Global Natural Fibers Market

Market Size in USD Billion

CAGR :

%

USD

60.42 Billion

USD

108.57 Billion

2024

2032

USD

60.42 Billion

USD

108.57 Billion

2024

2032

| 2025 –2032 | |

| USD 60.42 Billion | |

| USD 108.57 Billion | |

|

|

|

|

Natural Fibers Market Size

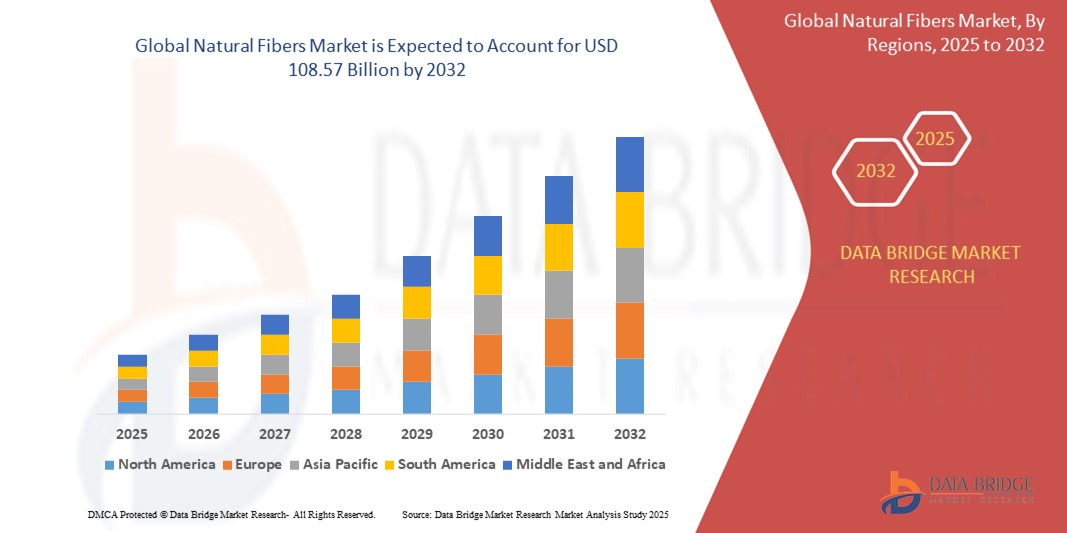

- The global natural fibers market size was valued at USD 60.42 billion in 2024 and is expected to reach USD 108.57 billion by 2032, at a CAGR of 7.60% during the forecast period

- The market growth is largely fuelled by the rising demand for eco-friendly, biodegradable alternatives to synthetic fibers across industries such as textiles, automotive, construction, and packaging

- Increasing consumer awareness regarding sustainability, along with regulatory pressures to reduce plastic and carbon footprints, is further accelerating the adoption of natural fibers in both developed and emerging economies

Natural Fibers Market Analysis

- The market is witnessing a shift toward sustainable materials such as cotton, flax, jute, hemp, coir, and sisal, which offer lower environmental impact and versatile applications

- Industries are increasingly integrating natural fibers into composites and textiles to meet green certification standards and appeal to environmentally conscious consumers

- Asia-Pacific dominated the natural fibers market with the largest revenue share of 38.74% in 2024, driven by a strong presence of raw material sources, low labor costs, and increasing demand from textile and packaging industries

- North America region is expected to witness the highest growth rate in the global natural fibers market, driven by growing consumer awareness toward sustainable and biodegradable materials, along with increasing demand for eco-friendly products in the fashion, automotive, and construction sectors

- The cotton segment dominated the market with the largest revenue share of 34.5% in 2024, driven by its widespread use in the textile and apparel industry due to comfort, breathability, and high consumer acceptance. Cotton’s biodegradable nature and compatibility with organic farming practices have also strengthened its appeal amid growing sustainability concerns. Manufacturers increasingly prefer organic cotton to meet eco-label requirements and consumer demand for ethical sourcing

Report Scope and Natural Fibers Market Segmentation

|

Attributes |

Natural Fibers Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Natural Fibers Market Trends

“Growing Integration of Natural Fibers in Automotive Composites”

- Natural fibers such as jute, flax, and kenaf are increasingly used in vehicle interiors, including door panels and dashboards

- Automakers prefer natural fibers for their light weight, which helps improve fuel efficiency

- Regulatory pressure in Europe is promoting bio-based and recyclable materials in automotive production

- Natural fiber composites offer lower environmental impact compared to traditional synthetic materials

- Investments in sustainable materials by automotive OEMs are boosting adoption of natural fibers

- For instance, BMW uses kenaf fiber in the door panels of its i3 electric car to reduce weight and enhance sustainability

Natural Fibers Market Dynamics

Driver

“Rising Demand for Sustainable and Biodegradable Materials”

- Environmental concerns are driving a global shift toward biodegradable and renewable materials

- Consumers increasingly prefer eco-friendly alternatives in textiles, packaging, and furnishings

- Government bans on plastics and non-biodegradable materials are supporting natural fiber adoption

- Natural fibers reduce landfill burden and carbon emissions compared to synthetic counterparts

- Brands are incorporating organic fibers to meet sustainability goals and appeal to conscious buyers

- For instance, Levi’s has introduced collections using hemp and organic cotton to support its climate-positive initiatives

Restraint/Challenge

“Inconsistent Quality and Supply Chain Issues”

- Natural fibers often vary in texture, strength, and durability due to farming and weather conditions

- Seasonal availability leads to unpredictable supply, impacting large-scale applications

- Poor storage and transport infrastructure can lead to spoilage and degradation of fibers

- Manufacturers struggle with standardizing fiber quality for high-performance applications

- Cost volatility due to inconsistent yields hinders long-term planning and procurement

- For instance, The construction sector has limited its use of jute in structural composites due to variable tensile strength across batches

Natural Fibers Market Scope

The market is segmented on the basis of fibers, distribution channel, and application.

