Global Local Bank Integrates Digital Payment Gateway Market

Market Size in USD Billion

CAGR :

%

USD

16.89 Billion

USD

43.64 Billion

2025

2033

USD

16.89 Billion

USD

43.64 Billion

2025

2033

| 2026 –2033 | |

| USD 16.89 Billion | |

| USD 43.64 Billion | |

|

|

|

|

Local Bank Integrates Digital Payment Gateway Market Size

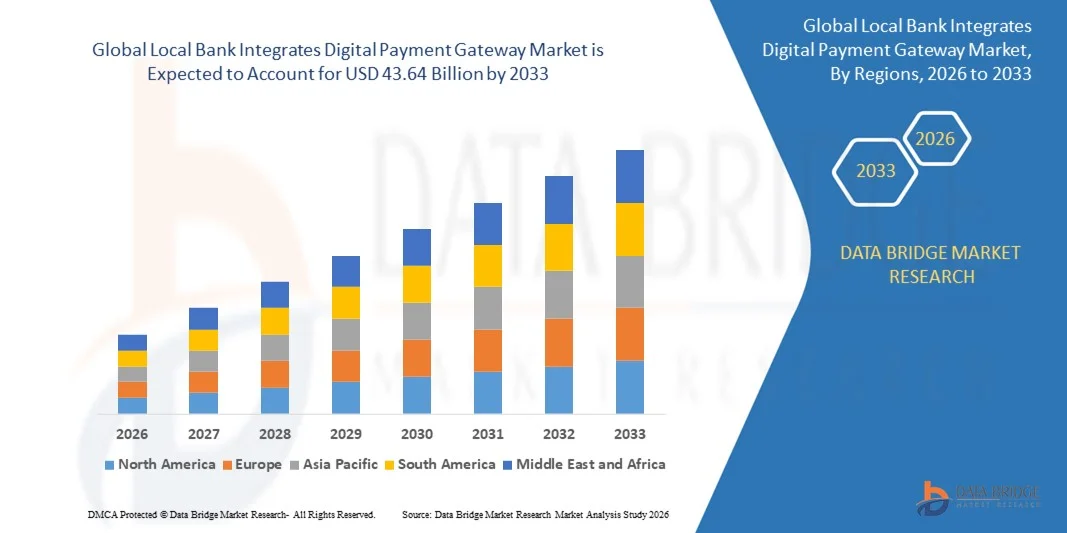

- The global local bank integrates digital payment gateway market size was valued at USD 16.89 billion in 2025 and is expected to reach USD 43.64 billion by 2033, at a CAGR of 12.60% during the forecast period

- The market growth is largely fueled by the increasing adoption of digital payments, rapid technological advancements in payment gateways, and the integration of banking systems with merchant and enterprise platforms, leading to greater efficiency and real-time transaction processing across sectors

- Furthermore, rising demand from businesses and consumers for secure, user-friendly, and seamless payment solutions is establishing local bank-integrated digital payment gateways as the preferred option for both large enterprises and small-to-medium businesses. These converging factors are accelerating the deployment of integrated gateway solutions, thereby significantly boosting market growth

Local Bank Integrates Digital Payment Gateway Market Analysis

- Local bank-integrated digital payment gateways, providing secure, real-time, and scalable transaction processing for merchants and enterprises, are becoming essential tools for both retail and corporate financial operations due to their enhanced convenience, compliance features, and integration with banking infrastructure

- The escalating demand for these gateways is primarily driven by the widespread adoption of digital banking, increased preference for cashless transactions, growing e-commerce penetration, and the need for reliable, bank-backed solutions that ensure secure and efficient payment processing across multiple channels

- North America dominated the local bank integrates digital payment gateway market in 2025, due to rapid digital payment adoption and the strong presence of financial institutions modernizing their transaction infrastructure

- Asia-Pacific is expected to be the fastest growing region in the local bank integrates digital payment gateway market during the forecast period due to rising digitalization, strong adoption of mobile-based transactions, and government initiatives promoting cashless economies in China, Japan, and India

- API/non-hosted payment gateways segment dominated the market with a market share of 43.1% in 2025, due to rising adoption among enterprises seeking full control over payment processing. Businesses prefer API-driven gateways for their flexibility, secure data handling, and ability to integrate seamlessly with customized platforms. The segment also benefits from increasing demand for advanced authentication, real-time transaction monitoring, and tailored checkout experiences that improve conversion rates. API-based solutions continue to gain traction as companies focus on enhancing security frameworks and meeting compliance requirements through controlled environments

Report Scope and Local Bank Integrates Digital Payment Gateway Market Segmentation

|

Attributes |

Local Bank Integrates Digital Payment Gateway Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Local Bank Integrates Digital Payment Gateway Market Trends

