Global Non Agriculture Smart Irrigation Controllers Market

Market Size in USD Million

CAGR :

%

USD

378.68 Million

USD

957.89 Million

2025

2033

USD

378.68 Million

USD

957.89 Million

2025

2033

| 2026 –2033 | |

| USD 378.68 Million | |

| USD 957.89 Million | |

|

|

|

|

Non-Agriculture Smart Irrigation Controllers Market Size

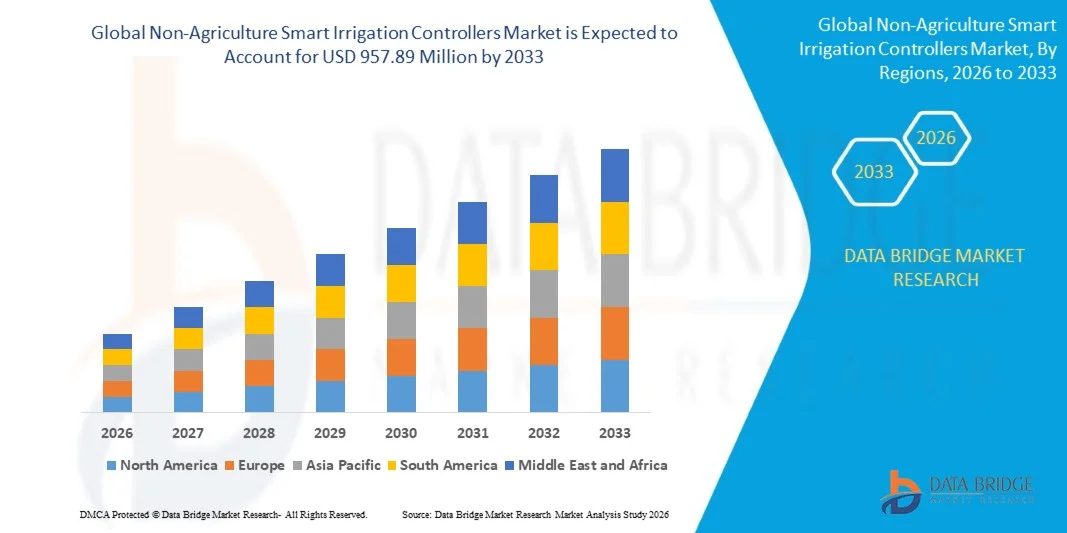

- The global non-agriculture smart irrigation controllers market size was valued at USD 378.68 million in 2025 and is expected to reach USD 957.89 million by 2033, at a CAGR of 12.3% during the forecast period

- The market growth is largely driven by the increasing adoption of smart irrigation solutions in commercial, municipal, and residential landscapes, coupled with advancements in IoT-enabled and cloud-connected irrigation technologies that enable precise water management and automation

- Furthermore, rising awareness of water conservation, regulatory support for efficient water usage, and the need to reduce operational costs in non-agricultural settings are positioning smart irrigation controllers as essential solutions for sustainable landscaping and facility management. For instance, companies such as Rachio Inc. and Rain Bird Corporation are expanding their connected irrigation offerings, which is accelerating market adoption

Non-Agriculture Smart Irrigation Controllers Market Analysis

- Non-agriculture smart irrigation controllers, providing automated and remote-controlled water management for parks, golf courses, commercial complexes, and residential landscapes, are becoming integral to efficient water usage strategies due to their ability to optimize watering schedules, reduce waste, and integrate with weather data and smart building systems

- The growing demand for these controllers is primarily fueled by technological advancements in sensors, connectivity, and cloud-based management platforms, increasing environmental awareness, and the push for operational efficiency. Companies such as Hunter Industries and Orbit Irrigation Products LLC are innovating in these areas to enhance controller performance and user experience

- North America dominated the non-agriculture smart irrigation controllers market with a share of around 40% in 2025, due to the rising adoption of smart landscaping solutions, growing awareness of water conservation, and advanced technological infrastructure