• By Fibers

On the basis of fibers, the natural fibers market is segmented into cotton, wool, flax, silk, jute, hemp, sisal, kenaf, and others. The cotton segment dominated the market with the largest revenue share of 34.5% in 2024, driven by its widespread use in the textile and apparel industry due to comfort, breathability, and high consumer acceptance. Cotton’s biodegradable nature and compatibility with organic farming practices have also strengthened its appeal amid growing sustainability concerns. Manufacturers increasingly prefer organic cotton to meet eco-label requirements and consumer demand for ethical sourcing.

The hemp segment is expected to witness the fastest growth rate from 2025 to 2032, fuelled by its rapid cultivation cycle, low environmental footprint, and emerging use in both textile and industrial applications. Hemp’s strength and durability, combined with its minimal need for pesticides, are attracting interest across fashion, automotive, and construction industries, especially in Europe and North America.

• By Distribution Channel

On the basis of distribution channel, the natural fibers market is segmented into manufacturers, distributors, wholesalers, retailers, and others. The manufacturers segment held the largest market revenue share in 2024, supported by the increasing number of vertically integrated companies focusing on sustainable sourcing and in-house processing to maintain quality and traceability. Direct engagement with fiber producers also enables manufacturers to reduce costs and customize fiber characteristics to suit end-use requirements.

The retailers segment is expected to witness the fastest growth rate from 2025 to 2032, driven by growing consumer interest in eco-friendly products and the expansion of specialty retail and e-commerce platforms. Retailers are capitalizing on the rising demand for sustainable clothing, home décor, and lifestyle goods by stocking natural fiber-based alternatives and promoting their environmental benefits through branding and certifications.

• By Application

On the basis of application, the natural fibers market is segmented into fashion & clothing, furnishing & home, and industrial & technical. The fashion & clothing segment captured the largest market revenue share in 2024, driven by rising consumer preference for breathable, skin-friendly fabrics and the surge in demand for sustainable fashion. Natural fibers such as cotton, wool, and silk are being increasingly adopted by global fashion brands looking to reduce their environmental footprint.

The industrial & technical segment is expected to witness the fastest growth rate from 2025 to 2032, supported by the increasing use of fibers such as flax, kenaf, and hemp in automotive, packaging, and construction applications. These fibers are being integrated into biocomposites and insulation materials, providing durable and lightweight solutions while aligning with regulatory and sustainability standards.

Natural Fibers Market Regional Analysis

- Asia-Pacific dominated the natural fibers market with the largest revenue share of 38.74% in 2024, driven by a strong presence of raw material sources, low labor costs, and increasing demand from textile and packaging industries

- Countries in the region benefit from established cotton and jute farming sectors, as well as a rapidly growing industrial base that utilizes hemp and kenaf for technical applications

- Government incentives promoting the use of biodegradable and eco-friendly materials are further accelerating the adoption of natural fibers in countries such as India, China, and Bangladesh

China Natural Fibers Market Insight

The China natural fibers market accounted for the largest revenue share in the Asia-Pacific region in 2024, driven by its strong production base in cotton, hemp, and silk, as well as the country’s leadership in global textile manufacturing. China's extensive supply chain capabilities, combined with government initiatives promoting sustainable agriculture and biodegradable materials, are propelling the use of natural fibers across apparel, furnishing, and industrial applications. Domestic brands and exporters are increasingly incorporating eco-friendly materials to meet global regulatory standards and consumer expectations, particularly from North American and European markets.

Japan Natural Fibers Market Insight

The Japan natural fibers market is expected to grow steadily during the forecast period, supported by rising consumer preference for high-quality, natural, and eco-conscious materials in fashion and home goods. Japan’s long-standing tradition of using silk and cotton, paired with modern innovation in textile blending and finishing, is encouraging the adoption of natural fibers in premium clothing and lifestyle segments. In addition, the country's emphasis on sustainable architecture and green packaging is fostering demand for natural fiber-based composites and materials in niche industrial applications.

North America Natural Fibers Market Insight

The North America natural fibers market is expected to witness the fastest growth rate from 2025 to 2032, supported by increasing consumer awareness regarding environmental impact, a shift toward organic textiles, and rising demand in home furnishing and packaging industries. Major brands in the U.S. are incorporating natural fibers such as organic cotton and wool into their product lines to meet sustainability targets and cater to the eco-conscious consumer segment.

U.S. Natural Fibers Market Insight

The U.S. natural fibers market is expected to witness the fastest growth rate from 2025 to 2032, due to rising interest in sustainable lifestyle choices, expanding organic cotton cultivation, and technological advancements in fiber processing. Fashion, furniture, and automotive industries are increasingly turning to natural fibers for applications ranging from upholstery to bio-composites. The presence of leading apparel brands and a strong retail infrastructure is also contributing to the market's growth, especially through both offline and online eco-retail channels.

Europe Natural Fibers Market Insight

The Europe is expected to witness the fastest growth rate from 2025 to 2032, driven by strong environmental regulations, consumer preference for sustainable products, and the integration of natural fibers into industrial applications. European Union policies supporting circular economy practices are encouraging the use of flax, hemp, and wool in fashion, automotive, and construction sectors. France, Germany, and the U.K. are leading innovation and adoption within the region.

