Global Microarray In Agriculture Market

Market Size in USD Million

CAGR :

%

USD

277.83 Million

USD

334.06 Million

2025

2033

USD

277.83 Million

USD

334.06 Million

2025

2033

| 2026 –2033 | |

| USD 277.83 Million | |

| USD 334.06 Million | |

|

|

|

|

What is the Global Microarray in Agriculture Market Size and Growth Rate?

- The global microarray in agriculture market size was valued at USD 277.83 million in 2025 and is expected to reach USD 334.06 million by 2033, at a CAGR of 4.90% during the forecast period

- Major factors that are expected to boost the growth of the microarray in agriculture market in the forecast period are the incredible advantages are accomplished in the speed and accuracy of plant breeding efforts through the utilization of molecular marker

What are the Major Takeaways of Microarray in Agriculture Market?

- The rise in the cost and logistical obstacles related to the technology which can hamper its application is further projected to impede the growth of the microarray in agriculture market in the timeline period

- In addition, the occurrence of various easy-to-use standardization and the easy accessibility of technology and products will further provide potential opportunities for the growth of the microarray in agriculture market in the coming years

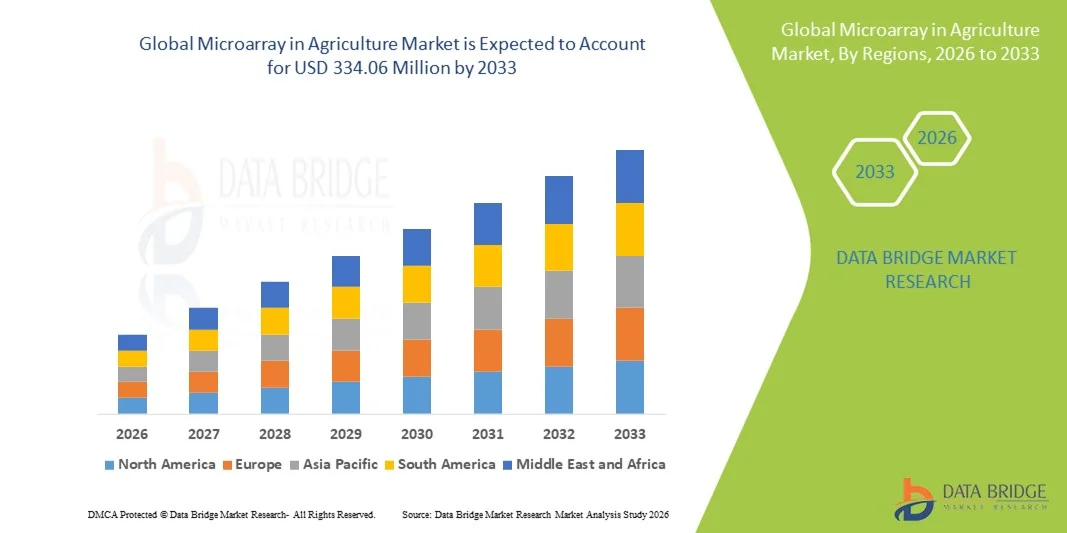

- North America dominated the microarray in agriculture market with a 40.8% revenue share in 2025, driven by strong investments in agricultural biotechnology, advanced genomics research, and precision farming technologies across the U.S. and Canada

- Asia-Pacific is projected to register the fastest CAGR of 11.02% from 2026 to 2033, driven by rising food demand, rapid agricultural modernization, and expanding biotechnology research across China, Japan, India, South Korea, and Southeast Asia

- The Oligonucleotide DNA Microarrays (oDNA) segment dominated the market with a 62.4% share in 2025, owing to their high specificity, reproducibility, and suitability for large-scale SNP genotyping and gene expression profiling in crops and livestock

Report Scope and Microarray in Agriculture Market Segmentation

|

Attributes |

Microarray in Agriculture Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Microarray in Agriculture Market?

Growing Adoption of Genomic-Based Crop Improvement and Precision Agriculture Technologies

- The microarray in agriculture market is witnessing increasing adoption of DNA microarray platforms for crop genotyping, trait mapping, disease resistance identification, and yield optimization programs

- Agricultural biotechnology companies are introducing high-throughput, multi-sample microarray kits with improved sensitivity, faster hybridization processes, and advanced bioinformatics integration

- Rising demand for precision agriculture, climate-resilient crops, and sustainable farming practices is accelerating deployment across research institutes, seed companies, and agri-biotech laboratories

- For instance, companies such as Illumina, Thermo Fisher Scientific, Agilent Technologies, and Merck KGaA have expanded genomic microarray solutions for plant breeding and agricultural research applications

- Increasing focus on reducing crop losses, improving nutritional value, and enhancing resistance to pests and environmental stress is strengthening reliance on molecular diagnostic tools

- As global food demand rises and climate variability intensifies, Microarray in Agriculture technologies will remain essential for advanced crop research, genetic diversity analysis, and sustainable agricultural innovation

What are the Key Drivers of Microarray in Agriculture Market?

