Global Internet Of Things Iot In Food Market

Market Size in USD Billion

CAGR :

%

USD

8.18 Billion

USD

16.90 Billion

2025

2033

USD

8.18 Billion

USD

16.90 Billion

2025

2033

| 2026 –2033 | |

| USD 8.18 Billion | |

| USD 16.90 Billion | |

|

|

|

|

Global Internet of Things (IoT) in Food Market Size

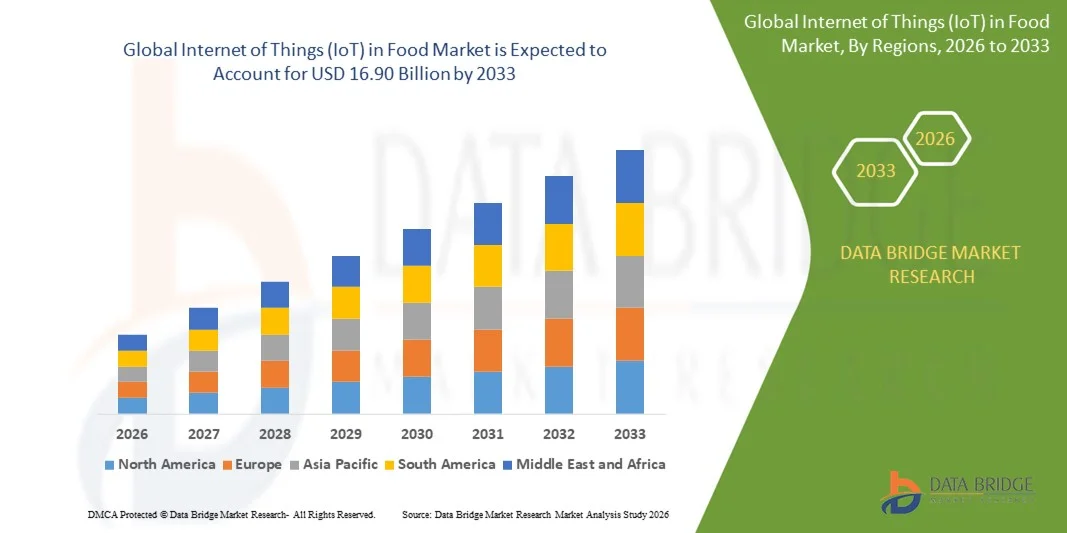

- The global Internet of Things (IoT) in Food Market was valued at USD 8.18 billion in 2025 and is projected to reach USD 16.90 billion by 2033, registering a CAGR of 9.50% over the forecast period.

- Market expansion is primarily driven by increasing deployment of connected devices and smart monitoring technologies across the food supply chain, enabling enhanced digitalization in production, processing, and distribution environments.

- Additionally, rising demand for real-time tracking, safety compliance, and automated quality control solutions is pushing food manufacturers and distributors toward advanced IoT-enabled systems. These combined forces are accelerating IoT adoption in the food sector, substantially strengthening overall market growth.

Global Internet of Things (IoT) in Food Market Analysis

- IoT-enabled systems, providing real-time monitoring, tracking, and automation across the food value chain, are becoming essential components of modern food production, processing, and distribution due to their ability to enhance traceability, safety, and operational efficiency through seamless connectivity and data integration.

- The accelerating demand for IoT in the food sector is primarily driven by the growing emphasis on food safety compliance, rising need for supply-chain transparency, and a strong industry shift toward automation and data-driven decision-making to reduce waste and improve productivity.

- North America dominated the Global Internet of Things (IoT) in Food Market with the largest revenue share of 32.1% in 2025, supported by early adoption of advanced monitoring technologies, strong regulatory standards for food safety, and high investment by leading food manufacturers and logistics providers, with the U.S. experiencing significant growth in IoT deployments across smart farming, cold-chain monitoring, and processing facilities.

- Asia-Pacific is expected to be the fastest-growing region in the Global Internet of Things (IoT) in Food Market during the forecast period due to rapid industrialization, expanding food production capacities, and increasing adoption of smart agriculture solutions driven by rising urbanization and changing consumer preferences.

- The software solutions segment dominated the market with the largest revenue share of approximately 48.6% in 2025, driven by the growing need for advanced analytics, real-time monitoring dashboards, predictive maintenance capabilities, and compliance-tracking systems across food production and supply chains.

