Global Omega 3 Fatty Acids Market

Market Size in USD Billion

CAGR :

%

USD

1.99 Billion

USD

3.50 Billion

2024

2032

USD

1.99 Billion

USD

3.50 Billion

2024

2032

| 2025 –2032 | |

| USD 1.99 Billion | |

| USD 3.50 Billion | |

|

|

|

|

Global Omega-3 Fatty Acids Market Segmentation, By Type (Docosahexaenoic Acid (DHA), Eicosapentaenoic Acid (EPA) and Alpha-Linolenic Acid (ALA)), Source (Marine and Plant), Manufacturing Process (Concentration Process, Fish Oil Processing, Decontamination, and Others), Application (Dietary Supplements, Functional Food and Beverages, Pharmaceuticals, Infant Formula, Clinical Nutrition, Pet Foods and Supplements, and Others) - Industry Trends and Forecast to 2032

What is the Global Omega-3 Fatty Acids Market Size and Growth Rate?

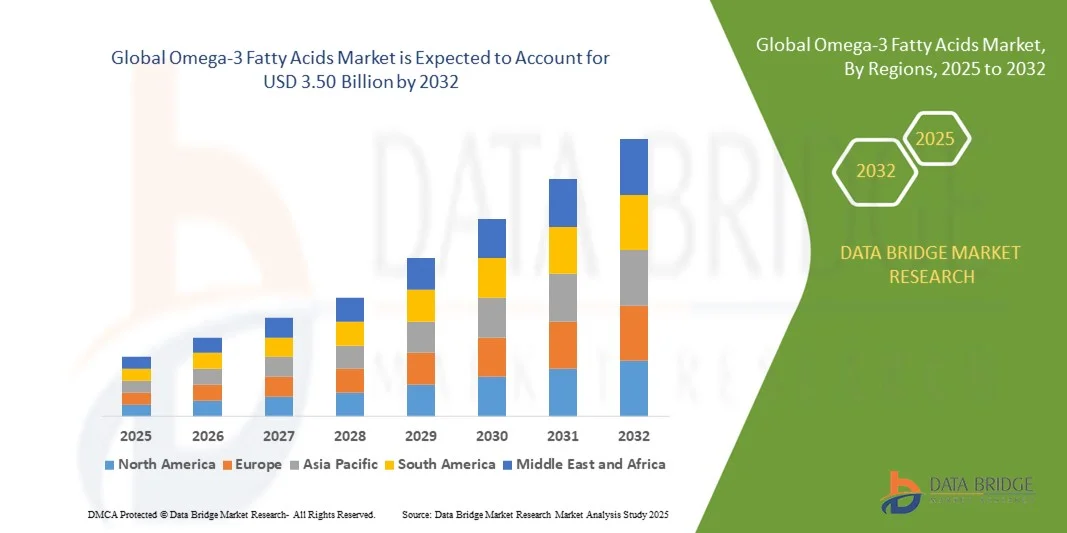

- The global Omega-3 fatty acids market size was valued at USD 1.99 billion in 2024 and is expected to reach USD 3.50 billion by 2032, at a CAGR of 7.26% during the forecast period

- Rising personal disposable income and growing awareness about maintaining a healthy lifestyle are the major factors fostering the growth of the market. Changing lifestyle, rising prevalence of chronic disorders and ever-rising global population are other important factors acting as market growth determinants

- Improving distribution channel, growth in the application by functional food industry and surge in the initiatives by the government to spread awareness on how to prevent diseases will further induce growth in the market value

What are the Major Takeaways of Omega-3 Fatty Acids Market?

- The ability of omega-3 fatty acids to prevent degenerative conditions in cats and dogs will further carve the way for the growth of market

- However, rising regarding the lack of sustainable nature of marine fisheries will pose a major challenge to the growth of the market

- North America dominated the Omega-3 Fatty Acids market with the largest revenue share of 43.32% in 2024, driven by rising health awareness, increasing preventive healthcare initiatives, and the widespread adoption of dietary supplements

- The Asia-Pacific Omega-3 Fatty Acids market is poised to grow at the fastest CAGR of 10.69% from 2025 to 2032, driven by increasing health awareness, rising disposable incomes, and urbanization in countries such as China, Japan, and India

- The DHA segment dominated the market with the largest revenue share of 45% in 2024, driven by its widespread use in infant nutrition, cognitive health supplements, and maternal health products

Report Scope and Omega-3 Fatty Acids Market Segmentation

|

Attributes |

Omega-3 Fatty Acids Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Omega-3 Fatty Acids Market?