Germany Natural Fibers Market Insight

The Germany is expected to witness the fastest growth rate from 2025 to 2032, owing to its robust textile and automotive sectors, which are actively adopting natural fibers such as flax and hemp in interiors and technical components. The country’s emphasis on eco-conscious living and energy-efficient construction is also creating a favorable environment for the use of biodegradable insulation and packaging solutions based on natural fibers.

U.K. Natural Fibers Market Insight

The U.K. natural fibers market is expected to witness the fastest growth rate from 2025 to 2032, driven by growing demand for ethically sourced fashion, supportive government sustainability goals, and the increasing popularity of natural home décor and furnishing materials. The presence of responsible retail chains and fashion labels promoting “green collections” is fueling consumer interest, while innovations in plant-based textiles are also drawing investments in research and development.

Natural Fibers Market Share

The Natural Fibers industry is primarily led by well-established companies, including:

- Vardhman Textiles Limited (India)

- Grasim Industries Limited (India)

- ANANDHI TEXSTYLES (India)

- Bcomp (Switzerland)

- The Natural Fibre Company (U.K.)

- Procotex (Belgium)

- FlexForm Technologies (U.S.)

- Bast Fibre Technologies Inc. (Canada)

- Lenzing AG (Austria)

- Barnhardt Natural Fibers (U.S.)

Latest Developments in Global Natural Fibers Market

- In October 2022, Bast Fibre Technologies Inc. entered a strategic financing agreement with Ahlstrom Capital Group, under which Ahlstrom acquired a 20% ownership stake in Bast. This investment is set to accelerate the expansion of Bast's fiber production operations, enhancing its manufacturing capabilities and reinforcing its position in the natural fibers market

- In February 2022, Bast Fibre Technologies Inc. completed the acquisition of Lumberton Cellulose from Georgia-Pacific, rebranding the facility as BFT Lumberton. The move is expected to increase the company’s annual production capacity to over 30,000 tonnes, establishing it as a key natural fiber processing hub in North America and strengthening its supply chain resilience

- In January 2022, Reality Paskov s.r.o. merged with Lenzing Biocel Paskov a.s., both based in the Czech Republic. This corporate consolidation is aimed at streamlining operations and supporting future growth, enabling Lenzing to better serve the increasing demand for natural and sustainable fibers across global markets

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE GLOBAL NATURAL FIBERS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.7 DBMR MARKET POSITION GRID

2.8 MULTIVARIATE MODELLING

2.9 TYPE LIFELINE CURVE

2.1 MARKET END USER COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.2 PORTER’S FIVE FORCES

4.3 IMPORT-EXPORT ANALYSIS

4.4 SUPPLY CHAIN ANALYSIS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 GROWING APPLICATION OF NATURAL FIBERS IN FASHION INDUSTRY

