Global Neoantigens Market

Market Size in USD Billion

CAGR :

%

USD

2.62 Billion

USD

29.00 Billion

2022

2030

USD

2.62 Billion

USD

29.00 Billion

2022

2030

| 2023 –2030 | |

| USD 2.62 Billion | |

| USD 29.00 Billion | |

|

|

|

|

Neoantigens Market Analysis and Size

The rising prevalence of cancer has put a strain on healthcare systems globally. According to the World Health Organization (WHO), cancer was the major cause of death among people under the age of 70 years in 183 countries and the fourth top cause of mortality in 123 countries in 2019. The recent clinical developments in biotechnology and increasing investments in the research of neoantigens and associated mechanisms are expected to increase the global neoantigens market.

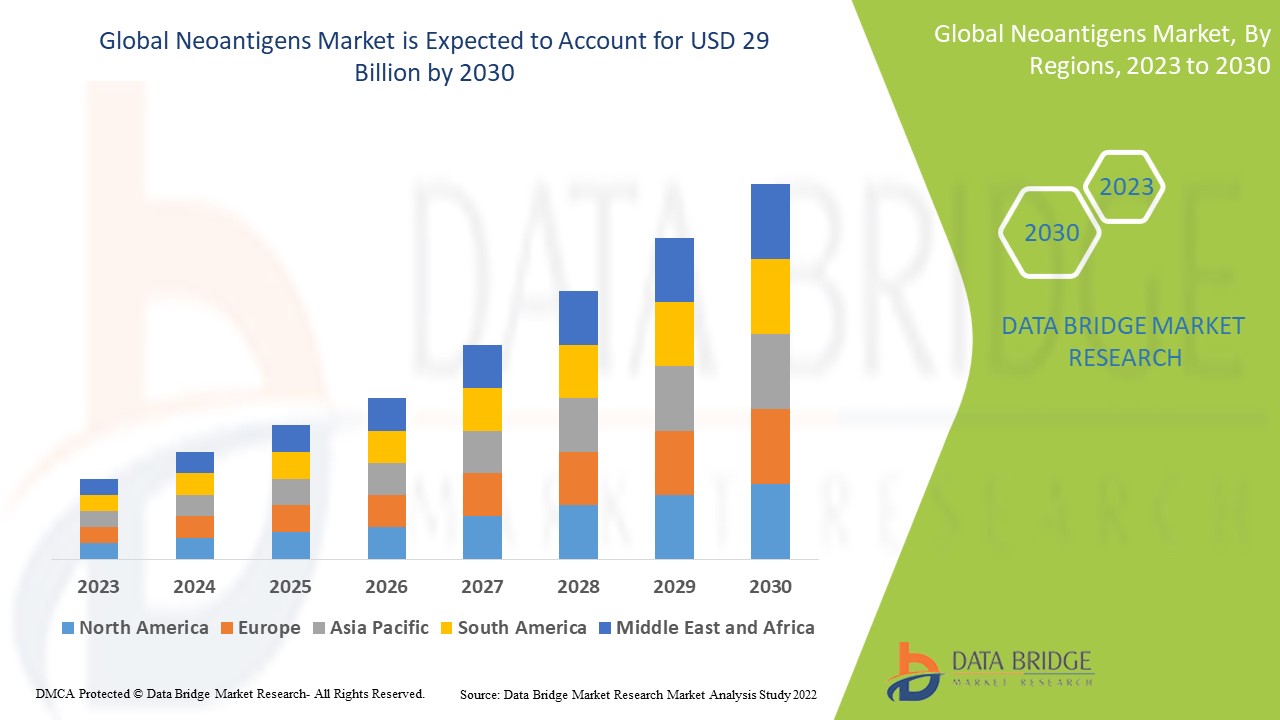

Data Bridge Market Research analyses a growth rate in the global neoantigens market in the forecast period 2023-2030. The expected CAGR of the global neoantigens market tends to be around 35.00% in the mentioned forecast period. The market was valued at USD 2.62 billion in 2022 and would grow to USD 29 billion by 2030. In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team also includes in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework.