- Asia-Pacific is expected to be the fastest growing region in the non-agriculture smart irrigation controllers market during the forecast period due to rapid urbanization, rising disposable incomes, and government initiatives promoting sustainable water management in countries such as China, Japan, and India

- Weather-based controllers segment dominated the market with a market share of 52.8% in 2025, due to their ability to automatically adjust watering schedules based on real-time weather conditions and forecasts. These controllers are widely used in residential and commercial landscapes where seasonal variations significantly impact water usage, helping reduce water waste while maintaining optimal plant health. Leading brands such as Rain Bird and Hunter Industries have strengthened the adoption of weather-based controllers through user-friendly mobile apps and cloud-based monitoring

Report Scope and Non-Agriculture Smart Irrigation Controllers Market Segmentation

|

Attributes |

Non-Agriculture Smart Irrigation Controllers Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Non-Agriculture Smart Irrigation Controllers Market Trends

“Rising Adoption of IoT-Enabled Smart Irrigation Solutions”

- A significant trend in the non-agriculture smart irrigation controllers market is the increasing integration of IoT-enabled controllers into commercial, municipal, and residential landscapes, driven by the growing need for efficient water management, operational cost reduction, and automated scheduling. This trend is elevating smart irrigation controllers as essential components for sustainable facility management and landscape maintenance

- For instance, companies such as Rachio Inc. and Rain Bird Corporation are offering advanced connected irrigation systems that provide real-time monitoring, remote control, and predictive scheduling, strengthening system reliability and enabling precise water usage

- The adoption of weather-based and sensor-driven irrigation controllers is growing rapidly as smart solutions enable soil moisture monitoring, leak detection, and water optimization. This is positioning these controllers as critical elements for large-scale commercial projects and public spaces that aim to conserve water

- Municipalities and commercial facilities are integrating smart irrigation controllers with existing building management systems to enhance resource efficiency and reduce utility expenses. This trend is accelerating the implementation of smart water management strategies across urban infrastructure

- The market is witnessing strong growth in cloud-connected platforms that allow data-driven irrigation management where analytics and automation contribute to improved efficiency. This rising incorporation of IoT technologies is reinforcing the overall shift toward smarter, more sustainable, and digitally managed irrigation systems

- Industries focusing on landscaping, hospitality, and sports facilities are expanding their use of automated irrigation solutions to ensure consistent turf and landscape health. This is shaping a stronger preference for controllers capable of operating reliably under varying environmental conditions and usage patterns

Non-Agriculture Smart Irrigation Controllers Market Dynamics

Driver

“Increasing Demand for Water Efficiency and Operational Cost Reduction”

- The growing focus on water conservation, rising operational costs, and the need for sustainable landscaping practices are driving the adoption of smart irrigation controllers that enable precise water application and scheduling

- For instance, companies such as Hunter Industries and Orbit Irrigation Products LLC provide solutions that integrate soil moisture sensors, weather data, and remote monitoring, allowing facility managers to reduce water wastage and lower maintenance costs

- The adoption of automated irrigation systems is fueled by regulatory initiatives and sustainability goals that encourage efficient water use in commercial, municipal, and residential spaces. Smart controllers provide actionable insights that help organizations meet these requirements effectively

- Large-scale commercial landscapes, golf courses, and municipal parks are increasingly adopting smart irrigation to optimize water usage without compromising landscape quality. This adoption is reinforcing the critical role of controllers in resource management and cost control

- The growing demand for connected and remote-controllable irrigation systems is boosting market growth, as these solutions allow proactive management, early leak detection, and predictive maintenance. The requirement for operational efficiency continues to strengthen this driver

Restraint/Challenge

“High Initial Investment and Integration Complexity”

- The non-agriculture smart irrigation controllers market faces challenges due to the high upfront costs of advanced controllers, sensors, and cloud connectivity solutions, which can deter small-scale facility managers or budget-conscious organizations

