Global Mango Puree Market

Market Size in USD Billion

CAGR :

%

USD

3.03 Billion

USD

5.49 Billion

2025

2033

USD

3.03 Billion

USD

5.49 Billion

2025

2033

| 2026 –2033 | |

| USD 3.03 Billion | |

| USD 5.49 Billion | |

|

|

|

|

Mango Puree Market Size

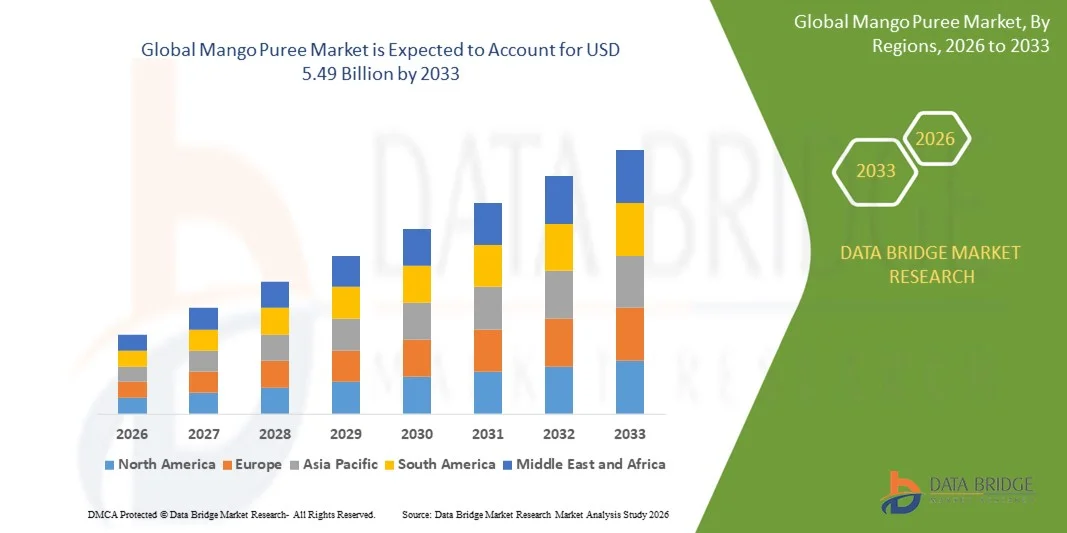

- The global mango puree market size was valued at USD 3.03 billion in 2025 and is expected to reach USD 5.49 billion by 2033, at a CAGR of 7.70% during the forecast period

- The market growth is largely fueled by increasing global demand for natural fruit-based ingredients in beverages, dairy products, baby foods, and confectionery, leading manufacturers to adopt mango purée as a key component for flavor, color, and nutritional value

- Furthermore, rising consumer preference for clean-label, organic, and preservative-free fruit products is driving adoption of high-quality mango purée across both industrial and retail segments. These converging factors are accelerating the utilization of mango purée, thereby significantly boosting the industry’s growth

Mango Puree Market Analysis

- Mango purée, offering concentrated fruit flavor, natural sweetness, and nutritional benefits, is increasingly integrated into beverages, desserts, sauces, and infant nutrition products due to its versatility, shelf stability, and ease of use

- The escalating demand for mango purée is primarily fueled by expanding beverage and baby food industries, growing preference for natural and organic ingredients, and increasing incorporation in value-added food formulations across global markets

- Asia-Pacific dominated the mango puree market with a share of 38.95% in 2025, due to extensive mango cultivation, strong processing capabilities, and a high concentration of purée-exporting countries

- North America is expected to be the fastest growing region in the mango puree market during the forecast period due to increasing demand for natural fruit ingredients in beverages, infant foods, and clean-label dairy products

- Conventional segment dominated the market with a market share of 80.46% in 2025, due to its wide cultivation base and strong suitability for industrial processing workflows. Manufacturers rely on conventional variants due to consistent supply cycles that support large beverage, dairy, and confectionery production lines. This segment also benefits from its cost-effective sourcing structure that enables mass-market pricing strategies in export and domestic channels. High compatibility with aseptic processing and bulk storage systems further strengthens its dominance. The steady procurement from major FMCG companies continues reinforcing the strong position of the conventional segment

