Global Measurement While Drilling Mwd Market

Market Size in USD Billion

CAGR :

%

USD

18.08 Billion

USD

33.96 Billion

2025

2033

USD

18.08 Billion

USD

33.96 Billion

2025

2033

| 2026 –2033 | |

| USD 18.08 Billion | |

| USD 33.96 Billion | |

|

|

|

|

Measurement While Drilling (M.W.D.) Market Size

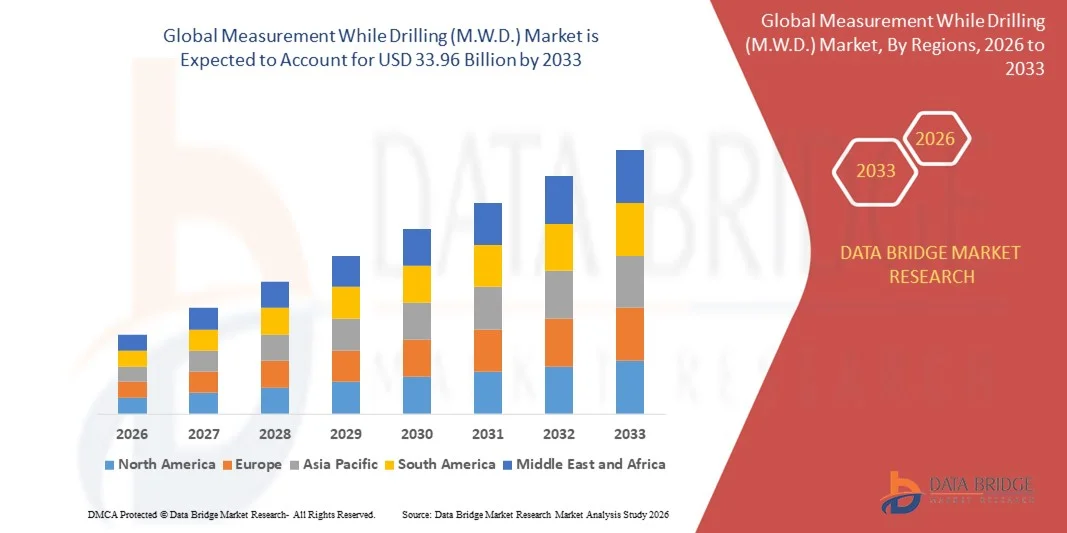

- The global Measurement While Drilling (M.W.D.) market size was valued at USD 18.08 billion in 2025 and is expected to reach USD 33.96 billion by 2033, at a CAGR of 8.2% during the forecast period

- The market growth is largely fueled by the increasing demand for real-time downhole data and advanced drilling analytics, enabling operators to optimize wellbore placement, improve drilling efficiency, and reduce non-productive time across both onshore and offshore operations

- Furthermore, rising adoption of digital oilfield technologies, automated drilling solutions, and integrated telemetry systems is enhancing the accuracy, safety, and reliability of drilling operations. These converging factors are driving the deployment of M.W.D. solutions, thereby significantly boosting the market's expansion

Measurement While Drilling (M.W.D.) Market Analysis

- Measurement While Drilling (M.W.D.) systems are advanced downhole tools that provide real-time data on wellbore trajectory, formation properties, and drilling parameters. These systems support directional and horizontal drilling, enabling precise reservoir targeting and efficient well construction

- The escalating demand for M.W.D. solutions is primarily fueled by increasing exploration and production activities, technological advancements in drilling operations, and the need for cost-effective, safe, and data-driven decision-making in complex geological environments

- North America dominated the Measurement While Drilling (M.W.D.) market with a share of 39% in 2025, due to high drilling activity levels, strong shale oil and gas production, and early adoption of advanced drilling technologies across onshore and offshore fields

- Asia-Pacific is expected to be the fastest growing region in the Measurement While Drilling (M.W.D.) market during the forecast period due to increasing energy demand, rising exploration and production activities, and expanding offshore projects

- Onshore segment dominated the market with a market share of 69.6% in 2025, due to the high volume of land-based drilling activities across major oil- and gas-producing regions. Onshore projects generally involve lower operational costs, easier logistics, and faster deployment of M.W.D. tools compared to offshore environments. The extensive presence of shale formations and unconventional reserves further supports strong adoption of M.W.D. systems in onshore drilling. In addition, frequent well interventions and the need for real-time directional data continue to reinforce demand for M.W.D. solutions in onshore fields

