Global On Board Passenger Information System Market

Market Size in USD Billion

CAGR :

%

USD

42.09 Billion

USD

105.72 Billion

2025

2033

USD

42.09 Billion

USD

105.72 Billion

2025

2033

| 2026 –2033 | |

| USD 42.09 Billion | |

| USD 105.72 Billion | |

|

|

|

|

On-Board Passenger Information System Market Size

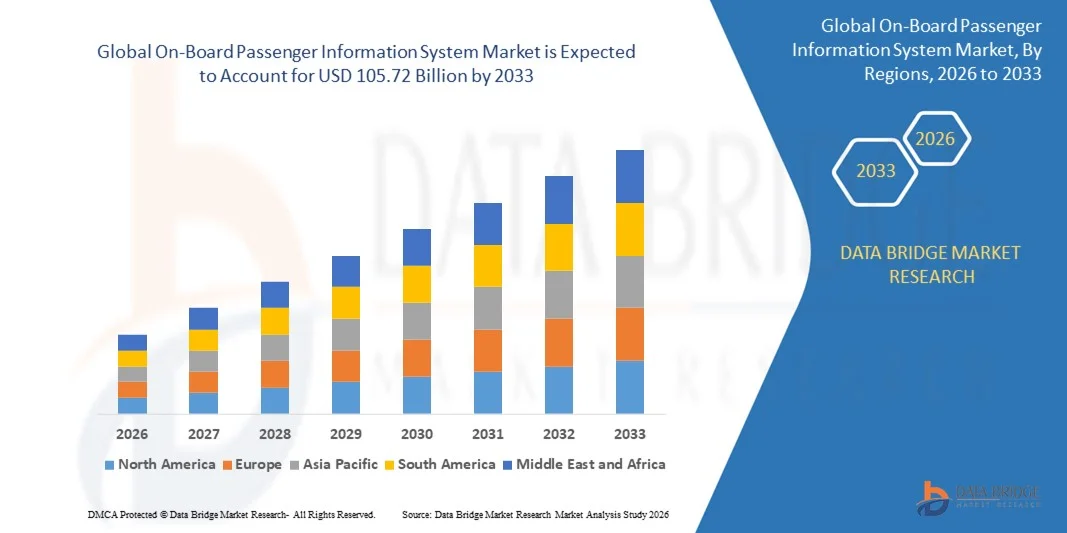

- The global on-board passenger information system market size was valued at USD 42.09 billion in 2025 and is expected to reach USD 105.72 billion by 2033, at a CAGR of 12.20% during the forecast period

- The market growth is largely fuelled by rising investments in intelligent transportation systems and the growing need for real-time passenger communication to enhance travel experience and operational efficiency

- Increasing adoption of digital display systems, automated announcements, and integrated infotainment solutions across public and private transport modes is supporting sustained market expansion

On-Board Passenger Information System Market Analysis

- The market is characterised by strong demand for integrated, user-friendly, and real-time information solutions that improve passenger satisfaction, safety, and journey transparency

- Continuous technological innovation, coupled with the shift toward smart mobility and connected transport infrastructure, is driving competitive differentiation and long-term market development

- North America dominated the on-board passenger information system market with the largest revenue share in 2025, driven by strong investments in intelligent transportation systems, advanced public transit infrastructure, and the early adoption of digital passenger communication technologies

- Asia-Pacific region is expected to witness the highest growth rate in the global on-board passenger information system market, driven by rising passenger volumes, large infrastructure investments, and accelerating adoption of smart transportation technologies

- The Solutions segment held the largest market revenue share in 2025 driven by the high adoption of integrated passenger information hardware and platforms such as display units, audio systems, and control interfaces across transport fleets. These solutions enable real-time communication, route updates, and service alerts, making them a core requirement for modern public and private transportation systems

Report Scope and On-Board Passenger Information System Market Segmentation

|

Attributes |

On-Board Passenger Information System Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

On-Board Passenger Information System Market Trends

Rising Demand for Real-Time Passenger Communication and Smart Mobility Solutions

- The growing emphasis on enhancing passenger experience and operational efficiency is significantly shaping the on-board passenger information system market, as transport operators increasingly adopt real-time information solutions that improve journey transparency, safety, and convenience. On-board passenger information systems are gaining traction due to their ability to deliver accurate announcements, live route updates, and service alerts across multiple transport modes, strengthening overall service quality and customer satisfaction

- Increasing investments in intelligent transportation systems and smart mobility initiatives have accelerated the adoption of advanced passenger information solutions across railways, metros, buses, and aviation. Public transport authorities and private operators are focusing on digital displays, automated audio announcements, and integrated infotainment platforms to modernize fleets and meet rising passenger expectations for seamless, connected travel experiences

- Digitalization and connectivity trends are influencing procurement decisions, with operators emphasizing system integration, reliability, and scalability. Cloud-based platforms, IoT-enabled devices, and AI-driven analytics are helping transport providers optimize operations, reduce delays, and enhance communication accuracy. These developments are also supporting long-term system upgrades and lifecycle management strategies