5.1.2 EXTENDED APPLICATION OF NATURAL FIBERS IN THE AUTOMOTIVE INDUSTRY

5.1.3 ADVANCEMENT IN THE APPLICATION OF NATURAL FIBERS IN THE PACKAGING INDUSTRY

5.1.4 TECHNOLOGICAL ADVANCEMENTS IN NATURAL FIBER PROCESSING

5.2 RESTRAINTS

5.2.1 REGIONAL CROP VARIABILITY

5.2.2 LIMITATIONS ASSOCIATED WITH NATURAL FIBERS

5.3 OPPORTUNITIES

5.3.1 RISING DEMAND FOR SILK

5.3.2 RISING SUSTAINABLE AGRICULTURE INITIATIVES

5.3.3 GROWING E-COMMERCE AND DIRECT-TO-CONSUMER MODELS

5.4 CHALLENGES

5.4.1 PRESENCE OF ALTERNATIVES SUCH AS SYNTHETIC POLYESTERS

5.4.2 INCREASING AWARENESS REGARDING VEGANISM CAN AFFECT THE ANIMAL DERIVED FIBERS

6 GLOBAL NATURAL FIBERS MARKET, BY FIBERS

6.1 OVERVIEW

6.2 COTTON

6.3 JUTE

6.4 FLAX

6.5 HEMP

6.6 WOOL

6.7 SILK

6.8 SISAL

6.9 KENAF

6.1 OTHERS

7 GLOBAL NATURAL FIBERS MARKET, BY DISTRIBUTION CHANNEL

7.1 OVERVIEW

7.2 MANUFACTURERS

7.3 DISTRIBUTORS

7.4 WHOLESALERS

7.5 RETAILERS

7.6 OTHERS

8 GLOBAL NATURAL FIBERS MARKET, BY APPLICATION

8.1 OVERVIEW

8.2 INDUSTRIAL & TECHNICAL

8.2.1 AUTOMOTIVE TEXTILES

8.2.1.1 CHAIR CUSHIONS

8.2.1.2 HEADLINERS

8.2.1.3 CAR COVERS

8.2.1.4 OTHERS

8.2.2 SMART TEXTILES

8.2.3 ROPES AND NETTINGS

8.2.4 MEDICAL TEXTILES

8.2.5 SUN BLINDS

8.2.6 OTHERS

8.3 FURNISHING & HOME

8.3.1 BED LINEN

8.3.2 CARPETS

8.3.3 CURTAINS

8.3.4 UPHOLSTERY

8.3.5 OTHERS

8.4 FASHION & CLOTHING

8.4.1 SUITS

8.4.2 COAT

8.4.3 DRESSES

8.4.4 SHIRTS

8.4.5 OTHERS

9 GLOBAL NATURAL FIBERS MARKET, BY REGION

9.1 OVERVIEW

9.2 ASIA-PACIFIC

9.2.1 CHINA

9.2.2 INDIA

9.2.3 HONG KONG

9.2.4 AUSTRALIA

9.2.5 JAPAN

9.2.6 THAILAND

9.2.7 INDONESIA

9.2.8 SINGAPORE

9.2.9 MALAYSIA

9.2.10 TAIWAN

9.2.11 SOUTH KOREA

9.2.12 PHILIPPINES

9.2.13 REST OF ASIA-PACIFIC

9.3 NORTH AMERICA

9.3.1 U.S.

9.3.2 MEXICO

9.3.3 CANADA

9.4 EUROPE

9.4.1 GERMANY

9.4.2 ITALY

9.4.3 U.K.

9.4.4 FRANCE

9.4.5 SPAIN

9.4.6 RUSSIA

9.4.7 BELGIUM

9.4.8 NETHERLANDS

9.4.9 TURKEY

9.4.10 SWITZERLAND

9.4.11 REST OF EUROPE

9.5 SOUTH AMERICA

9.5.1 BRAZIL

9.5.2 ARGENTINA

9.5.3 REST OF SOUTH AMERICA

9.6 MIDDLE EAST AND AFRICA

9.6.1 SOUTH AFRICA

9.6.2 EGYPT

9.6.3 SAUDI ARABIA

9.6.4 U.A.E

9.6.5 ISRAEL

9.6.6 REST OF AFRICA

10 GLOBAL NATURAL FIBERS MARKET: COMPANY LANDSCAPE

10.1 COMPANY SHARE ANALYSIS: GLOBAL

11 NORTH AMERICA NATURAL FIBERS MARKET: COMPANY LANDSCAPE

11.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

12 EUROPE NATURAL FIBERS MARKET: COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: EUROPE

13 ASIA-PACIFIC NATURAL FIBERS MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

14 SWOT ANALYSIS

15 COMPANY PROFILES

15.1 LENZING AG

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT DEVELOPMENTS

15.2 GRASIM INDUSTRIES LIMITED

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT DEVELOPMENTS

15.3 VARDHMAN TEXTILES LIMITED

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 COMPANY SHARE ANALYSIS

15.3.4 PRODUCT PORTFOLIO

15.3.5 RECENT DEVELOPMENT

15.4 BCOMP

15.4.1 COMPANY SNAPSHOT

15.4.2 COMPANY SHARE ANALYSIS

15.4.3 PRODUCT PORTFOLIO

15.4.4 RECENT DEVELOPMENT

15.5 BARNHARDT NATURAL FIBERS

15.5.1 COMPANY SNAPSHOT

15.5.2 COMPANY SHARE ANALYSIS

15.5.3 PRODUCT PORTFOLIO

15.5.4 RECENT DEVELOPMENT

15.6 ANANDHI TEXSTYLES

15.6.1 COMPANY SNAPSHOT

15.6.2 PRODUCT PORTFOLIO

15.6.3 RECENT DEVELOPMENT

15.7 BAST FIBRE TECHNOLOGIES INC.

15.7.1 COMPANY SNAPSHOT

15.7.2 PRODUCT PORTFOLIO

15.7.3 RECENT DEVELOPMENT (PRESS RELEASE)

15.8 FLEXFORM TECHNOLOGIES

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT DEVELOPMENT

15.9 PROCOTEX

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT DEVELOPMENT

15.1 THE NATURAL FIBRE COMPANY

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT DEVELOPMENT

16 QUESTIONNAIRE

17 RELATED REPORTS

List of Table

TABLE 1 IMPORT DATA OF WORLD AND TOP 10 COUNTRIES (2022) FOR " FLAX YARN "; HS CODE OF PRODUCT: 5306

TABLE 2 EXPORT DATA OF WORLD AND TOP 10 COUNTRIES (2022) FOR " FLAX YARN "; HS CODE OF PRODUCT: 5306

TABLE 3 GLOBAL NATURAL FIBERS MARKET, BY FIBERS, 2022-2031 (USD MILLION)

TABLE 4 GLOBAL COTTON IN NATURAL FIBERS MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 5 GLOBAL JUTE IN NATURAL FIBERS MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 6 GLOBAL FLAX IN NATURAL FIBERS MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 7 GLOBAL HEMP IN NATURAL FIBERS MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 8 GLOBAL WOOL IN NATURAL FIBERS MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 9 GLOBAL SILK IN NATURAL FIBERS MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 10 GLOBAL SISAL IN NATURAL FIBERS MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 11 GLOBAL KENAF IN NATURAL FIBERS MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 12 GLOBAL OTHERS IN NATURAL FIBERS MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 13 GLOBAL NATURAL FIBERS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 14 GLOBAL MANUFACTURERS IN NATURAL FIBERS MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 15 GLOBAL DISTRIBUTORS IN NATURAL FIBERS MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 16 GLOBAL WHOLESALERS IN NATURAL FIBERS MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 17 GLOBAL RETAILERS IN NATURAL FIBERS MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 18 GLOBAL OTHERS IN NATURAL FIBERS MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 19 GLOBAL NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 20 GLOBAL INDUSTRIAL & TECHNICAL IN NATURAL FIBERS MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 21 GLOBAL INDUSTRIAL & TECHNICAL IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 22 GLOBAL AUTOMOTIVE TEXTILES IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 23 GLOBAL FURNISHING & HOME IN NATURAL FIBERS MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 24 GLOBAL FURNISHING & HOME IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 25 GLOBAL FASHION & CLOTHING IN NATURAL FIBERS MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 26 GLOBAL FASHION & CLOTHING IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 27 GLOBAL NATURAL FIBERS MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 28 ASIA-PACIFIC NATURAL FIBERS MARKET, BY COUNTRY, 2022-2031 (USD MILLION)

