Global Medical Tapes Market

Market Size in USD Billion

CAGR :

%

USD

1.51 Billion

USD

2.25 Billion

2025

2033

USD

1.51 Billion

USD

2.25 Billion

2025

2033

| 2026 –2033 | |

| USD 1.51 Billion | |

| USD 2.25 Billion | |

|

|

|

|

Medical Tapes Market Size

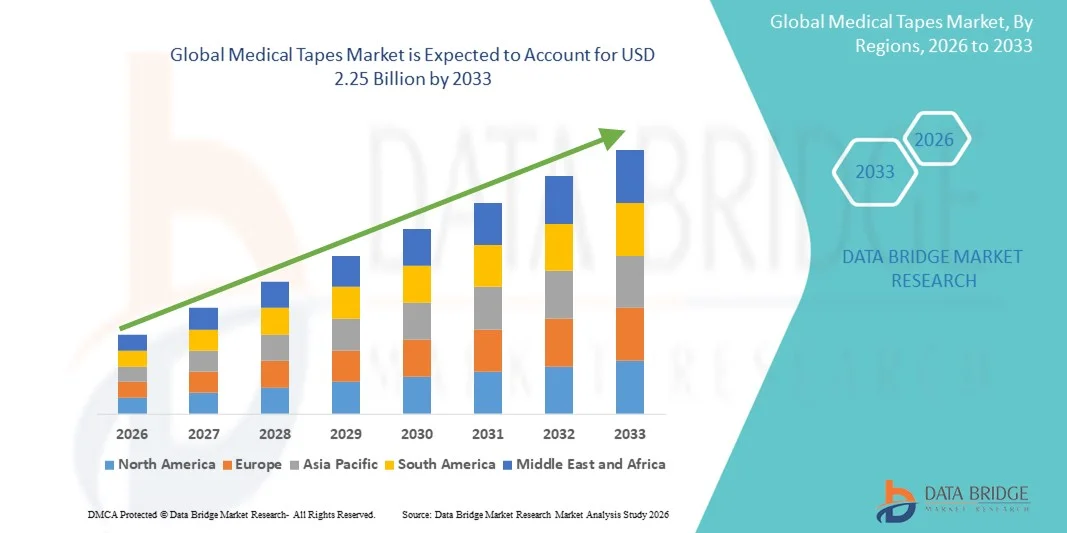

- The global medical tapes market size was valued at USD 1.51 billion in 2025 and is expected to reach USD 2.25 billion by 2033, at a CAGR of 5.16% during the forecast period

- The market growth is largely fueled by the growing adoption of advanced wound care and medical adhesion products, increasing surgical procedures, and rising demand for patient-friendly and skin-safe solutions in both hospitals and homecare settings

- Furthermore, growing awareness of infection prevention, need for efficient wound management, and increasing use of medical tapes in diagnostics, surgery, and therapy applications are accelerating the uptake of Medical Tapes solutions, thereby significantly boosting the industry's growth

Medical Tapes Market Analysis

- Medical tapes, providing secure adhesion for wound care, surgical, and diagnostic applications, are increasingly vital components in modern healthcare settings due to their ease of use, skin safety, and compatibility with various medical procedures

- The escalating demand for medical tapes is primarily fueled by the rising number of surgical procedures, growing awareness of infection prevention, and increasing adoption of advanced wound care solutions in hospitals, clinics, and homecare settings

- North America dominated the medical tapes market with the largest revenue share of approximately 38.7% in 2025, supported by a well-established healthcare system, high surgical procedure rates, strong adoption of advanced wound care solutions, and the presence of key domestic and multinational manufacturers. The U.S. specifically is experiencing substantial growth due to increased use in hospitals, surgical centers, and homecare applications

- Asia-Pacific is expected to be the fastest growing region in the medical tapes market during the forecast period, registering a robust CAGR of around 10.5%, driven by increasing healthcare expenditure, expanding hospital infrastructure, rising awareness of infection prevention, and growing adoption of medical tapes in countries such as China and India

- The adhesive tapes segment dominated the largest market revenue share of 42.5% in 2025, driven by their versatile use across hospitals, surgical centers, and homecare settings

Report Scope and Medical Tapes Market Segmentation

|

Attributes |

Medical Tapes Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

• Johnson & Johnson (U.S.) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Medical Tapes Market Trends

