Global Network Automation Market

Market Size in USD Billion

CAGR :

%

USD

8.89 Billion

USD

217.37 Billion

2025

2033

USD

8.89 Billion

USD

217.37 Billion

2025

2033

| 2026 –2033 | |

| USD 8.89 Billion | |

| USD 217.37 Billion | |

|

|

|

|

What is the Global Network Automation Market Size and Growth Rate?

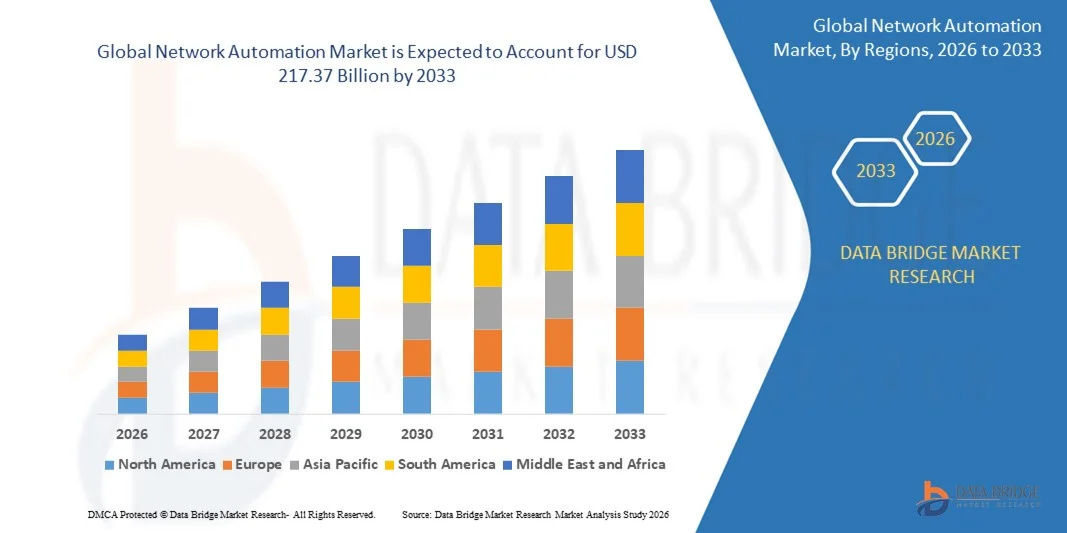

- The global network automation market size was valued at USD 8.89 billion in 2025 and is expected to reach USD 217.37 billion by 2033, at a CAGR of 49.10% during the forecast period

- The rapid surge in human error rates in manual systems causing network downtime have been directly influencing the growth of network automation market

- The high adoption of virtual and software-defined infrastructure as well as the increasing adoption of automation technologies such as AI and machine learning is also flourishing the growth of the network automation market

What are the Major Takeaways of Network Automation Market?

- The rising network traffic and cloud infrastructure leading to a major transition in data centers is also acting as an active growth driver towards the growth of the network automation market. Moreover, the increase in investment by network automation solution vendors is creating a huge demand for network automation as well as lifting the growth of the network automation market

- However, the availability of open-source automation tools as well as the dearth of awareness among network administrators are acting as the major restrictions for the growth of network automation in the above mentioned forecasted period, whereas the increasing security threats can challenge the network automation market

- North America dominated the network automation market with a 37.74% revenue share in 2025, driven by early adoption of advanced networking technologies, strong cloud infrastructure penetration, and large-scale deployment of automation across enterprise, data center, and telecom networks in the U.S. and Canada

- Asia-Pacific is projected to register the fastest CAGR of 9.79% from 2026 to 2033, driven by rapid digitalization, expanding telecom networks, cloud adoption, and large-scale enterprise IT modernization across China, Japan, India, South Korea, and Southeast Asia

- The Solutions segment dominated the market with an estimated 62.3% share in 2025, driven by strong adoption of network configuration management, orchestration platforms, policy-based automation tools, and intent-based networking solutions

Report Scope and Network Automation Market Segmentation

|

Attributes |

Network Automation Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Network Automation Market?

