Global Luxury Furniture Market

Market Size in USD Billion

CAGR :

%

USD

24.23 Billion

USD

33.94 Billion

2024

2032

USD

24.23 Billion

USD

33.94 Billion

2024

2032

| 2025 –2032 | |

| USD 24.23 Billion | |

| USD 33.94 Billion | |

|

|

|

|

Luxury Furniture Market Size

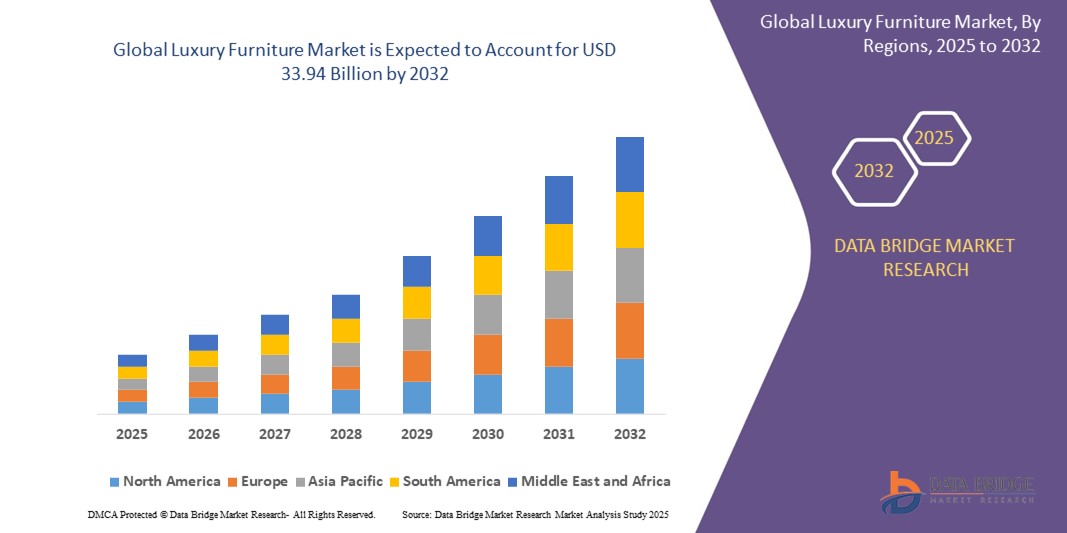

- The global luxury furniture market was valued at USD 24.23 billion in 2024 and is expected to reach USD 33.94 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 4.30%, primarily driven by rising disposable incomes

- This growth is driven by growing demand for premium and customized home decor and increasing consumer preference for luxury lifestyles

Luxury Furniture Market Analysis

- The luxury furniture market is growing steadily due to increasing disposable incomes, rising demand for premium home décor, and a stronger inclination toward luxurious lifestyles. Digital innovations, eco-friendly furniture trends, and celebrity-endorsed interior styles are further enhancing global demand for exclusive and high-quality furniture pieces

- Rising urbanization, expanding real estate projects, and growing influence of social media platforms are major drivers. Availability of luxury furniture collections for residential, commercial, and hospitality sectors continues to expand the global market

- Europe leads the luxury furniture market with strong demand in Italy, Germany, and France, driven by iconic craftsmanship, a rich tradition of furniture design, and the thriving luxury tourism sector. International furniture exhibitions, luxury showrooms, and established manufacturing hubs sustain the region’s dominance

- For instance, in Italy, brands such as Poltrona Frau, Molteni & C, and Flexform are expanding their luxury showrooms and global collaborations, attracting high-net-worth individuals seeking Italian craftsmanship, timeless designs, and personalized luxury solutions

- Globally, the rising trend of sustainable furniture, multi-functional smart furniture, and customizable luxury pieces are shaping the future of the luxury furniture market. Continuous innovation in design, eco-conscious production practices, and enhanced digital customer experiences are key to maintaining growth across both traditional and emerging markets

Report Scope and Luxury Furniture Market Segmentation

|

Attributes |

Luxury Furniture Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework |

Luxury Furniture Market Trends

“Growing Demand for Multi-Functional and Space-Saving Designs”

