Global Nanopore Sequencing Market

Market Size in USD Billion

CAGR :

%

USD

923.91 Billion

USD

2,395.95 Billion

2025

2033

USD

923.91 Billion

USD

2,395.95 Billion

2025

2033

| 2026 –2033 | |

| USD 923.91 Billion | |

| USD 2,395.95 Billion | |

|

|

|

|

Nanopore Sequencing Market Size

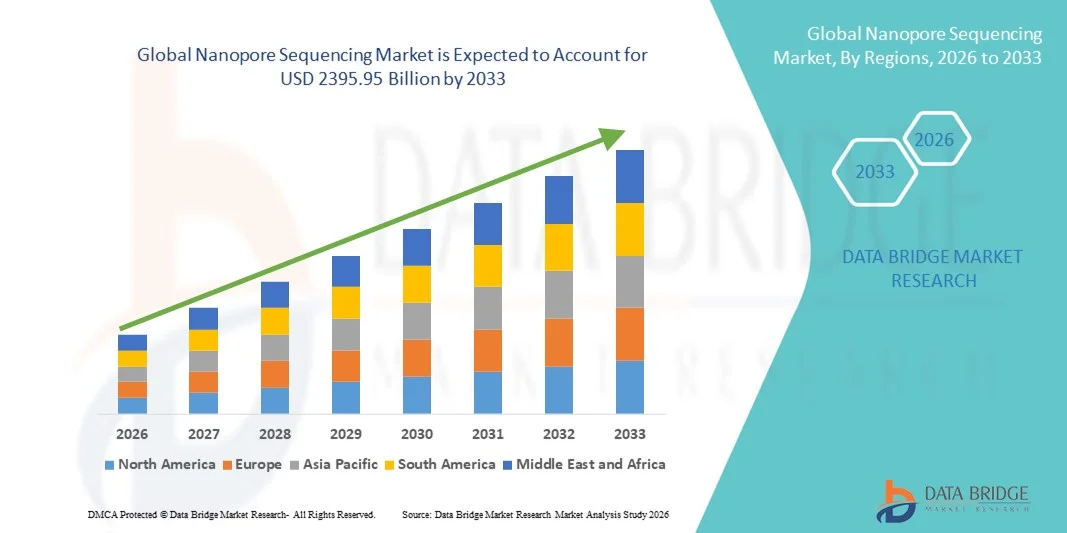

- The global nanopore sequencing market size was valued at USD 923.91 billion in 2025 and is expected to reach USD 2395.95 billion by 2033, at a CAGR of12.65% during the forecast period

- The market growth is largely fueled by rapid technological advancements in nanopore sequencing platforms — including improvements in real‑time, portable, and long‑read DNA/RNA sequencing that enable faster, more cost‑effective genomic analysis for diagnostics, research, and field applications

- Furthermore, increasing demand for personalized medicine, precision diagnostics, infectious disease surveillance, and genomic research is driving adoption of nanopore sequencing solutions across healthcare, biotechnology, and academic sectors, significantly boosting overall industry growth

Nanopore Sequencing Market Analysis

- Nanopore sequencing technologies — offering real‑time, long‑read DNA/RNA sequencing with portable and cost‑effective platforms — are becoming essential tools across genomics research, clinical diagnostics, infectious disease surveillance, and precision medicine due to their speed, flexibility, and on‑site sequencing capabilities

- The escalating demand for nanopore sequencing solutions is primarily driven by increasing genomic research activities, rising prevalence of genetic and infectious diseases, growth in clinical applications such as cancer and rare disease diagnostics, and broader adoption of advanced sequencing technologies by healthcare and life sciences sectors

- North America dominated the Nanopore Sequencing market with the largest revenue share of 40.74% in 2025, supported by advanced healthcare infrastructure, high research and development investment, and strong adoption of precision medicine programs — particularly in the United States

- Asia‑Pacific is expected to be the fastest‑growing region in the Nanopore Sequencing market during the forecast period, driven by expanding healthcare systems, increasing government funding for genomics, and rapid growth in biotechnology research — posting a high compound annual growth rate relative to other regions

- The DNA sequencing segment held the largest market share of 64.3% in 2025, driven by its use in human genomics, population studies, plant research, and clinical diagnostics

