Global Inhalable Insulin Market

Market Size in USD Million

CAGR :

%

USD

630.00 Million

USD

1,476.10 Million

2024

2032

USD

630.00 Million

USD

1,476.10 Million

2024

2032

| 2025 –2032 | |

| USD 630.00 Million | |

| USD 1,476.10 Million | |

|

|

|

|

Inhalable Insulin Market Size

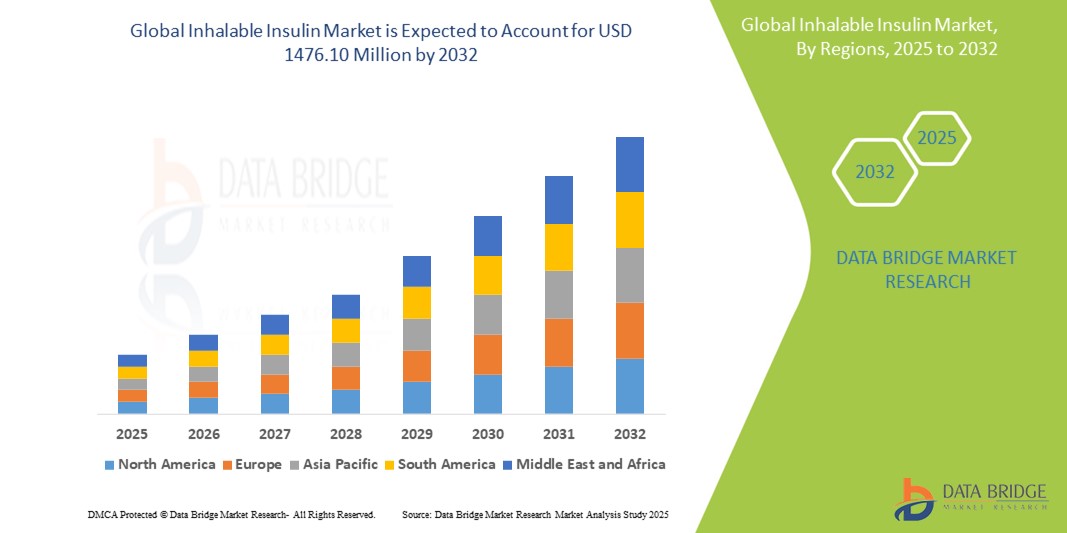

- The global inhalable insulin market size was valued at USD 630 million in 2024 and is expected to reach USD 1,476.10 million by 2032, at a CAGR of 11.23% during the forecast period

- The market growth is largely fueled by the rising prevalence of diabetes globally and the increasing need for non-invasive, patient-friendly insulin delivery methods, positioning inhalable insulin as a compelling alternative to traditional injectable insulin

- Furthermore, ongoing advancements in pulmonary drug delivery technologies and improved bioavailability of insulin through inhalation are driving greater adoption among both patients and healthcare providers. These converging factors are accelerating the uptake of inhalable insulin solutions, thereby significantly boosting the industry's growth

Inhalable Insulin Market Analysis

- Inhalable insulin, offering a needle-free alternative for diabetes management, is becoming an increasingly vital component of modern diabetes care due to its rapid onset of action, enhanced patient compliance, and ease of administration, especially for those with injection-related anxiety

- The escalating demand for inhalable insulin is primarily fueled by the growing prevalence of diabetes globally, increased focus on non-invasive treatment options, and rising awareness of alternative insulin delivery technologies

- North America dominates the inhalable insulin market with the largest revenue share of 38.5% in 2024, characterized by a high diabetic population, robust healthcare infrastructure, and favourable regulatory support

- Asia-Pacific is expected to be the fastest growing region in the inhalable insulin market during the forecast period. This growth is driven by increasing healthcare access, rising diabetes incidence, and expanding awareness of novel drug delivery systems across the region

- The type 1 diabetes segment dominates the inhalable insulin market with a market share of 45.1% in 2024, driven by the segment’s need for daily insulin administration and the potential of inhalable insulin to improve quality of life and treatment adherence among young and working-age populations

Report Scope and Inhalable Insulin Market Segmentation

|

Attributes |

Inhalable Insulin Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Inhalable Insulin Market Trends

“Enhanced Convenience Through Needle-Free Drug Delivery”