Report Scope and Mango Puree Market Segmentation

|

Attributes |

Mango Puree Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Mango Puree Market Trends

Rising Demand for Clean-Label and Organic Fruit Ingredients

- A significant trend in the mango purée market is the growing preference for clean-label, preservative-free, and organic fruit ingredients, driven by rising consumer awareness of health, nutrition, and natural food products. This trend is influencing both industrial and retail adoption as manufacturers seek high-quality mango purée for beverages, dairy products, desserts, and infant nutrition

- For instance, Lat Eko Food Ltd launched its Organic Mango-Banana-Quince Purée targeting infants, highlighting increasing interest in certified organic fruit blends. Such developments reinforce the demand for natural, high-quality purée and encourage manufacturers to diversify product offerings to meet health-conscious consumer expectations

- The incorporation of mango purée into value-added beverages, smoothies, and functional foods is accelerating as companies respond to rising demand for natural flavors and nutritional enhancement. This is positioning mango purée as a key ingredient in healthier, clean-label product portfolios

- The dairy sector is increasingly using mango purée in yoghurts, ice creams, and milkshakes to improve flavor, color, and nutritional content, supporting wider market penetration. Bakery and snack manufacturers are integrating mango purée in fruit fillings, snack bars, and pastries, responding to consumer preference for natural fruit ingredients and differentiating their product lines

- The expanding application of mango purée in ready-to-drink beverages and functional drinks is further boosting adoption, creating opportunities for processors to supply high-quality, stable purée

- Overall, the trend toward natural, preservative-free, and organic mango purée is reinforcing market growth and shaping product development strategies across the food and beverage industry

Mango Puree Market Dynamics

Driver

Increasing Adoption of Mango Purée in Beverages and Infant Nutrition

- The growing incorporation of mango purée in beverages, baby food, and dairy products is a major driver of market growth, as manufacturers respond to rising consumer demand for natural, flavorful, and nutritious ingredients. Mango purée provides convenience, consistency, and versatility, enabling its use across multiple processed food applications

- For instance, SKOT INDIA’s 2025-season Aseptic Alphonso Mango Purée is supplied in industrial drums and retail cans, strengthening availability for beverage and infant food manufacturers. This ensures consistent quality and flavor, supporting adoption in premium and mass-market applications

- The expanding global beverage industry, including juices, smoothies, and functional drinks, is boosting demand for mango purée as a natural fruit ingredient that enhances taste and nutrition

- Infant food producers are increasingly incorporating mango purée into baby products due to its smooth texture, mild flavor, and nutrient content, which aligns with health and safety standards for early-stage nutrition

- The growing trend of value-added and ready-to-consume food products ensures continuous uptake of mango purée across industrial and retail supply chains, positioning it as a staple ingredient in processed food formulations

Restraint/Challenge

Seasonal Supply Fluctuations and Quality Variability

- The mango purée market faces challenges from seasonal variations in mango harvests, which impact raw material availability, quality, and pricing, creating uncertainty for processors and manufacturers

- For instance, fluctuations in Alphonso and Totapuri production due to climatic conditions in India affect both domestic and export-oriented purée supply. This unpredictability necessitates careful sourcing, inventory management, and risk mitigation strategies by manufacturers

- Export-oriented markets often demand strict specifications for mango purée, increasing pressure on producers to maintain consistent quality across batches despite seasonal differences

- Storage, transport, and handling of raw mangoes during off-season periods also introduce operational challenges that can affect purée stability, flavor, and shelf life

- These factors collectively limit production flexibility, increase operational costs, and pose a challenge to sustaining continuous supply, making seasonal dependency a key constraint for the mango purée industry

Mango Puree Market Scope

The market is segmented on the basis of nature, packaging type, application, and distribution channel.