Neoantigens Market Scope and Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2015 - 2020) |

|

Quantitative Units |

Revenue in USD Billion, Volumes in Units, Pricing in USD |

|

Segments Covered |

Treatment (Combination Therapy and Mono Therapy), Therapeutic Specialty (Lung Cancer, Urinary System Cancer, Melanoma, Liver Cancer, Head and Neck Cancer, and Blood and Bone Marrow Cancer), Line of Therapy (First Line, Second Line, and Later Lines), End-Users (Hospitals, Homecare, Speciality Centres, Others), Distribution Channel (Hospital Pharmacy, Online Pharmacy, Retail Pharmacy) |

|

Countries Covered |

U.S., Canada, and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America |

|

Market Players Covered |

Achilles Therapeutics plc (U.K.), Advaxis Immunotherapies (U.S.), Genocea (U.S.), Gradalis, Inc.(U.S.), Gritstone bio (U.S.), Iovance Biotherapetics Inc (U.S.), Medigene AG (Germany), BioNTech SE (U.S.), Lilly (U.S.), Scicomvisuals (Netherlands), Moderna, Inc.(U.S.), F. Hoffmann-La Roche Ltd. (Switzerland)., Merck KGaA (Germany), Sun Pharmaceutical Industries Ltd. (India) |

|

Market Opportunities |

|

Market Definition

Neoantigens are known as newly formed antigens that are not previously recognized by the immune system. Neoantigens are used for targeted therapies for the treatment of cancerous cells. It is also tumor-specific and highly immunogenic. Therefore, neoantigens are not expressed in healthy tissue. The neoantigens play a major role in tumor-specific T-cell mediated antitumor response and cancer immunotherapies. Furthermore, many research studies stated that neoantigens could help in immune escape, immunoediting, and sensitivity to immune checkpoint inhibitors.

Global Neoantigens Market Dynamics

Drivers

- Increasing prevalence of cancers

The rising prevalence of different forms of cancer is estimated to enhance the market's growth. In 2012, WHO projected that 8.2 million people died globally due to various malignancies. Lung, colorectal, breast, and liver cancers were among the most common cancers, with lung, colorectal, and breast cancers being the most common. Brain tumors (medulloblastoma and glioma) and neuroblastoma are the most frequent solid tumors, whereas rhabdomyosarcoma and osteosarcoma are less common solid cancers.

- Higher demand for biotechnological advancements

Biotechnology advancements have resulted in a acceptance of immunotherapy, which is pushing its application in personalized medications. Immunotherapy is commonly used to treat cancer; a few treatments include neoantigens found on the surface of cancer cells. As a result, neoantigen use for cancer treatment is being far researched.

Opportunities

- Increasing government initiatives for cancer treatment

Numerous governments have launched initiatives and programs to improve cancer treatment and prevention. For instance, in 2017, the World Health Assembly passed Resolution Cancer (WHA70.12), an integrated approach to cancer prevention and control. The program has urged the WHO and other governments to increase the efforts to meet the targets outlined in the Global Action Plan (2013-2020) for the prevention and management of non-communicable diseases (NCDs) and the 2030 UN Agenda for Sustainable Development to reduce cancer-related premature deaths.

- Higher drug launches for fast patient recovery

There are varied drugs that are launched widely to increase the recovery process. For instance, in October 2019, Corning Incorporated launched two new products, Elplasia and Matrigel, to its organoid culture portfolio to provide new solutions to support spheroid and organoid culture models. Elplasia, a 3D cell culture microplate, features a microcavity technology that enables high-volume spheroid formation, culture, and analysis. The Matrigel matrix for organoid culture is optimized to support organoid growth and differentiation. Thus, this factor create many opportunities for market growth.

Restraints/Challenges

- High cost of neoantigens

The huge expenditure of the varied neoantigens hampers the market growth. It becomes quite unaffordable for many of the sections and thus restricts the market growth.

