Global Micromachining Market

Market Size in USD Billion

CAGR :

%

USD

4.37 Billion

USD

7.61 Billion

2025

2033

USD

4.37 Billion

USD

7.61 Billion

2025

2033

| 2026 –2033 | |

| USD 4.37 Billion | |

| USD 7.61 Billion | |

|

|

|

|

Micromachining Market Size

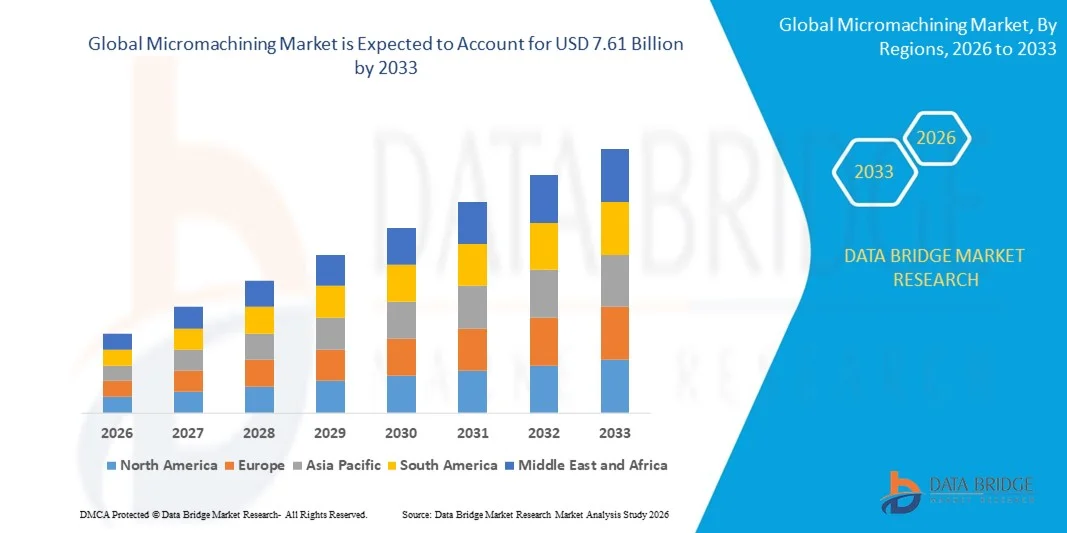

- The global micromachining market size was valued at USD 4.37 billion in 2025 and is expected to reach USD 7.61 billion by 2033, at a CAGR of 7.18% during the forecast period

- The market growth is largely fueled by the rising demand for high-precision and miniaturized components across electronics, medical devices, aerospace, and automotive industries, supported by continuous advancements in laser-based and non-traditional micromachining technologies that enable tighter tolerances and complex geometries

- Furthermore, increasing adoption of advanced manufacturing practices, automation, and Industry 4.0 frameworks is driving manufacturers to integrate micromachining solutions for improved accuracy, efficiency, and material utilization. These converging factors are accelerating the deployment of micromachining systems, thereby significantly boosting overall market growth

Micromachining Market Analysis

-

Micromachining, enabling the fabrication of micro-scale components with high dimensional accuracy and superior surface quality, has become a critical manufacturing process for applications requiring extreme precision in electronics, medical, aerospace, and semiconductor industries

- The growing demand for micromachining is primarily driven by rapid miniaturization trends, increasing use of advanced materials, and the need for high-performance components that cannot be efficiently produced using conventional machining methods

- Asia-Pacific dominated the micromachining market with a share of 50.3% in 2025, due to rapid industrialization, strong electronics and semiconductor manufacturing, and expanding automotive and medical device production

- North America is expected to be the fastest growing region in the micromachining market during the forecast period due to strong demand for advanced manufacturing solutions across aerospace, defense, medical, and semiconductor industries

- Laser segment dominated the market with a market share of 37% in 2025, due to its high precision, non-contact processing capability, and suitability for complex micro-scale geometries. Laser-based systems are widely adopted across electronics, medical devices, and aerospace applications due to their ability to process hard and brittle materials with minimal tool wear

Report Scope and Micromachining Market Segmentation

|

Attributes |

Micromachining Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Micromachining Market Trends