- Rising urbanization and shrinking living spaces are fueling demand for multi-functional luxury furniture that maximizes utility without compromising on aesthetics, leading to increased adoption of modular sofas, extendable dining tables, and smart storage beds

- Brands are innovating with transformable furniture concepts, such as foldable wall beds, hidden storage units, and reconfigurable seating systems, catering to consumers seeking versatility and elegance in modern homes

- For instance, in March 2025, Resource Furniture launched a new collection of luxury wall beds with integrated desks and sofas, offering high-end, space-saving solutions for urban dwellers valuing both form and function

- The trend toward compact luxury living is encouraging brands to focus on modularity, customization, and craftsmanship, creating new opportunities to design flexible, future-proof furniture solutions for premium urban residences

- As consumer expectations for luxury and functionality converge, brands that lead in designing smart, space-saving furniture are poised to capture significant market share and redefine luxury living standards globally

Luxury Furniture Market Dynamics

Driver

“Growing Emphasis on Personalization and Bespoke Furniture”

- Increasing consumer desire for individualized luxury experiences is driving demand for personalized and bespoke furniture, with customers seeking unique pieces tailored to their tastes, lifestyles, and home aesthetics

- Leading brands are offering customizable options in fabrics, finishes, dimensions, and configurations, enabling consumers to co-create exclusive furniture pieces that reflect personal style and prestige

- High-net-worth individuals (HNWIs) and luxury real estate projects are accelerating this trend, integrating bespoke furniture into private residences, yachts, and boutique hotels

- For instance, in February 2025, Poltrona Frau expanded its bespoke program, allowing clients to customize iconic chairs and sofas with rare leathers, artisanal finishes, and personalized monograms, enhancing brand exclusivity and customer loyalty

- As personalization becomes synonymous with modern luxury, brands that invest in craftsmanship, co-creation platforms, and exclusive design services will continue to strengthen their appeal among discerning global consumers

Opportunity

“Rise of Branded Luxury Furniture in Hospitality and Commercial Spaces”

- The booming luxury hospitality sector is creating new opportunities for branded luxury furniture to be integrated into premium hotels, resorts, executive offices, and co-working spaces, enhancing brand visibility and elevating guest experiences

- Brands are collaborating with hospitality chains, architects, and interior designers to create exclusive furniture collections that marry comfort, durability, and opulence

- Tailored solutions for luxury lobbies, lounges, and high-end suites are expanding the presence of luxury furniture brands beyond residential settings into vibrant commercial landscapes

For instance,

- In January 2025, Roche Bobois partnered with Four Seasons Hotels to furnish a series of penthouse suites with signature luxury pieces

- In November 2024, Flexform signed a deal to furnish premium co-working spaces in Dubai’s financial district

- In October 2024, Fendi Casa collaborated with luxury resorts across the Maldives to design bespoke villa interiors

- By tapping into hospitality and commercial sectors, luxury furniture brands can diversify revenue streams, amplify brand prestige, and engage affluent travelers and corporate clients globally

Restraint/Challenge

“High Cost of Raw Materials and Supply Chain Disruptions”

- The luxury furniture industry faces challenges from escalating costs of premium raw materials such as rare woods, fine leathers, and artisanal metals, impacting production costs and squeezing profit margins

- Ongoing global supply chain disruptions, including shipping delays and material shortages, are hindering timely manufacturing and delivery of luxury furniture orders, affecting customer satisfaction and brand reliability

- Brands are compelled to diversify sourcing strategies, maintain higher inventories, and invest in local production hubs to mitigate these risks and maintain operational resilience

For instance,

- In March 2025, Baker Interiors Group reported delayed deliveries due to sourcing issues for premium walnut wood from North America

- In January 2025, Ligne Roset announced plans to shift partial production to Europe to counter rising freight costs and supply chain instability

- In December 2024, Minotti faced leather shortages impacting its customized sofa collections

- As material costs and logistical challenges persist, brands must adopt agile, sustainable, and tech-enabled supply chain models to protect margins and ensure uninterrupted service in the competitive luxury landscape

