Global Laboratory Mixer Market

Market Size in USD Billion

CAGR :

%

USD

1.99 Billion

USD

2.58 Billion

2025

2033

USD

1.99 Billion

USD

2.58 Billion

2025

2033

| 2026 –2033 | |

| USD 1.99 Billion | |

| USD 2.58 Billion | |

|

|

|

|

Laboratory Mixer Market Size

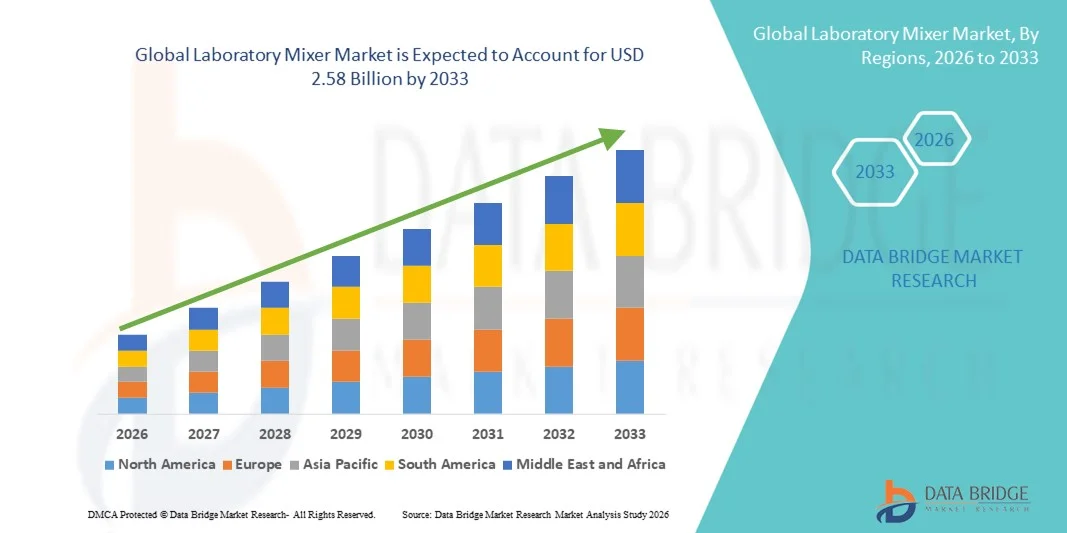

- The global laboratory mixer market size was valued at USD 1.99 billion in 2025 and is expected to reach USD 2.58 billion by 2033, at a CAGR of 3.30% during the forecast period

- The market growth is largely fueled by increasing adoption of advanced laboratory equipment and continuous technological advancements in mixing systems, leading to improved accuracy, efficiency, and reproducibility across pharmaceutical, biotechnology, chemical, and research laboratories

- Furthermore, rising demand for high-performance, user-friendly, and automated laboratory mixers is establishing these systems as essential tools for modern laboratory workflows. These converging factors are accelerating the uptake of laboratory mixer solutions, thereby significantly boosting overall market growth

Laboratory Mixer Market Analysis

- Laboratory mixers, used for blending, homogenizing, and dispersing samples, are essential equipment across pharmaceutical, biotechnology, chemical, and academic laboratories, as they ensure uniformity, process reliability, and accurate experimental results in both research and production environments

- The rising demand for laboratory mixers is driven by increased drug discovery activities, expansion of biotechnology research, growing emphasis on quality assurance in laboratory workflows, and the shift toward automated and precision-based laboratory instruments

- North America held the largest share of the laboratory mixer market at approximately 34.2% in 2025, supported by advanced laboratory infrastructure, high R&D spending in pharmaceuticals and life sciences, and early adoption of innovative mixing technologies across research institutes and industrial laboratories

- Asia-Pacific is projected to be the fastest-growing region, accounting for the laboratory mixer market by 2025, fueled by rapid expansion of pharmaceutical manufacturing, increasing government funding for scientific research, and rising establishment of contract research and testing laboratories

