Global Intrapartum Monitoring Devices Market

Market Size in USD Billion

CAGR :

%

USD

2.45 Billion

USD

3.94 Billion

2025

2033

USD

2.45 Billion

USD

3.94 Billion

2025

2033

| 2026 –2033 | |

| USD 2.45 Billion | |

| USD 3.94 Billion | |

|

|

|

|

Intrapartum Monitoring Devices Market Size

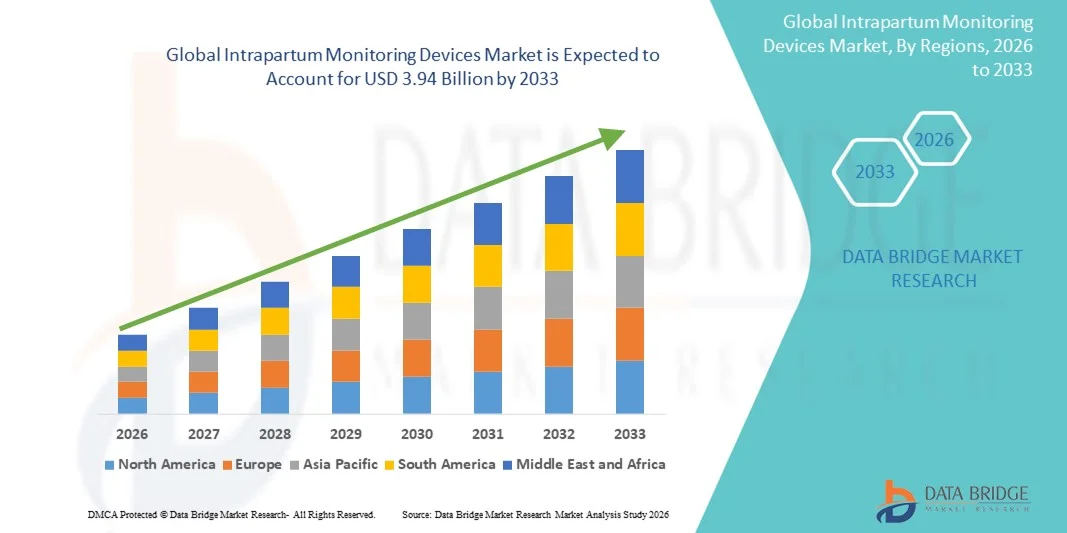

- The global Intrapartum Monitoring Devices market size was valued at USD 2.45 billion in 2025 and is expected to reach USD 3.94 billion by 2033, at a CAGR of 6.15% during the forecast period

- The market growth is largely fueled by the increasing adoption of advanced maternal healthcare technologies and rising awareness regarding maternal and neonatal health, leading to improved monitoring and management of labor and delivery in both hospital and clinical settings. Technological advancements in non-invasive and wireless monitoring systems are enhancing accuracy, convenience, and patient safety

- Furthermore, growing demand for real-time fetal and maternal monitoring, coupled with the rising prevalence of high-risk pregnancies and complications such as preterm birth, gestational diabetes, and hypertension, is establishing intrapartum monitoring devices as essential tools in modern obstetric care. These converging factors are accelerating the uptake of Intrapartum Monitoring Devices solutions, thereby significantly boosting the overall growth of the market

Intrapartum Monitoring Devices Market Analysis

- Intrapartum monitoring devices, including electronic fetal monitors, maternal vital sign monitors, and wireless/non-invasive monitoring systems, are increasingly vital in modern obstetric care due to their ability to provide real-time assessment of fetal and maternal health during labor and delivery. These devices enhance patient safety, improve clinical decision-making, and support better neonatal and maternal outcomes

- The escalating demand for intrapartum monitoring devices is primarily fueled by the rising prevalence of high-risk pregnancies, growing awareness of maternal and neonatal health, and increasing adoption of technologically advanced monitoring solutions in hospitals and birthing centers. Integration with hospital information systems and remote monitoring capabilities is further driving market adoption

- North America dominated the intrapartum monitoring devices market with the largest revenue share of approximately 41.2% in 2025, driven by advanced healthcare infrastructure, high adoption of digital health technologies, and the presence of leading medical device manufacturers. The U.S. accounted for the majority of regional demand, supported by widespread use in hospitals, maternity clinics, and specialized birthing centers

- Asia-Pacific is expected to be the fastest-growing region in the intrapartum monitoring devices market during the forecast period, with a CAGR higher than other regions, due to increasing healthcare investments, rising hospital births, growing awareness of maternal health, and expansion of private and public maternity care facilities in countries such as India, China, and Japan

