Global Medical Robots Market

Market Size in USD Billion

CAGR :

%

USD

18.28 Billion

USD

52.31 Billion

2024

2032

USD

18.28 Billion

USD

52.31 Billion

2024

2032

| 2025 –2032 | |

| USD 18.28 Billion | |

| USD 52.31 Billion | |

|

|

|

|

Medical Robots Market Size

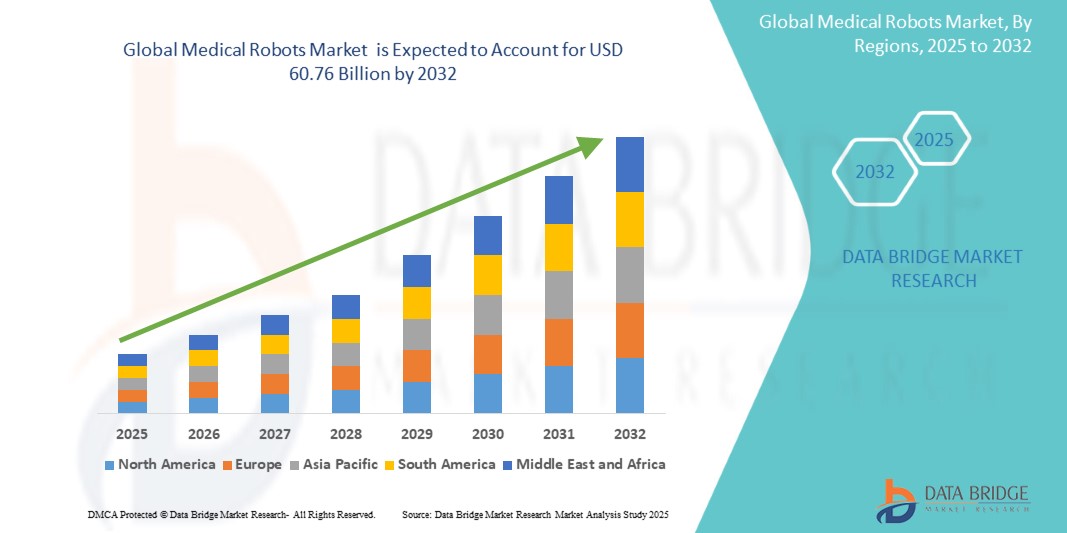

- The global medical robots market was valued at USD 18.28 billion in 2024 and is expected to reach USD 60.76 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 10.62%, primarily driven by the anticipated launch of surgical robots

- This growth is driven by factors such as the demand for minimally invasive procedures, and increasing prevalence of chronic conditions

Medical Robots Market Analysis

- Medical Robots are critical tools across various surgical disciplines, including cardiology, neurology, orthopedics, and minimally invasive procedures. They enhance precision, reduce recovery time, and minimize surgical risks through robotic-assisted technologies such as da Vinci systems, robotic catheters, and autonomous navigation platforms

- The global demand for medical robots is significantly driven by rising surgical volumes, increasing preference for minimally invasive procedures, and a growing elderly population. The integration of AI and machine learning into robotic platforms is further enhancing their capabilities and boosting market adoption

- The Asia-Pacific region is emerging as one of the fastest-growing markets for Medical Robots, supported by expanding healthcare infrastructure, increasing healthcare expenditure, and a rising number of government initiatives promoting advanced medical technologies

- For instance, countries such as China, Japan, and South Korea are heavily investing in healthcare automation, with a notable increase in robotic-assisted surgeries and locally manufactured robotic systems tailored for regional needs

- Globally, medical robots are ranked among the top three most crucial technological investments in modern operating rooms, following surgical navigation systems and endoscopic devices. Their role in improving surgical outcomes and optimizing operating room efficiency continues to expand across developed and emerging economies

Report Scope and Medical Robots Market Segmentation

|

Attributes |

Medical Robots Key Market Insights |

|

Segments Covered |

• By Type: External Large Robots, Geriatric Robots, Assistive Robots, and Miniature In Vivo Robots • By Product Type: Surgical Robots, Rehabilitation Robots, Hospital and Pharmacy Robots, Bio Robotics, Non-invasive Radio Surgery Robots, Telepresence Robots, Medical Transportation Robots, Sanitation and Disinfectant Robots • By Modality: Compact and Portable • By Components: Actuators, Sensors, Robot Controller, Patient Cart, Surgeon Console, Vision Cart, Dispensing System, and Additional Products • By Application: Neurology Applications, Cardiology Applications, Orthopedic Applications, Laparoscopic Applications, Physical Rehabilitation, and Pharmacy Applications • By End User: Hospitals, Specialty Clinics, Research Institutes, Ambulatory Surgical Centers (ASCs), Laboratories, Rehabilitation Centers, and Others • By Distribution Channel: Direct Tender, Retail Sales, Third Party Distributors, and Others |