Personalized Nutrition and Digital Health Integration

- A significant trend in the global Omega-3 Fatty Acids market is the increasing adoption of personalized nutrition solutions supported by digital health platforms and AI-based dietary recommendations. Consumers are now seeking tailored supplementation based on individual health data, lifestyle, and nutritional needs

- For instance, companies such as Cargill and DSM are leveraging AI and health apps to provide personalized omega-3 intake recommendations, enabling users to optimize cardiovascular, cognitive, and joint health outcomes

- AI integration in omega-3 solutions allows real-time tracking of consumption patterns, suggests optimal dosages, and alerts users to potential deficiencies. Personalized digital dashboards enhance adherence and transparency in supplementation

- The integration of omega-3 supplements with wellness apps and wearable devices facilitates holistic health management, allowing consumers to monitor heart rate, inflammation markers, and cognitive metrics in conjunction with their omega-3 intake

- This trend toward personalized, tech-enabled nutrition is reshaping user expectations, prompting manufacturers to develop more user-centric and adaptive omega-3 products

- The demand for digital-integrated, personalized omega-3 solutions is increasing across healthcare, fitness, and preventive wellness sectors, as consumers prioritize convenience, efficacy, and data-driven insights

What are the Key Drivers of Omega-3 Fatty Acids Market?

- Rising awareness of the health benefits of omega-3 fatty acids for heart health, brain function, and inflammation reduction is a major driver. Consumers increasingly seek preventive healthcare through diet and supplementation

- For instance, in 2024, Lonza expanded its omega-3 portfolio to include higher-concentration EPA/DHA formulations, enabling more effective cardiovascular support. Such strategic product innovations are expected to drive market growth

- Increasing adoption of fortified foods, beverages, and functional supplements with omega-3s is broadening consumer access and usage

- Growing integration with health apps and personalized nutrition platforms promotes consistent intake and education about optimal dosages, encouraging higher adoption

- The convenience of capsule, liquid, and chewable omega-3 formats, along with compatibility with multi-supplement regimens, further drives uptake in both clinical and lifestyle applications

Which Factor is Challenging the Growth of the Omega-3 Fatty Acids Market?

- High production costs and supply chain challenges for marine-derived omega-3s, including fish oil and krill oil, remain significant growth barriers. Variability in raw material quality and sustainability concerns affects consistency

- For instance, price fluctuations in fish oil have made some premium formulations less accessible to cost-sensitive consumers, particularly in emerging regions

- Limited consumer awareness of proper dosing, potential allergen concerns, and the availability of counterfeit or low-potency products can reduce trust and adoption

- Plant-based omega-3 alternatives (ALA-rich oils) often face bioavailability challenges, limiting their perceived effectiveness compared to EPA/DHA, creating hesitancy among health-conscious users

- Overcoming these challenges requires investment in sustainable sourcing, quality assurance, and consumer education to ensure product efficacy, affordability, and long-term market growth

How is the Omega-3 Fatty Acids Market Segmented?

The market is segmented on the basis of type, source, manufacturing process and application.

- By Type

On the basis of type, the Omega-3 Fatty Acids market is segmented into Docosahexaenoic Acid (DHA), Eicosapentaenoic Acid (EPA), and Alpha-Linolenic Acid (ALA). The DHA segment dominated the market with the largest revenue share of 45% in 2024, driven by its widespread use in infant nutrition, cognitive health supplements, and maternal health products. DHA is highly preferred due to its critical role in brain and eye development, making it a key component in dietary supplements and infant formulas.

The EPA segment is expected to witness the fastest CAGR of 18% from 2025 to 2032, fueled by growing adoption for cardiovascular health, anti-inflammatory benefits, and functional foods. Increasing consumer awareness regarding heart health and rising preventive healthcare initiatives are driving demand for EPA-rich formulations. In addition, advancements in purification and encapsulation technologies have improved stability and bioavailability, further boosting adoption of EPA and DHA supplements across clinical and consumer nutrition markets.

- By Source

On the basis of source, the Omega-3 Fatty Acids market is segmented into Marine and Plant. The marine segment dominated the market with a revenue share of 52% in 2024, due to the high potency of EPA and DHA found in fish oil, krill oil, and algae-derived products. Marine sources are widely preferred for their bioavailability, clinically proven benefits, and inclusion in infant formulas, pharmaceuticals, and dietary supplements.

The plant segment is expected to witness the fastest CAGR of 19% during 2025–2032, driven by rising demand for vegan, vegetarian, and sustainable omega-3 sources such as flaxseed, chia, and camelina oils. Growing health-conscious consumer trends, combined with environmental and ethical concerns, are boosting plant-based omega-3 adoption. Innovations in extraction and conversion processes, such as algal and microalgae-based DHA, are further enhancing plant-derived omega-3 efficacy and expanding their application in supplements and fortified food products.

- By Manufacturing Process

On the basis of manufacturing process, the Omega-3 Fatty Acids market is segmented into Concentration Process, Fish Oil Processing, Decontamination, and Others. The concentration process segment dominated the market with a 48% revenue share in 2024, owing to its ability to produce highly purified and potent EPA and DHA formulations suitable for pharmaceutical and clinical applications. Concentrated omega-3 products allow precise dosage control, better stability, and improved efficacy, which drives demand among supplement manufacturers and healthcare providers.

