Global Induction Cooktops Market

Market Size in USD Billion

CAGR :

%

USD

25.97 Billion

USD

38.08 Billion

2025

2033

USD

25.97 Billion

USD

38.08 Billion

2025

2033

| 2026 –2033 | |

| USD 25.97 Billion | |

| USD 38.08 Billion | |

|

|

|

|

Induction Cooktops Market Size

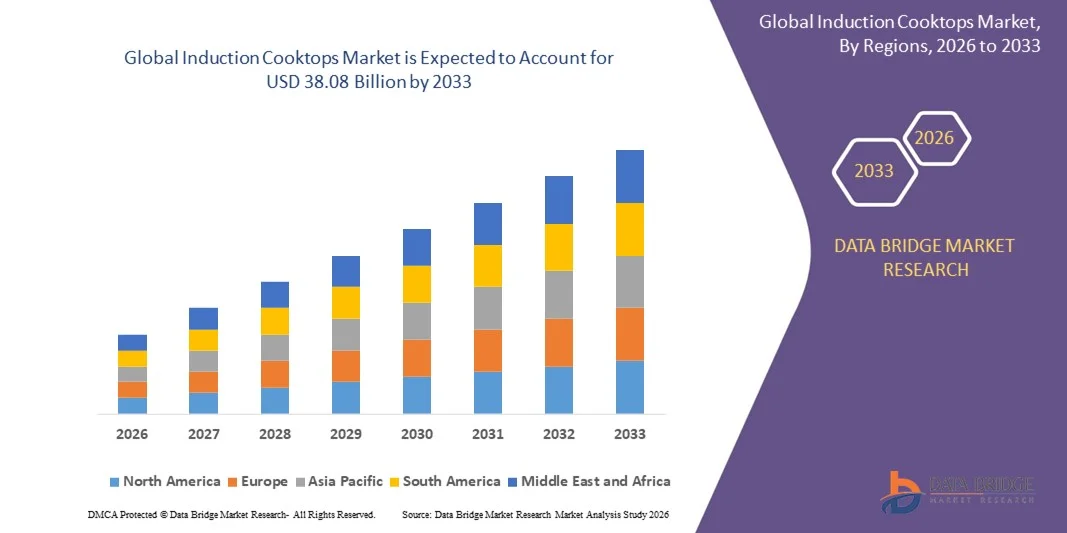

- The global induction cooktops market size was valued at USD 25.97 billion in 2025 and is expected to reach USD 38.08 billion by 2033, at a CAGR of 4.90% during the forecast period

- The market growth is largely driven by the increasing shift toward energy-efficient and electric cooking solutions, supported by rising environmental awareness and government initiatives promoting reduced reliance on gas-based appliances in residential and commercial kitchens

- Furthermore, growing consumer preference for faster cooking, enhanced safety, and precise temperature control is positioning induction cooktops as a preferred modern cooking technology. These combined factors are accelerating the adoption of induction cooktops, thereby significantly supporting overall market growth

Induction Cooktops Market Analysis

- Induction cooktops are advanced electric cooking appliances that use electromagnetic induction to directly heat cookware, offering higher efficiency, improved safety, and precise control compared to conventional gas and electric cooktops for household and commercial use

- The rising demand for induction cooktops is primarily fueled by urbanization, increasing disposable incomes, expanding modular kitchen installations, and a growing emphasis on clean, safe, and energy-efficient cooking solutions across global markets

- Europe dominated induction cooktops market with a share of 33.3% in 2025, due to strong adoption of energy-efficient cooking appliances and stringent regulations promoting low-emission and electric cooking solutions

- Asia-Pacific is expected to be the fastest growing region in the induction cooktops market during the forecast period due to rapid urbanization, growing middle-class population, and rising demand for affordable electric cooking solutions

- Free standing induction cooktops segment dominated the market with a market share of 58.5% in 2025, due to their affordability, portability, and ease of installation without the need for kitchen remodeling. These units are widely preferred by urban households, rental accommodations, and small food service operators due to their plug-and-play nature and flexibility in placement. Consumers value free standing models for energy efficiency, compact design, and suitability for space-constrained kitchens, which continues to sustain strong demand across emerging and developed markets

Report Scope and Induction Cooktops Market Segmentation

|

Attributes |

Induction Cooktops Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Induction Cooktops Market Trends

Rising Adoption of Energy-Efficient and Smart Induction Cooking Technologies

- A significant trend in the induction cooktops market is the rising adoption of energy-efficient and smart induction cooking technologies, driven by increasing consumer awareness regarding electricity savings, safety, and precision cooking. Induction cooktops are gaining preference across residential and commercial kitchens as they offer faster heating, minimal heat loss, and advanced control features that align with modern cooking requirements

