Global Icu Devices Market

Market Size in USD Billion

CAGR :

%

USD

7.40 Billion

USD

11.31 Billion

2021

2029

USD

7.40 Billion

USD

11.31 Billion

2021

2029

| 2022 –2029 | |

| USD 7.40 Billion | |

| USD 11.31 Billion | |

|

|

|

|

Intensive Care Unit (ICU) Devices Market Analysis and Size

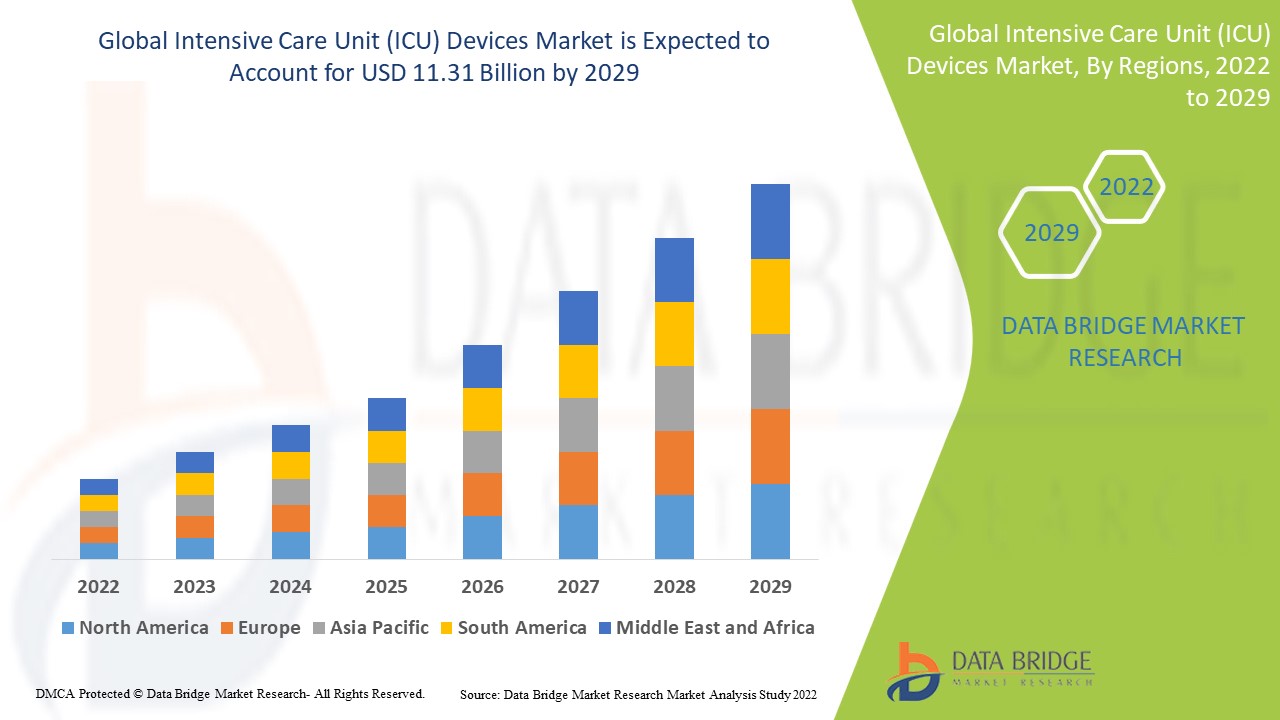

The market for intensive care unit (ICU) devices is expected to grow in the forecast period. In terms of the regional analysis, North America dominates the ICU devices market due to the high prevalence of patients suffering from cardiovascular and other diseases along with adoption of advanced technology, while APAC is expected to grow at the highest growth rate in the forecast period of 2022 to 2029 due to the prevalence of improved healthcare facilities.

Data Bridge Market Research analyses that the intensive care unit (ICU) devices market which was USD 7.4 billion in 2021, would rocket up to USD 11.31 billion by 2029, and is expected to undergo a CAGR of 5.45% during the forecast period 2022 to 2029. In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team also includes in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework.

Intensive Care Unit (ICU) Devices Market Scope and Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2014 - 2019) |

|

Quantitative Units |

Revenue in USD Billion, Volumes in Units, Pricing in USD |

|

Segments Covered |

Type (Mechanical Ventilators, Cardiac Monitors, Equipment for Constant Monitoring, Feeding Tubes, Nasogastric Tubes, Suction Pumps, Drains and Catheters), End-User (Hospitals, Ambulatory Surgical Center), Application (Adult ICU, Neonatal ICU) |

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America |

|

Market Players Covered |

GENERAL ELECTRIC (U.S.), Koninklijke Philips N.V. (Netherlands), Baxter (U.S.), Drägerwerk AG & Co. KGaA (Germany), Medtronic (Ireland), Fresenius Medical Care AG & Co. KGaA (Germany), Nihon Kohden Corporation (Japan), Stryker (U.S.), BD (U.S.), Shenzhen Mindray Bio-Medical Electronics Co., Ltd. (China), ResMed (U.S.), Siemens (Germany), ICU Medical, Inc. (U.S.), Terumo Corporation (Japan), B. Braun Melsungen AG (Germany) |

|

Market Opportunities |

|

Market Definition

In ICUs, ultrasound is a tool that is frequently employed. It serves as a simple and secure investigative tool as well as helping the doctor implant lines. The majority of the portable ultrasound devices used in intensive care might be utilised at the patient's bedside.