The fish oil processing segment is expected to witness the fastest CAGR of 17% from 2025 to 2032, fueled by increasing industrial-scale production and consumer demand for high-quality omega-3 oils. Technological advancements in extraction, molecular distillation, and deodorization techniques are enhancing product quality while reducing contaminants such as heavy metals, making fish oil processing a preferred method for both dietary supplements and functional foods.

- By Application

On the basis of application, the Omega-3 Fatty Acids market is segmented into Dietary Supplements, Functional Food and Beverages, Pharmaceuticals, Infant Formula, Clinical Nutrition, Pet Foods and Supplements, and Others. The dietary supplements segment dominated the market with the largest revenue share of 50% in 2024, driven by growing health awareness, rising preventive healthcare trends, and widespread accessibility of capsules, soft gels, and liquid formulations.

The functional food and beverages segment is expected to witness the fastest CAGR of 20% from 2025 to 2032, fueled by increasing fortification of foods with EPA and DHA, such as dairy products, bakery items, juices, and snacks. Consumer demand for convenient, ready-to-consume omega-3 products and integration with personalized nutrition programs is boosting adoption. In addition, regulatory approvals for fortified foods, rising R&D investments, and product innovations supporting heart, brain, and joint health are further accelerating growth across multiple application sectors.

Which Region Holds the Largest Share of the Omega-3 Fatty Acids Market?

- North America dominated the Omega-3 Fatty Acids market with the largest revenue share of 43.32% in 2024, driven by rising health awareness, increasing preventive healthcare initiatives, and the widespread adoption of dietary supplements

- Consumers in the region highly value high-quality, clinically tested omega-3 formulations, including DHA, EPA, and ALA, for cardiovascular, cognitive, and joint health

- The market growth is further supported by high disposable incomes, strong retail penetration, and the presence of leading global omega-3 manufacturers, establishing North America as the critical market for both supplement and functional food applications

U.S. Omega-3 Fatty Acids Market Insight

The U.S. Omega-3 Fatty Acids market captured the largest revenue share of 81% in 2024 within North America, fueled by increasing consumer focus on preventive health and wellness. Rising adoption of dietary supplements, fortified foods, and functional beverages is driving demand. In addition, the growing popularity of personalized nutrition and clinically validated omega-3 products is accelerating market growth. Regulatory support, coupled with strong distribution networks across pharmacies, online retail, and health stores, further reinforces U.S. market dominance.

Europe Omega-3 Fatty Acids Market Insight

The Europe Omega-3 Fatty Acids market is projected to expand at a substantial CAGR during the forecast period, driven by rising health-consciousness and aging populations. Governments are encouraging preventive health measures, including the consumption of omega-3 supplements. Increasing demand for functional foods, fortified beverages, and pharmaceutical-grade formulations further supports adoption. Markets in Germany, France, and the U.K. are seeing consistent growth, with strong R&D capabilities and the presence of key players enhancing product availability and innovation across the region.

U.K. Omega-3 Fatty Acids Market Insight

The U.K. Omega-3 Fatty Acids market is anticipated to grow at a moderate CAGR, supported by increasing consumer interest in heart, brain, and eye health. Rising awareness of supplement efficacy, coupled with robust retail and e-commerce infrastructure, is driving market penetration. Government initiatives promoting preventive healthcare and nutritional education also contribute to demand. High-quality formulations and transparent labeling are encouraging consumer trust, making the U.K. a key regional market within Europe.

Germany Omega-3 Fatty Acids Market Insight

The Germany Omega-3 Fatty Acids market is expected to expand at a notable CAGR due to rising health awareness and the preference for premium, clinically tested supplements. Germany’s strong pharmaceutical and nutraceutical industries, combined with high consumer purchasing power, promote adoption of omega-3 formulations for cardiovascular, cognitive, and joint health. The integration of omega-3s into functional foods, beverages, and infant nutrition is also driving growth, making Germany a critical hub for research-driven product launches and high-quality manufacturing.

Which Region is the Fastest Growing in the Omega-3 Fatty Acids Market?

The Asia-Pacific Omega-3 Fatty Acids market is poised to grow at the fastest CAGR of 10.69% from 2025 to 2032, driven by increasing health awareness, rising disposable incomes, and urbanization in countries such as China, Japan, and India. Rapid adoption of functional foods, fortified beverages, and dietary supplements is fueling demand. Government initiatives promoting nutrition, coupled with growing manufacturing capacity and availability of affordable omega-3 products, are expanding access. Rising prevalence of lifestyle-related diseases is further driving the need for preventive nutrition solutions.