- A significant and accelerating trend in the global inhalable insulin market is the increasing preference for non-invasive, needle-free drug delivery methods, particularly among patients with type 1 and type 2 diabetes who require regular insulin administration. This innovation is significantly improving patient compliance, convenience, and quality of life

- For instance, Technosphere Insulin (marketed as Afrezza by MannKind Corporation) offers a rapid-acting inhaled insulin alternative to mealtime injections, allowing users to inhale insulin powder through a compact inhaler. This reduces the discomfort and stigma associated with daily needle use

- Needle-free administration enables faster absorption through pulmonary delivery, offering quicker onset of action compared to traditional subcutaneous insulin. This can provide better postprandial glucose control and flexibility in diabetes management

- Furthermore, inhalable insulin devices are designed for portability and ease of use, making them especially beneficial for pediatric, geriatric, or needle-averse populations. The compact design allows for discreet usage, aligning with modern lifestyle demands for convenience

- Manufacturers are also working on refining inhalable insulin formulations and improving bioavailability, paving the way for broader use in type 2 diabetes and combination therapies. The global trend toward patient-centric care continues to drive demand for innovative, user-friendly solutions such as inhalable insulin

- The growing emphasis on improving medication adherence and the convenience offered by needle-free delivery methods are fueling increased adoption across both developed and developing regions, positioning the market for sustained growth

Inhalable Insulin Market Dynamics

Driver

“Growing Need Due to Patient Preference for Non-Invasive Delivery and Convenience”

- The increasing prevalence of diabetes globally, coupled with a significant portion of patients experiencing needle-phobia or seeking more convenient insulin delivery methods, is a major driver for the heightened demand for inhalable insulin

- For instance, in 2024, MannKind Corporation, the manufacturer of Afrezza, continued its efforts to expand patient access and education, highlighting the product's rapid-acting profile and ease of administration. Such strategies by key companies are expected to drive the Inhalable Insulin industry growth in the forecast period

- As diabetic patients become more aware of alternative delivery options and seek enhanced ease in their daily treatment regimen, inhalable insulin offers advanced features such as discreet administration, reduced burden of injections, and a potential for faster absorption, providing a compelling alternative to traditional subcutaneous insulin

- Furthermore, the growing focus on improving patient adherence to therapy and the desire for more user-friendly diabetes management tools are making inhalable insulin an integral component of comprehensive care plans, offering a differentiated option for mealtime insulin

- The convenience of a needle-free delivery system, the ability to carry and administer insulin without refrigeration (for specific products), and the potential for a less intrusive treatment experience are key factors propelling the adoption of inhalable insulin in the residential sector. The trend towards personalized diabetes management and the increasing availability of patient-friendly delivery options further contribute to market growth

Restraint/Challenge

“Concerns Regarding Historical Market Challenges and Perceived High Costs”

- Concerns surrounding the historical challenges faced by inhalable insulin products, including past withdrawals from the market and associated perception issues, pose a significant challenge to broader market penetration. As inhalable insulin relies on patient comfort with inhalation devices and a clear understanding of its benefits versus risks, it raises anxieties among potential consumers about its long-term viability and safety

- For instance, high-profile reports of the withdrawal of earlier inhalable insulin products (such as Exubera) have made some patients and healthcare providers hesitant to fully embrace this delivery method, creating a barrier to widespread adoption

- Addressing these concerns through robust clinical evidence, consistent patient education on proper usage and potential side effects, and transparent communication about product differentiation is crucial for building consumer trust. Companies such as MannKind emphasize the unique pharmacokinetic profile and patient benefits of Afrezza in their marketing to reassure potential users. In addition, the relatively high initial cost of some advanced Inhalable Insulin systems compared to traditional injectable insulin can be a barrier to adoption for price-sensitive consumers or those with restrictive insurance coverage. While the cost may be offset by convenience for some, the perceived premium can still hinder widespread use

- While continuous efforts are being made to refine products and reduce costs, the perceived premium for this specialized technology can still hinder widespread adoption, especially for those who do not see an immediate and significant advantage over well-established injectable alternatives.

Inhalable Insulin Market Scope

The market is segmented on the basis of type, delivery device, application, and end user.

• By Type

On the basis of type, the inhalable insulin market is segmented into rapid-acting inhalable insulin, long-acting inhalable insulin, and others. The rapid-acting inhalable insulin segment dominated the market with a revenue share of 52.5% in 2024, driven by its critical role in managing post-meal blood glucose spikes and its preference among patients seeking quick-acting solutions.