Rising Adoption of Real-Time and Mobile Payment Solutions

- The growing adoption of real-time and mobile payment solutions is a major trend in the local bank integrates digital payment gateway market as businesses and consumers increasingly prefer instant, cashless transactions for convenience and efficiency across retail, e-commerce, and corporate sectors

- For instance, PayU expanded its mobile and UPI-enabled payment gateway services in India in 2025, allowing merchants to process real-time payments from multiple digital channels seamlessly, significantly enhancing the adoption of bank-integrated solutions

- The surge in smartphone penetration and digital wallet usage is driving demand for mobile-first payment gateways that offer secure and instantaneous transaction processing, supporting the rapid expansion of digital commerce

- Enterprises and small-to-medium businesses are increasingly leveraging integrated gateways to streamline payments, reduce manual reconciliation, and improve financial transparency while offering consumers a faster checkout experience

- The integration of real-time processing features with analytics, fraud detection, and transaction monitoring tools is further accelerating adoption, as businesses prioritize operational efficiency and customer satisfaction

- Overall, the trend toward mobile and instant payments is reshaping the payment ecosystem, encouraging banks and merchants to adopt scalable, secure, and versatile gateway solutions to meet evolving consumer and enterprise needs

Local Bank Integrates Digital Payment Gateway Market Dynamics

Driver

Increasing Demand for Secure and Integrated Payment Gateways

- The rising demand for secure and integrated payment gateways is a key driver for market growth as businesses seek solutions that combine ease of use, multi-channel compatibility, and robust security measures for digital transactions

- For instance, in June 2025, RBL Bank partnered with Paytm to deploy integrated merchant payment solutions supporting cards, UPI, and wallets, helping small and medium enterprises securely manage real-time transactions while enhancing customer trust

- Banks and enterprises are increasingly adopting gateways that offer tokenization, encryption, and PCI-DSS compliance to mitigate fraud risks and protect sensitive financial data

- The growing need for consolidated payment management tools that integrate with enterprise resource planning, accounting systems, and CRM platforms is reinforcing the adoption of bank-integrated gateway solutions

- The combined focus on security, efficiency, and seamless integration is driving adoption across retail, corporate, and e-commerce sectors, strengthening the overall growth trajectory of the market

Restraint/Challenge

Regulatory Compliance and Data Security Concerns

- Regulatory compliance and data security concerns are significant challenges for the market as enterprises and banks must ensure that gateways meet local and international financial regulations while safeguarding sensitive payment data

- For instance, payment platforms such as PayPal frequently update their solutions to comply with GDPR, PCI-DSS, and other regional banking standards, which can increase implementation complexity and operational costs for enterprises adopting these gateways

- The need to maintain continuous monitoring, secure authentication, and encryption protocols adds operational overhead for banks and merchants deploying integrated gateways

- Variations in regulatory requirements across countries can slow cross-border adoption and create compliance challenges for multi-national enterprises using bank-integrated payment solutions

- Addressing these challenges through robust cybersecurity frameworks, proactive regulatory alignment, and continuous monitoring is essential for maintaining consumer trust, regulatory adherence, and long-term market growth

Local Bank Integrates Digital Payment Gateway Market Scope

The market is segmented on the basis of type, application, and end user.

- By Type

On the basis of type, the local bank integrates digital payment gateway market is segmented into API/non-hosted payment gateways, direct payment gateways, hosted payment gateways, local bank integrates, platform-based payment gateways, and pro/self-hosted payment gateways. The API/non-hosted payment gateways segment dominated the market with the largest revenue share of 43.1% in 2025, supported by rising adoption among enterprises seeking full control over payment processing. Businesses prefer API-driven gateways for their flexibility, secure data handling, and ability to integrate seamlessly with customized platforms. The segment also benefits from increasing demand for advanced authentication, real-time transaction monitoring, and tailored checkout experiences that improve conversion rates. API-based solutions continue to gain traction as companies focus on enhancing security frameworks and meeting compliance requirements through controlled environments.

The platform-based payment gateways segment is anticipated to witness the fastest growth rate from 2026 to 2033, driven by the rapid adoption of integrated financial ecosystems and all-in-one commerce platforms. These gateways attract SMEs due to their ease of deployment, reduced development effort, and built-in support for multi-channel payment processing. The rise of subscription-based platforms, e-commerce accelerators, and SaaS tools fuels demand for embedded payment capabilities, enabling businesses to streamline transactions without complex backend development. The segment’s strong future growth is supported by its scalability and the increasing shift toward unified digital business platforms.