Report Scope and Measurement While Drilling (M.W.D.) Market Segmentation

|

Attributes |

Measurement While Drilling (M.W.D.) Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Measurement While Drilling (M.W.D.) Market Trends

Rising Adoption of Automated and Digital Drilling Solutions

- A key trend in the Measurement While Drilling (M.W.D.) market is the increasing adoption of automated and digital drilling solutions, driven by the need to enhance drilling efficiency, reduce human intervention, and improve real-time decision-making capabilities. These solutions are enabling operators to monitor downhole conditions more accurately and respond faster to operational challenges

- For instance, Schlumberger and Halliburton are deploying advanced digital M.W.D. systems that integrate real-time telemetry and automated drilling controls, improving wellbore placement accuracy and reducing non-productive time

- The integration of smart sensors and IoT-enabled tools is expanding rapidly as operators leverage continuous downhole data for predictive maintenance and optimization of drilling parameters. This trend positions M.W.D. technologies as essential for reducing operational risks and improving well performance

- The market is witnessing growth in remote monitoring and control capabilities, where cloud-based platforms and AI-driven analytics allow drilling engineers to access and interpret data from multiple wells simultaneously. This capability is strengthening operational efficiency and enabling faster, data-driven decision-making

- Adoption of automated drilling workflows is supporting safer operations by minimizing manual interventions in hazardous downhole environments. This trend is encouraging broader implementation of M.W.D. solutions across onshore and offshore drilling projects

- The rising demand for unconventional resource exploration, such as shale and deepwater reservoirs, is driving investments in M.W.D. technologies that can operate under extreme pressures and temperatures. Operators are increasingly relying on these systems for high-precision drilling in complex geological formations

Measurement While Drilling (M.W.D.) Market Dynamics

Driver

Increasing Demand for Real-Time Downhole Data and Drilling Efficiency

- The growing need for accurate real-time downhole data to optimize drilling operations and reduce non-productive time is fueling demand for M.W.D. technologies. These systems provide critical information such as formation evaluation, directional surveys, and drilling dynamics that enhance operational decision-making

- For instance, Baker Hughes provides M.W.D. solutions that deliver continuous downhole measurements and drilling performance analytics, enabling operators to improve wellbore placement and drilling efficiency

- Operators are increasingly adopting M.W.D. solutions to support complex directional drilling, extended-reach wells, and high-angle boreholes where precise trajectory control is essential. This trend enhances drilling success rates and reduces costly errors

- Growing competition among oilfield service providers is incentivizing adoption of advanced M.W.D. technologies to differentiate service offerings. Companies that deploy reliable, high-accuracy M.W.D. solutions can achieve operational advantages and strengthen client relationships

- The continuous focus on maximizing resource recovery and minimizing environmental impact reinforces the importance of M.W.D. systems. Accurate real-time data allows operators to drill efficiently, reduce unnecessary interventions, and optimize hydrocarbon extraction

Restraint/Challenge

High Capital Investment and Operational Complexity

- The Measurement While Drilling (M.W.D.) market faces challenges due to the significant capital investment required for advanced downhole tools, telemetry systems, and supporting digital infrastructure. High initial costs can limit adoption, especially among smaller operators

- For instance, Weatherford’s high-end M.W.D. tools involve substantial upfront expenditure and require trained personnel for deployment and maintenance, which can restrict access for mid-tier drilling companies

- Integrating M.W.D. solutions into existing drilling operations requires specialized expertise and can increase operational complexity, particularly in deepwater and high-pressure, high-temperature wells

- Maintenance and calibration of sensitive downhole sensors and electronics add to operational costs and require downtime, which may affect overall project economics

- Logistical challenges in transporting, deploying, and recovering M.W.D. tools in remote or offshore locations further constrain market expansion. These factors collectively emphasize the need for careful planning, skilled personnel, and robust operational frameworks to maximize the value of M.W.D. investments

Measurement While Drilling (M.W.D.) Market Scope

The market is segmented on the basis of location and well type.