Rising Adoption of Advanced Medical Tapes for Patient Care and Wound Management

- A significant trend in the global medical tapes market is the increasing adoption of advanced medical tapes designed for improved patient comfort, adhesion, and skin protection

- Healthcare providers are increasingly using specialized tapes such as silicone tapes, breathable non-woven tapes, and elastic tapes in hospitals, clinics, and homecare settings. These tapes offer benefits such as reduced skin irritation, enhanced flexibility, and secure fixation for dressings, IV lines, and splints

- The focus on patient-centric care, especially for geriatric, pediatric, and burn care patients, is driving innovation in tape formulations and designs

- There is also a growing preference for tapes that are easy to tear, hypoallergenic, and compatible with sensitive skin, minimizing discomfort during removal

- Medical tapes are increasingly used in both surgical and post-operative applications, supporting faster healing and improved outcomes

- The development of breathable and water-resistant tapes is further enhancing their adoption in intensive care, outpatient, and homecare settings

- Global healthcare awareness campaigns, rising chronic wound prevalence, and the need for infection control are accelerating the use of medical tapes

- Integration with modern wound care protocols and hospital infection prevention guidelines is supporting widespread clinical adoption

- The trend is further strengthened by the availability of tapes in various forms, including adhesive, elastic, silicone, and non-woven varieties, catering to diverse patient needs

- Healthcare professionals are increasingly recognizing the role of medical tapes in reducing dressing displacement, protecting wounds, and providing secure fixation for medical devices

- Overall, the trend reflects a shift toward safer, more efficient, and patient-friendly solutions in wound management and general medical care

Medical Tapes Market Dynamics

Driver

Increasing Demand from Hospitals, Clinics, and Homecare Settings

- The growing prevalence of chronic wounds, post-surgical care requirements, and emergency trauma cases is driving strong demand for medical tapes

- For instance, in 2022, Smith & Nephew expanded its Durapore™ Surgical Tape usage in U.S. hospitals for secure IV line fixation and post-surgical wound management, demonstrating the growing adoption in hospital and clinical environments

- Hospitals remain the largest end-users, accounting for the majority of revenue due to high patient inflow and complex care requirements

- Ambulatory surgical centers (ASCs), clinics, and homecare settings are increasingly adopting medical tapes for secure fixation of dressings, IV lines, and ostomy seals

- Rising geriatric population and increasing incidence of diabetes, burns, and surgical procedures are major factors contributing to adoption

- The need for reliable, cost-effective, and safe tape solutions for wound care is encouraging hospitals and clinics to standardize their usage of premium tapes

- Homecare adoption is growing as more patients opt for outpatient therapy and self-managed wound care, especially in developed regions

- Medical tapes support infection prevention and reduce dressing replacement frequency, which improves patient outcomes and reduces healthcare costs

- Healthcare providers prefer tapes that can maintain secure adhesion over prolonged periods while being gentle on the skin

- Increased awareness among caregivers and patients regarding proper wound management is also boosting demand

- Growing healthcare infrastructure investments, expansion of hospital networks, and increasing number of surgeries globally further drive market growth

- In addition, the trend of minimally invasive surgeries and outpatient treatments is increasing the need for flexible, secure, and easy-to-use medical tapes

Restraint/Challenge

High Costs of Specialized Tapes and Regulatory Constraints

- The relatively high cost of advanced medical tapes compared to traditional adhesive solutions is a significant barrier, especially in developing regions and small healthcare facilities

- For instance, premium products like Medline’s Soft Silicone Tape are priced higher than standard adhesive tapes, limiting adoption in cost-sensitive markets despite offering superior skin protection and patient comfort

- Specialized tapes such as silicone, elastic, and breathable variants come at a premium due to their superior material properties and manufacturing processes

- Some healthcare providers and patients may prefer conventional tapes due to budget constraints, limiting the adoption of advanced solutions

- Strict regulatory requirements and compliance with international standards for medical-grade tapes can delay market entry for new products

- Inconsistent availability of premium tapes in remote or underdeveloped regions can restrict growth

- Healthcare staff require proper training to use specialized tapes effectively, which can be a challenge in facilities with limited resources

- Tape adhesion performance can vary depending on skin type, moisture, and environmental conditions, potentially reducing reliability

- Overcoming these challenges requires manufacturers to invest in cost-effective solutions, expand distribution networks, and provide training and educational support for healthcare professionals

- Continued innovation in affordable, skin-friendly, and durable tapes is critical to achieving wider market penetration

- Price sensitivity, especially in emerging economies, remains a key restraint affecting adoption rates of advanced medical tapes globally

Medical Tapes Market Scope

The market is segmented on the basis of product type, application, and distribution channel.