Report Scope and Nanopore Sequencing Market Segmentation

|

Attributes |

Nanopore Sequencing Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Nanopore Sequencing Market Trends

Rising Demand Due to Rapid Advancements in Genomic Research and Personalized Medicine

- The growing focus on precision medicine and personalized healthcare is driving strong demand for Nanopore Sequencing technologies globally. Researchers are increasingly relying on long-read sequencing platforms to identify genetic variations, structural variants, and epigenetic modifications with high accuracy

- Nanopore Sequencing offers real-time data generation and portability, allowing laboratories, hospitals, and research centers to conduct rapid genomic analysis, which accelerates drug development and disease diagnostics

- For instance, in 2025, Oxford Nanopore Technologies reported expanding usage of its MinION platform in clinical research, demonstrating increased adoption in oncology and infectious disease studies

- Academic institutions and biotech startups are investing heavily in sequencing capabilities to support translational research, population genomics, and disease biomarker discovery

- The ability to sequence long DNA and RNA fragments enables comprehensive genomic insights that were challenging with traditional short-read technologies, further driving preference for Nanopore platforms

- Integration with bioinformatics pipelines and cloud-based data analysis enhances throughput and efficiency, making Nanopore Sequencing increasingly attractive for large-scale genomic projects

- As personalized medicine gains traction globally, the demand for rapid, portable, and flexible sequencing solutions continues to rise, positioning Nanopore Sequencing as a key enabler of next-generation healthcare research

Nanopore Sequencing Market Dynamics

Driver

Increased Adoption in Clinical Diagnostics and Infectious Disease Surveillance

- Nanopore Sequencing technologies are gaining traction in clinical diagnostics due to their ability to rapidly detect pathogens, monitor antimicrobial resistance, and characterize outbreaks in real time

- For instance, several public health laboratories in Asia and Europe have adopted portable Nanopore platforms for rapid SARS-CoV-2 genome sequencing, enabling quick variant detection and epidemiological tracking

- The technology’s speed, portability, and low sample preparation requirements make it highly suitable for fieldwork, outbreak response, and point-of-care applications

- Increasing investments by hospitals, research centers, and government agencies to strengthen genomic surveillance infrastructure are further accelerating adoption

- Continuous improvements in sequencing accuracy and library preparation kits are enabling clinical laboratories to perform comprehensive genomic profiling with confidence

- Integration with bioinformatics tools and data-sharing networks enhances real-time monitoring of emerging pathogens, supporting public health interventions

- Overall, the critical role of Nanopore Sequencing in infectious disease monitoring and diagnostics is driving significant growth across both established and emerging market

Restraint/Challenge

High Initial Costs and Technical Complexity

- Despite the benefits, the relatively high initial cost of nanopore sequencing instruments and consumables can hinder adoption, particularly among small-scale laboratories, academic institutions, and emerging market organizations

- Technical complexity and the need for trained personnel to operate the platforms and analyze sequencing data remain significant barriers

- For instance, while portable devices such as MinION provide accessibility, advanced library preparation, and high-throughput setups require skilled operators and bioinformatics expertise

- The perception of high costs relative to short-read sequencing technologies can limit market penetration in price-sensitive regions

- Regular maintenance, calibration, and consumable replacement add to operational expenses, further increasing the total cost of ownership

- To overcome these challenges, companies are investing in simplified sample preparation kits, user-friendly software, and training programs to reduce the learning curve and expand accessibility

- While costs are gradually decreasing, careful budgeting and technical support remain critical for widespread adoption, particularly in smaller labs or resource-limited settings

Nanopore Sequencing Market Scope

The market is segmented on the basis of Product, Nucleotide Sequenced, Type, Type of Nanopore, Application, and End-User.

