Global Mobile Printer Market

Market Size in USD Billion

CAGR :

%

USD

11.52 Billion

USD

41.88 Billion

2025

2033

USD

11.52 Billion

USD

41.88 Billion

2025

2033

| 2026 –2033 | |

| USD 11.52 Billion | |

| USD 41.88 Billion | |

|

|

|

|

Mobile Printer Market Size

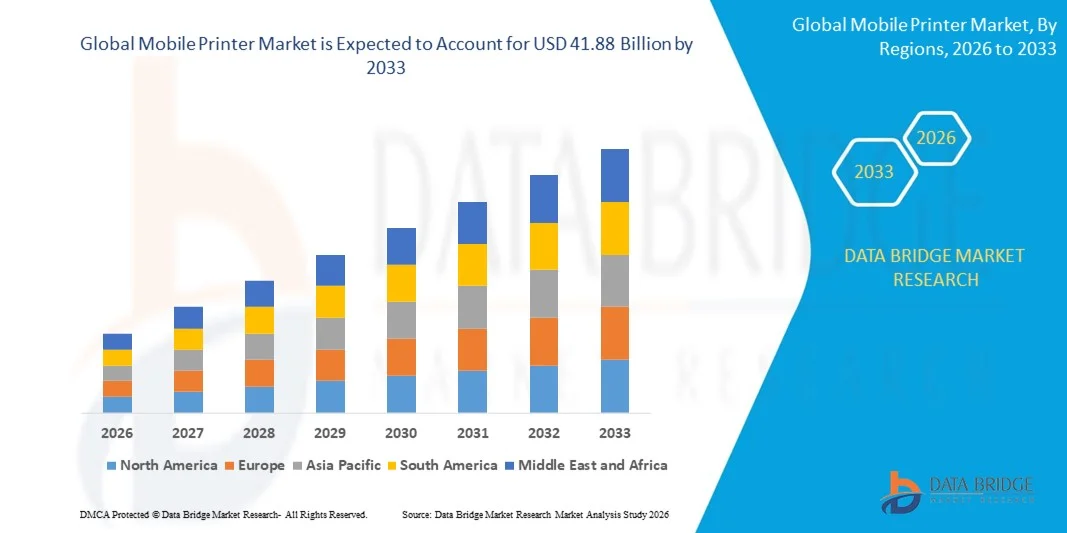

- The global mobile printer market size was valued at USD 11.52 billion in 2025 and is expected to reach USD 41.88 billion by 2033, at a CAGR of 17.50% during the forecast period

- The market growth is largely fuelled by the increasing demand for on-the-go printing solutions across retail, logistics, healthcare, and field services

- Growing adoption of mobile and cloud-based technologies, coupled with the rising need for real-time data printing, is further driving market expansion

Mobile Printer Market Analysis

- The market is witnessing a shift toward compact, lightweight, and wireless mobile printers that provide high-speed printing with enhanced connectivity options such as Bluetooth, Wi-Fi, and NFC

- Demand is being driven by industries requiring instant documentation, such as transportation, warehousing, healthcare, and retail, where mobility and efficiency are critical

- North America dominated the mobile printer market with the largest revenue share of 36.80% in 2025, driven by high adoption of mobile POS systems, retail automation, and demand for on-the-go printing solutions across logistics, healthcare, and corporate sectors

- Asia-Pacific region is expected to witness the highest growth rate in the global mobile printer market, driven by expanding e-commerce, logistics modernization, technological adoption, and increasing demand for portable, on-the-go printing solutions across emerging economies

- The Thermal segment held the largest market revenue share in 2025, driven by its high-speed printing, reliability, and widespread use in retail, logistics, and field service applications. Thermal printers are particularly popular for printing receipts, labels, and tickets due to low maintenance requirements and compatibility with mobile devices

Report Scope and Mobile Printer Market Segmentation

|

Attributes |

Mobile Printer Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Mobile Printer Market Trends

Rising Demand for On-the-Go and Portable Printing Solutions

- The growing need for mobility and real-time printing is significantly shaping the mobile printer market, as businesses increasingly require portable solutions that support instant documentation and receipt generation. Mobile printers are gaining traction due to their compact design, wireless connectivity, and ability to integrate with smartphones, tablets, and POS systems. This trend strengthens their adoption across retail, logistics, healthcare, and field service industries, encouraging manufacturers to innovate with new, lightweight models that enhance operational efficiency

