Global Mission Critical Communication Mcx Market

Market Size in USD Billion

CAGR :

%

USD

24.19 Billion

USD

52.25 Billion

2025

2033

USD

24.19 Billion

USD

52.25 Billion

2025

2033

| 2026 –2033 | |

| USD 24.19 Billion | |

| USD 52.25 Billion | |

|

|

|

|

Mission Critical Communication (MCX) Market Size

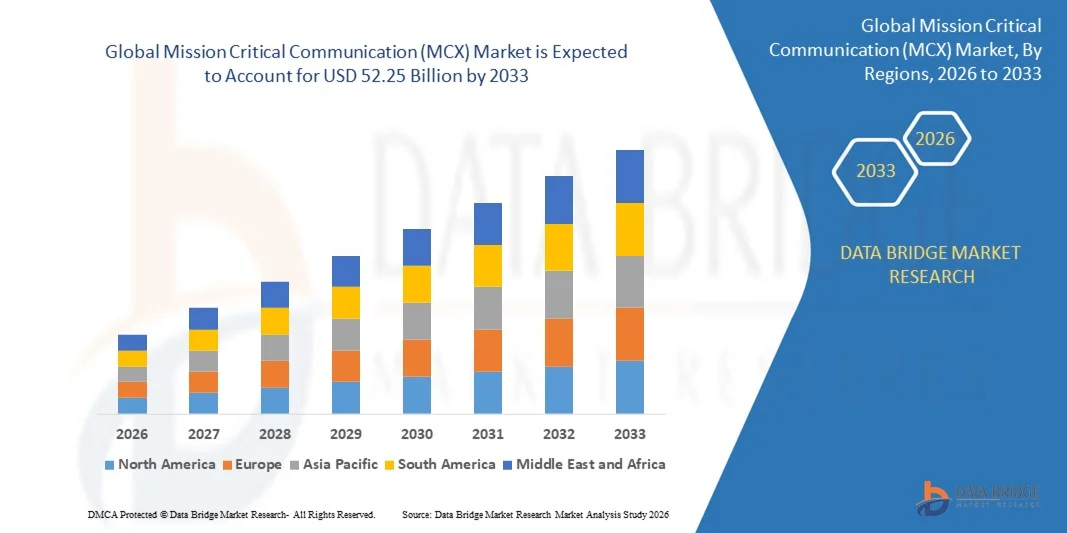

- The global mission critical communication (MCX) market size was valued at USD 24.19 billion in 2025 and is expected to reach USD 52.25 billion by 2033, at a CAGR of 10.10% during the forecast period

- The market growth is largely fuelled by the increasing demand for reliable, secure, and real-time communication solutions across public safety, defense, transportation, and industrial sectors

- Rising investments in next-generation communication technologies, such as LTE and 5G, along with growing adoption of cloud-based MCX platforms, are further supporting market expansion

Mission Critical Communication (MCX) Market Analysis

- The adoption of MCX solutions is being driven by the need for uninterrupted communication during emergencies, disasters, and mission-critical operations, enhancing operational efficiency and safety

- Integration with advanced technologies such as IoT, AI, and analytics is enabling organizations to optimize incident response, resource allocation, and real-time situational awareness

- North America dominated the MCX market with the largest revenue share of 38.75% in 2025, driven by increasing investments in public safety communication networks, emergency response systems, and government initiatives to modernize mission-critical infrastructure

- Asia-Pacific region is expected to witness the highest growth rate in the global mission critical communication (MCX) market, driven by expanding urban infrastructure, increasing industrialization, and rising demand for secure communication in public safety and utilities. Countries such as China, Japan, and Australia are investing heavily in LTE and next-generation MCX platforms

- The hardware segment held the largest market revenue share in 2025, driven by the growing deployment of rugged devices, base stations, and network infrastructure for mission-critical operations. Hardware solutions ensure reliable connectivity and durability in challenging environments, making them essential for public safety and industrial applications

Report Scope and Mission Critical Communication (MCX) Market Segmentation

|

Attributes |

Mission Critical Communication (MCX) Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Mission Critical Communication (MCX) Market Trends

Rise of Advanced Wireless Communication Solutions in Mission Critical Operations

- The growing adoption of advanced wireless communication solutions is transforming the MCX landscape by enabling real-time, reliable connectivity for public safety, emergency services, and industrial operations. These solutions ensure uninterrupted communication during critical incidents, improving response times and operational coordination. In addition, integration with AI-driven analytics allows predictive alerts and proactive incident management, minimizing operational downtime. Organizations are also leveraging mesh networks and edge computing to maintain connectivity in remote or disaster-hit regions, further strengthening the reliability of MCX deployments

