Global Neurovascular Coiling Assist Devices Market

Market Size in USD Billion

CAGR :

%

USD

2.22 Billion

USD

3.24 Billion

2025

2033

USD

2.22 Billion

USD

3.24 Billion

2025

2033

| 2026 –2033 | |

| USD 2.22 Billion | |

| USD 3.24 Billion | |

|

|

|

|

Neurovascular Coiling Assist Devices Market Size

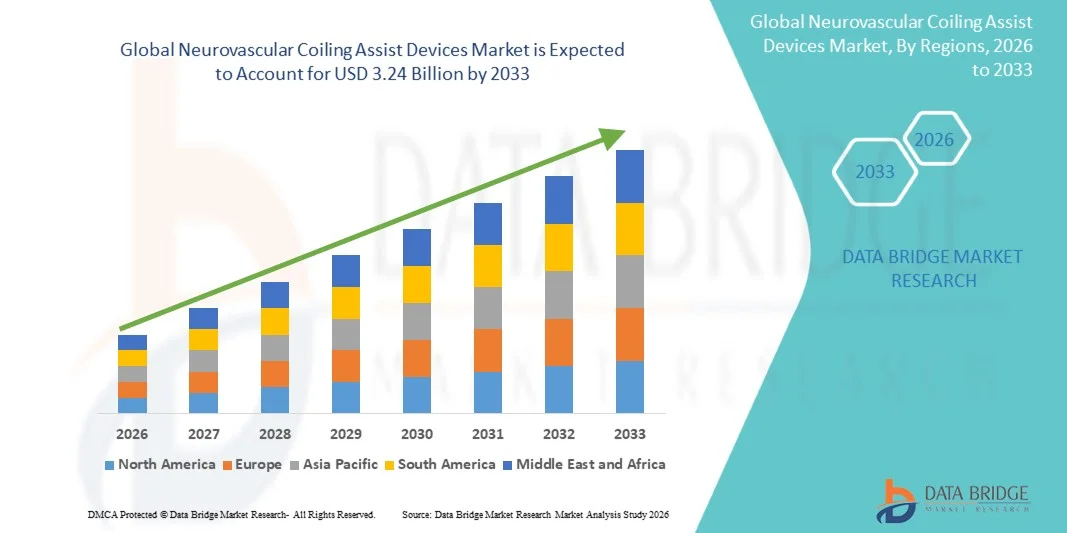

- The global neurovascular coiling assist devices market size was valued at USD 2.22 Billion in 2025 and is expected to reach USD 3.24 Billion by 2033, at a CAGR of 4.87% during the forecast period

- The market growth is largely fueled by the rising prevalence of neurovascular disorders such as intracranial aneurysms and arteriovenous malformations, increasing preference for minimally invasive endovascular procedures, and continuous technological advancements in coil assist stents and balloons that enhance procedural success and safety

- Furthermore, expanding healthcare infrastructure, growing awareness of advanced neurointerventional treatments, favorable reimbursement policies, and increasing healthcare expenditures are driving stronger adoption of coiling assist devices in hospitals and surgical centers worldwide

Neurovascular Coiling Assist Devices Market Analysis

- Neurovascular coiling assist devices, including coil assist stents and coil assist balloons, are increasingly vital components of minimally invasive treatments for intracranial aneurysms and other neurovascular disorders due to their enhanced procedural precision, safety, and ability to improve patient outcomes

- The escalating demand for neurovascular coiling assist devices is primarily fueled by the rising prevalence of intracranial aneurysms and arteriovenous malformations (AVMs), growing preference for minimally invasive interventions over open surgeries, and continuous technological advancements that improve device performance and procedural efficiency

- North America dominated the neurovascular coiling assist devices market with the largest revenue share of 41.5% in 2025, characterized by advanced healthcare infrastructure, high adoption of neurointerventional procedures, and a strong presence of key device manufacturers, with the U.S. experiencing substantial growth in hospitals and specialized neurointerventional centers, driven by innovations in coil assist stents and balloons for complex aneurysm treatments

- Asia-Pacific is expected to be the fastest growing region in the neurovascular coiling assist devices market during the forecast period due to increasing healthcare investments, expanding hospital and ambulatory surgical center infrastructure, and growing awareness of advanced neurointerventional treatments