- By Product

On the basis of product, the Nanopore Sequencing market is segmented into Consumables and Instruments. The Consumables segment held the largest market revenue share of 57.8% in 2025, driven by the recurring requirement for reagents, flow cells, and library preparation kits across research and clinical applications. Consumables are essential for continuous sequencing runs, supporting genomics, transcriptomics, and microbiology experiments. The demand is boosted by high-throughput sequencing projects in academic and industrial laboratories. Consumables allow flexibility in sample types and experimental protocols, encouraging repeat purchases. Integration with multi-omics workflows further enhances adoption. The ease of use, compatibility with existing sequencers, and consistent quality drive the segment’s dominance. Large-scale genomics projects favor consumables for scalability and reproducibility. The segment benefits from strong R&D investments to improve reagent stability and performance. Academic collaborations and government-funded projects sustain steady growth. Supply chain reliability and availability of diverse consumables contribute to the adoption. Increased adoption of personalized medicine and diagnostics also supports growth. Continuous innovation in reagent formulations ensures repeat purchases and market stability.

The Instruments segment is expected to grow at the fastest CAGR of 18.2% from 2026 to 2033, fueled by technological upgrades in nanopore sequencers, including longer read lengths, higher accuracy, and faster sequencing. Adoption of portable, benchtop, and automated sequencers is rising in biotechnology, clinical diagnostics, and environmental genomics. Instruments enable real-time data generation and AI-driven analytics, supporting precision medicine and plant genomics. Startups and academic institutions invest in modern instruments for multi-omics applications. Improved user interfaces, lower costs, and reduced laboratory footprint encourage adoption. Hybrid instruments capable of both DNA and RNA sequencing attract demand. Cloud connectivity and context-aware sequencing features increase interest. Growing awareness of genome editing and personalized therapies supports instrument adoption. Global collaborations and technology licensing agreements accelerate growth. Advanced materials and chip designs enhance throughput, reliability, and instrument longevity. Expansion of research infrastructure in developing regions supports instrument adoption. Continuous innovation and integration with bioinformatics pipelines boost market growth.

- By Nucleotide Sequenced

On the basis of nucleotide sequenced, the market is segmented into DNA and RNA. The DNA sequencing segment held the largest market share of 64.3% in 2025, driven by its use in human genomics, population studies, plant research, and clinical diagnostics. DNA sequencing enables identification of genetic variations, structural variants, and hereditary conditions. Clinical adoption is growing due to applications in disease diagnosis, pharmacogenomics, and prenatal testing. In plant and animal research, DNA sequencing supports crop improvement and biodiversity studies. The segment benefits from investments in genomic databases, bioinformatics pipelines, and sequencing centers. High reproducibility and reliable data generation support adoption. DNA sequencing instruments are compatible with multiple nanopore types and sample formats. Academic and commercial research heavily relies on DNA sequencing. The segment is critical for gene therapy and genome editing applications. Government initiatives in precision medicine sustain adoption. DNA sequencing protocols are well-established, reducing implementation barriers. Widespread availability of reagents and reference genomes further strengthens market dominance.

The RNA sequencing segment is projected to grow at a CAGR of 20.1% from 2026 to 2033, driven by rising interest in transcriptomics, single-cell RNA analysis, and biomarker discovery. RNA sequencing is extensively used in cancer research, virology, and functional genomics. Demand is increasing for understanding gene expression patterns and cellular heterogeneity. Technological improvements provide higher accuracy, lower input requirements, and real-time sequencing capabilities. Pharmaceutical and biotech companies leverage RNA sequencing for drug discovery and vaccine development. Academic research in RNA biology is expanding, supporting growth. RNA sequencing supports regulatory compliance in clinical trials. Portability and cost reductions attract adoption in smaller labs. Public health and infectious disease monitoring drive global demand. Integration with AI and cloud-based analytics enhances interpretation. Single-cell and multi-omics studies increasingly rely on RNA sequencing. Transcriptomic studies in personalized medicine and precision health further propel growth.

- By Type

On the basis of type, the market is segmented into Direct Current Sequencing, Synthetic DNA and Horizontal Tunnelling Current Sequencing, Optical Reading Techniques Sequencing, and Exonuclease Sequencing. The Direct Current Sequencing segment accounted for the largest market revenue share of 45.7% in 2025, owing to its high reliability, established usage protocols, and compatibility with diverse sample types. It provides stable signal detection, ensuring accurate base calling and reproducible results. This type is widely used in research and clinical laboratories for DNA and RNA sequencing. Laboratories prefer it for cost-effectiveness and ease of integration with existing workflows. Direct current sequencing supports long-read applications, multi-omics research, and clinical diagnostics. It benefits from standardized protocols, reducing errors and increasing confidence in results. Its adoption is reinforced by robust support from instrument manufacturers and availability of consumables. Academic institutions and government-funded projects extensively use direct current sequencing. Applications in human genomics, microbiology, and plant research further drive demand. The segment’s compatibility with multiple nanopore types ensures flexibility. Training programs and documentation ease the adoption in new labs. Continuous R&D in signal optimization sustains its market dominance.