- The increasing demand for interoperable communication platforms across first responders and government agencies is driving the deployment of LTE, 5G, and TETRA-based MCX solutions. These platforms facilitate seamless voice, video, and data transmission, ensuring efficient information exchange in high-stakes scenarios. Furthermore, software-defined networking capabilities allow agencies to dynamically manage bandwidth and prioritize critical communication, enhancing network efficiency. Standardized protocols are also enabling cross-border emergency response collaborations and joint operations among multiple agencies

- The integration of MCX solutions with IoT devices, cloud platforms, and analytics tools is enhancing situational awareness, asset tracking, and decision-making capabilities. Organizations can monitor operations in real time, leading to better safety outcomes and resource optimization. Advanced dashboards provide incident visualization and predictive trend analysis, helping emergency managers allocate resources more effectively. In addition, MCX-enabled wearables and connected sensors offer health monitoring of personnel in hazardous environments, further improving operational safety

- For instance, in 2023, several metropolitan police and fire departments in Europe implemented LTE-based MCX networks to improve emergency response coordination and public safety monitoring, resulting in faster incident management and reduced operational risks. The deployment also allowed inter-agency collaboration with hospitals and disaster management authorities, streamlining communication during high-volume incidents. Local governments reported improved citizen satisfaction due to reduced emergency response times and enhanced transparency of operations

- While advanced MCX solutions are improving operational efficiency and safety, their impact depends on continued technological innovation, network resilience, and training of personnel. Stakeholders must focus on scalable, secure, and interoperable communication platforms to fully leverage market opportunities. Investment in personnel training programs and periodic system audits ensures that users can maximize MCX capabilities while minimizing operational errors

Mission Critical Communication (MCX) Market Dynamics

Driver

Growing Need for Reliable and Interoperable Communication for Public Safety and Industrial Operations

- The increasing frequency of natural disasters, public safety threats, and industrial emergencies is driving governments and enterprises to invest in MCX solutions for uninterrupted, secure communication. Reliable networks help mitigate operational risks and improve response times. In addition, adoption of cloud-managed MCX platforms is enabling central monitoring of distributed sites, ensuring consistent performance across urban and remote locations. Enhanced redundancy mechanisms reduce downtime and maintain connectivity even during infrastructure failures

- Organizations are recognizing the importance of interoperable communication across agencies, departments, and regions to coordinate emergency response, disaster recovery, and critical operations. MCX platforms ensure compatibility and seamless data sharing between diverse teams and devices. Moreover, interoperability promotes shared training initiatives, cross-agency drills, and rapid deployment of multi-agency response teams in real time. This creates a unified ecosystem where first responders can access shared information without technological barriers

- Technological advancements in LTE, 5G, and TETRA networks are enabling enhanced coverage, low latency, and high-quality voice, video, and data services. These capabilities support real-time decision-making in mission-critical environments, enhancing operational efficiency. Emerging innovations, such as private 5G networks and network slicing, allow dedicated bandwidth for emergency services, ensuring priority access during peak network usage. Edge computing further reduces latency for real-time incident response, enhancing situational awareness

- For instance, in 2022, several European and North American transport authorities deployed LTE-MCX systems to enhance fleet monitoring, emergency response, and traffic management, significantly improving service reliability and operational safety. These deployments also enabled predictive maintenance alerts for vehicles and infrastructure, reducing service disruptions. Integration with city-wide smart traffic management systems optimized emergency vehicle routing, resulting in measurable time savings during incidents

- While demand for reliable communication is driving market growth, challenges remain in network standardization, coverage in remote areas, and integration with legacy systems, requiring continuous investment and innovation. Policymakers and private operators are increasingly collaborating to develop frameworks that encourage unified MCX adoption while ensuring cost-effectiveness and scalability

Restraint/Challenge

High Infrastructure Costs and Technical Integration Challenges

- Deploying MCX solutions often requires substantial investment in infrastructure, network upgrades, and specialized devices, making adoption challenging for smaller organizations or regions with limited budgets. High capital costs can slow widespread deployment. Additional expenses include ongoing maintenance, software licensing, and staff training, which can further limit adoption in cost-sensitive regions. Public-private partnerships are emerging as a strategy to share costs and accelerate deployment in such areas

