Global Medicated Feed Additives Market

Market Size in USD Billion

CAGR :

%

USD

17.45 Billion

USD

25.98 Billion

2025

2033

USD

17.45 Billion

USD

25.98 Billion

2025

2033

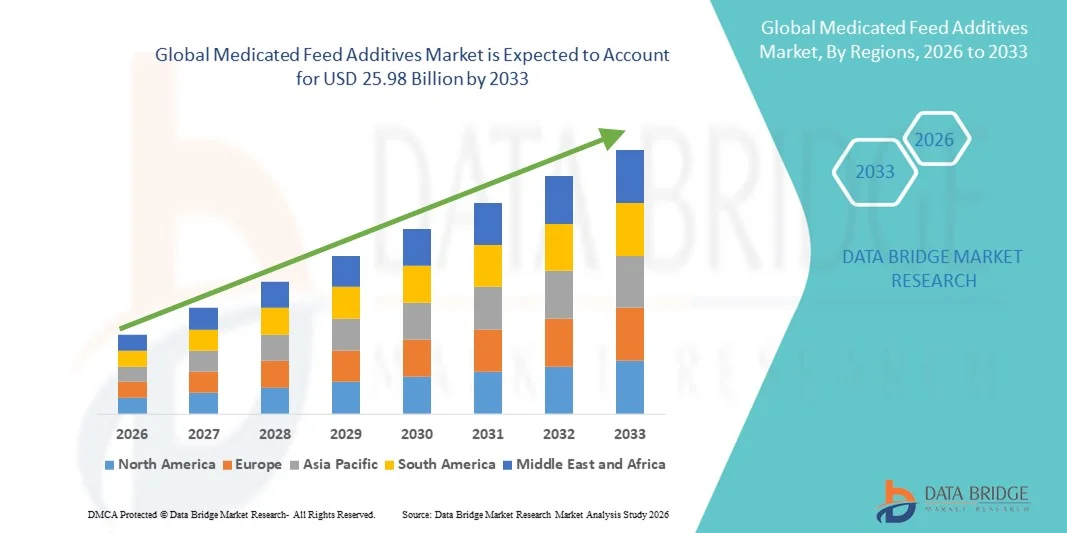

| 2026 –2033 | |

| USD 17.45 Billion | |

| USD 25.98 Billion | |

|

|

|

|

Medicated Feed Additives Market Size

- The global medicated feed additives market size was valued at USD 17.45 billion in 2025 and is expected to reach USD 25.98 billion by 2033, at a CAGR of 5.10% during the forecast period

- The market growth is largely fuelled by the rising prevalence of livestock diseases and increasing emphasis on animal health and productivity in commercial farming systems

- Growing demand for high-quality animal protein, particularly meat, dairy, and eggs, is supporting the adoption of medicated feed additives to improve feed efficiency and overall herd performance

Medicated Feed Additives Market Analysis

- The market is characterised by steady demand driven by intensive livestock farming practices and the need to maintain animal health under high-density rearing conditions

- Regulatory oversight and veterinary prescription requirements influence product development and usage patterns, encouraging manufacturers to focus on safe, effective, and compliant formulations

- North America dominated the medicated feed additives market with the largest revenue share in 2025, driven by advanced livestock farming practices, strong veterinary infrastructure, and high awareness regarding animal health and productivity

- Asia-Pacific region is expected to witness the highest growth rate in the global medicated feed additives market, driven by growing population, increasing meat consumption, expanding commercial farming activities, and improving awareness of livestock disease prevention

- The antibiotics segment held the largest market revenue share in 2025, driven by their widespread use in preventing and controlling bacterial infections in livestock and improving feed efficiency. Antibiotics continue to be adopted in regulated therapeutic applications to support animal health and productivity

Report Scope and Medicated Feed Additives Market Segmentation

|

Attributes |

Medicated Feed Additives Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

• ADM (U.S.) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Medicated Feed Additives Market Trends

