Global Luxury Perfume Market

Market Size in USD Billion

CAGR :

%

USD

17.91 Billion

USD

28.98 Billion

2025

2033

USD

17.91 Billion

USD

28.98 Billion

2025

2033

| 2026 –2033 | |

| USD 17.91 Billion | |

| USD 28.98 Billion | |

|

|

|

|

Luxury Perfume Market Size

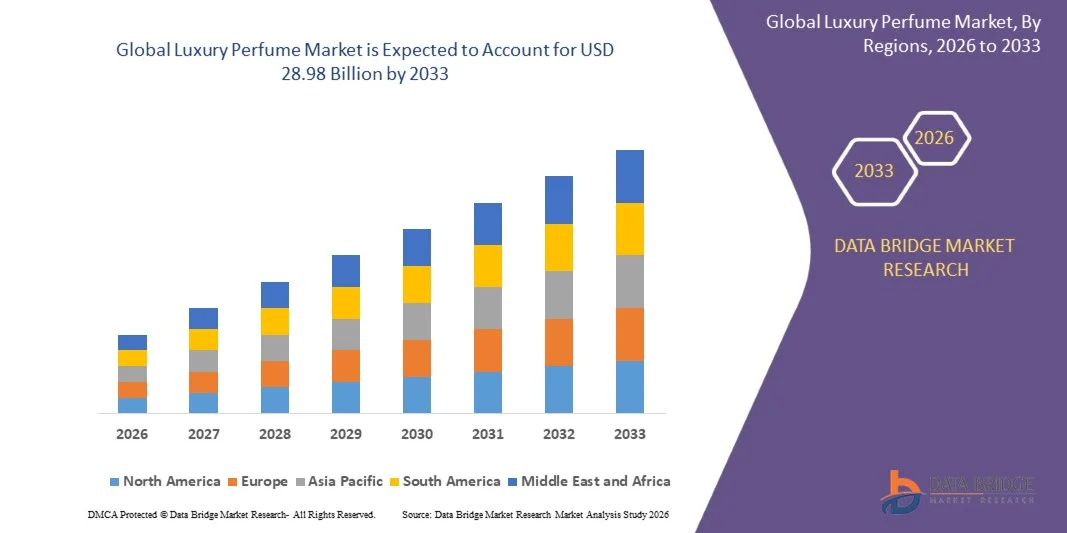

- The global luxury perfume market size was valued at USD 17.91 billion in 2025 and is expected to reach USD 28.98 billion by 2033, at a CAGR of 6.20% during the forecast period

- The market growth is largely fueled by rising consumer preference for premium and niche fragrances, along with increasing disposable incomes and a growing inclination toward luxury personal care products across developed and emerging markets

- Furthermore, the desire for exclusivity, sophisticated scent profiles, and branded experiences is driving demand for luxury perfumes, establishing them as status symbols and lifestyle essentials. These factors are accelerating the adoption of high-end fragrances, thereby significantly boosting the industry’s growth

Luxury Perfume Market Analysis

- Luxury perfumes, offering high-quality, long-lasting, and often signature scent experiences, are increasingly considered essential components of personal grooming and lifestyle expression in both residential and social settings due to their exclusivity, brand prestige, and distinctive olfactory profiles

- The escalating demand for luxury perfumes is primarily fueled by increasing brand awareness, expansion of retail and e-commerce channels, rising gifting culture, and a growing trend toward niche and artisanal fragrances that cater to evolving consumer preferences

- North America dominated luxury perfume market with a share of 37.3% in 2025, due to high disposable incomes, strong brand awareness, and growing demand for premium personal care products

- Asia-Pacific is expected to be the fastest growing region in the luxury perfume market during the forecast period due to rising disposable incomes, urbanization, and growing aspirational lifestyles in countries such as China, Japan, and India

- Eau de parfum segment dominated the market with a market share of 47.5% in 2025, due to its long-lasting fragrance profile and higher concentration of aromatic compounds. Consumers often prefer Eau de Parfum for its richer scent and versatility for both day and evening wear. The segment also benefits from strong brand promotion and premium packaging, enhancing its appeal among luxury perfume buyers

Report Scope and Luxury Perfume Market Segmentation

|

Attributes |

Luxury Perfume Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Luxury Perfume Market Trends

“Rising Demand for Niche and Artisanal Fragrances”

