Global Isolator Based Aseptic Filling Systems Market

Market Size in USD Billion

CAGR :

%

USD

774.65 Billion

USD

1,041.55 Billion

2025

2033

USD

774.65 Billion

USD

1,041.55 Billion

2025

2033

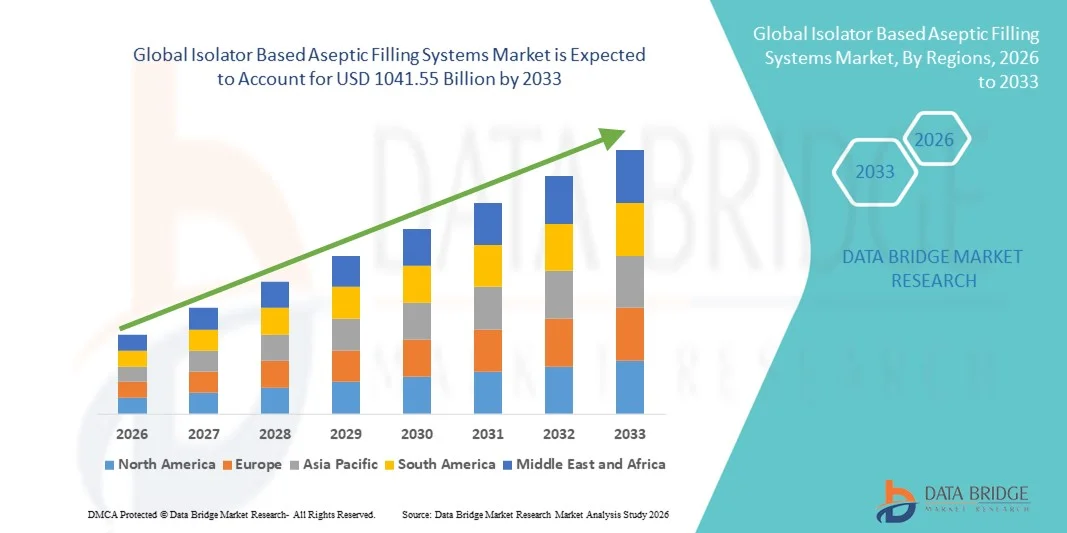

| 2026 –2033 | |

| USD 774.65 Billion | |

| USD 1,041.55 Billion | |

|

|

|

|

Isolator Based Aseptic Filling Systems Market Size

- The global isolator based aseptic filling systems market size was valued at USD 774.65 billion in 2025 and is expected to reach USD 1041.55 billion by 2033, at a CAGR of 3.77% during the forecast period

- The market growth is largely fueled by increasing adoption of advanced aseptic filling technologies, rising demand for sterile pharmaceutical products, and stringent regulatory requirements ensuring contamination-free manufacturing processes

- Furthermore, growing production of biologics, vaccines, and parenteral drugs, coupled with the need for minimizing human intervention and enhancing process efficiency, is accelerating the uptake of Isolator Based Aseptic Filling Systems solutions, thereby significantly boosting the industry's growth

Isolator Based Aseptic Filling Systems Market Analysis

- Smart isolator-based aseptic filling systems, offering fully enclosed sterile filling solutions, are increasingly vital components of modern pharmaceutical manufacturing processes due to their enhanced sterility assurance, reduced human intervention, and compliance with stringent regulatory standards

- The escalating demand for these systems is primarily fueled by the growing production of biologics, vaccines, and parenteral drugs, rising regulatory scrutiny for contamination-free manufacturing, and the need for high-efficiency, automated sterile filling solutions

- North America dominated the isolator based aseptic filling systems market with the largest revenue share of approximately 38.7% in 2025, supported by a well-established pharmaceutical industry, high adoption of advanced aseptic technologies, and strong presence of key industry players, with the U.S. accounting for the majority of regional revenue due to continuous innovation and increasing demand for biologics and vaccines

- Asia-Pacific is expected to be the fastest-growing region in the isolator based aseptic filling systems market during the forecast period, registering a CAGR of around 12.9%, driven by rapid expansion of pharmaceutical manufacturing, rising healthcare expenditure, improving regulatory frameworks, and growing demand for sterile injectable drugs in countries such as India, China, and Japan

- The commercial application segment dominated the market with a revenue share of 61.5% in 2025, driven by large-scale production of vaccines, biologics, and sterile injectables

