Global Magnetic Resonance Imaging Mri Market

Market Size in USD Billion

CAGR :

%

USD

326.90 Billion

USD

574.41 Billion

2024

2032

USD

326.90 Billion

USD

574.41 Billion

2024

2032

| 2025 –2032 | |

| USD 326.90 Billion | |

| USD 574.41 Billion | |

|

|

|

|

Magnetic Resonance Imaging (MRI) Market Size

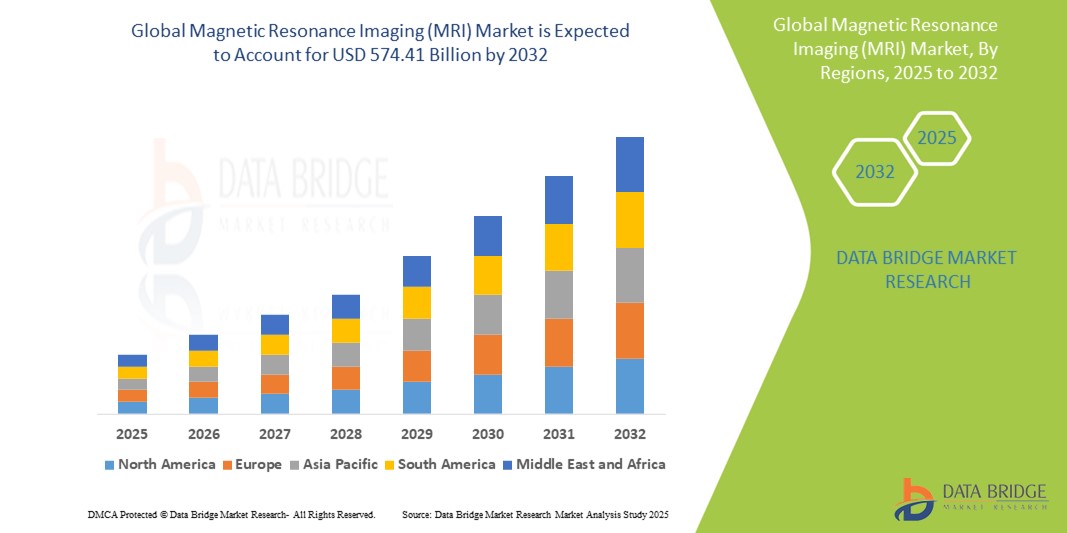

- The global magnetic resonance imaging (MRI) market was valued at USD 326.90 billion in 2024 and is expected to reach USD 574.41 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 7.30%, primarily driven by the increasing demand for non-invasive diagnostic techniques and rising prevalence of chronic diseases such as cancer and neurological disorders

- This growth is driven by factors such as the continuous advancement in MRI technology, growing geriatric population, and expanding applications in early disease detection and personalized medicine

Magnetic Resonance Imaging (MRI) Market Analysis

- Magnetic resonance imaging (MRI) systems are non-invasive diagnostic tools that provide high-resolution images of organs and tissues using strong magnetic fields and radio waves. They are widely used for detecting abnormalities in the brain, spine, joints, and internal organs without the need for ionizing radiation

- The demand for MRI systems is significantly driven by the rising incidence of chronic conditions such as neurological disorders, cancers, and cardiovascular diseases, alongside growing awareness about early and accurate diagnosis. Technological advancements such as high-field MRI and AI-enhanced imaging also contribute to market growth.

- North America stands out as one of the dominant markets for MRI systems, supported by strong healthcare infrastructure, increasing healthcare expenditure, and early adoption of cutting-edge diagnostic technologies

- For instance, the U.S. continues to invest in high-resolution imaging systems across hospitals and outpatient diagnostic centers, enhancing diagnostic accuracy and workflow efficiency

- Globally, MRI systems rank among the most essential imaging modalities in diagnostic radiology, following computed tomography (CT) scanners, and play a pivotal role in enabling early disease detection and guiding treatment planning

Report Scope and Magnetic Resonance Imaging (MRI) Market Segmentation

|

Attributes |

Magnetic Resonance Imaging (MRI) Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Magnetic Resonance Imaging (MRI) Market Trends

“Integration of Artificial Intelligence and Advanced Imaging Techniques”

