Global Leukapheresis Devices Market

Market Size in USD Million

CAGR :

%

USD

137.19 Million

USD

2,165.24 Million

2025

2033

USD

137.19 Million

USD

2,165.24 Million

2025

2033

| 2026 –2033 | |

| USD 137.19 Million | |

| USD 2,165.24 Million | |

|

|

|

|

Leukapheresis Devices Market Size

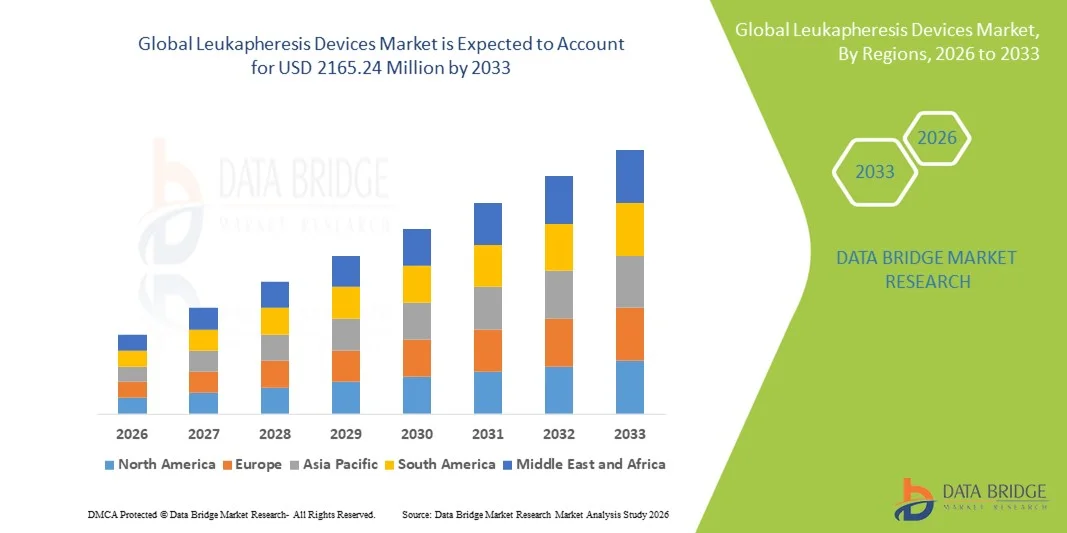

- The global leukapheresis devices market size was valued at USD 137.19 Million in 2025 and is expected to reach USD 2165.24 Million by 2033, at a CAGR of 41.18% during the forecast period

- The market growth is largely fueled by increasing adoption of advanced therapeutic procedures and technological advancements in blood component separation devices, driving efficiency and safety in both hospital and clinical settings

- Furthermore, rising demand for personalized medicine, stem cell therapies, and immunotherapy procedures is accelerating the adoption of leukapheresis devices, thereby significantly boosting the overall growth of the industry

Leukapheresis Devices Market Analysis

- Leukapheresis devices — medical systems used to separate and collect white blood cells for therapeutic and research applications — are increasingly vital in treating hematologic disorders, supporting cell and gene therapies, and enhancing clinical research due to technological innovation and growing procedural demand

- The escalating demand for leukapheresis devices is primarily driven by rising incidences of blood cancers and autoimmune diseases, increasing adoption of advanced therapeutic procedures, and expanding use of personalized medicine and immunotherapy platforms in healthcare and research

- North America dominated the leukapheresis devices market with the largest revenue share of approximately 45.20% in 2025, supported by advanced healthcare infrastructure, strong presence of major medical device manufacturers, high procedure volumes, and regulatory support for cell therapy technologies

- Asia‑Pacific is expected to be the fastest‑growing region in the leukapheresis devices market during the forecast period, with a high compound annual growth rate driven by expanding healthcare infrastructure, increasing investments in cell therapy and oncology treatment facilities, and rising demand for advanced blood separation procedure