Report Scope and Isolator Based Aseptic Filling Systems Market Segmentation

|

Attributes |

Isolator Based Aseptic Filling Systems Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Isolator Based Aseptic Filling Systems Market Trends

Rising Demand for Sterile and High-Quality Drug Manufacturing

- The increasing need for sterile production environments in the pharmaceutical and biotech industries is a key driver for the adoption of isolator based aseptic filling systems. These systems significantly reduce contamination risks during drug filling and packaging, ensuring product safety and regulatory compliance

- For instance, in March 2024, Bosch Packaging Technology reported the expansion of its isolator filling platform to accommodate high-potency and parenteral drugs, enabling manufacturers to safely fill cytotoxic and biologic drugs under fully enclosed conditions

- Regulatory agencies such as the FDA and EMA are imposing stricter guidelines on sterile drug production, including advanced environmental monitoring and process control, further encouraging pharmaceutical companies to upgrade to isolator-based systems

- The rising production of biologics, vaccines, and monoclonal antibodies requires aseptic filling solutions that support complex drug formulations while maintaining sterility, driving demand for isolator systems with advanced automation, robotic handling, and flexible batch sizes

- The trend toward outsourcing sterile manufacturing to Contract Development and Manufacturing Organizations (CDMOs) is also fueling market growth, as these service providers increasingly deploy isolator technology to meet client requirements efficiently and safely

Isolator Based Aseptic Filling Systems Market Dynamics

Driver

Focus on Automation, Flexibility, and Operational Efficiency

- Manufacturers are increasingly integrating automation into isolator based aseptic filling systems to minimize human intervention, reduce errors, and enhance productivity

- For instance, in July 2023, IMA Life introduced its FlexiFill isolator system, featuring automated vial handling, real-time process monitoring, and quick-change tooling to support multiple drug formats

- The growing adoption of modular systems enables manufacturers to scale operations rapidly, accommodate different container sizes, and switch between product types without extensive downtime, improving operational flexibility

- Advanced process analytical technology (PAT) integration allows real-time quality monitoring, reducing batch rejection rates and enhancing compliance with Good Manufacturing Practice (GMP) standards

- Pharmaceutical companies are also investing in systems that reduce cleaning and sterilization cycles, further optimizing throughput and minimizing costs while maintaining sterility assurance

Restraint/Challenge

High Capital Investment and Complex Validation Requirements

- The relatively high initial cost of isolator based aseptic filling systems compared to conventional cleanroom solutions is a significant barrier to adoption, especially for small and mid-sized pharmaceutical manufacturers

- For instance, In addition, these systems require extensive validation, including installation qualification (IQ), operational qualification (OQ), and performance qualification (PQ), which can extend project timelines and increase operational expenditure

- Maintaining operator training and adherence to aseptic handling protocols is critical; insufficient training can lead to operational inefficiencies and potential contamination risks

- Some manufacturers face challenges in retrofitting existing production lines with isolator systems, as compatibility with older equipment and facility constraints may necessitate additional infrastructure modifications

- Continuous regulatory updates and evolving sterility standards require ongoing system upgrades, which can increase long-term operational costs and complicate lifecycle management

Isolator Based Aseptic Filling Systems Market Scope

The market is segmented on the basis of systems, primary containers, and applications.

- By Systems

On the basis of systems, the Isolator Based Aseptic Filling Systems market is segmented into Filling and Turnkey Solutions. The filling systems segment dominated the largest market revenue share of 52.4% in 2025, driven by its critical role in sterile drug manufacturing, including vaccines, biologics, and injectable medications. Filling systems are essential for ensuring accuracy, contamination prevention, and high throughput in aseptic processes. Regulatory compliance with FDA, EMA, and WHO guidelines makes these systems indispensable for pharmaceutical manufacturers. The segment benefits from adoption in both clinical and commercial production. Filling systems are versatile, supporting multiple vial sizes and container types such as syringes, ampoules, and cartridges. High adoption in North America and Europe, where biologics manufacturing is prominent, strengthens dominance. Growing demand for sterile injectables, high-value drugs, and COVID-19 vaccine production drives revenue. Integration with automated inspection and labeling systems enhances efficiency. Continuous innovation in isolator design improves operator safety and process reliability. Advanced control systems ensure consistent dosing and reduce wastage. Production scalability and rapid deployment capabilities further support this segment’s leading position.