- Coil assist stents segment dominated the market with a share of 53.2% in 2025, driven by their established efficacy in supporting complex aneurysm procedures and widespread adoption in hospitals and surgical centers

Report Scope and Neurovascular Coiling Assist Devices Market Segmentation

|

Attributes |

Neurovascular Coiling Assist Devices Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Neurovascular Coiling Assist Devices Market Trends

“Advancements in Image-Guided and Robotic-Assisted Procedures”

- A significant and accelerating trend in the global neurovascular coiling assist devices market is the growing integration of image-guided navigation and robotic-assisted systems, enhancing procedural precision, reducing operative time, and improving patient outcomes

- For instance, robotic-assisted neurointerventional platforms are increasingly used with coil assist stents and balloons to facilitate accurate device placement in complex aneurysm anatomies, minimizing manual errors and improving safety

- Image-guided technologies allow real-time visualization of vascular structures, enabling more precise navigation of coils and assist devices, reducing procedure-related complications, and providing better long-term outcomes

- The integration of robotics and imaging platforms with coil assist devices supports minimally invasive interventions, allowing clinicians to perform complex aneurysm treatments with reduced radiation exposure and improved procedural efficiency

- This trend toward smarter, more precise, and technology-assisted neurointerventional procedures is fundamentally reshaping expectations for endovascular treatment standards. Consequently, companies such as Medtronic and Stryker are developing advanced coil assist stents compatible with image-guided and robotic systems

- The demand for coiling assist devices integrated with advanced imaging and robotic capabilities is growing rapidly across hospitals and specialized surgical centers, as providers increasingly prioritize procedural safety and optimized clinical outcomes

Neurovascular Coiling Assist Devices Market Dynamics

Driver

“Rising Prevalence of Aneurysms and AVMs”

- The increasing incidence of intracranial aneurysms and arteriovenous malformations, coupled with growing preference for minimally invasive interventions, is a significant driver of the heightened demand for neurovascular coiling assist devices

- For instance, in March 2025, Stryker reported increased utilization of its coil assist stents in endovascular aneurysm treatments across North America and Europe, reflecting a growing procedural adoption trend

- As patient populations age and vascular risk factors rise, hospitals increasingly prefer coil assist devices to reduce surgical complications, improve recovery times, and enhance long-term outcomes

- Furthermore, expanding healthcare infrastructure and increasing availability of neurointerventional programs in emerging regions are driving higher adoption of coil assist balloons and stents

- The convenience of minimally invasive procedures, coupled with enhanced device precision and improved safety profiles, is propelling the adoption of coil assist devices in both hospitals and ambulatory surgical centers

- Technological innovations, such as low-profile stents and next-generation balloons, are increasing the procedural success rate, further encouraging physician adoption

- Growing awareness among patients about minimally invasive neurointerventions is contributing to higher demand for coil assist devices in tertiary care centers globally

Restraint/Challenge

“High Device Costs and Regulatory Compliance Hurdles”

- The relatively high cost of coil assist devices compared to traditional surgical options poses a significant barrier to adoption, particularly in price-sensitive or emerging markets

- For instance, premium coil assist stents and balloons with advanced features can cost several times more than conventional devices, limiting accessibility in smaller hospitals or outpatient centers

- Regulatory approval requirements and stringent clinical validation protocols can delay product launches, creating hurdles for manufacturers attempting to expand their geographic presence or introduce next-generation devices

- While prices are gradually stabilizing with technological maturation and increased competition, the upfront investment for advanced neurovascular coiling assist devices can still hinder adoption in some healthcare settings

- Overcoming these challenges through device cost optimization, faster regulatory pathways, and evidence-based clinical validation will be vital for sustained market growth and broader procedural adoption

- Limited availability of trained neurointerventional specialists in emerging regions restricts market penetration despite growing demand for coil assist devices

- Potential complications during procedures, such as device migration or vessel perforation, necessitate careful training and hospital readiness, which can slow adoption in less specialized centers

Neurovascular Coiling Assist Devices Market Scope

The market is segmented on the basis of product type, application, and end user.