The Exonuclease Sequencing segment is expected to grow at a CAGR of 19.5% from 2026 to 2033, driven by its real-time sequencing capability and high accuracy at single-molecule resolution. It is increasingly used in cutting-edge applications, including single-cell genomics, epigenetics, and biomarker discovery. Startups and research institutions adopt exonuclease sequencing for innovative assays and diagnostic applications. It provides faster sample-to-result times and improved base-calling efficiency. Integration with AI and advanced analytics enhances performance and data interpretation. Pharmaceutical research and drug development pipelines are incorporating exonuclease sequencing. Its applications extend to RNA and DNA sequencing, enabling flexible use across studies. Technological improvements, including enhanced nanopore chemistries and microfluidics, boost adoption. The segment supports portable and benchtop sequencing platforms. Multi-disciplinary research adoption strengthens growth potential. Growing interest in precision medicine and personalized therapies contributes to market expansion. Continuous innovation and integration with cloud platforms accelerate global adoption.

- By Type of Nanopore

On the basis of type of nanopore, the market is segmented into Solid State, Biological, and Hybrid. The Biological nanopore segment held the largest market revenue share of 52.4% in 2025, driven by high specificity, reproducibility, and extensive application across DNA and RNA sequencing. Biological nanopores, such as protein-based pores, are widely used in human genomics and clinical diagnostics due to their predictable behavior and accuracy. Their well-characterized properties make them suitable for a range of sample types and experimental protocols. Laboratories and research institutions prefer biological nanopores for their consistency and reliability. Adoption is fueled by applications in transcriptomics, microbiome research, and pathogen detection. Integration with standardized instruments and consumables enhances usability. The segment benefits from decades of research, optimized reagents, and mature workflows. Academic, clinical, and industrial projects frequently utilize biological nanopores. Government-funded genomics initiatives further support adoption. The segment’s robustness and reproducibility make it the preferred choice for critical applications. Strong partnerships between nanopore manufacturers and research labs reinforce market share. Continuous improvements in protein engineering maintain its competitive edge.

The Solid-State nanopore segment is expected to register the fastest CAGR of 21.3% from 2026 to 2033, driven by innovations in semiconductor-based nanopores and electronic readout integration. Solid-state nanopores allow high-throughput sequencing with improved durability and potential for miniaturized devices. Adoption is increasing for portable sequencing platforms in field-based applications, environmental genomics, and industrial research. Enhanced sensitivity, stability, and customization options make solid-state nanopores attractive for next-generation sequencing. Integration with AI-enabled analytics enables real-time base calling and adaptive sequencing. The segment benefits from reduced costs in chip fabrication and scalable production. Multi-omics applications, including RNA and DNA sequencing, further support growth. Industrial R&D adoption, particularly in biotech and agriculture, is rising. Solid-state nanopores support multiplexing, increasing efficiency and throughput. Academic and commercial laboratories are investing in these technologies. Improved electronics and materials enhance reliability and sequencing accuracy. Government grants for emerging sequencing technologies accelerate development and market penetration.

- By Application

On the basis of application, the market is segmented into Human Genomics, Clinical Research, Plant Research, Microbiology, and Animal Research. The Human Genomics segment accounted for the largest market revenue share of 49.8% in 2025, driven by the expansion of precision medicine, population-scale genome projects, and personalized therapies. High adoption in healthcare institutions and research centers for disease mapping, genetic testing, and individualized treatment supports dominance. Sequencing platforms are widely used for oncology research, rare disease studies, and pharmacogenomics. Government-funded genomics projects and public health initiatives boost growth. The segment benefits from integration with multi-omics pipelines and bioinformatics tools. Academic collaborations and private-sector R&D further enhance adoption. Sequencing data from human genomics applications support diagnostics, therapeutics, and predictive medicine. Continuous demand for high-quality reference genomes sustains segment growth. Compatibility with multiple nanopore types and instruments increases utility. The segment drives repeat consumable purchases, strengthening revenue streams. Regulatory approvals and standardization in clinical applications encourage adoption. Advancements in read length and accuracy improve confidence in results, reinforcing market share.