The turnkey solutions segment is expected to witness the fastest CAGR of 10.1% from 2026 to 2033, fueled by growing demand for fully integrated, end-to-end aseptic filling lines. Pharmaceutical companies increasingly prefer turnkey providers to reduce project risk, optimize timelines, and ensure regulatory compliance. Turnkey systems combine filling, inspection, labeling, and packaging into a single automated solution. Expansion of biologics, cell therapy, and personalized medicine drives demand for customized turnkey systems. Emerging markets in Asia-Pacific and Latin America show growing adoption. Integration with digital control systems and real-time monitoring enhances process reliability. High upfront investment and the complexity of regulatory approvals make turnkey solutions a preferred choice for large-scale projects. Strategic partnerships between equipment manufacturers and pharmaceutical companies accelerate turnkey deployment. The segment benefits from rapid scaling needs in vaccine and sterile injectable production. Innovations in modular and flexible designs support faster setup. Overall, turnkey solutions are increasingly adopted for efficiency, compliance, and risk mitigation.

- By Primary Containers

On the basis of primary containers, the market is segmented into Ampoules, Bottles, Capsules, Cartridges, Syringes, Vials, and Others. The vials segment accounted for the largest market revenue share of 36.8% in 2025, due to their extensive use in vaccines, biologics, and injectable drugs. Vials offer ease of handling, compatibility with automation, and high-dose stability. Regulatory standards for sterility and containment favor vials over other containers in large-scale production. The segment sees strong adoption in North America and Europe, where vaccine and biologics manufacturing is concentrated. Multi-dose and single-dose vials support flexible dosing requirements. Integration with filling, stoppering, and capping systems ensures high throughput. High investment in cold-chain logistics for vaccines boosts vial usage. Pharmaceutical manufacturers prefer vials for consistent quality, long shelf life, and minimal contamination risk. Global vaccination campaigns and biologics growth further drive revenue. Vials’ compatibility with automated inspection systems reinforces adoption. The segment’s versatility in clinical and commercial applications strengthens its dominance. Expansion in emerging markets supports additional growth.

The syringes segment is expected to witness the fastest CAGR of 11.4% from 2026 to 2033, driven by growing demand for prefilled syringes in vaccines, biologics, and specialty injectables. Prefilled syringes enhance patient convenience, dosing accuracy, and reduce contamination risk. Rising adoption in immunization programs and home-care applications fuels demand. Advanced isolator-based filling systems ensure sterility and compliance with regulatory standards. Pharmaceutical companies increasingly prefer prefilled syringes for high-value therapies. Technological improvements in syringe materials, stoppers, and automation accelerate adoption. Expansion in emerging markets with growing healthcare infrastructure supports growth. Increasing adoption in hospitals, clinics, and outpatient settings drives segment growth. R&D in combination products, such as auto-injectors with syringes, further boosts demand. Prefilled syringes are preferred for biologics due to stability and precision. Overall, the segment shows strong growth potential in commercial and clinical applications.

- By Applications

On the basis of applications, the market is segmented into Clinical and Commercial. The commercial application segment dominated the market with a revenue share of 61.5% in 2025, driven by large-scale production of vaccines, biologics, and sterile injectables. Pharmaceutical manufacturers prioritize commercial-scale isolator systems for efficiency, throughput, and regulatory compliance. Expansion of global vaccine programs, oncology biologics, and high-demand injectables fuels adoption. Commercial applications require high-volume filling, inspection, and packaging systems integrated with automation. Advanced quality control systems ensure product sterility and compliance with FDA, EMA, and WHO regulations. High adoption in North America and Europe contributes to dominance. R&D and contract manufacturing organizations (CMOs) rely on commercial isolator-based filling systems for sterile production. Growing demand for high-value biologics, monoclonal antibodies, and personalized therapies supports segment growth. Integration with digital process monitoring enhances operational efficiency. Commercial systems benefit from advanced design, reduced contamination risk, and scalability. Increasing global investment in sterile manufacturing infrastructure further strengthens this segment.

The clinical application segment is expected to witness the fastest CAGR of 10.7% from 2026 to 2033, driven by expanding clinical trials for vaccines, biologics, and cell therapies. Clinical-scale filling systems are preferred for small-batch production with strict sterility and regulatory requirements. Rising demand for hospital-based injectable production and specialty therapies accelerates adoption. Automation in clinical isolator systems ensures process consistency and reduces operator contamination risk. Contract research organizations (CROs) increasingly invest in clinical isolator systems. Adoption is growing in emerging markets with expanding healthcare and clinical trial activities. Prefilled syringes, vials, and cartridges for clinical studies further drive growth. Technological advancements support rapid batch changes and high accuracy. Digital monitoring and compliance solutions enhance clinical system adoption. Overall, clinical applications show strong growth potential due to the increasing number of trials and biologic therapies.