- Therapeutic Applications segment dominated the largest market revenue share of 53% in 2025, driven by the growing prevalence of hematological disorders, autoimmune diseases, and cancer therapies requiring leukapheresis

Report Scope and Leukapheresis Devices Market Segmentation

|

Attributes |

Leukapheresis Devices Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Leukapheresis Devices Market Trends

Rising Demand for Advanced Blood Component Collection and Therapeutic Applications

- The growing prevalence of hematological disorders, autoimmune diseases, and cancers is driving the adoption of leukapheresis devices across hospitals, blood banks, and research institutions. Leukapheresis allows for precise collection of specific blood components, improving patient outcomes and treatment efficacy

- For instance, in 2025, Terumo BCT launched an advanced automated leukapheresis system capable of separating multiple blood components simultaneously, enhancing collection efficiency and patient safety. Such innovations are accelerating market growth by increasing procedural throughput and reducing donor fatigue

- The rise in bone marrow transplants, CAR-T therapies, and plasma-based treatments further fuels the demand for high-performance leukapheresis devices. Hospitals and specialty centers are prioritizing devices that ensure consistency, reproducibility, and minimal contamination risk

- Increasing awareness about the benefits of targeted blood component therapy among clinicians and patients is encouraging wider adoption. Educational programs and training workshops provided by manufacturers help healthcare professionals optimize device utilization

- Technological advancements, such as integrated software for donor management, real-time monitoring of collection parameters, and automated alerts for procedure adjustments, enhance operational efficiency and safety

- Developing countries are witnessing gradual adoption due to improving healthcare infrastructure, expanding hospital networks, and rising availability of trained personnel

- Strategic collaborations between manufacturers and hospitals for pilot studies and clinical validations are further driving adoption

- The global increase in therapeutic plasma exchange procedures, particularly for patients with autoimmune disorders, is contributing to the growing need for leukapheresis devices

- Institutional demand from oncology centers, hematology departments, and regenerative medicine units is expanding the market reach

- Overall, the integration of advanced features, higher reliability, and improved procedural efficiency makes leukapheresis devices a critical component in modern blood component therapies, driving sustained market growth

Leukapheresis Devices Market Dynamics

Driver

Increasing Investment in Healthcare Infrastructure and Blood Centers

- The expansion of healthcare infrastructure worldwide, including dedicated blood centers and hospital transfusion units, is supporting leukapheresis device adoption. Increased funding allows institutions to procure high-end devices with advanced automation and safety features

- For instance, in 2024, the Indian government invested in upgrading multiple state-run blood banks with automated leukapheresis systems, improving plasma collection efficiency and reliability. Such initiatives enhance access to safe blood components and stimulate device demand

- Developed regions are upgrading existing facilities to adopt next-generation devices capable of high-throughput and multi-component collection

- New hospital establishments in emerging markets are increasingly incorporating automated leukapheresis devices during initial setup, creating a direct market for manufacturers

- Public-private partnerships in healthcare are providing financial support for equipment acquisition, maintenance, and staff training

- The growth in specialized centers for apheresis therapy, including CAR-T and stem cell collection centers, further strengthens the market potential

- Investment in research and clinical trials necessitates modern, high-precision devices, supporting both clinical and research applications

- The modernization of blood banks, especially in urban areas, is increasing operational efficiency and boosting adoption

- Regional healthcare initiatives aimed at improving patient access to advanced therapies directly contribute to market expansion

- The focus on reducing procedural time, minimizing donor discomfort, and improving component purity makes investment in automated systems attractive for hospitals and research institutes globally

Restraint/Challenge

High Initial Investment and Operational Costs

- The high cost of procuring and maintaining advanced leukapheresis devices limits adoption, particularly among small hospitals and blood centers in developing regions. Initial capital outlay for equipment, software, and accessories can be significant

- For instance, in 2024, several regional clinics in Southeast Asia postponed device upgrades due to budget constraints, highlighting the barrier posed by high upfront costs

- Operational expenses, including disposable kits, reagents, and routine calibration, contribute to the total cost of ownership