- By Product Type

On the basis of product type, the Medical Tapes market is segmented into adhesive tapes, elastic tapes, silicone tapes, paper tapes, silk cloth tapes, medical breathable PE (polyethylene) tape, medical breathable non-woven tape, easy-tear non-woven cloth tape, and medical rayon tape. The adhesive tapes segment dominated the largest market revenue share of 42.5% in 2025, driven by their versatile use across hospitals, surgical centers, and homecare settings. Adhesive tapes are widely preferred due to their strong adhesion, ease of application, and compatibility with sensitive skin, which makes them suitable for securing dressings, IV lines, and surgical sites. The segment benefits from high recurring demand, as these tapes are single-use in most clinical procedures. Furthermore, their integration into wound care kits, post-operative care, and chronic wound management strengthens market penetration. The reliability, cost-effectiveness, and availability of diverse sizes and designs further reinforce their dominance. Leading manufacturers continuously innovate with hypoallergenic formulations and improved breathability to enhance patient comfort. In addition, the global increase in surgical procedures and rising awareness regarding infection control are key factors driving consistent adoption.

The silicone tapes segment is expected to witness the fastest CAGR of 11.3% from 2026 to 2033, owing to rising preference for skin-friendly, non-irritating tapes that are ideal for sensitive or compromised skin. Silicone tapes are increasingly utilized in wound care, burn care, and post-operative applications, especially among geriatric and pediatric patients. Their ability to adhere securely yet remove gently without damaging the skin is fueling adoption. Technological innovations in medical-grade silicone, coupled with growing awareness among healthcare providers and patients about skin integrity, are driving growth. The tapes’ flexibility, reusability in some applications, and compatibility with delicate areas such as the face or joints make them a preferred solution. Expansion of homecare and outpatient services, where gentle tapes are essential, further contributes to adoption. Moreover, clinicians’ recommendation for silicone-based solutions in chronic wound management and pressure ulcer care is supporting market expansion.

- By Application

On the basis of application, the Medical Tapes market is segmented into splints, wound dressings, secure IV lines, ostomy seals, and surgeries. The wound dressings segment held the largest market revenue share of 36.8% in 2025, driven by the high prevalence of chronic wounds, post-operative care needs, and acute injuries requiring frequent dressing changes. Hospitals and ambulatory surgical centers extensively use medical tapes to secure wound dressings, promote healing, and prevent contamination. The segment benefits from recurring usage and integration into standardized wound care protocols. Advanced adhesive technologies, including breathable and hypoallergenic tapes, further encourage adoption. Rising geriatric populations and increasing incidence of diabetes, vascular disorders, and post-surgical wounds contribute significantly to demand. Clinicians favor tapes that ensure secure fixation while maintaining patient comfort. Additionally, government healthcare initiatives promoting proper wound care practices are driving widespread usage.

The secure IV lines segment is projected to witness the fastest CAGR of 10.9% from 2026 to 2033, supported by growing use in hospitals, outpatient clinics, and homecare settings. Medical tapes are crucial in preventing IV dislodgement, reducing infection risk, and ensuring patient safety. Rising adoption of infusion therapy, chemotherapy, and hydration treatments contributes to increased demand. Elastic and easy-tear tapes that offer flexibility and secure adhesion are gaining popularity in clinical settings. Hospitals increasingly prefer pre-packaged IV kits with integrated tape solutions for standardization and efficiency. The trend toward minimally invasive procedures and short-stay treatments in ambulatory settings further drives market growth. Education and training programs emphasizing secure IV line management in nursing and homecare also support expansion.

- By Distribution Channel

On the basis of distribution channel, the Medical Tapes market is segmented into hospitals, ambulatory surgical centers (ASC), clinics, and homecare settings. The hospitals segment dominated with a revenue share of 41.6% in 2025, attributed to high patient volumes, surgical procedures, and standardized wound care protocols. Hospitals are primary buyers of medical tapes due to bulk procurement, regulatory compliance, and integration into surgical and post-operative care processes. The presence of advanced procurement systems, contracts with leading manufacturers, and strong clinical adoption ensure continuous demand. Hospitals also prefer high-quality, certified tapes that meet stringent hygiene and performance standards. Frequent usage in ICU, operating rooms, emergency care, and chronic wound management contributes to recurring demand. Additionally, hospitals increasingly adopt tapes with improved adhesion, hypoallergenic properties, and skin-friendliness to enhance patient outcomes.

