Global Marine Turbocharger Market

Market Size in USD Million

CAGR :

%

USD

796.20 Million

USD

1,473.72 Million

2025

2033

USD

796.20 Million

USD

1,473.72 Million

2025

2033

| 2026 –2033 | |

| USD 796.20 Million | |

| USD 1,473.72 Million | |

|

|

|

|

Marine Turbocharger Market Size

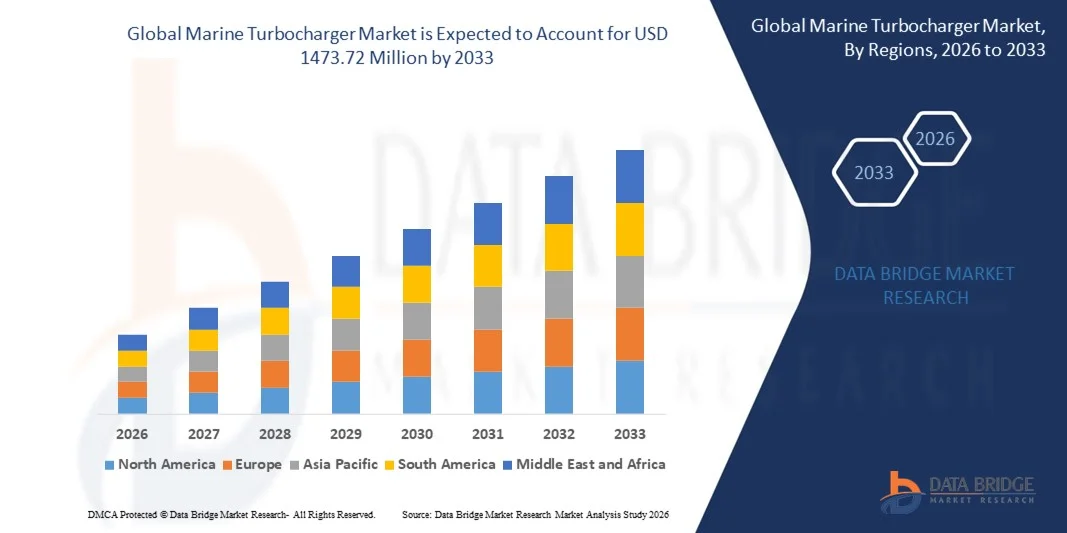

- The global marine turbocharger market size was valued at USD 796.20 million in 2025 and is expected to reach USD 1473.72 million by 2033, at a CAGR of 8.00% during the forecast period

- The market growth is largely driven by the increasing adoption of advanced marine propulsion systems and stricter emission regulations in the shipping and offshore sectors, which are compelling engine manufacturers to integrate high-performance turbochargers for enhanced fuel efficiency and reduced environmental impact

- Furthermore, rising demand for reliable, durable, and fuel-efficient solutions in commercial shipping, cruise liners, and naval vessels is positioning marine turbochargers as a critical component for achieving compliance with IMO Tier III emission standards. These converging factors are accelerating the adoption of next-generation turbocharging technologies, thereby significantly boosting the industry’s growth

Marine Turbocharger Market Analysis

- Marine turbochargers are mechanical devices that compress intake air for internal combustion engines in ships and marine vessels, improving engine power output, fuel efficiency, and overall performance. They are designed to withstand harsh marine environments and integrate with low-pressure or high-pressure EGR systems to meet emission standards

- The escalating demand for marine turbochargers is primarily fueled by the global push for greener and more efficient shipping operations, increasing fuel costs, and the growing trend toward electrified and hybrid propulsion systems that require advanced turbocharging solutions

- North America dominated the marine turbocharger market with a share of over 40% in 2025, due to the strong presence of commercial shipping fleets, cargo operations, and technologically advanced naval vessels

- Asia-Pacific is expected to be the fastest growing region in the marine turbocharger market during the forecast period due to increasing shipbuilding activities, growing cargo shipping operations, and expanding naval fleets in countries such as China, Japan, and India