- By Nature

On the basis of nature, the mango purée market is segmented into organic and conventional. The conventional segment dominated the market with the largest revenue share of 80.46% in 2025 driven by its wide cultivation base and strong suitability for industrial processing workflows. Manufacturers rely on conventional variants due to consistent supply cycles that support large beverage, dairy, and confectionery production lines. This segment also benefits from its cost-effective sourcing structure that enables mass-market pricing strategies in export and domestic channels. High compatibility with aseptic processing and bulk storage systems further strengthens its dominance. The steady procurement from major FMCG companies continues reinforcing the strong position of the conventional segment.

The organic segment is anticipated to witness the fastest growth rate from 2026 to 2033 fueled by rising preference for clean-label, residue-free fruit ingredients in premium food and beverage applications. Consumers increasingly associate organic mango purée with higher nutritional value and safer ingredient profiles, supporting its penetration into baby food, wellness drinks, and natural dessert products. Retailers in developed markets continue expanding their organic offerings, creating broader visibility for organic purée. Manufacturers benefit from certification-backed credibility that enhances acceptance in regulated regions. Shifts in health-centric consumption patterns position the organic category for rapid future expansion.

- By Packaging Type

On the basis of packaging type, the mango purée market is segmented into cans, pouches, P.E.T jars, and bottles. The can segment held the largest revenue share in 2025 driven by its extended shelf life and superior protection during long-distance transportation. Industrial food processors depend heavily on canned purée due to its compatibility with high-temperature sterilization and bulk filling operations. The format ensures product stability across varying climatic conditions, making it suitable for global exports. Its high durability and low spoilage risk support large-volume procurement cycles in beverages, bakery, and dairy industries. These advantages keep cans the most widely adopted format for commercial processing environments.

The pouch segment is expected to witness the fastest CAGR from 2026 to 2033 driven by strong adoption among consumer-facing brands prioritizing lightweight, portable, and convenient packaging solutions. Pouches support innovative spout and seal designs that enhance usability in baby food, smoothie blends, and ready-to-consume fruit products. Their reduced material usage aligns with sustainability trends influencing packaging choices in retail channels. Manufacturers benefit from lower transportation costs and improved logistics efficiency. Growing acceptance of flexible packaging across modern trade and e-commerce platforms reinforces the accelerating growth of pouches.

- By Application

On the basis of application, the mango purée market is segmented into infant food, beverage, bakery and snacks, ice cream and yoghurt, dressings and sauces, and others. The beverage segment dominated the market with the largest revenue share in 2025 driven by extensive incorporation of mango purée in juices, nectars, smoothies, flavored drinks, and concentrates. Beverage companies rely on the natural color, pulp texture, and flavor profile of mango purée to enhance product appeal in mass-market and premium drink lines. The segment benefits from high consumption volumes in tropical regions where mango-based beverages remain a staple preference. As global brands expand fruit-based drink portfolios, demand for purée continues strengthening their production cycles. These factors reinforce the leading position of beverages in overall purée utilization.

The infant food segment is anticipated to witness the fastest growth rate from 2026 to 2033 fueled by increasing demand for natural and easy-to-digest fruit ingredients in early-stage nutrition products. Parents favor mango purée due to its smooth texture and mild sweetness that suits baby feeding requirements. Organic and preservative-free baby purées drive additional momentum, supported by clean-label preferences among young parents. Regulatory encouragement for fruit-based formulations further promotes adoption. The rising presence of mango-infused multi-fruit blends in premium infant food categories accelerates future expansion of this segment.

- By Distribution Channel

On the basis of distribution channel, the mango purée market is segmented into direct and indirect. The indirect segment dominated the market with the largest revenue share in 2025 driven by the widespread role of distributors, wholesalers, and export intermediaries in coordinating bulk supply to global F&B manufacturers. These channels support streamlined logistics management and ensure steady availability across seasonal production cycles. Import-driven countries rely on intermediaries to manage compliance, documentation, and bulk shipment consolidation. Established networks of international purée suppliers facilitate efficient procurement for large industrial buyers. Such advantages maintain the strong dominance of indirect distribution in commercial applications.

The direct segment is expected to witness the fastest growth rate from 2026 to 2033 driven by expanding partnerships between mango processors and major food and beverage manufacturers seeking improved supply chain transparency. Direct sourcing supports better control over raw material quality and offers competitive pricing by reducing intermediary margins. Integrated farm-to-facility systems adopted by leading processors promote more structured and predictable supply planning. Digital procurement platforms also enhance accessibility for mid-sized buyers. These developments collectively support the growing preference for direct distribution in long-term sourcing strategies.