Global Intensive Care Unit (ICU) Devices Market Dynamics

Drivers

- Increase in number of patients

In the forecast period of 2022–2029, factors such as the rising number of patients with cardiovascular and other diseases, the global geriatric population, the adoption of minimally invasive surgeries, and the prevalence of better healthcare facilities are likely to boost the growth of the intensive care unit (ICU) devices market.

- Insurance policies

On the other hand, favourable insurance company policies and the development of cutting-edge technology will increase a number of chances and fuel the expansion of the intensive care unit (ICU) devices market during the time covered by the forecast.

- Rise in chronic diseases

The effective rise in surgical procedures largely drives the market for intensive care unit (ICU) devices, growth in geriatric patients, and development in occurrences of chronic syndromes like diabetes, asthma, blood pressure, and numerous others. Additionally, it is anticipated that the government and private sectors will increase their spending in healthcare infrastructure, driving the market growth in both developed and developing nations.

Opportunities

The market's growth is fueled by increase in aging populations and the growing incidence, prevalence of chronic diseases that lead to hospitalization, and increased need for ICUs for COVID-19 care.

Restraints/Challenges

- High cost

On the other hand, the high cost associated with the devices and lack of trained professionals in developing economies will obstruct the market's growth rate. The dearth of skilled professionals and lack of healthcare infrastructure in developing economies will challenge the market.

This intensive care unit (ICU) devices market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the intensive care unit (ICU) devices market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

COVID-19 Impact on Intensive Care Unit (ICU) Devices Market

COVID-19 has a positively impact on the market. Although there has been tremendous pressure on healthcare authorities and health services to draught and communicate preparedness plans that consist of the increase in number of ICU beds, to accommodate gravely ill patients, due to the frequent outbreaks of pandemic diseases like Influenza, Ebola, and the recent Covid-19. The majority of patients during pandemics need ICU admission, which drives up the need for ICU devices. As a result, it is projected that the global market for intensive care unit (ICU) devices will grow in the near future.

Global Intensive Care Unit (ICU) Devices Market Scope

The intensive care unit (ICU) devices market is segmented on the basis of type, application and end user. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Type

- Mechanical Ventilators

- Cardiac Monitors

- Equipment for Constant Monitoring

- Feeding Tubes

- Nasogastric Tubes

- Suction Pumps

- Drains and Catheters

End-User

- Hospitals

- Ambulatory Surgical Center

Application

- Adult ICU

- Neonatal ICU

Intensive Care Unit (ICU) Devices Market Regional Analysis/Insights

The intensive care unit (ICU) devices market is analysed and market size insights and trends are provided by country, type, application and end user as referenced above.

The countries covered in the ICU Devices market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

North America dominates the intensive care unit (ICU) Devices market due to the high prevalence of patients suffering from cardiovascular and other diseases along with adoption of advanced technology.

Asia-Pacific is expected to grow at the highest growth rate in the forecast period of 2022 to 2029 due to the prevalence of improved healthcare facilities.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Healthcare Infrastructure growth Installed base and New Technology Penetration

The intensive care unit (ICU) devices market also provides you with detailed market analysis for every country growth in healthcare expenditure for capital equipment, installed base of different kind of products for intensive care unit (ICU) devices market, impact of technology using life line curves and changes in healthcare regulatory scenarios and their impact on the intensive care unit (ICU) devices market. The data is available for historic period 2010-2020.

Competitive Landscape and Intensive Care Unit (ICU) Devices Market Share Analysis

The intensive care unit (ICU) devices market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to intensive care unit (ICU) devices market.

Some of the major players operating in the intensive care unit (ICU) devices market are:

- GENERAL ELECTRIC (U.S.)

- Koninklijke Philips N.V. (Netherlands)

- Baxter (U.S.)

- Drägerwerk AG & Co. KGaA (Germany)

- Medtronic (Ireland)

- Fresenius Medical Care AG & Co. KGaA (Germany)

- Nihon Kohden Corporation (Japan)

- Stryker (U.S.)

- BD (U.S.)

- Shenzhen Mindray Bio-Medical Electronics Co., Ltd. (China)

- ResMed (U.S.)

- Siemens (Germany)

- ICU Medical, Inc. (U.S.)

- Terumo Corporation (Japan)

- B. Braun Melsungen AG (Germany)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL INTENSIVE CARE UNIT (ICU) DEVICES MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL INTENSIVE CARE UNIT (ICU) DEVICES MARKET SIZE

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 TRIPOD DATA VALIDATION MODEL

2.2.4 MARKET GUIDE

2.2.5 MULTIVARIATE MODELLING

2.2.6 TOP TO BOTTOM ANALYSIS

2.2.7 CHALLENGE MATRIX

2.2.8 APPLICATION COVERAGE GRID

2.2.9 STANDARDS OF MEASUREMENT

2.2.10 VENDOR SHARE ANALYSIS

2.2.11 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.12 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL INTENSIVE CARE UNIT (ICU) DEVICES MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 PESTAL ANALYSIS