- For instance, municipalities and commercial property owners adopting systems from companies such as Netafim and CALSENSE often encounter integration challenges with existing infrastructure, including legacy irrigation networks and building management systems

- Implementing smart irrigation solutions requires skilled personnel for setup, calibration, and ongoing monitoring, increasing operational complexity and training requirements for users

- The reliance on multiple sensors, connectivity platforms, and software integration increases system complexity, which may lead to higher maintenance costs and operational downtime if not managed properly

- The market continues to face constraints in balancing technological sophistication with economic feasibility, as stakeholders must justify the return on investment while maintaining efficiency and reliability. These challenges collectively place pressure on manufacturers and end-users to optimize solutions for cost-effective deployment

Non-Agriculture Smart Irrigation Controllers Market Scope

The market is segmented on the basis of product type, type, and application.

• By Product Type

On the basis of product type, the non-agriculture smart irrigation controllers market is segmented into plug-in controllers, standalone controllers, and smart home controllers. The standalone controllers segment dominated the market with the largest market revenue share in 2025, driven by their ability to operate independently without requiring additional hardware or constant internet connectivity. These controllers are often prioritized for commercial and residential landscapes due to their reliability and ease of installation, allowing users to automate irrigation schedules efficiently. The segment also benefits from compatibility with multiple irrigation zones and advanced features such as seasonal adjustments, flow monitoring, and mobile app integration, enhancing water efficiency and convenience.

The smart home controllers segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by increasing adoption in tech-enabled residences and smart building projects. These controllers integrate seamlessly with smart home ecosystems, offering centralized management via smartphones, tablets, and voice assistants. Their advanced features, including weather forecasts, AI-based irrigation recommendations, and real-time alerts, make them highly appealing to homeowners seeking convenience and sustainability. The growing trend of connected home devices and energy-efficient solutions further accelerates their adoption across urban and suburban areas.

• By Type

On the basis of type, the market is segmented into weather-based controllers and sensor-based controllers. The weather-based controllers segment held the largest market revenue share of 52.8% in 2025, driven by their ability to automatically adjust watering schedules based on real-time weather conditions and forecasts. These controllers are widely used in residential and commercial landscapes where seasonal variations significantly impact water usage, helping reduce water waste while maintaining optimal plant health. Leading brands such as Rain Bird and Hunter Industries have strengthened the adoption of weather-based controllers through user-friendly mobile apps and cloud-based monitoring.

The sensor-based controllers segment is expected to witness the fastest CAGR from 2026 to 2033, driven by increasing awareness of water conservation and precision irrigation. Sensor-based systems utilize soil moisture, flow, and environmental sensors to provide highly localized and adaptive irrigation schedules. Their growing popularity in commercial properties, golf courses, and smart residential gardens is attributed to their ability to optimize water usage efficiently and prevent overwatering, ensuring both cost savings and sustainable landscaping practices.

• By Application

On the basis of application, the market is segmented into residential, commercial, and golf courses. The commercial segment dominated the market in 2025 with the largest market revenue share, driven by the extensive deployment of smart irrigation solutions in office complexes, retail landscapes, and public green spaces. Commercial properties often prioritize these controllers for efficient water management, regulatory compliance, and aesthetic maintenance of large landscaped areas, supported by scalable systems from companies such as Toro and Netafim.

The residential segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by the rising adoption of smart home technologies and sustainable living practices. Homeowners increasingly seek solutions that allow remote control, real-time monitoring, and automated watering schedules tailored to personal preferences and local weather patterns. Integration with home automation platforms and growing consumer awareness of water conservation are major factors contributing to the accelerated adoption of residential smart irrigation controllers, making this segment a key driver of market expansion.

