Global Neurovascular Embolization Devices Market

Market Size in USD Billion

CAGR :

%

USD

2.38 Billion

USD

3.55 Billion

2025

2033

USD

2.38 Billion

USD

3.55 Billion

2025

2033

| 2026 –2033 | |

| USD 2.38 Billion | |

| USD 3.55 Billion | |

|

|

|

|

Neurovascular Embolization Devices Market Size

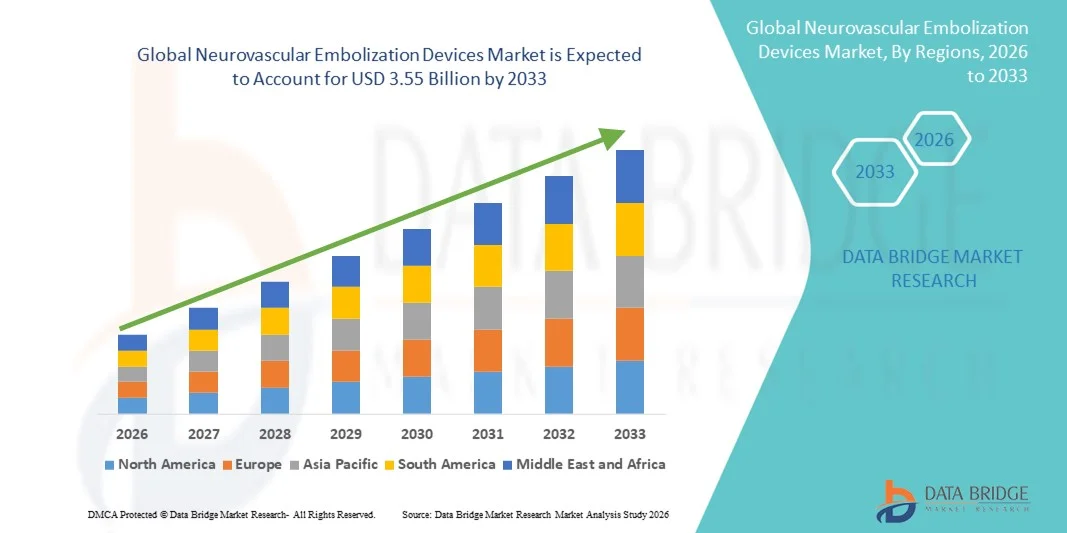

- The global neurovascular embolization devices market size was valued at USD 2.38 billion in 2025 and is expected to reach USD 3.55 billion by 2033, at a CAGR of 5.16% during the forecast period

- The market growth is largely fueled by the increasing prevalence of intracranial aneurysms, arteriovenous malformations (AVMs), and other neurovascular disorders, along with a strong global shift toward minimally invasive neuro‑interventional procedures, which are safer and more effective than traditional surgical approaches

- Furthermore, technological advancements in embolic coils, flow diversion devices, liquid embolic agents, and aneurysm clips, coupled with rising demand for effective and targeted treatment options in hospitals, specialty clinics, and outpatient settings, are positioning neurovascular embolization solutions as essential components of modern cerebrovascular therapy. These converging factors are accelerating adoption and significantly driving the industry’s growth

Neurovascular Embolization Devices Market Analysis

- Neurovascular embolization devices, including coils, flow diverters, liquid embolic agents, and stents, are increasingly vital components of modern cerebrovascular intervention due to their minimally invasive approach, precision in treating intracranial aneurysms and arteriovenous malformations (AVMs), and ability to reduce complications compared to traditional open surgeries

- The escalating demand for neurovascular embolization devices is primarily fueled by the rising prevalence of cerebrovascular disorders, increasing preference for minimally invasive procedures, and growing awareness of advanced interventional treatments among healthcare providers and patients

- North America dominated the neurovascular embolization devices market with the largest revenue share of 42.9% in 2025, driven by a strong healthcare infrastructure, early adoption of advanced medical technologies, high healthcare expenditure, and a robust presence of key industry players introducing innovative embolic devices and flow diversion technologies

