Global Natural Antioxidant For Feed Market

Market Size in USD Million

CAGR :

%

USD

188.95 Million

USD

399.18 Million

2025

2033

USD

188.95 Million

USD

399.18 Million

2025

2033

| 2026 –2033 | |

| USD 188.95 Million | |

| USD 399.18 Million | |

|

|

|

|

What is the Global Natural Antioxidant for Feed Market Size and Growth Rate?

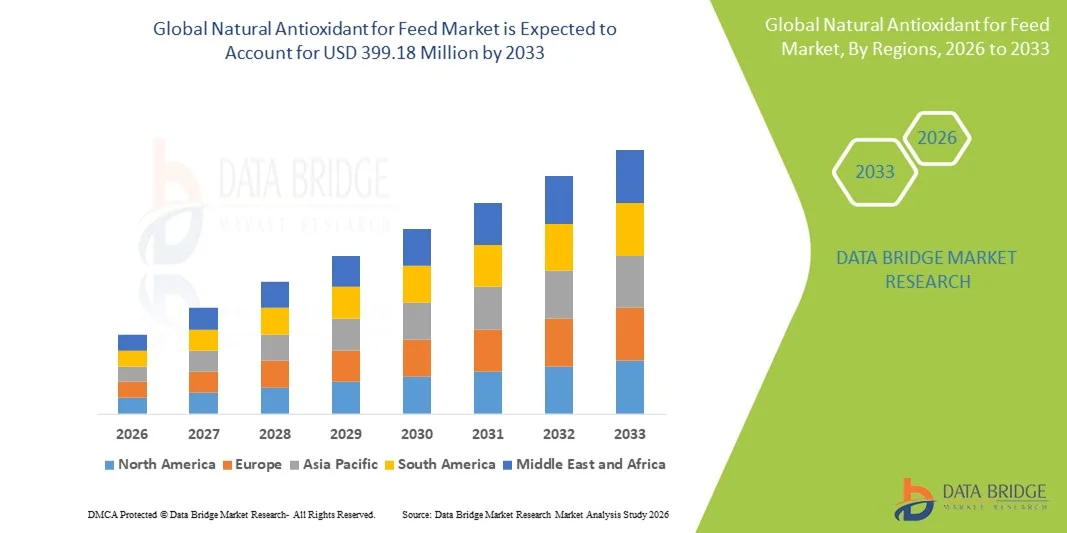

- The global natural antioxidant for Feed market size was valued at USD 188.95 million in 2025 and is expected to reach USD 399.18 million by 2033, at a CAGR of9.80% during the forecast period

- Growing awareness about various animal and livestock diseases coupled with increased focus of the farmers on promoting the overall health and body mass of animals or pets will emerge as the major factors fostering the growth of the market

What are the Major Takeaways of Natural Antioxidant for Feed Market?

- Growing demand for ingredients that promote the shelf life of animal feed and its nutritional quality is another important factor fostering the growth of the market

- Growth in the need for medical assistance in livestock breeding, surge in the livestock population, and increasing personal disposable income will further create lucrative and remunerative growth opportunities for the market

- Rising diseases in animals owing to the use of synthetic ingredients in feed and surging globalization will also carve the way for the growth of the market

- Europe dominated the natural antioxidant for feed market with a 37.78% revenue share in 2025, driven by stringent regulations on synthetic feed additives, strong adoption of clean-label animal nutrition, and high demand for natural, sustainable feed solutions across the U.K., Germany, France, Spain, and Italy

- Europe is also projected to register the fastest CAGR of 9.74% from 2026 to 2033, supported by tightening regulatory norms, rising consumer demand for sustainably produced animal products, and continuous innovation in natural feed additives

- The Tocopherols segment dominated the market with a 41.8% share in 2025, driven by their widespread use as natural vitamin E antioxidants to prevent lipid oxidation in animal feed

Report Scope and Natural Antioxidant for Feed Market Segmentation

|

Attributes |

Natural Antioxidant for Feed Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Natural Antioxidant for Feed Market?