- The monitors segment dominated the largest market revenue share of 57.3% in 2025, driven by the growing adoption of advanced fetal and maternal monitoring systems in hospitals and maternity centers

Report Scope and Intrapartum Monitoring Devices Market Segmentation

|

Attributes |

Intrapartum Monitoring Devices Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

• GE Healthcare (U.S.) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Intrapartum Monitoring Devices Market Trends

Rising Adoption of Advanced Intrapartum Monitoring Technologies

- A major and accelerating trend in the global intrapartum monitoring devices market is the increasing adoption of advanced fetal and maternal monitoring technologies in hospitals and birthing centers. These devices are being widely used to track fetal heart rate, uterine contractions, and maternal vitals, improving the safety and outcomes of labor and delivery

- For instance, in 2024, GE Healthcare launched its upgraded Corometrics fetal monitoring system featuring enhanced real-time data analytics for labor management, highlighting the push toward more sophisticated intrapartum monitoring solutions

- Growing awareness among healthcare providers of the importance of early detection of fetal distress and maternal complications is driving the demand for continuous and non-invasive monitoring technologies

- The shift toward high-risk pregnancy management, integration of wireless and telemetry monitoring systems, and adoption of digital record-keeping are further fueling the trend

- Hospitals and maternity care centers are increasingly focusing on patient-centered care, prompting the development of user-friendly and portable monitoring solutions that allow simultaneous tracking of multiple parameters for both mother and child

- Overall, the trend toward comprehensive, accurate, and easy-to-use intrapartum monitoring devices is shaping modern obstetric care and improving clinical decision-making

Intrapartum Monitoring Devices Market Dynamics

Driver

Increasing Need for Maternal and Fetal Safety

- The rising prevalence of maternal and neonatal complications, including preterm births and labor-related distress, is a major driver of the Intrapartum Monitoring Devices market. Continuous monitoring allows healthcare providers to intervene promptly, reducing risks during delivery

- For instance, in 2023, a large-scale clinical study in the U.S. demonstrated that continuous electronic fetal monitoring significantly reduced emergency cesarean rates, boosting the adoption of modern intrapartum monitoring devices in hospitals

- The growing number of hospital deliveries, rising awareness of maternal health, and expanding healthcare infrastructure in emerging economies are further driving market demand

- Increasing investments by hospitals in digital and connected medical devices for maternal care are strengthening the adoption of advanced monitoring systems

- Furthermore, government initiatives promoting maternal and neonatal health, such as safe childbirth programs, are encouraging the use of intrapartum monitoring devices in both developed and developing regions

Restraint/Challenge

High Cost and Limited Technical Expertise

- Despite their benefits, the high cost and technical complexity of intrapartum monitoring devices remain major challenges, particularly for small clinics and healthcare facilities in developing countries. Advanced systems often require trained personnel for accurate interpretation of data

- For instance, several community hospitals in Southeast Asia face difficulty adopting wireless telemetry monitoring systems due to budget constraints and limited staff training

- Maintenance, calibration, and integration with hospital IT systems can also increase operational costs and slow adoption

- In addition, lack of standardization across devices, variability in monitoring protocols, and concerns over data accuracy in some wireless systems can pose hurdles for healthcare providers

- Overcoming these challenges through cost-effective solutions, training programs, and standardized monitoring protocols will be essential for broader adoption and sustained growth of the Intrapartum Monitoring Devices market

Intrapartum Monitoring Devices Market Scope

The market is segmented on the basis of product and end-user.

- By Product

On the basis of product, the Intrapartum Monitoring Devices market is segmented into monitors and electrodes. The monitors segment dominated the largest market revenue share of 57.3% in 2025, driven by the growing adoption of advanced fetal and maternal monitoring systems in hospitals and maternity centers. Monitors offer real-time assessment of fetal heart rate, uterine contractions, and maternal vital signs, which are critical for early detection of complications during labor. The segment’s dominance is supported by rising awareness among healthcare professionals about maternal and neonatal safety and increasing investments in modern labor and delivery units. Monitors with integrated features such as wireless connectivity, touchscreen displays, and automated alarms enhance operational efficiency and clinical decision-making. In addition, growing adoption of electronic health record integration and remote monitoring capabilities contributes to their sustained demand. Government initiatives promoting maternal healthcare, coupled with rising patient preference for high-quality intrapartum care, further drive revenue. The availability of both wired and wireless monitor systems makes them versatile across various hospital setups. Furthermore, continuous technological advancements and training programs for healthcare staff ensure monitors remain the most preferred intrapartum monitoring product globally.