Rising Focus On Animal Health And Disease Prevention

- The increasing emphasis on maintaining animal health and preventing disease outbreaks is significantly shaping the medicated feed additives market, as livestock producers adopt preventive healthcare approaches to improve productivity and reduce mortality. Medicated feed additives are widely used to control infections, enhance growth performance, and improve feed efficiency, supporting consistent production outcomes in intensive farming systems. This trend is strengthening adoption across poultry, swine, cattle, and aquaculture operations, encouraging manufacturers to develop targeted and effective formulations

- Growing awareness among farmers and commercial producers regarding biosecurity, herd health management, and disease prevention has accelerated the use of medicated feed additives in animal diets. Rising demand for high-quality meat, dairy, and eggs is pushing producers to maintain animal health standards, leading to greater reliance on medicated feeds to ensure optimal growth and reduced disease incidence

- Advancements in veterinary science and feed technology are influencing market trends, with manufacturers focusing on improving efficacy, safety, and controlled dosage delivery of medicated feed additives. Clean production practices, regulatory compliance, and traceability are increasingly prioritised, helping producers meet industry standards and maintain consumer confidence in animal-derived food products

- For instance, in 2024, major animal nutrition companies expanded their medicated feed additive portfolios by introducing advanced formulations aimed at improving disease resistance and feed conversion efficiency in livestock. These products were adopted by large-scale commercial farms to support preventive health strategies and improve production consistency across supply chains

- While demand for medicated feed additives continues to rise, long-term market growth depends on regulatory alignment, responsible usage, and ongoing innovation to balance productivity benefits with concerns around antimicrobial resistance. Manufacturers are investing in research, improved formulations, and compliance-driven solutions to support sustainable market expansion

Medicated Feed Additives Market Dynamics

Driver

Growing Emphasis On Livestock Health And Productivity

- Rising incidence of livestock diseases and the need to maintain herd health are major drivers for the medicated feed additives market. Producers are increasingly incorporating medicated additives into animal feed to prevent infections, improve growth rates, and enhance feed efficiency, supporting higher productivity in intensive farming environments

- Expanding commercial livestock operations and increasing demand for animal protein are reinforcing the adoption of medicated feed additives. These additives help maintain animal performance and reduce economic losses associated with disease outbreaks, enabling producers to meet growing consumption demand while maintaining production efficiency

- Feed manufacturers and veterinary service providers are actively promoting medicated feed additive solutions through product innovation, advisory services, and compliance with veterinary guidelines. In addition, collaborations between feed producers and animal health companies are supporting the development of effective and regulated solutions that align with industry requirements

- For instance, in 2023, leading feed manufacturers reported increased use of medicated feed additives in poultry and swine production systems to manage disease risks and improve feed conversion ratios. These initiatives were driven by rising production targets and growing emphasis on preventive healthcare practices among large-scale farms

- Although livestock health concerns strongly support market growth, sustained adoption relies on responsible usage, veterinary oversight, and continuous innovation to address resistance risks and ensure long-term effectiveness

Restraint/Challenge

Stringent Regulations And Concerns Over Antimicrobial Resistance

- Strict regulatory frameworks governing the use of medicated feed additives present a key challenge for market growth. Compliance with veterinary prescriptions, usage limits, and withdrawal periods increases operational complexity for producers and manufacturers. These regulations can restrict product availability and slow adoption in certain production systems

- Growing concerns around antimicrobial resistance have heightened scrutiny on the use of medicated feed additives, particularly antibiotics. Increased awareness among regulators, consumers, and industry stakeholders is driving pressure to reduce routine usage, prompting manufacturers to invest in alternative solutions and improved formulations

- Regulatory compliance, documentation requirements, and monitoring systems also add to production and distribution costs. Manufacturers must invest in quality control, testing, and certification processes to meet regulatory standards, which can limit market penetration, particularly for smaller producers

- For instance, in 2024, livestock producers reported cautious adoption of medicated feed additives due to tighter regulations and increased inspections related to antimicrobial usage. These factors led some producers to limit usage to therapeutic applications only, affecting overall consumption volumes

- Addressing these challenges will require balanced regulatory approaches, continued research into safer and effective alternatives, and education initiatives to promote responsible use. Strengthening collaboration between regulators, manufacturers, and producers will be essential to support sustainable growth in the global medicated feed additives market

Medicated Feed Additives Market Scope

The market is segmented on the basis of type, mixture type, livestock, and category.