- Increasing digitization and the shift toward mobile-first operations have accelerated demand for mobile printers in delivery, transportation, and e-commerce sectors. Businesses are actively seeking printers that enable quick, on-site printing of invoices, labels, and receipts, prompting manufacturers to focus on wireless and cloud-enabled solutions. Integration with mobile applications and inventory management systems is also driving adoption

- Connectivity and ease-of-use trends are influencing purchasing decisions, with companies emphasizing Bluetooth, Wi-Fi, and NFC-enabled printers. These features help streamline workflow, reduce printing errors, and enhance productivity. Manufacturers are leveraging marketing campaigns to highlight these operational benefits to appeal to tech-savvy and efficiency-oriented clients

- For instance, in 2024, Zebra Technologies in the U.S. and Brother Industries in Japan expanded their mobile printer portfolios by launching compact, wireless models for retail and logistics applications. These launches responded to growing demand for efficient, on-the-go printing and were distributed across retail, e-commerce, and direct enterprise channels. The products were promoted as productivity-enhancing and easy-to-integrate solutions, strengthening brand reputation among end users

- While demand for mobile printers is growing, sustained market expansion depends on balancing cost, performance, and portability. Manufacturers are also focusing on improving battery life, print speed, and device ruggedness while maintaining compatibility with a wide range of applications and operating systems

Mobile Printer Market Dynamics

Driver

Growing Demand for Portable, On-the-Go Printing Solutions

- Rising business need for instant documentation, labeling, and receipt printing is a major driver for the mobile printer market. Companies are increasingly replacing traditional desktop printers with portable, wireless solutions to improve operational efficiency, reduce delays, and support mobile workforce requirements. This trend is also encouraging research into compact, lightweight, and multifunctional printer designs

- Expanding applications in retail, logistics, healthcare, field services, and transportation are influencing market growth. Mobile printers enhance operational workflow by enabling real-time printing and data capture in on-site environments, supporting rapid service delivery and customer satisfaction. Increasing adoption of mobile POS systems and handheld devices further reinforces this trend

- Printer manufacturers are actively promoting mobile printer-based solutions through product innovation, software integration, and industry partnerships. These efforts are supported by growing enterprise focus on automation, digitalization, and workflow optimization, encouraging collaborations between device makers, software providers, and end users to expand capabilities

- For instance, in 2023, Honeywell in the U.S. and Epson in Japan reported increased deployment of mobile printers across retail, logistics, and healthcare sectors. This expansion followed higher business demand for compact, wireless printing solutions that improve speed and accuracy. Both companies also highlighted connectivity, device durability, and ease-of-use in marketing campaigns to strengthen adoption and customer loyalty

- Although growing demand for mobility and real-time printing supports market growth, wider adoption depends on cost optimization, battery efficiency, and integration with enterprise systems. Investment in product innovation, cloud connectivity, and durable design will be critical for meeting global demand and maintaining competitive advantage

Restraint/Challenge

High Cost And Connectivity Limitations Compared To Conventional Printers

- The relatively higher cost of mobile printers compared to standard desktop printers remains a key challenge, limiting adoption among small and price-sensitive businesses. Advanced features such as wireless connectivity, rugged design, and high-speed printing contribute to elevated pricing. In addition, integration with mobile devices and software platforms can further affect cost-efficiency and deployment

- Awareness and technical know-how remain uneven, particularly in developing markets where mobile printing solutions are still emerging. Limited understanding of operational benefits restricts adoption across certain industries. This also leads to slower uptake in regions where digital and mobile infrastructure is less developed

- Battery life, print speed, and wireless reliability challenges also impact market growth, as mobile printers require robust performance in field conditions. Operational inefficiencies, connectivity drops, and maintenance requirements increase total cost of ownership. Companies must invest in training, support, and device management to ensure seamless deployment

- For instance, in 2024, small logistics firms in Southeast Asia reported slower adoption of mobile printers due to higher costs and concerns over device connectivity and battery life. Limited access to service networks and technical support further constrained uptake. These factors prompted some businesses to continue relying on stationary printers, affecting market penetration

- Overcoming these challenges will require cost-effective manufacturing, improved connectivity and battery performance, and focused training initiatives for end users. Collaboration with software providers, service partners, and enterprises can help unlock the long-term growth potential of the global mobile printer market. Furthermore, developing scalable, durable, and multifunctional devices will be essential for widespread adoption

Mobile Printer Market Scope

The market is segmented on the basis of type, output, technology, and end user.