- By Location

On the basis of location, the Measurement While Drilling (M.W.D.) market is segmented into onshore and offshore operations. The onshore segment dominated the largest market revenue share of 69.6% in 2025, driven by the high volume of land-based drilling activities across major oil- and gas-producing regions. Onshore projects generally involve lower operational costs, easier logistics, and faster deployment of M.W.D. tools compared to offshore environments. The extensive presence of shale formations and unconventional reserves further supports strong adoption of M.W.D. systems in onshore drilling. In addition, frequent well interventions and the need for real-time directional data continue to reinforce demand for M.W.D. solutions in onshore fields.

The offshore segment is anticipated to witness the fastest growth rate from 2026 to 2033, supported by increasing investments in deepwater and ultra-deepwater exploration projects. Offshore drilling requires high-precision wellbore data to manage complex geological conditions and mitigate operational risks, making M.W.D. systems critical. Advancements in tool reliability, high-temperature tolerance, and data transmission capabilities are improving suitability for offshore applications. Rising offshore exploration activity in regions such as the North Sea and Gulf of Mexico further accelerates growth.

- By Well Type

On the basis of well type, the Measurement While Drilling (M.W.D.) market is segmented into horizontal, directional, and vertical wells. The horizontal well segment accounted for the largest revenue share in 2025, driven by its extensive use in unconventional oil and gas extraction. Horizontal drilling maximizes reservoir contact and improves hydrocarbon recovery, increasing reliance on accurate real-time measurements provided by M.W.D. tools. Operators use M.W.D. data to precisely steer wellbores and optimize drilling efficiency in complex formations. The growing focus on shale gas and tight oil development continues to support dominance of this segment.

The directional well segment is expected to register the fastest growth during the forecast period, owing to its increasing application in mature fields and complex reservoir structures. Directional wells require continuous trajectory monitoring and formation evaluation, significantly increasing dependence on M.W.D. systems. These wells enable operators to access multiple targets from a single surface location, reducing environmental footprint and drilling costs. Technological improvements in downhole sensors and real-time data analytics are further enhancing adoption of M.W.D. solutions in directional drilling projects.

Measurement While Drilling (M.W.D.) Market Regional Analysis

- North America dominated the Measurement While Drilling (M.W.D.) market with the largest revenue share of 39% in 2025, driven by high drilling activity levels, strong shale oil and gas production, and early adoption of advanced drilling technologies across onshore and offshore fields

- Operators in the region emphasize real-time data acquisition, drilling efficiency, and wellbore accuracy, which has increased reliance on M.W.D. solutions for complex horizontal and directional drilling operations

- This dominance is supported by substantial upstream investments, a mature oil and gas ecosystem, and the presence of major service providers, positioning North America as a key hub for technologically advanced drilling operations

U.S. Measurement While Drilling (M.W.D.) Market Insight

The U.S. Measurement While Drilling (M.W.D.) market captured the largest revenue share within North America in 2025, supported by extensive shale developments in regions such as the Permian, Eagle Ford, and Bakken basins. The strong focus on horizontal drilling, coupled with the need for precise reservoir navigation and cost optimization, continues to drive M.W.D. adoption. Increasing integration of digital oilfield technologies and automation further strengthens market growth across onshore and offshore projects.

Europe Measurement While Drilling (M.W.D.) Market Insight

The Europe Measurement While Drilling (M.W.D.) market is projected to grow at a steady CAGR during the forecast period, driven by offshore exploration activities in the North Sea and continuous investments in mature field redevelopment. The region places strong emphasis on operational safety, environmental compliance, and drilling efficiency, encouraging the use of advanced M.W.D. systems. Adoption is further supported by technological upgrades in offshore rigs and enhanced focus on maximizing recovery from existing reserves.

U.K. Measurement While Drilling (M.W.D.) Market Insight

The U.K. Measurement While Drilling (M.W.D.) market is expected to expand at a moderate CAGR, supported by sustained offshore drilling activity in the North Sea. The need to improve drilling precision and reduce non-productive time in high-cost offshore environments is increasing the use of M.W.D. tools. Ongoing efforts to extend the life of mature offshore fields are also contributing to consistent demand for reliable downhole measurement technologies.

Germany Measurement While Drilling (M.W.D.) Market Insight

The Germany Measurement While Drilling (M.W.D.) market is anticipated to grow at a stable pace during the forecast period, driven mainly by technological research, engineering expertise, and the presence of equipment manufacturers supporting European drilling operations. While domestic drilling activity remains limited, Germany plays a critical role in supplying advanced M.W.D. components and systems to regional and international markets.