- Rising demand for high-throughput genomic analysis tools to support crop improvement, seed quality testing, and agricultural biotechnology research

- For instance, during 2025, leading genomics companies expanded plant-specific microarray panels to support drought tolerance research, hybrid seed validation, and pathogen detection programs

- Growing global population and increasing pressure on food security are driving investments in advanced molecular breeding technologies across the U.S., Europe, and Asia-Pacific

- Advancements in bioinformatics software, automated hybridization systems, and cost-efficient array fabrication have improved data accuracy and reduced processing time

- Expanding adoption of genetically improved crops, precision farming techniques, and agri-genomics research initiatives is accelerating demand for reliable gene expression and SNP analysis platforms

- Supported by government funding for agricultural R&D and rising private-sector investment in biotech-driven farming solutions, the Microarray in Agriculture market is expected to witness sustained long-term growth

Which Factor is Challenging the Growth of the Microarray in Agriculture Market?

- High costs associated with advanced genomic microarray platforms and specialized laboratory infrastructure limit adoption among small-scale agricultural research centers

- During 2024–2025, fluctuations in reagent prices, supply chain disruptions, and increasing raw material costs affected affordability for several regional laboratories

- Complexity in data interpretation, requirement for skilled bioinformatics professionals, and need for advanced laboratory setups create operational challenges

- Limited awareness and technical expertise in developing agricultural economies restrict broader penetration of genomic technologies

- Competition from next-generation sequencing (NGS) technologies and alternative molecular diagnostic tools is creating pricing pressure and shifting research preferences

- To overcome these challenges, companies are focusing on cost-effective array kits, simplified data analysis software, training programs, and collaborative research partnerships to expand global adoption of microarray in agriculture technologies

How is the Microarray in Agriculture Market Segmented?

The market is segmented on the basis of type and application.

- By Type

On the basis of type, the microarray in agriculture market is segmented into Oligonucleotide DNA Microarrays (oDNA) and Complementary DNA Microarrays (cDNA). The Oligonucleotide DNA Microarrays (oDNA) segment dominated the market with a 62.4% share in 2025, owing to their high specificity, reproducibility, and suitability for large-scale SNP genotyping and gene expression profiling in crops and livestock. oDNA arrays are widely used in plant breeding programs, trait mapping, and disease resistance studies due to their ability to detect precise genetic variations. Their standardized probe design, automation compatibility, and integration with bioinformatics platforms further enhance adoption across agricultural research institutes and biotechnology companies.

The Complementary DNA Microarrays (cDNA) segment is projected to grow at the fastest CAGR from 2026 to 2033, driven by increasing demand for cost-effective gene expression analysis in emerging agricultural research markets. Expanding use in functional genomics and stress-response studies is accelerating segment growth.

- By Application

On the basis of application, the market is segmented into Potato, Bovine, Sheep, Rice, and Others. The Rice segment dominated the market with a 34.7% share in 2025, supported by extensive global research focused on improving yield, drought tolerance, pest resistance, and nutritional quality. As rice is a staple food for a large portion of the global population, governments and agricultural research bodies are heavily investing in genomic studies and hybrid seed development programs. Microarrays are widely used for identifying gene markers, studying stress tolerance traits, and enhancing productivity in rice cultivation.

The Bovine segment is expected to grow at the fastest CAGR from 2026 to 2033, driven by rising demand for livestock productivity, disease resistance monitoring, and genetic improvement programs in dairy and meat production. Increasing adoption of genomic selection techniques and precision breeding strategies is accelerating the use of microarray platforms in cattle research and herd management applications.

Which Region Holds the Largest Share of the Microarray in Agriculture Market?

