Global Mattress Topper Market

Market Size in USD Billion

CAGR :

%

USD

1.20 Billion

USD

2.14 Billion

2025

2033

USD

1.20 Billion

USD

2.14 Billion

2025

2033

| 2026 –2033 | |

| USD 1.20 Billion | |

| USD 2.14 Billion | |

|

|

|

|

Mattress Topper Market Size

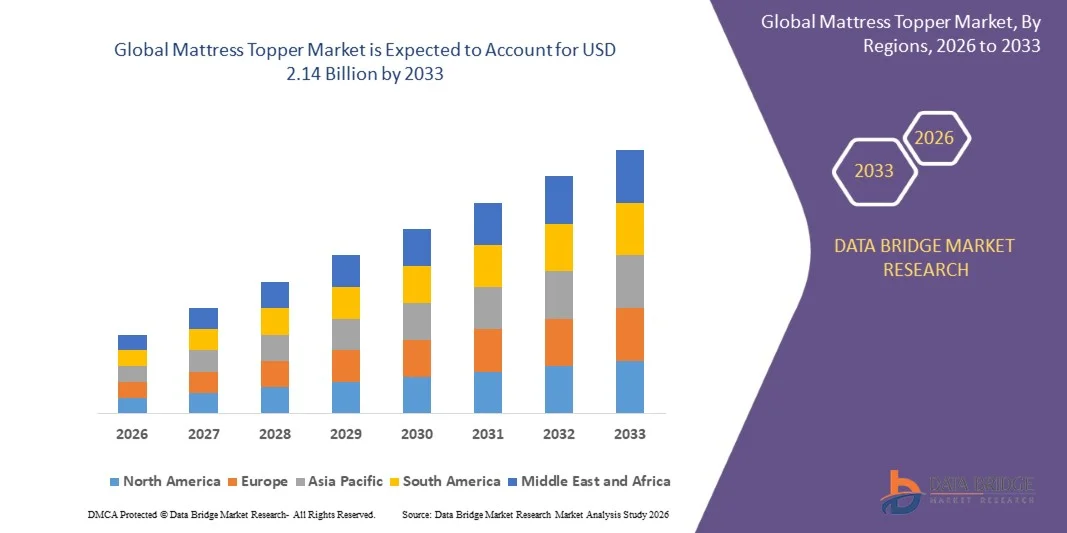

- The global mattress topper market size was valued at USD 1.20 billion in 2025 and is expected to reach USD 2.14 billion by 2033, at a CAGR of 7.50% during the forecast period

- The market growth is largely fueled by the rising consumer focus on sleep health, comfort, and ergonomic solutions, driving increased adoption of mattress toppers in both residential and commercial settings

- Furthermore, growing awareness of the benefits of pressure relief, spinal support, and enhanced sleep quality is establishing mattress toppers as essential additions to existing bedding systems. These converging factors are accelerating the uptake of mattress toppers, thereby significantly boosting the industry’s growth

Mattress Topper Market Analysis

- Mattress toppers, designed to improve comfort, support, and sleep quality, are increasingly vital components of modern bedding solutions in both residential and hospitality sectors due to their ability to enhance mattress performance and extend lifespan

- The escalating demand for mattress toppers is primarily fueled by increasing awareness of sleep-related health issues, rising disposable incomes, and a preference for customizable, high-quality sleep solutions that can be integrated with existing mattresses

- North America dominated mattress topper market with a share of over 40% in 2025, due to increasing consumer awareness of sleep health, rising disposable incomes, and the growing preference for home comfort and ergonomic solutions

- Asia-Pacific is expected to be the fastest growing region in the mattress topper market during the forecast period due to rising disposable incomes, urbanization, and increasing awareness of sleep wellness in countries such as China, Japan, and India

- Queen size segment dominated the market with a market share of 42.5% in 2025, due to its suitability for couples and compatibility with most standard bed frames. Queen size mattress toppers are highly preferred for balancing space and comfort, making them the most common choice in both residential and hospitality settings. The segment’s popularity is further supported by the wide availability of products in queen dimensions across multiple brands and price ranges

Report Scope and Mattress Topper Market Segmentation

|

Attributes |

Mattress Topper Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Mattress Topper Market Trends

“Rising Adoption of Memory Foam and Hybrid Mattress Toppers”

- A significant trend in the mattress topper market is the increasing adoption of memory foam and hybrid toppers across residential and hospitality sectors, driven by the growing consumer focus on sleep quality, pressure relief, and ergonomic support. These products are becoming essential additions to traditional mattresses, allowing users to enhance comfort and extend the lifespan of their beds

- For instance, Tempur-Pedic has expanded its line of memory foam and hybrid mattress toppers, offering enhanced pressure distribution and motion isolation features that cater to health-conscious and premium consumers. Such product innovations are helping the company capture a larger share in both residential and hotel bedding segments