Report Scope and Global Internet of Things (IoT) in Food Market Segmentation

|

Attributes |

Internet of Things (IoT) in Food Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

• IBM Corporation (U.S.) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Global Internet of Things (IoT) in Food Market Trends

Enhanced Efficiency Through AI and Intelligent Automation

- A major and rapidly advancing trend in the Global Internet of Things (IoT) in Food Market is the increasing integration of artificial intelligence (AI) with connected food systems, enabling smarter monitoring, predictive analytics, and real-time decision-making across the entire food value chain. This convergence of IoT and AI is significantly improving operational efficiency, safety, and supply-chain visibility.

- For Instance, AI-enabled IoT sensors used in food processing facilities can continuously assess temperature, humidity, and equipment conditions, automatically adjusting operations to maintain product quality and prevent spoilage. Similarly, AI-driven cold-chain monitoring platforms help ensure safe food transportation by identifying anomalies and initiating corrective actions in real time.

- AI integration in IoT food solutions enhances capabilities such as predictive maintenance, automated quality inspection, and intelligent alerts. Many systems are designed to learn from historical data—predicting equipment failures, optimizing resource usage, and identifying deviations in product quality. AI-powered image recognition technologies are increasingly used to detect contamination, grading errors, and packaging defects with high accuracy.

- Seamless integration of IoT platforms with centralized AI-driven food management systems allows stakeholders to monitor farms, factories, storage units, and distribution networks from a single dashboard. Users can manage inventory, track product movement, and assess food safety compliance alongside other operational metrics, creating a unified and automated ecosystem.

- This shift toward more connected, predictive, and autonomous food management systems is transforming expectations for efficiency and safety across the food sector. As a result, companies are developing advanced AI-enabled IoT solutions capable of automating inspections, optimizing logistics, and improving traceability from farm to fork.

- The demand for IoT platforms that incorporate AI-driven automation and intelligent analytics is accelerating across agriculture, food processing, logistics, and retail, as businesses increasingly prioritize efficiency, transparency, and proactive food safety management.

Global Internet of Things (IoT) in Food Market Dynamics

Driver

Growing Need Due to Rising Food Safety Concerns and Supply-Chain Digitalization

- Increasing concerns over food safety, contamination risks, and supply-chain inefficiencies, combined with the rapid adoption of digital and connected technologies across the food industry, are major drivers accelerating demand for IoT solutions in the Global Internet of Things (IoT) in Food Market.

- For Instance, leading industry players are integrating advanced IoT sensors and monitoring systems to improve real-time traceability and food quality oversight. Numerous companies are investing in IoT-driven cold-chain solutions, automated tracking devices, and connected quality-control systems to prevent spoilage and ensure compliance with stringent safety standards—initiatives expected to fuel substantial market growth during the forecast period.

- As food producers, distributors, and retailers seek stronger protection against operational risks, IoT solutions offer capabilities such as continuous condition monitoring, automated alerts, real-time inventory updates, and detailed activity logs, providing a major improvement over traditional manual methods.

- Furthermore, the rapid expansion of digital supply-chain ecosystems and the growing need for integrated, data-driven management platforms are making IoT technologies essential. Seamless connectivity with other smart systems—such as ERP platforms, predictive analytics tools, and logistics management software—enables streamlined, end-to-end oversight of food production and distribution.

- The benefits of remote monitoring, automated process control, and real-time visibility across multiple facilities and transport stages are driving strong adoption across agriculture, food processing, cold-chain logistics, and retail. Additionally, the rise of smart farming, e-commerce grocery delivery, and automated warehouse operations further contributes to market expansion.

Restraint/Challenge

Concerns Regarding Data Security, Interoperability, and High Deployment Costs

- Concerns surrounding cybersecurity vulnerabilities and data-privacy risks within connected food systems present significant challenges to broader IoT adoption. Since IoT platforms depend heavily on network connectivity and cloud-based data management, they are vulnerable to hacking, data breaches, and operational disruptions, creating hesitancy among food companies.

- For instance, High-profile cyber incidents involving IoT-based industrial systems have increased caution among stakeholders, particularly in facilities dealing with sensitive food safety data, proprietary processes, or regulatory compliance requirements.

