Global Moisturizing Cream Market

Market Size in USD Billion

CAGR :

%

USD

15.21 Billion

USD

22.47 Billion

2025

2033

USD

15.21 Billion

USD

22.47 Billion

2025

2033

| 2026 –2033 | |

| USD 15.21 Billion | |

| USD 22.47 Billion | |

|

|

|

|

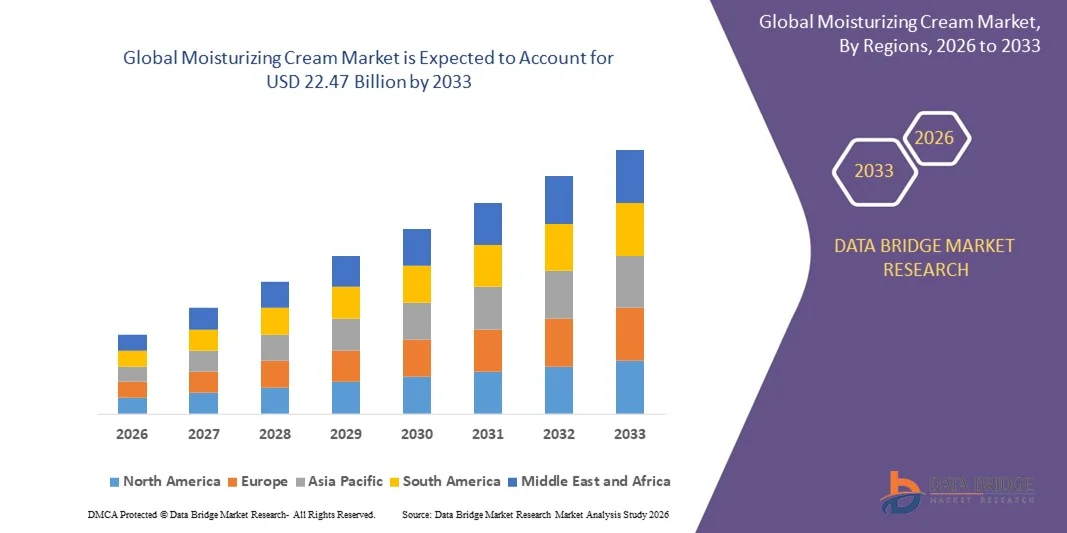

What is the Global Moisturizing Cream Market Size and Growth Rate?

- The global moisturizing cream market size was valued at USD 15.21 billion in 2025 and is expected to reach USD 22.47 billion by 2033, at a CAGR of5.00% during the forecast period

- The rise in concerns regarding skin among population across the globe acts as one of the major factors driving the growth of moisturizing cream market

- The increase in demand for the moisturizing cream for numerous applications such as tissue cuts repair, skin treatment, and anti-aging property, and high utilization of moisturizing creams and lotions for treating or preventing conditions such as dryness, rough, scaly, and itchy skin accelerate the market growth

What are the Major Takeaways of Moisturizing Cream Market?

- The introduction of natural and organic cosmetic and makeup products because of the growing awareness about organic products and rapid developments in the beauty and personal care industry further influence the market

- In addition, expansion of personal care sector, growth in awareness, surge in disposable income, and easy availability positively affect the moisturizing cream market. Furthermore, development of efficient personal care products extends profitable opportunities to the market player

- North America dominated the moisturizing cream market with a 37.45% revenue share in 2025, driven by high consumer awareness regarding skincare, strong penetration of premium and dermatologist-recommended products, and rising demand for solutions addressing dry skin, aging, and sensitive skin conditions across the U.S. and Canada

- Asia-Pacific is projected to register the fastest CAGR of 7.9% from 2026 to 2033, driven by rapid urbanization, rising disposable incomes, expanding middle-class population, and increasing awareness of skincare routines across China, Japan, India, South Korea, and Southeast Asia

- The Emollients segment dominated the market with an estimated 38.6% share in 2025, as emollient-based creams are widely used to soften skin, repair dryness, and improve texture across daily skincare routines

Report Scope and Moisturizing Cream Market Segmentation

|

Attributes |

Moisturizing Cream Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Moisturizing Cream Market?

Increasing Shift Toward Lightweight, Fast-Absorbing, and Dermatologically Advanced Moisturizing Creams

- The moisturizing cream market is witnessing strong adoption of lightweight, non-greasy, and fast-absorbing formulations designed to support daily skincare routines across diverse skin types and climates

- Manufacturers are increasingly introducing dermatologically tested, multi-functional creams offering hydration, barrier repair, anti-aging, and pollution protection in a single formulation

- Growing demand for compact, travel-friendly, and hygienic packaging formats is driving product usage across urban consumers, working professionals, and on-the-go lifestyles

- For instance, leading brands such as L’Oréal, Unilever, Estée Lauder, Procter & Gamble, and Beiersdorf have expanded portfolios with ceramide-based, hyaluronic acid-rich, and clinically proven moisturizing solutions

- Rising preference for quick-absorbing textures, fragrance-free variants, and sensitive-skin formulations is accelerating the shift toward advanced moisturizing creams

- As consumers prioritize skin health, convenience, and long-lasting hydration, moisturizing creams remain essential for daily skincare and preventive dermatology

What are the Key Drivers of Moisturizing Cream Market?