- The digital devices segment accounted for the largest market revenue share of around 61.5% in 2025, supported by the increasing demand for precision, repeatability, and process control in laboratory operations

Report Scope and Laboratory Mixer Market Segmentation

|

Attributes |

Laboratory Mixer Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Laboratory Mixer Market Trends

Advancements in Automation, Precision, and Digital Control

- A significant and accelerating trend in the global laboratory mixer market is the growing adoption of automated and digitally controlled mixing systems, aimed at improving precision, repeatability, and operational efficiency in laboratory workflows. Automated mixers reduce human error and ensure consistent sample preparation across pharmaceutical, biotechnology, and chemical laboratories

- For instance, several leading laboratory equipment manufacturers have introduced programmable overhead and magnetic mixers with digital speed control, timer functions, and real-time monitoring, enabling researchers to achieve highly reproducible mixing conditions for sensitive formulations and biological samples.

- Another major trend is the increasing demand for high-shear and homogenizing mixers capable of handling complex formulations, viscous samples, and nanoparticle suspensions. These advanced mixers are widely used in drug formulation, cosmetics R&D, and materials science to achieve uniform dispersion and stable emulsions

- The integration of IoT-enabled monitoring and data logging features is also gaining traction in modern laboratory mixers. These features allow laboratories to track operating parameters, maintain compliance with quality standards, and support data-driven process optimization in regulated environments such as pharmaceutical manufacturing and clinical research

- In addition, the market is witnessing a shift toward compact, energy-efficient, and ergonomically designed mixers, particularly for small-scale laboratories and academic institutions. These designs help optimize lab space while maintaining high performance and ease of use

- The growing focus on laboratory safety and contamination control is further shaping product development, with manufacturers emphasizing sealed designs, corrosion-resistant materials, and easy-to-clean components to meet stringent laboratory hygiene standards

Laboratory Mixer Market Dynamics

Driver

Rising Demand from Pharmaceutical, Biotechnology, and Research Laboratories

- The expanding pharmaceutical and biotechnology industries are a primary driver of growth in the Laboratory Mixer market, as these sectors require precise and reliable mixing solutions for drug formulation, vaccine development, and biological research. Increasing investments in R&D activities are significantly boosting demand for advanced laboratory mixing equipment

- For instance, the rapid growth in biologics, cell and gene therapy research, and vaccine production has intensified the need for high-performance mixers capable of handling sensitive biological samples without compromising integrity or stability

- Increasing adoption of quality-by-design (QbD) and good laboratory practices (GLP) is driving laboratories to invest in mixers that offer accurate control, repeatability, and documentation capabilities to meet regulatory requirements

- The rising number of academic research institutions and contract research organizations (CROs) worldwide is further supporting market growth, as these facilities require a wide range of mixers for routine experiments and advanced scientific studies

- Technological advancements, including digital interfaces, programmable settings, and automated mixing cycles, are encouraging laboratories to replace conventional manual mixers with modern, high-efficiency systems, contributing to sustained market expansion

- In addition, increasing funding for scientific research by governments and private organizations is accelerating the adoption of laboratory mixers across emerging and developed economies

Restraint/Challenge

High Equipment Costs and Maintenance Complexity

- The relatively high initial cost of advanced laboratory mixers, particularly high-shear, overhead, and homogenizing systems, poses a significant challenge for small laboratories, academic institutions, and budget-constrained research facilities

- For instance, mixers equipped with advanced automation, digital control, and specialized accessories often require substantial capital investment, which can limit adoption in cost-sensitive markets or smaller laboratories

- Maintenance and calibration requirements also present challenges, as laboratory mixers must operate under strict accuracy and performance standards. Regular servicing, component replacement, and validation can increase operational costs over time

- The need for trained personnel to operate sophisticated laboratory mixers and interpret digital control systems can further restrain adoption, particularly in regions with limited technical expertise

- In addition, compatibility issues between mixers and specialized containers or accessories can restrict flexibility and increase procurement complexity for laboratories handling diverse applications

- Overcoming these challenges through the development of cost-effective, user-friendly, and low-maintenance laboratory mixers, along with improved after-sales support and training, will be crucial for sustaining long-term market growth

Laboratory Mixer Market Scope

The market is segmented on the basis of product, type, and end-user.