Non-Agriculture Smart Irrigation Controllers Market Regional Analysis

- North America dominated the non-agriculture smart irrigation controllers market with the largest revenue share of around 40% in 2025, driven by the rising adoption of smart landscaping solutions, growing awareness of water conservation, and advanced technological infrastructure

- Consumers and commercial property owners in the region highly value the precision, automation, and remote management offered by smart irrigation controllers, which optimize water usage and reduce operational costs

- This widespread adoption is further supported by high disposable incomes, technologically inclined populations, and favorable regulations promoting sustainable landscaping, establishing smart irrigation controllers as a preferred solution across residential, commercial, and institutional applications

U.S. Non-Agriculture Smart Irrigation Controllers Market Insight

The U.S. market captured the largest revenue share in 2025 within North America, fueled by the swift adoption of IoT-enabled devices and smart landscaping trends. Homeowners, commercial establishments, and municipal properties increasingly prioritize efficiency, water conservation, and automated irrigation scheduling. The growing popularity of DIY smart home and landscape solutions, combined with the integration of mobile applications for remote monitoring, further accelerates market growth. In addition, partnerships with technology providers and manufacturers, including Hunter Industries and Rain Bird, are strengthening the availability and adoption of advanced smart irrigation controllers.

Europe Non-Agriculture Smart Irrigation Controllers Market Insight

The Europe market is projected to expand at a substantial CAGR during the forecast period, driven by stringent environmental regulations, water conservation initiatives, and the increasing need for smart landscaping solutions. Urbanization and the growth of commercial and residential properties are fostering adoption of connected irrigation controllers. European consumers and businesses are attracted to the convenience, water efficiency, and integration with smart home ecosystems that these controllers provide. Key markets across the region are implementing smart irrigation in both new construction and retrofitting projects to reduce water waste and operational costs.

U.K. Non-Agriculture Smart Irrigation Controllers Market Insight

The U.K. market is anticipated to grow at a noteworthy CAGR during the forecast period, propelled by the growing trend of smart home integration and sustainability-driven landscaping practices. Residential and commercial property owners increasingly prefer automated irrigation systems for efficiency, convenience, and optimized water usage. The U.K.’s mature technological infrastructure, combined with widespread e-commerce availability of smart irrigation solutions, is expected to continue stimulating market growth. Government incentives and campaigns promoting water conservation are further encouraging adoption.

Germany Non-Agriculture Smart Irrigation Controllers Market Insight

The Germany market is expected to expand at a considerable CAGR during the forecast period, fueled by increasing awareness of sustainable water management and advanced technological solutions. Germany’s focus on innovation, energy efficiency, and environmental regulations supports the adoption of smart irrigation controllers across commercial, residential, and public landscaping projects. Integration with building automation systems is becoming increasingly prevalent, and property owners prioritize solutions that offer precision, reliability, and data-driven insights for optimized water usage.

Asia-Pacific Non-Agriculture Smart Irrigation Controllers Market Insight

The Asia-Pacific market is poised to grow at the fastest CAGR during the forecast period of 2026 to 2033, driven by rapid urbanization, rising disposable incomes, and government initiatives promoting sustainable water management in countries such as China, Japan, and India. The region’s growing inclination toward smart homes and commercial landscapes is driving the adoption of smart irrigation controllers. Furthermore, APAC is emerging as a manufacturing hub for smart irrigation technologies, improving affordability and accessibility for a broader consumer base.

Japan Non-Agriculture Smart Irrigation Controllers Market Insight

The Japan market is witnessing strong growth due to the country’s high-tech culture, rapid urbanization, and the increasing demand for water-efficient landscaping solutions. Japanese consumers and commercial property owners place significant emphasis on sustainability and convenience, driving adoption of sensor- and weather-based smart irrigation controllers. Integration with other smart home and building management systems, as well as support for elderly-friendly interfaces, is further fueling growth across residential and commercial applications.