5.2 PORTER’S FIVE FORCES

5.3 ECONOMIC IMPACT OF DONOR MILK IN THE INTENSIVE CARE UNIT (ICU) DEVICES UNIT

5.4 CLINICAL GUIDELINES FOR HUMAN MILK BANKS AND DONOR MILK USE IN THE INTENSIVE CARE UNIT (ICU) DEVICES UNIT

6 INDUSTRY INSIGHTS

7 REGULATORY FRAMWORK

8 GLOBAL INTENSIVE CARE UNIT (ICU) DEVICES MARKET, BY PRODUCT TYPE

8.1 OVERVIEW

8.2 THERAPEUTIC DEVICES

8.2.1 VENTILATOR, BY TYPE

8.2.1.1. INVASIVE

8.2.1.1.1. VOLUME-CYCLED VENTILATORS

8.2.1.1.1.1 MARKET VALUE (USD MILLION)

8.2.1.1.1.2 MARKET VOLUME (UNITS)

8.2.1.1.1.3 AVERAGE SELLING PRICE (USD)

8.2.1.1.2. PRESSURE-CYCLED VENTILATORS

8.2.1.1.2.1 MARKET VALUE (USD MILLION)

8.2.1.1.2.2 MARKET VOLUME (UNITS)

8.2.1.1.2.3 AVERAGE SELLING PRICE (USD)

8.2.1.1.3. CONTINUOUS POSITIVE AIRWAY PRESSURE VENTILATORS

8.2.1.1.3.1 MARKET VALUE (USD MILLION)

8.2.1.1.3.2 MARKET VOLUME (UNITS)

8.2.1.1.3.3 AVERAGE SELLING PRICE (USD)

8.2.1.1.4. BI-LEVEL POSITIVE AIRWAY PRESSURE VENTILATORS

8.2.1.1.4.1 MARKET VALUE (USD MILLION)

8.2.1.1.4.2 MARKET VOLUME (UNITS)

8.2.1.1.4.3 AVERAGE SELLING PRICE (USD)

8.2.1.1.5. FLOW-CYCLED VENTILATORS

8.2.1.1.5.1 MARKET VALUE (USD MILLION)

8.2.1.1.5.2 MARKET VOLUME (UNITS)

8.2.1.1.5.3 AVERAGE SELLING PRICE (USD)

8.2.1.1.6. OTHERS

8.2.1.2. NON-INVASIVE

8.2.1.2.1. CONTINUOUS POSITIVE AIRWAY PRESSURE (CPAP)

8.2.1.2.1.1 MARKET VALUE (USD MILLION)

8.2.1.2.1.2 MARKET VOLUME (UNITS)

8.2.1.2.1.3 AVERAGE SELLING PRICE (USD)

8.2.1.2.2. AUTOTITRATING (ADJUSTABLE) POSITIVE AIRWAY PRESSURE

8.2.1.2.2.1 MARKET VALUE (USD MILLION)

8.2.1.2.2.2 MARKET VOLUME (UNITS)

8.2.1.2.2.3 AVERAGE SELLING PRICE (USD)

8.2.1.2.3. OTHERS

8.2.2 VENTILATOR, BY PRODUCT

8.2.2.1. HIGH-END VENTILATORS

8.2.2.1.1. MARKET VALUE (USD MILLION)

8.2.2.1.2. MARKET VOLUME (UNITS)

8.2.2.1.3. AVERAGE SELLING PRICE (USD)

8.2.2.2. MID-END VENTILATORS

8.2.2.2.1. MARKET VALUE (USD MILLION)

8.2.2.2.2. MARKET VOLUME (UNITS)

8.2.2.2.3. AVERAGE SELLING PRICE (USD)

8.2.2.3. BASIC VENTILATORS

8.2.2.3.1. MARKET VALUE (USD MILLION)

8.2.2.3.2. MARKET VOLUME (UNITS)

8.2.2.3.3. AVERAGE SELLING PRICE (USD)

8.2.3 SYRINGE PUMP

8.2.3.1. MARKET VALUE (USD MILLION)

8.2.3.2. MARKET VOLUME (UNITS)

8.2.3.3. AVERAGE SELLING PRICE (USD)

8.2.4 DEFIBRILLATOR & SUCTION PUMP

8.2.4.1. MARKET VALUE (USD MILLION)

8.2.4.2. MARKET VOLUME (UNITS)

8.2.4.3. AVERAGE SELLING PRICE (USD)

8.2.4.4. OTHERS

8.3 PATIENT MONITORING DEVICES

8.3.1 CARDIAC MONITORING DEVICES

8.3.1.1. ECG DEVICES

8.3.1.1.1. MARKET VALUE (USD MILLION)

8.3.1.1.2. MARKET VOLUME (UNITS)

8.3.1.1.3. AVERAGE SELLING PRICE (USD)

8.3.1.2. IMPLANTABLE LOOP RECORDERS

8.3.1.2.1. MARKET VALUE (USD MILLION)

8.3.1.2.2. MARKET VOLUME (UNITS)

8.3.1.2.3. AVERAGE SELLING PRICE (USD)

8.3.1.3. EVENT MONITORS

8.3.1.3.1. MARKET VALUE (USD MILLION)