- By Product

On the basis of product, the Laboratory Mixer market is segmented into shaker, magnetic stirrer, vortex mixer, conical mixers, overhead stirrers, and accessories. The magnetic stirrer segment dominated the largest market revenue share of approximately 36.8% in 2025, driven by its widespread usage across academic, pharmaceutical, and chemical laboratories for routine mixing applications. Magnetic stirrers are preferred due to their compact size, low maintenance requirements, and ability to deliver consistent mixing without mechanical wear. Their compatibility with temperature control features and hot plates further enhances their utility in sample preparation workflows. In addition, magnetic stirrers offer high reproducibility, which is critical in analytical and quality control laboratories. Growing adoption in life sciences research and pharmaceutical formulation laboratories has reinforced segment dominance. The availability of digital magnetic stirrers with programmable speed control and safety features has further boosted demand. Cost-effectiveness compared to complex mixing systems also supports high penetration. Increasing laboratory automation trends continue to favor magnetic stirrers for standardized operations.

The overhead stirrers segment is expected to witness the fastest CAGR of 8.9% from 2026 to 2033, owing to rising demand for high-viscosity and large-volume mixing applications. Overhead stirrers provide superior torque and speed control, making them suitable for complex formulations in pharmaceutical, biotechnology, and chemical research laboratories. Increasing adoption in pilot-scale and production-scale laboratory environments is accelerating growth. Advancements in motor efficiency and digital torque monitoring are enhancing performance and user safety. The growing need for precise mixing in biologics, polymers, and advanced materials research further supports expansion. In addition, expanding R&D investments across emerging economies are boosting adoption. Integration with automated laboratory systems is also driving market momentum.

- By Type

On the basis of type, the Laboratory Mixer market is segmented into digital devices and analog devices. The digital devices segment accounted for the largest market revenue share of around 61.5% in 2025, supported by the increasing demand for precision, repeatability, and process control in laboratory operations. Digital mixers offer advanced features such as programmable speed settings, digital displays, timer functions, and safety alarms, which enhance operational accuracy. These features are especially critical in pharmaceutical, biotechnology, and clinical research environments where reproducibility is mandatory. Digital devices also support data logging and integration with laboratory information management systems (LIMS). Growing adoption of automated and smart laboratories has further strengthened dominance. Enhanced user convenience and reduced human error contribute to sustained demand. Continuous innovation in touchscreen interfaces and IoT-enabled mixers also supports market leadership.

The analog devices segment is projected to grow at the fastest CAGR of 7.6% from 2026 to 2033, driven by their affordability and ease of use. Analog mixers remain popular in academic institutions, small research laboratories, and developing regions due to lower upfront costs. Their simple mechanical design ensures durability and minimal maintenance requirements. Increasing laboratory setups in cost-sensitive markets are favoring analog devices. These mixers are well-suited for basic mixing tasks where high precision is not mandatory. Growing demand from educational and training laboratories further supports growth. In addition, analog devices offer reliable performance in rugged laboratory environments.

- By End-User

On the basis of end-user, the Laboratory Mixer market is segmented into research laboratories, pharma-biotech companies, CROs, food laboratories, and environmental testing laboratories. The pharma-biotech segment dominated the market with a revenue share of approximately 34.2% in 2025, driven by intensive R&D activities and stringent quality requirements in drug development and biologics manufacturing. Laboratory mixers are essential for formulation development, sample homogenization, and compound testing in pharmaceutical workflows. Rising investment in biologics, vaccines, and personalized medicine has increased demand for advanced mixing equipment. Regulatory compliance requirements also necessitate precise and validated mixing processes. Expansion of pharmaceutical manufacturing facilities globally has further strengthened dominance. Continuous innovation in drug delivery systems supports sustained mixer utilization. In addition, the growing number of clinical trials globally is boosting equipment demand.