Mango Puree Market Regional Analysis

- Asia-Pacific dominated the mango puree market with the largest revenue share of 38.95% in 2025, driven by extensive mango cultivation, strong processing capabilities, and a high concentration of purée-exporting countries

- The region benefits from abundant raw material availability and well-established fruit processing clusters that support large-scale production. Rising demand from beverage, dairy, and infant food manufacturers within and outside the region is accelerating market growth

- Increasing investments in modern processing lines, ripening facilities, and aseptic packaging technologies further strengthen the region’s leadership. Government support for fruit export development and the presence of major purée suppliers contribute to the expanding consumption of mango purée across industrial applications

China Mango Purée Market Insight

China held the largest share in the Asia-Pacific mango purée market in 2025, owing to its rapidly expanding food and beverage processing sector and the increasing incorporation of fruit-based ingredients in packaged foods. The country’s strong manufacturing infrastructure and advanced filling and packaging technologies support rising consumption of purée in beverages, desserts, and dairy products. Growing domestic demand for tropical fruit formulations and continued investment in fruit-processing parks reinforce China’s market dominance. The presence of large-scale processors and wide distribution networks strengthens supply capabilities for both domestic and export markets.

India Mango Purée Market Insight

India is witnessing the fastest growth in the Asia-Pacific region, supported by its position as one of the world’s leading mango producers and a major global exporter of mango purée. Expanding processing capacity, rising adoption of aseptic packaging, and growing procurement by international beverage and baby food manufacturers are driving the market. Increased focus on value-added fruit processing and government initiatives promoting fruit export infrastructure support strong growth momentum. The rise of organized processing clusters and expanding global demand for Indian Alphonso and Totapuri purée varieties further contribute to rapid market expansion.

Europe Mango Purée Market Insight

The Europe mango purée market is expanding steadily, supported by growing demand for tropical fruit ingredients in beverages, dairy products, infant nutrition, and premium snacks. The region emphasizes high-quality imports and stringent quality standards, encouraging stable demand for pure, additive-free mango purée. Increasing adoption in innovative fruit blends, plant-based desserts, and clean-label formulations is contributing to market growth. Europe’s strong focus on sustainability, traceability, and certified ingredients reinforces consistent procurement from global suppliers. Rising use in customized product development further enhances the role of mango purée within the region’s processed food landscape.

Germany Mango Purée Market Insight

Germany’s mango purée market is driven by strong demand from premium beverage producers, dairy companies, and baby food manufacturers that rely on high-quality tropical fruit ingredients. The country’s advanced food processing ecosystem and its emphasis on stringent quality and safety compliance support stable consumption. Growing innovation in fruit-based drinks, functional snacks, and organic baby purée products strengthens demand. Germany’s well-developed retail sector and strong import channels ensure consistent availability of mango purée for both industrial and consumer-focused applications.

U.K. Mango Purée Market Insight

The U.K. market is supported by rising consumption of fruit-based beverages, smoothies, and plant-based food products where mango purée is widely incorporated. The country’s strong R&D and product innovation landscape encourages the use of tropical fruit ingredients in new formulations across dairy, dessert, and snack categories. Increasing demand for convenient and healthier food products boosts the use of mango purée in retail-oriented packaging formats. A mature import infrastructure and expanding interest in premium and organic fruit ingredients reinforce the U.K.’s continued role in the European market.

North America Mango Purée Market Insight

North America is projected to grow at the fastest CAGR from 2026 to 2033, driven by increasing demand for natural fruit ingredients in beverages, infant foods, and clean-label dairy products. The region’s strong focus on product innovation, rising adoption of tropical flavors, and expanding consumption of fruit-based snacks are powering market growth. Manufacturers are increasingly incorporating mango purée in smoothies, energy drinks, and frozen desserts, supported by shifting consumer preferences toward healthier alternatives. Growing reliance on high-quality imported purée and expanding collaborations between processors and beverage brands contribute to the region’s accelerating development.

