Global Mass Flow Controller Market

Market Size in USD Billion

CAGR :

%

USD

1.59 Billion

USD

2.76 Billion

2025

2033

USD

1.59 Billion

USD

2.76 Billion

2025

2033

| 2026 –2033 | |

| USD 1.59 Billion | |

| USD 2.76 Billion | |

|

|

|

|

Mass Flow Controller Market Size

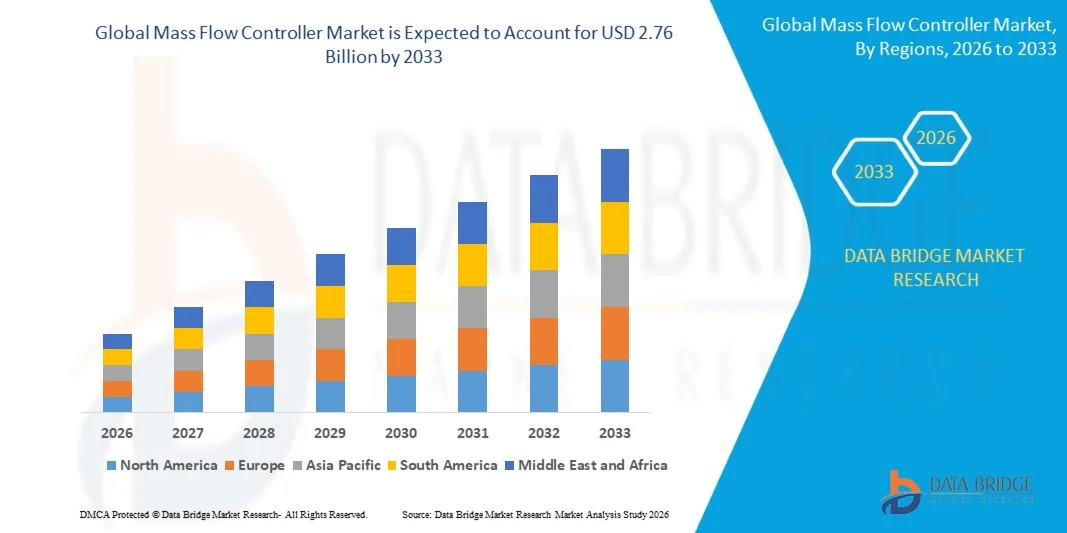

- The global mass flow controller market size was valued at USD 1.59 billion in 2025 and is expected to reach USD 2.76 billion by 2033, at a CAGR of 7.10% during the forecast period

- The market growth is largely driven by rising adoption of advanced process automation and increasing demand for precise flow control across semiconductor manufacturing, pharmaceuticals, chemicals, and industrial gas applications, where accuracy, repeatability, and process stability are critical for operational efficiency

- Furthermore, continuous technological advancements in mass flow controller design, integration with digital communication protocols, and growing emphasis on quality control and regulatory compliance are strengthening their role as essential components in modern industrial processes, thereby accelerating overall market growth

Mass Flow Controller Market Analysis

- Mass flow controllers, which enable accurate measurement and regulation of gas and liquid flow rates, have become indispensable in high-precision manufacturing and process industries due to their ability to ensure consistent product quality, reduced process variability, and improved operational control

- The increasing demand for mass flow controllers is primarily supported by expansion of semiconductor fabrication facilities, growth in pharmaceutical and specialty chemical production, and rising implementation of Industry 4.0 and smart manufacturing practices that rely on reliable, real-time flow control solutions

- Asia-Pacific dominated the mass flow controller market with a share of 42.7% in 2025, due to rapid expansion of semiconductor fabrication facilities, growing pharmaceutical manufacturing, and increasing investments in industrial automation across key economies

- North America is expected to be the fastest growing region in the mass flow controller market during the forecast period due to strong demand from semiconductor manufacturing, pharmaceuticals, and advanced materials industries

- Direct segment dominated the market with a market share of 45.1% in 2025, due to its high accuracy, faster response time, and ability to provide real-time flow control without intermediate components. Direct mass flow controllers are widely adopted in semiconductor fabrication, pharmaceuticals, and specialty chemicals, where precise gas and liquid dosing is critical for process consistency. Their simplified system architecture reduces signal losses and calibration complexity, supporting stable long-term performance

Report Scope and Mass Flow Controller Market Segmentation

|

Attributes |

Mass Flow Controller Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Mass Flow Controller Market Trends

“Growing Adoption of Digitally Connected Mass Flow Controllers”

