Global Liquid Smoke Market

Market Size in USD Million

CAGR :

%

USD

189.16 Million

USD

368.71 Million

2024

2032

USD

189.16 Million

USD

368.71 Million

2024

2032

| 2025 –2032 | |

| USD 189.16 Million | |

| USD 368.71 Million | |

|

|

|

|

Liquid Smoke Market Size

-

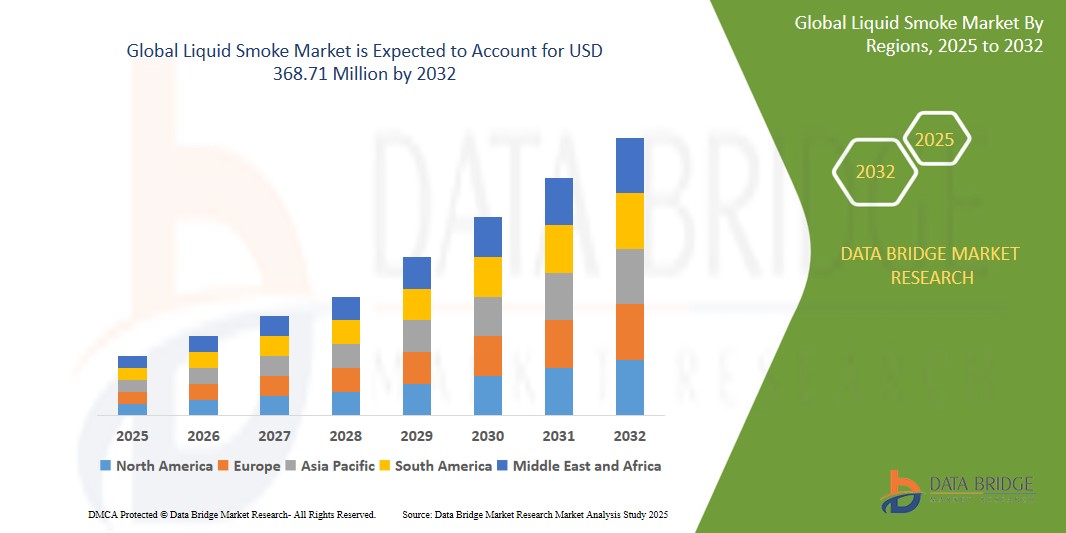

The global liquid smoke market size was valued at USD 189.16 million in 2024 and is expected to reach USD 368.71 million by 2032, at a CAGR of 8.70% during the forecast period

- This growth is driven by rise in preference for barbeque sauces

Liquid Smoke Market Analysis

-

Liquid Smoke is an important natural additive derived from the pyrolysis of wood, extensively used across food processing, pet food, pharmaceuticals, and industrial sectors for flavoring, preservation, and functional enhancement

- The market growth is largely fueled by rising consumer preference for clean-label and natural ingredients, increased demand for smoke-flavored food products, and the growing adoption of natural preservatives in both food and non-food applications

- North America is expected to dominate the liquid smoke market with a market share of 38.40% due to its rich barbecue culture, strong food innovation landscape, and growing use of natural flavor enhancers in meat, snacks, and sauces

- Asia-Pacific is projected to witness the fastest growth in the liquid smoke market, driven by growing urbanization, expansion of food processing industries, and increasing demand for plant-based and smoked-flavored ingredients in countries such as China and India

- The seafood and meat application segment is projected to dominate the liquid smoke market with a market share of 32.14%, as manufacturers increasingly use liquid smoke to enhance flavor profiles, improve product shelf life, and cater to evolving consumer taste preferences in protein-rich food categories

Report Scope and Liquid Smoke Market Segmentation

|

Attributes |

Liquid Smoke Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework |

Liquid Smoke Market Trends

“Rising Popularity of Plant-Based Smoke Flavors in Meat Alternatives”

- A key trend in the liquid smoke market is the increasing use of plant-derived smoke flavors in meat alternatives to replicate traditional barbecue and smoked meat taste profiles

- As flexitarian and vegan diets gain momentum, manufacturers are leveraging liquid smokes to enhance the sensory appeal of soy, pea, and mushroom-based meat substitutes

- These smoke flavors provide depth and authenticity in taste, making them ideal for plant-based burgers, sausages, and deli slices

- For instance, in September 2024, Beyond Meat introduced a new smoked plant-based bratwurst infused with applewood Liquid Smoke to capture traditional meat-eating consumers while catering to plant-based trends

This trend is propelling innovation in clean-label flavoring, helping brands deliver superior taste without artificial additives or animal-derived ingredients

Liquid Smoke Market Dynamics

Driver

“Increasing Demand for Natural Preservatives in Processed Foods”

- Liquid Smokes are increasingly being adopted as natural preservatives in processed foods due to their antimicrobial properties and ability to extend shelf life

- Growing concerns about synthetic additives and clean-label consumer preferences are prompting food manufacturers to turn to liquid smoke as a safer alternative

- It is particularly effective in smoked meats, cheeses, sauces, and ready meals where flavor retention and preservation are critical

- For instance, in March 2023, Hormel Foods incorporated hickory-based Liquid Smoke in its range of shelf-stable smoked turkey products, enhancing both shelf life and natural flavor profile

- This shift is expected to continue as regulatory bodies favor naturally derived food additives and consumers seek transparency in food ingredients

Opportunity

“Expansion into Pet Food and Treats Segment”

- With pet humanization on the rise, liquid smokes are being increasingly used to flavor pet foods and treats, especially in premium and gourmet segments