U.S. Mango Purée Market Insight

The U.S. accounted for the largest share in the North America mango purée market in 2025, underpinned by a mature food and beverage industry and high demand for fruit-based ingredients in packaged foods. The country’s strong innovation ecosystem and preference for natural flavoring ingredients promote wider adoption of mango purée in beverages, yoghurts, desserts, and baby foods. The presence of major food manufacturers, advanced distribution systems, and high consumer acceptance of tropical flavors reinforce the U.S.’s leading position. Growth is further supported by rising consumption of clean-label and plant-forward products that incorporate mango purée as a key component.

Mango Puree Market Share

The mango puree industry is primarily led by well-established companies, including:

- Treetop Juices (U.S.)

- Dohler (Germany)

- AGRANA Beteiligungs-AG (Austria)

- Galla Foods (India)

- MOTHER INDIA FARMS (India)

- FPD Food International, Inc. (U.S.)

- Ingredion Inc. (U.S.)

- Kiril Mischeff (U.K.)

- Capricorn Food Products India Ltd. (India)

- Industrias Borja (Ecuador)

- Jain Irrigation Systems Ltd (India)

- Riviana Foods Pty Ltd. (Australia)

- Newberry International Produce Limited (U.K.)

- Nestlé (Switzerland)

- TMN International (India)

- Sunrise Naturals Private Limited (India)

- Lemonconcentrate S.L.U. (Spain)

- Cropotto Foods (India)

- ZAIN NATURAL AGRO INDIA PVT. LTD. (India)

- Tricom Fruit Products Limited (India)

Latest Developments in Global Mango Puree Market

- In May 2025, Dole Food Company expanded its footprint in the fruit-processing industry by acquiring the mango-processing division of Sunrise Foods, a move that strengthens its global purée production capabilities. This development is expected to enhance the company’s supply stability, improve export capacity, and ensure consistent availability of high-quality mango purée for beverage, dairy, and baby food manufacturers. The acquisition also supports market growth by reducing raw-material bottlenecks and improving end-to-end supply chain efficiency for large-scale buyers

- In June 2025, SKOT INDIA began production of its 2025-season Aseptic Alphonso Mango Purée, using high-grade Alphonso mangoes and offering a 100% natural product free from added sugar, preservatives, or artificial flavors. By introducing both 215 kg aseptic drums and 3.1 kg cans, the company is catering to diverse industrial and retail requirements. This expansion directly strengthens the availability of premium Alphonso purée, improving supply reliability for manufacturers in beverages, desserts, infant foods, and confectionery segments that rely on consistent flavor and quality

- In January 2025, Sahyadri Farms entered a strategic partnership with the Centre of Excellence for FPOs (CoE-FPO) to support more than 1,460 Farmer Producer Organizations across Karnataka, focusing on improving mango quality, yield uniformity, and supply-chain discipline. This initiative boosts the upstream value chain by enhancing farmer training, post-harvest handling, and farm-level productivity, which ultimately ensures better consistency for mango pulp and purée processors. Strengthening farmer networks contributes to dependable sourcing and reduces seasonal fluctuations that affect the purée secto

- In January 2025, Lat Eko Food Ltd broadened its portfolio with the introduction of an Organic Mango-Banana-Quince Purée, designed for infants aged 4 months and above and offering an 18-month shelf life. This product addresses the rising demand for organic, clean-label baby food formulations, reinforcing the market’s shift toward natural fruit-based purées with transparent sourcing. The launch supports growing adoption in the infant nutrition sector, which continues to be a high-value application area for mango purée

- In July 2024, Coca-Cola India, through its foundation Anandana, collaborated with Gram Unnati to initiate Project Unnati Mango in Karnataka, aiming to promote sustainable cultivation of Alphonso and Totapuri mango varieties. The project enhances farmer income, improves agricultural practices, and strengthens the long-term supply base for mango pulp and purée processors. By focusing on productivity, sustainability, and supply reliability, this initiative helps stabilize raw-material availability and supports the expanding demand from beverage and fruit-ingredient industries.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Mango Puree Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Mango Puree Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Mango Puree Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.