Asia-Pacific Measurement While Drilling (M.W.D.) Market Insight

The Asia-Pacific Measurement While Drilling (M.W.D.) market is poised to grow at the fastest CAGR during the forecast period, driven by increasing energy demand, rising exploration and production activities, and expanding offshore projects. Countries such as China, India, and Australia are investing heavily in upstream oil and gas development to reduce import dependency. The growing adoption of horizontal and deepwater drilling techniques is accelerating demand for advanced M.W.D. solutions across the region.

China Measurement While Drilling (M.W.D.) Market Insight

The China Measurement While Drilling (M.W.D.) market accounted for the largest revenue share in Asia-Pacific in 2025, supported by aggressive exploration programs, shale gas development, and offshore expansion in the South China Sea. Strong government support for domestic energy production and continuous investments by national oil companies are driving M.W.D. adoption. The focus on improving drilling efficiency and reservoir characterization further reinforces market growth.

Japan Measurement While Drilling (M.W.D.) Market Insight

The Japan Measurement While Drilling (M.W.D.) market is witnessing gradual growth, driven by offshore exploration initiatives and the country’s emphasis on energy security. Advanced technological capabilities and collaborations with international oilfield service providers support the adoption of precision drilling tools. Japan’s focus on minimizing drilling risks and optimizing offshore operations continues to sustain demand for reliable M.W.D. systems.

Measurement While Drilling (M.W.D.) Market Share

The Measurement While Drilling (M.W.D.) industry is primarily led by well-established companies, including:

- Schlumberger Limited (U.S.)

- Halliburton (U.S.)

- Weatherford (U.S.)

- Cathedral Energy Services (Canada)

- N.O.V. Inc. (U.S.)

- Gyrodata (U.S.)

- Scientific Drilling International (U.S.)

- LEAM Drilling Services Ltd. (U.K.)

- Jindal Drilling & Industries Ltd. (India)

- Nabors Industries Ltd. (U.S.)

- Calmena Energy Services Inc. (Canada)

- Baker Hughes Company (U.S.)

- Cougar Drilling Solutions (Canada)

- Newsco International Energy Services Inc. (U.S.)

- Target Well Control Ltd. (U.K.)

- China Oilfield Services Limited (China)

- United Drilling Tools Ltd. (India)

- Ulterra (U.S.)

- Moog Inc. (U.S.)

- Saint-Gobain (France)

Latest Developments in Global Measurement While Drilling (M.W.D.) Market

- In June 2025, Chevron and Halliburton advanced the Measurement While Drilling (M.W.D.) market by deploying the ZEUS IQ intelligent fracturing platform, enabling automated stage execution using real-time subsurface feedback. This development strengthens demand for integrated M.W.D. solutions by improving operational precision, reducing non-productive time, and enhancing overall well performance through data-driven decision-making

- In April 2025, Baker Hughes expanded its AutoTrak intelligent rotary steerable and measurement technologies portfolio to support more complex well trajectories. This development reinforced the M.W.D. market by improving downhole data accuracy and drilling efficiency, particularly in extended-reach and high-temperature formations, supporting greater adoption in advanced drilling environments

- In March 2025, SLB introduced the EWC electric well-control system, replacing traditional hydraulic units with digitally enabled electric controls that provide continuous data streams. This innovation positively impacted the M.W.D. market by enhancing drilling safety, improving real-time monitoring capabilities, and supporting tighter integration between well control systems and downhole measurement technologies

- In February 2025, Halliburton and Sekal AS successfully deployed the first autonomous on-bottom drilling solution on the Norwegian Continental Shelf. This milestone accelerated M.W.D. market growth by demonstrating how automated drilling systems can leverage continuous measurement data to optimize drilling parameters, reduce human intervention, and improve operational consistency in offshore environments

- In January 2025, SLB and Star Energy Geothermal entered an agreement to accelerate the development of drilling technologies for geothermal assets, with a strong focus on subsurface characterization. This collaboration expanded the application scope of M.W.D. systems beyond oil and gas, driving market growth by opening new opportunities in geothermal drilling and renewable energy projects

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Measurement While Drilling Mwd Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Measurement While Drilling Mwd Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Measurement While Drilling Mwd Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.