8.3.1.3.2. MARKET VOLUME (UNITS)

8.3.1.3.3. AVERAGE SELLING PRICE (USD)

8.3.1.4. MULTI-PARAMETER MONITORING DEVICES

8.3.1.4.1. LOW-ACUITY MONITORING DEVICES

8.3.1.4.1.1 MARKET VALUE (USD MILLION)

8.3.1.4.1.2 MARKET VOLUME (UNITS)

8.3.1.4.1.3 AVERAGE SELLING PRICE (USD)

8.3.1.4.2. MID-ACUITY MONITORING DEVICES

8.3.1.4.2.1 MARKET VALUE (USD MILLION)

8.3.1.4.2.2 MARKET VOLUME (UNITS)

8.3.1.4.2.3 AVERAGE SELLING PRICE (USD)

8.3.1.4.3. HIGH-ACUITY MONITORING DEVICES

8.3.1.4.3.1 MARKET VALUE (USD MILLION)

8.3.1.4.3.2 MARKET VOLUME (UNITS)

8.3.1.4.3.3 AVERAGE SELLING PRICE (USD)

8.3.1.5. RESPIRATORY MONITORING DEVICES

8.3.1.5.1. PULSE OXIMETERS

8.3.1.5.1.1 MARKET VALUE (USD MILLION)

8.3.1.5.1.2 MARKET VOLUME (UNITS)

8.3.1.5.1.3 AVERAGE SELLING PRICE (USD)

8.3.1.5.2. SPIROMETERS

8.3.1.5.2.1 MARKET VALUE (USD MILLION)

8.3.1.5.2.2 MARKET VOLUME (UNITS)

8.3.1.5.2.3 AVERAGE SELLING PRICE (USD)

8.3.1.5.3. CAPNOGRAPHS

8.3.1.5.3.1 MARKET VALUE (USD MILLION)

8.3.1.5.3.2 MARKET VOLUME (UNITS)

8.3.1.5.3.3 AVERAGE SELLING PRICE (USD)

8.3.1.5.4. PEAK FLOW METERS

8.3.1.5.4.1 MARKET VALUE (USD MILLION)

8.3.1.5.4.2 MARKET VOLUME (UNITS)

8.3.1.5.4.3 AVERAGE SELLING PRICE (USD)

8.3.2 TEMPERATURE MONITORING DEVICES

8.3.2.1. HANDHELD TEMPERATURE MONITORING DEVICES

8.3.2.1.1. MARKET VALUE (USD MILLION)

8.3.2.1.2. MARKET VOLUME (UNITS)

8.3.2.1.3. AVERAGE SELLING PRICE (USD)

8.3.2.2. TABLE-TOP TEMPERATURE MONITORING DEVICES

8.3.2.2.1. MARKET VALUE (USD MILLION)

8.3.2.2.2. MARKET VOLUME (UNITS)

8.3.2.2.3. AVERAGE SELLING PRICE (USD)

8.3.2.3. INVASIVE TEMPERATURE MONITORING DEVICES

8.3.2.3.1. MARKET VALUE (USD MILLION)

8.3.2.3.2. MARKET VOLUME (UNITS)

8.3.2.3.3. AVERAGE SELLING PRICE (USD)

8.3.3 HEMODYNAMIC/PRESSURE MONITORING DEVICES

8.3.3.1. HEMODYNAMIC MONITORS

8.3.3.1.1. MARKET VALUE (USD MILLION)

8.3.3.1.2. MARKET VOLUME (UNITS)

8.3.3.1.3. AVERAGE SELLING PRICE (USD)

8.3.3.2. BLOOD PRESSURE MONITORS

8.3.3.2.1. MARKET VALUE (USD MILLION)

8.3.3.2.2. MARKET VOLUME (UNITS)

8.3.3.2.3. AVERAGE SELLING PRICE (USD)

8.3.3.3. DISPOSABLES

8.3.3.3.1. MARKET VALUE (USD MILLION)

8.3.3.3.2. MARKET VOLUME (UNITS)

8.3.3.3.3. AVERAGE SELLING PRICE (USD)

8.3.4 NEUROMONITORING DEVICES

8.3.4.1. ELECTROENCEPHALOGRAPH MACHINES

8.3.4.1.1. MARKET VALUE (USD MILLION)

8.3.4.1.2. MARKET VOLUME (UNITS)

8.3.4.1.3. AVERAGE SELLING PRICE (USD)

8.3.4.2. ELECTROMYOGRAPHY MACHINES

8.3.4.2.1. MARKET VALUE (USD MILLION)

8.3.4.2.2. MARKET VOLUME (UNITS)

8.3.4.2.3. AVERAGE SELLING PRICE (USD)

8.3.4.3. CEREBRAL OXIMETERS

8.3.4.3.1. MARKET VALUE (USD MILLION)

8.3.4.3.2. MARKET VOLUME (UNITS)

8.3.4.3.3. AVERAGE SELLING PRICE (USD)

8.3.4.4. INTRACRANIAL PRESSURE MONITORS

8.3.4.4.1. MARKET VALUE (USD MILLION)

8.3.4.4.2. MARKET VOLUME (UNITS)

8.3.4.4.3. AVERAGE SELLING PRICE (USD)