- A significant trend in the luxury perfume market is the growing consumer preference for niche and artisanal fragrances, driven by an increasing desire for personalized, exclusive, and unique scent experiences. This trend is encouraging brands to develop limited-edition perfumes, small-batch collections, and signature olfactory profiles that cater to evolving consumer tastes

- For instance, Le Labo, under Estée Lauder Companies Inc., offers hand-blended fragrances in limited quantities, emphasizing customization and rare ingredients, which has strengthened its appeal among luxury perfume enthusiasts seeking distinctive scents

- The adoption of niche perfumes is also expanding among younger and affluent consumer segments, who are influenced by social media, celebrity endorsements, and digital marketing campaigns highlighting artisanal craftsmanship. This is positioning luxury perfumes as lifestyle statements rather than mere personal care products

- Luxury perfume houses such as Hermès and Byredo are innovating with creative scent compositions that merge classic and contemporary notes, meeting rising expectations for originality and premium quality. This innovation is fostering growth in the high-end fragrance segment globally

- The market is witnessing increased interest in rare ingredients, sustainable sourcing, and storytelling behind fragrances, which is reinforcing consumer loyalty and creating opportunities for brands to differentiate themselves in a crowded market

- Retailers and boutique stores are increasingly curating exclusive in-store experiences and personalized consultations for niche perfumes, enhancing the overall consumer experience and strengthening brand positioning in the premium segment

Luxury Perfume Market Dynamics

Driver

“Growing Consumer Preference for Premium and Branded Perfumes”

- The growing global demand for premium and branded perfumes is driving the luxury perfume market, as consumers increasingly associate well-known brands with status, quality, and sophistication. This preference is motivating leading companies to expand product portfolios and strengthen marketing efforts

- For instance, Chanel continues to leverage its iconic No. 5 brand and limited-edition launches, such as the No. 5 L’Eau Drop, to attract both loyal and new consumers, reinforcing brand dominance in the luxury perfume sector

- Expanding e-commerce channels and digital marketing campaigns by brands such as Dior and Gucci are further enabling consumers to access luxury perfumes conveniently, thereby supporting consistent market growth

- The focus on exclusive collections, gift sets, and seasonal launches by companies such as Estée Lauder and Puig is creating continuous engagement with consumers, fueling repeat purchases and reinforcing market expansion

- Increasing awareness of global luxury trends, combined with rising disposable incomes in emerging markets such as China and India, is amplifying the appeal of premium perfumes, further supporting market growth

Restraint/Challenge

“High Pricing and Limited Accessibility in Emerging Markets”

- The luxury perfume market faces challenges due to the high cost of premium fragrances, which limits accessibility among broader consumer segments in emerging regions. These pricing barriers can restrict adoption and reduce potential market penetration

- For instance, limited availability of brands such as Guerlain and Byredo in certain Asian and African markets affects consumer access to high-end fragrances, creating reliance on international travel retail or e-commerce for purchases

- Production costs related to rare ingredients, artisanal craftsmanship, and premium packaging contribute to elevated retail prices, impacting affordability and wider adoption

- Market growth can also be hindered by regulatory challenges, import duties, and taxes on luxury goods in several emerging economies, which increase overall product cost and affect competitive positioning

- These factors collectively create a barrier for new consumer acquisition and limit the ability of brands to expand rapidly across all global regions, especially where disposable income and luxury awareness are still developing

Luxury Perfume Market Scope

The market is segmented on the basis of product type, gender, fragrance family, and distribution channel.

• By Product Type

On the basis of product type, the luxury perfume market is segmented into Eau de Parfum, Eau de Toilette, Parfum, Eau Fraiche, and Cologne. The Eau de Parfum segment dominated the market with the largest market revenue share of 47.5% in 2025, driven by its long-lasting fragrance profile and higher concentration of aromatic compounds. Consumers often prefer Eau de Parfum for its richer scent and versatility for both day and evening wear. The segment also benefits from strong brand promotion and premium packaging, enhancing its appeal among luxury perfume buyers.

The Parfum segment is anticipated to witness the fastest growth rate of 18.9% from 2026 to 2033, fueled by increasing demand among high-net-worth individuals and collectors. Parfum offers the most concentrated fragrance experience, requiring only a small application to achieve a long-lasting effect. Rising awareness of premium and niche perfumery, combined with exclusive launches from brands such as Chanel and Dior, is expected to drive its adoption further.