The homecare settings segment is expected to witness the fastest CAGR of 10.7% from 2026 to 2033, fueled by rising outpatient care, chronic wound management, and DIY healthcare practices. Growth in homecare services for post-operative care, IV therapy, and pressure ulcer management is driving tape usage. Patients and caregivers prefer easy-to-use, skin-friendly, and secure medical tapes for daily wound care. Increasing awareness about infection prevention, convenience, and home treatment options is promoting adoption. Technological improvements, such as breathable, elastic, and hypoallergenic tapes, enhance usability in home settings. Rising disposable income, access to online retail channels, and availability of homecare kits further accelerate growth. The trend toward patient-centric care and telemedicine-based home monitoring is also contributing to increased tape usage in homecare applications.

Medical Tapes Market Regional Analysis

- North America dominated the medical tapes market with the largest revenue share of approximately 38.7% in 2025, driven by a well-established healthcare system, high rates of surgical procedures, and strong adoption of advanced wound care solutions. The presence of major domestic and multinational manufacturers further strengthens market leadership. The U.S. specifically captured the majority of the regional share, supported by increasing utilization of medical tapes across hospitals, ambulatory surgical centers, and homecare applications

- Rising awareness about infection prevention and advancements in surgical and wound care practices are fueling demand. In addition, the integration of innovative tape technologies with specialized adhesives and hypoallergenic materials is promoting adoption. High healthcare expenditure, coupled with robust insurance coverage, facilitates accessibility to premium medical tapes

- Continuous R&D investments by key players, along with regulatory approvals for new products, further enhance market penetration. The convenience, safety, and efficiency offered by modern medical tapes are leading to sustained preference among healthcare providers

U.S. Medical Tapes Market Insight

The U.S. medical tapes market accounted for the largest share in North America, driven by substantial demand across hospitals and homecare settings in 2025. Adoption is fueled by increased awareness of wound care protocols and preventive healthcare practices. Hospitals and surgical centers are increasingly using advanced tapes for post-operative care, secure dressing fixation, and patient comfort. The rising prevalence of chronic wounds, coupled with a growing geriatric population, supports continuous growth. Innovations in adhesive technology, including skin-friendly, breathable, and waterproof options, are enhancing product performance. Furthermore, integration with hospital supply chains and institutional procurement strategies ensures consistent demand. The market benefits from strong domestic manufacturing and distribution infrastructure. Rising healthcare expenditure and insurance coverage for wound care products further stimulate adoption. Market expansion is also supported by educational campaigns emphasizing proper wound care management.

Europe Medical Tapes Market Insight

The Europe medical tapes market is projected to expand at a steady CAGR throughout the forecast period, supported by stringent healthcare regulations and growing adoption of advanced wound care practices. Increasing urbanization, coupled with higher incidence of surgical procedures, is driving the need for reliable medical tapes in hospitals, clinics, and homecare. Countries such as Germany, France, and Italy are witnessing rising investments in healthcare infrastructure, which supports product penetration. European consumers and healthcare providers increasingly favor innovative, skin-friendly tapes that reduce irritation and enhance healing. The growth of private and public healthcare institutions, along with reimbursement policies for medical consumables, further bolsters market expansion. Emphasis on infection prevention, post-operative care, and chronic wound management drives consistent product usage. Continuous R&D by regional manufacturers ensures the availability of high-quality, innovative tapes.

Germany Medical Tapes Market Insight

The Germany medical tapes market is expected to expand at a considerable CAGR during the forecast period, fueled by a strong focus on digital healthcare and advanced surgical practices. Germany’s well-developed healthcare infrastructure, along with its emphasis on innovation and sustainable medical solutions, encourages the adoption of advanced medical tapes. Hospitals, surgical centers, and long-term care facilities prefer tapes with enhanced adhesion, breathability, and hypoallergenic properties. Integration with wound care protocols and advanced dressing systems improves patient outcomes. Regulatory frameworks ensure quality and safety, increasing physician confidence in products. In addition, Germany’s emphasis on preventive healthcare and infection control supports higher usage. The availability of eco-friendly and technologically advanced medical tapes aligns with consumer and institutional preferences, contributing to sustained market growth.