- Commercial segment dominated the market with a market share of 45.5% in 2025, due to the increasing demand for cargo and container ships that require high engine efficiency and reduced fuel consumption. Commercial vessels often prioritize turbochargers for their ability to enhance engine performance while complying with stringent emission regulations. The segment benefits from long operational hours and heavy engine loads, which make turbochargers indispensable for operational efficiency. Manufacturers are focusing on durable and high-capacity turbochargers tailored for commercial marine engines, further boosting market adoption

Report Scope and Marine Turbocharger Market Segmentation

|

Attributes |

Marine Turbocharger Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Marine Turbocharger Market Trends

Growth of Hybrid and Electrified Marine Propulsion

- A significant trend in the marine turbocharger market is the increasing adoption of hybrid and electrified propulsion systems across commercial shipping, cruise liners, and naval vessels. This trend is driven by the need for fuel-efficient operations, reduced emissions, and compliance with stricter International Maritime Organization (IMO) Tier III regulations

- For instance, Porsche Marine and ABB (Accelleron) are developing electrically assisted turbochargers for hybrid marine engines, which enhance engine responsiveness while lowering fuel consumption. Such innovations are positioning marine turbochargers as essential components in next-generation marine propulsion systems

- The integration of low-pressure and high-pressure EGR systems with turbochargers is gaining traction to further reduce NOx and particulate emissions. This integration is encouraging shipbuilders and engine manufacturers to adopt advanced turbocharging solutions for both new builds and retrofitted vessels

- Manufacturers are also focusing on enhancing turbocharger durability under harsh marine conditions, including high humidity, saltwater exposure, and continuous load cycles. These developments are driving demand for corrosion-resistant materials and robust designs that can maintain performance over extended lifespans

- The market is witnessing rising adoption of variable geometry turbochargers (VGT) and wastegate turbochargers that optimize engine efficiency under varying load conditions. These advancements are reinforcing the role of turbochargers as key enablers of sustainable and efficient marine operations

- In addition, global emphasis on decarbonization and green shipping initiatives is accelerating research in hybrid and electrified turbocharging technologies. This is positioning marine turbochargers as critical components for meeting both performance and environmental objectives across the maritime sector

Marine Turbocharger Market Dynamics

Driver

Strict Emission Regulations Boosting Turbocharger Demand

- The growing stringency of global emission standards, particularly IMO Tier III and EPA marine regulations, is driving the adoption of fuel-efficient and low-emission turbochargers in marine engines. These regulations are compelling shipbuilders and engine manufacturers to implement advanced turbocharging solutions to comply with environmental mandates

- For instance, Mitsubishi Heavy Industries Marine Machinery & Equipment Co., Ltd. has supplied MET-series turbochargers integrated with low-pressure EGR systems to achieve NOx reduction in two-stroke marine engines. Such solutions help operators meet regulatory compliance while improving fuel efficiency and engine longevity

- The rising adoption of dual-fuel engines in LNG carriers and container ships is further boosting demand for high-performance turbochargers that can operate reliably across fuel types. This is establishing turbochargers as indispensable components for modern emission-compliant marine propulsion systems

- OEMs are investing in R&D to optimize turbocharger designs, including VGT and electrically assisted turbochargers, to improve load response, reduce fuel consumption, and minimize emissions. This sustained innovation is reinforcing the criticality of turbocharging technology in achieving operational and environmental targets

- Global maritime fleet expansion, especially in Asia-Pacific regions such as China and South Korea, is increasing the overall demand for marine engines equipped with advanced turbochargers. These market dynamics are solidifying turbochargers as a strategic element in both newbuilds and retrofitting projects

Restraint/Challenge

High Maintenance and Technical Complexity

- The marine turbocharger market faces challenges due to the technical complexity of advanced turbocharging systems, which require precise engineering, specialized installation, and regular maintenance to ensure optimal performance. These factors increase operational costs and can limit adoption, especially in smaller shipping operators