- The requirement for trained personnel to operate sophisticated devices further increases recurring costs

- Price-sensitive healthcare facilities may opt for manual apheresis or shared-device models, limiting market penetration

- While leasing and subscription-based models are emerging, they are not yet widespread, especially in low-income regions

- Device downtime due to maintenance or calibration can affect operational efficiency, creating reluctance to invest in high-end systems

- Some facilities struggle to justify the ROI in regions where patient volumes for specialized procedures are lower

- Ensuring compliance with international safety standards and acquiring necessary certifications adds to initial costs

- Manufacturers are addressing these challenges by offering flexible financing, training, and bundled service packages, but cost remains a critical barrier to adoption

Leukapheresis Devices Market Scope

The market is segmented on the basis of type, application, and end user.

- By Type

On the basis of type, the Leukapheresis Devices market is segmented into Apheresis Devices, Leukapheresis Columns and Cell Separators, and Leukoreduction Filters. The Apheresis Devices segment dominated the largest market revenue share of 46.5% in 2025, driven by its high efficiency in selectively collecting white blood cells for therapeutic and research applications. Hospitals, blood centers, and research institutes prioritize these devices for their reliability, ease of use, and compatibility with automated workflows. Continuous technological innovation, including improved software, reduced procedure time, and enhanced safety features, supports adoption. The segment also benefits from the rising prevalence of hematological disorders, cancers, and autoimmune diseases that require leukapheresis procedures. Integration with clinical information systems and digital monitoring tools enhances operational efficiency. Apheresis devices allow reproducible collection of immune cells, enabling standardized protocols in both therapeutic and research settings. Strong adoption in North America and Europe is supported by advanced healthcare infrastructure, skilled staff, and regulatory support. Manufacturers are continuously upgrading disposable kits, tubing, and columns to improve workflow efficiency. Patient comfort and safety considerations also drive preference. The segment’s market leadership is further strengthened by robust R&D investments and established supplier networks.

The Leukoreduction Filters segment is expected to witness the fastest CAGR of 19.8% from 2026 to 2033, fueled by the increasing demand for high-quality filtered blood components to reduce transfusion-related complications. Filters are widely adopted in hospitals, blood banks, and clinical laboratories to improve patient safety and meet regulatory standards. Technological advances in filter design improve cell viability and filtration efficiency. Rising prevalence of chronic diseases, increased blood transfusions, and use in pediatric and immunocompromised populations drive demand. Compatibility with multiple leukapheresis systems facilitates easy integration into existing workflows. Pharmaceutical and biotech companies also use leukoreduction filters for manufacturing consistent therapeutic products. Government initiatives promoting safe blood transfusions accelerate adoption. Filters are affordable, portable, and easy to use, making them attractive in emerging markets. The Asia-Pacific region shows notable growth due to healthcare infrastructure expansion and increased blood donation programs. Continuous improvements in filter materials, design, and performance support scalability. Awareness campaigns about transfusion safety further boost adoption.

- By Application

On the basis of application, the Leukapheresis Devices market is segmented into Research Applications and Therapeutic Applications. The Therapeutic Applications segment dominated the largest market revenue share of 53% in 2025, driven by the growing prevalence of hematological disorders, autoimmune diseases, and cancer therapies requiring leukapheresis. Hospitals and transfusion centers adopt therapeutic leukapheresis for stem cell collection, immune modulation, and other clinical treatments. Advanced automated systems improve patient safety, throughput, and reproducibility, enhancing clinical adoption. Rising awareness among clinicians and patients about treatment efficacy supports growth. Favorable reimbursement policies in North America and Europe further encourage adoption. Integration with EMR systems and digital monitoring tools streamlines workflow. Hospitals prioritize devices that reduce adverse effects, save procedure time, and improve operational efficiency. Technological innovations in disposable kits, tubing, and columns enhance workflow and patient comfort. Expansion into emerging markets is driven by healthcare infrastructure development and government support. Regulatory approvals and standardization initiatives reinforce adoption globally. Continuous R&D ensures reliable performance and competitive advantage. Adoption in academic and research hospitals also fuels growth.