- Asia-Pacific is expected to be the fastest growing region in the neurovascular embolization devices market during the forecast period due to increasing incidence of cerebrovascular diseases, expanding healthcare facilities, rising healthcare investments, and growing adoption of minimally invasive neuro-interventional procedures in countries such as China and India

- Embolic coils segment dominated the neurovascular embolization devices market with a market share of 45.6% in 2025, driven by their proven efficacy, widespread clinical acceptance, and compatibility with a range of aneurysm sizes and types, making them a preferred choice among interventional neuroradiologists

Report Scope and Neurovascular Embolization Devices Market Segmentation

|

Attributes |

Neurovascular Embolization Devices Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Neurovascular Embolization Devices Market Trends

Minimally Invasive Flow Diversion and Advanced Coil Technologies

- A significant and accelerating trend in the global neurovascular embolization devices market is the development and adoption of advanced flow diversion devices and next-generation embolic coils, which enable minimally invasive treatment of complex aneurysms and AVMs with higher efficacy and safety

- For instance, the Pipeline™ Flex Embolization Device allows neurointerventionalists to treat wide-neck intracranial aneurysms with improved vessel coverage and reduced retreatment rates. Similarly, the Axium™ detachable coil system enhances precision in coil deployment for small or tortuous aneurysms

- Flow diversion and coil innovations allow physicians to better tailor treatments to patient-specific anatomy, reduce procedural complications, and shorten recovery times. For instance, some new coils feature bioactive coatings to promote faster aneurysm occlusion while minimizing inflammatory response

- The integration of advanced imaging and navigation technologies with embolization devices facilitates real-time treatment monitoring, allowing for safer, more accurate deployment of devices in delicate neurovascular structures

- This trend toward more precise, minimally invasive, and device-integrated therapies is fundamentally improving clinical outcomes and shaping the expectations of both physicians and patients. Consequently, companies such as Medtronic and Stryker are introducing next-generation coils and flow diverters with enhanced deliverability and long-term safety profiles

- The demand for innovative, minimally invasive neurovascular embolization solutions is growing rapidly across hospitals and specialty neuro-interventional centers, as clinicians increasingly prioritize patient safety, procedural efficiency, and improved long-term outcomes

- Personalized device selection and sizing based on advanced 3D imaging and AI-driven simulations is becoming a key trend, improving treatment success rates and patient-specific outcomes

Neurovascular Embolization Devices Market Dynamics

Driver

Rising Incidence of Cerebrovascular Disorders and Preference for Minimally Invasive Procedures

- The increasing prevalence of intracranial aneurysms, AVMs, and other cerebrovascular disorders, combined with a global shift toward minimally invasive interventions, is a significant driver for the growing demand for neurovascular embolization devices

- For instance, in March 2025, Stryker announced the CE mark approval for its new flow diversion device aimed at treating complex aneurysms, highlighting the growing focus on advanced interventional solutions

- As clinicians seek safer alternatives to open surgical procedures, embolization devices offer precision, reduced procedural risk, and shorter hospital stays, making them an attractive treatment option for patients

- Furthermore, the expansion of specialized neuro-interventional centers and growing awareness of endovascular therapies among healthcare providers is increasing adoption rates of these devices in both developed and emerging markets

- The ability to treat complex cerebrovascular conditions with minimally invasive tools, combined with improved patient outcomes and faster recovery, is propelling the adoption of embolization devices across hospitals, specialty clinics, and outpatient centers

- Increasing investments in healthcare infrastructure, coupled with rising reimbursement coverage for minimally invasive neurovascular procedures, further support market growth in the forecast period

- Rising clinical evidence supporting long-term safety and efficacy of flow diverters and coils is encouraging more physicians to adopt these advanced therapies as standard care

- Collaborations between device manufacturers and hospitals for training programs are increasing adoption, as clinicians gain confidence in performing complex neurovascular procedures safely