This global neoantigens market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the global neoantigens market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Global Neoantigens Market Scope

The global neoantigens market is segmented on the basis of treatment, therapeutic specialty, line of therapy, distribution channel and end-user. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Therapeutic Specialty

- Lung Cancer

- Urinary System Cancer

- Melanoma

- Liver Cancer

- Head and Neck Cancer

- Blood and Bone Marrow Cancer

Treatment

- Combination Therapy

- Mono Therapy

Line of Therapy

- First Line

- Second Line

- Later Lines

End-Users

- Hospitals

- Homecare

- Speciality Centres

- Others

Distribution Channel

- Hospital Pharmacy

- Online Pharmacy

- Retail Pharmacy

Neoantigens Market Regional Analysis/Insights

The global neoantigens market is analyzed and market size insights and trends are provided by treatment, therapeutic specialty, line of therapy, distribution channel and end-user as referenced above.

The major countries covered in the global neoantigens market report are the U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

Asia-Pacific is expected to have the highest market growth due to the presence of key product manufacturers, increasing research and development activities, and healthcare expenditure.

North America dominates the market due to the latest technology development and the presence of a variety of innovative drug molecules to enhance the treatment procedure.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Global Neoantigens Market Share Analysis

The global neoantigens market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to global neoantigens market.

Key players operating in the global neoantigens market include:

- Achilles Therapeutics plc (U.K.)

- Advaxis Immunotherapies (U.S.)

- Genocea (U.S.)

- Gradalis, Inc.(U.S.)

- Gritstone bio (U.S.)

- Iovance Biotherapetics Inc (U.S.)

- Medigene AG (Germany)

- BioNTech SE (U.S.)

- Lilly (U.S.)

- Scicomvisuals (Netherlands)

- Moderna, Inc.(U.S.)

- F. Hoffmann-La Roche Ltd. (Switzerland).

- Merck KGaA (Germany)

- Sun Pharmaceutical Industries Ltd. (India)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL NEOANTIGENS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL NEOANTIGENS MARKET SIZE

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 TRIPOD DATA VALIDATION MODEL

2.2.4 MARKET GUIDE

2.2.5 MULTIVARIATE MODELLING

2.2.6 TOP TO BOTTOM ANALYSIS

2.2.7 CHALLENGE MATRIX

2.2.8 APPLICATION COVERAGE GRID

2.2.9 STANDARDS OF MEASUREMENT

2.2.10 VENDOR SHARE ANALYSIS

2.2.11 EPIDEMIOLOGY BASED MODEL

2.2.12 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.13 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL NEOANTIGENS MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 PESTEL ANALYSIS