The electrodes segment is expected to witness the fastest CAGR of 10.8% from 2026 to 2033, fueled by increasing use of disposable and reusable electrodes in continuous fetal and maternal monitoring. Electrodes are critical for accurate signal acquisition in both external and internal monitoring systems, providing reliable data for fetal heart rate and uterine activity. Growth is further supported by rising adoption of minimally invasive monitoring techniques and increasing focus on reducing maternal and neonatal risks during labor. Hospitals and maternity centers are increasingly investing in high-quality electrodes to complement advanced monitoring systems. The segment benefits from advancements in material science, improved conductivity, and better patient comfort, which enhance usability and compliance. Expanding training programs for nurses and clinicians on electrode application and signal interpretation also contribute to adoption. Furthermore, the demand for cost-effective yet reliable electrodes in emerging markets is expected to accelerate growth, making this segment the fastest-growing product category in the market.

- By End-User

On the basis of end-user, the Intrapartum Monitoring Devices market is segmented into hospitals, maternity centers, and others. The hospitals segment accounted for the largest market revenue share of 63.7% in 2025, driven by the increasing number of deliveries in tertiary care hospitals, rising hospital infrastructure investments, and the integration of advanced labor and delivery units. Hospitals adopt comprehensive intrapartum monitoring solutions, including high-end monitors and electrodes, to manage high-risk pregnancies and ensure maternal and neonatal safety. The segment’s dominance is supported by continuous training of clinical staff, government regulations enforcing maternal health standards, and hospital accreditation requirements mandating state-of-the-art monitoring systems. In addition, hospitals benefit from centralized monitoring systems that allow remote tracking of multiple patients simultaneously, enhancing efficiency and outcomes. The growing awareness among expecting mothers about the availability of technologically advanced monitoring options further reinforces adoption. Hospitals also tend to invest in multi-functional and upgradeable devices, which increases the market share of this end-user segment. The widespread presence of hospitals across urban and semi-urban areas ensures sustained revenue growth for intrapartum monitoring devices.

The maternity centers segment is expected to witness the fastest CAGR of 11.5% from 2026 to 2033, fueled by the rising preference for specialized birthing centers and outpatient maternal care facilities. Maternity centers increasingly adopt portable monitors and non-invasive electrode systems to provide personalized and continuous fetal and maternal monitoring. Growth is further driven by the global trend toward natural and low-intervention births, where real-time monitoring ensures safety without hospitalization. These centers leverage wireless and easy-to-use monitoring devices to enhance patient experience while ensuring clinical accuracy. The segment benefits from increasing awareness about prenatal care, rising healthcare expenditure, and supportive government initiatives for maternal health. Expanding maternity tourism and private birthing services in emerging markets also contribute to rapid adoption. Moreover, advancements in lightweight, user-friendly, and cost-effective monitoring devices are expected to further accelerate growth in maternity centers globally.

Intrapartum Monitoring Devices Market Regional Analysis

- North America dominated the Intrapartum Monitoring Devices market with the largest revenue share of approximately 41.2% in 2025, driven by advanced healthcare infrastructure, high adoption of digital health technologies, and the presence of leading medical device manufacturers

- The region’s strong demand is supported by widespread use of intrapartum monitoring devices in hospitals, maternity clinics, and specialized birthing centers, ensuring better maternal and fetal outcomes

- High healthcare spending, technological advancements, and increasing focus on maternal and neonatal care are further reinforcing North America’s leadership in the market

U.S. Intrapartum Monitoring Devices Market Insight

The U.S. intrapartum monitoring devices market accounted for the majority of regional demand in 2025, fueled by the adoption of advanced fetal monitoring systems, electronic health records integration, and digital patient monitoring solutions. The increasing prevalence of hospital births, growing focus on maternal and neonatal health, and rising awareness of high-risk pregnancies are driving market growth. In addition, investments by hospitals and maternity care facilities in innovative monitoring technologies are accelerating the adoption of intrapartum devices across the country.

Europe Intrapartum Monitoring Devices Market Insight

The Europe intrapartum monitoring devices market is projected to expand at a steady CAGR during the forecast period, driven by rising awareness of maternal health, government initiatives supporting safe childbirth, and increasing use of digital monitoring solutions. Countries such as Germany, France, and the U.K. are witnessing growth due to modernized maternity care facilities, increased hospital deliveries, and demand for technologically advanced monitoring devices that improve fetal and maternal outcomes.