Rising Adoption of Laser and Hybrid Micromachining Technologies

- A major trend in the micromachining market is the increasing adoption of laser and hybrid micromachining technologies, driven by the need for extreme precision, minimal material distortion, and the ability to process complex micro-scale geometries. These technologies are becoming essential in industries that require high accuracy and consistency, particularly electronics, medical devices, and aerospace manufacturing

- For instance, Coherent, Inc. and IPG Photonics Corporation supply advanced laser systems widely used for micromachining applications in semiconductor fabrication and microelectronics production. These systems enable non-contact processing and high repeatability, improving manufacturing efficiency and component quality

- Hybrid micromachining approaches, which combine laser processing with mechanical or electrochemical techniques, are gaining traction as they address limitations of single-process methods. This trend supports machining of hard, brittle, and advanced materials used in next-generation electronic and medical components

- The electronics industry is increasingly adopting laser micromachining for applications such as PCB drilling, micro-cutting, and wafer processing, where precision and speed are critical. This is strengthening the role of laser-based solutions in high-volume micro manufacturing environments

- Medical device manufacturers are integrating laser micromachining to produce micro-implants, stents, and surgical instruments that require tight tolerances and smooth surface finishes. This trend is accelerating innovation in minimally invasive and high-performance medical technologies

- Overall, the growing reliance on laser and hybrid micromachining technologies is reshaping manufacturing workflows and reinforcing their importance in precision-driven industrial applications across global markets

Micromachining Market Dynamics

Driver

Growing Demand for Miniaturized and High-Precision Components

- The increasing demand for miniaturized and high-precision components across electronics, medical, aerospace, and automotive industries is a key driver of the micromachining market. As products become smaller and more complex, manufacturers require advanced machining solutions capable of delivering micro-level accuracy and superior surface quality

- For instance, Makino provides precision micromachining systems used extensively in aerospace and medical manufacturing, enabling production of intricate components with high dimensional accuracy. Such systems support complex designs that cannot be achieved through conventional machining methods

- The semiconductor and electronics sector is driving strong demand for micromachining due to ongoing miniaturization of integrated circuits, sensors, and microelectromechanical systems. Precision micromachining plays a critical role in meeting strict tolerance and performance requirements in these applications

- In the medical sector, rising use of implantable devices and micro surgical tools is increasing reliance on micromachining technologies that ensure biocompatibility and consistency. This is reinforcing sustained investment in advanced micro manufacturing capabilities

- Aerospace manufacturers are adopting micromachining to produce lightweight, high-performance components with complex geometries. This growing need for precision and reliability continues to strengthen the driver and support long-term market growth

Restraint/Challenge

High Equipment Cost and Technical Complexity

- The micromachining market faces significant challenges due to the high capital cost of advanced equipment and the technical complexity associated with operating and maintaining these systems. Laser and hybrid micromachining machines require sophisticated control systems, precision optics, and specialized software, increasing upfront investment requirements

- For instance, companies such as 3D-Micromac AG develop highly advanced micromachining platforms that demand skilled operators and rigorous calibration procedures. These factors raise operational complexity and limit adoption among small and mid-sized manufacturers

- The requirement for highly trained personnel to manage precision processes further increases operational costs and creates workforce challenges. A shortage of skilled technicians can restrict effective utilization of micromachining systems

- Maintenance of high-precision equipment involves specialized components and service support, contributing to higher lifecycle costs. Downtime associated with equipment servicing can also impact production efficiency

- These challenges collectively constrain broader market penetration, particularly in cost-sensitive regions, and place pressure on manufacturers to balance technological advancement with affordability and operational simplicity

Micromachining Market Scope

The market is segmented on the basis of type, process, axis, material, and industry vertical.

- By Type

On the basis of type, the micromachining market is segmented into traditional, non-traditional, Electro Discharge Machining (EDM), Electrochemical Machining (ECM), laser, and hybrid. The laser micromachining segment dominated the market with the largest share of 37% in 2025, supported by its high precision, non-contact processing capability, and suitability for complex micro-scale geometries. Laser-based systems are widely adopted across electronics, medical devices, and aerospace applications due to their ability to process hard and brittle materials with minimal tool wear. The growing need for miniaturized components and tight tolerance manufacturing continues to strengthen the dominance of this segment.

The hybrid micromachining segment is expected to witness the fastest growth from 2026 to 2033, driven by its ability to combine multiple machining principles for enhanced accuracy and efficiency. Hybrid systems enable manufacturers to overcome limitations of single-process techniques, particularly when working with advanced materials and intricate designs. Rising adoption in high-value manufacturing sectors and ongoing technological advancements are accelerating the growth of this segment.