- For instance, Rolls-Royce Power Systems AG and MAN Energy Solutions offer high-performance turbochargers that demand rigorous maintenance schedules and technical expertise, which may pose operational challenges for fleet operators lacking trained personnel. Such requirements increase total cost of ownership and necessitate ongoing support from OEMs

- Harsh marine environments, including exposure to saltwater, high humidity, and continuous engine loads, exacerbate wear and tear on turbochargers, requiring corrosion-resistant materials and frequent inspections. These conditions further complicate maintenance and operational planning for ship operators

- The complexity of integrating turbochargers with hybrid, dual-fuel, and emission-control systems also presents challenges, as precise calibration is required to maintain efficiency and compliance. This increases dependency on OEM support and technical services

- Limited availability of spare parts and repair expertise in certain regions can disrupt marine operations, highlighting the need for reliable service networks and local support infrastructure. These challenges collectively constrain market expansion while emphasizing the importance of technical reliability and support services

Marine Turbocharger Market Scope

The market is segmented on the basis of type, technology, component, operation, end-use industries, application, and system.

- By Type

On the basis of type, the marine turbocharger market is segmented into commercial, private, and navy. The commercial segment dominated the largest market revenue share of 45.5% in 2025, driven by the increasing demand for cargo and container ships that require high engine efficiency and reduced fuel consumption. Commercial vessels often prioritize turbochargers for their ability to enhance engine performance while complying with stringent emission regulations. The segment benefits from long operational hours and heavy engine loads, which make turbochargers indispensable for operational efficiency. Manufacturers are focusing on durable and high-capacity turbochargers tailored for commercial marine engines, further boosting market adoption.

The private segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by rising demand for luxury yachts and recreational boats. Private vessels increasingly integrate turbochargers to achieve higher speed, better fuel efficiency, and reduced engine wear. For instance, companies such as Rolls-Royce Marine are offering compact, high-performance turbochargers designed specifically for luxury yachts. The growing trend of recreational boating and rising disposable income in regions such as North America and Europe are further driving the adoption of turbochargers in private vessels.

- By Technology

On the basis of technology, the marine turbocharger market is segmented into single turbocharger, twin-turbocharger, electro-assist turbocharger, and variable geometry turbocharger (VGT). The single turbocharger segment held the largest market revenue share in 2025 due to its cost-effectiveness and proven reliability in a wide range of marine engines. Single turbochargers offer ease of maintenance and retrofit options for existing engines, making them a preferred choice for commercial and small-scale vessels. Their simple design reduces downtime and enhances operational continuity, while manufacturers provide a range of capacities to suit different engine specifications.

The electro-assist turbocharger segment is expected to witness the fastest CAGR from 2026 to 2033, driven by the growing adoption of hybrid and energy-efficient marine propulsion systems. For instance, ABB Marine has developed electro-assist turbochargers that optimize engine performance while lowering emissions. These turbochargers help reduce turbo lag, improve fuel efficiency, and provide better maneuverability for vessels. Rising regulations on greenhouse gas emissions and increased interest in eco-friendly shipping solutions are further propelling the adoption of electro-assist technology.

- By Component

On the basis of component, the marine turbocharger market is segmented into compressor, turbine, shaft, and others. The turbine segment dominated the largest market revenue share in 2025, as it plays a critical role in converting exhaust gas energy into mechanical power, directly impacting engine efficiency. Turbines are engineered for high durability under extreme temperatures and pressures, making them essential for commercial marine engines operating on long voyages. Advanced materials and coatings are increasingly being used to enhance turbine longevity and performance, driving their continued demand.

The compressor segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by technological advancements that enable higher air compression and improved combustion efficiency. For instance, MAN Energy Solutions has introduced high-efficiency compressors that optimize fuel use in large marine engines. The rising focus on reducing fuel consumption and emissions in shipping industries is encouraging widespread adoption of advanced compressor components. Enhanced airflow designs and lightweight materials further increase their attractiveness for both commercial and private vessels.

