Global Loafers Market

Market Size in USD Billion

CAGR :

%

USD

27.55 Billion

USD

37.71 Billion

2025

2033

USD

27.55 Billion

USD

37.71 Billion

2025

2033

| 2026 –2033 | |

| USD 27.55 Billion | |

| USD 37.71 Billion | |

|

|

|

|

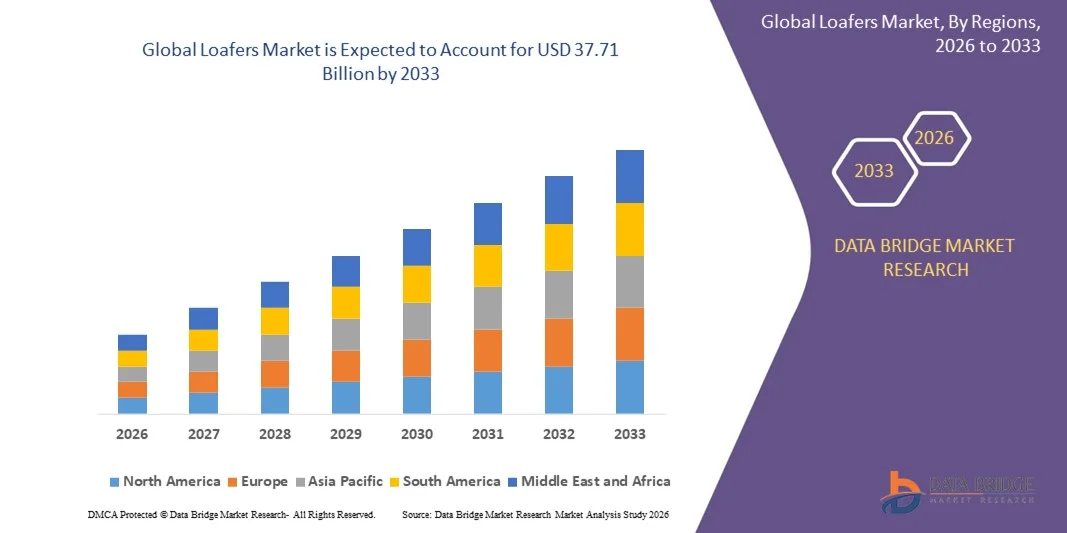

What is the Global Loafers Market Size and Growth Rate?

- The global loafers market size was valued at USD 27.55 billion in 2025 and is expected to reach USD 37.71 billion by 2033, at a CAGR of4.00% during the forecast period

- The rapid rise in demand for designer footwear is one of the major factors anticipated to drive the loafers market growth rate

- Moreover, the rapid transformation in lifestyles and the high demand for luxurious, designer footwear amongst the working-class population is also expected to fuel the growth of the loafers market

What are the Major Takeaways of Loafers Market?

- The rise in the requirements of stylish and comfortable footwear among the middle-aged working population and the increase in the disposable income are also expected to highly impact the growth of the loafers market

- While, the increase in the manufacturing of the product and rise in the exports of these products are also amongst the major factors expected to fuel the growth of the loafers market

- Asia-Pacific dominated the loafers market with a 45.1% revenue share in 2025, driven by a large consumer base, rising disposable incomes, and strong footwear manufacturing ecosystems across China, India, Vietnam, and Indonesia

- North America is expected to register the fastest CAGR of 7.36% from 2026 to 2033, driven by increasing demand for premium, comfort-oriented, and lifestyle loafers across the U.S. and Canada. Rising adoption of smart-casual dress codes, workplace flexibility, and athleisure-inspired footwear is accelerating market growth

- The Leather segment dominated the market with a 54.3% share in 2025, owing to strong consumer preference for premium appearance, durability, and comfort

Report Scope and Loafers Market Segmentation

|

Attributes |

Loafers Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Loafers Market?