- By Process

On the basis of process, the micromachining market is segmented into additive, subtractive, and others. The subtractive process segment held the largest market share in 2025, owing to its extensive use in precision material removal for micro-scale components. Subtractive micromachining is widely employed in semiconductor, automotive, and medical manufacturing where dimensional accuracy and surface finish are critical. Its established infrastructure and compatibility with a wide range of materials further support its market dominance.

The additive process segment is projected to grow at the fastest rate during the forecast period, supported by increasing demand for rapid prototyping and complex micro-structured components. Additive micromachining enables design flexibility, reduced material waste, and faster product development cycles. The expanding use of micro-additive techniques in electronics and biomedical applications is driving accelerated adoption.

- By Axis

On the basis of axis, the micromachining market is segmented into 3-axes, 4-axes, 5-axes, and others. The 3-axis micromachining segment dominated the market in 2025, driven by its cost-effectiveness and widespread use in standard precision manufacturing tasks. These systems are preferred for high-volume production where component complexity is moderate and operational simplicity is required. Their ease of integration into existing manufacturing setups supports continued demand.

The 5-axis segment is expected to register the fastest growth from 2026 to 2033, fueled by rising demand for complex and multi-dimensional micro components. Five-axis systems allow simultaneous machining from multiple angles, reducing setup time and improving accuracy. Increased adoption in aerospace, medical implants, and advanced electronics manufacturing is accelerating this growth trend.

- By Material

On the basis of material, the micromachining market is segmented into metals and alloys, polymers, glass and quartz, ceramics, and others. The metals and alloys segment accounted for the largest revenue share in 2025, supported by extensive use in automotive, aerospace, and industrial applications. Metals offer high mechanical strength and thermal stability, making them suitable for precision micromachining processes. The demand for lightweight and high-performance components continues to reinforce this segment’s dominance.

The ceramics segment is anticipated to witness the fastest growth during the forecast period, driven by increasing applications in electronics, medical devices, and energy systems. Ceramics offer superior thermal resistance, electrical insulation, and chemical stability, which are critical for advanced micro components. Technological improvements in machining brittle materials are further supporting rapid adoption.

- By Industry Vertical

On the basis of industry vertical, the micromachining market is segmented into automotive, semiconductor and electronics, aerospace and defense, medical and aesthetics, telecommunications, power and energy, plastics and polymers, gems and jewellery, and others. The semiconductor and electronics segment dominated the market in 2025, driven by rising demand for miniaturized electronic components and high-density circuit designs. Micromachining plays a critical role in wafer processing, micro-sensors, and electronic packaging. Continuous innovation in consumer electronics and industrial electronics sustains strong market leadership.

The medical and aesthetics segment is expected to grow at the fastest rate from 2026 to 2033, supported by increasing demand for micro-scale medical devices and minimally invasive surgical tools. Micromachining enables high-precision fabrication of implants, diagnostic equipment, and aesthetic instruments. The growing focus on advanced healthcare technologies and personalized medical solutions is accelerating growth in this segment.

Micromachining Market Regional Analysis

- Asia-Pacific dominated the micromachining market with the largest revenue share of 50.3% in 2025, driven by rapid industrialization, strong electronics and semiconductor manufacturing, and expanding automotive and medical device production

- The region benefits from cost-efficient manufacturing ecosystems, high adoption of precision manufacturing technologies, and increasing investments in advanced production facilities

- Growing demand for miniaturized components, availability of skilled technical workforce, and supportive government initiatives are accelerating micromachining adoption across multiple industries

China Micromachining Market Insight

China held the largest share in the Asia-Pacific micromachining market in 2025, supported by its dominance in electronics manufacturing, semiconductor fabrication, and automotive production. The country’s strong industrial infrastructure, large-scale investments in advanced manufacturing equipment, and focus on high-precision component production are key growth drivers. Continuous expansion of domestic manufacturing capacity and export-oriented production further strengthen market demand.

India Micromachining Market Insight

India is witnessing the fastest growth within the Asia-Pacific region, fueled by rising investments in electronics manufacturing, medical devices, and aerospace components. Government initiatives promoting domestic manufacturing and increasing adoption of precision engineering technologies are supporting market expansion. Growing demand for micro-scale components across automotive and healthcare sectors is further accelerating growth.