TABLE 29 ASIA-PACIFIC NATURAL FIBERS MARKET, BY FIBERS, 2022-2031 (USD MILLION)

TABLE 30 ASIA-PACIFIC NATURAL FIBERS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 31 ASIA-PACIFIC NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 32 ASIA-PACIFIC INDUSTRIAL & TECHNICAL IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 33 ASIA-PACIFIC AUTOMOTIVE TEXTILES IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 34 ASIA-PACIFIC FURNISHING & HOME IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 35 ASIA-PACIFIC FASHION & CLOTHING IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 36 CHINA NATURAL FIBERS MARKET, BY FIBERS, 2022-2031 (USD MILLION)

TABLE 37 CHINA NATURAL FIBERS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 38 CHINA NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 39 CHINA INDUSTRIAL & TECHNICAL IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 40 CHINA AUTOMOTIVE TEXTILES IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 41 CHINA FURNISHING & HOME IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 42 CHINA FASHION & CLOTHING IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 43 INDIA NATURAL FIBERS MARKET, BY FIBERS, 2022-2031 (USD MILLION)

TABLE 44 INDIA NATURAL FIBERS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 45 INDIA NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 46 INDIA INDUSTRIAL & TECHNICAL IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 47 INDIA AUTOMOTIVE TEXTILES IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 48 INDIA FURNISHING & HOME IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 49 INDIA FASHION & CLOTHING IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 50 HONG KONG NATURAL FIBERS MARKET, BY FIBERS, 2022-2031 (USD MILLION)

TABLE 51 HONG KONG NATURAL FIBERS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 52 HONG KONG NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 53 HONG KONG INDUSTRIAL & TECHNICAL IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 54 HONG KONG AUTOMOTIVE TEXTILES IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 55 HONG KONG FURNISHING & HOME IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 56 HONG KONG FASHION & CLOTHING IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 57 AUSTRALIA AND NEW ZEALAND NATURAL FIBERS MARKET, BY FIBERS, 2022-2031 (USD MILLION)

TABLE 58 AUSTRALIA AND NEW ZEALAND NATURAL FIBERS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 59 AUSTRALIA AND NEW ZEALAND NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 60 AUSTRALIA AND NEW ZEALAND INDUSTRIAL & TECHNICAL IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 61 AUSTRALIA AND NEW ZEALAND AUTOMOTIVE TEXTILES IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 62 AUSTRALIA AND NEW ZEALAND FURNISHING & HOME IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 63 AUSTRALIA AND NEW ZEALAND FASHION & CLOTHING IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 64 JAPAN NATURAL FIBERS MARKET, BY FIBERS, 2022-2031 (USD MILLION)

TABLE 65 JAPAN NATURAL FIBERS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 66 JAPAN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 67 JAPAN INDUSTRIAL & TECHNICAL IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 68 JAPAN AUTOMOTIVE TEXTILES IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 69 JAPAN FURNISHING & HOME IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 70 JAPAN FASHION & CLOTHING IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 71 THAILAND NATURAL FIBERS MARKET, BY FIBERS, 2022-2031 (USD MILLION)

TABLE 72 THAILAND NATURAL FIBERS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 73 THAILAND NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 74 THAILAND INDUSTRIAL & TECHNICAL IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 75 THAILAND AUTOMOTIVE TEXTILES IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 76 THAILAND FURNISHING & HOME IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 77 THAILAND FASHION & CLOTHING IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 78 INDONESIA NATURAL FIBERS MARKET, BY FIBERS, 2022-2031 (USD MILLION)

TABLE 79 INDONESIA NATURAL FIBERS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 80 INDONESIA NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 81 INDONESIA INDUSTRIAL & TECHNICAL IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 82 INDONESIA AUTOMOTIVE TEXTILES IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 83 INDONESIA FURNISHING & HOME IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 84 INDONESIA FASHION & CLOTHING IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 85 SINGAPORE NATURAL FIBERS MARKET, BY FIBERS, 2022-2031 (USD MILLION)

TABLE 86 SINGAPORE NATURAL FIBERS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 87 SINGAPORE NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 88 SINGAPORE INDUSTRIAL & TECHNICAL IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 89 SINGAPORE AUTOMOTIVE TEXTILES IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 90 SINGAPORE FURNISHING & HOME IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 91 SINGAPORE FASHION & CLOTHING IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 92 MALAYSIA NATURAL FIBERS MARKET, BY FIBERS, 2022-2031 (USD MILLION)

TABLE 93 MALAYSIA NATURAL FIBERS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 94 MALAYSIA NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 95 MALAYSIA INDUSTRIAL & TECHNICAL IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 96 MALAYSIA AUTOMOTIVE TEXTILES IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 97 MALAYSIA FURNISHING & HOME IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 98 MALAYSIA FASHION & CLOTHING IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 99 TAIWAN NATURAL FIBERS MARKET, BY FIBERS, 2022-2031 (USD MILLION)

TABLE 100 TAIWAN NATURAL FIBERS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 101 TAIWAN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 102 TAIWAN INDUSTRIAL & TECHNICAL IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 103 TAIWAN AUTOMOTIVE TEXTILES IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 104 TAIWAN FURNISHING & HOME IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 105 TAIWAN FASHION & CLOTHING IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 106 SOUTH KOREA NATURAL FIBERS MARKET, BY FIBERS, 2022-2031 (USD MILLION)