The long-acting inhalable insulin segment is expected to witness the fastest CAGR of 19.3% from 2025 to 2032, fueled by growing research and development efforts to provide sustained glucose control with improved patient compliance.

• By Delivery Device

On the basis of delivery device, the inhalable insulin market is segmented into dry powder inhalers, soft mist inhalers, and others. Dry powder inhalers held the largest market share of 65.7% in 2024, attributed to their ease of use, portability, and widespread availability.

Soft mist inhalers are expected to experience the fastest CAGR of 18.8% during the forecast period, supported by advancements in inhalation technology that offer better lung deposition and enhanced drug bioavailability.

• By Application

On the basis of application, the inhalable insulin market is segmented into type 1 diabetes, type 2 diabetes, and others. The type 1 diabetes segment dominates the inhalable insulin market with a market share of 45.1% in 2024, driven by the segment’s need for daily insulin administration and the potential of inhalable insulin to improve quality of life and treatment adherence among young and working-age populations

The type 1 diabetes segment is expected to witness the fastest CAGR of 17.6% from 2025 to 2032, driven by ongoing clinical adoption and patient demand for alternatives to injectable insulin.

• By End User

On the basis of end user, the inhalable insulin market is divided into hospitals, homecare, clinics, and others. The homecare segment lead the market with a revenue share of 49.3% in 2024, propelled by the growing trend of home-based diabetes management and telemedicine.

The hospitals segment is expected to witness the fastest CAGR of 20.1% over the forecast period, driven by increasing institutional adoption of inhalable insulin therapies for both inpatient and outpatient care settings.

Inhalable Insulin Market Regional Analysis

- North America dominates the Inhalable Insulin market with the largest revenue share of 38.5% in 2024, driven by the increasing prevalence of diabetes, rising preference for non-invasive drug delivery methods, and growing awareness about the benefits of inhalable insulin among patients and healthcare providers

- The region’s strong healthcare infrastructure, higher adoption rates of advanced technologies, and favorable regulatory support for novel drug delivery systems contribute significantly to market expansion

- Moreover, increasing investments in diabetes care innovations and a rising number of clinical studies aimed at enhancing the efficacy and safety of inhalable insulin solutions are further propelling market growth, making North America a leading region in the global landscape

U.S. Inhalable Insulin Market Insight

The U.S. inhalable insulin market captured the largest revenue share of 77.9% in 2024 within North America. This is fueled by the demand for convenient insulin delivery methods, particularly for individuals with needle-phobia or those seeking rapid-acting mealtime insulin. Consumers are increasingly prioritizing ease of administration and the potential for a less intrusive treatment experience. Ongoing efforts by pharmaceutical companies to improve device design and patient education further propel the Inhalable Insulin segment. Moreover, the increasing focus on personalized diabetes management, which includes diverse delivery options, is contributing to the market's presence.

Europe Inhalable Insulin Market Insight

The Europe inhalable insulin market is projected to expand at a cautious but substantial CAGR throughout the forecast period. This growth is primarily driven by the high prevalence of diabetes across the continent and the ongoing efforts to improve patient adherence through diverse delivery methods. The increase in awareness regarding different insulin administration options, coupled with demand for user-friendly devices, is fostering the adoption of inhalable insulin where approved. European healthcare systems are also evaluating the convenience and potential impact on patient quality of life that these devices offer. The region may see gradual growth in specific patient populations, particularly in countries with well-developed diabetes care networks.

U.K. Inhalable Insulin Market Insight

The U.K. inhalable insulin market is anticipated to grow at a noteworthy CAGR during the forecast period. This is driven by the escalating burden of diabetes and the desire for more convenient insulin delivery options. In addition, patient preferences for non-invasive treatments are encouraging both healthcare providers and individuals to consider alternatives to traditional injections. The UK’s focus on improving patient outcomes in diabetes management, alongside its national healthcare framework, could provide opportunities for specialized insulin delivery systems to gain traction.

Germany Inhalable Insulin Market Insight

The Germany inhalable insulin market is expected to expand at a considerable CAGR during the forecast period. This is fueled by increasing awareness of advanced diabetes care solutions and the demand for patient-centric treatment options. Germany’s well-developed healthcare infrastructure, combined with its emphasis on precision medicine and patient safety, promotes the adoption of diverse insulin delivery methods. The integration of convenient and less invasive insulin administration into comprehensive diabetes management plans is also becoming increasingly prevalent, aligning with local patient and physician preferences.