Japan Omega-3 Fatty Acids Market Insight

The Japan Omega-3 Fatty Acids market is gaining traction due to the country’s aging population, high health consciousness, and preference for preventive nutrition. DHA and EPA supplements are particularly popular for cognitive, cardiovascular, and maternal health applications. Integration of omega-3s into functional foods and beverages is also rising. Consumers are increasingly seeking high-quality, clinically validated formulations, driving market growth in both retail and pharmaceutical channels.

China Omega-3 Fatty Acids Market Insight

The China Omega-3 Fatty Acids market accounted for the largest revenue share in Asia-Pacific in 2024, attributed to rising disposable incomes, growing urban middle class, and increasing health awareness. Rapid adoption of dietary supplements, fortified foods, and functional beverages is driving demand. Domestic manufacturers, supported by government initiatives promoting nutrition and preventive health, are expanding production capacity. Affordable omega-3 products, combined with strong retail and e-commerce networks, are making supplements widely accessible, propelling China as a key growth market in the Asia-Pacific region.

Which are the Top Companies in Omega-3 Fatty Acids Market?

The Omega-3 fatty acids industry is primarily led by well-established companies, including:

- Lonza (Switzerland)

- BASF SE (Germany)

- Evonik Industries AG (Germany)

- Cargill, Incorporated (U.S.)

- DSM (Netherlands)

- Epax (Norway)

- Croda International Plc (U.K.)

- Amway (U.S.)

- Sanofi (France)

- Unilever (U.K.)

- Nestlé (Switzerland)

- Reckitt Benckiser Group plc (U.K.)

- VivoMega (U.S.)

- Omega Protein Corporation (U.S.)

- ARISTA INDUSTRIES (U.S.)

- Polaris Inc. (U.S.)

- Pharma Marine AS (Norway)

- Merck KGaA (Germany)

- Nordic Naturals, Inc. (U.S.)

- Corbion NV (Netherlands)

What are the Recent Developments in Global Omega-3 Fatty Acids Market?

- In March 2023, Epax announced an investment of USD 40 million in molecular distillation technology for enhancing the processing of highly concentrated omega-3, aiming to improve purity and potency, which is expected to strengthen their market position and production efficiency

- In May 2023, Nuseed Global introduced Nuseed Nutriterra, a plant-based oil enriched with omega-3, specifically developed for the human nutrition and dietary supplement markets, supporting the growing consumer shift towards plant-based, sustainable nutritional solutions

- In July 2021, Neptune Wellness Solutions Inc., a diversified health and wellness company focused on plant-based and sustainable lifestyle brands, launched Forest Remedies’ Multi Omega 3-6-9 gummies and soft gels with Ahiflower as a key ingredient, enabling consumers to meet their daily omega nutrient requirements conveniently

- In February 2021, India-based start-up OZiva launched new vegan Omega-3 multivitamins, designed to address the increasing demand for plant-based dietary supplements, further supporting the growth of clean-label and plant-based nutrition options

- In March 2020, Wiley Companies introduced its first omega-3 concentrate in powdered form for food and beverage applications, formulated without fishy taste or odor, ensuring an appealing sensory experience for consumers while expanding product versatility

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL OMEGA-3 FATTY ACIDS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL OMEGA-3 FATTY ACIDS MARKET SIZE

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 MARKET GUIDE

2.2.4 COMPANY POSITIONING GRID

2.2.5 COMAPANY MARKET SHARE ANALYSIS

2.2.6 MULTIVARIATE MODELLING

2.2.7 DEMAND AND SUPPLY-SIDE VARIABLES

2.2.8 CONSUMPTION TREND OF END PRODUCTS

2.2.9 TOP TO BOTTOM ANALYSIS

2.2.10 STANDARDS OF MEASUREMENT

2.2.11 VENDOR SHARE ANALYSIS

2.2.12 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.13 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL OMEGA-3 FATTY ACIDS MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 VALUE CHAIN ANALYSIS