- By Application

On the basis of application, the market is segmented into large enterprise, micro and small enterprise, and mid-sized enterprise. The large enterprise segment dominated the market in 2025, attributed to their strong investments in digital financial infrastructure and high transaction volumes requiring secure and reliable gateway integration. Large organizations prefer advanced gateway solutions that support multi-currency processing, tokenization, fraud prevention, and compliance with evolving regulatory frameworks. Their focus on improving customer experience through seamless checkout flows and omnichannel payments further strengthens segment leadership. Large enterprises also benefit from the ability to integrate with ERP, CRM, and core banking systems, enhancing payment visibility and operational efficiency.

The micro and small enterprise segment is anticipated to witness the fastest growth from 2026 to 2033, driven by increasing digital adoption among small merchants transitioning to online and contactless payments. SMEs opt for simple onboarding, low-cost subscription plans, and plug-and-play gateway integrations that support rapid setup with minimal technical expertise. Rising penetration of mobile commerce and digital wallets encourages small businesses to implement flexible gateway solutions that improve accessibility and customer engagement. Government initiatives supporting small-business digitalization and incentives for cash-free transactions further accelerate segment expansion.

- By End User

On the basis of end user, the market is segmented into banking, retail, and travel. The banking segment dominated the market in 2025, supported by rapid modernization of financial services and the surge in digital transactions managed by banks. Financial institutions prioritize secure gateway integrations to manage real-time payments, recurring billing, and mobile banking transactions with strengthened authentication. The segment benefits from growing use of online banking portals, UPI-based transfers, and card-not-present payments that require advanced gateway infrastructure. Banks also rely on integrated gateways to enhance fraud detection, improve reconciliation, and support cross-border digital transactions.

The retail segment is projected to record the fastest growth from 2026 to 2033, driven by the expansion of e-commerce, hyperlocal delivery platforms, and omnichannel shopping. Retailers adopt advanced payment gateways to support diverse payment modes, frictionless checkouts, and secure digital wallet integration. Rising consumer preference for online shopping, mobile payments, and instant refunds pushes retailers to deploy flexible and scalable gateway solutions. The segment’s growth is further encouraged by loyalty programs, personalized payment experiences, and the increased use of data-driven payment analytics to enhance buyer engagement.

Local Bank Integrates Digital Payment Gateway Market Regional Analysis

- North America dominated the local bank integrates digital payment gateway market with the largest revenue share in 2025, driven by rapid digital payment adoption and the strong presence of financial institutions modernizing their transaction infrastructure

- Businesses across the region prioritize secure, real-time payment processing supported by gateways that seamlessly integrate with banking platforms and enterprise systems. The rising consumer preference for cashless transactions, combined with the widespread use of online and mobile banking, supports the continued expansion of digital payment gateway deployment.

- The region’s mature technological environment, high awareness of digital security, and strong regulatory frameworks reinforce the demand for advanced gateway solutions among enterprises and banks

U.S. Local Bank Integrates Digital Payment Gateway Market Insight

The U.S. captured the largest revenue share within North America in 2025, supported by the rapid adoption of digital financial services, strong preference for seamless online and mobile transactions, and increasing enterprise reliance on secure gateway integrations. Banks and businesses across the country prioritize real-time payments, tokenization, and enhanced fraud monitoring, while the growth of cloud-based financial platforms and digital wallets strengthens gateway deployment. The expanding fintech ecosystem further accelerates integration with advanced payment systems.

Europe Local Bank Integrates Digital Payment Gateway Market Insight

Europe is projected to grow at a substantial CAGR throughout the forecast period, supported by stringent financial regulations, rising digital payment penetration, and growing enterprise demand for compliant and secure transaction systems. The region’s shift toward online commerce and mobile banking fuels the adoption of integrated gateways offering fraud detection, multi-channel support, and strong data protection. Increased urbanization, expanding digital infrastructure, and adoption of connected financial tools reinforce the growth of bank-linked payment solutions across residential, commercial, and institutional sectors.

U.K. Local Bank Integrates Digital Payment Gateway Market Insight

The U.K. market is expected to grow at a notable CAGR, driven by rising adoption of digital banking services, expansion of fintech platforms, and heightened focus on payment security and compliance. Businesses across the U.K. embrace integrated gateways to streamline digital transactions, improve transparency, and support multiple payment modes. The widespread use of contactless payments, mobile wallets, and online retail channels further fuels adoption, supported by strong digital infrastructure and increasing reliance on cashless ecosystems.