- A prominent trend in the mass flow controller market is the increasing adoption of digitally connected and smart MFC systems, driven by the demand for real-time monitoring, automated calibration, and improved process control across critical industries. These connected devices enable seamless integration with factory automation, data analytics platforms, and cloud-based monitoring systems, enhancing operational efficiency and process accuracy

- For instance, Brooks Instrument and MKS Instruments offer digital mass flow controllers with advanced connectivity and integrated software that allow remote monitoring, predictive maintenance, and precise flow adjustments. Such solutions are enhancing productivity and reducing downtime in semiconductor and pharmaceutical manufacturing

- The semiconductor sector is leveraging digital MFCs for ultra-precise gas delivery during wafer fabrication, supporting tighter process tolerances and higher yields. This is establishing digitally connected MFCs as essential tools for next-generation microelectronics manufacturing

- In pharmaceutical and biotech applications, digitally enabled MFCs ensure accurate reagent and gas delivery, supporting regulatory compliance and consistent batch quality. The adoption of such devices is improving reproducibility and reducing human error in critical production processes

- Industries focused on chemical processing and advanced materials are integrating smart MFCs for automated flow control and process optimization, enabling energy savings and higher safety standards. This trend is driving the transition from traditional analog systems to intelligent, networked devices

- The growing emphasis on Industry 4.0 and smart manufacturing initiatives is reinforcing the shift toward digitally connected MFCs. Continuous integration of IoT-enabled controllers is expected to accelerate process automation, data-driven optimization, and system interoperability across industrial operations

Mass Flow Controller Market Dynamics

Driver

“Rising Demand for Precise Flow Control in Semiconductors and Pharmaceuticals”

- The increasing complexity of semiconductor manufacturing processes and pharmaceutical production is driving demand for mass flow controllers capable of delivering highly accurate, stable, and repeatable flow rates. These devices ensure precise gas and liquid delivery, minimizing defects and maintaining consistent product quality

- For instance, MKS Instruments provides high-precision mass flow controllers used in semiconductor fabs to regulate process gases with sub-percent accuracy, supporting next-generation chip fabrication. These controllers help maintain stringent process tolerances and improve overall device yield

- The growth of advanced pharmaceutical formulations, biologics, and vaccine manufacturing requires precise flow control for critical reactions and sterile operations. MFCs play a pivotal role in ensuring controlled environments and reproducible production outcomes

- Increasing adoption of microelectronics, MEMS devices, and advanced coatings further amplifies the need for precision gas and liquid handling systems. Accurate flow management directly impacts product reliability and performance in these sectors

- Research and development activities across chemical, biotech, and materials science industries are boosting investments in high-accuracy mass flow control equipment. This continued reliance on precision MFCs is solidifying their role as essential components in high-value, process-critical applications

Restraint/Challenge

“High Cost of Advanced Mass Flow Controller Systems”

- The mass flow controller market faces challenges due to the high costs associated with advanced digital and precision systems, which include complex sensor technologies, calibration equipment, and specialized control electronics. These costs can limit adoption, particularly among smaller manufacturers or emerging economies

- For instance, Brooks Instrument’s digital MFCs involve sophisticated thermal and pressure sensor arrays along with embedded control software, making these systems significantly more expensive than traditional analog controllers. High upfront investment can slow adoption despite operational benefits

- Maintaining system accuracy under variable environmental and process conditions requires ongoing calibration, technical expertise, and periodic maintenance, further contributing to operational expenditure

- The need for integration with factory automation systems and software platforms adds additional financial and technical barriers. Compatibility and network configuration requirements can increase implementation complexity and cost

- Manufacturers face the challenge of balancing performance, reliability, and cost-effectiveness while meeting growing demand for precision MFCs. These constraints may influence procurement decisions and adoption rates across industries requiring high-precision flow control

Mass Flow Controller Market Scope

The market is segmented on the basis of connection type, flow measurement, connectivity, and end user.

• By Connection Type

On the basis of connection type, the mass flow controller market is segmented into direct, indirect, and others. The direct connection segment dominated the market with the largest revenue share of 45.1% in 2025, driven by its high accuracy, faster response time, and ability to provide real-time flow control without intermediate components. Direct mass flow controllers are widely adopted in semiconductor fabrication, pharmaceuticals, and specialty chemicals, where precise gas and liquid dosing is critical for process consistency. Their simplified system architecture reduces signal losses and calibration complexity, supporting stable long-term performance.

The indirect connection segment is expected to witness the fastest growth from 2026 to 2033, supported by its suitability for complex industrial systems requiring flexible installation and integration with existing piping or instrumentation. Indirect configurations enable cost optimization in large-scale plants by allowing centralized sensing and control. Growing adoption in oil and gas processing, bulk chemical manufacturing, and water treatment facilities continues to accelerate demand for indirect mass flow controller solutions.

