Global Off Highway Equipment Lubricants Market

Market Size in USD Million

CAGR :

%

USD

675.60 Million

USD

1,269.13 Million

2025

2033

USD

675.60 Million

USD

1,269.13 Million

2025

2033

| 2026 –2033 | |

| USD 675.60 Million | |

| USD 1,269.13 Million | |

|

|

|

|

Off-Highway Equipment Lubricants Market Size

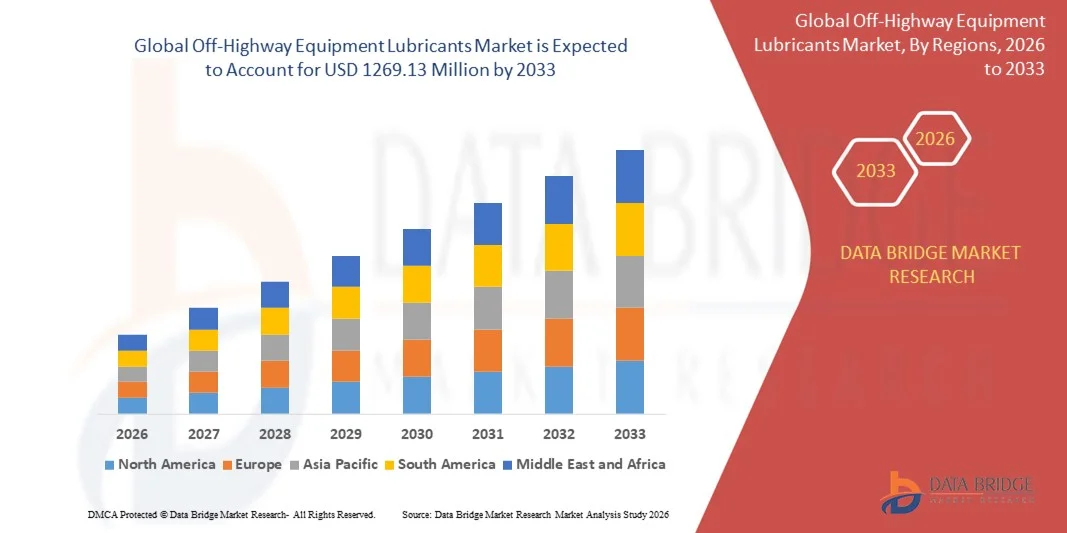

- The global off-highway equipment lubricants market size was valued at USD 675.60 million in 2025 and is expected to reach USD 1269.13 million by 2033, at a CAGR of 8.20% during the forecast period

- The market growth is largely fueled by the increasing adoption of advanced off-highway machinery across construction, mining, agriculture, and industrial sectors, leading to higher demand for high-performance lubricants that ensure equipment reliability, durability, and operational efficiency

- Furthermore, rising emphasis on reducing maintenance costs, extending machinery lifespan, and improving fuel efficiency is driving the demand for specialized lubricants tailored to heavy-duty engines, hydraulic systems, and transmissions. These factors are accelerating the adoption of premium lubricant solutions, thereby significantly boosting market growth

Off-Highway Equipment Lubricants Market Analysis

- Off-highway equipment lubricants, including heavy-duty engine oils, hydraulic fluids, transmission fluids, greases, and gear oils, are essential for maintaining the performance, longevity, and efficiency of construction, mining, and agricultural machinery under extreme operating conditions

- The escalating demand for these lubricants is primarily fueled by rapid industrialization, mechanization of agriculture, expanding infrastructure projects, and increasing awareness of preventive maintenance practices among equipment operators and OEMs

- Asia-Pacific dominated the off-highway equipment lubricants market with a share of around 35% in 2025, due to rapid industrialization, expanding construction and mining activities, and increasing mechanization in agriculture

- North America is expected to be the fastest growing region in the off-highway equipment lubricants market during the forecast period due to rising investments in construction, mining, and industrial automation

- Heavy-duty engine oils segment dominated the market with a market share of 43.2% in 2025, due to the critical role these oils play in ensuring engine efficiency, reducing wear and tear, and extending the operational lifespan of off-highway machinery. Heavy-duty engine oils are increasingly preferred by fleet operators and equipment manufacturers for their high thermal stability, oxidation resistance, and compatibility with advanced emission norms. Strong aftermarket demand and OEM recommendations further reinforce their market dominance. Their adoption is also fueled by the growing mechanization of construction, mining, and agricultural sectors, where equipment reliability is a top priority

Report Scope and Off-Highway Equipment Lubricants Market Segmentation

|

Attributes |

Off-Highway Equipment Lubricants Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Off-Highway Equipment Lubricants Market Trends