- By Operation

On the basis of operation, the marine turbocharger market is segmented into axial flow turbocharger and radial flow turbocharger. The axial flow turbocharger segment held the largest market revenue share in 2025 due to its suitability for high-capacity engines and continuous heavy-duty marine operations. Axial flow designs allow greater airflow at higher efficiency levels, making them ideal for cargo ships and large naval vessels. The ability to operate efficiently under sustained engine loads has established axial flow turbochargers as a reliable solution in commercial shipping fleets.

The radial flow turbocharger segment is expected to witness the fastest CAGR from 2026 to 2033, driven by increasing use in compact and high-speed marine engines where space and weight constraints are critical. For instance, Wärtsilä’s radial turbochargers are designed to provide high pressure ratios while maintaining compact engine architecture. Radial designs enhance acceleration response and overall engine performance, contributing to their growing adoption in private yachts, ferries, and smaller naval ships.

- By End-Use Industries

On the basis of end-use industries, the marine turbocharger market is segmented into navy & defence systems, cargo & shipping industries, fisheries, and oil & gas. The cargo & shipping industries segment dominated the largest market revenue share in 2025 due to high volumes of international trade and the operational need for fuel-efficient, high-performance engines. Shipping companies prioritize turbochargers to improve engine efficiency, reduce maintenance costs, and comply with emission standards such as IMO 2020. Heavy reliance on long-haul shipping and retrofitting existing fleets with advanced turbochargers further reinforces market dominance.

The navy & defence systems segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by modernization of naval fleets and rising defense budgets globally. For instance, Rolls-Royce Marine has supplied advanced turbocharging systems for modern naval frigates and patrol vessels. Turbochargers improve propulsion efficiency, speed, and maneuverability, which are critical for defense applications. Strategic investments in naval technology and increased focus on energy-efficient propulsion systems are driving market growth in this segment.

- By Application

On the basis of application, the marine turbocharger market is segmented into cargo ships, high-speed boats, cruises, and naval ships. The cargo ships segment dominated the largest market revenue share in 2025 due to the high demand for large marine engines capable of sustaining long-distance operations. Cargo vessels rely on turbochargers to maximize engine power output and fuel efficiency while reducing emissions. The adoption of turbochargers in container ships and bulk carriers has become a standard practice for operational cost reduction and compliance with environmental regulations.

The high-speed boats segment is expected to witness the fastest CAGR from 2026 to 2033, driven by rising recreational boating activities and increasing adoption of turbochargers to enhance engine performance. For instance, Volvo Penta has introduced high-performance turbocharged engines specifically for speedboats and luxury yachts. Turbochargers help achieve higher acceleration, better fuel efficiency, and reduced engine strain, making them popular among private and commercial speedboat operators.

- By System

On the basis of system, the marine turbocharger market is segmented into constant pressure system turbocharging and pulse system turbocharging. The constant pressure system turbocharging segment held the largest market revenue share in 2025 due to its ability to provide consistent and stable airflow across engine cylinders, improving overall performance and fuel efficiency. This system is widely adopted in large commercial vessels where maintaining continuous engine output is crucial. Engine manufacturers also prefer constant pressure systems for their durability and predictable performance under varying load conditions.

The pulse system turbocharging segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by the growing demand for compact and high-performance engines in private vessels and high-speed boats. For instance, Mitsubishi Heavy Industries has developed pulse turbochargers that enhance power delivery in smaller marine engines. The pulse system improves torque response and reduces turbo lag, supporting higher efficiency and faster vessel acceleration. Rising interest in performance-optimized marine propulsion is driving adoption in niche segments.