Germany Local Bank Integrates Digital Payment Gateway Market Insight

The Germany market is anticipated to expand at a considerable CAGR, driven by strong emphasis on financial security, high consumer preference for digital transactions, and sustained modernization of banking systems. Enterprises and banks adopt integrated gateways to enhance data privacy, reduce fraud risk, and support fast, seamless digital payments. Germany’s advanced infrastructure, innovation-focused environment, and commitment to compliance standards accelerate gateway integration across sectors such as retail, BFSI, and enterprise financial platforms.

Asia-Pacific Local Bank Integrates Digital Payment Gateway Market Insight

The Asia-Pacific market is projected to grow at the fastest CAGR during the forecast period, supported by rising digitalization, strong adoption of mobile-based transactions, and government initiatives promoting cashless economies in China, Japan, and India. Expanding e-commerce, widespread smartphone penetration, and modernization of banking networks increase demand for secure, scalable gateway integrations. As APAC emerges as a technology manufacturing hub, increased affordability and accessibility of payment systems further accelerate adoption across businesses of all sizes.

Japan Local Bank Integrates Digital Payment Gateway Market Insight

Japan is gaining steady traction due to its advanced digital environment, high consumer demand for convenience, and strong integration of banking services with cashless payment systems. Growing adoption of mobile wallets, IoT-enabled payment technologies, and connected financial tools supports market expansion. Japan’s aging population further encourages the use of simple, secure, and accessible digital payment solutions across both residential and commercial settings.

China Local Bank Integrates Digital Payment Gateway Market Insight

China accounted for the largest market revenue share in Asia-Pacific in 2025, driven by rapid digital financial adoption, strong presence of domestic payment technology providers, and widespread use of online and mobile transactions. The country’s booming e-commerce sector, large digital user base, and government-backed smart city initiatives support accelerated gateway integration. Availability of affordable, scalable payment technologies fuels broad adoption across enterprises, retailers, and financial institutions.

Local Bank Integrates Digital Payment Gateway Market Share

The local bank integrates digital payment gateway industry is primarily led by well-established companies, including:

- Alipay (China)

- Amazon, Inc. (U.S.)

- Wirecard (Germany)

- PesoPay (Singapore)

- PayU (Netherlands)

- PayPal (U.S.)

- Paymill (Germany)

- MOLPay (Malaysia)

- eWAY AU (Australia)

- Net (Sweden)

- Worldpay (U.K.)

- Beanstream (Canada)

- Stripe (U.S.)

- Klarna (Sweden)

- Realex (Ireland)

- CashU (U.A.E.)

- WebMoney (Russia)

- Pagosonline (Colombia)

- 99bill (China)

- MyGate (South Africa)

- ServiRed (Spain)

- Payson (Sweden)

- Cardstream (U.K.)

- Sage Pay (U.K.)

- e-Path (Australia)

- NAB Transact (Australia)

- MercadoPago (Argentina)

- CCBill (U.S.)

Latest Developments in Global Local Bank Integrates Digital Payment Gateway Market

- In October 2025, HDFC Bank launched My Business QR powered by Vyaparify, providing India’s small merchants a unified digital-commerce identity through a single QR code. This development significantly lowers the barriers for micro and small businesses to adopt digital payments, allowing them to accept multiple payment modes, engage customers, and manage transactions seamlessly. The integration of bank-backed gateways with such tools expands the addressable market for local bank payment solutions and enhances financial inclusion by bringing a larger segment of SMBs into the digital ecosystem

- In April 2025, CCAvenue expanded collaboration with RBL Bank by integrating the bank’s corporate net-banking facilities into its payment aggregator platform. This initiative allows large enterprises to utilize secure, bank-integrated gateways for corporate payments, broadening the customer base beyond retail and SMB segments. The move enhances enterprise adoption, improves transaction efficiency, and positions bank-integrated gateways as reliable, scalable solutions for high-volume financial operations

- In March 2025, Paytm partnered with RBL Bank to deploy Soundbox and card-machine solutions across RBL Bank’s merchant network, enabling merchants to accept payments through UPI, cards, EMI, and other digital modes. This partnership accelerates the adoption of integrated payment gateways by offering flexibility, real-time transaction monitoring, and improved reconciliation for merchants. By simplifying payment acceptance, the development strengthens merchant engagement, increases transaction volumes, and boosts confidence in bank-linked payment solutions

- In 2025, CAMS launched the CAMSPay Payment Gateway in partnership with Mylapay, supported by RBL Bank, offering a high-performance gateway capable of handling thousands of transactions per second with real-time analytics and compliance certifications. This innovation reinforces the scalability and reliability of bank-integrated gateways for high-volume merchants and fintech platforms. By addressing the growing demand for secure and efficient processing, it strengthens enterprise trust in integrated solutions and expands the market for banks offering such services

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.