8.3.4.5. MAGNETOENCEPHALOGRAPH MACHINES

8.3.4.5.1. MARKET VALUE (USD MILLION)

8.3.4.5.2. MARKET VOLUME (UNITS)

8.3.4.5.3. AVERAGE SELLING PRICE (USD)

8.3.4.6. TRANSCRANIAL DOPPLER MACHINES

8.3.4.6.1. MARKET VALUE (USD MILLION)

8.3.4.6.2. MARKET VOLUME (UNITS)

8.3.4.6.3. AVERAGE SELLING PRICE (USD)

8.4 DIAGNOSTIC DEVICES

8.4.1 ULTRASONOGRAPHY MACHINE

8.4.1.1. MARKET VALUE (USD MILLION)

8.4.1.2. MARKET VOLUME (UNITS)

8.4.1.3. AVERAGE SELLING PRICE (USD)

8.4.2 ELECTROCARDIOGRAM (ECG) MACHINE

8.4.2.1. MARKET VALUE (USD MILLION)

8.4.2.2. MARKET VOLUME (UNITS)

8.4.2.3. AVERAGE SELLING PRICE (USD)

8.4.3 MOBILE X-RAY MACHINE

8.4.3.1. MARKET VALUE (USD MILLION)

8.4.3.2. MARKET VOLUME (UNITS)

8.4.3.3. AVERAGE SELLING PRICE (USD)

8.4.4 ABG MACHINE

8.4.4.1. MARKET VALUE (USD MILLION)

8.4.4.2. MARKET VOLUME (UNITS)

8.4.4.3. AVERAGE SELLING PRICE (USD)

8.5 UNITS & SYSTEMS

8.5.1 MEDICAL SUPPLY SYSTEMS

8.5.1.1. CEILING SUPPLY UNIT

8.5.1.1.1. MARKET VALUE (USD MILLION)

8.5.1.1.2. MARKET VOLUME (UNITS)

8.5.1.1.3. AVERAGE SELLING PRICE (USD)

8.5.1.2. CEILING ARM SYSTEM

8.5.1.2.1. MARKET VALUE (USD MILLION)

8.5.1.2.2. MARKET VOLUME (UNITS)

8.5.1.2.3. AVERAGE SELLING PRICE (USD)

8.5.1.3. CEILING BEAM SYSTEM

8.5.1.3.1. MARKET VALUE (USD MILLION)

8.5.1.3.2. MARKET VOLUME (UNITS)

8.5.1.3.3. AVERAGE SELLING PRICE (USD)

8.5.1.4. WALL-MOUNT SYSTEM

8.5.1.4.1. MARKET VALUE (USD MILLION)

8.5.1.4.2. MARKET VOLUME (UNITS)

8.5.1.4.3. AVERAGE SELLING PRICE (USD)

8.5.1.5. WALL SUPPLY UNIT

8.5.1.5.1. MARKET VALUE (USD MILLION)

8.5.1.5.2. MARKET VOLUME (UNITS)

8.5.1.5.3. AVERAGE SELLING PRICE (USD)

8.5.2 SURGICAL AND EXAMINATION LIGHTS

8.5.2.1. MEDICAL LIGHTS

8.5.2.1.1. MARKET VALUE (USD MILLION)

8.5.2.1.2. MARKET VOLUME (UNITS)

8.5.2.1.3. AVERAGE SELLING PRICE (USD)

8.5.2.2. SURGICAL LIGHT

8.5.2.2.1. MARKET VALUE (USD MILLION)

8.5.2.2.2. MARKET VOLUME (UNITS)

8.5.2.2.3. AVERAGE SELLING PRICE (USD)

8.5.2.3. EXAMINATION LIGHT

8.5.2.3.1. MARKET VALUE (USD MILLION)

8.5.2.3.2. MARKET VOLUME (UNITS)

8.5.2.3.3. AVERAGE SELLING PRICE (USD)

8.5.3 OTHERS

8.6 OTHER DEVICES

8.6.1 INFUSION PUMPS

8.6.1.1. MARKET VALUE (USD MILLION)

8.6.1.2. MARKET VOLUME (UNITS)

8.6.1.3. AVERAGE SELLING PRICE (USD)

8.6.2 SLEEP APNEA DEVICES

8.6.2.1. MARKET VALUE (USD MILLION)

8.6.2.2. MARKET VOLUME (UNITS)

8.6.2.3. AVERAGE SELLING PRICE (USD)

8.6.3 BLOOD WARMER

8.6.3.1. MARKET VALUE (USD MILLION)

8.6.3.2. MARKET VOLUME (UNITS)

8.6.3.3. AVERAGE SELLING PRICE (USD)

8.6.4 WARMERS & INCUBATORS

8.6.4.1. TRANSPORT INCUBATOR

8.6.4.1.1. EXTERNAL TRANSPORT INCUBATOR

8.6.4.1.1.1 MARKET VALUE (USD MILLION)

8.6.4.1.1.2 MARKET VOLUME (UNITS)

8.6.4.1.1.3 AVERAGE SELLING PRICE (USD)

8.6.4.1.2. INTERNAL TRANSPORT INCUBATOR

8.6.4.1.2.1 MARKET VALUE (USD MILLION)