The Research Applications segment is expected to witness the fastest CAGR of 18.5% from 2026 to 2033, driven by growing demand in cellular research, immunotherapy, and regenerative medicine. Research institutions and biotech companies use leukapheresis devices to isolate white blood cells, T cells, and other immune components for experimentation and therapeutic development. Advances in automated systems, columns, and filters improve workflow efficiency and reproducibility. Stem cell therapy programs and CAR-T research pipelines further support adoption. Integration with laboratory information management systems (LIMS) streamlines data tracking and reporting. Emerging markets in Asia-Pacific are showing increased research investments, especially in China and India. Disposable kits and high-throughput devices facilitate multicenter studies. Collaboration between academic and biotech sectors accelerates technology transfer. Regulatory guidance ensures compliance for research-grade samples. Continuous improvements in automation, safety, and throughput enhance research outcomes.

- By End User

On the basis of end user, the Leukapheresis Devices market is segmented into Blood Component Providers and Blood Centres, Academic and Research Institutes, Pharmaceutical and Biotechnology Companies, and Hospitals and Transfusion Centres. The Blood Component Providers and Blood Centres segment dominated the largest market revenue share of 48% in 2025, driven by the need for safe, high-quality blood and cellular components for transfusions and therapeutic use. Centers prioritize automated leukapheresis devices, columns, and leukoreduction filters to improve efficiency, reproducibility, and patient safety. Regulatory focus on standardized procedures and blood product quality supports adoption. Integration with digital monitoring systems and EMR platforms enhances operational control. Rising prevalence of anemia, leukemia, and immune deficiencies increases demand. Cost-effectiveness, device durability, and procedure efficiency remain key selection criteria. Expansion of donor programs and mobile collection units also drives growth. Adoption is particularly strong in North America and Europe due to advanced infrastructure. Hospitals collaborate with blood centers to ensure supply for clinical procedures. Continuous R&D, technological upgrades, and supply chain networks reinforce market leadership.

The Pharmaceutical and Biotechnology Companies segment is expected to witness the fastest CAGR of 20.2% from 2026 to 2033, driven by growing investment in immunotherapy, CAR-T, and regenerative medicine requiring high-quality leukapheresis products. Biotech companies adopt advanced leukapheresis devices, cell separators, and filters for research and therapeutic development. Automation, standardized protocols, and digital monitoring ensure reproducibility and compliance. Expansion of clinical trials, stem cell therapy pipelines, and precision medicine programs accelerates adoption. Collaboration with hospitals and academic centers facilitates access to patient-derived cells. Disposable kits, advanced columns, and filter technologies support scalable cell processing. Emerging markets in Asia-Pacific show increased biotech activity. Regulatory frameworks for cell therapy manufacturing drive adoption. High-throughput, safe, and reliable systems remain priorities. Integration with digital workflows enhances tracking, compliance, and analytics. Continuous R&D ensures faster adoption of cutting-edge technologies globally.

Leukapheresis Devices Market Regional Analysis

- North America dominated the leukapheresis devices market with the largest revenue share of approximately 45.20% in 2025, supported by advanced healthcare infrastructure, high procedure volumes, strong presence of major medical device manufacturers, and regulatory support for cell therapy technologies

- The market accounted for the majority of the regional share, driven by rising prevalence of hematologic disorders, cancer, and autoimmune diseases that require leukapheresis procedures, along with increasing adoption of automated, high-throughput blood separation systems in hospitals and specialty centers

- Favorable reimbursement policies, strategic partnerships between hospitals and device manufacturers, and growing investment in advanced therapeutic and research applications are further strengthening market growth, establishing North America as the dominant region globally

U.S. Leukapheresis Devices Market Insight

The U.S. leukapheresis devices market captured the largest revenue share within North America in 2025, propelled by the increasing adoption of automated blood component collection systems and the rising prevalence of hematologic and autoimmune conditions. Hospitals and specialized oncology centers are prioritizing efficient, high-throughput devices capable of supporting complex therapeutic procedures. Growing investments in CAR-T therapies, bone marrow transplantation, and plasma exchange programs further boost demand. Strategic partnerships between medical institutions and device manufacturers for training, clinical validation, and research support market expansion. In addition, favorable reimbursement policies and regulatory approvals for advanced devices strengthen market growth in the U.S., solidifying its leading position in the region.

