and the use of hydrochloric acid in producing corn syrups, high-fructose corn syrup, and as an acidifier in sauces and canned goods, particularly in emerging economies

- By Distribution Channel

On the basis of distribution channel, the global hydrochloric acid market is segmented into E-Commerce, B2B, Specialty Stores, and Others. The B2B segment dominated the market with a revenue share of 71.38% in 2024, due to the industrial nature of hydrochloric acid applications, with bulk transactions supporting industries such as steel manufacturing, chemical production, and oil and gas.

The E-Commerce segment is anticipated to experience significant growth from 2025 to 2032, driven by the increasing digitalization of chemical procurement and the convenience of online platforms for sourcing hydrochloric acid, particularly for small and medium-sized enterprises.

- By End-User

On the basis of end-user, the global hydrochloric acid market is segmented into Food and Beverages, Steel Industry, Pharmaceuticals, Textile, Oil and Gas, Chemistry Industry, and Others. The Food and Beverages segment held the largest market revenue share of 27.70% in 2024, attributed to its extensive use in pH regulation, neutralization, and as an ingredient in various food products, supported by the growing demand for processed and packaged foods.

The Pharmaceuticals segment is expected to witness rapid growth from 2025 to 2032, fueled by the increasing global demand for medications, where hydrochloric acid is a critical raw material for drug synthesis and pH adjustment in formulations.

Hydrochloric Acid Market Regional Analysis

- North America dominated the hydrochloric acid market with the largest revenue share of 38.5% in 2024, driven by robust industrial infrastructure, high demand from the steel and oil and gas sectors, and the presence of major chemical manufacturers in the U.S.

- Industries prioritize hydrochloric acid for its versatility in chemical processes, cost-effectiveness, and efficacy in applications such as ore processing and pool sanitation, particularly in regions with advanced industrial infrastructure

- Growth is supported by advancements in production technologies, including synthetic and by-product hydrochloric acid, alongside increasing adoption in both industrial and consumer segments

U.S. Hydrochloric Acid Market Insight

The U.S. hydrochloric acid market captured the largest revenue share of 76.9% in 2024 within North America, fueled by strong demand from the steel industry, oil and gas sector, and food processing applications. Growing awareness of the chemical’s role in efficient industrial processes and stringent quality standards drives market expansion. The rise in domestic manufacturing and integration in end-user industries, such as pharmaceuticals and textiles, further supports a diverse market ecosystem.

Europe Hydrochloric Acid Market Insight

The Europe hydrochloric acid market is expected to witness significant growth, driven by regulatory focus on industrial efficiency and environmental compliance. Industries demand high-purity hydrochloric acid for applications such as steel pickling and chemical synthesis. Growth is prominent in both large-scale industrial applications and niche sectors, with countries such as Germany and France showing notable adoption due to advanced manufacturing and sustainability initiatives.

U.K. Hydrochloric Acid Market Insight

The U.K. market for hydrochloric acid is expected to witness rapid growth, driven by demand from the chemical and pharmaceutical industries. Increased focus on efficient ore processing and pool sanitation applications encourages adoption. Evolving regulations on industrial emissions and chemical safety influence market dynamics, balancing quality with compliance.

Germany Hydrochloric Acid Market Insight

Germany is expected to witness the fastest growth rate in the European hydrochloric acid market, attributed to its advanced industrial sector and emphasis on energy-efficient chemical processes. German industries prefer high-quality hydrochloric acid for steel pickling, chemical synthesis, and pharmaceutical applications, contributing to reduced operational costs. The integration of hydrochloric acid in both large-scale manufacturing and specialty applications supports sustained market growth.

Asia-Pacific Hydrochloric Acid Market Insight

The Asia-Pacific region is expected to witness the fastest growth rate, driven by rapid industrialization, expanding chemical manufacturing, and rising demand in countries such as China, India, and Japan. Increasing awareness of hydrochloric acid’s applications in steel pickling, oil well acidizing, and food processing boosts demand. Government initiatives promoting industrial growth and environmental safety further encourage the adoption of advanced hydrochloric acid solutions.

Japan Hydrochloric Acid Market Insight

Japan’s hydrochloric acid market is expected to witness rapid growth, driven by strong consumer preference for high-purity, technologically advanced hydrochloric acid for industrial and food processing applications. The presence of major chemical and steel manufacturers, along with integration in industrial processes, accelerates market penetration. Rising interest in sustainable chemical solutions also contributes to growth.