Rapid Shift Toward AI-Driven, Cloud-Native, and Software-Defined Network Automation Platforms

- The network automation market is witnessing strong adoption of cloud-native, API-driven, and software-based automation platforms designed to manage complex enterprise, data center, and service provider networks

- Vendors are increasingly integrating AI, machine learning, and intent-based networking capabilities to enable real-time configuration, policy enforcement, fault detection, and self-healing networks

- Growing demand for scalable, cost-efficient, and centrally managed network operations is driving adoption across enterprises, telecom operators, hyperscale data centers, and managed service providers

- For instance, companies such as Cisco, IBM, VMware, and SolarWinds are enhancing their network automation portfolios with AI-powered analytics, zero-touch provisioning, and multi-vendor orchestration capabilities

- Rising need for faster network provisioning, reduced manual errors, and improved service reliability is accelerating the shift toward automated and controller-based network architectures

- As networks become more distributed, virtualized, and software-defined, Network Automations will remain critical for operational efficiency, agility, and large-scale network management

What are the Key Drivers of Network Automation Market?

- Increasing complexity of enterprise and telecom networks due to cloud adoption, SDN, NFV, and hybrid IT environments

- For instance, in 2025, leading vendors such as Cisco, Juniper Networks, and VMware expanded AI-enabled network automation solutions to support intent-based operations and predictive maintenance

- Rapid growth of data traffic, 5G deployment, IoT connectivity, and remote work environments is boosting demand for automated network monitoring and orchestration

- Advancements in AI analytics, network programmability, APIs, and controller-based architectures have improved automation accuracy, scalability, and responsiveness

- Rising focus on reducing operational expenditure (OPEX), minimizing downtime, and improving network security is accelerating automation adoption

- Supported by continuous investments in digital transformation and cloud infrastructure, the network automation market is expected to witness strong long-term growth

Which Factor is Challenging the Growth of the Network Automation Market?

- High initial implementation costs and integration complexity associated with advanced network automation platforms limit adoption among small and mid-sized enterprises

- For instance, during 2024–2025, integration challenges with legacy network infrastructure and multi-vendor environments slowed automation deployment for several organizations

- Shortage of skilled professionals capable of managing AI-driven, software-defined, and programmable networks increases training and operational challenges

- Limited awareness in emerging markets regarding automation benefits, intent-based networking, and AI-driven network operations restrains adoption

- Concerns related to security, data privacy, and loss of manual control create hesitation in fully automated network environments

- To overcome these challenges, vendors are focusing on simplified deployment models, cloud-based automation platforms, enhanced training programs, and improved interoperability to expand global adoption of network automations

How is the Network Automation Market Segmented?

The market is segmented on the basis of channel count, application, and vertical.

- By Component

On the basis of component, the network automation market is segmented into Solutions and Services. The Solutions segment dominated the market with an estimated 62.3% share in 2025, driven by strong adoption of network configuration management, orchestration platforms, policy-based automation tools, and intent-based networking solutions. Enterprises increasingly deploy automation software to reduce manual intervention, minimize network downtime, and enhance operational efficiency across complex IT infrastructures.

The Services segment is expected to grow at the fastest CAGR from 2026 to 2033, supported by rising demand for consulting, integration, training, and managed services. As organizations adopt multi-vendor and hybrid network environments, reliance on professional and managed services for deployment, customization, and continuous optimization is increasing, particularly among SMEs and cloud-native enterprises.

- By Type

On the basis of type, the network automation market is segmented into Local Area Network (LAN), Wide Area Network (WAN), Data Center Networks, Cloud Networks, and Wireless Networks. The Data Center Networks segment dominated the market with a 34.6% share in 2025, owing to rapid growth in hyperscale data centers, virtualization, and software-defined networking. Automation is extensively used to manage traffic flows, optimize workloads, and ensure high availability in data-intensive environments.

The Cloud Networks segment is projected to grow at the fastest CAGR from 2026 to 2033, driven by accelerated cloud migration, adoption of multi-cloud strategies, and increasing reliance on automated provisioning, monitoring, and scaling. Cloud-native enterprises require advanced automation to manage dynamic network workloads, security policies, and performance across distributed cloud infrastructures.

- By Network Type

On the basis of network type, the network automation market is segmented into Physical Network, Virtual Network, and Hybrid Network. The Physical Network segment held the largest market share of 41.8% in 2025, supported by continued deployment of automation tools in traditional enterprise networks, telecom backbones, and on-premises data centers. Automation enables efficient hardware configuration, fault management, and network visibility across large physical infrastructures.