- For instance, Samsung Electronics has introduced AI-enabled induction cooktops that automatically adjust heat settings and optimize energy consumption, strengthening consumer confidence in smart cooking solutions. Such developments enhance user convenience and support the transition toward intelligent kitchen ecosystems

- The integration of smart features such as touch controls, flexible cooking zones, and connectivity with smart home systems is expanding rapidly, particularly in premium and modular kitchen segments. This trend is encouraging consumers to upgrade from conventional gas and electric cooktops to advanced induction-based alternatives

- Manufacturers are also focusing on improved surface durability and enhanced coil designs to increase cooking flexibility and appliance lifespan. These innovations are improving product performance and reinforcing induction cooktops as reliable long-term kitchen investments

- The increasing availability of aesthetically appealing built-in induction cooktops is further shaping demand across urban households. This growing emphasis on efficiency, design, and smart functionality is strengthening the long-term market outlook for induction cooktops globally

Induction Cooktops Market Dynamics

Driver

Growing Shift from Gas-Based Cooking to Electric and Induction Appliances

- The growing shift from gas-based cooking to electric and induction appliances is a key driver accelerating the induction cooktops market, supported by environmental concerns and government initiatives promoting cleaner cooking technologies. Induction cooktops reduce indoor air pollution and improve energy efficiency, making them increasingly attractive to modern households

- For instance, Electrolux has expanded its induction cooking portfolio to support sustainability goals by promoting appliances that reduce carbon emissions through efficient energy usage. Such initiatives encourage consumers to adopt induction cooking as a cleaner alternative to traditional gas stoves

- Rising urbanization and the expansion of apartment living are increasing demand for safe and compact cooking solutions that do not rely on gas pipelines. Induction cooktops address these needs by offering enhanced safety features such as auto shut-off and surface temperature control

- The increasing cost volatility of LPG and natural gas is also influencing households to transition toward electric cooking appliances. This economic factor further strengthens the demand for induction cooktops across both developed and emerging markets

- The continued emphasis on energy efficiency standards and electrification of home appliances is reinforcing this driver. The sustained movement away from gas-based systems is positioning induction cooktops as a core component of future kitchens

Restraint/Challenge

High Initial Cost and Cookware Compatibility Constraints

- The induction cooktops market faces challenges related to high initial costs and cookware compatibility requirements, which can limit adoption among price-sensitive consumers. Induction cooktops typically require higher upfront investment compared to traditional gas stoves, affecting purchasing decisions in cost-conscious regions

- For instance, premium induction models offered by brands such as Miele are priced significantly higher due to advanced technology and build quality, which restricts accessibility for middle-income households. This pricing barrier slows penetration in certain developing markets

- Induction cooking also requires compatible cookware made from ferromagnetic materials, which creates additional replacement costs for consumers transitioning from conventional cooking systems. This requirement can discourage first-time buyers and delay adoption

- Limited awareness regarding cookware compatibility and perceived complexity of induction technology further add to consumer hesitation. These factors collectively restrain faster market expansion, particularly in rural and semi-urban areas

- Despite technological advancements, balancing affordability with performance remains a key challenge for manufacturers. Addressing cost concerns and improving consumer education will be essential to overcome these constraints and unlock broader market growth

Induction Cooktops Market Scope

The market is segmented on the basis of product type, size, surface, power, application, and distribution channel.

- By Product Type

On the basis of product type, the induction cooktops market is segmented into free standing induction cooktops and integrated induction cooktops. The free standing induction cooktops segment dominated the largest market revenue share of 58.5% in 2025, supported by their affordability, portability, and ease of installation without the need for kitchen remodeling. These units are widely preferred by urban households, rental accommodations, and small food service operators due to their plug-and-play nature and flexibility in placement. Consumers value free standing models for energy efficiency, compact design, and suitability for space-constrained kitchens, which continues to sustain strong demand across emerging and developed markets.

The integrated induction cooktops segment is expected to witness the fastest growth from 2026 to 2033, driven by rising adoption of modular kitchens and premium built-in appliances. Integrated models offer seamless aesthetics, optimized space utilization, and advanced features such as multi-zone cooking and precise temperature control, making them attractive to high-income households and luxury residential projects. Growing investments in smart homes and high-end kitchen renovations further accelerate the uptake of integrated induction cooktops.

- By Size

On the basis of size, the induction cooktops market is segmented into small, medium, and large. The medium-size induction cooktops segment held the dominant market revenue share in 2025, as it offers an optimal balance between cooking capacity and space efficiency. Medium-sized units cater effectively to average household requirements, supporting multiple cookware sizes while fitting standard kitchen layouts. Their versatility, moderate power consumption, and competitive pricing have positioned them as the most widely adopted option across residential users.