- By Product Type

On the basis of product type, the neurovascular coiling assist devices market is segmented into coil assist stents and coil assist balloons. The coil assist stents segment dominated the market with the largest revenue share of 53.2% in 2025, driven by its widespread adoption in complex intracranial aneurysm treatments and high procedural success rates. Clinicians often prefer coil assist stents for their ability to provide stable coil support in wide-necked aneurysms, reducing the risk of coil migration. The segment also benefits from strong clinical evidence supporting improved patient outcomes and lower recurrence rates. Hospitals and specialized neurointerventional centers increasingly rely on stent-assisted coiling as the standard approach for challenging aneurysm anatomies. Continuous technological advancements, such as low-profile and flexible stents, further enhance their procedural efficiency and ease of navigation in tortuous vessels. The growing preference for stent-assisted procedures across mature and emerging markets sustains the dominant position of this segment.

The coil assist balloons segment is anticipated to witness the fastest growth rate of 9.5% CAGR from 2026 to 2033, fueled by increasing adoption in minimally invasive procedures where temporary vessel remodeling is required. Balloons offer precise control over coil deployment and are especially useful in wide-neck aneurysms or bifurcation points. Their ease of use and ability to reduce procedure time make them increasingly preferred by neurointerventionalists in high-volume hospitals. Growing awareness of balloon-assisted techniques and rising training programs in Asia-Pacific and Latin America are expanding the market base. The development of more flexible, low-profile balloons compatible with modern microcatheter systems further accelerates adoption. In addition, the segment’s versatility in both aneurysm and AVM treatments supports its rapid growth potential over the forecast period.

- By Application

On the basis of application, the market is segmented into aneurysms, arteriovascular malformations (AVMs), and others. The aneurysms segment dominated the market with a share of 62% in 2025, driven by the high prevalence of intracranial aneurysms and preference for minimally invasive endovascular interventions. Coil assist devices are increasingly preferred over open surgical clipping due to reduced procedural risks and shorter recovery times. Hospitals prioritize aneurysm treatments using stents and balloons because of strong clinical evidence demonstrating improved occlusion rates and lower recurrence. The segment benefits from continuous technological innovation, including advanced stent designs and balloon remodeling techniques. Patient awareness campaigns and physician training programs also contribute to the segment’s dominance. The growing demand for neurointerventional procedures in aging populations further reinforces the aneurysm segment’s market leadership.

The AVMs segment is expected to witness the fastest CAGR of 8.7% from 2026 to 2033, fueled by rising diagnosis rates and expanding availability of endovascular interventions for complex malformations. Coil assist devices enable precise embolization in AVMs while minimizing collateral damage to surrounding brain tissue. Emerging hospitals in Asia-Pacific and Latin America are increasingly adopting minimally invasive AVM procedures, driving growth. Improved imaging technologies and procedural planning software enhance the effectiveness of coil assist interventions in AVMs. Collaborative initiatives between device manufacturers and neurosurgical centers are accelerating training and adoption. The segment’s focus on challenging neurovascular conditions ensures sustained high growth over the forecast period.

- By End User

On the basis of end user, the market is segmented into hospitals, ambulatory surgical centers, and others. The hospitals segment dominated the market with a share of 75% in 2025, driven by the high volume of complex neurointerventional procedures performed in tertiary care and specialized neurovascular centers. Hospitals have the infrastructure, trained staff, and imaging capabilities required for stent- and balloon-assisted coiling procedures. The segment benefits from continuous investment in neurointerventional programs and adoption of advanced coil assist devices. Patient demand for minimally invasive procedures and favorable reimbursement policies further support the dominance of hospitals. In addition, the integration of training programs and clinical trials in hospitals enhances procedural expertise and device adoption. Hospitals continue to be the primary end users due to their capability to handle high-risk neurovascular interventions.

The ambulatory surgical centers segment is expected to witness the fastest growth rate of 10% CAGR from 2026 to 2033, fueled by the increasing adoption of minimally invasive neurointerventional procedures in outpatient settings. These centers offer cost-effective treatment options with shorter recovery times for low- to medium-complexity aneurysm and AVM procedures. Expansion of neurointerventional services in emerging markets and growing collaborations with device manufacturers are driving adoption. Improved safety profiles of coil assist devices and supportive regulatory frameworks enhance confidence in ambulatory care adoption. Rising patient preference for outpatient procedures and convenience further contributes to growth. The segment’s rapid expansion is also supported by the development of smaller, portable imaging systems compatible with minimally invasive interventions.