- The market is witnessing a shift toward hybrid materials that combine foam, latex, and gel layers, providing balanced support and improved airflow. This is positioning mattress toppers as critical sleep-enhancing solutions that appeal to consumers seeking tailored comfort without replacing their entire mattress

- Increasing awareness of spinal alignment, orthopedic support, and sleep-related health benefits is also contributing to the demand for high-quality toppers. This trend is reinforced by marketing campaigns and consumer education initiatives highlighting the health advantages of using memory foam and hybrid products

- Hospitality and healthcare sectors are increasingly incorporating advanced mattress toppers to improve guest satisfaction and patient comfort, respectively. Such institutional adoption is accelerating market penetration and driving innovation in topper designs, materials, and performance features

- The growing trend of online customization and direct-to-consumer offerings enables consumers to select toppers based on firmness, thickness, and material composition. This rising personalization is further strengthening the adoption of memory foam and hybrid mattress toppers globally

Mattress Topper Market Dynamics

Driver

“Growing Consumer Focus on Sleep Health and Comfort”

- The growing consumer emphasis on sleep wellness, comfort, and ergonomic solutions is a primary driver of mattress topper market growth, as individuals seek products that improve sleep quality and overall well-being

- For instance, Sleep Number has integrated AI-driven sleep analytics with its mattress toppers to provide personalized comfort adjustments and insights, catering to tech-savvy consumers concerned about health and sleep optimization. This approach reinforces the importance of health-focused innovations in driving market expansion

- Rising awareness of the impact of poor sleep on productivity, mental health, and physical well-being is fueling the adoption of memory foam, latex, and hybrid toppers that relieve pressure points and reduce motion transfer

- Consumers are increasingly investing in premium bedding accessories to complement existing mattresses without the higher cost of full mattress replacement. This has led to steady growth in the mid-to-high-end topper segments

- Growing urbanization, higher disposable incomes, and a shift toward luxury home products are also enabling increased penetration of advanced mattress toppers in emerging and mature markets, further strengthening this growth driver

Restraint/Challenge

“High Cost of Premium Mattress Toppers”

- The mattress topper market faces challenges due to the relatively high cost of premium memory foam, hybrid, and latex products, which can limit adoption among price-sensitive consumers

- For instance, Tempur-Pedic’s high-end memory foam and hybrid toppers, while technologically advanced, command premium pricing that may deter middle-market consumers, restricting growth in cost-sensitive regions

- Manufacturing these products involves sourcing high-quality materials and employing specialized production processes such as multi-layer foam compression, cooling gel infusion, and precise thickness calibration. These steps increase production costs and affect retail pricing

- Price barriers are more pronounced in emerging markets, where consumers may opt for lower-cost alternatives such as basic foam or fiber-filled toppers, limiting the market penetration of advanced products

- Balancing performance, durability, and affordability remains a key challenge for manufacturers, who must innovate cost-effectively to expand consumer reach while maintaining high-quality sleep-enhancing features

Mattress Topper Market Scope

The market is segmented on the basis of product type, size, application, distribution channel, and price range.

• By Product Type

On the basis of product type, the mattress topper market is segmented into memory foam, feather, hybrid, innerspring, latex, water bed, air bed, adjustable bases, wool, and others. The memory foam segment dominated the market with the largest market revenue share in 2025, driven by its ability to provide superior comfort, pressure relief, and motion isolation. Consumers often prefer memory foam toppers for their durability and adaptability to different sleeping positions, enhancing overall sleep quality. The rising awareness of ergonomic and orthopedic benefits also supports the widespread adoption of memory foam mattress toppers.

The hybrid segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by increasing consumer demand for products that combine the softness of foam with the support of innerspring systems. For instance, Tempur-Pedic has launched hybrid mattress toppers that integrate multiple materials to enhance comfort and support, catering to a wide range of sleepers. The growing popularity of hybrid designs in both residential and commercial spaces also contributes to their rapid adoption.

• By Size

On the basis of size, the mattress topper market is segmented into twin or single size, twin XL size, full or double size, queen size, king size mattress, and others. The queen size segment held the largest market revenue share of 42.5% in 2025, driven by its suitability for couples and compatibility with most standard bed frames. Queen size mattress toppers are highly preferred for balancing space and comfort, making them the most common choice in both residential and hospitality settings. The segment’s popularity is further supported by the wide availability of products in queen dimensions across multiple brands and price ranges.

The king size segment is expected to witness the fastest CAGR from 2026 to 2033, fueled by increasing demand for luxury and larger sleeping surfaces. For instance, Saatva offers king size mattress toppers that enhance the comfort of premium beds, catering to high-end residential and hotel applications. The trend toward oversized beds and personalized sleep solutions contributes to the growing adoption of king size toppers.