The large-size induction cooktops segment is projected to register the fastest growth rate during the forecast period, fueled by increasing demand from large families and commercial-style home kitchens. These cooktops enable simultaneous multi-dish preparation, higher power output, and enhanced control features, aligning with evolving cooking habits and premium kitchen preferences. Growth in hospitality-style residential cooking and shared living spaces further strengthens demand for larger induction cooktops.

- By Surface

On the basis of surface, the induction cooktops market is segmented into flat surface and concave surface. The flat surface segment accounted for the largest market share in 2025, attributed to its modern design, ease of cleaning, and broad compatibility with different cookware types. Flat surface induction cooktops are widely adopted in residential kitchens due to their sleek appearance and ability to integrate seamlessly with contemporary kitchen countertops. Their uniform heating performance and user-friendly interface continue to support strong market penetration.

The concave surface segment is anticipated to experience the fastest growth from 2026 to 2033, driven by increasing usage in commercial kitchens and professional cooking environments. Concave surfaces provide improved cookware stability, reduced spillage, and enhanced heat concentration, which is critical for high-intensity cooking operations. Expanding adoption in restaurants, catering services, and institutional kitchens is expected to accelerate growth in this segment.

- By Power

On the basis of power, the induction cooktops market is segmented into less than 5 KW, between 5 KW–10 KW, and more than 10 KW. The less than 5 KW segment dominated the market revenue share in 2025, supported by its suitability for household use and energy-efficient performance. These cooktops meet everyday cooking requirements while aligning with standard residential electrical infrastructure, making them a preferred choice for apartments and small homes. Cost-effectiveness and lower operational expenses further reinforce their dominance.

The more than 10 KW segment is expected to witness the fastest growth rate over the forecast period, driven by rising demand from commercial kitchens and high-capacity cooking applications. High-power induction cooktops enable rapid heating, continuous operation, and precise control, which are essential for restaurants and large-scale food service providers. Expansion of the food service industry and modernization of commercial kitchens continue to propel this segment.

- By Application

On the basis of application, the induction cooktops market is segmented into household and commercial. The household segment held the largest market revenue share in 2025, driven by growing awareness of energy-efficient cooking solutions and increasing adoption of electric appliances in residential settings. Induction cooktops are favored in households for safety features, faster cooking times, and reduced heat loss, aligning with sustainability and convenience priorities. Urbanization and rising disposable incomes further support sustained demand in this segment.

The commercial segment is projected to grow at the fastest pace from 2026 to 2033, supported by the expansion of restaurants, hotels, and institutional food services. Commercial users increasingly adopt induction cooktops to enhance kitchen efficiency, reduce operational costs, and comply with energy regulations. The shift toward cleaner cooking technologies in professional kitchens significantly contributes to rapid growth in this segment.

- By Distribution Channel

On the basis of distribution channel, the induction cooktops market is segmented into supermarkets, specialty stores, online stores, and others. The specialty stores segment dominated the market share in 2025, as consumers prefer personalized assistance, product demonstrations, and after-sales support when purchasing kitchen appliances. Specialty retailers offer a wide range of models and brands, enabling informed decision-making and fostering consumer trust. Their established presence in urban retail ecosystems continues to sustain strong sales volumes.

The online stores segment is expected to register the fastest growth rate during the forecast period, driven by increasing e-commerce penetration and digital purchasing behavior. Online platforms provide extensive product comparisons, competitive pricing, and doorstep delivery, appealing to tech-savvy and time-constrained consumers. Growth of digital retail infrastructure and promotional strategies by manufacturers further accelerate adoption through online channels.

Induction Cooktops Market Regional Analysis

- Europe dominated the induction cooktops market with the largest revenue share of 33.3% in 2025, driven by strong adoption of energy-efficient cooking appliances and stringent regulations promoting low-emission and electric cooking solutions

- Consumers across Europe increasingly prefer induction cooktops due to their high energy efficiency, safety features, and alignment with sustainability goals encouraged by regional energy policies

- The dominance of Europe is further supported by high penetration of modular kitchens, strong replacement demand for traditional gas cooktops, and widespread awareness of advanced cooking technologies across residential and commercial sectors

Germany Induction Cooktops Market Insight

The Germany induction cooktops market captured the largest share within Europe in 2025, driven by strong consumer emphasis on energy efficiency, product quality, and technological innovation. German households show high preference for built-in and integrated induction cooktops that align with modern kitchen designs. The country’s focus on sustainability and electrification of home appliances continues to support steady market expansion.

