Global Medium Density Fibreboard Mdf Decorative Overlays Market

Market Size in USD Million

CAGR :

%

USD

499.29 Million

USD

801.82 Million

2025

2033

USD

499.29 Million

USD

801.82 Million

2025

2033

| 2026 –2033 | |

| USD 499.29 Million | |

| USD 801.82 Million | |

|

|

|

|

Medium-density Fibreboard (MDF) Decorative Overlays Market Size

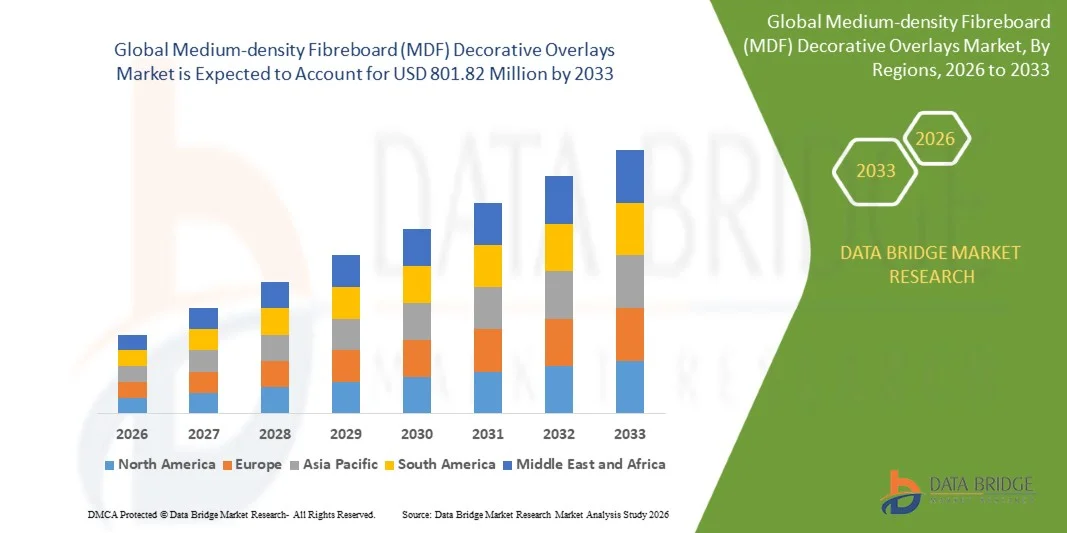

- The global medium-density fibreboard (MDF) decorative overlays market size was valued at USD 499.29 million in 2025 and is expected to reach USD 801.82 million by 2033, at a CAGR of 6.10% during the forecast period

- The market growth is largely fuelled by the increasing demand for aesthetically enhanced and cost-effective furniture and interior décor solutions across residential and commercial sectors

- Rising urbanization and expansion of real estate and construction activities are significantly contributing to the adoption of MDF decorative overlays in flooring, wall panels, cabinetry, and furniture applications

Medium-density Fibreboard (MDF) Decorative Overlays Market Analysis

- The market is witnessing steady growth driven by rising consumer inclination toward modern interior designs, wood-like finishes, and decorative surfaces that offer durability and visual appeal at lower costs compared to solid wood alternatives

- Technological advancements in digital printing, thermally fused laminates, and surface texturing are enhancing product quality and customization capabilities, enabling manufacturers to cater to diverse design preferences and sustainability requirements

- North America dominated the medium-density fibreboard (MDF) decorative overlays market with the largest revenue share in 2025, driven by strong demand for modular furniture, interior renovation projects, and advanced decorative surface technologies

- Asia-Pacific region is expected to witness the highest growth rate in the global medium-density fibreboard (MDF) decorative overlays market, driven by expanding construction activities, rising disposable incomes, growing furniture manufacturing base, and increasing adoption of modern interior design trends

- The Polyvinyl Chloride (PVC) segment held the largest market revenue share in 2025 driven by its durability, moisture resistance, and cost-effectiveness. PVC overlays are widely used in furniture and cabinetry applications as they provide enhanced surface protection, design flexibility, and ease of maintenance. Their compatibility with various textures and finishes makes them a preferred choice for residential and commercial interiors

Report Scope and Medium-density Fibreboard (MDF) Decorative Overlays Market Segmentation

|

Attributes |

Medium-density Fibreboard (MDF) Decorative Overlays Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Medium-density Fibreboard (MDF) Decorative Overlays Market Trends

“Rising Demand for Aesthetic And Cost-Effective Interior Solutions”