The Hybrid Network segment is anticipated to grow at the fastest CAGR from 2026 to 2033, as organizations increasingly combine physical and virtual networks to support cloud integration, remote operations, and digital transformation initiatives. The growing complexity of hybrid environments is driving demand for unified automation platforms capable of managing diverse network architectures seamlessly.

- By Deployment Model

On the basis of deployment model, the network automation market is segmented into On-Premises and Cloud. The On-Premises segment dominated the market with a 55.1% share in 2025, as large enterprises, BFSI institutions, and government organizations prioritize data security, regulatory compliance, and control over critical network infrastructure. On-premises automation solutions are widely used in legacy systems and mission-critical environments.

The Cloud deployment segment is expected to witness the fastest growth from 2026 to 2033, driven by scalability, lower upfront costs, and ease of integration with cloud-native applications. Increasing adoption of SaaS-based automation platforms and remote network management is accelerating cloud deployment across SMEs and digitally driven enterprises.

- By Organization Size

On the basis of organization size, the network automation market is segmented into Small and Medium-Sized Enterprises (SMEs) and Large Enterprises. The Large Enterprises segment dominated the market with a 64.7% share in 2025, due to complex network infrastructures, high traffic volumes, and strong investments in advanced IT and automation technologies. Large organizations deploy automation to improve network reliability, reduce operational costs, and enhance service quality.

The SMEs segment is projected to grow at the fastest CAGR from 2026 to 2033, supported by rising cloud adoption, digitalization initiatives, and availability of cost-effective, scalable automation solutions. Automation enables SMEs to manage networks efficiently with limited IT resources, driving rapid adoption across emerging markets.

- By User Type

On the basis of user type, the network automation market is segmented into Enterprise Vertical and Service Providers. The Enterprise Vertical segment accounted for the largest share of 58.9% in 2025, driven by widespread use of automation across corporate IT networks, data centers, and cloud infrastructures to enhance performance, security, and operational agility.

The Service Providers segment is expected to grow at the fastest CAGR from 2026 to 2033, fueled by rising demand for automated network provisioning, real-time monitoring, and service assurance. Telecom operators and managed service providers increasingly rely on automation to support 5G deployment, SD-WAN services, and large-scale customer networks.

- By End User

On the basis of end user, the network automation market is segmented into Banking, Financial Services, and Insurance (BFSI), Information Technology, Education, Energy and Utilities, IT and Telecom, Manufacturing, and Others. The IT and Telecom segment dominated the market with a 33.4% share in 2025, supported by high network complexity, large-scale data traffic, and continuous technology upgrades. Automation plays a critical role in managing telecom networks, cloud services, and enterprise connectivity.

The BFSI segment is expected to grow at the fastest CAGR from 2026 to 2033, driven by increasing digital banking adoption, cybersecurity requirements, and demand for high network reliability. Automated network management helps financial institutions ensure secure, compliant, and uninterrupted digital services.

Which Region Holds the Largest Share of the Network Automation Market?

- North America dominated the network automation market with a 37.74% revenue share in 2025, driven by early adoption of advanced networking technologies, strong cloud infrastructure penetration, and large-scale deployment of automation across enterprise, data center, and telecom networks in the U.S. and Canada. High reliance on software-defined networking (SDN), network function virtualization (NFV), and intent-based networking continues to fuel demand for automated configuration, monitoring, and orchestration solutions across BFSI, IT, telecom, healthcare, and manufacturing sectors

- Leading companies in North America are actively launching AI-driven, cloud-integrated, and multi-vendor network automation platforms that support real-time visibility, predictive analytics, and zero-touch provisioning, strengthening the region’s technological leadership

- High concentration of skilled IT professionals, strong innovation ecosystems, and sustained investments in digital transformation and cloud networking further reinforce North America’s market dominance

U.S. Network Automation Market Insight

The U.S. is the largest contributor in North America, supported by widespread adoption of cloud computing, hyperscale data centers, and complex enterprise networks. Strong demand from telecom operators, managed service providers, and large enterprises for automated network provisioning, performance optimization, and security enforcement drives market growth. Increasing deployment of 5G, SD-WAN, hybrid cloud, and AI-enabled networking solutions further accelerates adoption of Network Automation across industries.