• By Flow Measurement

On the basis of flow measurement, the mass flow controller market is segmented into low, medium, high, and others. The low flow measurement segment accounted for the largest market revenue share in 2025, driven by strong demand from semiconductor manufacturing, laboratory research, and pharmaceutical production, where ultra-precise flow regulation is essential. Low flow controllers support advanced process control in applications involving specialty gases and critical reactions, ensuring repeatability and yield optimization. Their increasing use in R&D environments and pilot-scale production further reinforces segment dominance.

The high flow measurement segment is projected to register the fastest growth during the forecast period, driven by expanding requirements in oil and gas, metals processing, and large-scale chemical plants. High flow mass flow controllers enable efficient handling of bulk gases and liquids while maintaining process stability. Industrial expansion and rising investments in infrastructure-scale processing facilities continue to support rapid adoption of high flow solutions.

• By Connectivity

On the basis of connectivity, the mass flow controller market is segmented into analog, Profibus, Profinet, RS-485, EtherCAT, Modbus RTU, DeviceNet, Modbus TCP/IP, Foundation Fieldbus, and others. The analog connectivity segment dominated the market in 2025 due to its widespread compatibility with legacy control systems and ease of implementation across industrial environments. Many manufacturing facilities continue to rely on analog signals for reliable, cost-effective flow control, particularly in established process industries. The simplicity and proven performance of analog interfaces sustain their strong market presence.

The EtherCAT connectivity segment is anticipated to witness the fastest growth from 2026 to 2033, driven by increasing adoption of Industry 4.0 and high-speed automation systems. EtherCAT-enabled mass flow controllers support real-time data exchange, precise synchronization, and advanced diagnostics, which are critical for smart factories. Rising digitalization across semiconductor and advanced manufacturing facilities continues to accelerate demand for high-performance connectivity solutions.

• By End User

On the basis of end user, the mass flow controller market is segmented into chemicals, oil and gas, pharmaceuticals, semiconductors, food and beverages, water and wastewater treatment, and metals and mining. The semiconductor segment dominated the market with the largest revenue share in 2025, driven by stringent requirements for precise gas flow control in wafer fabrication and chip manufacturing processes. Mass flow controllers play a critical role in ensuring process accuracy, yield enhancement, and contamination control in cleanroom environments. Continuous advancements in semiconductor technologies further strengthen segment leadership.

The pharmaceuticals segment is expected to grow at the fastest rate during the forecast period, supported by rising biologics production, increased vaccine manufacturing, and stringent regulatory standards. Mass flow controllers enable accurate dosing and consistent process control across drug formulation and sterile manufacturing operations. Expanding pharmaceutical production capacities and ongoing investments in advanced manufacturing technologies continue to drive strong growth in this segment.

Mass Flow Controller Market Regional Analysis

- Asia-Pacific dominated the mass flow controller market with the largest revenue share of 42.7% in 2025, driven by rapid expansion of semiconductor fabrication facilities, growing pharmaceutical manufacturing, and increasing investments in industrial automation across key economies

- Strong growth in electronics manufacturing, rising adoption of advanced process control systems, and cost-efficient production capabilities are accelerating large-scale deployment of mass flow controllers across the region

- Supportive government policies, availability of skilled technical workforce, and continuous industrialization in developing economies are contributing to sustained demand for precise flow control solutions in both gas and liquid applications

China Mass Flow Controller Market Insight

China held the largest share in the Asia-Pacific mass flow controller market in 2025, supported by its dominant position in semiconductor manufacturing, chemicals, and electronics production. The country’s extensive industrial base, strong government backing for domestic semiconductor supply chains, and increasing investments in advanced manufacturing equipment are key growth drivers. Rising adoption of automation and smart factory initiatives continues to strengthen demand for high-precision mass flow controllers.

India Mass Flow Controller Market Insight

India is witnessing the fastest growth in the Asia-Pacific region, driven by expanding pharmaceutical production, rising investments in semiconductor assembly and testing, and increasing focus on process automation. Government initiatives supporting domestic manufacturing, coupled with growth in specialty chemicals and industrial gases, are accelerating adoption of mass flow controllers. Expanding R&D activities and capacity additions across multiple industries are further supporting market growth.

Europe Mass Flow Controller Market Insight

The Europe mass flow controller market is growing steadily, supported by strong emphasis on process accuracy, strict regulatory compliance, and high demand from pharmaceuticals, chemicals, and advanced manufacturing sectors. The region’s focus on energy efficiency, sustainability, and high-quality production standards is driving adoption of advanced flow control technologies. Continuous investments in industrial modernization and automation are reinforcing market stability.