TABLE 107 SOUTH KOREA NATURAL FIBERS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 108 SOUTH KOREA NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 109 SOUTH KOREA INDUSTRIAL & TECHNICAL IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 110 SOUTH KOREA AUTOMOTIVE TEXTILES IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 111 SOUTH KOREA FURNISHING & HOME IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 112 SOUTH KOREA FASHION & CLOTHING IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 113 PHILIPPINES NATURAL FIBERS MARKET, BY FIBERS, 2022-2031 (USD MILLION)

TABLE 114 PHILIPPINES NATURAL FIBERS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 115 PHILIPPINES NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 116 PHILIPPINES INDUSTRIAL & TECHNICAL IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 117 PHILIPPINES AUTOMOTIVE TEXTILES IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 118 PHILIPPINES FURNISHING & HOME IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 119 PHILIPPINES FASHION & CLOTHING IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 120 REST OF ASIA-PACIFIC NATURAL FIBERS MARKET, BY FIBERS, 2022-2031 (USD MILLION)

TABLE 121 NORTH AMERICA NATURAL FIBERS MARKET, BY COUNTRY, 2022-2031 (USD MILLION)

TABLE 122 NORTH AMERICA NATURAL FIBERS MARKET, BY FIBERS, 2022-2031 (USD MILLION)

TABLE 123 NORTH AMERICA NATURAL FIBERS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 124 NORTH AMERICA NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 125 NORTH AMERICA INDUSTRIAL & TECHNICAL IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 126 NORTH AMERICA AUTOMOTIVE TEXTILES IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 127 NORTH AMERICA FURNISHING & HOME IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 128 NORTH AMERICA FASHION & CLOTHING IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 129 U.S. NATURAL FIBERS MARKET, BY FIBERS, 2022-2031 (USD MILLION)

TABLE 130 U.S. NATURAL FIBERS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 131 U.S. NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 132 U.S. INDUSTRIAL & TECHNICAL IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 133 U.S. AUTOMOTIVE TEXTILES IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 134 U.S. FURNISHING & HOME IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 135 U.S. FASHION & CLOTHING IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 136 MEXICO NATURAL FIBERS MARKET, BY FIBERS, 2022-2031 (USD MILLION)

TABLE 137 MEXICO NATURAL FIBERS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 138 MEXICO NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 139 MEXICO INDUSTRIAL & TECHNICAL IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 140 MEXICO AUTOMOTIVE TEXTILES IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 141 MEXICO FURNISHING & HOME IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 142 MEXICO FASHION & CLOTHING IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 143 CANADA NATURAL FIBERS MARKET, BY FIBERS, 2022-2031 (USD MILLION)

TABLE 144 CANADA NATURAL FIBERS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 145 CANADA NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 146 CANADA INDUSTRIAL & TECHNICAL IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 147 CANADA AUTOMOTIVE TEXTILES IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 148 CANADA FURNISHING & HOME IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 149 CANADA FASHION & CLOTHING IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 150 EUROPE NATURAL FIBERS MARKET, BY COUNTRY, 2022-2031 (USD MILLION)

TABLE 151 EUROPE NATURAL FIBERS MARKET, BY FIBERS, 2022-2031 (USD MILLION)

TABLE 152 EUROPE NATURAL FIBERS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 153 EUROPE NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 154 EUROPE INDUSTRIAL & TECHNICAL IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 155 EUROPE AUTOMOTIVE TEXTILES IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 156 EUROPE FURNISHING & HOME IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 157 EUROPE FASHION & CLOTHING IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 158 GERMANY NATURAL FIBERS MARKET, BY FIBERS, 2022-2031 (USD MILLION)

TABLE 159 GERMANY NATURAL FIBERS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 160 GERMANY NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 161 GERMANY INDUSTRIAL & TECHNICAL IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 162 GERMANY AUTOMOTIVE TEXTILES IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 163 GERMANY FURNISHING & HOME IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 164 GERMANY FASHION & CLOTHING IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 165 ITALY NATURAL FIBERS MARKET, BY FIBERS, 2022-2031 (USD MILLION)

TABLE 166 ITALY NATURAL FIBERS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 167 ITALY NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 168 ITALY INDUSTRIAL & TECHNICAL IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 169 ITALY AUTOMOTIVE TEXTILES IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 170 ITALY FURNISHING & HOME IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 171 ITALY FASHION & CLOTHING IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 172 U.K. NATURAL FIBERS MARKET, BY FIBERS, 2022-2031 (USD MILLION)

TABLE 173 U.K. NATURAL FIBERS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 174 U.K. NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 175 U.K. INDUSTRIAL & TECHNICAL IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 176 U.K. AUTOMOTIVE TEXTILES IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 177 U.K. FURNISHING & HOME IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 178 U.K. FASHION & CLOTHING IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 179 FRANCE NATURAL FIBERS MARKET, BY FIBERS, 2022-2031 (USD MILLION)

TABLE 180 FRANCE NATURAL FIBERS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 181 FRANCE NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 182 FRANCE INDUSTRIAL & TECHNICAL IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 183 FRANCE AUTOMOTIVE TEXTILES IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 184 FRANCE FURNISHING & HOME IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 185 FRANCE FASHION & CLOTHING IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 186 SPAIN NATURAL FIBERS MARKET, BY FIBERS, 2022-2031 (USD MILLION)

TABLE 187 SPAIN NATURAL FIBERS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 188 SPAIN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 189 SPAIN INDUSTRIAL & TECHNICAL IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 190 SPAIN AUTOMOTIVE TEXTILES IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 191 SPAIN FURNISHING & HOME IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 192 SPAIN FASHION & CLOTHING IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 193 RUSSIA NATURAL FIBERS MARKET, BY FIBERS, 2022-2031 (USD MILLION)