• By Application

On the basis of application, the mattress topper market is segmented into residential and commercial. The residential segment dominated the market in 2025, driven by rising consumer awareness of sleep health and the increasing adoption of home-based comfort solutions. Homeowners often invest in mattress toppers to improve sleep quality, alleviate back pain, and extend the lifespan of existing mattresses. The segment also benefits from the growing popularity of online sales channels and easy-to-install, ready-to-use products that appeal to individual consumers.

The commercial segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by the expanding hospitality and healthcare sectors. For instance, Marriott International has increasingly adopted high-quality mattress toppers across its hotel chains to enhance guest comfort and satisfaction. The demand for durable and easy-to-maintain toppers in commercial spaces further supports the segment’s growth trajectory.

• By Distribution Channel

On the basis of distribution channel, the mattress topper market is segmented into offline and online distribution channels. The offline segment held the largest market revenue share in 2025, driven by consumers’ preference to physically experience product comfort and firmness before purchase. Retailers and specialty stores provide personalized guidance, allowing customers to select toppers based on feel, material, and thickness, increasing consumer confidence in purchase decisions. The strong presence of established retail chains also contributes to offline sales dominance.

The online distribution channel is expected to witness the fastest CAGR from 2026 to 2033, fueled by the convenience of doorstep delivery, extensive product variety, and attractive e-commerce discounts. For instance, Amazon and Wayfair have expanded their mattress topper offerings with detailed product descriptions, customer reviews, and virtual trials to enhance purchase confidence. The rise of online-exclusive brands offering direct-to-consumer models also supports rapid adoption.

• By Price Range

On the basis of price range, the mattress topper market is segmented into low, medium, and high. The medium-price range segment dominated the market in 2025, driven by its balance of affordability and quality. Consumers often prefer medium-range toppers as they provide premium features such as memory foam or hybrid construction without the high cost of luxury variants. The segment’s wide availability across multiple brands and materials also supports its market leadership.

The high-price range segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by increasing consumer inclination toward premium sleep solutions. For instance, Sleep Number offers high-end mattress toppers with advanced cooling and adaptive support technologies catering to luxury residential and commercial applications. Growing disposable income and a focus on personalized comfort experiences contribute to the rapid adoption of high-price range toppers.

Mattress Topper Market Regional Analysis

- North America dominated the mattress topper market with the largest revenue share of over 40% in 2025, driven by increasing consumer awareness of sleep health, rising disposable incomes, and the growing preference for home comfort and ergonomic solutions

- Consumers in the region highly value enhanced sleep quality, pressure relief, and customizable comfort offered by mattress toppers made from memory foam, latex, and hybrid materials

- This widespread adoption is further supported by a technologically savvy population, strong retail and e-commerce infrastructure, and the rising trend of wellness-focused home products, establishing mattress toppers as a favored solution for residential and commercial applications

U.S. Mattress Topper Market Insight

The U.S. mattress topper market captured the largest revenue share in 2025 within North America, fueled by increasing demand for personalized sleep solutions and premium comfort products. Consumers are prioritizing the enhancement of sleep quality through memory foam and hybrid toppers. The growing trend of home wellness and the preference for adjustable and orthopedic solutions, combined with robust demand for online purchase convenience, further propels the mattress topper market. Moreover, rising awareness of sleep-related health issues and the integration of mattress toppers with high-end mattresses are significantly contributing to market growth.

Europe Mattress Topper Market Insight

The Europe mattress topper market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by rising disposable incomes, growing health consciousness, and increasing adoption of premium sleep products. The trend of ergonomic sleep solutions and the preference for high-quality materials are fostering mattress topper adoption. European consumers are drawn to comfort, durability, and the ability to enhance existing mattresses. The region is experiencing significant growth across residential, hospitality, and healthcare applications, with toppers being incorporated into both new and renovated bed setups.

U.K. Mattress Topper Market Insight

The U.K. mattress topper market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by rising demand for ergonomic sleep products and increasing awareness of back and joint health. Concerns regarding sleep quality and comfort are encouraging homeowners and hotels to adopt mattress toppers. The U.K.’s strong retail network, widespread e-commerce adoption, and preference for high-quality bedding products are expected to continue stimulating market growth.

Germany Mattress Topper Market Insight

The Germany mattress topper market is expected to expand at a considerable CAGR during the forecast period, fueled by growing awareness of sleep health, preference for eco-friendly materials, and demand for innovative comfort solutions. Germany’s well-developed retail infrastructure and focus on sustainability promote the adoption of toppers, particularly in residential and hospitality sectors. Integration of advanced materials such as memory foam and latex with existing mattresses is becoming increasingly prevalent, with strong consumer demand for durable and high-performance sleep products.