Marine Turbocharger Market Regional Analysis

- North America dominated the marine turbocharger market with the largest revenue share of over 40% in 2025, driven by the strong presence of commercial shipping fleets, cargo operations, and technologically advanced naval vessels

- Consumers and operators in the region highly value efficiency, fuel savings, and reduced emissions offered by advanced turbocharger systems such as electro-assist and variable geometry turbochargers

- This widespread adoption is further supported by stringent emission regulations, the modernization of port infrastructure, and government incentives promoting energy-efficient marine engines, establishing turbochargers as a preferred solution for commercial, private, and naval vessels

U.S. Marine Turbocharger Market Insight

The U.S. marine turbocharger market captured the largest revenue share in North America in 2025, fueled by a high volume of cargo and naval ships requiring optimized propulsion systems. Operators increasingly prioritize turbochargers for improved engine performance, fuel efficiency, and compliance with EPA marine emission standards. The growing trend of retrofitting older vessels with high-performance turbochargers, combined with robust demand for hybrid and energy-efficient propulsion systems, further propels market growth. In addition, the adoption of advanced technologies, such as variable geometry turbochargers and electro-assist systems, is significantly contributing to the expansion of the U.S. market.

Europe Marine Turbocharger Market Insight

The Europe marine turbocharger market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by strict IMO emission regulations and the increasing need for fuel-efficient shipping operations. The modernization of European ports, coupled with the demand for eco-friendly propulsion systems, is fostering the adoption of turbochargers across commercial and naval vessels. Operators are also drawn to advanced turbocharger technologies that reduce operational costs and improve engine performance. The region is witnessing significant growth across cargo shipping, fisheries, and naval defense applications, with turbochargers being integrated into both new builds and retrofitted vessels.

U.K. Marine Turbocharger Market Insight

The U.K. marine turbocharger market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the modernization of the U.K.’s shipping and naval fleets and the adoption of high-performance propulsion systems. Concerns regarding rising fuel costs and environmental impact are encouraging shipping companies and naval operators to implement efficient turbocharging solutions. The U.K.’s strong maritime infrastructure, technological adoption, and strategic shipbuilding activities are expected to continue stimulating market growth, particularly in the commercial shipping and naval defense sectors.

Germany Marine Turbocharger Market Insight

The Germany marine turbocharger market is expected to expand at a considerable CAGR during the forecast period, fueled by increasing awareness of energy efficiency, emission reduction, and advanced engine technologies. Germany’s well-established shipbuilding and naval defense industries, combined with a focus on innovation and sustainable solutions, promote the adoption of marine turbochargers across commercial, private, and defense vessels. Integration with hybrid and eco-friendly propulsion systems is becoming increasingly prevalent, with operators favoring high-performance, durable, and emission-compliant turbochargers.

Asia-Pacific Marine Turbocharger Market Insight

The Asia-Pacific marine turbocharger market is poised to grow at the fastest CAGR during the forecast period of 2026 to 2033, driven by increasing shipbuilding activities, growing cargo shipping operations, and expanding naval fleets in countries such as China, Japan, and India. The region’s rising inclination toward fuel-efficient and high-performance engines, supported by government initiatives promoting cleaner shipping, is accelerating turbocharger adoption. Furthermore, APAC emerging as a hub for turbocharger manufacturing and technological innovation is enhancing affordability, accessibility, and local supply for commercial and defense vessels.

Japan Marine Turbocharger Market Insight

The Japan marine turbocharger market is gaining momentum due to the country’s advanced shipbuilding industry, high-tech naval fleets, and emphasis on fuel-efficient propulsion systems. Operators in Japan place a significant emphasis on performance optimization, and the adoption of advanced turbochargers is driven by the need for reliable, low-emission engines in commercial, high-speed, and naval vessels. Integration with other propulsion technologies and hybrid systems is further fueling growth, while Japan’s aging maritime workforce is likely to favor automated, efficient, and low-maintenance turbocharger solutions.