- Integrating MCX platforms with existing legacy networks, communication systems, and enterprise applications can be complex, requiring technical expertise and robust IT support. Improper integration may lead to communication disruptions and reduced effectiveness during critical incidents. Compatibility issues with older radios, control systems, and dispatch software often require customized middleware solutions, increasing project timelines and costs

- Ensuring network security, encryption, and compliance with regulatory standards is a major challenge, as MCX networks carry sensitive voice, video, and data transmissions. Organizations must implement rigorous monitoring and cybersecurity measures to prevent breaches. Continuous threat assessment and automated intrusion detection systems are increasingly deployed to maintain data integrity and operational confidentiality. Regulatory compliance audits also require periodic investment and specialized personnel

- For instance, in 2023, several municipal emergency services in Asia and Africa faced delays in MCX adoption due to high infrastructure costs and difficulties integrating with older communication systems, impacting real-time operational efficiency. These challenges often resulted in phased rollouts or limited geographic coverage, delaying full operational benefits. Some agencies leveraged government grants and international funding to overcome financial hurdles

- While MCX technologies continue to evolve, addressing cost, integration, and security challenges is critical. Stakeholders must focus on scalable, interoperable, and resilient networks to maximize market potential and ensure safe, efficient mission-critical communication. Innovations such as cloud-managed MCX solutions and virtualized network functions are emerging to reduce costs and simplify integration, helping expand adoption globally

Mission Critical Communication (MCX) Market Scope

The market is segmented on the basis of component, technology, and end user.

- By Component

On the basis of component, the MCX market is segmented into hardware, software, and services. The hardware segment held the largest market revenue share in 2025, driven by the growing deployment of rugged devices, base stations, and network infrastructure for mission-critical operations. Hardware solutions ensure reliable connectivity and durability in challenging environments, making them essential for public safety and industrial applications.

The software segment is expected to witness the fastest growth rate from 2026 to 2033, fueled by the adoption of advanced MCX platforms, management applications, and analytics tools. Software solutions enable real-time monitoring, resource optimization, and seamless integration with legacy systems, enhancing operational efficiency and situational awareness for organizations in high-risk environments.

- By Technology

On the basis of technology, the MCX market is segmented into Land Mobile Radio (LMR) and Long-Term Evolution (LTE). The LMR segment held a significant market share in 2025, owing to its long-standing reliability, robustness, and widespread deployment in public safety and emergency communication networks. LMR systems continue to be preferred for voice-centric operations, secure communications, and compatibility with legacy infrastructure.

The LTE segment is expected to witness the fastest growth rate from 2026 to 2033 to its ability to support high-speed data, voice, and video services, interoperability across networks, and advanced mission-critical functionalities. LTE adoption is further fueled by 4G/5G deployments and government initiatives to modernize communication networks.

- By End User

On the basis of end user, the MCX market is segmented into public safety and government agencies, transportation, energy and utilities, mining, and others. The public safety and government agencies segment held the largest revenue share in 2025, driven by rising investments in emergency response systems, secure communication networks, and disaster management platforms.

The transportation segment is expected to witness the fastest growth rate from 2026 to 2033, fueled by the adoption of MCX solutions for fleet management, real-time coordination, and enhanced operational safety. The energy and utilities segment is also witnessing significant growth due to the increasing need for reliable communication in remote and hazardous operational areas.

Mission Critical Communication (MCX) Market Regional Analysis

- North America dominated the MCX market with the largest revenue share of 38.75% in 2025, driven by increasing investments in public safety communication networks, emergency response systems, and government initiatives to modernize mission-critical infrastructure

- Organizations in the region prioritize reliable, secure, and real-time communication for first responders, law enforcement, and industrial operations, enhancing operational efficiency and safety

- The widespread adoption is further supported by robust technological infrastructure, government funding, and stringent regulations on emergency communication systems, establishing MCX solutions as essential across public safety and industrial sectors

U.S. MCX Market Insight

The U.S. MCX market captured the largest revenue share in North America in 2025, fueled by the deployment of advanced LTE and LMR networks for mission-critical communications. Government agencies and public safety organizations are increasingly integrating interoperable MCX solutions to improve emergency response and operational coordination. The growing adoption of rugged devices, mobile applications, and analytics tools further strengthens network efficiency, while federal funding and modernization programs continue to drive market expansion.