Increasing Shift Toward Premium, Comfortable, and Versatile Loafers

- The loafers market is witnessing strong adoption of lightweight, ergonomically designed, and comfort-enhanced footwear suited for both formal and casual wear

- Manufacturers are introducing innovative materials, cushioned insoles, breathable linings, and flexible outsoles to improve all-day comfort and durability

- Growing demand for versatile footwear that seamlessly transitions from work to casual settings is driving adoption across professional, travel, and lifestyle segments

- For instance, companies such as Gucci, Clarks, Allen Edmonds, Cole Haan, and Nike have expanded their loafer portfolios with modern silhouettes, premium leather, sustainable materials, and hybrid designs

- Increasing influence of athleisure, smart-casual fashion trends, and minimalist aesthetics is accelerating the shift toward contemporary loafers

- As consumers prioritize style, comfort, and versatility, Loafers will remain a key footwear category across formal, casual, and lifestyle segments

What are the Key Drivers of Loafers Market?

- Rising demand for comfortable, easy-to-wear, and slip-on footwear suitable for long working hours and daily use

- For instance, in 2025, leading brands such as Skechers, Clarks, Bata, and Hush Puppies introduced upgraded loafer collections featuring memory foam cushioning, lightweight soles, and improved arch support

- Growing adoption of smart-casual dress codes, remote work culture, and flexible workplace norms is boosting demand across North America, Europe, and Asia-Pacific

- Advancements in footwear manufacturing technologies, including 3D molding, lightweight composites, and sustainable materials, have enhanced product quality and comfort

- Rising consumer preference for premium leather, eco-friendly materials, and customized fit options is driving value growth in the market

- Supported by expanding retail networks, e-commerce penetration, and brand-led innovation, the Loafers market is expected to witness steady long-term growth

Which Factor is Challenging the Growth of the Loafers Market?

- High prices associated with premium and branded loafers restrict adoption among price-sensitive consumers

- For instance, during 2024–2025, fluctuations in leather prices, synthetic material costs, and global supply chain disruptions increased production expenses for several footwear manufacturers

- Intense competition from casual sneakers, moccasins, and hybrid footwear styles reduces product differentiation and impacts consumer preference

- Limited awareness regarding ergonomic benefits and premium craftsmanship in emerging markets slows value-based adoption

- Presence of counterfeit products and unorganized local manufacturers creates pricing pressure for established brands

- To address these challenges, companies are focusing on cost-optimized designs, sustainable sourcing, direct-to-consumer channels, and enhanced brand storytelling to strengthen global adoption of loafers

How is the Loafers Market Segmented?

The market is segmented on the basis of product type and distribution channel.

- By Product Type

On the basis of product type, the loafers market is segmented into Leather, Fabric, and Others. The Leather segment dominated the market with a 54.3% share in 2025, owing to strong consumer preference for premium appearance, durability, and comfort. Leather loafers are widely adopted across formal, semi-formal, and smart-casual applications, particularly among working professionals and premium lifestyle consumers. Their superior breathability, long lifespan, and ability to adapt to various fashion trends support sustained demand across North America and Europe. Leading brands continue to innovate with full-grain, suede, and sustainable leather variants to enhance appeal and value perception.

The Fabric segment is expected to grow at the fastest CAGR from 2026 to 2033, driven by rising demand for lightweight, breathable, and casual footwear. Increasing adoption of fabric loafers for travel, daily wear, and summer usage, along with growing interest in eco-friendly and vegan materials, is accelerating segment growth.

- By Distribution Channel

On the basis of distribution channel, the loafers market is segmented into Supermarkets and Hypermarkets, Specialty Stores, E-commerce, and Online. The Specialty Stores segment dominated the market with a 38.7% share in 2025, as consumers prefer physical retail outlets to assess fit, comfort, material quality, and craftsmanship before purchase. Brand-owned stores and premium footwear boutiques offer personalized services, wide product variety, and strong brand experience, driving higher conversion rates.

The E-commerce segment is projected to grow at the fastest CAGR from 2026 to 2033, supported by expanding digital retail infrastructure, increasing smartphone penetration, and growing consumer confidence in online shopping. Features such as virtual try-ons, flexible return policies, detailed size guides, and competitive pricing are further boosting online sales of loafers across global markets.

Which Region Holds the Largest Share of the Loafers Market?