8.6.4.1.2.2 MARKET VOLUME (UNITS)

8.6.4.1.2.3 AVERAGE SELLING PRICE (USD)

8.6.4.2. LABOR AND DELIVERY

8.6.4.2.1. LABOR AND DELIVERY WARMER

8.6.4.2.1.1 MARKET VALUE (USD MILLION)

8.6.4.2.1.2 MARKET VOLUME (UNITS)

8.6.4.2.1.3 AVERAGE SELLING PRICE (USD)

8.6.4.2.2. LABOR AND DELIVERY INCUBATOR

8.6.4.2.2.1 MARKET VALUE (USD MILLION)

8.6.4.2.2.2 MARKET VOLUME (UNITS)

8.6.4.2.2.3 AVERAGE SELLING PRICE (USD)

8.6.4.3. INTENSIVE CARE UNIT (ICU) DEVICES UNIT (NICU)

8.6.4.3.1. NICU CONVERTIBLE WARMER/INCUBATOR

8.6.4.3.1.1 MARKET VALUE (USD MILLION)

8.6.4.3.1.2 MARKET VOLUME (UNITS)

8.6.4.3.1.3 AVERAGE SELLING PRICE (USD)

8.6.4.3.2. NICU INCUBATOR

8.6.4.3.2.1 MARKET VALUE (USD MILLION)

8.6.4.3.2.2 MARKET VOLUME (UNITS)

8.6.4.3.2.3 AVERAGE SELLING PRICE (USD)

8.6.4.3.3. NICU WARMER

8.6.4.3.3.1 MARKET VALUE (USD MILLION)

8.6.4.3.3.2 MARKET VOLUME (UNITS)

8.6.4.3.3.3 AVERAGE SELLING PRICE (USD)

8.6.5 ANESTHESIA MACHINE

8.6.5.1. MARKET VALUE (USD MILLION)

8.6.5.2. MARKET VOLUME (UNITS)

8.6.5.3. AVERAGE SELLING PRICE (USD)

8.6.6 MEDICAL ACCESSORIES AND CONSUMABLES

8.6.6.1. POSITIVE AIRWAY PRESSURE (PAP) SYSTEM

8.6.6.1.1. MARKET VALUE (USD MILLION)

8.6.6.1.2. MARKET VOLUME (UNITS)

8.6.6.1.3. AVERAGE SELLING PRICE (USD)

8.6.6.2. ANESTHESIA CIRCUIT KITS

8.6.6.2.1. MARKET VALUE (USD MILLION)

8.6.6.2.2. MARKET VOLUME (UNITS)

8.6.6.2.3. AVERAGE SELLING PRICE (USD)

8.6.6.3. ECG LEADS

8.6.6.3.1. MARKET VALUE (USD MILLION)

8.6.6.3.2. MARKET VOLUME (UNITS)

8.6.6.3.3. AVERAGE SELLING PRICE (USD)

8.6.6.4. BABYFLOW PLUS

8.6.6.4.1. MARKET VALUE (USD MILLION)

8.6.6.4.2. MARKET VOLUME (UNITS)

8.6.6.4.3. AVERAGE SELLING PRICE (USD)

8.6.6.5. CATHETERS

8.6.6.5.1. MARKET VALUE (USD MILLION)

8.6.6.5.2. MARKET VOLUME (UNITS)

8.6.6.5.3. AVERAGE SELLING PRICE (USD)

8.6.6.6. OTHERS

8.6.7 OTHERS

9 GLOBAL INTENSIVE CARE UNIT (ICU) DEVICES MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 NEONATAL ICU

9.3 ADULTS ICU

10 GLOBAL INTENSIVE CARE UNIT (ICU) DEVICES MARKET, BY PURCHASE MODE

10.1 OVERVIEW

10.2 GROUP PURCHASE ORGANIZATION

10.3 INDIVIDUAL PURCHASE

11 GLOBAL INTENSIVE CARE UNIT (ICU) DEVICES MARKET, BY FACILITY SIZE

11.1 OVERVIEW

11.2 LARGE

11.3 MEDIUM AND SMALL

12 GLOBAL INTENSIVE CARE UNIT (ICU) DEVICES MARKET, BY END USER

12.1 OVERVIEW

12.2 HOSPITALS

12.2.1 PRIVATE

12.2.2 PUBLIC

12.3 SPECIALTY CLINICS

12.4 AMBULATORY SURGICAL CENTERS

12.5 EMERGENCY SETTING

12.6 OTHERS

13 GLOBAL INTENSIVE CARE UNIT (ICU) DEVICES MARKET, BY DISTRIBUTION CHANNEL

13.1 OVERVIEW

13.2 DIRECT TENDERS

13.3 RETAIL SALES

13.4 THIRD PARTY DISTRIBUTION

13.5 OTHERS

14 GLOBAL INTENSIVE CARE UNIT (ICU) DEVICES MARKET, BY GEOGRAPHY

GLOBAL INTENSIVE CARE UNIT (ICU) DEVICES Market (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