Neurovascular Coiling Assist Devices Market Regional Analysis

- North America dominated the neurovascular coiling assist devices market with the largest revenue share of 41.5% in 2025, characterized by advanced healthcare infrastructure, high adoption of neurointerventional procedures, and a strong presence of key device manufacturers

- Hospitals and specialized neurointerventional centers in the region highly value the precision, procedural safety, and improved patient outcomes provided by coil assist stents and balloons, making these devices the preferred choice for complex aneurysm treatments

- This widespread adoption is further supported by continuous technological innovation, the presence of leading device manufacturers, favorable reimbursement policies, and a growing focus on training programs for neurointerventional specialists, establishing coil assist devices as the standard solution in North American tertiary care hospitals

U.S. Neurovascular Coiling Assist Devices Market Insight

The U.S. neurovascular coiling assist devices market captured the largest revenue share of 82% in North America in 2025, fueled by the high prevalence of intracranial aneurysms and arteriovenous malformations, advanced healthcare infrastructure, and early adoption of minimally invasive neurointerventional procedures. Hospitals and specialized neurointerventional centers increasingly prioritize coil assist stents and balloons for complex aneurysm treatments, driven by proven clinical outcomes and high procedural success rates. The growing emphasis on patient safety, combined with robust reimbursement policies, further propels market growth. Moreover, the integration of advanced imaging and robotic-assisted systems enhances procedural precision and efficiency. Continuous physician training programs and collaborations with device manufacturers also support the expansion of coil assist device utilization across hospitals.

Europe Neurovascular Coiling Assist Devices Market Insight

The Europe neurovascular coiling assist devices market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by rising awareness of minimally invasive neurointerventional procedures and increasing prevalence of intracranial aneurysms. Strong healthcare infrastructure and increasing investment in neurovascular programs are fostering device adoption. European hospitals and specialized centers prioritize procedural safety and patient outcomes, supporting widespread adoption of coil assist stents and balloons. The region also sees growing adoption in multi-hospital networks and private healthcare facilities. Advancements in imaging technologies and training initiatives contribute to the market’s expansion. Regulatory support for endovascular interventions further enhances the adoption of neurovascular coiling assist devices across Europe.

U.K. Neurovascular Coiling Assist Devices Market Insight

The U.K. neurovascular coiling assist devices market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by increasing demand for minimally invasive aneurysm and AVM interventions and a focus on improving patient outcomes. Hospitals and specialized neurointerventional centers are adopting stent- and balloon-assisted procedures due to proven procedural success and reduced recovery times. In addition, increasing investments in neurointerventional infrastructure, alongside skilled healthcare professionals, are promoting device adoption. The country’s emphasis on patient safety, advanced imaging capabilities, and procedural precision further supports growth. The integration of coil assist devices with advanced endovascular technologies is becoming more common, fueling market expansion.

Germany Neurovascular Coiling Assist Devices Market Insight

The Germany neurovascular coiling assist devices market is expected to expand at a considerable CAGR during the forecast period, fueled by increasing prevalence of intracranial aneurysms, AVMs, and the demand for technologically advanced treatment solutions. Hospitals and specialized neurointerventional centers prioritize coil assist stents and balloons due to their procedural efficiency and safety profiles. Germany’s strong healthcare infrastructure, research initiatives, and innovation-focused environment encourage adoption of advanced endovascular devices. Integration with image-guided navigation systems and robotic-assisted platforms is gaining traction. In addition, patient awareness and early diagnosis programs are contributing to procedural uptake. Continuous training of neurointerventional specialists further drives device utilization.