Asia-Pacific Medical Tapes Market Insight

The Asia-Pacific medical tapes market is poised to grow at the fastest CAGR of around 10.5% during the forecast period, driven by increasing healthcare expenditure, expanding hospital infrastructure, and rising awareness of infection prevention. Countries such as China, India, Japan, and South Korea are witnessing rapid growth in surgical procedures, chronic wound management, and homecare services. Adoption is fueled by government initiatives to improve healthcare accessibility, urbanization, and the growing middle-class population. Technological advancements in adhesive materials, skin-friendly formulations, and multifunctional tapes are accelerating adoption. Increasing collaborations between global and local manufacturers enhance product availability and affordability. Hospitals, clinics, and homecare providers are investing in reliable, high-performance tapes to improve patient outcomes. Rising awareness of post-operative care and wound management practices also strengthens market growth in the region.

China Medical Tapes Market Insight

The China medical tapes market accounted for the largest revenue share in Asia-Pacific in 2025, supported by rapid urbanization, expanding hospital infrastructure, and a growing middle-class population. The country’s healthcare sector is experiencing significant modernization, with increased surgical procedures and homecare adoption driving demand for medical tapes. Government healthcare initiatives and investment in hospital expansion further boost usage. The rise in chronic diseases, post-operative care, and awareness of infection control practices increases reliance on high-quality tapes. Availability of cost-effective products and a strong domestic manufacturing base ensures wide accessibility. Adoption is further enhanced by increasing collaborations with multinational manufacturers to bring innovative products to local markets.

Japan Medical Tapes Market Insight

The Japan medical tapes market is growing steadily due to the country’s high-tech healthcare infrastructure, aging population, and emphasis on patient convenience. Hospitals and homecare providers increasingly rely on advanced medical tapes for surgical, chronic wound, and post-operative applications. Skin-friendly, hypoallergenic, and waterproof tapes are particularly preferred to address sensitive skin issues among the elderly. Integration with modern wound care protocols and homecare services strengthens adoption. Government policies promoting high-quality healthcare and insurance coverage for wound care products support market growth. The trend towards minimally invasive surgeries and enhanced patient comfort drives continuous demand. Japan’s preference for technologically advanced medical solutions ensures the introduction and adoption of innovative tape products.

Medical Tapes Market Share

The Medical Tapes industry is primarily led by well-established companies, including:

• Johnson & Johnson (U.S.)

• Medline Industries (U.S.)

• Smith & Nephew (U.K.)

• Cardinal Health (U.S.)

• HARTMANN Group (Germany)

• Nitto Denko Corporation (Japan)

• Paul Hartmann AG (Germany)

• Beiersdorf AG (Germany)

• Andover Healthcare (U.S.)

• Lohmann & Rauscher (Germany)

Latest Developments in Global Medical Tapes Market

- In February 2023, 3M, a leading global healthcare and adhesive solutions provider, launched the 3M Medical Tape 4578, an innovative adhesive tape designed to provide extended wear of up to 28 days for sensors, health monitors, and long‑term medical wearables, doubling the industry standard and enhancing comfort and durability for chronic patient applications. This launch marked a significant step in tape technology by enabling more reliable, long‑term device attachment in both clinical and home care environments

- In January 2023, H.B. Fuller Company introduced Swift Melt 1515‑I, a bio‑compatible adhesive engineered for medical tape applications, offering superior skin adhesion even in hot and humid conditions, particularly tailored for non‑woven surgical tapes and sensitive patient use. This product underscores the growing industry focus on patient‑centric, high‑performance materials suitable for global environments

- In October 2024, Solventum launched a new double‑coated medical tape featuring both hi‑tack silicone and acrylate adhesives designed for sensitive‑skin applications, responding to clinical demand for tapes that combine strong adhesion with reduced skin trauma, especially in repeated or long‑duration applications

- In December 2024, Ahlstrom, a major fiber and adhesive manufacturer, unveiled a fiber‑based transparent tape backing aimed at reducing plastic use and improving sustainability in medical adhesive tapes, supporting healthcare institutions’ increasing emphasis on environmentally friendly consumables and waste reduction

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.