- North America dominated the microarray in agriculture market with a 40.8% revenue share in 2025, driven by strong investments in agricultural biotechnology, advanced genomics research, and precision farming technologies across the U.S. and Canada. Extensive presence of leading genomics companies, well-established research universities, and government-funded agricultural innovation programs continues to fuel market demand

- Leading companies in North America are introducing high-throughput, automated, and bioinformatics-integrated microarray platforms designed for crop improvement, livestock genotyping, and disease resistance analysis. Continuous funding in sustainable agriculture, climate-resilient crops, and food security initiatives strengthens regional technological leadership

- Strong R&D infrastructure, availability of skilled molecular biologists, and collaboration between biotech firms and agricultural institutions further reinforce North America’s dominant market position

U.S. Microarray in Agriculture Market Insight

The U.S. is the largest contributor within North America, supported by extensive agricultural genomics research, large-scale seed production companies, and advanced livestock breeding programs. Rising focus on improving crop yield, pest resistance, and nutritional enhancement is accelerating the adoption of DNA microarray technologies. Government initiatives supporting precision agriculture and biotechnology innovation, along with strong private-sector investment in agri-genomics startups, are driving sustained demand for microarray platforms across research laboratories and commercial agricultural enterprises.

Canada Microarray in Agriculture Market Insight

Canada contributes significantly to regional growth, driven by expanding agricultural research centers and increasing adoption of genomic tools in crop and livestock improvement. Research institutions are actively utilizing microarrays for wheat, canola, and dairy cattle genetic studies. Government-supported innovation funding and focus on sustainable farming practices further promote market expansion across the country.

Asia-Pacific Microarray in Agriculture Market

Asia-Pacific is projected to register the fastest CAGR of 11.02% from 2026 to 2033, driven by rising food demand, rapid agricultural modernization, and expanding biotechnology research across China, Japan, India, South Korea, and Southeast Asia. Governments are increasingly investing in crop genomics, hybrid seed development, and livestock productivity enhancement programs. Growing awareness of precision farming and molecular breeding technologies is accelerating adoption of advanced microarray platforms across regional research institutions and agri-biotech companies.

China Microarray in Agriculture Market Insight

China is the largest contributor within Asia-Pacific due to strong government support for agricultural biotechnology and large-scale investments in crop genomics research. Rapid development of high-yield rice, corn, and soybean varieties drives demand for advanced DNA microarray solutions. Expansion of domestic biotech companies and research collaborations further strengthens market growth.

Japan Microarray in Agriculture Market Insight

Japan shows steady growth supported by advanced agricultural research infrastructure and focus on high-quality crop varieties. Increasing research in stress-resistant crops and precision livestock breeding supports continued adoption of microarray technologies.

India Microarray in Agriculture Market Insight

India is emerging as a major growth hub, driven by rising investment in agricultural R&D, expansion of hybrid seed programs, and government initiatives promoting biotechnology-driven farming. Increasing focus on improving rice, wheat, and dairy productivity accelerates market penetration.

South Korea Microarray in Agriculture Market Insight

South Korea contributes significantly due to growing research in smart agriculture, genetic crop improvement, and livestock productivity programs. Technological advancement, government-backed agri-biotech initiatives, and expanding research capabilities support sustained market growth across the country.

Which are the Top Companies in Microarray in Agriculture Market?

The microarray in agriculture industry is primarily led by well-established companies, including:

- Illumina, Inc. (U.S.)

- Affymetrix (U.S.)

- Agilent Technologies, Inc. (U.S.)

- Thermo Fisher Scientific Inc. (U.S.)

- PerkinElmer, Inc. (U.S.)

- Merck KGaA (Germany)

- General Electric Company (U.S.)

- Molecular Devices, LLC. (U.S.)

- Arrayit Corporation (U.S.)

- Microarrays Inc (U.S.)

What are the Recent Developments in Global Microarray in Agriculture Market?

- In March 2025, UNSW Sydney announced the launch of its first Applied Biosystems Axiom PangenomiX Array project aimed at genotyping hundreds of thousands of genetic variants, strengthening its large-scale genomic research and precision analysis capabilities. This initiative enhances advanced genotyping applications and expands institutional research capacity

- In December 2023, Spectrum Solutions acquired Alimetrix, Inc., and Microarrays, Inc., to expand its laboratory infrastructure and broaden its diagnostic and testing service capabilities. This strategic acquisition strengthens its market presence and integrated microarray testing portfolio

- In October 2023, Sengenics Corporation LLC introduced the i-ome discovery platform, a comprehensive protein microarray solution capable of analyzing more than 1,800 autoantigens. This launch advances high-throughput proteomic research and enhances autoimmune disease profiling capabilities

- In July 2023, Arrayjet collaborated with Chemspace to accelerate its small molecule microarray (SMM) service offerings and improve compound screening efficiency. This partnership expands drug discovery applications and strengthens innovation in molecular interaction studies

- In May 2020, PEPperPRINT GmbH announced the availability of the PEPperCHIP Pan-Corona Spike Protein Microarray to support global coronavirus research initiatives. This development reinforced rapid infectious disease research and accelerated immune response analysis capabilities

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.