• The growing preference for visually appealing and affordable interior décor solutions is significantly shaping the MDF decorative overlays market, as consumers increasingly seek wood-like finishes and premium surface designs at lower costs. MDF decorative overlays are gaining traction due to their ability to enhance appearance, durability, and surface performance without the high expense of solid wood. This trend strengthens their adoption across residential, commercial, and institutional construction projects, encouraging manufacturers to introduce innovative textures, colors, and finishes that align with modern design preferences

• Increasing urbanization and expansion of real estate and renovation activities have accelerated the demand for MDF decorative overlays in furniture, cabinetry, flooring, and wall panel applications. Homeowners, architects, and interior designers are actively selecting decorative overlays that offer design flexibility and consistent quality. This has also led to collaborations between overlay manufacturers and furniture producers to develop customized and trend-driven surface solutions

• Design innovation and sustainability trends are influencing purchasing decisions, with manufacturers emphasizing eco-friendly materials, low-emission resins, and certified wood sources. These factors are helping brands differentiate products in a competitive market and build trust among environmentally conscious consumers, while also driving the adoption of green building certifications and sustainable construction practices

• For instance, in 2024, leading furniture manufacturers in Germany and Italy expanded their modular furniture collections by incorporating advanced thermally fused laminates and decorative overlays on MDF panels. These product launches were introduced in response to rising demand for contemporary interior styles and cost-efficient furnishing solutions, with distribution across retail showrooms and online platforms. The collections were also promoted as sustainable and durable alternatives to solid wood furniture, enhancing brand positioning

• While demand for MDF decorative overlays is growing, sustained market expansion depends on continuous technological advancements, cost-effective production, and maintaining performance standards such as scratch resistance and moisture durability. Manufacturers are also focusing on improving digital printing capabilities, supply chain efficiency, and scalable manufacturing processes to meet increasing global demand

Medium-density Fibreboard (MDF) Decorative Overlays Market Dynamics

Driver

“Growing Construction And Furniture Industry Expansion”

• Rising investments in residential and commercial construction projects are a major driver for the MDF decorative overlays market. Developers and contractors are increasingly utilizing MDF panels with decorative overlays to achieve aesthetic appeal and cost efficiency in large-scale projects. This trend is also pushing innovation in overlay materials and surface finishing technologies to enhance product performance and longevity

• Expanding applications in modular furniture, kitchen cabinetry, wardrobes, retail fixtures, and office interiors are influencing market growth. MDF decorative overlays help improve surface durability, design consistency, and ease of installation while maintaining affordability, enabling manufacturers to meet growing demand for stylish and functional interior products. The increasing popularity of ready-to-assemble furniture globally further reinforces this trend

• Furniture and building material manufacturers are actively promoting MDF overlay-based solutions through product innovation, digital customization tools, and sustainability certifications. These efforts are supported by rising consumer demand for modern interior aesthetics and eco-conscious materials, encouraging partnerships between panel producers and decorative surface suppliers to improve quality and reduce environmental impact

• For instance, in 2023, manufacturers in the U.S. and China reported increased production of laminated MDF boards for use in residential renovation and commercial interior projects. This expansion followed higher demand for affordable and design-oriented furnishing materials, driving repeat procurement from construction firms and furniture brands. Companies also highlighted compliance with emission standards and sustainable sourcing practices to strengthen customer confidence

• Although rising construction activities support growth, broader adoption depends on raw material price stability, efficient manufacturing processes, and compliance with environmental regulations. Investment in advanced surface technologies, recycling initiatives, and optimized logistics networks will be critical for sustaining long-term competitiveness

Restraint/Challenge

“Volatility In Raw Material Prices And Environmental Concerns”

• Fluctuating prices of wood fibers, resins, and decorative papers remain a key challenge, impacting production costs and profit margins for MDF decorative overlay manufacturers. Dependence on timber supply and petrochemical-based adhesives can create cost instability. In addition, stricter environmental regulations regarding formaldehyde emissions can increase compliance costs and limit product acceptance in certain regions

• Awareness regarding environmental sustainability and indoor air quality is increasing, particularly in developed markets. Concerns related to emissions from MDF products may restrict adoption if manufacturers fail to meet regulatory standards. This also encourages a shift toward alternative materials, intensifying competition within the decorative surface industry

• Supply chain and distribution complexities also influence market growth, as manufacturers must source certified raw materials and ensure adherence to quality and environmental standards. Logistical challenges and transportation costs can affect pricing competitiveness, especially in export-oriented markets. Companies must invest in efficient sourcing strategies and sustainable production technologies to maintain product reliability