- Addressing these concerns through advanced encryption, secure communication protocols, and frequent system updates is essential for building confidence. Many solution providers emphasize their secure architecture, multi-layer authentication, and compliance with global standards to reassure customers. Additionally, the initially high cost of deploying IoT infrastructure—including sensors, hardware, analytics platforms, and skilled labor—can be a barrier for small and medium-sized enterprises, especially in developing regions.

- While costs are decreasing as technology matures, the perception of IoT as a premium, complex investment still hinders adoption for companies that do not immediately see quantifiable returns.

- Expanding the market will require stronger cybersecurity frameworks, greater standardization for device interoperability, simplified onboarding processes, and the development of cost-effective IoT solutions tailored to smaller producers and emerging markets.

Global Internet of Things (IoT) in Food Market Scope

Internet of things (IoT) in food market is segmented on the basis of component, node component, and connectivity technology and network infrastructure.

- By Component

On the basis of component, the Global Internet of Things (IoT) in Food Market is segmented into software solutions, services, and platform. The software solutions segment dominated the market with the largest revenue share of approximately 48.6% in 2025, driven by the growing need for advanced analytics, real-time monitoring dashboards, predictive maintenance capabilities, and compliance-tracking systems across food production and supply chains. Food manufacturers and logistics companies increasingly rely on software-driven IoT ecosystems to enhance visibility, automate processes, and meet regulatory standards for safety and traceability.

The platform segment is expected to witness the fastest CAGR from 2026 to 2033, supported by the rising adoption of integrated IoT hubs that unify sensor data, cloud storage, and AI-powered analytics into a single management interface. As stakeholders seek scalable, interoperable solutions that can streamline operations from farm to fork, IoT platforms are becoming essential for digital transformation in the food sector.

- By Node Component

On the basis of node component, the market is segmented into processor, sensor, and connectivity IC. The sensor segment dominated the market with the largest revenue share of approximately 52.3% in 2025, owing to the expanding use of temperature, humidity, gas, and motion sensors across food storage, processing, and cold-chain logistics. Sensors form the backbone of IoT food ecosystems, enabling real-time condition monitoring, automated quality checks, and rapid detection of anomalies to prevent spoilage and contamination.

The connectivity IC segment is projected to record the fastest growth from 2026 to 2033, fueled by demand for low-power, compact chips that support Wi-Fi, BLE, LPWAN, and cellular connectivity. As IoT devices proliferate across distributed food environments—farms, warehouses, transport fleets, and retail shelves—the need for cost-efficient and robust connectivity ICs continues to rise, driving strong market acceleration.

- By Network Infrastructure: Server, Storage, Ethernet Switch and Routing, Gateway

on the basis of network infrastructure, the Global Internet of Things (IoT) in Food Market is segmented into server, storage, Ethernet switch and routing, and gateway. The gateway segment held the largest revenue share of approximately 41.8% in 2025, driven by its crucial role in linking IoT devices to cloud platforms, aggregating sensor data, and enabling secure communication across distributed food systems. Gateways support interoperability between heterogeneous devices and protocols, making them indispensable for smart farming, automated facilities, and cold-chain monitoring networks.

The storage segment is expected to witness the fastest CAGR from 2026 to 2033, propelled by a surge in high-density IoT data generated from imaging systems, environmental sensors, compliance tracking, and predictive analytics tools. With food companies increasingly embracing data-driven operations, scalable storage solutions—both on-premise and cloud-based—are essential for long-term data retention, regulatory compliance, and advanced AI model training.

- By Connectivity Technology

On the basis of connectivity technology, the market is segmented into Wi-Fi, Bluetooth Low Energy (BLE), Zigbee, Near Field Communication (NFC), cellular, satellite, and others. The cellular segment dominated the market with the largest revenue share of approximately 39.5% in 2025, due to its broad coverage, reliability, and suitability for large-scale food logistics and remote farming operations requiring uninterrupted real-time monitoring. Cellular IoT technologies such as LTE-M and NB-IoT have become instrumental in enabling long-range data transfer for supply-chain transparency and cold-chain management.

The BLE segment is anticipated to grow at the fastest CAGR from 2026 to 2033, driven by its low-power consumption and increasing deployment in localized monitoring systems, smart packaging, and short-range inventory tracking. BLE is particularly favored for cost-efficient sensor networks in storage facilities and retail environments, supporting scalable IoT adoption.