5.2 PORTER’S 5 FORCES MODEL

6 INDUSTRY INSIGHTS

6.1 PATENT ANALYSIS

6.1.1 PATENT LANDSCAPE

6.1.2 USPTO NUMBER

6.1.3 PATENT EXPIRY

6.1.4 EPIO NUMBER

6.1.5 PATENT STRENGTH AND QUALITY

6.1.6 PATENT CLAIMS

6.1.7 PATENT CITATIONS

6.1.8 PATENT LITIGATION AND LICENSING

6.1.9 FILE OF PATENT

6.1.10 PATENT RECEIVED CONTRIES

6.1.11 TECHNOLOGY BACKGROUND

6.2 DRUG TREATMENT RATE BY MATURED MARKETS

6.3 DEMOGRAPHIC TRENDS: IMPACTS ON ALL INCIDENCE RATES

6.4 PATIENT FLOW DIAGRAM

6.5 KEY PRICING STRATEGIES

6.6 KEY PATIENT ENROLLMENT STRATEGIES

6.7 INTERVIEWS WITH SPECIALIST

6.8 OTHER KOL SNAPSHOTS

7 MERGERS AND ACQUISITION

7.1 LICENSING

7.2 COMMERCIALIZATION AGREEMENTS

8 REGULATORY FRAMEWORK

8.1 REGULATORY APPROVAL PROCESS

8.2 GEOGRAPHIES’ EASE OF REGULATORY APPROVAL

8.3 REGULATORY APPROVAL PATHWAYS

8.4 LICENSING AND REGISTRATION

8.5 POST-MARKETING SURVEILLANCE

8.6 GOOD MANUFACTURING PRACTICES (GMPS) GUIDELINES

9 PIPELINE ANALYSIS

9.1 CLINICAL TRIALS AND PHASE ANALYSIS

9.2 DRUG THERAPY PIPELINE

9.3 PHASE III CANDIDATES

9.4 PHASE II CANDIDATES

9.5 PHASE I CANDIDATES

9.6 OTHERS (PRE-CLINICAL AND RESEARCH)

10 R & D ANALYSIS

10.1 COMPARATIVE ANALYSIS

10.2 DRUG DEVELOPMENTAL LANDSCAPE

10.3 IN-DEPTH INSIGHTS ON REGULATORY MILESTONES

10.4 THERAPEUTIC ASSESSMENT

10.5 ASSET-BASED COLLABORATIONS AND PARTNERSHIPS

11 GLOBAL NEOANTIGENS MARKET, BY TREATMENT

11.1 OVERVIEW

11.2 COMBINATION THERAPY

11.3 MONO THERAPY

12 GLOBAL NEOANTIGENS MARKET, BY TYPE

12.1 OVERVIEW

12.2 PERSONALIZED NEOANTIGEN VACCINES

12.3 OFF-THE-SHELF NEOANTIGEN VACCINES

13 GLOBAL NEOANTIGENS MARKET, BY PRODUCT TYPE

13.1 OVERVIEW

13.2 VACCINES

13.2.1 NUCLEIC ACID/DNA VACCINES

13.2.1.1. BY THERAPY

13.2.1.1.1. COMBINATION THERAPY

13.2.1.1.2. MONO THERAPY

13.2.1.2. BY TYPE

13.2.1.2.1. PERSONALIZED NEOANTIGEN VACCINES

13.2.1.2.2. OFF-THE-SHELF NEOANTIGEN VACCINES

13.2.2 RNA VACCINES

13.2.2.1. BY TYPE

13.2.2.1.1. COMBINATION THERAPY

13.2.2.1.2. MONO THERAPY

13.2.2.2. BY TYPE

13.2.2.2.1. PERSONALIZED NEOANTIGEN VACCINES

13.2.2.2.2. OFF-THE-SHELF NEOANTIGEN VACCINES

13.2.3 PEPTIDE VACCINES

13.2.3.1. BY TYPE

13.2.3.1.1. COMBINATION THERAPY

13.2.3.1.2. MONO THERAPY

13.2.3.2. BY TYPE

13.2.3.2.1. PERSONALIZED NEOANTIGEN VACCINES

13.2.3.2.2. OFF-THE-SHELF NEOANTIGEN VACCINES

13.2.4 DENDRITIC CELL–BASED VACCINES

13.2.4.1. BY TYPE

13.2.4.1.1. COMBINATION THERAPY

13.2.4.1.2. MONO THERAPY

13.2.4.2. BY TYPE

13.2.4.2.1. PERSONALIZED NEOANTIGEN VACCINES

13.2.4.2.2. OFF-THE-SHELF NEOANTIGEN VACCINES

13.3 ADOPTIVE T CELL THERAPY

13.3.1 EMERGING DRUGS

13.3.1.1. NIVOLUMAB