- For instance, in 2024, Siemens Mobility in Germany and Alstom in France expanded their on-board passenger information system offerings for metro and rail projects by integrating real-time data analytics and multimedia display solutions. These deployments were aligned with smart transport upgrades and were implemented across new and existing fleets to improve passenger engagement and operational efficiency

- While demand for on-board passenger information systems is rising, sustained market growth depends on continuous technological innovation, cybersecurity readiness, and seamless integration with existing transport infrastructure. Manufacturers and operators are focusing on improving system interoperability, reliability, and user experience to support large-scale adoption

On-Board Passenger Information System Market Dynamics

Driver

Growing Focus on Smart Transportation and Enhanced Passenger Experience

- Rising demand for smart transportation solutions is a major driver for the on-board passenger information system market. Transport authorities and operators are increasingly investing in digital communication platforms to deliver real-time updates, improve service reliability, and enhance passenger satisfaction. This trend is also driving the integration of passenger information systems with traffic management and fleet monitoring technologies

- Expanding deployment across rail, metro, bus, and aviation sectors is supporting market growth. On-board passenger information systems help streamline communication, reduce confusion during service disruptions, and improve accessibility for diverse passenger groups, enabling operators to meet regulatory requirements and customer expectations

- Public and private transport stakeholders are actively promoting advanced passenger information systems through infrastructure modernization projects, public-private partnerships, and smart city initiatives. These efforts are reinforced by the need to optimize operations, reduce congestion, and improve overall transport efficiency, encouraging collaboration between system providers and transport authorities

- For instance, in 2023, Hitachi Rail in Japan and Thales Group in France reported increased adoption of on-board passenger information systems in urban rail and metro projects. These deployments were driven by the need for real-time service communication, improved accessibility features, and enhanced passenger engagement, contributing to higher ridership satisfaction and system reliability

- Although smart mobility trends support market expansion, long-term growth relies on sustained investment, standardization, and integration with broader intelligent transport ecosystems. Continued focus on innovation and interoperability will be essential to maintain competitive advantage

Restraint/Challenge

High Implementation Costs and Integration Complexity

- The relatively high cost of implementing on-board passenger information systems remains a key challenge, particularly for budget-constrained transport operators. Hardware installation, software integration, and ongoing maintenance contribute to elevated upfront and operational costs, limiting adoption in smaller or developing transport networks

- Integration complexity with legacy systems poses another challenge, as older fleets and infrastructure may require significant upgrades to support modern passenger information technologies. Compatibility issues can increase deployment time, project risk, and overall expenditure, slowing adoption across certain transport segments

- Cybersecurity and data management concerns also affect market growth, as connected passenger information systems handle real-time operational data and passenger-facing content. Operators must invest in secure networks, data protection measures, and system resilience to prevent service disruptions and protect sensitive information

- For instance, in 2024, transport operators in Brazil and Indonesia deploying on-board passenger information systems for bus and rail networks reported delays due to high integration costs and technical challenges with legacy infrastructure. Cybersecurity compliance and system customization further increased project complexity and costs

- Addressing these challenges will require cost-effective system designs, modular solutions, and stronger collaboration between technology providers and transport authorities. In addition, standardization, workforce training, and long-term digital infrastructure planning will be critical to unlocking the full growth potential of the global on-board passenger information system market

On-Board Passenger Information System Market Scope

The market is segmented on the basis of component, mode of transportation, and functional model.

- By Component

On the basis of component, the global on-board passenger information system market is segmented into Solutions, Services, and Software. The Solutions segment held the largest market revenue share in 2025 driven by the high adoption of integrated passenger information hardware and platforms such as display units, audio systems, and control interfaces across transport fleets. These solutions enable real-time communication, route updates, and service alerts, making them a core requirement for modern public and private transportation systems.

The Software segment is expected to witness the fastest growth rate from 2026 to 2033, driven by the rising adoption of cloud-based platforms, data analytics, and content management systems. Software solutions support system customization, remote updates, predictive maintenance, and seamless integration with other intelligent transportation systems, enhancing operational efficiency and scalability.

- By Mode of Transportation

On the basis of mode of transportation, the market is segmented into Railways, Roadways, Airways, and Waterways. The Railways segment dominated the market in 2025 due to large-scale deployment of on-board passenger information systems in metro, suburban, and long-distance rail networks. High passenger volumes and the need for accurate real-time information regarding schedules, delays, and safety announcements are driving strong adoption in this segment.

The Roadways segment is expected to register the highest growth from 2026 to 2033, supported by increasing investments in smart bus systems and intelligent urban mobility solutions. Public transit buses and intercity coaches are increasingly equipped with digital displays and automated announcement systems to improve passenger experience and service reliability.

- By Functional Model

On the basis of functional model, the on-board passenger information system market is segmented into Multimedia Displays, Audio Systems, Computing Systems, Networking and Communication Devices, Video Surveillance, Content Management System, and Other Functional Models. The Multimedia Displays segment accounted for the largest share in 2025, driven by their extensive use in providing visual information such as route maps, next-stop details, advertisements, and emergency messages.