• By Gender

On the basis of gender, the luxury perfume market is segmented into male, female, and unisex fragrances. The female segment held the largest market revenue share in 2025, driven by a wider variety of offerings and higher consumer engagement in premium fragrance purchases. Women often explore multiple fragrance options, supporting repeat purchases and loyalty to luxury brands. Marketing campaigns targeting female consumers and seasonal launches also contribute to its sustained dominance.

The unisex segment is expected to witness the fastest CAGR from 2026 to 2033, driven by evolving consumer preferences toward gender-neutral and versatile fragrances. For instance, brands such as Tom Ford have popularized unisex scents that appeal to a broad audience. Social trends promoting inclusivity and minimalism in personal care are likely to boost unisex perfume sales in both online and offline channels.

• By Fragrance Family

On the basis of fragrance family, the luxury perfume market is segmented into floral, woody, oriental, fresh, and citrus. The floral segment dominated the market with the largest revenue share in 2025, driven by its timeless appeal and strong association with elegance and femininity. Floral fragrances are widely preferred for everyday wear, gifting, and special occasions, making them a staple in luxury perfume collections. The availability of sub-varieties such as rose, jasmine, and peony further strengthens its market position.

The woody segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by increasing consumer interest in deeper, more sophisticated scents. For instance, brands such as Creed and Jo Malone offer woody fragrances that cater to both male and female consumers seeking long-lasting, signature scents. The rising trend of niche and artisanal perfumery, emphasizing natural and exotic wood notes, is expected to propel its growth further.

• By Distribution Channel

On the basis of distribution channel, the luxury perfume market is segmented into online retail, department stores, specialty stores, perfume boutiques, and supermarkets. The department stores segment held the largest market revenue share in 2025, driven by its ability to offer immersive brand experiences and personalized consultations. Department stores often showcase a wide variety of premium brands, enhancing cross-selling opportunities and consumer engagement. Seasonal promotions and exclusive in-store launches also help maintain its market dominance.

The online retail segment is expected to witness the fastest CAGR from 2026 to 2033, driven by the growing preference for convenience and home delivery among luxury consumers. For instance, e-commerce platforms such as Sephora and FragranceNet have expanded their online presence to offer virtual fragrance consultations and exclusive online launches. The increasing penetration of smartphones and secure payment gateways is expected to further accelerate online sales of luxury perfumes.

Luxury Perfume Market Regional Analysis

- North America dominated the luxury perfume market with the largest revenue share of 37.3% in 2025, driven by high disposable incomes, strong brand awareness, and growing demand for premium personal care products

- Consumers in the region highly value exclusivity, high-quality ingredients, and unique fragrance experiences offered by luxury perfumes from established global brands

- This widespread adoption is further supported by advanced retail infrastructure, strong online and offline distribution channels, and the growing trend of gifting luxury perfumes, establishing them as a preferred choice among affluent consumers

U.S. Luxury Perfume Market Insight

The U.S. luxury perfume market captured the largest revenue share in 2025 within North America, fueled by the rapid expansion of premium retail and e-commerce channels. Consumers are increasingly seeking iconic, long-lasting fragrances and niche perfumery collections. The growing trend of personalized and limited-edition perfumes, combined with the rising influence of celebrity endorsements and marketing campaigns, further propels the market. Moreover, the integration of omnichannel retail strategies and luxury brand experiences is significantly contributing to the market’s growth.

Europe Luxury Perfume Market Insight

The Europe luxury perfume market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by high fashion awareness and a strong heritage of perfumery in countries such as France and Italy. Urbanization, growing tourism, and the presence of iconic perfume brands foster the adoption of luxury fragrances. European consumers are also drawn to sophisticated, designer scents and sustainable, high-quality ingredients. The region is experiencing significant growth across premium retail stores, specialty boutiques, and online channels, enhancing brand accessibility.

U.K. Luxury Perfume Market Insight

The U.K. luxury perfume market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by a growing preference for premium fragrances and gifting culture. Rising consumer awareness of exclusive brands and innovative scent compositions is encouraging purchases from both physical and online stores. The country’s well-established e-commerce and retail infrastructure is expected to continue supporting luxury perfume sales. In addition, demand for niche and unisex perfumes is influencing market dynamics in the region.