Global Internet of Things (IoT) in Food Market Regional Analysis

- North America dominated the Global Internet of Things (IoT) in Food Market with the largest revenue share of 32.1% in 2025, driven by the strong adoption of digital technologies across food production, processing, and distribution, as well as stringent regulatory requirements for food safety and traceability.

- Companies in the region increasingly rely on IoT-enabled systems for real-time monitoring, supply-chain transparency, and predictive maintenance, supporting higher operational efficiency and improved compliance. The presence of advanced technological infrastructure and early deployment of smart sensors and automation tools further accelerates adoption.

- This widespread integration is additionally supported by high investment capacity, a tech-savvy industrial base, and a growing preference for data-driven food management solutions. As a result, IoT platforms have become essential for enhancing cold-chain visibility, reducing waste, and ensuring consistent product quality, making North America a leading market for IoT in food across both commercial and industrial applications.

U.S. IoT in Food Market Insight

The U.S. IoT in food market captured the largest revenue share of 81% within North America in 2025, driven by the rapid adoption of connected technologies across agriculture, processing, storage, and distribution. Food companies are increasingly prioritizing real-time monitoring, automation, and data analytics to enhance operational efficiency and regulatory compliance. Strong demand for digital traceability, paired with the rising use of smart sensors and cloud-based management systems, continues to accelerate adoption. Additionally, the integration of IoT platforms with AI, blockchain, and advanced supply-chain software is significantly strengthening the market. The nation’s tech-forward ecosystem, presence of leading IoT providers, and large-scale investment in smart farming and cold-chain modernization further propel growth.

Europe IoT in Food Market Insight

The Europe IoT in food market is projected to expand at a substantial CAGR throughout the forecast period, supported by stringent food safety regulations and the increasing need for enhanced supply-chain transparency. Rising urbanization, digital transformation in the food sector, and strong government focus on traceability and sustainability are accelerating IoT adoption across farms, manufacturing facilities, and retail environments. European consumers and businesses are drawn to the efficiency gains, reduced waste, and improved quality assurance provided by IoT-enabled systems. The region is witnessing robust uptake across agriculture, logistics, and processing, with IoT solutions becoming integral to new and modernized food infrastructure projects.

U.K. IoT in Food Market Insight

The U.K. IoT in food market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by expanding digitalization initiatives, rising food safety concerns, and the demand for automation across the supply chain. Food producers and retailers increasingly adopt IoT systems to monitor inventory, track environmental conditions, and ensure compliance with evolving regulatory standards. The growth of connected devices and strong e-commerce infrastructure in the U.K. is also propelling adoption. As businesses seek to improve efficiency and minimize waste, IoT-based monitoring and predictive analytics solutions are becoming central to operational decision-making.

Germany IoT in Food Market Insight

The Germany IoT in food market is expected to expand at a considerable CAGR during the forecast period, fueled by rising awareness of digital traceability, sustainability goals, and the need for high-precision monitoring across food operations. Germany’s advanced industrial infrastructure and strong emphasis on innovation support the rapid integration of IoT in food manufacturing, smart farming, and automated logistics. Increasing adoption of secure, efficient, and environmentally responsible IoT solutions aligns with consumer expectations and regulatory pressures. Integration with smart factory technologies and Industry 4.0 initiatives is further strengthening IoT uptake across the food sector.

Asia-Pacific IoT in Food Market Insight

The Asia-Pacific IoT in food market is poised to grow at the fastest CAGR of around 24% from 2026 to 2033, driven by rapid urbanization, rising disposable incomes, and accelerated technological development in China, Japan, India, and Southeast Asia. Growing awareness of food safety, government-led digitalization programs, and expansion of smart agriculture practices support strong adoption. As APAC emerges as a global hub for IoT device manufacturing and sensor technologies, the affordability and accessibility of IoT systems continue to improve. Increasing penetration of online food retail, automated warehouses, and modernized cold-chain networks is further widening the user base.