The contract research organizations (CROs) segment is expected to register the fastest CAGR of 9.4% from 2026 to 2033, fueled by the outsourcing of research activities by pharmaceutical and biotechnology companies. CROs require versatile and high-throughput laboratory mixers to support diverse research projects. Increasing clinical trial volumes and preclinical research activities are accelerating equipment adoption. The expansion of CRO operations in Asia-Pacific and Latin America further supports growth. Demand for flexible and scalable laboratory infrastructure is driving mixer installations. Technological advancements enabling multi-sample processing are also boosting adoption. Growing collaboration between CROs and biotech startups continues to expand this segment rapidly.

Laboratory Mixer Market Regional Analysis

- North America held the largest share of the laboratory mixer market at approximately 34.2% in 2025, supported by advanced laboratory infrastructure, high R&D expenditure in pharmaceuticals, biotechnology, and life sciences, and the early adoption of innovative mixing technologies across research institutes and industrial laboratories

- The region benefits from strong demand for precision laboratory equipment used in drug formulation, chemical analysis, food testing, and academic research, where accurate and reproducible mixing is critical

- The presence of major pharmaceutical companies, contract research organizations (CROs), and well-funded universities further accelerates the adoption of high-performance laboratory mixers with advanced control features and automation capabilities

U.S. Laboratory Mixer Market Insight

The U.S. laboratory mixer market captured the largest revenue share within North America in 2025, driven by substantial investments in pharmaceutical R&D, biologics development, and clinical research activities. The growing focus on drug discovery, vaccine production, and personalized medicine is increasing demand for reliable and scalable laboratory mixing solutions. In addition, the strong presence of leading laboratory equipment manufacturers and rapid adoption of automated and digitally controlled mixers are contributing significantly to market growth.

Europe Laboratory Mixer Market Insight

The Europe laboratory mixer market is projected to expand at a steady CAGR over the forecast period, primarily driven by strong regulatory emphasis on quality control, standardization, and safety in laboratory operations. Increasing research activities in pharmaceuticals, chemicals, and food & beverage testing are supporting market expansion. European laboratories are increasingly adopting energy-efficient, compact, and precision-based mixing systems, particularly in academic research centers and industrial quality assurance laboratories.

U.K. Laboratory Mixer Market Insight

The U.K. laboratory mixer market is expected to grow at a notable CAGR during the forecast period, supported by rising investments in life sciences research, biotechnology startups, and academic collaborations. The country’s strong focus on pharmaceutical innovation, clinical trials, and laboratory modernization is driving demand for advanced laboratory mixers. Moreover, government-backed research funding and the presence of globally recognized universities continue to support sustained market growth.

Germany Laboratory Mixer Market Insight

The Germany laboratory mixer market is anticipated to expand at a considerable CAGR, driven by the country’s strong industrial base, advanced chemical and pharmaceutical sectors, and emphasis on precision engineering. German laboratories prioritize high-quality, durable, and technologically advanced mixing equipment to support research, testing, and production-scale applications. The growing integration of digital controls and automation in laboratory equipment aligns well with Germany’s focus on Industry 4.0 and smart laboratory solutions.

Asia-Pacific Laboratory Mixer Market Insight

The Asia-Pacific laboratory mixer market region is projected to be the fastest-growing Laboratory Mixer market, driven by the rapid expansion of pharmaceutical manufacturing, increasing government funding for scientific research, and the rising establishment of contract research and testing laboratories. Countries such as China, India, Japan, and South Korea are witnessing strong demand for laboratory mixers due to growing investments in healthcare infrastructure, drug development, and academic research. In addition, the region’s emergence as a global manufacturing hub is improving the affordability and accessibility of laboratory equipment.