Europe Micromachining Market Insight

The Europe micromachining market is growing steadily, driven by strong demand from aerospace, automotive, and medical industries requiring high-precision components. The region emphasizes advanced manufacturing standards, quality compliance, and technological innovation. Increasing adoption of micromachining for complex and high-value applications is supporting sustained market growth.

Germany Micromachining Market Insight

Germany’s micromachining market is supported by its leadership in precision engineering, automotive manufacturing, and industrial automation. The country’s strong focus on research and development, advanced tooling technologies, and high-quality manufacturing processes drives consistent demand. Extensive collaboration between industrial manufacturers and technology providers further enhances market maturity.

U.K. Micromachining Market Insight

The U.K. micromachining market is driven by demand from aerospace, medical technology, and advanced electronics sectors. Increasing investments in high-precision manufacturing and innovation-led production environments support market development. Strong academic and industrial research capabilities continue to encourage adoption of advanced micromachining techniques.

North America Micromachining Market Insight

North America is projected to grow at the fastest CAGR from 2026 to 2033, driven by strong demand for advanced manufacturing solutions across aerospace, defense, medical, and semiconductor industries. The region’s focus on innovation, automation, and high-precision production is boosting micromachining adoption. Rising investments in next-generation manufacturing technologies further support rapid growth.

U.S. Micromachining Market Insight

The U.S. accounted for the largest share of the North America micromachining market in 2025, supported by a well-established industrial base and strong presence of high-tech manufacturing sectors. Significant investment in research and development, advanced production equipment, and precision engineering capabilities underpins market leadership. Growing demand for miniaturized and high-performance components continues to reinforce the U.S. position in the region.

Micromachining Market Share

The micromachining industry is primarily led by well-established companies, including:

- Coherent, Inc. (U.S.)

- Makino (Japan)

- Lumentum Operations LLC (U.S.)

- MITSUBISHI HEAVY INDUSTRIES, LTD. (Japan)

- Han’s Laser Technology Industry Group Co., Ltd (China)

- Electro Scientific Industries, Inc. (U.S.)

- IPG Photonics Corporation (U.S.)

- Heraeus Holding (Germany)

- AMADA WELD TECH Co., Ltd. (Japan)

- Humanetics Group (U.S.)

- 3D-Micromac AG (Germany)

- 4JET microtech GmbH (Germany)

- Oxford Lasers (U.K.)

- PhotoMachining, Inc. (U.S.)

- Potomac Laser (U.S.)

- Millux (France)

- Posalux SA (Switzerland)

- SCANLAB (Germany)

- TORNOS SA (Switzerland)

- Swisstec 3D Akus AG (Switzerland)

- Kugler Company (Germany)

Latest Developments in Global Micromachining Market

- In June 2024, ABC Technologies introduced an advanced micromachining technique that significantly enhances surface finish while reducing machining time for micro components, strengthening competitiveness across electronics manufacturing. This innovation improves production efficiency and yield rates, supporting growing demand for high-precision and miniaturized electronic components and reinforcing technological differentiation in the micromachining market

- In March 2024, DEF Systems expanded its micromachining capabilities through the acquisition of a leading micro machining technology provider, broadening its solution portfolio for aerospace and medical device applications. The move enhances end-to-end manufacturing capabilities, supports complex component production, and positions the company to capture higher-value contracts in regulated, precision-driven industries

- In January 2024, Integer acquired Pulse Technologies for $140 million to strengthen advanced manufacturing and specialized medical technology capabilities. This acquisition expands Integer’s product depth and process expertise, accelerating innovation cycles and improving its competitive standing in precision medical device manufacturing that relies on micromachining

- In November 2023, GHI Innovations launched a software platform to optimize micromachining processes with improved control and Industry 4.0 integration. The platform enhances operational efficiency, data-driven process optimization, and interoperability, supporting broader adoption of smart manufacturing practices within micromachining operations

- In September 2023, JKL Manufacturing announced a major investment to upgrade its micromachining facilities to meet rising demand for high-precision components across multiple industries. The capacity and capability expansion improves throughput and quality consistency, enabling the company to address growing requirements from electronics, medical, and aerospace customers

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Micromachining Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Micromachining Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Micromachining Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.