Germany Mass Flow Controller Market Insight

Germany’s mass flow controller market is driven by its strong industrial automation ecosystem, leadership in chemical processing, and advanced manufacturing infrastructure. The country’s well-established engineering capabilities and focus on precision manufacturing support high demand for accurate flow control systems. Strong collaboration between equipment manufacturers and end users further promotes innovation and technology adoption.

U.K. Mass Flow Controller Market Insight

The U.K. market is supported by a robust pharmaceutical and life sciences sector, growing investments in clean manufacturing, and increasing adoption of automation technologies. Rising demand for precise gas and liquid flow control in research laboratories and production facilities is driving market growth. Continued focus on innovation and advanced process control sustains the U.K.’s role in the regional market.

North America Mass Flow Controller Market Insight

North America is projected to grow at the fastest CAGR from 2026 to 2033, driven by strong demand from semiconductor manufacturing, pharmaceuticals, and advanced materials industries. Increasing investments in next-generation chip fabrication, expansion of biopharmaceutical production, and rapid adoption of Industry 4.0 technologies are key growth factors. The region’s focus on high-precision manufacturing and automation continues to boost market expansion.

U.S. Mass Flow Controller Market Insight

The U.S. accounted for the largest share in the North America mass flow controller market in 2025, supported by its advanced semiconductor ecosystem, strong pharmaceutical manufacturing base, and significant R&D investments. High demand for ultra-precise flow control in wafer fabrication, drug production, and specialty chemical processing underpins market leadership. Presence of major equipment manufacturers and rapid adoption of smart manufacturing technologies further strengthen the U.S.’s dominant position.

Mass Flow Controller Market Share

The mass flow controller industry is primarily led by well-established companies, including:

- HORIBA, Ltd. (Japan)

- Sensirion AG (Switzerland)

- MKS Instruments (U.S.)

- Teledyne Technologies Incorporated (U.S.)

- Bronkhorst (Netherlands)

- Brooks Instrument. (U.S.)

- Christian Bürkert GmbH & Co. KG (Germany)

- Sierra Instruments, Inc. (U.S.)

- Alicat Scientific, Inc. (U.S.)

- PASKER HANNIFIN CORP (U.S.)

- TOKYO KEISO CO., LTD. (Japan)

- Vögtlin Instruments GmbH (Switzerland)

- Azbil Corporation (China)

- Axetris AG (Switzerland)

- Aalborg (U.S.)

Latest Developments in Global Mass Flow Controller Market

- In February 2024, Brooks Instrument introduced the XacTorr XMz Series, a vacuum mass flow controller engineered for high-precision semiconductor manufacturing. Designed to enhance atomic layer deposition (ALD) and chemical vapor deposition (CVD) processes, this advanced controller offers higher accuracy and rapid response times, ensuring optimal performance in critical applications. The XMz Series integrates cutting-edge technology to improve process stability and efficiency

- In December 2023, Horiba expanded its mass flow controller lineup, introducing new models compatible with corrosive gases. This strategic move aims to meet the growing demand in semiconductor and chemical processing industries across Asia and Europe. The latest controllers offer high accuracy, fast response times, and enhanced durability, ensuring optimal performance in challenging environments

- In September 2023, Sensirion AG launched the SFC6000 series, a compact mass flow controller designed for OEMs in medical and analytical instrumentation. This innovative series offers plug-and-play capability, low power consumption, and digital interfaces, ensuring seamless system integration. The SFC6000 controllers provide high accuracy, fast response times, and robust performance, making them ideal for gas chromatography, bioreactors, and medical equipment

- In July 2023, MKS Instruments introduced enhancements to its P-Series mass flow controllers, improving gas compatibility and integrating real-time diagnostics to support Industry 4.0 manufacturing environments. These upgrades aim to optimize performance across electronics, life sciences, and energy sectors, ensuring greater efficiency and reliability in industrial applications. The P-Series controllers now offer advanced monitoring capabilities, enabling precise control and predictive maintenance

- In April 2023, Alicat Scientific introduced the Whisper series, a new generation of low-pressure-drop mass flow controllers designed for biotech, aerospace, and environmental testing applications. These controllers ensure stable control even under extremely low inlet pressures, making them ideal for precision gas flow measurement. The Whisper series features fast response times, high accuracy, and minimal system impact, enhancing performance in critical industries

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Mass Flow Controller Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Mass Flow Controller Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Mass Flow Controller Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.