Japan Laboratory Mixer Market Insight

The Japan laboratory mixer market is gaining momentum due to the country’s strong focus on technological innovation, precision research, and high-quality laboratory standards. Demand is driven by extensive research activities in pharmaceuticals, biotechnology, and advanced materials. Japanese laboratories favor compact, highly accurate, and automated mixing systems that ensure consistency and reliability. Furthermore, continuous investments in R&D and the modernization of laboratory infrastructure are supporting steady market growth.

China Laboratory Mixer Market Insight

China laboratory mixer market accounted for the largest revenue share in the Asia-Pacific Laboratory Mixer market in 2025, supported by rapid expansion of pharmaceutical production, increasing government support for scientific research, and a growing number of research institutions and testing laboratories. The country’s strong domestic manufacturing base enables the availability of cost-effective laboratory mixers, encouraging widespread adoption across academic, industrial, and clinical laboratories. The push toward innovation-driven growth and self-sufficiency in life sciences further strengthens market prospects in China.

Laboratory Mixer Market Share

The Laboratory Mixer industry is primarily led by well-established companies, including:

- Heidolph Instruments GmbH & Co. KG (Germany)

- Thermo Fisher Scientific Inc. (U.S.)

- Sartorius AG (Germany)

- Eppendorf AG (Germany)

- Benchmark Scientific Inc. (U.S.)

- Cole-Parmer Instrument Company LLC (U.S.)

- Scilogex LLC (U.S.)

- VWR International LLC (U.S.)

- Labnet International Inc. (U.S.)

- J-KEM Scientific Inc. (U.S.)

- AMS Biotechnology (U.K.)

- Metrohm AG (Switzerland)

- IKA Works India Pvt. Ltd. (India)

- C-MAG (Germany)

- GFL Gesellschaft für Labortechnik mbH (Germany)

- Huber Kältemaschinenbau GmbH (Germany)

- SP Scientific (U.S.)

Latest Developments in Global Laboratory Mixer Market

- In July 2022, IKA‑Werke launched the TWISTER convertible mixing device, a single‑position or multi‑position magnetic stirrer that enhances versatility for various laboratory mixing applications, allowing users to perform multiple operations with a single device. This product broadened the functional scope of magnetic stirrers in research and industrial labs

- In August 2022, Admix, Inc. introduced the Benchmix 10 high shear laboratory mixer featuring the patented Rotosolver mix head, designed to deliver efficient powder dispersion and uniform mixing, catering to pharmaceutical, biotech, and chemical lab requirements. This launch responded to rising demand for high‑performance benchtop mixers

- In March 2023, Thermo Fisher Scientific launched the Solaris Benchtop Temperature Controlled Orbital Shakers, offering improved energy efficiency and performance for lab workflows, with versions capable of incubated and refrigerated operation, advancing sustainability and utility in sample mixing

- In March 2024, Starlab launched a cutting‑edge vortex mixer designed to enhance laboratory mixing efficiency, featuring a glove‑compatible touchscreen, adjustable speed range from 300–3,500 rpm, and quiet operation ≤55 dBA, supporting a wide variety of tube formats. This product targeted versatility and user comfort in busy labs

- In June 2024, multiple vendors in the laboratory mixer market advanced product portfolios with mixers featuring integrated digital controls, connectivity options, and modular designs that support LIMS integration and remote diagnostics, reflecting a broader trend toward smart and automated lab equipment

- In June 2025, Thermo Fisher Scientific announced expansion of its lab equipment portfolio with new automated and digital‑ready mixers aimed at improving reproducibility, reducing human error, and supporting complex workflows in pharmaceutical and biotech research labs. These initiatives were part of broader efforts to modernize lab infrastructure

- In April 2025, Asynt broadened its DrySyn Vortex family by introducing an oil‑free, temperature‑controlled overhead stirring module, enabling parallel mixing of multiple flasks and enhancing thermal control, which improves efficiency for researchers handling sensitive reactions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.