China Non-Agriculture Smart Irrigation Controllers Market Insight

The China market accounted for the largest market revenue share in Asia-Pacific in 2025, driven by rapid urbanization, expanding commercial infrastructure, and growing environmental awareness. Smart irrigation controllers are increasingly adopted in residential complexes, commercial properties, and public landscaping projects. Government-led smart city initiatives, availability of cost-effective solutions, and strong domestic manufacturers such as Rain Bird China and Hunter Industries China are key factors contributing to the market’s growth in the region.

Non-Agriculture Smart Irrigation Controllers Market Share

The non-agriculture smart irrigation controllers industry is primarily led by well-established companies, including:

- HUNTER INDUSTRIES (U.S.)

- Skydrop, LLC (U.S.)

- The Scotts Company LLC (U.S.)

- The Toro Company (U.S.)

- Weathermatic (U.S.)

- Rain Bird Corporation (U.S.)

- CALSENSE (U.S.)

- Rachio Inc. (U.S.)

- Galcon (Israel)

- HydroPoint Data Systems, Inc. (U.S.)

- Orbit Irrigation Products LLC (U.S.)

- Nelson Irrigation (U.S.)

- NETAFIM (Israel)

- Valmont Industries, Inc. (U.S.)

- Lindsay Corporation (U.S.)

- Mottech Water Solutions Ltd. (Israel)

- Jain Irrigation, Inc. (India)

- Holman Industries (Australia)

- Jain Irrigation Systems Ltd (India)

- Banyan Water, Inc. (U.S.)

- FlyBird Farm Innovations Pvt. Ltd (India)

Latest Developments in Global Non-Agriculture Smart Irrigation Controllers Market

- In November 2024, ImoLaza launched the ImoLaza ULTRA Smart Sprinkler Controller, featuring real-time clock chips, smart fault detection, and surge protection. This launch enhances system reliability and performance, allowing landscape managers and residential users to achieve precise irrigation control. The introduction of these advanced features strengthens ImoLaza’s competitive position in the non-agriculture smart irrigation controllers market by addressing the growing demand for durable, intelligent, and automated water management solutions

- In July 2024, Baseline introduced a Cloud Network Module, a new networking device for its line of water management controllers. The module enables seamless two-way communication with cloud-based platforms, allowing users to monitor, schedule, and optimize irrigation remotely. This development accelerates the adoption of connected irrigation systems by providing scalability, data-driven insights, and integration with broader smart building or smart home ecosystems, reinforcing Baseline’s presence in the rapidly growing smart irrigation market

- In November 2023, Hunter Industries launched the Hydrawise App, an advanced irrigation management software designed to enhance control, monitoring, and efficiency for landscape operations. The app allows both commercial and residential users to optimize water usage, detect system anomalies, and implement automated schedules. This innovation strengthens Hunter Industries’ position in the market by meeting increasing consumer demand for mobile-enabled, intelligent irrigation solutions that reduce operational costs and improve sustainability

- In June 2023, Netro unveiled the Pixie Smart Sprinkler Controller, a solar-powered device equipped with AI-driven scheduling and soil moisture monitoring. This controller optimizes water usage while reducing energy dependency, making it particularly attractive for environmentally conscious users and regions facing water scarcity. The launch positions Netro as a key player in the smart irrigation market, tapping into the growing demand for sustainable, AI-integrated irrigation technologies

- In July 2020, Tri Cascade, Inc. announced a strategic partnership with Skydrop LLC, a pioneer in smart sprinkler controllers and technology. Leveraging Tri Cascade’s NB-IoT technology, the collaboration enhanced Skydrop’s existing smart irrigation system and enabled its integration into Tri Cascade’s broader product suite. This partnership expanded market reach, strengthened technological capabilities, and reinforced the adoption of connected, IoT-enabled irrigation solutions across commercial and residential applications

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Non Agriculture Smart Irrigation Controllers Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Non Agriculture Smart Irrigation Controllers Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Non Agriculture Smart Irrigation Controllers Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.