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Medical Robots Market Trends

“Increasing Adoption of Minimally Invasive Robotic Surgery (MIS)”

- A prominent trend in the global medical robots market is the increasing adoption of minimally invasive robotic surgery across various specialties

- These robotic systems enhance surgical precision, offer greater dexterity and visualization for surgeons, leading to smaller incisions, reduced blood loss, faster recovery times, and potentially better patient outcomes

- For instance, robotic surgery allows for complex procedures to be performed through small incisions, reducing the risk of infection and scarring compared to traditional open surgery. This is particularly beneficial in areas like urology, gynecology, and general surgery

- The integration of advanced imaging, AI-powered assistance, and enhanced instrumentation within these robotic platforms further expands their capabilities and applicability in a wider range of surgical interventions

- This trend is transforming surgical practices, improving patient experiences, and driving the demand for sophisticated minimally invasive robotic surgery systems globally

Medical Robots Market Dynamics

Driver

“Growing Demand for Precision and Accuracy in Surgical Procedures”

- The increasing complexity of surgical procedures and the growing emphasis on improving patient outcomes are significantly driving the demand for medical robots

- Robotic systems offer surgeons enhanced precision, stability, and control during delicate and intricate surgeries, minimizing human error and improving the accuracy of interventions

- This is particularly crucial in specialties like neurosurgery, cardiac surgery, and orthopedics, where even small inaccuracies can have significant consequences for the patient

For instance,

- In March 2024, according to an article published by National Center for Biotechnology Information, the development of minimally invasive spinal surgery utilizing navigation and robotics has significantly improved the feasibility, accuracy, and efficiency of this surgery

- In December 2022, according to the article published by National Center for Biotechnology Information, Robotics in spinal surgery offers a promising potential to refine and improve the minimally invasive transforaminal lumbar interbody fusion (MI-TLIF) technique. Suitable surgeons for this technique include those who are already familiar with robotic-guided lumbar pedicle screw placement and want to advance their skillset by incorporating posterior-based interbody fusion

- The ability of robots to perform complex movements in confined spaces and with greater dexterity than human hands further contributes to their increasing adoption in demanding surgical fields

- As the focus on surgical precision and patient safety intensifies, the demand for medical robots capable of delivering these benefits continues to rise

Opportunity

“Leveraging Artificial Intelligence (AI) and Machine Learning (ML) for Enhanced Robotic Capabilities”

- The integration of AI and ML into medical robots presents a significant opportunity to enhance their capabilities in areas such as surgical planning, intraoperative guidance, and autonomous tasks

- AI algorithms can analyze vast amounts of medical data, including imaging and patient history, to assist surgeons in pre-operative planning, optimize surgical pathways, and provide real-time decision support during procedures

For instance,

- In January 2025, according to an article published in the World Laparoscopy Hospital, AI algorithms integrated with robotic surgery systems can analyze vast amounts of medical data and previous surgical outcomes to guide surgeons with precision, potentially reducing human error

- In November 2023, according to an article published in the National Library of Medicine, AI algorithms can analyze real-time images and provide instant feedback to surgeons during surgical procedures, helping identify potential complications and optimize surgical pathways

- ML algorithms can enable robots to learn from past surgical data, potentially leading to the development of robots capable of performing certain surgical tasks with increasing autonomy, under the supervision of a surgeon.

- This integration of AI and ML has the potential to revolutionize surgical workflows, improve accuracy, reduce surgeon fatigue, and ultimately enhance patient outcomes.

Restraint/Challenge

“High Initial Investment and Maintenance Costs”

- The substantial upfront cost of acquiring medical robotic systems and the ongoing expenses associated with their maintenance, specialized training, and consumables pose a significant challenge to market penetration, particularly for smaller hospitals and healthcare facilities in developing economies

- The high capital expenditure required for these advanced technologies can create a barrier to entry, limiting their adoption to larger, well-funded institutions

For instance,

- In November 2024, according to an article published by the Ningbo Haishu HONYU Opto-Electro Co., Ltd, the initial investment for a robotic surgery system, such as the da Vinci Surgical System, can range from USD 1 million to USD 2.5 million, depending on the model and additional features

- The need for specialized surgical teams trained in robotic surgery and the costs associated with their training further contribute to the overall financial burden

- Addressing these high costs through innovative financing models, cost-effective robotic solutions, and government support will be crucial for broader market adoption and equitable access to these advanced surgical technologies