- Asia-Pacific dominated the loafers market with a 45.1% revenue share in 2025, driven by a large consumer base, rising disposable incomes, and strong footwear manufacturing ecosystems across China, India, Vietnam, and Indonesia. High demand for affordable, stylish, and versatile loafers supports widespread adoption across formal, casual, and daily-wear segments

- Regional manufacturers and global brands are expanding localized production, introducing cost-effective designs, and strengthening retail networks to cater to diverse consumer preferences, reinforcing Asia-Pacific’s leadership

- Rapid urbanization, evolving fashion trends, and growing penetration of organized retail and e-commerce platforms further support sustained market dominance

China Loafers Market Insight

China is the largest contributor in Asia-Pacific, supported by large-scale footwear manufacturing capacity, competitive pricing, and strong domestic consumption. Growing preference for smart-casual footwear, expanding middle-class population, and robust export demand drive steady market growth. Continuous investments in design innovation and supply chain efficiency further strengthen China’s position in the global loafers market.

India Loafers Market Insight

India contributes significantly to regional dominance, driven by rising urbanization, increasing fashion awareness, and growing demand for affordable branded footwear. Expansion of domestic brands, rapid growth of e-commerce platforms, and improving retail accessibility accelerate adoption across metropolitan and tier-II cities.

Japan Loafers Market Insight

Japan shows stable growth due to strong demand for premium-quality, minimalist, and comfort-focused loafers. Consumer preference for durability, craftsmanship, and ergonomic design supports steady adoption among working professionals and aging populations.

North America Loafers Market

North America is expected to register the fastest CAGR of 7.36% from 2026 to 2033, driven by increasing demand for premium, comfort-oriented, and lifestyle loafers across the U.S. and Canada. Rising adoption of smart-casual dress codes, workplace flexibility, and athleisure-inspired footwear is accelerating market growth. Strong brand presence, high spending capacity, and expanding direct-to-consumer and online retail channels further boost regional expansion

U.S. Loafers Market Insight

The U.S. leads North America, supported by high demand for premium and designer loafers, strong fashion influence, and rapid adoption of comfort-enhancing footwear technologies. Growing preference for versatile footwear suitable for both work and leisure continues to drive market growth.

Canada Loafers Market Insight

Canada contributes steadily due to increasing preference for durable, weather-appropriate, and comfort-driven loafers. Growth in online footwear sales, urban lifestyle trends, and strong brand penetration support continued market expansion.

Which are the Top Companies in Loafers Market?

The loafers industry is primarily led by well-established companies, including:

- Nike, Inc. (U.S.)

- ADIDAS AG (Germany)

- PUMA SE (Germany)

- ZARA (Spain)

- Louis Vuitton Malletier SAS (France)

- Alpinestars (Italy)

- Allen Edmonds Corporation (U.S.)

- GIANNI FALCO S.R.L. (Italy)

- Lee Cooper (U.K.)

- Wolf & Shepherd (U.S.)

- Guccio Gucci S.p.A. (Italy)

- Tommy Hilfiger Licensing B.V. (Netherlands)

- FILA Luxembourg S.a.r.l. (Luxembourg)

- RUOSH (India)

- C&J Clark International (U.K.)

- SKECHERS USA, Inc. (U.S.)

- BATA INDIA LIMITED (India)

- Hush Puppies (U.S.)

- Relaxo Footwears Limited (India)

- Woodland Worldwide (India)

What are the Recent Developments in Global Loafers Market?

- In March 2023, C. & J. Clark International Ltd partnered with Fitbit, a leading wearable technology company, to develop a new range of smart loafers capable of tracking fitness and health-related metrics, highlighting the brand’s move toward integrating digital technology and wellness features into everyday footwear

- In January 2023, Bally opened a new flagship store in New York City to showcase its latest collection of premium loafers, emphasizing craftsmanship, luxury design, and modern styling, strengthening the brand’s visibility and premium positioning in the North American market

- In October 2022, Geox S.p.A introduced a new range of waterproof loafers featuring proprietary breathable technology designed to keep feet dry and comfortable in varying conditions, reinforcing the company’s focus on functional innovation and comfort-driven footwear solutions

- In May 2022, Rothy’s Inc. launched a new collection of sustainable loafers made from recycled materials in collaboration with fashion brand Veronica Beard, underscoring growing industry emphasis on sustainability and eco-friendly footwear manufacturing

- In March 2021, Clarks developed GORE-TEX loafers incorporating a layered membrane structure with microscopic pores that allow water vapor to escape while preventing water droplets from entering the shoe, enhancing product performance by combining breathability, waterproofing, and long-term wearer comfort

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.