Europe Leukapheresis Devices Market Insight

The Europe leukapheresis devices market is projected to expand at a substantial CAGR during the forecast period, driven by advanced healthcare systems, increasing awareness of blood component therapies, and regulatory support for cellular and immunotherapy procedures. Countries such as Germany, France, and Italy are investing in modernizing blood centers and oncology units with automated leukapheresis systems to meet rising clinical demand. Hospitals are adopting devices with enhanced procedural safety, automated monitoring, and multi-component collection capabilities. Urbanization, rising patient volumes, and strong healthcare infrastructure contribute to robust market growth across Europe, with both clinical and research applications driving adoption.

U.K. Leukapheresis Devices Market Insight

The U.K. leukapheresis devices market is expected to grow at a noteworthy CAGR during the forecast period, fueled by increasing adoption of advanced therapeutic procedures such as stem cell collection, plasma exchange, and immunotherapy. Hospitals and specialized research centers are focusing on automating leukapheresis workflows to improve efficiency and ensure procedural safety. Government initiatives supporting healthcare infrastructure development, clinical research, and cell therapy adoption are further driving market growth. The growing emphasis on precision medicine, patient safety, and operational efficiency positions the U.K. as a key regional contributor to the European market.

Germany Leukapheresis Devices Market Insight

The Germany leukapheresis devices market is anticipated to expand at a considerable CAGR during the forecast period, driven by robust healthcare infrastructure, high patient volumes, and increasing adoption of advanced cell therapy procedures. Hospitals and specialized oncology centers are integrating automated leukapheresis systems to optimize blood component collection and ensure treatment efficacy. Germany’s strong emphasis on research and innovation, along with regulatory support for novel therapeutic devices, supports market expansion. The integration of advanced monitoring systems, multi-component collection capabilities, and safety features further enhances device adoption in both hospital and research applications.

Asia-Pacific Leukapheresis Devices Market Insight

The Asia-Pacific leukapheresis devices market is poised to grow at the fastest CAGR during the forecast period of 2026–2033, driven by expanding healthcare infrastructure, increasing investments in cell therapy and oncology treatment facilities, and rising demand for advanced blood separation procedures. Countries such as China, Japan, India, and South Korea are witnessing rapid hospital modernization, adoption of automated systems, and increased patient volumes for therapeutic and research applications. Government initiatives promoting advanced healthcare technology, along with the availability of skilled clinical personnel, further accelerate market growth. The emergence of APAC as a manufacturing hub for leukapheresis devices enhances affordability and accessibility, broadening adoption across clinical and research centers.

Japan Leukapheresis Devices Market Insight

The Japan leukapheresis devices market is gaining momentum due to increasing healthcare modernization, high procedural volumes, and a growing focus on advanced therapies such as CAR-T and plasma exchange. Hospitals and research centers are adopting high-performance, automated leukapheresis systems to improve patient safety, procedural efficiency, and blood component yield. Japan’s aging population and emphasis on precision medicine further stimulate demand for advanced leukapheresis devices in both hospital and clinical research settings.

China Leukapheresis Devices Market Insight

The China leukapheresis devices market accounted for the largest revenue share in Asia-Pacific in 2025, supported by rapid urbanization, rising patient volumes, expanding healthcare infrastructure, and growing adoption of advanced cell therapy and therapeutic plasma exchange procedures. Government initiatives promoting healthcare modernization and investment in oncology and hematology centers further accelerate device adoption. The presence of domestic manufacturers providing cost-effective, high-quality leukapheresis devices enhances accessibility across hospitals and research centers, strengthening China’s leading position in the APAC market.