Canada Network Automation Market Insight

Canada contributes significantly to regional growth, driven by expanding cloud adoption, digital government initiatives, and modernization of enterprise IT infrastructure. Organizations increasingly deploy Network Automation to improve network reliability, reduce operational complexity, and support remote and hybrid work environments. Growing investments in telecom upgrades, data centers, and managed network services support steady market expansion across the country.

Asia-Pacific Network Automation Market

Asia-Pacific is projected to register the fastest CAGR of 9.79% from 2026 to 2033, driven by rapid digitalization, expanding telecom networks, cloud adoption, and large-scale enterprise IT modernization across China, Japan, India, South Korea, and Southeast Asia. Rising deployment of 5G, data centers, and cloud-native applications increases demand for automated network management, orchestration, and optimization solutions. Strong growth in manufacturing, IT services, and smart infrastructure continues to accelerate Network Automation adoption across the region.

China Network Automation Market Insight

China is the largest contributor to Asia-Pacific, supported by massive investments in telecom infrastructure, cloud data centers, and enterprise digital transformation. Large-scale deployment of 5G, AI-driven networks, and software-defined infrastructure drives strong demand for Network Automation solutions that enhance scalability, performance, and operational efficiency.

Japan Network Automation Market Insight

Japan shows steady growth, driven by advanced enterprise networks, strong telecom infrastructure, and increasing adoption of automation to support reliability and low-latency requirements. Enterprises focus on high-quality, secure, and resilient network operations, supporting sustained adoption of Network Automation platforms.

India Network Automation Market Insight

India is emerging as a key growth market, fueled by rapid cloud adoption, expanding data center capacity, and increasing demand for automated network operations among enterprises and service providers. Government-led digital initiatives, startup ecosystem growth, and rising IT services exports accelerate market penetration.

South Korea Network Automation Market Insight

South Korea contributes strongly due to advanced telecom networks, early 5G adoption, and high demand for automated network performance management. Growth in cloud services, AI infrastructure, and enterprise networking supports long-term expansion of the Network Automation market.

Which are the Top Companies in Network Automation Market?

The network automation industry is primarily led by well-established companies, including:

- Cisco Systems, Inc. (U.S.)

- IBM (U.S.)

- VMware, Inc. (U.S.)

- SolarWinds Worldwide, LLC (U.S.)

- BMC Software, Inc. (U.S.)

- Micro Focus (U.K.)

- NetBrain Technologies, Inc. (U.S.)

- Forward Networks, Inc. (U.S.)

- Anuta Networks Private Limited (India)

- Apstra (U.S.)

- BlueCat Networks (Canada)

- Park Place Technologies (U.S.)

- Riverbed Technology (U.S.)

- Itential (U.S.)

- BackBox Software, LTD. (Israel)

- AppViewX (U.S.)

- Sedona Systems (U.S.)

- Kentik (U.S.)

- NetYCE (Netherlands)

- Versa Networks, Inc. (U.S.)

- Paessler (Germany)

What are the Recent Developments in Global Network Automation Market?

- In July 2025, HPE announced the successful completion of its acquisition of Juniper Networks, a leader in AI-native networking, strengthening HPE’s position in the fast-growing AI and hybrid cloud landscape through a comprehensive cloud-native, AI-driven IT and networking portfolio. This development significantly enhances HPE’s ability to deliver end-to-end intelligent networking solutions at scale

- In July 2025, Ericsson, in collaboration with AT&T, revealed that a third-party RAN automation application (rApp) successfully executed optimization functions on a live CSP production network using standardized R1 interfaces and SMO platforms. This milestone validates open, standards-based RAN automation and accelerates industry-wide adoption of intelligent network operations

- In June 2025, Cisco launched a secure, AI-ready network architecture designed to accelerate workplace AI transformation across campus, branch, and industrial environments through unified management, AI-optimized hardware, and built-in security. This launch reinforces Cisco’s leadership in AI-driven enterprise networking modernization

- In March 2025, Huawei introduced its AI Core Network, transitioning from AI-powered to fully AI-native infrastructure capable of autonomous optimization and self-maintenance across intelligent network ecosystems. This innovation marks a major step toward fully autonomous, generative network architectures

- In February 2025, IBM and Juniper Networks announced plans to expand collaboration across joint sales, marketing, and product integration, combining Juniper’s Mist AI platform with IBM watsonx to enhance end-to-end, AI-driven enterprise networking experiences. This partnership strengthens AI integration across enterprise networking and cloud workflows

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.