- By Type

On the basis of type, the mobile printer market is segmented into Inkjet, Thermal, and Impact. The Thermal segment held the largest market revenue share in 2025, driven by its high-speed printing, reliability, and widespread use in retail, logistics, and field service applications. Thermal printers are particularly popular for printing receipts, labels, and tickets due to low maintenance requirements and compatibility with mobile devices.

The Inkjet segment is expected to witness the fastest growth rate from 2026 to 2033, driven by its ability to produce high-quality prints, flexibility in printing various formats, and ease of integration with portable devices. Inkjet mobile printers are increasingly adopted in healthcare, corporate offices, and specialized retail applications for on-the-go documentation and labeling.

- By Output

On the basis of output, the market is segmented into Barcode Labels, Documents, Receipts, Pictures, and Other. The Receipts segment held the largest market share in 2025, due to the growing use of mobile POS systems in retail, restaurants, and transportation. Receipt printing is a key application for mobile printers, supporting real-time transactions and customer service efficiency.

The Barcode Labels segment is expected to register the fastest growth from 2026 to 2033, fueled by increasing demand for inventory tracking, logistics operations, and e-commerce fulfillment. Mobile barcode printers offer portability, speed, and connectivity that enable businesses to streamline supply chain management.

- By Technology

On the basis of technology, the market is segmented into Infrared Data Association (IrDA), Bluetooth, Wi-Fi, and Others. The Wi-Fi segment held the largest market revenue share in 2025, driven by seamless wireless connectivity, cloud integration, and ease of remote printing across multiple devices. Wi-Fi-enabled mobile printers are widely preferred in corporate offices, healthcare facilities, and large-scale retail chains.

The Bluetooth segment is expected to witness the fastest growth rate from 2026 to 2033, driven by low power consumption, peer-to-peer connectivity, and simple pairing with smartphones and tablets. Bluetooth-enabled mobile printers are particularly popular in field service, logistics, and on-site applications where portability and instant printing are essential.

- By End User

On the basis of end user, the market is segmented into Residential, Corporate Office, Retail, Telecom, Transportation and Logistics, Healthcare, and Others. The Retail segment held the largest market share in 2025, owing to widespread adoption of mobile POS systems, e-commerce delivery services, and demand for on-the-spot receipts and labels.

The Transportation and Logistics segment is expected to witness the fastest growth rate from 2026 to 2033, fueled by the need for instant documentation, labeling, and tracking in supply chains, warehouses, and delivery services. Mobile printers in this segment improve operational efficiency, reduce errors, and support real-time reporting.

Mobile Printer Market Regional Analysis

- North America dominated the mobile printer market with the largest revenue share of 36.80% in 2025, driven by high adoption of mobile POS systems, retail automation, and demand for on-the-go printing solutions across logistics, healthcare, and corporate sectors

- Consumers in the region highly value portability, wireless connectivity, and seamless integration with smartphones, tablets, and cloud platforms, making mobile printers a preferred choice for real-time printing needs

- This widespread adoption is further supported by advanced infrastructure, high technological literacy, and growing enterprise focus on efficiency and workflow automation, establishing mobile printers as essential tools for businesses

U.S. Mobile Printer Market Insight

The U.S. mobile printer market captured the largest revenue share in 2025 within North America, fueled by rapid deployment of mobile POS systems, expanding e-commerce operations, and demand for field-based printing solutions. Businesses are increasingly prioritizing compact, wireless printers that enable instant receipt, label, and document generation. The growing use of cloud-connected and app-integrated printers, alongside rugged and high-speed models, further supports market growth. Moreover, corporate and retail sectors are driving adoption through investments in digital and mobile workflow solutions.

Europe Mobile Printer Market Insight

The Europe mobile printer market is expected to witness the fastest growth rate from 2026 to 2033, primarily driven by increasing adoption of mobile POS systems, warehouse automation, and digitization across logistics and healthcare industries. The demand for portable, efficient, and wireless printing solutions is rising as businesses focus on operational efficiency and customer experience. European companies are also investing in connected devices and cloud-based systems to improve real-time printing capabilities, particularly in retail and corporate office applications.