5.2 SUPPLY CHAIN ANALYSIS

5.3 IMPORT-EXPORT ANALYSIS

5.4 PORTER’S FIVE FORCES ANALYSIS

5.4.1 BARGAINING POWER OF SUPPLIERS

5.4.2 BARGAINING POWER OF BUYERS/CONSUMERS

5.4.3 THREAT OF NEW ENTRANTS

5.4.4 THREAT OF SUBSTITUTE PRODUCTS

5.4.5 INTENSITY OF COMPETITIVE RIVALRY

5.5 RAW MATERIAL SOURCING ANALYSIS

5.6 OVERVIEW OF TECHNOLOGICAL INNOVATIONS

5.7 INDUSTRY TRENDS AND FUTURE PERSPECTIVE

5.8 GROWTH STRATEGIES ADOPTED BY KEY MARKET PLAYERS

5.9 FACTORS INFLUENCING PURCHASING DECISION OF END-USERS

6 IMPACT OF ECONOMIC SLOW DOWN ON MARKET

6.1 IMPACT ON PRICE

6.2 IMPACT ON SUPPLY CHAIN

6.3 IMPACT ON SHIPMENT

6.4 IMPACT ON COMPANY’S STRATEGIC DECISIONS

7 REGULATORY FRAMEWORK AND GUIDELINES

8 PRICING INDEX (PRICE AT B2B END & PRICES AT FOB)

9 PRODUCTION CAPACITY OF KEY MANUFACTURERES

10 BRAND OUTLOOK

10.1 COMPARATIVE BRAND ANALYSIS

10.2 PRODUCT VS BRAND OVERVIEW

11 GLOBAL OMEGA-3 FATTY ACIDS MARKET, BY TYPE, (2022-2031) (USD MILLION) (KILO TONS)

11.1 OVERVIEW

11.2 ALPHA-LINOLENIC ACID (ALA)

11.3 EICOSAPENTAENOIC ACID (EPA)

11.4 DOCOSAHEXAENOIC ACID (DHA)

11.5 EICOSAPENTAENOIC ACID (EPA)+ DOCOSAHEXAENOIC ACID (DHA)

12 GLOBAL OMEGA-3 FATTY ACIDS MARKET, BY SOURCE, (2022-2031) (USD MILLION)

12.1 OVERVIEW

12.2 MARINE BASED

12.2.1 TUNA OIL

12.2.2 MENHADEN OIL

12.2.3 SALMON OIL

12.2.4 HOKI OIL

12.2.5 POLLOCK OIL

12.2.6 COD LIVER OIL

12.2.7 MUSSEL OIL

12.2.8 CALANUS OIL

12.2.9 KRILL OIL

12.2.10 MACKEREL OIL

12.2.11 SARDINE OIL

12.2.12 OTHERS

12.3 ALGAE -BASED

12.3.1 OMEGA-3 FATTY ACID

12.3.2 MACROALGAL

12.4 PLANT-BASED

12.4.1 WALNUT

12.4.2 PUMPKINSEEDS

12.4.3 SOYBEAN

12.4.4 CANOLA

12.4.5 FLAXSEED

12.4.6 CHIA SEED

12.4.7 HEMP SEED

12.4.8 OTHERS

13 GLOBAL OMEGA-3 FATTY ACIDS MARKET, BY FORM, (2022-2031) (USD MILLION)

13.1 OVERVIEW

13.2 DRY

13.3 LIQUID

14 GLOBAL OMEGA-3 FATTY ACIDS MARKET, BY CATEGORY, (2022-2031) (USD MILLION)

14.1 OVERVIEW

14.2 ORGANIC

14.3 CONVENTIONAL

15 GLOBAL OMEGA-3 FATTY ACIDS MARKET, BY NATURE, (2022-2031) (USD MILLION)

15.1 OVERVIEW

15.2 PURE

15.3 BLENDED

16 GLOBAL OMEGA-3 FATTY ACIDS MARKET, BY FUNCTION, (2022-2031) (USD MILLION)

16.1 OVERVIEW

16.2 BRAIN & MENTAL HEALTH

16.3 IMMUNE SYSTEM

16.4 VISION

16.5 SKIN HEALTH

16.6 BONE HEALTH

16.7 CARDIOVASCULAR HEALTH

16.8 ANTI CANCER

16.9 LUNG HEALTH

16.1 BLOOD VESSEL HEALTH

16.11 BONE HEALTH

16.12 WOMAN HEALTH

16.13 ANTI-CHOLESTEROL

16.14 OTHERS

17 GLOBAL OMEGA-3 FATTY ACIDS MARKET, BY APPLICATION, (2022-2031) (USD MILLION)

17.1 OVERVIEW

17.2 FOOD PRODUCTS

17.2.1 FOOD PRODUCTS, BY APPLICATION

17.2.1.1. BAKERY PRODUCTS

17.2.1.1.1. CAKES AND PASTRIES

17.2.1.1.2. COOKIES AND BISCUITS

17.2.1.1.3. BREADS AND ROLLS

17.2.1.1.4. DONUTS

17.2.1.1.5. OTHERS

17.2.1.2. CHOCOLATES AND CONFECTIONARY

17.2.1.2.1. CHOCOLATES

17.2.1.2.2. GUMMIES/JELLIES

17.2.1.2.3. HARD CANDIES