The Content Management System segment is expected to register the highest growth from 2026 to 2033, owing to the growing need for centralized control, real-time content updates, and seamless synchronization across multiple vehicles and transport modes. Advanced content management systems enable operators to manage passenger communication efficiently while supporting dynamic, data-driven information delivery.

On-Board Passenger Information System Market Regional Analysis

- North America dominated the on-board passenger information system market with the largest revenue share in 2025, driven by strong investments in intelligent transportation systems, advanced public transit infrastructure, and the early adoption of digital passenger communication technologies

- Transport authorities and operators in the region place high value on real-time information delivery, service reliability, and enhanced passenger experience through digital displays, automated announcements, and integrated infotainment systems

- This widespread adoption is further supported by high public spending on transport modernization, a technology-driven ecosystem, and the growing focus on smart mobility and connected transport solutions across rail, bus, and aviation networks

U.S. On-Board Passenger Information System Market Insight

The U.S. on-board passenger information system market captured the largest revenue share in 2025 within North America, fueled by large-scale upgrades of railways, metros, and urban bus fleets. Transport operators are increasingly prioritizing real-time passenger updates, accessibility compliance, and integration with cloud-based and mobile platforms. The strong presence of leading technology providers, coupled with rising smart city initiatives and digital transit solutions, continues to propel market growth.

Europe On-Board Passenger Information System Market Insight

The Europe on-board passenger information system market is expected to witness the fastest growth rate from 2026 to 2033, primarily driven by stringent passenger safety regulations, sustainability goals, and ongoing investments in public transport modernization. Increasing urbanization and demand for seamless multimodal travel are encouraging the deployment of advanced passenger information systems across rail, metro, and bus networks. The region is seeing strong adoption in both new transport projects and retrofit upgrades.

U.K. On-Board Passenger Information System Market Insight

The U.K. on-board passenger information system market is expected to witness the fastest growth rate from 2026 to 2033, driven by continuous investments in rail and urban transit infrastructure and a strong focus on improving passenger communication. Rising demand for real-time service updates, accessibility features, and digital signage across public transport systems is supporting adoption. The U.K.’s emphasis on smart transport and connected mobility solutions further contributes to market expansion.

Germany On-Board Passenger Information System Market Insight

The Germany on-board passenger information system market is expected to witness the fastest growth rate from 2026 to 2033, supported by the country’s advanced rail network, focus on innovation, and commitment to sustainable transportation. Increasing deployment of digital displays, automated announcements, and integrated control systems in trains and metros is driving market growth. Germany’s emphasis on efficiency, reliability, and data-driven transport management aligns strongly with advanced passenger information technologies.

Asia-Pacific On-Board Passenger Information System Market Insight

The Asia-Pacific on-board passenger information system market is expected to witness the fastest growth rate from 2026 to 2033, driven by rapid urbanization, expanding public transport networks, and rising investments in smart city projects across countries such as China, Japan, and India. Growing passenger volumes and the need for efficient communication systems are accelerating adoption across railways, metros, and bus transportation. The region’s focus on large-scale infrastructure development is creating strong growth opportunities.

Japan On-Board Passenger Information System Market Insight

The Japan on-board passenger information system market is expected to witness the fastest growth rate from 2026 to 2033 due to the country’s technologically advanced transport systems and high expectations for punctuality and passenger service quality. Japan places strong emphasis on real-time accuracy, multilingual information, and system reliability, driving continuous upgrades of on-board information solutions. Integration with IoT and smart mobility platforms is further supporting market growth across rail and urban transit systems.

China On-Board Passenger Information System Market Insight

The China on-board passenger information system market accounted for the largest market revenue share in Asia Pacific in 2025, attributed to massive investments in railways, high-speed trains, metros, and smart city infrastructure. Rapid urbanization, increasing passenger traffic, and government-led digital transportation initiatives are driving widespread adoption. The presence of large domestic manufacturers and cost-effective technology solutions is further accelerating deployment across both urban and intercity transport networks.

On-Board Passenger Information System Market Share

The On-Board Passenger Information System industry is primarily led by well-established companies, including:

• Advantech Co., Ltd. (Taiwan)

• Alstom (France)

• Wabtec Corporation (U.S.)

• Cubic Corporation (U.S.)

• Cisco (U.S.)

• Siemens (Germany)

• Hitachi, Ltd. (Japan)

• Huawei Technologies Co., Ltd. (China)

• Thales Group (France)

• Teleste Corporation (Finland)

• Mitsubishi Electric Corporation (Japan)

• ST Engineering (Singapore)

• Dysten Sp. z o.o. (Poland)

• Televic (Belgium)

• Lunetta (U.S.)

• r2p GmbH (Germany)

• Indra (Spain)

• ICON Multimedia S.L. (Spain)

• Passio (U.S.)

• LANCom (U.K.)

• Simpleway Europe a.s. (Czech Republic)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.