Increasing Shift Toward Natural, Clean-Label, and Plant-Based Antioxidant Solutions

- The natural antioxidant for feed market is witnessing strong adoption of plant-derived, clean-label antioxidant solutions such as tocopherols, rosemary extract, flavonoids, and polyphenols to replace synthetic alternatives

- Feed manufacturers are increasingly formulating multi-component antioxidant blends that improve lipid stability, extend feed shelf life, and enhance nutritional integrity across poultry, swine, ruminant, and aquaculture feeds

- Growing demand for antibiotic-free, organic, and sustainable animal nutrition is driving the use of natural antioxidants in commercial and specialty feed formulations

- For instance, companies such as Cargill, DSM, BASF SE, Kemin Industries, and Novozymes have expanded their natural antioxidant portfolios to support oxidative stability and animal health

- Increasing regulatory pressure on synthetic additives and rising consumer demand for traceable and sustainable livestock production are accelerating adoption of natural feed antioxidants

- As feed quality and animal performance gain importance, Natural Antioxidants for Feed will remain essential for preserving feed efficacy and improving animal health outcomes

What are the Key Drivers of Natural Antioxidant for Feed Market?

- Rising demand for natural and safe feed additives to prevent lipid oxidation and nutrient degradation in animal feed is driving market growth

- For instance, in 2024–2025, leading companies such as DSM, Kemin Industries, and Alltech launched enhanced antioxidant blends aimed at improving feed stability and animal performance

- Growing global production of poultry, swine, aquaculture, and ruminant feed is boosting demand for effective natural preservation solutions across the U.S., Europe, and Asia-Pacific

- Advancements in extraction technologies, encapsulation methods, and bioavailability enhancement have improved the efficiency and cost-effectiveness of natural antioxidants

- Rising awareness of animal immunity, gut health, and oxidative stress management is creating sustained demand for antioxidant-enriched feed formulations

- Supported by investments in sustainable agriculture and animal nutrition R&D, the Natural Antioxidant for Feed market is expected to witness steady long-term growth

Which Factor is Challenging the Growth of the Natural Antioxidant for Feed Market?

- Higher costs associated with plant-based extracts, fermentation-derived ingredients, and natural antioxidant blends limit adoption in price-sensitive feed markets

- For instance, during 2024–2025, fluctuations in raw material availability, crop yields, and extraction costs impacted pricing stability for several natural antioxidant suppliers

- Variability in antioxidant potency, stability, and consistency compared to synthetic alternatives presents formulation challenges for feed manufacturers

- Limited awareness among small-scale feed producers regarding dosage optimization and performance benefits slows broader adoption

- Competition from cost-effective synthetic antioxidants continues to create pricing pressure and adoption barriers

- To address these challenges, companies are focusing on process optimization, blended formulations, and education initiatives, supporting wider adoption of Natural Antioxidants for Feed

How is the Natural Antioxidant for Feed Market Segmented?

The market is segmented on the basis of product type, livestock, and form.

- By Product Type

On the basis of product type, the natural antioxidant for feed market is segmented into Carotenoids, Tocopherols, Botanical Extracts, and Vitamins. The Tocopherols segment dominated the market with a 41.8% share in 2025, driven by their widespread use as natural vitamin E antioxidants to prevent lipid oxidation in animal feed. Tocopherols are highly effective in stabilizing fats and oils, improving feed shelf life, and supporting animal health, making them a preferred choice across poultry, swine, and ruminant nutrition. Their natural origin, regulatory acceptance, and compatibility with multiple feed formulations further support dominance.

The Botanical Extracts segment is expected to grow at the fastest CAGR from 2026 to 2033, fueled by rising demand for clean-label, plant-based feed additives. Increasing use of rosemary, green tea, and herbal extracts for oxidative stability and immunity enhancement is accelerating adoption globally.

- By Livestock

On the basis of livestock, the natural antioxidant for feed market is segmented into Swine, Poultry, Cattle, Aquaculture, Pets, and Others. The Poultry segment dominated the market with a 38.6% share in 2025, supported by high global poultry feed production and strong sensitivity of poultry diets to lipid oxidation. Natural antioxidants are extensively used to maintain feed quality, improve meat quality, and support immune function in broilers and layers. Rapid production cycles and large-scale commercial operations further strengthen demand in this segment.

The Aquaculture segment is projected to grow at the fastest CAGR from 2026 to 2033, driven by increasing global seafood consumption and rising adoption of high-fat aquafeeds. Natural antioxidants are increasingly used to enhance feed stability, fish health, and growth performance, supporting rapid segment expansion.