13.3.1.2. PEMBROLIZUMAB

13.3.1.3. FLUDARABINE

13.3.1.4. CYCLOPHOSPHAMIDE

13.3.1.5. OTHERS

14 GLOBAL NEOANTIGENS MARKET, BY APPROACH

14.1 OVERVIEW

14.2 NEOANTIGEN-BASED CANCER VACCINES

14.3 NEOANTIGEN-BASED ADOPTIVE CELL TRANSFER (ACT)

15 GLOBAL NEOANTIGENS MARKET, BY LINE OF THERAPY

15.1 OVERVIEW

15.2 FIRST LINE NEOVACCINES REGIMENS

15.3 SECOND LINE NEOVACCINE REGIMENS

15.4 LATER LINES NEOVACCINES REGIMENS

16 GLOBAL NEOANTIGENS MARKET, BY THERAPEUTIC

16.1 OVERVIEW

16.2 HEMATOLOGICAL MALIGNANCIES

16.2.1 BY APPROCH

16.2.1.1. NEOANTIGEN-BASED CANCER VACCINES

16.2.1.2. NEOANTIGEN-BASED ADOPTIVE CELL TRANSFER (ACT)

16.2.2 BY LINE OF THERAPY

16.2.2.1. FIRST LINE NEOVACCINES REGIMENS

16.2.2.2. SECOND LINE NEOVACCINE REGIMENS

16.2.2.3. LATER LINES NEOVACCINES REGIMENS

16.3 MELANOMA

16.3.1 BY APPROCH

16.3.1.1. NEOANTIGEN-BASED CANCER VACCINES

16.3.1.2. NEOANTIGEN-BASED ADOPTIVE CELL TRANSFER (ACT)

16.3.2 BY LINE OF THERAPY

16.3.2.1. FIRST LINE NEOVACCINES REGIMENS

16.3.2.2. SECOND LINE NEOVACCINE REGIMENS

16.3.2.3. LATER LINES NEOVACCINES REGIMENS

16.4 BREAST CANCER

16.4.1 BY APPROCH

16.4.1.1. NEOANTIGEN-BASED CANCER VACCINES

16.4.1.2. NEOANTIGEN-BASED ADOPTIVE CELL TRANSFER (ACT)

16.4.2 BY LINE OF THERAPY

16.4.2.1. FIRST LINE NEOVACCINES REGIMENS

16.4.2.2. SECOND LINE NEOVACCINE REGIMENS

16.4.2.3. LATER LINES NEOVACCINES REGIMENS

16.5 GASTROINTESTINAL CANCER

16.5.1 BY APPROCH

16.5.1.1. NEOANTIGEN-BASED CANCER VACCINES

16.5.1.2. NEOANTIGEN-BASED ADOPTIVE CELL TRANSFER (ACT)

16.5.2 BY LINE OF THERAPY

16.5.2.1. FIRST LINE NEOVACCINES REGIMENS

16.5.2.2. SECOND LINE NEOVACCINE REGIMENS

16.5.2.3. LATER LINES NEOVACCINES REGIMENS

16.6 LUNG CANCER

16.6.1 BY APPROCH

16.6.1.1. NEOANTIGEN-BASED CANCER VACCINES

16.6.1.2. NEOANTIGEN-BASED ADOPTIVE CELL TRANSFER (ACT)

16.6.2 BY LINE OF THERAPY

16.6.2.1. FIRST LINE NEOVACCINES REGIMENS

16.6.2.2. SECOND LINE NEOVACCINE REGIMENS

16.6.2.3. LATER LINES NEOVACCINES REGIMENS

16.7 SOLID TUMORS

16.7.1 BY APPROCH

16.7.1.1. NEOANTIGEN-BASED CANCER VACCINES

16.7.1.2. NEOANTIGEN-BASED ADOPTIVE CELL TRANSFER (ACT)

16.7.2 BY LINE OF THERAPY

16.7.2.1. FIRST LINE NEOVACCINES REGIMENS

16.7.2.2. SECOND LINE NEOVACCINE REGIMENS

16.7.2.3. LATER LINES NEOVACCINES REGIMENS

16.8 URINARY SYSTEM CANCER

16.8.1 BY APPROCH

16.8.1.1. NEOANTIGEN-BASED CANCER VACCINES

16.8.1.2. NEOANTIGEN-BASED ADOPTIVE CELL TRANSFER (ACT)

16.8.2 BY LINE OF THERAPY

16.8.2.1. FIRST LINE NEOVACCINES REGIMENS

16.8.2.2. SECOND LINE NEOVACCINE REGIMENS

16.8.2.3. LATER LINES NEOVACCINES REGIMENS

16.9 PROSTATE CANCER

16.9.1 BY APPROCH

