Global Medium Density Fiberboard Market

Market Size in USD Billion

CAGR :

%

USD

36.30 Billion

USD

57.00 Billion

2025

2033

USD

36.30 Billion

USD

57.00 Billion

2025

2033

| 2026 –2033 | |

| USD 36.30 Billion | |

| USD 57.00 Billion | |

|

|

|

|

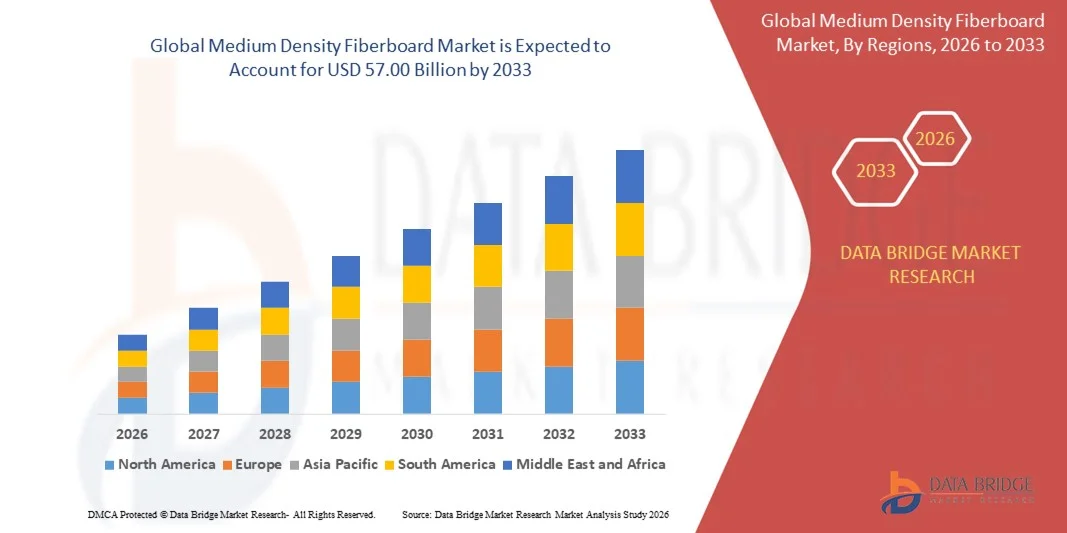

What is the Global Medium Density Fiberboard Market Size and Growth Rate?

- The global medium density fiberboard market size was valued at USD 36.30 billion in 2025 and is expected to reach USD 57.00 billion by 2033, at a CAGR of5.8% during the forecast period

- The rise in the product application in the furniture and construction applications acts as one of the major factors driving the growth of the medium density fiberboard market

- The increase in demand for MDF in furniture and extensive use of these boards in building materials, and rise in the production of these boards due to the easy availability of raw materials accelerate the market growth

What are the Major Takeaways of Medium Density Fiberboard Market?

- The increase in demand for medium density fiberboard due to the structural and non-structural applications within the construction industry and the advent of superior adhesion techniques with low formaldehyde resins such as phenol-formaldehyde further influence the market

- In addition, increases in disposable income in developing nations, urbanization and industrialization, and job-driven migration positively affect the medium density fiberboard market. Furthermore, technical innovations and improvements in the production process extend profitable opportunities to the market players

- North America dominated the medium density fiberboard market with a 34.26% revenue share in 2025, driven by strong growth in residential construction, furniture manufacturing, interior remodeling, and commercial infrastructure development across the U.S. and Canada

- Europe is projected to register the fastest CAGR of 8.36% from 2026 to 2033, driven by rising demand for sustainable building materials, strict environmental regulations, and growing adoption of low-emission MDF products

- The Standard MDF segment dominated the market with an estimated 54.6% revenue share in 2025, owing to its wide usage in furniture manufacturing, cabinetry, wall panels, and interior applications

Report Scope and Medium Density Fiberboard Market Segmentation

|

Attributes |

Medium Density Fiberboard Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Medium Density Fiberboard Market?

Increasing Shift Toward Sustainable, Lightweight, and High-Performance Wood-Based Panels

- The medium density fiberboard market is witnessing a growing shift toward eco-friendly, low-emission, and sustainably sourced MDF products to meet tightening environmental regulations

- Manufacturers are introducing lightweight, moisture-resistant, and high-density MDF variants with improved surface finish for furniture, cabinetry, and interior applications

- Rising demand for engineered wood products in modular furniture, ready-to-assemble furniture, and interior décor is driving innovation in MDF formulations

- For instance, companies such as Kronospan, EGGER Group, ARAUCO, Georgia-Pacific, and West Fraser are expanding production of E0/E1-grade MDF with enhanced durability and sustainability credentials

- Increasing focus on circular economy practices, including recycled wood fibers and bio-based resins, is accelerating adoption across residential and commercial construction

- As demand for cost-effective, versatile, and environmentally responsible materials grows, MDF continues to gain importance in global furniture and building industries

What are the Key Drivers of Medium Density Fiberboard Market?