Germany Luxury Perfume Market Insight

The Germany luxury perfume market is expected to expand at a considerable CAGR during the forecast period, fueled by increasing awareness of premium personal care and international luxury brands. Germany’s focus on quality, sustainability, and innovation in consumer products promotes the adoption of luxury perfumes, particularly among affluent urban populations. The integration of fragrances with personalized gifting options and exclusive retail experiences is further driving growth. The market is witnessing rising demand for both classic and contemporary scents across retail and specialty stores.

Asia-Pacific Luxury Perfume Market Insight

The Asia-Pacific luxury perfume market is poised to grow at the fastest CAGR during the forecast period of 2026 to 2033, driven by rising disposable incomes, urbanization, and growing aspirational lifestyles in countries such as China, Japan, and India. The increasing exposure to global brands and trends through social media and digital marketing is boosting adoption. Furthermore, expanding online retail channels, availability of international perfumes, and a growing preference for premium gifting are contributing to the market’s rapid growth.

Japan Luxury Perfume Market Insight

The Japan luxury perfume market is gaining momentum due to high fashion consciousness, urban lifestyles, and demand for sophisticated fragrances. Japanese consumers show strong preference for designer brands and niche scents that reflect personal style. The growth of specialty boutiques and online platforms enhances accessibility to luxury perfumes. Moreover, increasing gifting occasions and seasonal launches are expected to further stimulate market expansion.

China Luxury Perfume Market Insight

The China luxury perfume market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to the rising middle class, growing urban population, and increasing awareness of international luxury brands. Premium perfumes are becoming a status symbol in both personal use and gifting occasions. Government initiatives promoting luxury retail growth and the proliferation of e-commerce platforms offering authentic international fragrances are key factors driving market expansion.

Luxury Perfume Market Share

The luxury perfume industry is primarily led by well-established companies, including:

- Chanel SA (France)

- LVMH Moët Hennessy Louis Vuitton SE (France)

- Burberry (U.K.)

- Estée Lauder Inc. (U.S.)

- Elizabeth Arden, Inc. (U.S.)

- Dolce&Gabbana Beauty (Italy)

- Tommy Hilfiger Licensing, LLC (U.S.)

- Lancôme (France)

- NARS (U.S.)

- Christian Dior SE (France)

- Charlotte Tilbury Beauty Ltd. (U.K.)

- Chanel (France)

- Estée Lauder Companies Inc. (U.S.)

- L’Oréal S.A. (France)

- Giorgio Armani S.p.A. (Italy)

- Biotherm (France)

- Guerlain (France)

- Shiseido Company Limited (Japan)

- Givenchy (France)

- Yves Saint Laurent Beauté (France)

- Puig SL (Spain)

Latest Developments in Global Luxury Perfume Market

- In December 2025, Coty announced a long‑term licensing agreement to develop, produce, and distribute Swarovski “Pop Luxury” fragrances, marking a strategic expansion in the luxury perfume segment by leveraging Swarovski’s global brand recognition to diversify product offerings and drive growth across key markets such as the Americas, EMEA, and Asia — a move expected to strengthen Coty’s luxury fragrance portfolio and competitive positioning through 2026 and beyond

- In February 2025, Puig reported a 14% increase in net profit for the previous year, reflecting strong performance from its luxury perfume brands such as Rabanne and Carolina Herrera, while also forecasting slower revenue growth (6–8%) in 2025 due to moderation in makeup and skincare segments and potential US tariffs — an outcome indicating resilience in perfume revenue but challenges ahead in broader beauty categories

- In February 2024, Hermès launched Oud Alezan, a new addition to its Hermessence collection that combines earthy oud with rose water and rose oxide, commanding a premium price of USD 371. This launch reinforced Hermès’s commitment to high‑end niche fragrances and contributed to bolstering consumer interest in luxury oud fragrances known for sophistication and exclusivity

- In June 2024, CHANEL marked over a century of its iconic No. 5 with the limited‑edition Chanel No. 5 L’Eau Drop collectible bottle priced at USD 188. This special edition refreshed consumer engagement with a lighter, citrus‑infused interpretation of the classic scent, driving interest among collectors and younger luxury buyers seeking modern twists on heritage perfumes

- In May 2024, Coty Inc. and Marni announced a groundbreaking long‑term licensing partnership aimed at launching a new line of fragrances and beauty products beginning in 2026 — a strategic alliance expected to amplify Coty’s presence in the high‑end fragrance market by combining Marni’s artistic fashion identity with Coty’s beauty development expertise

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.