Isolator Based Aseptic Filling Systems Market Regional Analysis

- North America dominated the isolator based aseptic filling systems market with the largest revenue share of approximately 38.7% in 2025. This growth is supported by a well-established pharmaceutical industry, high adoption of advanced aseptic technologies, and the strong presence of key industry players

- The market accounted for the majority of regional revenue due to continuous innovation in isolator technologies and increasing demand for biologics and vaccines. Manufacturers in the region are investing heavily in automated isolator systems that ensure sterility, improve operational efficiency, and comply with stringent regulatory standards

- The North American market benefits from high R&D expenditure, favorable regulatory policies, and a focus on next-generation aseptic filling solutions, which collectively drive adoption across both commercial and contract manufacturing operations

U.S. Isolator Based Aseptic Filling Systems Market Insight

The U.S. isolator based aseptic filling systems market captured the largest revenue share of 81% in 2025 within North America. The market is fueled by rising demand for biologics, vaccines, and high-potency drugs, along with the continuous integration of automation, robotics, and real-time environmental monitoring in sterile manufacturing. Strong regulatory support from the FDA, coupled with investment in pandemic preparedness and small-batch production capabilities, further accelerates growth. Key pharmaceutical manufacturers are adopting isolator systems capable of handling cytotoxic, high-potency, and personalized drugs safely and efficiently, ensuring compliance with Good Manufacturing Practice (GMP) standards.

Europe Isolator Based Aseptic Filling Systems Market Insight

The Europe isolator based aseptic filling systems market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by stringent EU regulations on sterile drug manufacturing and growing demand for biologics. The increase in urbanization, advanced pharmaceutical infrastructure, and adoption of automated isolator systems are fostering market growth. European manufacturers increasingly prefer isolators over traditional cleanroom setups due to lower contamination risks, improved production efficiency, and compliance with GMP standards. The rise of contract development and manufacturing organizations (CDMOs) is also contributing to adoption, especially for small-batch and high-potency drug production.

U.K. Isolator Based Aseptic Filling Systems Market Insight

The U.K. isolator based aseptic filling systems market is anticipated to grow at a noteworthy CAGR, driven by the expansion of biologics manufacturing and the rising adoption of automated aseptic systems. Concerns regarding product sterility, compliance, and efficiency are motivating pharmaceutical manufacturers and CDMOs to invest in isolator-based solutions. The country’s robust pharmaceutical ecosystem, strong regulatory framework, and increasing outsourcing of sterile drug production are expected to continue stimulating market growth.

Germany Isolator Based Aseptic Filling Systems Market Insight

The Germany isolator based aseptic filling systems market is expected to expand at a considerable CAGR during the forecast period. Increasing awareness of digitalization in pharmaceutical manufacturing, emphasis on eco-conscious and sustainable solutions, and well-developed infrastructure drive the adoption of advanced isolator systems. The integration of isolators with automated filling, sterilization, and environmental monitoring processes is becoming increasingly prevalent, meeting local consumer and regulatory expectations for safe, high-quality sterile drug production.

Asia-Pacific Isolator Based Aseptic Filling Systems Market Insight

The Asia-Pacific isolator based aseptic filling systems market is poised to grow at the fastest CAGR of around 12.9% during the forecast period. Growth is driven by rapid expansion of pharmaceutical manufacturing, rising healthcare expenditure, improving regulatory frameworks, and increasing demand for sterile injectable drugs in countries such as India, China, and Japan. The region is emerging as a manufacturing hub for biologics and vaccines, with manufacturers adopting advanced isolator systems to ensure production efficiency, sterility, and compliance. The affordability and accessibility of modern aseptic filling solutions are enabling wider adoption across both domestic and export-oriented pharmaceutical operations.

Japan Isolator Based Aseptic Filling Systems Market Insight

The isolator based aseptic filling systems market is gaining momentum due to high investment in pharmaceutical R&D, a mature biologics sector, and increasing demand for automated aseptic systems. The Japanese market places strong emphasis on safety, efficiency, and reliability, with manufacturers adopting isolator systems capable of handling high-potency and personalized drugs. An aging population further drives demand for efficient and secure production of injectable drugs in both hospital and commercial sectors.