Rising Adoption of High-Performance and Synthetic Lubricants

- A significant trend in the off-highway equipment lubricants market is the increasing adoption of high-performance and synthetic lubricants, driven by the need for enhanced engine protection, longer equipment life, and improved operational efficiency across construction, mining, and agricultural machinery. This adoption is positioning lubricants as critical enablers for maximizing uptime and reducing maintenance costs in harsh operational environments

- For instance, Shell and ExxonMobil supply advanced synthetic and semi-synthetic lubricants for heavy-duty machinery, which improve wear resistance, thermal stability, and fuel efficiency. Such products are gaining preference among fleet operators seeking to enhance equipment longevity and minimize unscheduled downtime

- The trend toward environmentally sustainable lubricants is accelerating as companies focus on biodegradable and low-emission formulations that comply with stringent environmental regulations. These products reduce ecological impact and align with global sustainability initiatives in the industrial and agricultural sectors

- Manufacturers are increasingly developing multifunctional lubricants that perform under extreme pressures, high temperatures, and variable load conditions. This trend is driving the evolution of specialized formulations that cater to different equipment types and operational requirements

- The rising emphasis on predictive maintenance in off-highway operations is encouraging the use of high-performance lubricants with advanced additive technologies that monitor wear and prevent failures. This is enabling more efficient maintenance schedules and reducing operational interruptions

- The market is witnessing growth in demand for premium lubricants from equipment manufacturers and fleet operators seeking reliable, long-lasting performance. This trend is reinforcing the critical role of advanced lubricants in supporting heavy machinery productivity and overall operational efficiency

Off-Highway Equipment Lubricants Market Dynamics

Driver

Growing Mechanization in Construction, Mining, and Agriculture

- The increasing mechanization in construction, mining, and agriculture is driving the demand for off-highway equipment lubricants, as more sophisticated machinery requires advanced lubrication solutions to maintain optimal performance and prevent downtime. Mechanization is accelerating productivity, making reliable lubricants a critical component of operational efficiency

- For instance, Caterpillar and Komatsu have highlighted the importance of high-quality lubricants in maintaining their heavy equipment fleets under continuous operation. This has led to closer partnerships with lubricant suppliers to ensure performance consistency and longer maintenance intervals

- The adoption of advanced machinery with higher power outputs and complex hydraulic systems is increasing the need for specialized lubricants that can withstand extreme pressures and thermal stresses. These lubricants support machinery reliability and extend service life

- Expanding infrastructure projects worldwide are driving higher utilization of construction and mining equipment, further boosting lubricant consumption. This is particularly evident in emerging markets where modernization of agricultural practices is also contributing to growing lubricant demand

- The focus on maximizing machinery performance while reducing operational costs is strengthening this driver. The demand for technologically advanced lubricants is expected to rise as industries continue mechanizing their operations

Restraint/Challenge

Volatility in Base Oil Prices and Raw Material Supply

- The off-highway equipment lubricants market faces challenges due to fluctuations in base oil prices and uncertainties in raw material availability, which can impact production costs and supply stability. Price volatility affects manufacturers’ ability to maintain competitive pricing and consistent supply to end users

- For instance, BP and Chevron have reported that fluctuations in crude oil and base oil prices directly affect lubricant production costs, influencing market pricing and procurement strategies. This volatility requires companies to adopt flexible sourcing and risk mitigation strategies

- Global supply chain disruptions can lead to inconsistent availability of high-quality base oils and additive components, limiting manufacturers’ capacity to meet demand. These disruptions can delay product deliveries and affect customer confidence

- The reliance on specialty additives and synthetic formulations increases exposure to raw material price swings and sourcing risks. These dependencies make cost management more complex for lubricant producers and can hinder scalability

- The market continues to encounter challenges related to balancing cost pressures with the demand for high-performance and environmentally friendly lubricants. These constraints collectively affect profit margins, production planning, and market growth trajectory

Off-Highway Equipment Lubricants Market Scope

The market is segmented on the basis of product and end use.

- By Product

On the basis of product, the off-highway equipment lubricants market is segmented into heavy-duty engine oils, transmission fluids, hydraulic fluids, greases, gear oils, and others. The heavy-duty engine oils segment dominated the market with the largest market revenue share of 43.2% in 2025, driven by the critical role these oils play in ensuring engine efficiency, reducing wear and tear, and extending the operational lifespan of off-highway machinery. Heavy-duty engine oils are increasingly preferred by fleet operators and equipment manufacturers for their high thermal stability, oxidation resistance, and compatibility with advanced emission norms. Strong aftermarket demand and OEM recommendations further reinforce their market dominance. Their adoption is also fueled by the growing mechanization of construction, mining, and agricultural sectors, where equipment reliability is a top priority.