Asia-Pacific Neurovascular Coiling Assist Devices Market Insight

The Asia-Pacific neurovascular coiling assist devices market is poised to grow at the fastest CAGR of 10% during 2026–2033, driven by rising prevalence of aneurysms and AVMs, expanding healthcare infrastructure, and increasing availability of minimally invasive neurointerventional procedures in countries such as China, Japan, and India. The region’s growing focus on endovascular treatment programs, supported by government healthcare initiatives, is driving device adoption. Hospitals and specialized centers are rapidly adopting coil assist stents and balloons for complex procedures. Technological advancements, affordability improvements, and training programs for neurointerventional specialists further fuel market growth. The expansion of private healthcare networks and increasing patient awareness are also significant contributors.

Japan Neurovascular Coiling Assist Devices Market Insight

The Japan neurovascular coiling assist devices market is gaining momentum due to advanced healthcare infrastructure, growing aging population, and increasing prevalence of intracranial aneurysms and AVMs. Hospitals prioritize minimally invasive procedures using coil assist stents and balloons to enhance procedural precision and reduce recovery time. Integration with robotic-assisted and image-guided systems further supports device adoption. The high demand for advanced, safe, and efficient treatment solutions in both residential and commercial healthcare settings drives market expansion. Training programs for neurointerventional specialists are increasing, supporting procedural uptake. Japan’s focus on technology-driven healthcare solutions further accelerates growth.

India Neurovascular Coiling Assist Devices Market Insight

The India neurovascular coiling assist devices market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to expanding healthcare infrastructure, growing hospital networks, and increasing awareness of minimally invasive neurointerventional procedures. Hospitals and specialty centers are adopting coil assist stents and balloons for aneurysm and AVM treatments due to procedural safety and efficiency. Government initiatives promoting advanced healthcare and digital interventions are supporting adoption. Rising patient awareness and increasing physician training programs further contribute to market growth. The availability of cost-effective coil assist devices and partnerships with domestic and international manufacturers enhance accessibility. Rapid urbanization and increasing procedural volumes are key factors propelling market expansion in India.

Neurovascular Coiling Assist Devices Market Share

The Neurovascular Coiling Assist Devices industry is primarily led by well-established companies, including:

- Medtronic (Ireland)

- Stryker (U.S.)

- Penumbra, Inc. (U.S.)

- Terumo Neuro (Japan)

- Balt Extrusion S.A.S. (France)

- Phenox GmbH (Germany)

- Acandis GmbH & Co. KG (Germany)

- NeuroVasc Technologies Inc. (U.S.)

- Abbott (U.S.)

- Boston Scientific Corporation (U.S.)

- MicroPort Scientific Corporation (China)

- Lepu Medical Technology (China)

- Kaneka Corporation (Japan)

- Wallaby Medical (U.S.)

- Perflow Medical Ltd. (Israel)

- Cerus Endovascular Ltd. (U.S.)

- ASAHI INTECC Co., Ltd. (Japan)

- Rapid Medical Ltd. (Israel)

- Evasc Neurovascular Enterprises ULC (Canada)

What are the Recent Developments in Global Neurovascular Coiling Assist Devices Market?

- In October 2025, Penumbra launched its SwiftSET™ neuroembolization coil, a complex embolization coil engineered to provide adaptive vessel wall apposition and smooth, controlled deployment for dense occlusion in small and tortuous neurovascular anatomies, expanding procedural versatility for aneurysms and AVMs

- In September 2025, Penumbra received CE Mark approval for its SwiftPAC™ neuroembolisation coils in Europe, making this soft “liquid‑metal” style embolization coil commercially available to clinicians across Europe for versatile embolization procedures

- In February 2025, Penumbra expanded its swiftPAC™ coil line with new size configurations, including 20 cm and 25 cm lengths, providing physicians greater flexibility for dense embolization in various neurovascular conditions and meeting growing clinical demand

- In February 2025, Penumbra announced the launch of its ACCESS25™ Delivery Microcatheter, a single‑lumen microcatheter designed to aid physicians in accessing the neurovasculature for delivery of Penumbra’s advanced .020‑inch coil platform, improving trackability and procedural stability for aneurysm embolization and offering enhanced packing efficiency and reduced procedure times

- In June 2024, MicroVention’s LVIS™ EVO™ intraluminal support device became commercially available in the U.S., representing the first fully visible coil‑assist intracranial stent for wide‑neck aneurysm treatment in the U.S. market and enhancing procedural precision

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.