14.1 NORTH AMERICA

14.1.1 U.S.

14.1.1.1. U.S. INTENSIVE CARE UNIT (ICU) DEVICES MARKET, BY PRODUCT TYPE

14.1.1.2. U.S. INTENSIVE CARE UNIT (ICU) DEVICES MARKET, BY END USER

14.1.1.3. U.S. INTENSIVE CARE UNIT (ICU) DEVICES MARKET, BY DISTRIBUTION CHANNEL

14.1.2 CANADA

14.1.3 MEXICO

14.2 EUROPE

14.2.1 GERMANY

14.2.2 FRANCE

14.2.3 U.K.

14.2.4 ITALY

14.2.5 SPAIN

14.2.6 RUSSIA

14.2.7 TURKEY

14.2.8 BELGIUM

14.2.9 NETHERLANDS

14.2.10 SWITZERLAND

14.2.11 REST OF EUROPE

14.3 ASIA-PACIFIC

14.3.1 JAPAN

14.3.2 CHINA

14.3.3 SOUTH KOREA

14.3.4 INDIA

14.3.5 AUSTRALIA

14.3.6 SINGAPORE

14.3.7 THAILAND

14.3.8 MALAYSIA

14.3.9 INDONESIA

14.3.10 PHILIPPINES

14.3.11 REST OF ASIA-PACIFIC

14.4 SOUTH AMERICA

14.4.1 BRAZIL

14.4.2 ARGENTINA

14.4.3 REST OF SOUTH AMERICA

14.5 MIDDLE EAST AND AFRICA

14.5.1 SOUTH AFRICA

14.5.2 SAUDI ARABIA

14.5.3 UAE

14.5.4 EGYPT

14.5.5 ISRAEL

14.5.6 REST OF MIDDLE EAST AND AFRICA

14.6 KEY PRIMARY INSIGHTS: BY MAJOR COUNTRIES

15 GLOBAL INTENSIVE CARE UNIT (ICU) DEVICES MARKET, SWOT AND DBR ANALYSIS

16 GLOBAL INTENSIVE CARE UNIT (ICU) DEVICES MARKET, COMPANY LANDSCAPE

16.1 COMPANY SHARE ANALYSIS: GLOBAL

16.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

16.3 COMPANY SHARE ANALYSIS: EUROPE

16.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

16.5 MERGERS & ACQUISITIONS

16.6 NEW PRODUCT DEVELOPMENT & APPROVALS

16.7 EXPANSIONS

16.8 REGULATORY CHANGES

16.9 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

17 GLOBAL INTENSIVE CARE UNIT (ICU) DEVICES MARKET, COMPANY PROFILE

17.1 KONINKLIJKE PHILIPS N.V.

17.1.1 COMPANY OVERVIEW

17.1.2 REVENUE ANALYSIS

17.1.3 GEOGRAPHIC PRESENCE

17.1.4 PRODUCT PORTFOLIO

17.1.5 RECENT DEVELOPMENTS

17.2 GENERAL ELECTRIC COMPANY

17.2.1 COMPANY OVERVIEW

17.2.2 REVENUE ANALYSIS

17.2.3 GEOGRAPHIC PRESENCE

17.2.4 PRODUCT PORTFOLIO

17.2.5 RECENT DEVELOPMENTS

17.3 COOK MEDICAL

17.3.1 COMPANY OVERVIEW

17.3.2 REVENUE ANALYSIS

17.3.3 GEOGRAPHIC PRESENCE

17.3.4 PRODUCT PORTFOLIO

17.3.5 RECENT DEVELOPMENTS

17.4 BD

17.4.1 COMPANY OVERVIEW

17.4.2 REVENUE ANALYSIS

17.4.3 GEOGRAPHIC PRESENCE

17.4.4 PRODUCT PORTFOLIO

17.4.5 RECENT DEVELOPMENTS

17.5 GETINGE AB

17.5.1 COMPANY OVERVIEW

17.5.2 REVENUE ANALYSIS

17.5.3 GEOGRAPHIC PRESENCE

17.5.4 PRODUCT PORTFOLIO

17.5.5 RECENT DEVELOPMENTS

17.6 HEYER MEDICAL AG

17.6.1 COMPANY OVERVIEW

17.6.2 REVENUE ANALYSIS

17.6.3 GEOGRAPHIC PRESENCE

17.6.4 PRODUCT PORTFOLIO

17.6.5 RECENT DEVELOPMENTS

17.7 DRÄGERWERK AG & CO. KGAA

17.7.1 COMPANY OVERVIEW

17.7.2 REVENUE ANALYSIS

17.7.3 GEOGRAPHIC PRESENCE

17.7.4 PRODUCT PORTFOLIO

17.7.5 RECENT DEVELOPMENTS

17.8 MEDTRONIC

17.8.1 COMPANY OVERVIEW

17.8.2 REVENUE ANALYSIS

17.8.3 GEOGRAPHIC PRESENCE

17.8.4 PRODUCT PORTFOLIO

17.8.5 RECENT DEVELOPMENTS

17.9 B. BRAUN MELSUNGEN AG

17.9.1 COMPANY OVERVIEW

17.9.2 REVENUE ANALYSIS

17.9.3 GEOGRAPHIC PRESENCE

17.9.4 PRODUCT PORTFOLIO

17.9.5 RECENT DEVELOPMENTS

17.1 ICU MEDICAL INC

17.10.1 COMPANY OVERVIEW

17.10.2 REVENUE ANALYSIS

17.10.3 GEOGRAPHIC PRESENCE

17.10.4 PRODUCT PORTFOLIO

17.10.5 RECENT DEVELOPMENTS