The Plant Research segment is expected to witness the fastest CAGR of 22.0% from 2026 to 2033, fueled by increasing adoption of nanopore sequencing for crop improvement, trait discovery, and environmental genomics. Researchers use sequencing for plant genome assembly, genotyping, and studying stress responses. Rising investment in agricultural biotechnology, government initiatives, and precision agriculture projects drive growth. Portability of nanopore sequencers supports field-based applications in diverse geographies. Improved sequencing accuracy and reduced cost enable small-scale labs and startups to adopt the technology. Integration with bioinformatics pipelines and AI analytics supports complex trait analysis. Sequencing facilitates studies in plant-microbe interactions and biodiversity assessment. Academic and private research centers are increasingly using plant genomics for sustainable agriculture. The segment benefits from multi-omics studies linking genomics with phenotypic data. Continuous innovations in flow cells and reagents support rapid adoption. Demand is rising for understanding gene-environment interactions and stress tolerance. Emerging markets in Asia-Pacific and Africa are contributing to adoption.

- By End-User

On the basis of end-user, the market is segmented into Biotechnology Companies, Clinical Laboratories, and Academic & Research Institutes. The Academic & Research Institutes segment held the largest market revenue share of 55.6% in 2025, driven by extensive research projects, government funding, and early adoption of cutting-edge sequencing technologies. Academic institutions leverage nanopore sequencing for genomics, transcriptomics, functional studies, and environmental research. Government grants and collaborations with private organizations support adoption. Universities and public labs implement high-throughput sequencing for large-scale projects, enhancing data generation and scientific output. Access to training, standardized protocols, and shared facilities strengthens adoption. The segment benefits from a culture of innovation and early testing of new sequencing instruments. Multi-disciplinary research programs increase platform utilization. Academic research drives demand for consumables and instruments, generating consistent revenue. Collaboration with biotech startups facilitates technology transfer and commercialization. The segment supports development of novel algorithms, bioinformatics pipelines, and analytics tools. Adoption in teaching and training further encourages widespread use.

The Biotechnology Companies segment is expected to witness the fastest CAGR of 19.8% from 2026 to 2033, driven by commercialization of nanopore-based diagnostic kits, R&D in synthetic biology, and integration of sequencing platforms into drug discovery pipelines. Biotechnology firms leverage nanopore sequencing for biomarker discovery, functional genomics, and precision medicine applications. Startups are rapidly adopting portable sequencers for field-based applications. Integration with AI and cloud platforms enhances data interpretation and scalability. Investment in workflow automation and high-throughput analysis supports efficiency. Multi-omics and real-time sequencing applications create competitive advantages. Industry-academic collaborations accelerate innovation and adoption. The segment benefits from increasing demand for diagnostics, therapeutics, and industrial biotechnology solutions. Regulatory compliance and high-quality data output drive commercial adoption. Expansion into emerging markets provides additional growth opportunities. Partnerships with instrument manufacturers strengthen technology access. Continuous R&D and product innovation support sustained CAGR growth.

Nanopore Sequencing Market Regional Analysis

- North America dominated the nanopore sequencing market with the largest revenue share of 40.74% in 2025, supported by advanced healthcare infrastructure, high research and development investment, and strong adoption of precision medicine programs — particularly in the United States

- The region benefits from well-established genomic research centers, clinical laboratories, and biotechnology firms that actively deploy Nanopore Sequencing platforms for diagnostics, personalized medicine, and translational research. The U.S., as the largest contributor within North America, accounted for, driven by early adoption of advanced sequencing technologies, growing demand for rapid genomic insights, and investments in clinical genomics. Hospitals, research institutes, and biotech companies are leveraging portable and high-throughput Nanopore systems to accelerate drug discovery, disease surveillance, and biomarker identification. Strong regulatory support, technological expertise, and availability of skilled professionals further enhance adoption