China Marine Turbocharger Market Insight

The China marine turbocharger market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to the country’s dominance in commercial shipping, rapid expansion of port infrastructure, and growing naval modernization programs. China stands as one of the largest manufacturers and consumers of marine engines, and turbochargers are increasingly incorporated into cargo ships, high-speed vessels, and naval fleets. Government policies promoting green shipping, the availability of cost-effective turbocharger solutions, and strong domestic manufacturers such as Weichai Power and Shanghai Diesel Engine are key factors propelling the market in China.

Marine Turbocharger Market Share

The marine turbocharger industry is primarily led by well-established companies, including:

- Kompressorenbau Bannewitz GmbH (Germany)

- Napier Turbochargers Ltd. (U.K.)

- MAN Energy Solutions (Germany)

- Mitsubishi Heavy Industries Marine Machinery & Equipment Co., Ltd. (Japan)

- Rotomaster International (Italy)

- Shanghai Daewin Marine Parts Limited (China)

- La Meccanica Turbo Diesel (Italy)

- BorgWarner Turbo Systems (U.S.)

- Cummins Inc. (U.S.)

- Kawasaki Heavy Industries, Ltd. (Japan)

- Liaoning RongLi Turbocharger Co., Ltd. (China)

- PBS Turbo s.r.o. (Czech Republic)

- Accelleron (Switzerland)

- Rolls-Royce Power Systems AG (Germany)

Latest Developments in Global Marine Turbocharger Market

- In February 2025, BorgWarner extended its turbocharger supply contracts with a major North American OEM to provide wastegate turbochargers for mid‑sized gasoline engines. This extension reinforces BorgWarner’s position as a leading supplier in the gasoline engine segment, securing long-term demand in a competitive market. By supplying advanced turbochargers, the company supports OEMs in meeting stricter emissions regulations and improving fuel efficiency, demonstrating how strategic supply agreements are becoming a key driver for market stability and adoption of efficient turbocharging solutions across widely used vehicle platforms

- In October 2024, Porsche unveiled an electric turbocharger on its 911 GTS T‑Hybrid that eliminates turbo lag and significantly boosts performance. This move highlights the industry’s shift toward electrified and hybrid-compatible turbocharging technology. The introduction of e-turbo solutions enhances power delivery and vehicle responsiveness while reducing emissions, indicating that electrified boost systems are no longer limited to experimental projects but are becoming essential in high-performance and hybrid markets. This trend is likely to push competitors to accelerate research and development in similar next-generation turbo technologies

- in June 2023, Mitsubishi Heavy Industries Marine Machinery & Equipment (MHI-MME) received an order for a MET-53MB turbocharger for a J-ENG 2-stroke engine equipped with a low-pressure EGR system. This order reinforces MHI-MME’s leadership in marine turbocharging solutions, providing technologies that help reduce NOx emissions and enhance fuel efficiency in large two-stroke engines. Such marine-focused advancements are increasingly important as stricter international maritime emission regulations drive demand for high-performance and environmentally compliant turbochargers, positioning MHI-MME as a preferred partner in the global shipping and marine energy sectors

- In August 2022, Cummins Inc. announced plans to launch its 8th generation Holset Series 400 variable geometry turbocharger in 2024, aimed at enhancing efficiency and reducing emissions in commercial diesel engines. Specifically designed for the 10–15L heavy-duty truck market, this turbocharger is set to offer high reliability, durability, and superior performance. By targeting one of the largest segments of the commercial vehicle market, Cummins strengthens its capability to provide emission-compliant, fuel-efficient engines, which is crucial in a global market increasingly focused on reducing carbon footprint and operational costs for fleet operators

- In February 2022, ABB's Turbocharging division rebranded as Accelleron, reflecting its ambition to continue as a global leader in heavy-duty turbocharging for diesel and gas engines across marine, energy, rail, and off-highway sectors. The rebranding emphasizes a renewed focus on sustainable and reliable power solutions, underlining the company’s strategy to drive innovation in advanced turbocharging technologies. This move also strengthens brand visibility in global markets, signaling to OEMs and end-users that Accelleron is committed to delivering high-performance, emission-compliant solutions across multiple industries, from maritime transport to energy generation

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.