Luxury Furniture Market Scope

The market is segmented on the basis of material, end-use, product type, furniture type, and distribution channel.

|

Segmentation |

Sub-Segmentation |

|

By Material |

|

|

By End-Use |

|

|

By Product Type |

|

|

By Furniture Type |

|

|

By Distribution Channel |

|

Luxury Furniture Market Regional Analysis

“Europe is the Dominant Region in the Luxury Furniture Market”

- Europe holds the largest share in the luxury furniture market, supported by a strong demand for premium home décor, heritage craftsmanship, and high-end residential and commercial projects

- Countries such as Italy, Germany, France, and the U.K. are major contributors, known for their luxury brands, skilled artisans, and growing investments in bespoke furniture collections

- The rise in luxury real estate developments, hospitality projects, and sustainable furniture trends further strengthens Europe’s leadership position in the global luxury furniture market

- With its rich design heritage, innovation in sustainable materials, and strong retail presence, Europe is expected to remain the dominant region in the luxury furniture market over the forecast period

“Asia-Pacific is projected to register the Highest Growth Rate”

- Asia-Pacific is projected to register the highest growth rate in the luxury furniture market, driven by rapid urbanization, rising disposable incomes, and increasing demand for premium lifestyle products across major economies

- Countries such as China, India, Japan, and South Korea are experiencing a boom in luxury real estate and hospitality sectors, creating a strong demand for high-end, customized furniture solutions

- Expanding e-commerce platforms, international brand penetration, and a growing preference for modern and sustainable luxury designs are further accelerating market growth in the Asia-Pacific region

- With dynamic economic growth, a rising affluent population, and evolving consumer preferences, Asia-Pacific is expected to become the fastest-growing region in the global luxury furniture market

Luxury Furniture Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- MUEBLE DE ESPAÑA (Spain)

- Giovanni Visentin (Italy)

- Expand Furniture (Canada)

- Flexsteel Industries, Inc. (U.S.)

- Meco (U.S.)

- Haworth Inc. (U.S.)

- Ashley Global Retail, LLC (U.S.)

- Inter IKEA Systems B.V. (Netherlands)

- Murphy Wall Beds Hardware Inc. (Canada)

- Resource Furniture (U.S.)

- The Bedder Way Co. (U.S.)

- La-Z-Boy Incorporated (U.S.)

- Leggett & Platt, Incorporated (U.S.)

- Sauder Woodworking Co. (U.S.)

- Flexfurn (Belgium)

- Gopak Ltd. (U.K.)

- Nilkamal (India)

- Up Closets (U.S.)

- Duresta (U.K.)

- Dorel Industries (Canada)

Latest Developments in Global Luxury Furniture Market

- In November 2024, Indian luxury furniture brand DIVIANA opened its first showroom in Milan’s prestigious Montenapoleone Fashion District, marking a major milestone in its EUR 50 million European expansion with a 3,200-square-foot space blending traditional craftsmanship and modern design, reinforcing its growing global presence

- In October 2024, Pepperfry, a leading e-commerce platform for furniture and home décor, introduced a luxury segment featuring over 650 furniture items and 1,000+ home décor products from renowned brands such as Freedom Tree and Jaipur Rugs, further strengthening its premium product portfolio

- In May 2024, Remax Furnitures celebrated the launch of its flagship store, presenting a wide range of customizable furniture that highlights innovative interior design solutions, showcasing the brand’s dedication to delivering unique and immersive experiences to customers

- In April 2024, Luxury Living Group and Bugatti hosted an extraordinary exhibition at Palazzo Chiesa’s gardens in Corso Venezia, unveiling the latest evolution of their luxury design philosophy, enhancing their reputation for creating exclusive and artistic furniture collections

- In October 2022, Linly Designs, a Chicago-based interior design and retail company, acquired Marge Carson, a renowned handcrafted furniture manufacturer from California, securing Marge Carson’s global legacy of high-quality, proportionate designs and luxurious textiles in the furniture industry

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.