Leukapheresis Devices Market Share

The Leukapheresis Devices industry is primarily led by well-established companies, including:

- Terumo BCT (Japan)

- Fresenius Kabi (Germany)

- Haemonetics Corporation (U.S.)

- Asahi Kasei Medical (Japan)

- Macopharma (France)

- Miltenyi Biotec (Germany)

- Kaneka Corporation (Japan)

- B. Braun Melsungen AG (Germany)

- Fenwal, Inc. (U.S.)

- Baxter International Inc. (U.S.)

- Cytapheresis Solutions (U.S.)

- Nipro Corporation (Japan)

- STEMCELL Technologies (Canada)

- Cerus Corporation (U.S.)

- Ortho Clinical Diagnostics (U.S.)

- Greiner Bio-One (Austria)

- Immunetics, Inc. (U.S.)

- GE Healthcare (U.S.)

- BioLife Solutions (U.S.)

- Cobe Cardiovascular (U.S.)

Latest Developments in Global Leukapheresis Devices Market

- In January 2023, Charles River Laboratories International, Inc. launched its CliniPrime Fresh Leukopak offering, providing GMP‑compliant cellular starting materials to support advanced cell therapy development and accelerate research workflows. This launch strengthens the company’s portfolio of leukapheresis‑related products used in immunotherapy and oncology research

- In April 2023, Fresenius Kabi upgraded its Amicus Blue ECP system with new software and a flexible single‑use disposable kit, enhancing procedural efficiency and usability for leukapheresis and related blood‑processing workflows. The update improved ease‑of‑use and access options for clinical operators

- In May 2023, Terumo BCT introduced a specialized training program aimed at helping cell and gene therapy manufacturers optimize leukocyte collection processes, improving scale‑up and commercialization of advanced therapeutics. This initiative supports broader industry adoption of leukapheresis in biotherapeutic production

- In June 2023, Haemonetics Corporation received FDA clearance for enhancements to its NexSys PCS plasma collection system, featuring a novel plasma collection bowl and Express Plus Technology designed to reduce procedure time and improve performance in leukapheresis‑related workflows

- In August 2023, the U.S. Food and Drug Administration (FDA) granted clearance for Terumo Blood and Cell Technologies’ Reveos Automated Whole Blood Processing System, the first system of its kind in the U.S. that processes whole blood into multiple components, enhancing efficiency of white blood‑cell and platelet processing

- In May 2024, Asahi Kasei Medical launched its PLASAUTO Sigma system in European markets, featuring advanced automation and real‑time monitoring capability designed for high‑volume therapeutic leukapheresis applications. This introduced improved device performance and operator productivity

- In July 2024, Haemonetics Corporation entered a strategic collaboration with Lonza Group to develop specialized collection protocols for next‑generation cellular therapies, focusing on optimizing leukocyte collection efficiency and manufacturing success rates for emerging cell therapies

- In September 2024, Fresenius Kabi received FDA approval for its COM.TEC cell processing system, integrating with leukapheresis collection procedures to provide automated cell washing and concentration capabilities. This addresses the growing need for streamlined cell processing in cell therapy manufacturing

- In January 2025, Fresenius, via its operating company Fresenius Kabi, received FDA 510(k) clearance for the Adaptive Nomogram for the Aurora Xi Plasmapheresis System, enabling improved plasma collection efficiency with enhanced algorithmic control

- In August 2025, Fresenius Kabi led a new consortium, EASYGEN, aimed at decentralizing CAR‑T cell therapy and improving hospital workflows, marking a collaborative effort to accelerate cell therapy delivery efficiencies

- In September 2025, additional product innovations in leukapheresis and blood processing systems were reported as significant industry drivers, with continued emphasis on device automation, safety, and expanded clinical utilization

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.