- One prominent trend in the global magnetic resonance imaging (MRI) market is the integration of artificial intelligence (AI) and advanced imaging techniques to enhance diagnostic capabilities and workflow efficiency

- AI-powered MRI systems enable faster image reconstruction, automated detection of anomalies, and improved scan accuracy, significantly reducing scanning time and enhancing clinical decision-making

- For instance, AI algorithms can automatically identify and segment lesions or tumors in brain scans, supporting radiologists in early and more precise diagnosis of neurological disorders

- Advanced imaging techniques such as diffusion tensor imaging (DTI), functional MRI (fMRI), and magnetic resonance spectroscopy (MRS) are increasingly being adopted for their ability to provide functional and metabolic insights beyond anatomical imaging

- This trend is transforming diagnostic radiology by offering deeper clinical insights, improving patient outcomes, and driving the demand for next-generation MRI systems globally

Magnetic Resonance Imaging (MRI) Market Dynamics

Driver

“Rising Burden of Chronic Diseases and Demand for Early Diagnosis”

- The increasing global burden of chronic diseases such as cancer, neurological disorders, cardiovascular diseases, and musculoskeletal conditions is a major driver for the growing demand for MRI systems

- As populations age and lifestyles become more sedentary, the incidence of these conditions continues to rise, creating a greater need for advanced, non-invasive diagnostic tools capable of early and accurate detection

- MRI offers superior soft tissue contrast and does not use ionizing radiation, making it ideal for repeated use in monitoring and managing chronic conditions

- The Technological advancements, including higher field strength magnets and faster imaging capabilities, have made MRI scans more precise and accessible, further boosting their adoption in clinical settings worldwide

- As healthcare providers prioritize early diagnosis and personalized treatment plans, the role of MRI in comprehensive patient assessment becomes increasingly essential

For instance,

- According to the World Health Organization (WHO), non-communicable diseases (NCDs) such as cancer and heart disease account for approximately 74% of global deaths as of 2022, emphasizing the need for early and effective diagnostic tools such as MRI

- In January 2023, a study published in The Lancet highlighted that MRI usage in neurology and oncology has increased significantly across developed and emerging economies due to its ability to detect early-stage abnormalities and guide treatment decisions

- As the global healthcare landscape shifts toward prevention and early intervention, the demand for advanced MRI systems is expected to grow steadily, supporting better patient outcomes and reducing long-term healthcare costs

Opportunity

“Transforming MRI Capabilities Through Artificial Intelligence Integration”

- The integration of artificial intelligence (AI) in MRI systems presents a major opportunity to revolutionize diagnostic imaging by improving speed, accuracy, and operational efficiency

- AI-powered MRI solutions can automate image acquisition, reconstruction, and interpretation, significantly reducing scan times while enhancing image clarity and diagnostic precision

- These systems can also assist radiologists by identifying abnormalities such as tumors, lesions, and structural anomalies, allowing for earlier detection and more personalized treatment strategies

For instance,

- In March 2024, a study published in Radiology: Artificial Intelligence reported that deep learning algorithms reduced MRI scan times by up to 40% while maintaining diagnostic quality, allowing facilities to increase patient throughput and reduce wait times

- In August 2023, according to a report by the Journal of the American College of Radiology, AI models demonstrated over 90% accuracy in detecting neurological conditions such as Alzheimer’s disease and multiple sclerosis, enhancing early intervention efforts

- By leveraging AI to streamline workflow and optimize diagnostic accuracy, healthcare providers can enhance patient outcomes, reduce costs, and expand access to high-quality imaging services—particularly in underserved or resource-limited regions

Restraint/Challenge

“High Equipment and Installation Costs Limiting Market Accessibility”

- The high cost associated with MRI systems presents a significant barrier to widespread adoption, particularly in low- and middle-income countries and smaller healthcare facilities

- MRI machines can cost anywhere from several hundred thousand to over a million dollars, excluding expenses related to site preparation, maintenance, and the need for highly trained personnel

- This financial burden can prevent many healthcare institutions from investing in new MRI technology or expanding their imaging capabilities, limiting patient access to advanced diagnostic service

For instance,

- In October 2024, according to a report published by the International Journal of Health Economics, the average cost of installing a 1.5T MRI system—including infrastructure modifications and shielding—can exceed USD 2 million, discouraging adoption in budget-constrained healthcare settings