Japan IoT in Food Market Insight

The Japan IoT in food market is gaining momentum due to the country’s high-tech environment, rapid urbanization, and commitment to efficiency and safety in food operations. IoT solutions are increasingly deployed for smart farming, automated processing, and retail monitoring. Integration with complementary IoT systems such as smart refrigeration, imaging-based quality inspection, and intelligent inventory management is fueling adoption. Additionally, Japan’s aging population is likely to drive demand for highly automated, low-labor food production and monitoring solutions across both industrial and retail settings.

China IoT in Food Market Insight

The China IoT in food market accounted for the largest revenue share in Asia-Pacific in 2025, supported by its large population, expanding middle class, and extensive digital transformation across the food sector. China remains one of the world’s largest adopters of IoT and smart manufacturing technologies, with IoT use rapidly increasing across agriculture, smart warehouses, cold-chain logistics, and retail automation. National initiatives promoting smart cities, digital agriculture, and food safety compliance, combined with strong domestic manufacturing of IoT sensors and systems, are major factors propelling market expansion. The availability of cost-effective IoT products further contributes to widespread adoption across both large enterprises and smaller food businesses.

Global Internet of Things (IoT) in Food Market Share

The Internet of Things (IoT) in Food industry is primarily led by well-established companies, including:

• IBM Corporation (U.S.)

• Siemens AG (Germany)

• Cisco Systems, Inc. (U.S.)

• Schneider Electric SE (France)

• Honeywell International Inc. (U.S.)

• ABB Ltd. (Switzerland)

• SAP SE (Germany)

• Microsoft Corporation (U.S.)

• PTC, Inc. (U.S.)

• GE Digital / General Electric Company (U.S.)

• Rockwell Automation, Inc. (U.S.)

• Emerson Electric Co. (U.S.)

• Tetra Pak International S.A. (Switzerland)

• Advantech Co., Ltd. (Taiwan)

• Yokogawa Electric Corporation (Japan)

• VusionGroup (France)

• Invengo Information Technology Co., Ltd. (China)

• Bosch Rexroth AG (Germany)

• Oracle Corporation (U.S.)

• Hitachi, Ltd. (Japan)

What are the Recent Developments in Global Internet of Things (IoT) in Food Market?

- In April 2024, IBM Corporation, a global leader in digital transformation and data solutions, launched a strategic initiative in South Africa focused on enhancing food safety and operational efficiency through advanced IoT-enabled monitoring technologies. This initiative reflects the company’s commitment to delivering innovative, scalable solutions tailored to regional supply-chain challenges. By leveraging its global expertise in AI, cloud, and IoT integration, IBM is strengthening real-time food traceability and reinforcing its growing influence in the expanding Global Internet of Things (IoT) in Food Market.

- In March 2024, Siemens AG introduced a next-generation IoT-powered automation system designed specifically for food processing and packaging environments. The solution enhances production line visibility, optimizes equipment performance, and improves quality control through intelligent sensor networks. This advancement underscores Siemens’ dedication to elevating safety and efficiency within the food sector, supporting manufacturers in meeting rising consumer expectations and strict regulatory standards.

- In March 2024, Honeywell International Inc. successfully deployed an IoT-driven urban food safety initiative in Bengaluru, aimed at strengthening cold-chain reliability and improving perishable food monitoring across the city. Utilizing advanced sensors and connected platforms, the project enhances real-time temperature tracking, reduces spoilage, and supports a more resilient food distribution network. This initiative highlights Honeywell’s commitment to leveraging smart technologies to create safer, more efficient food ecosystems.

- In February 2024, Cisco Systems, Inc. announced a strategic partnership with a major U.S. agricultural cooperative to implement a unified IoT-based data management and monitoring platform. The collaboration focuses on improving farm-to-warehouse traceability, automating crop condition analysis, and enhancing communication across distributed farming sites. This partnership demonstrates Cisco’s goal of driving innovation and improving operational transparency across the agriculture and food industries.

- In January 2024, Schneider Electric unveiled its new EcoStruxure Food Traceability Suite at an international food technology conference. Equipped with IoT connectivity, real-time analytics, and cloud integration, the platform enables food producers to remotely monitor production stages, manage energy usage, and enhance compliance reporting. The solution reinforces Schneider Electric’s commitment to advancing digitalization in the food sector, offering companies greater control over quality, safety, and sustainability.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Internet Of Things Iot In Food Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Internet Of Things Iot In Food Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Internet Of Things Iot In Food Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.