TABLE 194 RUSSIA NATURAL FIBERS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 195 RUSSIA NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 196 RUSSIA INDUSTRIAL & TECHNICAL IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 197 RUSSIA AUTOMOTIVE TEXTILES IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 198 RUSSIA FURNISHING & HOME IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 199 RUSSIA FASHION & CLOTHING IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 200 BELGIUM NATURAL FIBERS MARKET, BY FIBERS, 2022-2031 (USD MILLION)

TABLE 201 BELGIUM NATURAL FIBERS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 202 BELGIUM NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 203 BELGIUM INDUSTRIAL & TECHNICAL IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 204 BELGIUM AUTOMOTIVE TEXTILES IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 205 BELGIUM FURNISHING & HOME IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 206 BELGIUM FASHION & CLOTHING IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 207 NETHERLANDS NATURAL FIBERS MARKET, BY FIBERS, 2022-2031 (USD MILLION)

TABLE 208 NETHERLANDS NATURAL FIBERS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 209 NETHERLANDS NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 210 NETHERLANDS INDUSTRIAL & TECHNICAL IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 211 NETHERLANDS AUTOMOTIVE TEXTILES IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 212 NETHERLANDS FURNISHING & HOME IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 213 NETHERLANDS FASHION & CLOTHING IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 214 TURKEY NATURAL FIBERS MARKET, BY FIBERS, 2022-2031 (USD MILLION)

TABLE 215 TURKEY NATURAL FIBERS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 216 TURKEY NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 217 TURKEY INDUSTRIAL & TECHNICAL IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 218 TURKEY AUTOMOTIVE TEXTILES IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 219 TURKEY FURNISHING & HOME IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 220 TURKEY FASHION & CLOTHING IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 221 SWITZERLAND NATURAL FIBERS MARKET, BY FIBERS, 2022-2031 (USD MILLION)

TABLE 222 SWITZERLAND NATURAL FIBERS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 223 SWITZERLAND NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 224 SWITZERLAND INDUSTRIAL & TECHNICAL IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 225 SWITZERLAND AUTOMOTIVE TEXTILES IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 226 SWITZERLAND FURNISHING & HOME IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 227 SWITZERLAND FASHION & CLOTHING IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 228 REST OF EUROPE NATURAL FIBERS MARKET, BY FIBERS, 2022-2031 (USD MILLION)

TABLE 229 SOUTH AMERICA NATURAL FIBERS MARKET, BY COUNTRY, 2022-2031 (USD MILLION)

TABLE 230 SOUTH AMERICA NATURAL FIBERS MARKET, BY FIBERS, 2022-2031 (USD MILLION)

TABLE 231 SOUTH AMERICA NATURAL FIBERS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 232 SOUTH AMERICA NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 233 SOUTH AMERICA INDUSTRIAL & TECHNICAL IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 234 SOUTH AMERICA AUTOMOTIVE TEXTILES IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 235 SOUTH AMERICA FURNISHING & HOME IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 236 SOUTH AMERICA FASHION & CLOTHING IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 237 BRAZIL NATURAL FIBERS MARKET, BY FIBERS, 2022-2031 (USD MILLION)

TABLE 238 BRAZIL NATURAL FIBERS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 239 BRAZIL NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 240 BRAZIL INDUSTRIAL & TECHNICAL IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 241 BRAZIL AUTOMOTIVE TEXTILES IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 242 BRAZIL FURNISHING & HOME IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 243 BRAZIL FASHION & CLOTHING IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 244 ARGENTINA NATURAL FIBERS MARKET, BY FIBERS, 2022-2031 (USD MILLION)

TABLE 245 ARGENTINA NATURAL FIBERS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 246 ARGENTINA NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 247 ARGENTINA INDUSTRIAL & TECHNICAL IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 248 ARGENTINA AUTOMOTIVE TEXTILES IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 249 ARGENTINA FURNISHING & HOME IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 250 ARGENTINA FASHION & CLOTHING IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 251 REST OF SOUTH AMERICA NATURAL FIBERS MARKET, BY FIBERS, 2022-2031 (USD MILLION)

TABLE 252 MIDDLE EAST AND AFRICA NATURAL FIBERS MARKET, BY COUNTRY, 2022-2031 (USD MILLION)

TABLE 253 MIDDLE EAST AND AFRICA NATURAL FIBERS MARKET, BY FIBERS, 2022-2031 (USD MILLION)

TABLE 254 MIDDLE EAST AND AFRICA NATURAL FIBERS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 255 MIDDLE EAST AND AFRICA NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 256 MIDDLE EAST AND AFRICA INDUSTRIAL & TECHNICAL IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 257 MIDDLE EAST AND AFRICA AUTOMOTIVE TEXTILES IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 258 MIDDLE EAST AND AFRICA FURNISHING & HOME IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 259 MIDDLE EAST AND AFRICA FASHION & CLOTHING IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 260 SOUTH AFRICA NATURAL FIBERS MARKET, BY FIBERS, 2022-2031 (USD MILLION)

TABLE 261 SOUTH AFRICA NATURAL FIBERS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 262 SOUTH AFRICA NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 263 SOUTH AFRICA INDUSTRIAL & TECHNICAL IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 264 SOUTH AFRICA AUTOMOTIVE TEXTILES IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 265 SOUTH AFRICA FURNISHING & HOME IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 266 SOUTH AFRICA FASHION & CLOTHING IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 267 EGYPT NATURAL FIBERS MARKET, BY FIBERS, 2022-2031 (USD MILLION)