- By Type

On the basis of type, the global medicated feed additives market is segmented into Amino Acids, Tryptophan, Lysine, Methionine, Threonine, Feed Enzymes, Phytase, Non-Starch Polysaccharides, Other Enzymes, Antibiotics, Acidifiers, Antioxidants, Natural, Synthetic, and Others. The antibiotics segment held the largest market revenue share in 2025, driven by their widespread use in preventing and controlling bacterial infections in livestock and improving feed efficiency. Antibiotics continue to be adopted in regulated therapeutic applications to support animal health and productivity.

The feed enzymes segment is expected to witness significant growth from 2026 to 2033, supported by rising demand for improved nutrient absorption and feed efficiency. Enzymes such as phytase and non-starch polysaccharides are increasingly used to enhance digestibility, reduce feed costs, and support sustainable livestock production practices.

- By Mixture Type

On the basis of mixture type, the market is segmented into Supplements, Concentrates, Premix Feeds, and Base Mixes. The premix feeds segment accounted for the largest share in 2025, driven by their balanced formulation, ease of use, and consistent nutrient delivery across commercial livestock operations. Premixes are widely preferred by feed manufacturers and large farms due to their ability to ensure uniform distribution of medicated additives.

The supplements segment is expected to witness significant growth from 2026 to 2033, supported by increasing adoption in targeted nutrition and disease prevention programs. Supplements offer flexibility in dosage and formulation, making them suitable for specific health conditions and growth stages.

- By Livestock

Based on livestock, the global medicated feed additives market is segmented into Ruminants, Poultry, Swine, Aquaculture, and Others. The poultry segment dominated the market in 2025, driven by high production volumes, short growth cycles, and greater vulnerability to infectious diseases. Medicated feed additives are extensively used in poultry to improve feed conversion ratios and reduce mortality rates.

The aquaculture segment is expected to register the fastest growth from 2026 to 2033, supported by the rapid expansion of fish and shrimp farming and increasing focus on disease control in aquatic environments. Rising global demand for seafood is further encouraging the use of medicated feeds in aquaculture systems.

- By Category

On the basis of category, the market is segmented into Supplement, Concentrate, Premix Feed, Base Mix, and Others. The premix feed category held the largest market share in 2025, attributed to its convenience, consistent quality, and widespread adoption in industrial feed production. Premix feeds help ensure accurate dosing of medicated additives while meeting regulatory requirements.

The supplement category is expected to witness significant growth from 2026 to 2033, driven by increasing demand for customized feeding solutions and preventive healthcare strategies. In addition, supplements are gaining traction among producers seeking flexible and cost-effective approaches to animal health management.

Medicated Feed Additives Market Regional Analysis

- North America dominated the medicated feed additives market with the largest revenue share in 2025, driven by advanced livestock farming practices, strong veterinary infrastructure, and high awareness regarding animal health and productivity

- Livestock producers in the region place strong emphasis on disease prevention, feed efficiency, and consistent animal performance, supporting widespread adoption of medicated feed additives across commercial operations

- This dominance is further supported by high investment in animal nutrition, stringent quality standards, and the growing demand for meat, dairy, and poultry products, positioning medicated feed additives as a critical component of modern livestock production

U.S. Medicated Feed Additives Market Insight

The U.S. medicated feed additives market captured the largest revenue share in 2025 within North America, supported by large-scale commercial livestock operations and strong focus on preventive animal healthcare. Producers are increasingly incorporating medicated feed additives to manage disease risks, improve feed conversion ratios, and enhance overall productivity. In addition, well-established feed manufacturing infrastructure and strong regulatory oversight are supporting steady market growth.

Europe Medicated Feed Additives Market Insight

The Europe medicated feed additives market is expected to witness steady growth from 2026 to 2033, driven by strict animal health regulations and increasing focus on food safety and traceability. Rising demand for high-quality animal protein and emphasis on controlled use of medicated feeds are supporting adoption. The region is seeing growing use of regulated and prescription-based medicated additives across poultry, swine, and ruminant production systems.