China Isolator Based Aseptic Filling Systems Market Insight

The China isolator based aseptic filling systems market accounted for the largest revenue share in Asia-Pacific in 2025. This growth is attributed to rapid urbanization, expansion of domestic pharmaceutical manufacturing, high adoption of automated aseptic technologies, and supportive government policies. China’s pharmaceutical companies are increasingly deploying isolator systems for vaccine, biologic, and sterile drug production, ensuring compliance with GMP standards and catering to both domestic and global demand. The push toward smart, flexible, and high-capacity aseptic filling systems is expected to continue driving market growth.

Isolator Based Aseptic Filling Systems Market Share

The Isolator Based Aseptic Filling Systems industry is primarily led by well-established companies, including:

- Bosch Packaging Technology (Germany)

- Sartorius Stedim Biotech (Germany)

- Bausch+Ströbel (Germany)

- IMA Life (Italy)

- Rommelag (Germany)

- Getinge (Sweden)

- Stevanato Group (Italy)

- SP Scientific (U.S.)

- Groninger & Co. (Germany)

- Marchesini Group (Italy)

- Optima Packaging Group (Germany)

- Syntegon Technology (Germany)

- Aseptic Technologies (France)

- Fuji Systems (Japan)

- Tianhe Pharmaceutical Equipment (China)

- Romaco Group (Germany)

- AMS Filling Systems (U.S.)

- Vetter Pharma (Germany)

- Almac Group (U.K.)

- GEA Group (Germany)

Latest Developments in Global Isolator Based Aseptic Filling Systems Market

- In May 2025, Syntegon unveiled its SynTiso isolator platform at the Pharmatag event, featuring a novel gloveless design with extensive automation that minimizes human intervention and contamination risk while adhering to stringent Annex 1 sterility requirements for aseptic filling operations. This innovation enhances product safety and makes isolator-based filling more efficient for small to medium batch sizes

- In May 2025, Fedegari Autoclavi launched its new ‘BIO‑X’ isolator platform for aseptic manufacturing, featuring integrated clean‑room control systems and modular design to speed up sterile fill‑finish processes and support scalable pharmaceutical production. This new platform strengthens the company’s portfolio in advanced isolator technologies for biologics and injectables

- In April 2025, Sartorius entered into a strategic partnership with Merck KGaA to co‑develop a next‑generation isolator‑based aseptic manufacturing line tailored for high‑value biologics, combining strengths in equipment technology and biopharmaceutical production expertise. This collaboration is expected to accelerate technology adoption in complex aseptic processing

- In November 2025, Sovereign Pharma commissioned a high‑volume isolator‑based ampoule filling line in India, representing one of the first fully contained isolator installations for high‑volume sterile injectable production in the region and highlighting the global geographic expansion of isolator technology. This system improves sterility assurance and aligns with evolving EU and US regulatory expectations

- In June 2024, SKAN AG increased its equity stake in its Belgian subsidiary Aseptic Technologies to 90%, consolidating its aseptic solution development and enhancing its advanced isolator and filling technology capabilities for high‑containment pharmaceutical manufacturing. The move reflects continued investment in expanding isolator technology portfolios

- In July 2024, IMA Group completed an acquisition of a specialized isolator technology firm to strengthen its aseptic filling capabilities and reinforce its position in biotech and sensitive drug manufacturing markets. The acquisition brings advanced closed isolator systems and robotic handling technologies into IMA’s offerings

- In June 2024, SKAN AG partnered with a leading pharmaceutical automation company to co‑develop fully integrated isolator lines combining advanced robotics with isolator technology for automated sterile processing, targeting flexible and efficient biotech manufacturing. This partnership underscores the integration of automation and isolators in next‑gen aseptic fill‑finish solutions

- In April 2024, Azbil Telstar inaugurated a new state‑of‑the‑art manufacturing facility in Spain dedicated to advanced isolator systems, incorporating sustainable practices and robust quality control to meet rising European demand for isolator‑based equipment in sterile pharmaceutical production. This addresses the growing global need for efficient aseptic systems

- In March 2024, Fedegari Autoclavi launched a modular isolator system designed for small‑batch pharmaceutical filling and clinical trial manufacturing, featuring rapid reconfiguration and validated cleaning procedures to support diverse product portfolios while ensuring regulatory compliance. This fills a niche between clinical and commercial manufacturing need

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.