Restraint/Challenge

High Device Costs and Regulatory Compliance Hurdles

- The relatively high cost of advanced neurovascular embolization devices compared to traditional surgical options poses a challenge for widespread adoption, especially in price-sensitive or emerging markets

- For instance, complex flow diverters and bioactive coils can cost several thousand dollars per procedure, limiting access in smaller hospitals or regions with lower healthcare expenditure

- Strict regulatory requirements for medical device approval in different regions, including FDA and CE mark certifications, can delay product launches and increase development costs, creating barriers to entry for smaller players

- While reimbursement policies are improving in some regions, inconsistent coverage and procedural coding complexities can limit adoption rates and affect overall market penetration

- Overcoming these challenges requires ongoing investment in cost-effective device designs, streamlined regulatory approval processes, and clinician training programs to optimize procedure efficiency and justify the value of advanced embolization solutions

- Manufacturers such as Medtronic and Penumbra emphasize regulatory compliance, clinical evidence generation, and cost management strategies to address these hurdles and foster wider acceptance of neurovascular embolization technologies

- Limited availability of trained neurointerventionalists in certain regions restricts market growth despite increasing demand for minimally invasive procedures

- Potential procedural complications and liability concerns associated with complex neurovascular interventions may make some hospitals cautious in adopting new devices quickly

Neurovascular Embolization Devices Market Scope

The market is segmented on the basis of product, process, therapeutic application, and end-use.

- By Product

On the basis of product, the market is segmented into embolic coils, bare detachable coils, coated detachable coils, flow diversion devices, liquid embolic agents, cerebral balloon angioplasty and stenting systems, carotid artery stents, embolic protection systems, distal filter devices, balloon occlusion devices, support devices, microcatheters, microguidewires, neurothrombectomy devices, clot retrieval devices, suction and aspiration devices, and snares. Embolic coils dominated the market with the largest revenue share of 45.6% in 2025, driven by their proven efficacy in treating intracranial aneurysms and AVMs with high occlusion rates. Hospitals and specialty neuro-interventional centers prefer embolic coils due to their versatility in treating a wide range of aneurysm sizes and morphologies. Coils provide minimally invasive options, reducing patient recovery time and procedural risks compared to open surgery. Their widespread clinical adoption and extensive historical data supporting long-term safety further strengthen market dominance. In addition, embolic coils are compatible with a variety of microcatheters and delivery systems, increasing their procedural flexibility. Continuous innovations such as bioactive coatings and detachable systems enhance performance, ensuring sustained demand.

The flow diversion devices segment is anticipated to witness the fastest CAGR of 11% from 2026 to 2033, fueled by their ability to treat complex and wide-neck aneurysms not suitable for standard coiling techniques. These devices redirect blood flow away from the aneurysm sac, promoting natural vessel healing, which improves patient outcomes. Rising clinical evidence demonstrating lower recurrence rates and higher procedural success is boosting adoption. Hospitals are increasingly investing in flow diversion technologies due to demand from neurosurgeons for minimally invasive alternatives. Regulatory approvals in multiple regions are further driving adoption, alongside targeted training programs for interventionalists. The segment’s growth is also supported by ongoing R&D and collaborations to develop smaller-profile, easier-to-deliver flow diverters.

- By Process

On the basis of process, the market is segmented into neurothrombectomy, cerebral angiography, carotid endarterectomy, stenting, microsurgical clipping, coiling, and flow diversion. Coiling dominated the market with the largest revenue share in 2025, as it remains the most established minimally invasive treatment for intracranial aneurysms. It is widely adopted due to its proven safety profile, high success rates, and lower complication rates compared to open surgical clipping. Hospitals prefer coiling procedures for both elective and emergency aneurysm cases. Technological enhancements in coil materials and delivery systems improve procedural precision and patient outcomes. Clinical familiarity among neurointerventionalists also contributes to sustained dominance. The availability of detachable and coated coils for specialized aneurysm treatment further drives the segment’s revenue.