16.9.1.1. NEOANTIGEN-BASED CANCER VACCINES

16.9.1.2. NEOANTIGEN-BASED ADOPTIVE CELL TRANSFER (ACT)

16.9.2 BY LINE OF THERAPY

16.9.2.1. FIRST LINE NEOVACCINES REGIMENS

16.9.2.2. SECOND LINE NEOVACCINE REGIMENS

16.9.2.3. LATER LINES NEOVACCINES REGIMENS

16.1 HEAD AND NECK CANCERS

16.10.1 BY APPROCH

16.10.1.1. NEOANTIGEN-BASED CANCER VACCINES

16.10.1.2. NEOANTIGEN-BASED ADOPTIVE CELL TRANSFER (ACT)

16.10.2 BY LINE OF THERAPY

16.10.2.1. FIRST LINE NEOVACCINES REGIMENS

16.10.2.2. SECOND LINE NEOVACCINE REGIMENS

16.10.2.3. LATER LINES NEOVACCINES REGIMENS

16.11 GYNECOLOGIC CANCERS

16.11.1 BY APPROCH

16.11.1.1. NEOANTIGEN-BASED CANCER VACCINES

16.11.1.2. NEOANTIGEN-BASED ADOPTIVE CELL TRANSFER (ACT)

16.11.2 BY LINE OF THERAPY

16.11.2.1. FIRST LINE NEOVACCINES REGIMENS

16.11.2.2. SECOND LINE NEOVACCINE REGIMENS

16.11.2.3. LATER LINES NEOVACCINES REGIMENS

16.12 BRAIN CANCER

16.12.1 BY APPROCH

16.12.1.1. NEOANTIGEN-BASED CANCER VACCINES

16.12.1.2. NEOANTIGEN-BASED ADOPTIVE CELL TRANSFER (ACT)

16.12.2 BY LINE OF THERAPY

16.12.2.1. FIRST LINE NEOVACCINES REGIMENS

16.12.2.2. SECOND LINE NEOVACCINE REGIMENS

16.12.2.3. LATER LINES NEOVACCINES REGIMENS

16.13 OTHERS

17 GLOBAL NEOANTIGENS MARKET, BY AGE GROUP

17.1 OVERVIEW

17.2 PEDIATRICS

17.3 ADULTS

17.4 GERIATRICS

18 GLOBAL NEOANTIGENS MARKET, BY GENDER

18.1 OVERVIEW

18.2 MALE

18.3 FEMALE

19 GLOBAL NEOANTIGENS MARKET, BY END USER

19.1 OVERVIEW

19.2 HOSPITAL

19.2.1 PUBLIC

19.2.2 PRIVATE

19.3 CLINICS

19.4 COMMUNITY CENTERS

19.5 OTHERS

20 GLOBAL NEOANTIGENS MARKET, BY DISTRIBUTION

20.1 OVERVIEW

20.2 DIRECT TENDER

20.3 RETAIL SALES

20.4 OTHERS

21 GLOBAL NEOANTIGENS MARKET, COMPANY LANDSCAPE

21.1 COMPANY SHARE ANALYSIS: GLOBAL

21.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

21.3 COMPANY SHARE ANALYSIS: EUROPE

21.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

21.5 MERGERS & ACQUISITIONS

21.6 NEW PRODUCT DEVELOPMENT & APPROVALS

21.7 EXPANSIONS

21.8 REGULATORY CHANGES

21.9 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

22 GLOBAL NEOANTIGENS MARKET, BY GEOGRAPHY

Global Neoantigens market (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

22.1 NORTH AMERICA

22.1.1 U.S.

22.1.2 CANADA

22.1.3 MEXICO

22.2 EUROPE

22.2.1 GERMANY

22.2.2 FRANCE

22.2.3 U.K.

22.2.4 HUNGARY

22.2.5 LITHUANIA

22.2.6 AUSTRIA

22.2.7 IRELAND

22.2.8 NORWAY

22.2.9 POLAND

22.2.10 ITALY

22.2.11 SPAIN

22.2.12 RUSSIA

22.2.13 TURKEY

22.2.14 NETHERLANDS

22.2.15 SWITZERLAND

22.2.16 REST OF EUROPE

22.3 ASIA-PACIFIC

22.3.1 JAPAN

22.3.2 CHINA

22.3.3 SOUTH KOREA

22.3.4 INDIA

22.3.5 AUSTRALIA

22.3.6 SINGAPORE