The hydraulic fluids segment is anticipated to witness the fastest growth rate from 2026 to 2033, driven by rising demand for hydraulic-driven off-highway machinery in construction, mining, and agricultural applications. For instance, Shell’s range of hydraulic fluids is widely adopted due to its ability to maintain viscosity under extreme pressures and temperatures, ensuring smooth operation of hydraulic systems. The increasing focus on energy efficiency, system longevity, and environmental compliance is accelerating the replacement of conventional fluids with advanced hydraulic formulations. In addition, integration of automated and precision-controlled machinery requires hydraulic fluids that provide consistent performance, low maintenance, and compatibility with multiple system components.

- By End Use

On the basis of end use, the off-highway equipment lubricants market is segmented into transportation and industrial. The transportation segment dominated the market with the largest revenue share in 2025, driven by the extensive use of off-highway vehicles in construction, mining, agriculture, and material handling operations. Transportation machinery demands high-performance lubricants that reduce downtime, optimize fuel efficiency, and protect engine and drivetrain components under harsh operational conditions. OEM approvals, regular maintenance schedules, and the need for extended equipment life contribute to the sustained demand for specialized lubricants in this segment.

The industrial segment is expected to witness the fastest growth from 2026 to 2033, fueled by increasing adoption of off-highway equipment in industrial manufacturing, logistics, and heavy engineering sectors. For instance, ExxonMobil’s industrial lubricant portfolio is widely utilized for its ability to enhance machinery efficiency and minimize wear in industrial equipment. Rising investments in industrial infrastructure, automation, and mechanization are boosting demand for high-performance lubricants that ensure smooth operation, reduce maintenance costs, and comply with environmental standards. Enhanced focus on operational safety and reliability in industrial applications further supports the growth of this segment.

Off-Highway Equipment Lubricants Market Regional Analysis

- Asia-Pacific dominated the off-highway equipment lubricants market with the largest revenue share of around 35% in 2025, driven by rapid industrialization, expanding construction and mining activities, and increasing mechanization in agriculture

- The region’s cost-effective manufacturing base, availability of skilled labor, and rising investments in heavy machinery and infrastructure projects are accelerating lubricant consumption

- Growing adoption of advanced off-highway equipment and emphasis on reducing operational downtime are further contributing to market growth across both developed and developing economies

China Off-Highway Equipment Lubricants Market Insight

China held the largest share in the Asia-Pacific off-highway equipment lubricants market in 2025, owing to its position as a global leader in construction, mining, and agricultural machinery manufacturing. The country’s strong industrial base, supportive government policies for infrastructure development, and extensive OEM presence are key growth drivers. Rising demand for high-performance lubricants to enhance equipment lifespan, reduce maintenance costs, and improve fuel efficiency is further strengthening market adoption.

India Off-Highway Equipment Lubricants Market Insight

India is witnessing the fastest growth in the Asia-Pacific region, fueled by expanding infrastructure projects, mechanization of agriculture, and increasing industrial automation. For instance, L&T Construction and Escorts Group are investing in modern off-highway machinery that requires specialized lubricants to ensure optimal performance and reliability. Government initiatives promoting industrial growth and “Make in India” programs are further boosting lubricant demand, alongside growing awareness of preventive maintenance and operational efficiency.

Europe Off-Highway Equipment Lubricants Market Insight

The Europe off-highway equipment lubricants market is expanding steadily, supported by stringent environmental regulations, high adoption of advanced machinery, and growing focus on sustainable lubricant formulations. The region emphasizes quality, long-lasting performance, and compliance with emission norms, particularly in construction, mining, and industrial applications. Increasing demand for synthetic and eco-friendly lubricants is enhancing the adoption of high-performance solutions across multiple end-use sectors.

Germany Off-Highway Equipment Lubricants Market Insight

Germany’s market is driven by its strong construction and industrial machinery manufacturing base, technological advancements in off-highway equipment, and high-quality maintenance standards. The country has extensive R&D capabilities, well-established OEM networks, and a strong focus on efficiency and sustainability. Demand is particularly strong for heavy-duty engine oils and hydraulic fluids that extend equipment life and reduce operational costs.

U.K. Off-Highway Equipment Lubricants Market Insight

The U.K. market is supported by modern infrastructure projects, a mature construction and industrial sector, and increasing adoption of advanced off-highway machinery. For instance, companies such as JCB and Terex are utilizing specialized lubricants to enhance machinery reliability and productivity. Focus on regulatory compliance, sustainability, and innovation in lubricant technology is further strengthening market demand.