Asia-Pacific Inhalable Insulin Market Insight

The Asia-Pacific inhalable insulin market, is poised to grow at the fastest CAGR of 14% during the forecast period of 2025 to 2032. This growth is driven by the rapidly increasing diabetes prevalence, rising disposable incomes, and improving healthcare access in countries such as China, Japan, and India. The region's growing understanding of diabetes management, supported by government initiatives promoting better patient care, is fostering the exploration of various insulin delivery options. Furthermore, as APAC's pharmaceutical manufacturing capabilities expand, the potential for local production and increased affordability of inhalable insulin solutions could broaden their accessibility to a wider patient base.

China Inhalable Insulin Market Insight

The China inhalable insulin market accounted for a notable market revenue share in Asia Pacific. This is attributed to the country's vast diabetic population, rapid expansion of healthcare facilities, and increasing acceptance of innovative medical technologies. China stands as a significant market for diabetes management, and alternative insulin delivery methods are becoming increasingly explored in both urban and rural settings. The push towards modernizing diabetes care and the availability of diverse treatment options, alongside strong domestic and international pharmaceutical players, are key factors propelling the market in China.

India Inhalable Insulin Market Insight

The India inhalable insulin market, is expected to expand at fastest CAGR during the forecast period. This growth is driven by the immense and rapidly growing diabetic population, increasing awareness about advanced diabetes management, and the desire for non-injectable insulin options. The increasing number of diagnosed diabetes cases, coupled with improving access to specialized healthcare and the potential for a more comfortable treatment experience, is fostering interest in inhalable insulin. In addition, the development of domestic pharmaceutical capabilities and efforts to make innovative therapies more accessible could significantly contribute to the market's growth across the country.

Inhalable Insulin Market Share

The inhalable insulin industry is primarily led by well-established companies, including:

- MannKind Corporation (U.S.)

- Cipla (India)

- Pfizer Inc. (U.S.)

- Nektar (U.S.)

- Sanofi (France)

- Lilly (U.S.)

- Novo Nordisk A/S (Denmark)

- Biocon (India)

- Alkermes plc (Ireland)

- AstraZeneca (U.K.)

- Boehringer Ingelheim International GmbH (Germany)

- Oramed (Israel)

Latest Developments in Global Inhalable Insulin Market

- In April 2024, MannKind Corporation, a key player in inhalable insulin, announced the initiation of a new Phase 3 clinical trial in Europe for its flagship product Afrezza. The study aims to evaluate the long-term pulmonary safety and efficacy of inhaled insulin in patients with Type 2 diabetes. This marks a significant step in expanding the regulatory footprint of Afrezza across European markets and underscores MannKind’s strategic commitment to global expansion and innovation in non-invasive insulin delivery

- In March 2024, Dance Biopharm (rebranded as Aerami Therapeutics) revealed its partnership with a leading Asian pharmaceutical firm to co-develop and commercialize its inhalable insulin platform AER-501. This collaboration aims to accelerate access to needle-free insulin delivery in high-prevalence markets such as China and India. The alliance combines Dance’s inhalation technology with regional expertise to address unmet clinical needs and support broader patient adoption

- In February 2024, Sanofi announced an investment in the development of a next-generation inhalable insulin formulation with extended stability and room-temperature shelf life. The R&D initiative focuses on improving patient adherence in lower-resource settings and expanding Sanofi’s diabetes care portfolio. The company also indicated potential pilot testing in Latin America by late 2025, targeting affordability and scalability

- In January 2024, Cipla Ltd., a major Indian pharmaceutical company, disclosed its plan to enter the inhalable insulin segment via a strategic acquisition of a local biotech startup specializing in pulmonary drug delivery. The move is expected to bolster Cipla's pipeline of diabetes therapeutics and introduce a cost-effective inhaled insulin product in India by 2026. This development reflects growing domestic interest and investment in needle-free diabetic solutions

- In December 2023, Biocon Biologics, a biosimilar leader, completed pre-clinical trials for its proprietary inhalable insulin candidate, demonstrating bioequivalence with traditional subcutaneous insulin. The company plans to enter Phase 1 human trials in 2025. Biocon’s entry signals increasing competition in this niche market and represents India’s push toward more patient-friendly biologic innovations

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.