U.K. Intrapartum Monitoring Devices Market Insight

The U.K. intrapartum monitoring devices market is expected to grow at a notable CAGR during the forecast period, fueled by rising hospital births, government programs promoting maternal care, and investments in advanced birthing technologies. Increasing awareness among healthcare professionals regarding fetal and maternal safety, along with growing adoption of non-invasive monitoring systems, is supporting market expansion.

Germany Intrapartum Monitoring Devices Market Insight

The Germany intrapartum monitoring devices market is anticipated to register healthy growth, supported by a well-developed healthcare system, advanced maternity care facilities, and high adoption of digital monitoring technologies. The country’s emphasis on maternal and neonatal safety, along with increasing hospital deliveries and technological upgrades in labor wards, is driving market demand.

Asia-Pacific Intrapartum Monitoring Devices Market Insight

The Asia-Pacific intrapartum monitoring devices market is expected to be the fastest-growing region during the forecast period, with a CAGR surpassing other regions. Growth is driven by rising healthcare investments, increasing hospital births, growing awareness of maternal health, and expansion of both private and public maternity care facilities in countries such as India, China, and Japan. The adoption of digital and non-invasive monitoring systems, coupled with initiatives to improve maternal and neonatal outcomes, is accelerating market growth.

Japan Intrapartum Monitoring Devices Market Insight

The Japan intrapartum monitoring devices market is gaining traction due to the country’s focus on advanced maternal care, increasing hospital deliveries, and adoption of digital monitoring solutions. The demand is further supported by rising awareness of fetal safety, well-equipped birthing centers, and integration of monitoring devices with hospital IT systems, ensuring efficient maternal and neonatal care.

China Intrapartum Monitoring Devices Market Insight

The China intrapartum monitoring devices market accounted for the largest market share in the Asia-Pacific region in 2025, driven by the expanding healthcare infrastructure, growing number of hospital births, and rising awareness of maternal health. The adoption of advanced intrapartum monitoring devices in both public and private maternity care facilities, along with government initiatives to improve maternal and neonatal outcomes, is propelling market growth. Rapid urbanization and increasing investments in healthcare technology are further supporting the market.

Intrapartum Monitoring Devices Market Share

The Intrapartum Monitoring Devices industry is primarily led by well-established companies, including:

• GE Healthcare (U.S.)

• Philips Healthcare (Netherlands)

• Medtronic (Ireland)

• Siemens Healthineers (Germany)

• Nihon Kohden Corporation (Japan)

• Hill-Rom Holdings, Inc. (U.S.)

• Edan Instruments, Inc. (China)

• Roche Diagnostics (Switzerland)

• Drägerwerk AG & Co. KGaA (Germany)

• Contec Medical Systems Co., Ltd. (China)

• Philips Avalon (Netherlands)

• Hans Dinslage GmbH (Germany)

• Comen Medical Instruments Co., Ltd. (China)

• TocoMedica (U.S.)

• Neoventa Medical AB (Sweden)

Latest Developments in Global Intrapartum Monitoring Devices Market

- In February 2024, GE HealthCare announced that its Novii+ Wireless Patch Solution received 510(k) clearance from the U.S. Food and Drug Administration (FDA) for expanded use in maternal and fetal monitoring for pregnant patients at 34 weeks gestation and greater. The Novii+ system is a belt‑free, wireless intrapartum monitoring device that non‑invasively measures and displays fetal heart rate, maternal heart rate, and uterine activity in real time. This expanded clearance allows clinicians to monitor a broader population of high‑risk pregnancies, providing improved mobility and comfort for laboring mothers while maintaining clinical reliability

- In June 2024, Philips Healthcare launched the Avalon CL Fetal and Maternal Pod and Patch for continuous, non‑invasive monitoring during labor, offering healthcare professionals a wireless maternal and fetal monitoring solution that enhances maternal comfort and supports clinical decision‑making. This technology enables expectant mothers greater freedom of movement while maintaining continuous tracking of fetal heart rate and uterine activity, reflecting industry demand for patient‑centric intrapartum monitoring

- In February 2024, Masimo received Health Canada approval for its Rad‑97 Pulse CO‑Oximeter with integrated fetal monitoring capabilities, enabling the sale and distribution of a combined maternal and fetal monitoring device in Canada. The Rad‑97 platform includes integrated monitoring features that help clinicians track vital maternal and fetal parameters during labor and delivery

- In January 2024, Medtronic plc announced FDA approval of its Infinity Fetal and Maternal Monitoring System, which integrates wireless fetal and maternal monitoring aimed at enhancing labor and delivery safety through advanced signal processing and connectivity features to support clinicians

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.