Europe MCX Market Insight

The Europe MCX market is expected to witness the fastest growth rate from 2026 to 2033, primarily driven by government initiatives to upgrade public safety communication networks and ensure compliance with EU-wide emergency response regulations. Increased urbanization, demand for smart city infrastructure, and industrial automation are fostering adoption. European agencies and private sector operators are focusing on interoperable MCX systems to enhance safety, response time, and network reliability.

U.K. MCX Market Insight

The U.K. MCX market is expected to witness the fastest growth rate from 2026 to 2033, fueled by investments in nationwide public safety communication projects and industrial MCX deployments. Law enforcement and emergency services are integrating LTE-based MCX solutions to improve coordination and communication efficiency. The country’s strong emphasis on technological innovation and infrastructure modernization continues to support growth in both public safety and industrial applications.

Germany MCX Market Insight

The Germany MCX market is expected to witness the fastest growth rate from 2026 to 2033, driven by the modernization of public safety networks and adoption of advanced MCX technologies for industrial operations. Germany’s well-developed infrastructure, combined with government policies promoting secure and interoperable communication networks, is encouraging the deployment of LMR and LTE solutions. Organizations are increasingly leveraging MCX systems for enhanced reliability, situational awareness, and operational efficiency in critical environments.

Asia-Pacific MCX Market Insight

The Asia-Pacific MCX market is expected to witness the fastest growth rate from 2026 to 2033, propelled by rapid urbanization, industrial growth, and government initiatives to upgrade emergency communication systems in countries such as China, Japan, and India. The growing need for efficient disaster response, public safety, and industrial communication networks is driving adoption. In addition, the region is emerging as a hub for MCX equipment manufacturing, improving affordability and accessibility of advanced communication solutions.

Japan MCX Market Insight

The Japan MCX market is expected to witness the fastest growth rate from 2026 to 2033, due to the country’s focus on disaster preparedness, urban infrastructure modernization, and adoption of advanced communication technologies. Public safety agencies and industrial sectors are deploying LTE and LMR solutions to ensure seamless connectivity, real-time monitoring, and enhanced operational efficiency. Japan’s emphasis on technological innovation and robust industrial infrastructure is expected to continue supporting MCX market growth.

China MCX Market Insight

The China MCX market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to large-scale government investments in public safety communication networks, smart city projects, and industrial automation initiatives. Increasing urbanization, high adoption of LTE and LMR technologies, and strong domestic MCX manufacturers are driving market growth. China’s focus on ensuring secure, reliable, and interoperable communication networks further propels the adoption of MCX solutions across public safety and industrial applications.

Mission Critical Communication (MCX) Market Share

The Mission Critical Communication (MCX) industry is primarily led by well-established companies, including:

- Motorola Solutions, Inc. (U.S.)

- Nokia (Finland)

- ZTE Corporation (China)

- Telefonaktiebolaget LM Ericsson (Sweden)

- Huawei Technologies Co. Ltd. (China)

- AT\&T Intellectual Property (U.S.)

- L3Harris Technologies, Inc. (U.S.)

- Hytera Communications Corporation Limited (China)

- Ascom (Switzerland)

- Mentura Group OY (Finland)

- Leonardo S.p.A. (Italy)

- Inmarsat Global Limited (U.K.)

- Zenitel (Belgium)

- Telstra (Australia)

- TASSTA GmbH (Germany)

- Thales Group (France)

- Atos SE (France)

- TKH Group (Netherlands)

- Tait Communications (New Zealand)

- Simoco Wireless Solutions (U.K.)

Latest Developments in Global Mission Critical Communication (MCX) Market

- In May 2023, Sofant Technologies, a portfolio company of EMV Capital, in collaboration with Inmarsat Government, announced a joint development to enhance aircraft communication capabilities. The partnership aims to create an innovative, low-profile communication solution for government airborne users, improving efficiency, reliability, and operational performance in critical missions

- In August 2023, L3Harris launched the Two47 Base Station, a high-power, portable P25 base station designed to meet all mission-critical communication requirements. The product supports up to 10 channels in a single rack, integrates auxiliary site equipment, and ensures compliance with P25 standards, enabling faster deployment and enhanced connectivity for public safety and emergency response operations

- In May 2021, Leonardo partnered with Ericsson to develop new 5G solutions targeting industrial, public safety, and critical infrastructure applications. The collaboration focuses on enhancing cybersecurity, improving secure and reliable communications, and accelerating the deployment of advanced 5G-enabled networks, thereby strengthening operational efficiency and resilience for strategic infrastructures

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.