• For instance, in 2024, panel distributors in parts of Southeast Asia reported cautious procurement due to rising resin prices and increased regulatory scrutiny on emission standards. Some furniture producers temporarily reduced inventory levels to manage costs and compliance requirements, affecting short-term demand for decorative overlays. These factors also prompted manufacturers to explore low-emission adhesives and recycled fiber alternatives

• Overcoming these challenges will require investment in sustainable raw materials, emission-reducing technologies, and cost optimization strategies. Collaboration with regulatory bodies, certification agencies, and construction stakeholders can help unlock the long-term growth potential of the global MDF decorative overlays market. Furthermore, strengthening recycling initiatives and promoting eco-friendly product lines will be essential for maintaining market acceptance and competitive positioning

Medium-density Fibreboard (MDF) Decorative Overlays Market Scope

The market is segmented on the basis of product type, medium-density fibreboard (MDF) type, and application.

• By Product Type

On the basis of product type, the global medium-density fibreboard (MDF) decorative overlays market is segmented into Polyvinyl Chloride (PVC), Polyethylene Terephthalate (PET) and Others. The Polyvinyl Chloride (PVC) segment held the largest market revenue share in 2025 driven by its durability, moisture resistance, and cost-effectiveness. PVC overlays are widely used in furniture and cabinetry applications as they provide enhanced surface protection, design flexibility, and ease of maintenance. Their compatibility with various textures and finishes makes them a preferred choice for residential and commercial interiors.

The Polyethylene Terephthalate (PET) segment is expected to witness the fastest growth rate from 2026 to 2033, driven by rising demand for environmentally friendly and low-emission decorative materials. PET overlays offer recyclability, improved surface clarity, and strong resistance to scratches and stains, making them suitable for modern interior applications. Growing focus on sustainable construction materials further supports the adoption of PET-based overlays.

• By Medium-density Fibreboard (MDF) Type

On the basis of medium-density fibreboard (MDF) type, the market is segmented into Softwood Medium-density Fibreboard (MDF) and Hardwood Medium-density Fibreboard (MDF). The Softwood Medium-density Fibreboard (MDF) segment accounted for the largest market revenue share in 2025 owing to its widespread availability, uniform texture, and cost efficiency. Softwood MDF is extensively utilized in decorative overlay applications such as wall panels, shelving, and ready-to-assemble furniture due to its ease of machining and finishing.

The Hardwood Medium-density Fibreboard (MDF) segment is projected to register steady growth during the forecast period, supported by its higher density and enhanced strength characteristics. Hardwood MDF is increasingly preferred in premium furniture, doors, and high-load applications where durability and structural integrity are critical.

• By Application

On the basis of application, the global MDF decorative overlays market is segmented into Furniture, Kitchen Cabinets, Doors and Others. The Furniture segment dominated the market in 2025 driven by rising demand for modular, aesthetically appealing, and affordable furniture products. Decorative overlays enhance the visual appeal, surface finish, and durability of tables, wardrobes, and storage units, making them widely adopted in residential and commercial spaces.

The Kitchen Cabinets segment is expected to witness significant growth from 2026 to 2033, fueled by increasing renovation activities and demand for moisture-resistant and easy-to-maintain surfaces. Decorative overlays provide scratch resistance and design versatility, making them suitable for modern kitchen interiors. The Doors and Others segment also contributes to market expansion as builders and interior designers increasingly incorporate decorative MDF panels into interior door designs and architectural applications.

Medium-density Fibreboard (MDF) Decorative Overlays Market Regional Analysis

• North America dominated the medium-density fibreboard (MDF) decorative overlays market with the largest revenue share in 2025, driven by strong demand for modular furniture, interior renovation projects, and advanced decorative surface technologies

• Consumers in the region highly value durable, aesthetically appealing, and cost-effective surface finishes that replicate natural wood textures while ensuring long-term performance

• This widespread adoption is further supported by a well-established construction sector, high residential remodeling activity, and the presence of leading furniture manufacturers, establishing MDF decorative overlays as a preferred solution for residential and commercial interior applications

U.S. Medium-density Fibreboard (MDF) Decorative Overlays Market Insight

The U.S. medium-density fibreboard (MDF) decorative overlays market captured the largest revenue share in 2025 within North America, fueled by increasing home renovation activities and strong demand for ready-to-assemble and customized furniture. Consumers are increasingly prioritizing modern interior aesthetics combined with affordability and durability. The growing preference for laminated and thermally fused decorative surfaces, along with expansion in residential and commercial construction projects, further propels the MDF decorative overlays industry. Moreover, compliance with emission standards and adoption of sustainable materials are significantly contributing to market growth.