- Rising consumer demand for effective, affordable, and dermatologist-recommended skincare products to address dryness, sensitivity, aging, and environmental stress

- For instance, in 2024–2025, major brands such as CeraVe, NIVEA, Neutrogena, and Cetaphil launched upgraded moisturizing creams with enhanced skin-barrier repair technologies

- Growing awareness of skincare routines, self-care practices, and preventive dermatology is boosting demand across North America, Europe, and Asia-Pacific

- Advancements in ingredient science, including ceramides, niacinamide, peptides, and botanical extracts, have improved product efficacy and consumer trust

- Increasing use of moisturizing creams across men’s grooming, baby care, and medical skincare segments is expanding market penetration

- Supported by strong investments in cosmetic R&D, clinical validation, and premium skincare branding, the Moisturizing Cream market is expected to witness steady long-term growth

Which Factor is Challenging the Growth of the Moisturizing Cream Market?

- High costs associated with premium formulations, clinical testing, and specialized active ingredients limit adoption among price-sensitive consumers

- For instance, during 2024–2025, raw material price volatility, supply chain disruptions, and regulatory compliance costs increased production expenses for several global brands

- Complexity in addressing diverse skin concerns, regional climate differences, and formulation stability increases product development timelines

- Limited consumer awareness in emerging markets regarding ingredient benefits, proper usage, and product differentiation slows adoption

- Intense competition from natural oils, serums, lotions, and multifunctional skincare products creates pricing pressure and brand saturation

- To overcome these challenges, companies are focusing on cost-optimized formulations, clean-label positioning, consumer education, and digital marketing strategies to strengthen global adoption of moisturizing creams

How is the Moisturizing Cream Market Segmented?

The market is segmented on the basis of product type, category, consumer group, and distribution channel.

- By Product Type

On the basis of product type, the moisturizing cream market is segmented into Emollients, Ceramides, Occlusive, Humectants, and Others. The Emollients segment dominated the market with an estimated 38.6% share in 2025, as emollient-based creams are widely used to soften skin, repair dryness, and improve texture across daily skincare routines. These products are preferred due to their immediate soothing effect, broad consumer acceptance, and suitability for sensitive and dry skin conditions. Strong demand from mass-market brands and dermatology-backed products further supports segment leadership.

The Ceramides segment is expected to grow at the fastest CAGR from 2026 to 2033, driven by rising awareness of skin-barrier repair, dermatologist recommendations, and increasing incidence of eczema, dermatitis, and compromised skin conditions. Growing use of ceramide-rich formulations in premium and medical skincare is accelerating segment growth.

- By Category

On the basis of category, the market is segmented into Premium and Mass. The Mass segment dominated the market with a 64.2% share in 2025, supported by high consumer penetration, affordability, and widespread availability across supermarkets, pharmacies, and convenience stores. Mass moisturizing creams are extensively used for daily hydration by a broad demographic, particularly in emerging economies and price-sensitive markets. Strong brand recognition and consistent demand for basic skincare solutions drive volume sales.

The Premium segment is projected to register the fastest CAGR from 2026 to 2033, driven by rising disposable income, increasing focus on ingredient transparency, and growing preference for dermatologically tested, clean-label, and multifunctional skincare products. Expansion of premium brands through e-commerce and dermatologist channels further strengthens growth momentum.

- By Consumer Group

On the basis of consumer group, the moisturizing cream market is segmented into Adults and Children. The Adults segment accounted for the largest market share of 71.8% in 2025, driven by high usage frequency, increasing awareness of skincare routines, and growing concerns related to aging, dryness, pollution exposure, and sensitive skin. Adult consumers actively seek specialized creams for anti-aging, hydration, and barrier repair, supporting sustained demand.

The Children segment is expected to grow at the fastest CAGR from 2026 to 2033, owing to rising awareness of baby skincare, increasing birth rates in emerging markets, and growing preference for pediatrician-recommended and hypoallergenic products. Demand for gentle, fragrance-free, and dermatologically safe formulations is boosting adoption across this segment.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into Store-Based and Non-Store Based. The Store-Based segment dominated the market with a 58.9% share in 2025, supported by strong presence of pharmacies, supermarkets, specialty cosmetic stores, and dermatology clinics. Physical retail allows consumers to evaluate products, seek professional advice, and benefit from brand trust and promotions.

The Non-Store-Based segment is anticipated to grow at the fastest CAGR from 2026 to 2033, driven by rapid expansion of e-commerce platforms, direct-to-consumer brands, subscription models, and digital skincare consultations. Increasing online discounts, convenience, and access to global brands are accelerating digital channel adoption.

Which Region Holds the Largest Share of the Moisturizing Cream Market?