17.11 NIHON KOHDEN CORPORATION

17.11.1 COMPANY OVERVIEW

17.11.2 REVENUE ANALYSIS

17.11.3 GEOGRAPHIC PRESENCE

17.11.4 PRODUCT PORTFOLIO

17.11.5 RECENT DEVELOPMENTS

17.12 FRESENIUS SE & CO. KGAA

17.12.1 COMPANY OVERVIEW

17.12.2 REVENUE ANALYSIS

17.12.3 GEOGRAPHIC PRESENCE

17.12.4 PRODUCT PORTFOLIO

17.12.5 RECENT DEVELOPMENTS

17.13 SKANRAY TECHNOLOGIES PVT. LTD

17.13.1 COMPANY OVERVIEW

17.13.2 REVENUE ANALYSIS

17.13.3 GEOGRAPHIC PRESENCE

17.13.4 PRODUCT PORTFOLIO

17.13.5 RECENT DEVELOPMENTS

17.14 ABBOTT

17.14.1 COMPANY OVERVIEW

17.14.2 REVENUE ANALYSIS

17.14.3 GEOGRAPHIC PRESENCE

17.14.4 PRODUCT PORTFOLIO

17.14.5 RECENT DEVELOPMENTS

17.15 SCHILLER

17.15.1 COMPANY OVERVIEW

17.15.2 REVENUE ANALYSIS

17.15.3 GEOGRAPHIC PRESENCE

17.15.4 PRODUCT PORTFOLIO

17.15.5 RECENT DEVELOPMENTS

17.16 STERIS PLC

17.16.1 COMPANY OVERVIEW

17.16.2 REVENUE ANALYSIS

17.16.3 GEOGRAPHIC PRESENCE

17.16.4 PRODUCT PORTFOLIO

17.16.5 RECENT DEVELOPMENTS

17.17 HILL-ROM SERVICES, INC.

17.17.1 COMPANY OVERVIEW

17.17.2 REVENUE ANALYSIS

17.17.3 GEOGRAPHIC PRESENCE

17.17.4 PRODUCT PORTFOLIO

17.17.5 RECENT DEVELOPMENTS

17.18 MASIMO

17.18.1 COMPANY OVERVIEW

17.18.2 REVENUE ANALYSIS

17.18.3 GEOGRAPHIC PRESENCE

17.18.4 PRODUCT PORTFOLIO

17.18.5 RECENT DEVELOPMENTS

17.19 NATUS MEDICAL

17.19.1 COMPANY OVERVIEW

17.19.2 REVENUE ANALYSIS

17.19.3 GEOGRAPHIC PRESENCE

17.19.4 PRODUCT PORTFOLIO

17.19.5 RECENT DEVELOPMENTS

17.2 SHENZHEN MINDRAY BIO-MEDICAL ELECTRONICS CO., LTD

17.20.1 COMPANY OVERVIEW

17.20.2 REVENUE ANALYSIS

17.20.3 GEOGRAPHIC PRESENCE

17.20.4 PRODUCT PORTFOLIO

17.20.5 RECENT DEVELOPMENTS

17.21 BOSTON SCIENTIFIC CORPORATION

17.21.1 COMPANY OVERVIEW

17.21.2 REVENUE ANALYSIS

17.21.3 GEOGRAPHIC PRESENCE

17.21.4 PRODUCT PORTFOLIO

17.21.5 RECENT DEVELOPMENTS

17.22 FISHER AND PAYKEL HEALTHCARE

17.22.1 COMPANY OVERVIEW

17.22.2 REVENUE ANALYSIS

17.22.3 GEOGRAPHIC PRESENCE

17.22.4 PRODUCT PORTFOLIO

17.22.5 RECENT DEVELOPMENTS

17.23 NONIN

17.23.1 COMPANY OVERVIEW

17.23.2 REVENUE ANALYSIS

17.23.3 GEOGRAPHIC PRESENCE

17.23.4 PRODUCT PORTFOLIO

17.23.5 RECENT DEVELOPMENTS

17.24 DIXION

17.24.1 COMPANY OVERVIEW

17.24.2 REVENUE ANALYSIS

17.24.3 GEOGRAPHIC PRESENCE

17.24.4 PRODUCT PORTFOLIO

17.24.5 RECENT DEVELOPMENTS

17.25 SS TECHNOMED (P) LTD.

17.25.1 COMPANY OVERVIEW

17.25.2 REVENUE ANALYSIS

17.25.3 GEOGRAPHIC PRESENCE

17.25.4 PRODUCT PORTFOLIO

17.25.5 RECENT DEVELOPMENTS

17.26 VIA GLOBAL HEALTH

17.26.1 COMPANY OVERVIEW

17.26.2 REVENUE ANALYSIS

17.26.3 GEOGRAPHIC PRESENCE

17.26.4 PRODUCT PORTFOLIO

17.26.5 RECENT DEVELOPMENTS

17.27 CROWN HEALTHCARE

17.27.1 COMPANY OVERVIEW

17.27.2 REVENUE ANALYSIS

17.27.3 GEOGRAPHIC PRESENCE

17.27.4 PRODUCT PORTFOLIO

17.27.5 RECENT DEVELOPMENTS

17.28 ADVIN HEALTH CARE

17.28.1 COMPANY OVERVIEW

17.28.2 REVENUE ANALYSIS

17.28.3 GEOGRAPHIC PRESENCE

17.28.4 PRODUCT PORTFOLIO

17.28.5 RECENT DEVELOPMENT

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST RELATED REPORTS

18 CONCLUSION

19 QUESTIONNAIRE

20 ABOUT DATA BRIDGE MARKET RESEARCH

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.