- Continuous innovations in sequencing accuracy, data analysis tools, and bioinformatics platforms are expanding the applications of Nanopore Sequencing across healthcare and research sectors. The combination of advanced infrastructure, high R&D spending, and strong market awareness establishes North America as the dominant regional market

U.S. Nanopore Sequencing Market Insight

The U.S. nanopore sequencing market captured the largest share within North America in 2025, fueled by widespread adoption of precision medicine programs and the increasing integration of genomic sequencing into clinical diagnostics. Research institutions, hospitals, and biotechnology companies are increasingly using Nanopore Sequencing platforms for rapid pathogen identification, disease monitoring, and personalized therapy development. The availability of skilled personnel, government funding for genomics research, and high investment in laboratory infrastructure further support market expansion. Growth is additionally driven by rising adoption of long-read sequencing for structural variant detection, epigenetic studies, and transcriptomics, which enable comprehensive genomic analysis in both clinical and research applications.

Europe Nanopore Sequencing Market Insight

The Europe nanopore sequencing market is projected to expand at a substantial CAGR during the forecast period, driven by increasing investments in healthcare infrastructure, genomics research, and precision medicine initiatives. Countries across the region are emphasizing advanced molecular diagnostics and public health surveillance, which rely on rapid and accurate sequencing solutions. Adoption is growing across clinical, academic, and industrial research applications, including oncology, rare disease studies, and pathogen detection. Regulatory support, increasing collaboration among research institutes, and rising demand for portable sequencing platforms further propel growth. The region is also experiencing expansion in multi-institutional genomics projects and population-scale sequencing studies.

U.K. Nanopore Sequencing Market Insight

The U.K. nanopore sequencing market is anticipated to grow at a noteworthy CAGR during the forecast period, supported by national genomics initiatives, investments in clinical research, and expanding biotechnology infrastructure. The country has witnessed rising adoption of long-read sequencing in hospitals, universities, and private labs for disease research, diagnostics, and pathogen surveillance. Government-backed programs and collaborations with biotech startups have strengthened the market. Additionally, the increasing focus on precision medicine and translational genomics is encouraging wider deployment of Nanopore Sequencing platforms across healthcare and research applications.

Germany Nanopore Sequencing Market Insight

The Germany nanopore sequencing market is expected to expand at a considerable CAGR during the forecast period, driven by growing awareness of molecular diagnostics, precision medicine adoption, and research-focused healthcare policies. Strong infrastructure, high investments in biotech R&D, and emphasis on sustainable and technology-driven healthcare solutions are supporting the market. German hospitals and research institutes increasingly integrate long-read sequencing for oncology, rare disease, and infectious disease studies. Collaborative genomics programs, government funding, and rising demand for real-time sequencing further enhance adoption in both clinical and research segments.

Asia-Pacific Nanopore Sequencing Market Insight

The Asia-Pacific nanopore sequencing market is poised to be the fastest-growing region during the forecast period, driven by expanding healthcare systems, increasing government funding for genomics research, and rapid growth in biotechnology and life sciences R&D. Countries such as China, India, Japan, and South Korea are increasingly adopting Nanopore platforms for clinical diagnostics, infectious disease surveillance, and personalized medicine applications. Rising investments in smart laboratories, academic research centers, and biotech startups, along with the affordability of portable sequencing solutions, are contributing to regional growth. The region is emerging as both a consumer and a manufacturing hub for Nanopore Sequencing instruments, expanding accessibility and adoption.

Japan Nanopore Sequencing Market Insight

The Japan nanopore sequencing market is gaining momentum due to high healthcare standards, technological advancements, and strong focus on research and development. The market is driven by the increasing need for rapid disease diagnostics, genomic studies, and precision medicine applications. Rising adoption in hospitals, academic research institutions, and biotechnology companies is fueling growth. Additionally, Japan’s aging population encourages the integration of advanced genomic tools to improve healthcare outcomes and accelerate biomedical research.