- Rising demand for affordable and versatile materials in furniture manufacturing, interior design, and construction sectors

- For instance, during 2024–2025, leading MDF manufacturers increased capacity and introduced low-formaldehyde and CARB-compliant boards to meet regulatory and consumer expectations

- Rapid urbanization, growth in residential housing, and expansion of commercial spaces across Asia-Pacific and Latin America are boosting MDF consumption

- Advancements in pressing technology, resin systems, and surface finishing have improved strength, machinability, and aesthetic appeal

- Growing use of MDF in flooring substrates, wall panels, doors, and cabinetry supports sustained demand

- Supported by expanding furniture exports, rising disposable income, and continuous product innovation, the Medium Density Fiberboard market is expected to witness steady long-term growth

Which Factor is Challenging the Growth of the Medium Density Fiberboard Market?

- Volatility in raw material prices, particularly wood fibers and resins, impacts production costs and profit margins

- For instance, during 2024–2025, fluctuations in timber supply, energy costs, and transportation expenses affected MDF manufacturing economics

- Environmental concerns related to formaldehyde emissions and deforestation increase compliance costs for producers

- Competition from plywood, particleboard, and alternative engineered panels limits pricing flexibility

- Sensitivity to moisture and lower structural strength compared to solid wood restricts usage in certain applications

- To address these challenges, manufacturers are focusing on sustainable sourcing, advanced resin technologies, lightweight MDF development, and regulatory compliance to strengthen global market adoption

How is the Medium Density Fiberboard Market Segmented?

The market is segmented on the basis of product, application, and end-user.

- By Product

On the basis of product, the medium density fiberboard market is segmented into Standard MDF, Moisture Resistant MDF, and Fire Resistant MDF. The Standard MDF segment dominated the market with an estimated 54.6% revenue share in 2025, owing to its wide usage in furniture manufacturing, cabinetry, wall panels, and interior applications. Standard MDF offers a smooth surface finish, excellent machinability, and cost-effectiveness, making it the preferred choice for mass-market residential and commercial furniture. High availability, ease of customization, and compatibility with laminates and veneers further support strong adoption across developing and developed regions.

The Moisture Resistant MDF segment is expected to grow at the fastest CAGR from 2026 to 2033, driven by rising demand for MDF in kitchens, bathrooms, flooring substrates, and humid environments. Increasing construction activity, improved resin technologies, and growing awareness of durable engineered wood solutions are accelerating adoption of moisture-resistant MDF products globally.

- By Application

On the basis of application, the medium density fiberboard market is segmented into Cabinet, Flooring, Furniture, Molding, Door and Millwork, Packaging System, and Others. The Furniture segment dominated the market with a 41.8% share in 2025, supported by rapid growth in ready-to-assemble furniture, modular furniture, and home décor industries. MDF is extensively used in furniture due to its uniform density, design flexibility, smooth edges, and ability to support intricate designs. Expansion of residential housing, rising urbanization, and increasing demand for cost-effective furniture solutions further strengthen this segment.

The Flooring segment is projected to grow at the fastest CAGR from 2026 to 2033, driven by rising adoption of MDF as a core material in laminated and engineered flooring systems. Growth in commercial construction, renovation activities, and demand for aesthetically appealing, durable flooring solutions are fueling segment expansion.

- By End-user

On the basis of end-user, the medium density fiberboard market is segmented into Residential, Commercial, and Institutional. The Residential segment dominated the market with a 49.3% revenue share in 2025, driven by strong demand for MDF-based furniture, cabinets, doors, and interior fittings in housing projects. Rising disposable income, increased home renovation activities, and growing preference for modern interior designs significantly boost MDF consumption in residential applications. The affordability and versatility of MDF make it a preferred material for homeowners and furniture manufacturers asuch as.

The Commercial segment is expected to grow at the fastest CAGR from 2026 to 2033, supported by expanding office spaces, retail outlets, hospitality infrastructure, and corporate buildings. Increasing use of MDF in partitions, furniture, wall panels, and decorative interiors is driving strong demand across commercial construction projects worldwide.

Which Region Holds the Largest Share of the Medium Density Fiberboard Market?