Asia-Pacific Mattress Topper Market Insight

The Asia-Pacific mattress topper market is poised to grow at the fastest CAGR during the forecast period of 2026 to 2033, driven by rising disposable incomes, urbanization, and increasing awareness of sleep wellness in countries such as China, Japan, and India. The region's growing preference for comfortable and ergonomic sleep solutions, supported by lifestyle changes and the expansion of retail and e-commerce platforms, is driving adoption. Furthermore, as APAC becomes a manufacturing hub for mattress topper materials and components, affordability and accessibility are expanding to a wider consumer base.

Japan Mattress Topper Market Insight

The Japan mattress topper market is gaining momentum due to the country’s focus on wellness, high disposable incomes, and increasing interest in premium sleep products. Japanese consumers prioritize comfort, durability, and ergonomic support, driving demand for memory foam and hybrid toppers. The integration of toppers with adjustable and high-end mattresses, along with the aging population’s need for easy-to-use and supportive solutions, is fueling market growth.

China Mattress Topper Market Insight

The China mattress topper market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to rising urbanization, growing middle-class households, and increasing awareness of sleep quality. China stands as one of the largest markets for home comfort products, and mattress toppers are increasingly adopted in residential, hospitality, and rental properties. The expansion of e-commerce, the availability of affordable and diverse topper options, and strong domestic manufacturers are key factors propelling market growth in China.

Mattress Topper Market Share

The mattress topper industry is primarily led by well-established companies, including:

- Drive DeVilbiss Healthcare (U.S.)

- ALPS Brands (U.S.)

- Serta, Inc. (U.S.)

- KING KOIL (U.S.)

- SINOMAX (U.S.)

- Bestway Inflatables & Material Corp. (China)

- Somnio Global (U.S.)

- American National Manufacturing, Inc. (U.S.)

- WENZEL Group (Germany)

- Exxel Outdoors, LLC. (U.S.)

- Al Mattress (U.S.)

- Newell Brands (U.S.)

- SERTA SIMMONS BEDDING, LLC (U.S.)

- Intex Development Co. Ltd (China)

- Relyon Beds Ltd. (U.K.)

- Magenta Lifecare Pvt. Ltd. (India)

- King Koil India (India)

- PARAMOUNT BED CO., LTD. (Japan)

- Spring Air International (U.S.)

- Southerland Sleep (U.S.)

Latest Developments in Global Mattress Topper Market

- In September 2023, Sleep Number announced a partnership with a leading sleep technology firm to integrate AI-driven sleep analytics into its mattress toppers. This collaboration is poised to significantly impact the mattress topper market by providing personalized sleep insights, thereby enhancing user experience and comfort. By leveraging AI technology, Sleep Number differentiates itself in a competitive market, appealing to tech-savvy consumers seeking advanced, data-driven sleep solutions. This strategic initiative is likely to strengthen the brand’s positioning and drive higher adoption of its innovative toppers in both residential and premium segments

- In August 2023, Tempur-Pedic launched a new line of eco-friendly mattress toppers made from sustainable materials. This move addresses the growing consumer demand for environmentally responsible sleep products, enhancing the brand’s reputation as a leader in sustainability within the mattress industry. By aligning its offerings with eco-conscious preferences, Tempur-Pedic is likely to attract a wider demographic of environmentally aware consumers while reinforcing customer loyalty. The introduction of sustainable toppers also positions the company to capture market share in the expanding segment of green sleep solutions

- In July 2023, Serta Simmons Bedding expanded its distribution network through a strategic alliance with a major online retailer. This initiative is expected to improve the company’s accessibility and market reach, particularly among younger, digitally active consumers who favor online shopping channels. By optimizing distribution and leveraging e-commerce platforms, Serta Simmons Bedding strengthens its competitive position and is better equipped to respond to evolving consumer purchasing behaviors. The move is anticipated to boost sales volumes and enhance market share in the mattress topper segment

- In 2023, Brooklyn Bedding relocated to a new 650,000-square-foot facility in Glendale, equipped with a full cut-and-sew operation, pocket-coil production, foam pour line, and assembly conveyor system. This expansion is likely to increase production capacity, streamline operations, and enhance product quality, enabling the company to meet growing market demand. The upgraded facility positions Brooklyn Bedding to scale efficiently and respond swiftly to both residential and commercial market needs, strengthening its presence and competitiveness in the mattress and topper market

- In 2023, Sinomax USA Inc., headquartered in Houston, Texas, introduced an expanded range of Vibe branded products and sustainable sleep solutions. The acquisition of the exclusive Vibe license enables the company to launch new top-of-bed accessories, such as pillows and mattress toppers, complementing the existing mattress lineup. This strategic expansion enhances Sinomax’s product portfolio, addressing evolving consumer preferences for integrated sleep solutions while reinforcing its market presence in the US. The move is likely to increase brand visibility and attract consumers seeking both comfort and sustainability in sleep products

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.