- Consequently, the disparity in access to high-quality imaging across different regions and economic tiers limits the potential growth of the global MRI market and poses challenges to achieving equitable healthcare delivery

Magnetic Resonance Imaging (MRI) Market Scope

The market is segmented on the basis of type, process, field strength, architecture, application, and end user.

|

Segmentation |

Sub-Segmentation |

|

By Type |

|

|

By Process |

|

|

By Field Strength |

|

|

By Architecture

|

|

|

By Application |

|

|

By End User

|

|

Magnetic Resonance Imaging (MRI) Market Regional Analysis

“North America is the Dominant Region in the Magnetic Resonance Imaging (MRI) Market”

- North America dominates the global MRI market due to its robust healthcare infrastructure, early adoption of advanced imaging technologies, and high diagnostic imaging utilization rates

- U.S. holds a substantial market share, driven by increasing prevalence of chronic diseases, growing geriatric population, and extensive investments in healthcare innovation and imaging research

- The favorable reimbursement frameworks and strong presence of leading MRI system manufacturers such as GE Healthcare, Siemens Healthineers, and Philips Healthcare further support regional dominance

- In addition, the demand for high-field and AI-integrated MRI systems in hospitals and diagnostic centers continues to rise, as healthcare providers focus on precision diagnostics and improved patient outcomes

“Asia-Pacific is Projected to Register the Highest Growth Rate”

- Asia-Pacific is expected to experience the highest growth in the MRI market, fueled by rapidly developing healthcare infrastructure, increasing awareness of early disease detection, and rising healthcare spending

- Countries such as China, India, and Japan are seeing a surge in demand for advanced imaging modalities due to the rising burden of chronic diseases and expanding middle-class populations

- Japan continues to maintain a strong MRI market presence with its technologically advanced healthcare system and high MRI scanner density per capita

- China and India are emerging as key growth hubs due to their large patient populations, increasing government investments in diagnostic imaging, and efforts to expand access to quality healthcare in rural and urban areas alike

Magnetic Resonance Imaging (MRI) Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Siemens (Germany)

- GE HealthCare (U.S.)

- Koninklijke Philips N.V. (Netherlands)

- Hitachi, Ltd. (Japan)

- Esaote SPA (Italy)

- Aspect Imaging Ltd. (Israel)

- FONAR Corp. (U.S.)

- Neusoft Corporation (China)

- Aurora Health Care (U.S.)

- Shenzhen Mindray Bio-Medical Electronics Co., Ltd. (China)

- Shimadzu Corporation (Japan)

- Bruker (U.S.)

- Elekta (Sweden)

- Analogic Corporation (U.S.)

- CANON MEDICAL SYSTEMS CORPORATION (Japan)

- Mediso Ltd. (Hungary)

- Samsung Medison Co., Ltd. (South Korea)

- FUJIFILM Corporation (Japan)

- Sanrad (India)

- Shenzhen Anke High-tech Co., Ltd. (China)

Latest Developments in Global Magnetic Resonance Imaging (MRI) Market

- In January 2024, Siemens Healthineers received FDA clearance for the MAGNETOM Cima.X, a 3 Tesla MRI scanner featuring the industry's strongest gradient system. This advancement enhances the visibility of smaller structures and accelerates image acquisition, facilitating improved diagnostics in oncology, cardiology, and neurology

- In 2024, GE HealthCare announced the FDA clearance of the SIGNA Champion, a 1.5 Tesla MRI system designed to democratize advanced imaging. It integrates AI technologies such as AIR Recon DL and Sonic DL, offering faster and more precise scans. This system aims to enhance accessibility to high-quality MRI services globally

- In November 2024, Philips unveiled its next-generation BlueSeal MRI system at RSNA 2024. This 1.5T wide-bore scanner operates without helium, reducing operational costs and environmental impact. It features AI-enabled Smart Reading for enhanced diagnostic accuracy and patient throughput

- In June 2024, Philips introduced the UK's first mobile MRI system equipped with BlueSeal technology at the UK Imaging and Oncology Congress. This mobile unit offers flexible and sustainable MRI services, providing high-quality diagnostics in remote and underserved areas

- In 2020, Siemens launched its smallest and most lightweight whole-body MRI, High-V MRI. It has a unique blend of digital technologies and an increased 0.55-tesla field strength, which expands the spectrum of clinical applications for MRI scanners

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.