22.3.7 THAILAND

22.3.8 MALAYSIA

22.3.9 INDONESIA

22.3.10 PHILIPPINES

22.3.11 VIETNAM

22.3.12 REST OF ASIA-PACIFIC

22.4 SOUTH AMERICA

22.4.1 BRAZIL

22.4.2 ARGENTINA

22.4.3 PERU

22.4.4 REST OF SOUTH AMERICA

22.5 MIDDLE EAST AND AFRICA

22.5.1 SOUTH AFRICA

22.5.2 SAUDI ARABIA

22.5.3 UAE

22.5.4 EGYPT

22.5.5 KUWAIT

22.5.6 ISRAEL

22.5.7 REST OF MIDDLE EAST AND AFRICA

22.6 KEY PRIMARY INSIGHTS: BY MAJOR COUNTRIES

23 GLOBAL NEOANTIGENS MARKET, SWOT AND DBMR ANALYSIS

24 GLOBAL NEOANTIGENS MARKET, COMPANY PROFILE

24.1 MODERNA, INC.

24.1.1 COMPANY OVERVIEW

24.1.2 REVENUE ANALYSIS

24.1.3 GEOGRAPHIC PRESENCE

24.1.4 PRODUCT PORTFOLIO

24.1.5 RECENT DEVELOPEMENTS

24.2 F. HOFFMANN-LA ROCHE LTD

24.2.1 COMPANY OVERVIEW

24.2.2 REVENUE ANALYSIS

24.2.3 GEOGRAPHIC PRESENCE

24.2.4 PRODUCT PORTFOLIO

24.2.5 RECENT DEVELOPEMENTS

24.3 AGENUS INC.

24.3.1 COMPANY OVERVIEW

24.3.2 REVENUE ANALYSIS

24.3.3 GEOGRAPHIC PRESENCE

24.3.4 PRODUCT PORTFOLIO

24.3.5 RECENT DEVELOPEMENTS

24.4 ADVAXIS, INC./AMGEN INC

24.4.1 COMPANY OVERVIEW

24.4.2 REVENUE ANALYSIS

24.4.3 GEOGRAPHIC PRESENCE

24.4.4 PRODUCT PORTFOLIO

24.4.5 RECENT DEVELOPEMENTS

24.5 MEDIGENE AG

24.5.1 COMPANY OVERVIEW

24.5.2 REVENUE ANALYSIS

24.5.3 GEOGRAPHIC PRESENCE

24.5.4 PRODUCT PORTFOLIO

24.5.5 RECENT DEVELOPEMENTS

24.6 GRITSTONE ONCOLOGY

24.6.1 COMPANY OVERVIEW

24.6.2 REVENUE ANALYSIS

24.6.3 GEOGRAPHIC PRESENCE

24.6.4 PRODUCT PORTFOLIO

24.6.5 RECENT DEVELOPEMENTS

24.7 NOUSCOM

24.7.1 COMPANY OVERVIEW

24.7.2 REVENUE ANALYSIS

24.7.3 GEOGRAPHIC PRESENCE

24.7.4 PRODUCT PORTFOLIO

24.7.5 RECENT DEVELOPEMENTS

24.8 BIOLINERX LTD.

24.8.1 COMPANY OVERVIEW

24.8.2 REVENUE ANALYSIS

24.8.3 GEOGRAPHIC PRESENCE

24.8.4 PRODUCT PORTFOLIO

24.8.5 RECENT DEVELOPEMENTS

24.9 GENEOS THERAPEUTICS, INC.

24.9.1 COMPANY OVERVIEW

24.9.2 REVENUE ANALYSIS

24.9.3 GEOGRAPHIC PRESENCE

24.9.4 PRODUCT PORTFOLIO

24.9.5 RECENT DEVELOPEMENTS

24.1 ACHILLES THERAPEUTICS PLC

24.10.1 COMPANY OVERVIEW

24.10.2 REVENUE ANALYSIS

24.10.3 GEOGRAPHIC PRESENCE

24.10.4 PRODUCT PORTFOLIO

24.10.5 RECENT DEVELOPMENTS

24.11 BIONTECH SE

24.11.1 COMPANY OVERVIEW

24.11.2 REVENUE ANALYSIS

24.11.3 GEOGRAPHIC PRESENCE

24.11.4 PRODUCT PORTFOLIO

24.11.5 RECENT DEVELOPEMENTS

24.12 GRADALIS, INC.

24.12.1 COMPANY OVERVIEW

24.12.2 REVENUE ANALYSIS

24.12.3 GEOGRAPHIC PRESENCE

24.12.4 PRODUCT PORTFOLIO

24.12.5 RECENT DEVELOPEMENTS

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

25 RELATED REPORTS

26 CONCLUSION

27 QUESTIONNAIRE

28 ABOUT DATA BRIDGE MARKET RESEARCH

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.