17.2.1.2.4. SUGAR CONFECTIONARY

17.2.1.2.5. OTHERS

17.2.1.3. PROCESSED FOOD

17.2.1.3.1. PASTA

17.2.1.3.2. NOODLES

17.2.1.3.3. EXTRUDED SNACKS

17.2.1.3.4. SOUPS AND SAUCES

17.2.1.3.5. OTHERS

17.2.1.4. BREAKFAST CEREALS

17.2.1.5. INSTANT FOOD

17.2.1.6. MEAT AND POULTRY PRODUCTS

17.2.1.7. DRESSINGS AND SEASONINGS

17.2.1.8. INFANT FORMULA

17.2.1.9. SPORTS NUTRITION

17.2.1.9.1. SPORTS NUTRITION BARS

17.2.1.9.2. SPORTS PROTEIN POWDERS

17.2.1.9.3. OTHERS

17.2.1.10. CEREAL BARS

17.2.1.11. DAIRY PRODUCTS

17.2.1.11.1. ICE CREAM

17.2.1.11.2. BUTTER

17.2.1.11.3. YOUGUT

17.2.1.11.4. PUDDING

17.2.1.11.5. CHEESE

17.2.1.11.6. MILK

17.2.1.11.7. CREAM

17.2.1.11.8. OTHERS

17.2.1.12. DAIRY ALTERNATIVE PRODUCTS

17.2.1.13. FROZEN FOOD

17.2.1.14. OTHERS

17.2.2 FOOD PRODUCTS, BY TYPE

17.2.2.1. ALPHA-LINOLENIC ACID (ALA)

17.2.2.2. DOCOSAHEXAENOIC ACID (DHA)

17.2.2.3. EICOSAPENTAENOIC ACID (EPA)

17.3 BEVERAGES

17.3.1 BEVERAGES, APPLICATION

17.3.1.1. ALCOHOLIC BEVERAGES

17.3.1.1.1. WINE

17.3.1.1.2. BEER

17.3.1.1.3. SPIRIT DRINKS

17.3.1.1.4. OTHERS

17.3.1.2. NON-ALCOHOLIC BEVERAGES

17.3.1.2.1. CARBONATED DRINKS

17.3.1.2.2. SPORTS & ENERGY DRINKS

17.3.1.2.3. SMOOTHIES

17.3.1.2.4. RTD COFFEE & TEA

17.3.1.2.5. OTHERS

17.3.2 BEVERAGES, BY TYPE

17.3.2.1. ALPHA-LINOLENIC ACID (ALA)

17.3.2.2. DOCOSAHEXAENOIC ACID (DHA)

17.3.2.3. EICOSAPENTAENOIC ACID (EPA)

17.4 NUTRACEUTICALS AND DIETARY SUPPLEMENTS

17.4.1 NUTRACEUTICALS AND DIETARY SUPPLEMENTS, BY TYPE

17.4.1.1. ALPHA-LINOLENIC ACID (ALA)

17.4.1.2. DOCOSAHEXAENOIC ACID (DHA)

17.4.1.3. EICOSAPENTAENOIC ACID (EPA)

17.5 COSMETICS AND PERSONAL CARE

17.5.1 COSMETICS AND PERSONAL CARE, APPLICATION

17.5.1.1. SKIN CARE

17.5.1.1.1. SUN SCREEN LOTION

17.5.1.1.2. SERUM

17.5.1.1.3. MOISTURIZER

17.5.1.1.4. SCRUB

17.5.1.1.5. LIP CARE CREAM

17.5.1.1.6. OTHERS

17.5.1.2. HAIR CARE

17.5.1.2.1. SHAMPOO

17.5.1.2.2. CONDITIONER

17.5.1.2.3. HAIR OIL AND SERUM

17.5.1.2.4. OTHERS

17.5.1.3. SOAPS AND BODY WASH

17.5.1.4. OTHERS

17.5.2 COSMETICS AND PERSONAL CARE, BY TYPE

17.5.2.1. ALPHA-LINOLENIC ACID (ALA)

17.5.2.2. DOCOSAHEXAENOIC ACID (DHA)

17.5.2.3. EICOSAPENTAENOIC ACID (EPA)

17.6 ANIMAL FEED

17.6.1 ANIMAL FEED, APPLICATION

17.6.1.1. RUMINANTS

17.6.1.2. POULTRY

17.6.1.3. SWINE

17.6.1.4. PETS

17.6.1.5. AQUATIC ANIMAL

17.6.1.6. OTHERS

17.6.2 ANIMAL FEED, BY TYPE

17.6.2.1. ALPHA-LINOLENIC ACID (ALA)

17.6.2.2. DOCOSAHEXAENOIC ACID (DHA)

17.6.2.3. EICOSAPENTAENOIC ACID (EPA)

17.7 PHARMACEUTICALS

17.7.1 PHARMACEUTICALS, BY TYPE

17.7.1.1. ALPHA-LINOLENIC ACID (ALA)

17.7.1.2. DOCOSAHEXAENOIC ACID (DHA)

17.7.1.3. EICOSAPENTAENOIC ACID (EPA)

17.8 OTHERS

18 GLOBAL OMEGA-3 FATTY ACIDS MARKET, BY GEOGRAPHY, (2022-2031) (USD MILLION) (KILO TONS)

GLOBAL OMEGA-3 FATTY ACIDS MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