- Pet food manufacturers are leveraging liquid smoke for its palatability, preservation qualities, and natural sourcing to appeal to health-conscious pet owners

- It offers a cost-effective way to impart meaty, grilled flavors to kibble, chews, and biscuits without using artificial enhancers

- For instance, in October 2023, Blue Buffalo launched a smoked chicken-flavored dental chew made with mesquite Liquid Smoke, targeting the premium pet care market

This emerging application is opening new revenue channels for liquid smoke suppliers looking to diversify their product portfolios beyond human consumption

Restraint/Challenge

“Lack of Regulatory Uniformity across Global Markets”

- One of the major challenges in the liquid smoke market is the fragmented regulatory landscape, with different countries imposing varied restrictions on the use and labeling of smoke flavorings

- Manufacturers must navigate complex registration processes, safety approvals, and labeling standards, which vary significantly between the U.S., E.U., and Asia-Pacific regions

- This inconsistency can lead to higher compliance costs, delayed product launches, and limited international market access

- For instance, in July 2024, a new European Food Safety Authority (EFSA) guideline delayed the approval of certain Liquid Smoke flavorings for export from the U.S. due to updated toxicity evaluation protocols

Such disparities hinder market harmonization and pose barriers for global expansion, especially for small-to-mid-sized companies

Liquid Smoke Market Scope

The market is segmented on the basis of product, applications, and distribution channel.

|

Segmentation |

Sub-Segmentation |

|

By Products |

|

|

By Applications |

|

|

By Distribution Channel |

|

In 2025, the seafood and meat is projected to dominate the market with a largest share in applications segment

The seafood and meat segment is expected to dominate the liquid smoke market with the largest share of 32.14 % in 2025 due to several benefits to meat sellers, including enhanced tenderness, extended shelf life, and improved overall quality. Participants in the meat industry use liquid smoke to enhance flavor, improve texture and color, and add authenticity to their products.

The brown algae is expected to account for the largest share during the forecast period in application segment

In 2025, the hickory segment is expected to dominate the market with the largest market share of 33.41% due to its more versatile nature than other types of liquid smoke, as it can be used across a wide range of foods, including red meats, fish, and vegetables.

Liquid Smoke Market Regional Analysis

“North America Holds the Largest Share in the Liquid Smoke Market”

- North America dominates the global liquid smoke market with a market share of 38.40%, driven by high consumer demand for smoked-flavored food products, established barbecue traditions, and widespread use of natural flavor enhancers in processed foods

- U.S. leads the region, supported by its strong meat processing industry, rising preference for natural preservatives, and the popularity of smoked meats, snacks, and plant-based alternatives

- The presence of major players and continuous innovations in smoke flavor formulations further contribute to the region’s leadership in the market

- Increased awareness regarding clean-label products and growing demand for authentic, natural flavors continue to boost the consumption of liquid smoke across food service and retail sectors in North America

“Asia-Pacific is Projected to Register the Highest CAGR in the Liquid Smoke Market”

- Asia-Pacific is expected to witness the highest growth rate in the liquid smoke market, fueled by rapid urbanization, growing meat consumption, and increasing demand for natural food additives in processed and ready-to-eat foods

- Countries such as China, India, and South Korea are emerging as key markets due to rising consumer awareness of clean-label products, expansion of food processing industries, and growing preference for authentic smoky flavors in snacks and meat alternatives

- The region is also seeing increased adoption of liquid smoke in pet food, sauces, and bakery applications, supported by a shift toward eco-friendly and plant-based ingredients

- Investments in modern retail infrastructure, rising disposable incomes, and a surge in quick-service restaurants are further accelerating the demand for liquid smoke products across the Asia-Pacific region

Liquid Smoke Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Azelis Group NV (Belgium)

- Baumer Foods, Inc. (U.S.)

- Besmoke Ltd (U.K.)

- B&G Foods, Inc. (U.S.)

- International Flavors & Fragrances Inc. (U.S.)

- Kerry Group plc (Ireland)

- MSK Ingredients Ltd (U.K.)

- Ruitenberg Ingredients B.V. (Netherlands)

- Colgin, Inc. (U.S.)

- Bell Flavors & Fragrances (U.S.)

Latest Developments in Global Liquid Smoke Market

- In June 2024, McCormick & Company published its 2023 Purpose-led Performance (PLP) Progress Report, detailing key advancements in sustainability goals and responsible sourcing practices across its flavor solutions. This underscores McCormick's ongoing commitment to environmental stewardship in the food and seasoning industry

- In May 2024, Kerry provided updates regarding regulatory developments in the European Union related to the usage of smoke flavorings, aligning its practices with evolving compliance standards. This move reflects Kerry’s proactive approach to regulatory adaptation and transparent communication

- In August 2021, LANXESS finalized the acquisition of International Flavors & Fragrances’ (IFF) microbial control business, expanding its presence in the specialty chemicals and preservation solutions space. The acquisition strengthens LANXESS’s portfolio and capabilities in antimicrobial protection

- In March 2021, PS Seasoning introduced a new collection of gourmet spring seasoning blends, including flavors such as Bacon Bomb Jalapeno Hickory and Citrus Smash Lemon Pepper Grinder, crafted for seasonal consumer appeal. This launch highlights PS Seasoning’s focus on innovation and trend-driven flavor development

- In February 2021, Azelis announced the opening of a new smoke production facility in Denmark, developed with proprietary technology and featuring fully automated distillation and extraction processes. The facility enhances Azelis’s manufacturing footprint and technological capabilities in the flavor industry

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Liquid Smoke Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Liquid Smoke Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Liquid Smoke Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.