Neurothrombectomy is expected to witness the fastest CAGR from 2026 to 2033, driven by the increasing incidence of ischemic strokes worldwide. Mechanical clot retrieval using advanced suction and aspiration devices improves reperfusion rates and reduces long-term disability. Hospitals and stroke centers are increasingly adopting neurothrombectomy as standard care for eligible patients due to improved clinical outcomes. Continuous innovation in device design, such as retrievable stent-based thrombectomy systems, enhances procedural efficiency. Rising awareness among healthcare providers and rapid emergency stroke interventions are further driving growth. Reimbursement coverage for thrombectomy procedures in developed markets also supports adoption.

- By Therapeutic Application

On the basis of therapeutic application, the market is segmented into brain aneurysm, stenosis, and ischemic strokes. The brain aneurysm segment dominated the market with a revenue share of 50% in 2025, due to the high prevalence of intracranial aneurysms and the growing preference for minimally invasive endovascular treatments. Hospitals prefer treating aneurysms with coils and flow diverters, which offer precise, targeted therapy and reduced recovery time. Clinical guidelines increasingly recommend endovascular procedures over open surgery, supporting demand. Advanced imaging systems and neuro-navigation tools enhance procedural accuracy. Established clinical outcomes and high adoption by neurointerventionalists reinforce the dominance of this segment. Rising patient awareness and early diagnosis further strengthen market growth.

The ischemic stroke segment is expected to witness the fastest CAGR from 2026 to 2033, fueled by the rising global prevalence of stroke and increasing demand for neurothrombectomy procedures. Hospitals and stroke centers are investing in suction and clot retrieval devices to achieve rapid reperfusion and reduce post-stroke disability. Technological innovations in thrombectomy and aspiration devices improve procedural success and expand the eligible patient population. Growing government initiatives for stroke awareness and early intervention are boosting adoption. Favorable reimbursement policies in developed markets accelerate growth. Increasing awareness among neurologists and patients about endovascular interventions is driving rapid uptake.

- By End-use

On the basis of end-use, the market is segmented into hospitals, ambulatory surgical centers, and clinics. Hospitals dominated the neurovascular embolization devices market with the largest revenue share in 2025, due to their advanced infrastructure, availability of trained neurointerventionalists, and capability to perform complex procedures. Hospitals invest heavily in state-of-the-art devices such as flow diverters, coils, and thrombectomy systems. They also manage both emergency and elective procedures, increasing overall device utilization. High patient volumes and specialized stroke and neurosurgery units further strengthen dominance. Hospitals often adopt multiple device types, including microcatheters and microguidewires, for procedural flexibility. Strong collaborations with manufacturers for clinical trials and training also contribute to revenue leadership.

Ambulatory surgical centers (ASCs) are expected to witness the fastest CAGR from 2026 to 2033, driven by the increasing preference for outpatient minimally invasive procedures. ASCs offer lower procedural costs and faster recovery times, appealing to patients and payers. Expansion of ASCs in emerging markets is increasing access to neuro-interventional therapies. Rising availability of compact and portable neurovascular devices suitable for outpatient use supports growth. Physician-owned ASCs are increasingly adopting advanced coils and thrombectomy devices to improve procedural efficiency. Favorable insurance coverage and rising awareness of outpatient care options are accelerating market adoption.

Neurovascular Embolization Devices Market Regional Analysis

- North America dominated the neurovascular embolization devices market with the largest revenue share of 42.9% in 2025, driven by a strong healthcare infrastructure, early adoption of advanced medical technologies, high healthcare expenditure, and a robust presence of key industry players introducing innovative embolic devices and flow diversion technologies

- Healthcare providers in the region prioritize advanced treatment options for intracranial aneurysms, AVMs, and ischemic strokes, leveraging embolic coils, flow diversion devices, and thrombectomy systems to improve clinical outcomes and reduce procedural risks