- North America dominated the medium density fiberboard market with a 34.26% revenue share in 2025, driven by strong growth in residential construction, furniture manufacturing, interior remodeling, and commercial infrastructure development across the U.S. and Canada. High demand for ready-to-assemble furniture, cabinets, flooring substrates, and decorative panels continues to fuel MDF consumption across housing projects, offices, retail spaces, and hospitality facilities

- Leading manufacturers in North America are investing in advanced production technologies, low-emission resins, moisture-resistant MDF grades, and sustainable wood sourcing, strengthening the region’s market leadership. Continuous focus on green building standards and eco-certified wood products supports long-term growth

- Well-established furniture industries, strong distribution networks, and high consumer spending on home improvement further reinforce North America’s dominance

U.S. Medium Density Fiberboard Market Insight

The U.S. is the largest contributor in North America, supported by strong housing demand, extensive furniture production, and rising renovation activities. Increasing preference for engineered wood products in cabinetry, doors, flooring, and interior applications drives steady MDF consumption. Presence of major furniture brands, robust construction spending, and innovation in MDF finishes further support market growth.

Canada Medium Density Fiberboard Market Insight

Canada contributes significantly due to growth in residential construction, renovation projects, and furniture manufacturing. Rising adoption of MDF in cabinets, wall panels, and interior décor, along with increasing focus on sustainable building materials, strengthens market demand across the country.

Europe Medium Density Fiberboard Market

Europe is projected to register the fastest CAGR of 8.36% from 2026 to 2033, driven by rising demand for sustainable building materials, strict environmental regulations, and growing adoption of low-emission MDF products. Expansion of modular furniture, prefabricated construction, and interior renovation activities across Germany, France, the U.K., Italy, and Eastern Europe is accelerating MDF usage. Strong emphasis on circular economy practices, recycled wood fiber usage, and eco-label certifications supports rapid market expansion.

Germany Medium Density Fiberboard Market Insight

Germany leads the European market due to a strong furniture manufacturing base, advanced wood processing technologies, and high adoption of eco-friendly MDF products. Demand from residential, commercial, and industrial interiors continues to grow steadily.

Which are the Top Companies in Medium Density Fiberboard Market?

The medium density fiberboard industry is primarily led by well-established companies, including:

- GREEN HIGH LANDS (China)

- Clarion Industries (U.S.)

- Guangxi Sunway Forest Products Industry Co., Ltd. (China)

- Nelson Pine Industries Limited (New Zealand)

- Focus Technology Co., Ltd. (China)

- Kronospan (Austria)

- EGGER Group (Austria)

- Yonglin Group (China)

- shundefurniture (China)

- Georgia-Pacific (U.S.)

- Guangxi Fenglin Wood Industry Group Co., Ltd. (China)

- Dongwha Group (South Korea)

- Dare Panel Group Co., Ltd. (China)

- Norbord (Canada)

- Nag Hamady Fiber Board Co. (Egypt)

- Kastamonu Entegre (Turkey)

- ARAUCO (Chile)

- West Fraser (Canada)

- CenturyPly (India)

- Calplant I, LLC. (U.S.)

- EVERGREEN FIBREBOARD BERHAD (Malaysia)

What are the Recent Developments in Global Medium Density Fiberboard Market?

- In May 2025, Homanit, a German MDF manufacturer, announced plans to establish its first U.S. manufacturing facility in Alcolu, South Carolina, with an investment of USD 250 million. The greenfield plant is expected to be operational by 2028 and aims to strengthen Homanit's presence in the North American market while creating around 300 new jobs, reinforcing the company’s commitment to global expansion and local employment growth

- In February 2025, Greenpanel Industries, India’s leading MDF producer, expanded its annual production capacity from 660,000 CBM to 891,000 CBM at its Srikalahasti facility in Andhra Pradesh. The expansion introduced a thin MDF range (1.5 mm to 1.7 mm) using advanced ContiPress Technology (Dieffenbacher CPS+) to ensure high-quality output, demonstrating Greenpanel’s focus on innovation and maintaining industry leadership

- In 2023, Sonae Arauco, a wood-based panel manufacturer, launched its new Innovus Collection at interzum Cologne. The collection features more than 220 decorative solutions and over 40 new decor innovations, including natural woods such as Karlstad Oak and fantasy designs such as textile Canasta and stone decor Fossil Brown, highlighting the company’s commitment to design excellence and trend-driven product development

- In December 2020, Arauco acquired a majority stake in Odd Industries, an ethically-driven industrial artificial intelligence developer. The company plans to integrate Odd Industries’ AI platform with its LiDAR-based sustainable forestry experience to address climate change, emphasizing Arauco’s strategic focus on innovation and environmental sustainability

- In June 2020, Centuryply entered the Indian e-commerce sector by signing an agreement with Flipkart. The company launched product lines such as Club Prime, Sainik 710, and Sainik MR on the platform and plans to expand offerings further, marking a significant step toward digital adoption and leveraging the post-pandemic online shopping trend

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Medium Density Fiberboard Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Medium Density Fiberboard Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Medium Density Fiberboard Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.