U.K. Mobile Printer Market Insight

The U.K. mobile printer market is expected to witness the fastest growth rate from 2026 to 2033, driven by the increasing trend of mobile commerce, field services, and on-site transaction processing. Concerns about operational efficiency, accuracy, and speed are encouraging businesses to adopt portable printers for receipts, labels, and documents. The U.K.’s robust retail and logistics infrastructure, coupled with widespread e-commerce penetration, is expected to continue supporting market expansion.

Germany Mobile Printer Market Insight

The Germany mobile printer market is expected to witness the fastest growth rate from 2026 to 2033, fueled by the country’s strong industrial base, technological advancement, and emphasis on workflow automation. Businesses increasingly prefer mobile printers for logistics, warehouse, and corporate applications, benefiting from high-speed, wireless, and durable printing solutions. Integration with enterprise systems and cloud platforms is also promoting adoption, while sustainability and energy-efficient designs are becoming key considerations.

Asia-Pacific Mobile Printer Market Insight

The Asia-Pacific mobile printer market is expected to witness the fastest growth rate from 2026 to 2033, driven by rapid urbanization, increasing adoption of mobile POS systems, and growth of e-commerce and logistics sectors in countries such as China, Japan, and India. The region’s rising technological adoption, government support for digital infrastructure, and expanding manufacturing capabilities are boosting the availability and affordability of mobile printers.

Japan Mobile Printer Market Insight

The Japan mobile printer market is expected to witness the fastest growth rate from 2026 to 2033 due to the country’s advanced technology adoption, high demand for mobility, and focus on workflow efficiency. Businesses in retail, logistics, and healthcare increasingly rely on mobile printers for real-time document, label, and receipt printing. Integration with IoT devices, smartphones, and cloud systems is accelerating growth, while the aging population drives demand for easier-to-use and portable printing solutions.

China Mobile Printer Market Insight

The China mobile printer market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to rapid urbanization, high enterprise adoption of mobile POS systems, and expanding logistics and retail operations. China is one of the largest markets for mobile printers, driven by demand for portable, high-speed, and wireless printing solutions. The growth of e-commerce, development of smart warehouses, and increasing affordability of mobile printers from domestic manufacturers are key factors propelling the market.

Mobile Printer Market Share

The Mobile Printer industry is primarily led by well-established companies, including:

- STAR MICRONICS CO. LTD. (Japan)

- Printek, L.L.C. (U.S.)

- Brother International Corporation (Japan)

- HP Development Company, L.P. (U.S.)

- Zebra Technologies Corp. (U.S.)

- Toshiba Tec Corporation (Japan)

- Seiko Epson Corporation (Japan)

- Honeywell International Inc. (U.S.)

- Canon U.S.A., Inc. (U.S.)

- Xerox Corporation (U.S.)

- BIXOLON CO. LTD. (South Korea)

- CITIZEN SYSTEMS JAPAN CO., LTD. (Japan)

- FUJITSU (Japan)

- OKI Data Australia (Australia)

- SATO Holdings Corporation (Japan)

- Star Micronics (Japan)

- KEYENCE CORPORATION (Japan)

- DOMIPOS POS Solutions LLP (India)

- TSC Auto ID Technology Co., Ltd. (Taiwan)

- DataCol Solutions Ltd. (U.K.)

Latest Developments in Global Mobile Printer Market

- In August 2025, Zebra Technologies (U.S.) launched a new mobile printer with integrated AI capabilities, aimed at enhancing operational efficiency. This development is expected to attract customers in sectors requiring real-time data processing and on-the-go printing, positioning Zebra as a technological innovator and strengthening its market presence

- In September 2025, Brother Industries (Japan) introduced a line of eco-friendly mobile printers designed to reduce environmental impact. This initiative supports global sustainability trends, enhances brand reputation among environmentally conscious consumers, and may increase customer loyalty and market share

- In October 2025, Canon Inc. (Japan) entered a strategic partnership with a leading logistics firm to expand its mobile printing solutions for the supply chain sector. The collaboration leverages Canon’s technology and the partner’s market reach, providing tailored solutions and demonstrating the growing trend of collaborative innovation in the mobile printer market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Mobile Printer Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Mobile Printer Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Mobile Printer Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.