18.1 NORTH AMERICA

18.1.1 U.S.

18.1.2 CANADA

18.1.3 MEXICO

18.2 EUROPE

18.2.1 GERMANY

18.2.2 U.K.

18.2.3 ITALY

18.2.4 FRANCE

18.2.5 SPAIN

18.2.6 SWITZERLAND

18.2.7 NETHERLANDS

18.2.8 BELGIUM

18.2.9 RUSSIA

18.2.10 DENMARK

18.2.11 SWEDEN

18.2.12 POLAND

18.2.13 TURKEY

18.2.14 REST OF EUROPE

18.3 ASIA-PACIFIC

18.3.1 JAPAN

18.3.2 CHINA

18.3.3 SOUTH KOREA

18.3.4 INDIA

18.3.5 AUSTRALIA

18.3.6 SINGAPORE

18.3.7 THAILAND

18.3.8 INDONESIA

18.3.9 MALAYSIA

18.3.10 PHILIPPINES

18.3.11 NEW ZEALAND

18.3.12 VIETNAM

18.3.13 REST OF ASIA-PACIFIC

18.4 SOUTH AMERICA

18.4.1 BRAZIL

18.4.2 ARGENTINA

18.4.3 REST OF SOUTH AMERICA

18.5 MIDDLE EAST AND AFRICA

18.5.1 SOUTH AFRICA

18.5.2 UAE

18.5.3 SAUDI ARABIA

18.5.4 OMAN

18.5.5 QATAR

18.5.6 KUWAIT

18.5.7 REST OF MIDDLE EAST AND AFRICA

19 GLOBAL OMEGA-3 FATTY ACIDS MARKET, COMPANY LANDSCAPE

19.1 COMPANY SHARE ANALYSIS: GLOBAL

19.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

19.3 COMPANY SHARE ANALYSIS: EUROPE

19.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

19.5 COMPANY SHARE ANALYSIS: MIDDLE EAST AND AFRICA

19.6 MERGERS & ACQUISITIONS

19.7 NEW PRODUCT DEVELOPMENT & APPROVALS

19.8 EXPANSIONS & PARTNERSHIP

19.9 REGULATORY CHANGES

20 GLOBAL OMEGA-3 FATTY ACIDS MARKET, SWOT & DBMR ANALYSIS

21 GLOBAL OMEGA-3 FATTY ACIDS MARKET, COMPANY PROFILES

21.1 CARGILL, INCORPORATED

21.1.1 COMPANY OVERVIEW

21.1.2 REVENUE ANALYSIS

21.1.3 PRODUCT PORTFOLIO

21.1.4 RECENT DEVELOPMENTS

21.2 PELAGIA AS

21.2.1 COMPANY OVERVIEW

21.2.2 REVENUE ANALYSIS

21.2.3 PRODUCT PORTFOLIO

21.2.4 RECENT DEVELOPMENTS

21.3 CRODA INTERNATIONAL PLC

21.3.1 COMPANY OVERVIEW

21.3.2 REVENUE ANALYSIS

21.3.3 PRODUCT PORTFOLIO

21.3.4 RECENT DEVELOPMENTS

21.4 ROYAL DSM

21.4.1 COMPANY OVERVIEW

21.4.2 REVENUE ANALYSIS

21.4.3 PRODUCT PORTFOLIO

21.4.4 RECENT DEVELOPMENTS

21.5 OLVEA FISH OILS

21.5.1 COMPANY OVERVIEW

21.5.2 REVENUE ANALYSIS

21.5.3 PRODUCT PORTFOLIO

21.5.4 RECENT DEVELOPMENTS

21.6 OMEGA PROTEIN CORPORATION

21.6.1 COMPANY OVERVIEW

21.6.2 REVENUE ANALYSIS

21.6.3 PRODUCT PORTFOLIO

21.6.4 RECENT DEVELOPMENTS

21.7 GC RIEBER OILS

21.7.1 COMPANY OVERVIEW

21.7.2 REVENUE ANALYSIS

21.7.3 PRODUCT PORTFOLIO

21.7.4 RECENT DEVELOPMENTS

21.8 LUHUA BIOMARINE (SHANDONG) CO., LTD.

21.8.1 COMPANY OVERVIEW

21.8.2 REVENUE ANALYSIS

21.8.3 PRODUCT PORTFOLIO

21.8.4 RECENT DEVELOPMENTS

21.9 PHARMA MARINE AS

21.9.1 COMPANY OVERVIEW

21.9.2 REVENUE ANALYSIS

21.9.3 PRODUCT PORTFOLIO

21.9.4 RECENT DEVELOPMENTS

21.1 POLARIS

21.10.1 COMPANY OVERVIEW

21.10.2 REVENUE ANALYSIS

21.10.3 PRODUCT PORTFOLIO

21.10.4 RECENT DEVELOPMENTS

21.11 EVONIK

21.11.1 COMPANY OVERVIEW

21.11.2 REVENUE ANALYSIS

21.11.3 PRODUCT PORTFOLIO

21.11.4 RECENT DEVELOPMENTS

21.12 BASF SE

21.12.1 COMPANY OVERVIEW