Medical Robots Market Scope

The market is segmented on the basis of type, product, modality, components, application, end user, and distribution channel.

|

Segmentation |

Sub-Segmentation |

|

By Type |

|

|

By Product |

|

|

By Modality |

|

|

By Components

|

|

|

By Application |

|

|

By End User

|

|

|

Distribution Channel |

|

Medical Robots Market Regional Analysis

“North America is the Dominant Region in the Medical Robots Market”

- North America holds the largest share in the global medical robots market, primarily due to its well-established healthcare infrastructure, high adoption of robotic-assisted surgeries, and continuous innovation in surgical technology

- The presence of key market players such as Intuitive Surgical, Medtronic, and Stryker contributes to the region’s dominance through ongoing R&D and frequent product launches.

- The region also benefits from favorable reimbursement scenarios and strong regulatory support for advanced surgical systems

- For instance, in March 2023, the Cleveland Clinic in the U.S. inaugurated a center for robotic and advanced surgery, aiming to strengthen robotic surgery innovation and physician training

“Asia-Pacific is Projected to Register the Highest Growth Rate”

- Asia-Pacific is expected to witness the fastest CAGR during the forecast period, driven by rapid healthcare digitization, government support, rising awareness, and a growing patient population in need of advanced medical interventions

- Countries like China, India, Japan, and South Korea are at the forefront of robotics adoption, fueled by domestic innovation and expanding healthcare access

- Increased investment by both public and private players in healthcare infrastructure is propelling market penetration across urban and semi-urban centers

- For instance, in August 2023, AIIMS Delhi, a premier medical institute in India, installed its third robotic surgery system to increase access to minimally invasive surgeries

Medical Robots Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- iRobot Corporation (U.S.)

- Titan Medical Inc. (Canada)

- Hansen Technologies (Australia)

- Renishaw plc (U.K.)

- Intuitive Surgical Operations, Inc. (U.S.)

- Medtronic (Ireland)

- DENSO CORPORATION. (U.S.)

- Accuray Incorporated (U.S.)

- Stryker (U.S.)

- Varian Medical Systems, Inc. (U.K.)

- Stereotaxis, Inc. (U.S.)

- Ekso Bionics (U.S.)

- CYBERDYNE INC. (Japan)

- BIONIK (U.S.)

- Smith+Nephew (U.K.)

- Zimmer Biomet (U.S.)

- ARxIUM (Canada)

Latest Developments in Global Medical Robots Market

- In July 2024, AIRS Medical successfully secured USD 20 million in a Series C funding round aimed at advancing the development of large language model (LLM)-driven companion robots designed to enhance mental well-being. This funding will facilitate the creation of innovative robotic solutions that leverage AI to support individuals in managing their mental health. The investment underscores a growing interest in integrating technology into mental health care, paving the way for improved therapeutic options

- In May 2024, AiM Medical Robotics formed a partnership with Brigham and Women’s Hospital to assess the capabilities of its robotic system for deep brain stimulation in patients suffering from Parkinson’s disease. This collaboration aims to explore the potential benefits of robotic-assisted interventions in enhancing treatment outcomes for individuals with this neurological condition. The agreement highlights the growing interest in integrating advanced robotics into clinical practice to improve patient care and therapeutic efficacy

- In February 2024, Medical Microinstruments successfully raised USD 110 million in a Series C funding round dedicated to the development of advanced microsurgical robots. This significant investment aims to enhance the precision and effectiveness of surgical procedures through innovative robotic technology. The funding reflects a strong commitment to advancing microsurgery and underscores the growing interest in integrating robotics into the medical field to improve patient outcomes

- In June 2023, Touchlab, a deep tech robotics company, unveiled a groundbreaking robot designed to enable doctors to remotely "feel" their patients during a trial at a hospital in Finland. The Välkky telerobot is operated by individuals wearing specialized gloves, utilizing advanced electronic skin technology to convey tactile sensations from its robotic hand to the users. During a three-month trial at Laakso Hospital in Helsinki, a trained team of nurses will assess the robot's effectiveness in enhancing patient care, reducing their workload, and minimizing the risk of transmitting infections or diseases

- In October 2021, Medtronic obtained CE mark approval for its Hugo robotic-assisted surgery (RAS) system, allowing the sale of this innovative technology across Europe. Earlier, in April 2021, Zimmer Biomet secured FDA clearance for its ROSA Partial Knee System, designed for robotically assisted partial knee replacement surgeries. These approvals reflect a growing recognition of robotic systems in enhancing surgical precision and patient outcomes in the evolving landscape of medical technology

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.