U.K. Medicated Feed Additives Market Insight

The U.K. medicated feed additives market is expected to witness steady growth from 2026 to 2033, supported by increasing focus on animal welfare and disease prevention in livestock farming. Concerns related to animal health, productivity, and biosecurity are encouraging the use of medicated feed additives under veterinary supervision. In addition, demand from commercial poultry and dairy farms continues to support market expansion.

Germany Medicated Feed Additives Market Insight

The Germany medicated feed additives market is expected to witness consistent growth from 2026 to 2033, driven by advanced livestock management practices and strong emphasis on animal health and sustainability. Germany’s well-developed agricultural infrastructure and focus on regulated feed solutions support the adoption of medicated feed additives. The market also benefits from ongoing innovation in feed formulations and compliance-driven usage.

Asia-Pacific Medicated Feed Additives Market Insight

The Asia-Pacific medicated feed additives market is expected to witness the fastest growth rate from 2026 to 2033, driven by rapid expansion of livestock farming, rising population, and increasing demand for animal protein in countries such as China, India, and Japan. Improving awareness of animal health management and growing commercial farming activities are accelerating the adoption of medicated feed additives across the region.

Japan Medicated Feed Additives Market Insight

The Japan medicated feed additives market is expected to witness steady growth from 2026 to 2033, supported by high standards of animal health management and advanced farming technologies. The country’s focus on disease prevention, feed efficiency, and livestock productivity is driving adoption. In addition, aging farmer demographics are encouraging the use of efficient and reliable feed solutions to maintain production levels.

China Medicated Feed Additives Market Insight

The China medicated feed additives market accounted for the largest revenue share in Asia Pacific in 2025, driven by large livestock populations, rapid industrialisation of animal farming, and strong demand for meat and poultry products. The expansion of commercial farms and increasing emphasis on disease control are supporting widespread use of medicated feed additives. In addition, government focus on food security and productivity enhancement continues to propel market growth in China.

Medicated Feed Additives Market Share

The Medicated Feed Additives industry is primarily led by well-established companies, including:

• ADM (U.S.)

• Cargill, Incorporated. (U.S.)

• CHS Inc. (U.S.)

• Zoetis Inc. (U.S.)

• Land O’Lakes, Inc. (U.S.)

• Delacon Biotechnik GmbH (Austria)

• Biomin GmbH (Austria)

• Dow (U.S.)

• Natural Remedies (India)

• Synthite Industries Ltd. (India)

• Adisseo (France)

• Alltech (U.S.)

• Zagro (Singapore)

• Hipro Ic Ve Dis Ticaret San.ve Tic Ltd.sti. (Turkey)

• Biostadt India Limited. (India)

• BASF SE (Germany)

• Evonik Industries AG (Germany)

• Nutreco N.V. (Netherlands)

• Novozymes (Denmark)

• Phibro Animal Health Corporation (U.S.)

Latest Developments in Global Medicated Feed Additives Market

- In March 2025, Kemin Industries, Inc., product launch, introduced PROSIDIUM, a feed pathogen control system based on peroxy acids, aimed at eliminating Salmonella and viruses in animal feed. This development enhances feed and food safety by improving biosecurity and ensuring uniform application, strengthening Kemin’s position in feed hygiene solutions and supporting overall market advancement

- In October 2024, Phibro Animal Health Corporation, acquisition, acquired a portfolio of medicated feed additives and water-soluble products from Zoetis Inc. for USD 350 million. The acquisition expanded Phibro’s animal health and nutrition offerings across cattle, swine, and poultry, enhancing its competitive presence while enabling Zoetis to refocus investments on vaccines and biologics, influencing market consolidation

- In August 2024, Boehringer Ingelheim India, strategic partnership, entered a distribution agreement with Vvaan Lifesciences Private Limited to expand its pet parasiticide portfolio. This collaboration aims to strengthen market penetration, improve customer reach, and support growth of animal health solutions, contributing to broader adoption of medicated feed and health products

- In July 2024, Merck Animal Health, acquisition, acquired the aquaculture business of Elanco Animal Health Incorporated. This move enhances Merck’s aquaculture capabilities by offering integrated solutions for fish health, welfare, and sustainability, reinforcing its market position and supporting the expansion of medicated feed additives in aquaculture applications

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.