- By Form

On the basis of form, the natural antioxidant for feed market is segmented into Dry and Liquid. The Dry segment dominated the market with a 63.4% share in 2025, owing to its ease of handling, longer shelf life, and compatibility with premixes and compound feed manufacturing processes. Dry antioxidants are widely preferred in large-scale feed mills due to stable dosing, lower transportation costs, and improved formulation flexibility across livestock feed types.

The Liquid segment is expected to grow at the fastest CAGR from 2026 to 2033, driven by increasing use in fat-rich feed formulations and on-farm feed blending applications. Improved dispersion, faster absorption, and suitability for liquid feed systems are supporting rising adoption of liquid natural antioxidants.

Which Region Holds the Largest Share of the Natural Antioxidant for Feed Market?

- Europe dominated the natural antioxidant for feed market with a 37.78% revenue share in 2025, driven by stringent regulations on synthetic feed additives, strong adoption of clean-label animal nutrition, and high demand for natural, sustainable feed solutions across the U.K., Germany, France, Spain, and Italy. Increasing focus on animal health, feed quality, and oxidative stability in livestock production continues to fuel demand for natural antioxidants across poultry, swine, cattle, and aquaculture feed

- Leading companies in Europe are actively developing plant-based, tocopherol-rich, and botanical antioxidant formulations, supported by advanced feed R&D capabilities and strong regulatory compliance frameworks. Continuous innovation in natural feed additives reinforces the region’s leadership position

- Strong livestock production, high awareness of animal welfare, and sustained investments in sustainable agriculture further strengthen Europe’s dominance in the natural antioxidant for feed market

Germany Natural Antioxidant for Feed Market Insight

Germany is a major contributor to regional growth, supported by a well-established animal feed industry and strong presence of global feed additive manufacturers. High adoption of natural antioxidants in poultry and swine feed, along with strict quality standards, drives consistent market demand.

France Natural Antioxidant for Feed Market Insight

France shows steady growth driven by increasing emphasis on organic livestock farming and reduced reliance on synthetic additives. Rising use of botanical extracts and tocopherols in animal nutrition supports market expansion.

U.K. Natural Antioxidant for Feed Market Insight

The U.K. contributes significantly through growing demand for clean-label and antibiotic-free animal feed. Increasing awareness of oxidative stress management and animal immunity strengthens adoption of natural antioxidants.

Europe Natural Antioxidant for Feed Market Growth Outlook

Europe is also projected to register the fastest CAGR of 9.74% from 2026 to 2033, supported by tightening regulatory norms, rising consumer demand for sustainably produced animal products, and continuous innovation in natural feed additives. Strong collaboration between feed manufacturers, ingredient suppliers, and research institutions accelerates market expansion.

Italy Natural Antioxidant for Feed Market Insight

Italy’s market growth is supported by strong demand from poultry and aquaculture feed producers. Increasing use of natural antioxidants to improve feed shelf life and animal performance supports adoption.

Spain Natural Antioxidant for Feed Market Insight

Spain contributes to regional growth through expanding livestock production and increasing focus on feed quality optimization. Rising exports of animal products and compliance with EU feed regulations further drive market demand.

Which are the Top Companies in Natural Antioxidant for Feed Market?

The natural antioxidant for Feed industry is primarily led by well-established companies, including:

- Cargill, Incorporated (U.S.)

- DuPont (U.S.)

- DSM (Switzerland)

- Novozymes (Denmark)

- BASF SE (Germany)

- Kemin Industries, Inc. (U.S.)

- Adisseo (France)

- Alltech (U.S.)

- AB Vista (U.K.)

- ADM (U.S.)

- Caldic B.V. (Netherlands)

- Novus International (U.S.)

- Camlin Fine Sciences Ltd (India)

- OXIRIS (France)

- VDH CHEM TECH PVT. LTD. (India)

- BERTOL COMPANY S.R.O. (Czech Republic)

- FoodSafe Technologies (U.S.)

- Lallemand Inc. (Canada)

- Diana Group (France)

- INDUSTRIAL TECNICA PECUARIA, S.A. (Spain)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.