China Nanopore Sequencing Market Insight

The China nanopore sequencing market accounted for the largest revenue share in Asia-Pacific in 2025, supported by rapid urbanization, growing middle-class healthcare demand, and significant investment in genomics research. China is a leading hub for biotechnology and molecular diagnostics, with hospitals, research institutes, and commercial labs increasingly adopting Nanopore Sequencing platforms. Government initiatives promoting precision medicine, smart healthcare infrastructure, and smart city projects further strengthen market growth. Affordable sequencing instruments and a strong domestic manufacturing base enable widespread adoption across clinical, research, and industrial applications.

Nanopore Sequencing Market Share

The Nanopore Sequencing industry is primarily led by well-established companies, including:

- Oxford Nanopore Technologies (U.K.)

- Illumina (U.S.)

- Thermo Fisher Scientific (U.S.)

- Pacific Biosciences (U.S.)

- Roche Diagnostics (Switzerland)

- QIAGEN (Germany)

- Agilent Technologies (U.S.)

- Bio-Rad Laboratories (U.S.)

- New England Biolabs (U.S.)

- BGI Genomics (China)

- Integrated DNA Technologies (U.S.)

- Takara Bio (Japan)

- Promega Corporation (U.S.)

- GenapSys (U.S.)

- Sengenics (Malaysia)

- Danaher Corporation (U.S.)

- PerkinElmer (U.S.)

- SomaLogic (U.S.)

- Oxford University Innovation (U.K.)

- SeqWell (U.S.)

Latest Developments in Global Nanopore Sequencing Market

- In March 2021, Oxford Nanopore Technologies introduced its Q20+ chemistry kit, which enabled single‑molecule, single‑pass sequencing reads with modal accuracy above 99 % (Q20+). This marked a critical accuracy milestone for nanopore sequencing, significantly enhancing read fidelity for both DNA and RNA applications and driving broader adoption in genomics research worldwide

- In September 2021, Oxford Nanopore Technologies went public with its initial public offering (IPO) on the London Stock Exchange, marking a major financial milestone for the nanopore sequencing sector and signaling investor confidence in long‑read, portable sequencing technologies

- In February 2023, Oxford Nanopore expanded its logistics and global delivery network by teaming up with UPS Healthcare to accelerate delivery of its DNA/RNA sequencing products and consumables across key Asia Pacific markets, reducing delivery times and strengthening regional market access

- In June 2023, Oxford Nanopore Technologies and Geneyx jointly announced the development of the first scalable, end‑to‑end software solution for nanopore sequencing analysis, designed to streamline clinical interpretation of whole‑genome data through a unified platform. This partnership aimed to support newborn screening and rare disease research with simplified data workflows

- In May 2024, at its annual London Calling conference, Oxford Nanopore unveiled breakthroughs including a nanopore‑only telomere‑to‑telomere (T2T) genome assembly toolset and continual accuracy improvements across DNA and RNA sequencing workflows, emphasizing enhanced multiomic data and new capabilities for methylation and epigenetic analysis

- In August 2024, Novo Holdings, a major life sciences investor, announced a £50 million investment in Oxford Nanopore Technologies, strengthening the company’s funding for next‑generation sequencing R&D and global market expansion. The investment supported technology development and scaling operations internationally

- In August 2024, Oxford Nanopore entered a landmark collaboration with Singapore’s National Precision Medicine programme, committing to sequence 10,000 human genomes representing diverse ethnic groups to enhance understanding of genetic variability and support precision healthcare across regions

- In April 2025, Oxford Nanopore Technologies expanded its Compatible Products Programme by certifying integration with products from industry leaders like 10x Genomics, Agilent Technologies, and Thermo Fisher Scientific, enabling broader ecosystem support and enhanced interoperability for nanopore workflows

- In April 2025, Oxford Nanopore partnered with Cepheid to launch an integrated, scalable automated nanopore sequencing solution for clinical labs, combining Cepheid’s GeneXpert sample preparation systems with Oxford Nanopore’s analysis platform to accelerate infectious disease profiling with faster turnaround times

- In June 2025, bioMérieux completed the acquisition of Day Zero Diagnostics, a move aimed at expanding rapid infectious disease diagnostics and strengthening nanopore‑powered sequencing solutions to combat antibiotic resistance and infectious threats globally

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.