21.12.2 REVENUE ANALYSIS

21.12.3 PRODUCT PORTFOLIO

21.12.4 RECENT DEVELOPMENTS

21.13 GOLDEN OMEGA

21.13.1 COMPANY OVERVIEW

21.13.2 REVENUE ANALYSIS

21.13.3 PRODUCT PORTFOLIO

21.13.4 RECENT DEVELOPMENTS

21.14 CORBION

21.14.1 COMPANY OVERVIEW

21.14.2 REVENUE ANALYSIS

21.14.3 PRODUCT PORTFOLIO

21.14.4 RECENT DEVELOPMENTS

21.15 SOLUTEX

21.15.1 COMPANY OVERVIEW

21.15.2 REVENUE ANALYSIS

21.15.3 PRODUCT PORTFOLIO

21.15.4 RECENT DEVELOPMENTS

21.16 NISSUI

21.16.1 COMPANY OVERVIEW

21.16.2 REVENUE ANALYSIS

21.16.3 PRODUCT PORTFOLIO

21.16.4 RECENT DEVELOPMENTS

21.17 HUATAI BIOPHARM INC.

21.17.1 COMPANY OVERVIEW

21.17.2 REVENUE ANALYSIS

21.17.3 PRODUCT PORTFOLIO

21.17.4 RECENT DEVELOPMENTS

21.18 KD NUTRA

21.18.1 COMPANY OVERVIEW

21.18.2 REVENUE ANALYSIS

21.18.3 PRODUCT PORTFOLIO

21.18.4 RECENT DEVELOPMENTS

21.19 KINOMEGA BIOPHARM INC

21.19.1 COMPANY OVERVIEW

21.19.2 REVENUE ANALYSIS

21.19.3 PRODUCT PORTFOLIO

21.19.4 RECENT DEVELOPMENTS

21.2 AKER BIOMARINE

21.20.1 COMPANY OVERVIEW

21.20.2 REVENUE ANALYSIS

21.20.3 PRODUCT PORTFOLIO

21.20.4 RECENT DEVELOPMENTS

21.21 CHAMBIO CO., LTD.

21.21.1 COMPANY OVERVIEW

21.21.2 REVENUE ANALYSIS

21.21.3 PRODUCT PORTFOLIO

21.21.4 RECENT DEVELOPMENTS

21.22 BIZEN CHEMICAL CO.LTD

21.22.1 COMPANY OVERVIEW

21.22.2 REVENUE ANALYSIS

21.22.3 PRODUCT PORTFOLIO

21.22.4 RECENT DEVELOPMENTS

21.23 WILEY COMPANIES

21.23.1 COMPANY OVERVIEW

21.23.2 REVENUE ANALYSIS

21.23.3 PRODUCT PORTFOLIO

21.23.4 RECENT DEVELOPMENTS

21.24 STEPAN COMPANY

21.24.1 COMPANY OVERVIEW

21.24.2 REVENUE ANALYSIS

21.24.3 PRODUCT PORTFOLIO

21.24.4 RECENT DEVELOPMENTS

21.25 CLOVER CORPORATION LIMITED

21.25.1 COMPANY OVERVIEW

21.25.2 REVENUE ANALYSIS

21.25.3 PRODUCT PORTFOLIO

21.25.4 RECENT DEVELOPMENTS

21.26 CELLANA INC.

21.26.1 COMPANY OVERVIEW

21.26.2 REVENUE ANALYSIS

21.26.3 PRODUCT PORTFOLIO

21.26.4 RECENT DEVELOPMENTS

21.27 BIOSEARCH LIFE

21.27.1 COMPANY OVERVIEW

21.27.2 REVENUE ANALYSIS

21.27.3 PRODUCT PORTFOLIO

21.27.4 RECENT DEVELOPMENTS

21.28 BRUDYTECHNOLOGY

21.28.1 COMPANY OVERVIEW

21.28.2 REVENUE ANALYSIS

21.28.3 PRODUCT PORTFOLIO

21.28.4 RECENT DEVELOPMENTS

21.29 NATURMEGA

21.29.1 COMPANY OVERVIEW

21.29.2 REVENUE ANALYSIS

21.29.3 PRODUCT PORTFOLIO

21.29.4 RECENT DEVELOPMENTS

21.3 ALIMENTOS MARINOS SA DE CV

21.30.1 COMPANY OVERVIEW

21.30.2 REVENUE ANALYSIS

21.30.3 PRODUCT PORTFOLIO

21.30.4 RECENT DEVELOPMENTS

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

22 RELATED REPORTS

23 QUESTIONNAIRE

24 ABOUT DATA BRIDGE MARKET RESEARCH

Global Omega 3 Fatty Acids Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Omega 3 Fatty Acids Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Omega 3 Fatty Acids Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.