- This widespread adoption is further supported by high healthcare expenditure, early regulatory approvals, a technologically skilled workforce, and strong presence of key market players such as Medtronic, Stryker, and Penumbra, establishing North America as the leading market for neurovascular interventions

U.S. Neurovascular Embolization Devices Market Insight

The U.S. neurovascular embolization devices market captured the largest revenue share of 40% in 2025 within North America, fueled by the widespread adoption of minimally invasive neuro-interventional procedures and the presence of advanced healthcare infrastructure. Hospitals and specialty neuro-interventional centers increasingly prioritize endovascular treatments for intracranial aneurysms, AVMs, and ischemic strokes. Rising awareness of cerebrovascular disorders, combined with a growing number of trained neurointerventionalists, is supporting higher procedure volumes. Furthermore, ongoing technological innovations in flow diversion devices, embolic coils, and thrombectomy systems enhance clinical outcomes and procedural efficiency. Strong collaborations between leading device manufacturers and healthcare institutions also reinforce market growth. Government initiatives supporting stroke care and reimbursement coverage further drive adoption.

Europe Neurovascular Embolization Devices Market Insight

The Europe neurovascular embolization devices market is projected to expand at a significant CAGR during the forecast period, primarily driven by the increasing prevalence of cerebrovascular disorders and rising preference for minimally invasive treatments. Countries such as Germany, France, and Italy are witnessing growing adoption of embolization devices in hospitals and specialized centers. The emphasis on advanced healthcare technologies, coupled with stringent clinical and safety regulations, ensures the use of high-quality devices. Moreover, increasing awareness campaigns and training programs for neuro-interventional procedures are fostering adoption. Europe is seeing growth across both elective and emergency procedures, with hospitals investing in comprehensive neurovascular suites. Reimbursement support and government initiatives promoting early stroke intervention also contribute to market expansion.

U.K. Neurovascular Embolization Devices Market Insight

The U.K. neurovascular embolization devices market is expected to grow at a noteworthy CAGR during the forecast period, driven by the rising incidence of cerebrovascular diseases and increasing demand for minimally invasive interventions. Hospitals and stroke centers in the U.K. are adopting embolic coils, flow diversion devices, and thrombectomy systems to improve clinical outcomes and reduce procedural risks. The country’s robust healthcare infrastructure and high adoption of advanced medical technologies further stimulate market growth. In addition, awareness among healthcare professionals regarding the benefits of endovascular procedures over open surgery supports adoption. Ongoing clinical studies and local collaborations with device manufacturers continue to drive the market. A focus on patient safety and procedural efficiency enhances the adoption of advanced neurovascular devices in both public and private healthcare settings.

Germany Neurovascular Embolization Devices Market Insight

The Germany neurovascular embolization devices market is expected to expand at a considerable CAGR during the forecast period, fueled by increasing awareness of cerebrovascular disorders and preference for minimally invasive solutions. Hospitals are investing in state-of-the-art embolic coils, flow diversion devices, and thrombectomy systems to treat aneurysms, AVMs, and ischemic strokes. The country’s well-developed healthcare infrastructure, coupled with strong research and development activities, promotes adoption. Integration of advanced imaging and navigation technologies further supports precision interventions. Growing government initiatives on stroke prevention and early diagnosis are driving demand. Germany’s focus on innovation and patient-centric healthcare ensures widespread adoption in both residential hospital setups and specialty neuro-interventional centers.

Asia-Pacific Neurovascular Embolization Devices Market Insight

The Asia-Pacific neurovascular embolization devices market is poised to grow at the fastest CAGR of 12% during 2026–2033, driven by rising prevalence of stroke, aneurysms, and AVMs, coupled with increasing investments in healthcare infrastructure. Countries such as China, India, and Japan are rapidly adopting minimally invasive neuro-interventional procedures. Rising awareness among physicians and patients, government initiatives promoting stroke care, and expanding specialized hospitals and stroke centers are key factors driving adoption. In addition, increasing accessibility to advanced embolization devices and training for neurointerventionalists is contributing to market growth. Growing healthcare spending and improvements in diagnostic capabilities are further supporting the expansion of the market across the region.