U.K. Induction Cooktops Market Insight

The U.K. induction cooktops market is projected to grow at a notable CAGR during the forecast period, supported by increasing shifts away from gas cooking and rising adoption of electric cooking appliances. Growing urbanization, smaller kitchen spaces, and demand for faster and safer cooking solutions are accelerating induction cooktop adoption. Expansion of online retail and premium kitchen renovation trends further contribute to market growth.

North America Induction Cooktops Market Insight

The North America induction cooktops market is witnessing steady growth, driven by increasing awareness of energy-efficient appliances and rising interest in modern kitchen technologies. Consumers are gradually transitioning from conventional electric and gas cooktops to induction systems due to benefits such as precise temperature control and improved safety. Growth is supported by higher disposable incomes and ongoing residential remodeling activities.

Asia-Pacific Induction Cooktops Market Insight

The Asia-Pacific induction cooktops market is expected to register the fastest CAGR from 2026 to 2033, driven by rapid urbanization, growing middle-class population, and rising demand for affordable electric cooking solutions. Increasing adoption of induction cooktops in densely populated urban households and expanding commercial food service sectors are key growth drivers. Government initiatives promoting clean cooking technologies further accelerate adoption across the region.

China Induction Cooktops Market Insight

The China induction cooktops market accounted for the largest revenue share in Asia-Pacific in 2025, supported by large-scale domestic manufacturing, competitive pricing, and widespread use of induction cooking in households. Strong demand from residential users, combined with high penetration of electric appliances, positions China as a major contributor to regional growth. Continuous product innovation by domestic manufacturers further strengthens market expansion.

Japan Induction Cooktops Market Insight

The Japan induction cooktops market is growing steadily, driven by high consumer acceptance of advanced electronic appliances and compact kitchen solutions. Induction cooktops are widely adopted due to safety advantages, precise cooking control, and suitability for smaller living spaces. The country’s aging population and preference for clean, easy-to-use cooking technologies continue to support sustained demand across residential and commercial applications.

Induction Cooktops Market Share

The induction cooktops industry is primarily led by well-established companies, including:

- Electrolux (Sweden)

- Elica S.p.A. (Italy)

- Whirlpool of India Ltd. (India)

- LG Electronics (South Korea)

- Faber (Italy)

- Midea Group (China)

- BSH Home Appliances Group (Germany)

- Robert Bosch GmbH (Germany)

- Haier Inc. (China)

- Miele (Germany)

- Panasonic Corporation (Japan)

- IFB Industries Ltd. (India)

- FABER S.p.A. (Italy)

- Sunflame Enterprises Pvt. Ltd. (India)

- KAFF Appliances (India)

- Glen Appliances Pvt. Ltd. (India)

- Hindware Appliances (India)

Latest Developments in Global Induction Cooktops Market

- In May 2024, Samsung unveiled its latest AI-enabled induction cooktop at Eurocucina in Milan, introducing a redesigned coil system that delivers 50% more usable cooking space and a highly durable non-scratch surface capable of withstanding significantly higher pressure. This development strengthens Samsung’s competitive position in the premium induction cooktops market by addressing key consumer demands for flexibility, durability, and intelligent cooking assistance, thereby accelerating adoption in high-end residential segments

- In April 2024, Electrolux Professional Group acquired Adventys, a France-based specialist in induction cooking solutions, for approximately USD 23.9 million, reinforcing its strategic focus on sustainable and energy-efficient cooking technologies. This acquisition enhances Electrolux Professional’s induction innovation capabilities and expands its presence in commercial kitchens, supporting broader market growth as businesses increasingly shift toward low-emission and high-efficiency cooking systems

- In January 2024, Bosch Home Appliances expanded its advanced FlexInduction cooktop portfolio in Europe, emphasizing adaptive cooking zones and improved power distribution for professional-style cooking at home. This development supports market growth by improving usability and performance, encouraging consumers to transition from conventional electric and gas cooktops to induction-based solutions

- In September 2023, LG Electronics introduced an upgraded smart induction cooktop range with enhanced connectivity and precision temperature control, enabling seamless integration with smart kitchen ecosystems. This innovation contributes to market expansion by aligning induction cooktops with smart home trends, increasing their appeal among tech-savvy consumers and modern households

- In January 2023, Midea launched its Celestial Flex Series, becoming the first to adopt the finalized Ki wireless power standard, allowing small kitchen appliances to operate cordlessly using power transferred directly from the induction cooktop. This breakthrough elevated the functional value of induction cooktops beyond cooking, positioning them as multifunctional kitchen hubs and driving renewed interest and differentiation within the global induction cooktops market.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.