- North America dominated the moisturizing cream market with a 37.45% revenue share in 2025, driven by high consumer awareness regarding skincare, strong penetration of premium and dermatologist-recommended products, and rising demand for solutions addressing dry skin, aging, and sensitive skin conditions across the U.S. and Canada. Widespread adoption of daily skincare routines, high disposable income, and strong brand presence continue to support market leadership

- Leading companies in North America are introducing advanced formulations enriched with ceramides, hyaluronic acid, peptides, and clean-label ingredients, strengthening the region’s innovation edge. Continuous investment in product research, clinical testing, and sustainable packaging further fuels long-term market growth

- High concentration of global skincare brands, strong retail infrastructure, and well-established e-commerce ecosystems reinforce North America’s dominance in the Moisturizing Cream market

U.S. Moisturizing Cream Market Insight

The U.S. is the largest contributor in North America, supported by high consumer spending on personal care, growing demand for anti-aging and dermatologically tested products, and strong influence of social media and beauty influencers. Increasing preference for premium, clean, and multifunctional moisturizing creams across adult and pediatric segments continues to drive market expansion.

Canada Moisturizing Cream Market Insight

Canada contributes significantly to regional growth due to rising awareness of skin health in cold climates, growing demand for hydration-focused products, and increasing adoption of organic and hypoallergenic formulations. Strong pharmacy retail networks and expanding online sales channels further support market growth.

Asia-Pacific Moisturizing Cream Market

Asia-Pacific is projected to register the fastest CAGR of 7.9% from 2026 to 2033, driven by rapid urbanization, rising disposable incomes, expanding middle-class population, and increasing awareness of skincare routines across China, Japan, India, South Korea, and Southeast Asia. Growing demand for whitening, hydration, sun-protection, and anti-aging products, combined with the influence of K-beauty and J-beauty trends, is accelerating market adoption. Expansion of e-commerce platforms, local manufacturing, and affordable product offerings is significantly increasing market penetration across both urban and semi-urban areas

China Moisturizing Cream Market Insight

China is the largest contributor to Asia-Pacific, supported by a massive consumer base, rising beauty consciousness, and strong domestic and international brand presence. Increasing demand for premium and functional skincare products is driving sustained growth.

Japan Moisturizing Cream Market Insight

Japan shows steady growth due to strong preference for high-quality, gentle, and scientifically formulated skincare products. Aging population and focus on skin barrier protection support long-term demand.

India Moisturizing Cream Market Insight

India is emerging as a high-growth market, driven by rising awareness of skincare, expanding youth population, increasing penetration of affordable brands, and rapid growth of online beauty platforms.

South Korea Moisturizing Cream Market Insight

South Korea contributes significantly due to innovation-driven skincare culture, strong global influence of K-beauty, and high demand for advanced moisturizing and skin-repair formulations, supporting sustained market growth.

Which are the Top Companies in Moisturizing Cream Market?

The moisturizing cream industry is primarily led by well-established companies, including:

- Procter & Gamble (U.S.)

- L’Oréal (France)

- Unilever (U.K.)

- Estée Lauder Companies (U.S.)

- LVMH (Moët Hennessy Louis Vuitton) (France)

- Shiseido Company, Limited (Japan)

- Coty Inc. (U.S.)

- New Avon Company (U.S.)

- CHANEL (France)

- Revlon (U.S.)

- Giorgio Armani S.p.A. (Italy)

- Amway Corp. (U.S.)

- Johnson & Johnson Services, Inc. (U.S.)

- Kao Corporation (Japan)

- Henkel AG & Co. KGaA (Germany)

- L Brands (U.S.)

- Natura (Brazil)

- Oriflame Cosmetics AG (Sweden)

- Babor (Germany)

- Lotus Herbals (India)

- Mary Kay Inc. (U.S.)

- Nature Republic USA (U.S.)

- Clarins (France)

What are the Recent Developments in Global Moisturizing Cream Market?

- In February 2024, PÜR Beauty, a U.S.-based beauty and skincare company, introduced its new standout skincare range, including the Tropical C Brightening Vitamin C & Peptide Moisturizer, across the Canadian market, strengthening its international presence and expanding access to vitamin C–based formulations in North America

- In January 2024, BeautyStat Cosmetics, a New York–based cosmetics brand, launched its peptide wrinkle-relaxing moisturizer exclusively through ULTA.com and Beautystat.com, reinforcing its direct-to-consumer strategy and highlighting growing demand for peptide-driven anti-aging skincare solutions

- In February 2023, Keomi Beauty, an Indian beauty and skincare company, announced plans to expand its product portfolio with new launches by April 2023, including a Daily Youth Serum, Sunscreen SPF 50 PA+++, and Hyaluronic Acid Serum, reflecting the company’s focus on hydration, sun protection, and anti-aging care

- In January 2023, Charlotte Tilbury, a U.K.-based skincare and makeup brand, unveiled its Magic Body Cream formulated with ingredients such as hyaluronic acid and caffeine, extending the success of its iconic Magic Cream Moisturizer into the body care segment and enhancing brand-led premium skincare innovation

- In August 2022, Sand&Sky, an Australian natural skincare brand, launched the Glow Berries Intense Moisturizer enriched with Vitamin C, targeting age-related skin concerns and underscoring Australia’s rising demand for natural and anti-aging moisturizing creams

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.