Japan Neurovascular Embolization Devices Market Insight

The Japan neurovascular embolization devices market is gaining momentum due to the country’s advanced healthcare system, aging population, and high adoption of minimally invasive interventions. Hospitals and stroke centers are increasingly performing endovascular procedures using flow diversion devices, embolic coils, and thrombectomy systems. Technologically advanced hospitals leverage integrated imaging and navigation tools to improve procedural success and patient outcomes. Rising awareness of cerebrovascular disease management among healthcare professionals further supports growth. Japan’s emphasis on innovation and patient-centric solutions drives adoption in both public and private healthcare facilities. In addition, the growing need for safe, effective, and precise neurovascular therapies in an aging population is bolstering market expansion.

India Neurovascular Embolization Devices Market Insight

The India neurovascular embolization devices market accounted for a significant share in Asia-Pacific in 2025, driven by increasing incidence of stroke and aneurysms, expanding healthcare infrastructure, and rising awareness of minimally invasive neuro-interventional procedures. Hospitals and specialty neuro-interventional centers are investing in embolic coils, flow diversion devices, and thrombectomy systems to improve treatment outcomes. The push towards smart hospitals, government initiatives for stroke management, and expanding training programs for neurointerventionalists are supporting adoption. Availability of cost-effective devices and growing number of urban healthcare facilities further drive market growth. In addition, rising healthcare expenditure and increased patient awareness about advanced treatment options are fueling the expansion of neurovascular embolization devices across residential and commercial hospital setups.

Neurovascular Embolization Devices Market Share

The Neurovascular Embolization Devices industry is primarily led by well-established companies, including:

- Medtronic (Ireland)

- Stryker (U.S.)

- Penumbra, Inc. (U.S.)

- Terumo Corporation (Japan)

- MicroVention, Inc. (U.S.)

- Balt USA LLC (France)

- Acandis GmbH & Co. KG (Germany)

- Phenox GmbH (Germany)

- B. Braun SE (Germany)

- Boston Scientific Corporation (U.S.)

- Cook (U.S.)

- Abbott (U.S.)

- Kaneka Corporation (Japan)

- Rapid Medical Ltd (Israel)

- InspireMD Inc. (U.S.)

- Vesalio LLC (U.S.)

- EmbolX Inc. (U.S.)

- Asahi Intecc Co., Ltd. (Japan)

- InNeuroCo Inc. (U.S.)

What are the Recent Developments in Global Neurovascular Embolization Devices Market?

- In October 2025, Penumbra announced the commercial launch of the SwiftSet neuro embolization coil, a next‑generation embolization coil engineered for adaptive vessel wall apposition and controlled deployment, enhancing occlusion performance in complex neurovascular anatomies

- In September 2025, Penumbra’s SwiftPAC Neuroembolization Coil received CE Mark approval in Europe, enabling commercial availability of this advanced coil designed for dense, versatile embolization in various neurovascular conditions, offering soft “liquid metal” conformability and precise deployment across vessel anatomies

- In December 2024, Fluid Biomed Inc. closed a USD 27 million Series A financing round to advance clinical investigations of its bioabsorbable polymer‑based ReSolv™ stent technology, securing funding to expand patient studies and progress toward broader clinical validation and eventual commercialization

- In June 2023, Fluid Biomed Inc. initiated the first‑in‑human clinical trial (REDIRECT) of its ReSolv™ hybrid polymer‑metal flow‑diverting stent, marking the world’s first implantation of a novel polymer‑based flow diverting stent aimed at transforming brain aneurysm treatment

- In April 2021, Medtronic received U.S. FDA approval for the Pipeline™ Flex Embolization Device with Shield Technology™, a surface‑modified flow diverter designed to reduce thrombogenicity and improve delivery performance, representing a significant advancement in flow diversion therapy for complex cerebral aneurysm

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.