North America Off-Highway Equipment Lubricants Market Insight

North America is projected to grow at the fastest CAGR from 2026 to 2033, driven by rising investments in construction, mining, and industrial automation. A strong focus on fleet modernization, adoption of high-performance lubricants for durability and fuel efficiency, and reshoring of industrial manufacturing are boosting demand. Advanced OEM-recommended lubricants and collaborations between lubricant manufacturers and equipment producers are further supporting market expansion.

U.S. Off-Highway Equipment Lubricants Market Insight

The U.S. accounted for the largest share in the North America market in 2025, underpinned by its expansive construction and mining industry, high adoption of off-highway machinery, and advanced R&D infrastructure. Leading lubricant producers such as Chevron and ExxonMobil provide high-performance solutions that reduce maintenance costs, enhance operational efficiency, and comply with stringent environmental regulations. The presence of mature distribution networks and growing industrial investments further solidify the U.S.’s leading position in the region.

Off-Highway Equipment Lubricants Market Share

The off-highway equipment lubricants industry is primarily led by well-established companies, including:

- BASF SE (Germany)

- Chevron Corporation (U.S.)

- Exxon Mobil Corporation (U.S.)

- Royal Dutch Shell plc (Netherlands)

- BP p.l.c. (U.K.)

- TotalEnergies SE (France)

- LUKOIL (Russia)

- Petroliam Nasional Berhad (PETRONAS) (Malaysia)

- The Lubrizol Corporation (U.S.)

- FUCHS Petrolub SE (Germany)

- Amsoil, Inc. (U.S.)

- Valvoline LLC (U.S.)

- PetroChina Company Limited (China)

- Phillips 66 Company (U.S.)

- Calumet Branded Products, LLC (U.S.)

- Evonik Industries AG (Germany)

- Sinopec Limited (China)

- Afton Chemical Corporation (U.S.)

- Idemitsu Kosan Co., Ltd. (Japan)

- Millers Oil Ltd (U.K.)

Latest Developments in Global Off-Highway Equipment Lubricants Market

- In December 2025, Gulf Oil Lubricants India Limited introduced its new Syntrac engine oil range at India Bike Week (IBW) 2025 in Panchgani, targeting the premium and high-performance motorcycle segment. This launch is expected to strengthen Gulf Oil’s presence in the high-value two-wheeler lubricant market and capture growing consumer demand for advanced, performance-oriented products. The Syntrac range positions the company competitively within a segment that increasingly prioritizes engine longevity, fuel efficiency, and premium performance characteristics, potentially driving market share expansion in India’s evolving motorcycle lubricant sector

- In October 2025, TotalEnergies expanded its distribution network in Asia through the acquisition of a local lubricant manufacturer. This strategic move enhances TotalEnergies’ market penetration in a region experiencing rapid growth in construction and industrial equipment usage. By localizing its supply chain and establishing closer ties with regional customers, the company is positioned to respond more effectively to market demand, reduce lead times, and offer tailored lubricant solutions, thereby strengthening its competitive position in the fast-growing Asian off-highway equipment lubricants market

- In September 2025, BP launched a new line of biodegradable lubricants specifically for off-highway construction equipment. This initiative supports BP’s strategy to address increasing regulatory pressures on environmental sustainability and growing customer demand for eco-friendly products. The introduction of biodegradable lubricants is expected to expand BP’s market appeal, attract environmentally conscious customers, and reinforce its position as a leader in sustainable solutions within the off-highway equipment segment, creating a potential differentiation advantage in a competitive market

- In August 2025, Chevron announced a strategic partnership with a leading technology firm to develop AI-driven lubricant formulations aimed at enhancing equipment performance and minimizing environmental impact. This development reflects Chevron’s commitment to innovation and positions the company to set new standards in lubricant efficiency. By leveraging AI, Chevron can optimize formulations for durability, fuel economy, and operational efficiency, which is likely to strengthen its market leadership in high-performance and sustainable lubricant solutions, while meeting evolving industry expectations

- In May 2022, the European Automobile Manufacturers’ Association (ACEA) introduced the 11th revision to the Heavy-Duty Diesel Sequences, effective May 1, 2022. This revision sets new minimum quality standards for service-fill oils used by ACEA members in commercial vehicles. The updated sequences are designed to ensure lubricants can withstand higher operating temperatures, harsher conditions, and longer service intervals, supporting improved engine efficiency, reduced emissions, and enhanced durability of after-treatment systems. This regulatory update has significant implications for lubricant manufacturers, encouraging the development of advanced products that meet stricter performance and environmental requirements in the European commercial vehicle market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Off Highway Equipment Lubricants Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Off Highway Equipment Lubricants Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Off Highway Equipment Lubricants Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.