Europe Medium-density Fibreboard (MDF) Decorative Overlays Market Insight

The Europe medium-density fibreboard (MDF) decorative overlays market is expected to witness the fastest growth rate from 2026 to 2033, primarily driven by rising demand for eco-friendly building materials and high-quality interior finishes. Increasing renovation of residential properties and expansion of commercial spaces are fostering product adoption. European consumers are also drawn to premium textures and sustainable decorative solutions. The region is experiencing significant growth across furniture, cabinetry, and door applications, with overlays being incorporated into both new construction and refurbishment projects.

U.K. Medium-density Fibreboard (MDF) Decorative Overlays Market Insight

The U.K. medium-density fibreboard (MDF) decorative overlays market is expected to witness the fastest growth rate from 2026 to 2033, driven by expanding residential remodeling projects and growing demand for stylish yet affordable furniture solutions. In addition, increasing focus on space optimization and modular interior designs is encouraging the use of decorative MDF panels. The U.K.’s strong retail distribution network and rising adoption of sustainable construction materials are expected to continue stimulating market growth.

Germany Medium-density Fibreboard (MDF) Decorative Overlays Market Insight

The Germany medium-density fibreboard (MDF) decorative overlays market is expected to witness the fastest growth rate from 2026 to 2033, fueled by strong demand for precision-engineered furniture and high-performance decorative surfaces. Germany’s advanced manufacturing capabilities, combined with its emphasis on sustainability and emission compliance, promote the adoption of innovative overlay technologies. The integration of recyclable materials and low-emission adhesives is becoming increasingly prevalent, aligning with stringent regulatory standards and consumer expectations.

Asia-Pacific Medium-density Fibreboard (MDF) Decorative Overlays Market Insight

The Asia-Pacific medium-density fibreboard (MDF) decorative overlays market is expected to witness the fastest growth rate from 2026 to 2033, driven by rapid urbanization, rising disposable incomes, and expanding construction activities in countries such as China, Japan, and India. The region’s growing furniture manufacturing base and increasing demand for cost-efficient interior materials are accelerating product adoption. Furthermore, improvements in local production capabilities and distribution networks are enhancing affordability and market accessibility across residential and commercial segments.

Japan Medium-density Fibreboard (MDF) Decorative Overlays Market Insight

The Japan medium-density fibreboard (MDF) decorative overlays market is expected to witness the fastest growth rate from 2026 to 2033 due to rising demand for compact, functional, and visually refined interior solutions. The Japanese market places strong emphasis on quality craftsmanship and efficient space utilization. The adoption of decorative MDF panels in residential apartments, offices, and retail interiors is supporting growth. Moreover, technological advancements in surface finishing and moisture-resistant overlays are encouraging wider application in both residential and commercial projects.

China Medium-density Fibreboard (MDF) Decorative Overlays Market Insight

The China medium-density fibreboard (MDF) decorative overlays market accounted for the largest market revenue share in Asia Pacific in 2025, attributed to rapid urban development, expanding middle-class population, and strong domestic furniture production. China represents one of the largest manufacturing hubs for MDF panels and decorative materials, supporting large-scale supply and cost competitiveness. The push toward modern housing projects and the availability of affordable decorative overlay solutions, alongside strong local manufacturers, are key factors propelling the market in China.

Medium-density Fibreboard (MDF) Decorative Overlays Market Share

The Medium-density Fibreboard (MDF) Decorative Overlays industry is primarily led by well-established companies, including:

- Hyundai L&C. (South Korea)

- TAGHLEEF INDUSTRIES GROUP (U.A.E.)

- HUECK FOLIEN GmbH (Germany)

- ISA International (Italy)

- Eurovinyl Plus (Italy)

- OMNOVA Solutions Inc. (U.S.)

- RENOLIT SE (Germany)

- DACKOR, INC. (U.S.)

- Mitsubishi Polyester Film, Inc. (Japan)

- RIKEN TECHNOS CORP (Japan)

- ALNO AG (Germany)

- Inter IKEA Systems B.V. (Netherlands)

- DAIKEN CORPORATION (Japan)

- Nobia (Sweden)

- Kastamonu Integrated (Turkey)

- West Fraser (Canada)

- EGGER Group (Austria)

- Kronoplus Limited (U.K.)

- Alvic (Spain)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Medium Density Fibreboard Mdf Decorative Overlays Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Medium Density Fibreboard Mdf Decorative Overlays Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Medium Density Fibreboard Mdf Decorative Overlays Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.