China Hydrochloric Acid Market Insight

China holds the largest share of the Asia-Pacific hydrochloric acid market, propelled by rapid industrialization, increasing chemical production, and growing demand for applications such as steel pickling and calcium chloride production. The country’s expanding industrial base and focus on cost-effective chemical solutions support adoption. Strong domestic manufacturing capabilities and competitive pricing enhance market accessibility.

Hydrochloric Acid Market Share

The hydrochloric acid industry is primarily led by well-established companies, including:

- Ashland (U.S.)

- Arkema (France)

- BASF SE (Germany)

- Kemira (Finland)

- The Lubrizol Corporation (U.S.)

- NIPPON SHOKUBAI CO. LTD (Japan)

- Dow (U.S.)

- Henan Qingshuiyuan Technology CO., Ltd., (China)

- Aurora Fine Chemicals (U.S.)

- Zouping Dongfang Chemical Co., Ltd. (China)

- ACURO ORGANICS LIMITED (U.S.)

- Maxwell Additives Pvt. Ltd (India)

- Chemtex Speciality Limited (India)

- Polysciences, Inc.(U.S.)

- PROTEX INTERNATIONAL (France)

- Corporate.Evonik (Germany)

What are the Recent Developments in Global Hydrochloric Acid Market?

- In January 2025, Jones-Hamilton Co., a leading U.S.-based chemical manufacturer, acquired Nexchlor LLC, a Dallas-based subsidiary of Copperbeck Energy Partners. This strategic acquisition significantly expanded Jones-Hamilton’s hydrochloric acid (HCl) portfolio, reinforcing its position as a premier supplier across North America. With the addition of Nexchlor’s assets and expertise, Jones-Hamilton aims to deliver greater value to customers, enhance supply chain capabilities, and strengthen its chlor-alkali business. The move also supports the company’s long-term growth strategy and commitment to safety and sustainability under the Responsible Care initiative

- In May 2024, Wynnchurch Capital, L.P. acquired Reagent Chemical & Research, LLC, the leading specialty distributor of hydrochloric acid (HCl) in North America. Headquartered in Ringoes, New Jersey, Reagent brings a robust infrastructure of terminals, railcars, trailers, and pipelines, enabling reliable service across diverse industrial markets. This strategic acquisition marks Wynnchurch’s entry into the chemical distribution sector, enhancing its market presence, supply chain capabilities, and long-term growth potential. The partnership also reflects Wynnchurch’s focus on investing in companies with strong operational excellence and customer-centric service models

- In August 2023, Wacker Chemie AG completed the expansion of its hyperpure hydrogen chloride (HCl) production facility at its Burghausen site in Germany. Commissioned in mid-July, the new production line significantly boosts Wacker’s capacity to supply ultra-pure HCl—a critical processing aid for the semiconductor industry, used in etching hyperpure silicon wafers and cleaning plant components. The investment, in the low double-digit million euro range, strengthens Wacker’s specialty chemicals portfolio and addresses growing demand amid a tightening global supply. The facility now produces HCl with 99.9995% purity, exceeding industry benchmarks

- In February 2022, Westlake Chemical Corporation completed its $1.2 billion acquisition of Hexion Inc.’s global epoxy business, marking a significant step in expanding its downstream portfolio and integrated operations. While the acquisition primarily focused on epoxy resins, coatings, and composites, it also enhanced Westlake’s capabilities in specialty chemicals, indirectly supporting its hydrochloric acid (HCl) market presence through synergies in chloro-vinyls and coatings applications. The move aligns with Westlake’s strategy to serve high-growth, sustainability-driven sectors such as renewable energy and lightweight automotive components, reinforcing its role as a diversified chemical leader

- In August 2021, Occidental Petroleum Corporation, through its subsidiary OxyChem, announced the closure of its Niagara Falls, New York chemical plant. The facility, which had operated for over a century, produced key chemicals including hydrochloric acid, chlorine, and caustic soda. The decision was driven by unfavorable regional market conditions and escalating rail transportation costs, which rendered the plant economically unsustainable despite years of effort to maintain viability. The closure impacted approximately 150 workers and marked a significant shift in Occidental’s strategic focus within the chemical sector

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Hydrochloric Acid Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Hydrochloric Acid Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Hydrochloric Acid Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.