TABLE 268 EGYPT NATURAL FIBERS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 269 EGYPT NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 270 EGYPT INDUSTRIAL & TECHNICAL IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 271 EGYPT AUTOMOTIVE TEXTILES IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 272 EGYPT FURNISHING & HOME IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 273 EGYPT FASHION & CLOTHING IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 274 SAUDI ARABIA NATURAL FIBERS MARKET, BY FIBERS, 2022-2031 (USD MILLION)

TABLE 275 SAUDI ARABIA NATURAL FIBERS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 276 SAUDI ARABIA NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 277 SAUDI ARABIA INDUSTRIAL & TECHNICAL IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 278 SAUDI ARABIA AUTOMOTIVE TEXTILES IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 279 SAUDI ARABIA FURNISHING & HOME IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 280 SAUDI ARABIA FASHION & CLOTHING IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 281 U.A.E. NATURAL FIBERS MARKET, BY FIBERS, 2022-2031 (USD MILLION)

TABLE 282 U.A.E. NATURAL FIBERS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 283 U.A.E. NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 284 U.A.E. INDUSTRIAL & TECHNICAL IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 285 U.A.E. AUTOMOTIVE TEXTILES IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 286 U.A.E. FURNISHING & HOME IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 287 U.A.E. FASHION & CLOTHING IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 288 ISRAEL NATURAL FIBERS MARKET, BY FIBERS, 2022-2031 (USD MILLION)

TABLE 289 ISRAEL NATURAL FIBERS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 290 ISRAEL NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 291 ISRAEL INDUSTRIAL & TECHNICAL IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 292 ISRAEL AUTOMOTIVE TEXTILES IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 293 ISRAEL FURNISHING & HOME IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 294 ISRAEL FASHION & CLOTHING IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 295 REST OF MIDDLE EAST AND AFRICA NATURAL FIBERS MARKET, BY FIBERS, 2022-2031 (USD MILLION)

List of Figure

FIGURE 1 GLOBAL NATURAL FIBERS MARKET: SEGMENTATION

FIGURE 2 GLOBAL NATURAL FIBERS MARKET: DATA TRIANGULATION

FIGURE 3 GLOBAL NATURAL FIBERS MARKET: DROC ANALYSIS

FIGURE 4 GLOBAL NATURAL FIBERS MARKET: GLOBAL VS REGIONAL MARKET ANALYSIS

FIGURE 5 GLOBAL NATURAL FIBERS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 GLOBAL NATURAL FIBERS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 GLOBAL NATURAL FIBERS MARKET: DBMR MARKET POSITION GRID

FIGURE 8 GLOBAL NATURAL FIBERS MARKET: MARKET END USER COVERAGE GRID

FIGURE 9 GLOBAL NATURAL FIBERS MARKET: SEGMENTATION

FIGURE 10 ASIA-PACIFIC REGION IS EXPECTED TO DOMINATE THE GLOBAL NATURAL FIBERS MARKET AND GROWING WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2024 TO 2031

FIGURE 11 EXTENDED APPLICATION OF NATURAL FIBERS IN AUTOMOTIVE INDUSTRY IS DRIVING THE GROWTH OF THE GLOBAL NATURAL FIBERS MARKET IN THE FORECAST PERIOD OF 2024 TO 2031

FIGURE 12 COTTON SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE GLOBAL NATURAL FIBERS MARKET IN 2024 & 2031

FIGURE 13 ASIA-PACIFIC IS THE FASTEST-GROWING MARKET FOR NATURAL FIBERS MANUFACTURERS IN THE FORECAST PERIOD OF 2024 TO 2031

FIGURE 14 SUPPLY CHAIN ANALYSIS

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF GLOBAL NATURAL FIBERS MARKET

FIGURE 16 GLOBAL NATURAL FIBERS MARKET: BY FIBERS, 2023

FIGURE 17 GLOBAL NATURAL FIBERS MARKET: BY FIBERS, 2024-2031 (USD MILLION)

FIGURE 18 GLOBAL NATURAL FIBERS MARKET: BY FIBERS, CAGR (2024-2031)

FIGURE 19 GLOBAL NATURAL FIBERS MARKET: BY FIBERS, LIFELINE CURVE

FIGURE 20 GLOBAL NATURAL FIBERS MARKET: BY DISTRIBUTION CHANNEL, 2023

FIGURE 21 GLOBAL NATURAL FIBERS MARKET: BY DISTRIBUTION CHANNEL, 2024-2031 (USD MILLION)

FIGURE 22 GLOBAL NATURAL FIBERS MARKET: BY DISTRIBUTION CHANNEL, CAGR (2024-2031)

FIGURE 23 GLOBAL NATURAL FIBERS MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 24 GLOBAL NATURAL FIBERS MARKET: BY APPLICATION, 2023

FIGURE 25 GLOBAL NATURAL FIBERS MARKET: BY APPLICATION, 2024-2031 (USD MILLION)

FIGURE 26 GLOBAL NATURAL FIBERS MARKET: BY APPLICATION, CAGR (2024-2031)

FIGURE 27 GLOBAL NATURAL FIBERS MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 28 GLOBAL NATURAL FIBERS MARKET: SNAPSHOT (2023)

FIGURE 29 GLOBAL NATURAL FIBERS MARKET: COMPANY SHARE 2023 (%)

FIGURE 30 NORTH AMERICA NATURAL FIBERS MARKET: COMPANY SHARE 2023 (%)

FIGURE 31 EUROPE NATURAL FIBERS MARKET: COMPANY SHARE 2023 (%)

FIGURE 32 AISA-PACIFIC NATURAL FIBERS MARKET: COMPANY SHARE 2023 (%)

Global Natural Fibers Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Natural Fibers Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Natural Fibers Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.